MAIN PAGE

> Back to contents

Security Issues

Reference:

Gorbaneva O.I.

Economic corruption in a static model of a combination of general and private interests

// Security Issues.

2022. ¹ 1.

P. 21-34.

DOI: 10.25136/2409-7543.2022.1.33483 URL: https://en.nbpublish.com/library_read_article.php?id=33483

Economic corruption in a static model of a combination of general and private interests

Gorbaneva Ol'ga Ivanovna

Doctor of Technical Science

Associate Professor, Department of Applied Mathematics and Programming, Southern Federal University

344090, Russia, Rostovskaya oblast', g. Rostov-Na-Donu, ul. Mil'chakova, 8a, kab. 212

|

gorbaneva@mail.ru

|

|

|

Other publications by this author

|

|

|

DOI: 10.25136/2409-7543.2022.1.33483

Received:

18-07-2020

Published:

04-04-2022

Abstract:

The article is devoted to the study of corruption in the previously studied static model of the combination of general and private interests (SOCHI model) of several agents. In this article, special attention is paid to the study of economic corruption. To do this, an intermediate level is introduced into the previously considered two-level system between the Principal and the Agents - a supervisor who represents the interests of the Principal, but in exchange for a bribe can improve the position of the agent at the expense of the Principal. The latter sets for each agent, himself and the supervisor a share of participation in the total income. The supervisor can increase the agent's share in exchange for a bribe, reducing the Principal's share. This article examines a three-level hierarchical system in which the supervisor uses an economic corruption mechanism, in the study of which two approaches are used: descriptive and optimization. The descriptive approach assumes that the functions of bribery in question are known. The optimization approach involves the use of Hermeyer's theorem. The influence of economic corruption on systemic consistency in the SOCHI model is investigated: it is proved that economic corruption can theoretically increase consistency. But this requires the fulfillment of many conditions, the joint fulfillment of which is unlikely. It is proved that economic corruption is always beneficial for agents, and also for the supervisor. The only way to combat this kind of corruption has been found.

Keywords:

SOCHI-models, corruption mechanism, system consistency, Principal, Supervisor, agent, economic corruption, descriptive approach, optimization approach, the function of bribery

This article is automatically translated.

You can find original text of the article here.

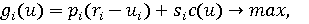

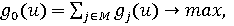

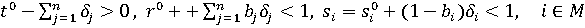

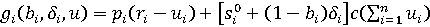

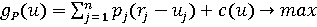

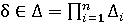

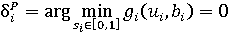

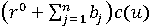

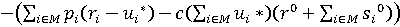

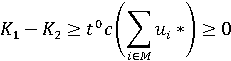

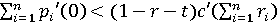

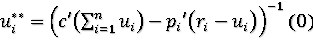

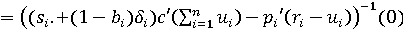

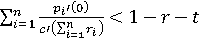

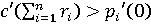

1. Introduction. The topic of corruption in hierarchical management systems, and not only in them, is quite sensitive. On the one hand, corruption undoubtedly causes damage to society. On the other hand, it allows you to redistribute funds between participants in public relations, which are initially redistributed not always fairly (in proportion to the work and responsibility assigned to the agent). In this regard, there are many controversial works on the topic of corruption, in particular, administrative. Rybasov, Ugolnitsky [2] introduced the classification of administrative and economic corruption for the first time, highlighting among each of them hard corruption (extortion) and soft (connivance). In particular, economic corruption is understood as an increase in the provision of material goods or a reduction in expenses, in particular taxes, in exchange for a bribe. Malsagov, Usov, Ugolnitsky in [3] gave recommendations on combating economic corruption, stating the fact that the interests of the agent are not taken into account in economic corruption. Only the supervisor's interests matter. However, it is noted that it does not cause much damage to society. In the author's works, economic corruption is considered in three-level models of resource allocation [4]. Two cases are considered: an unselfish center and a center with private interests. This article is devoted to the study of economic corruption in the hierarchical system of SOCHI models described earlier [1]. The "supervisor" element is introduced into the system between the principal and the agent, which acts in the interests of the principal, but can make concessions to the agent in exchange for a bribe. Possible economic corruption mechanisms of the supervisor's actions are introduced and described, and descriptive or optimization approaches can be applied to the study of each of them. The further structure of the work is as follows. In the second paragraph, the hierarchical superstructure built earlier in [2] over the SOCHI model is supplemented and complicated by the supervisor's target functions and limitations, a new agent-bribe strategy is introduced, a new system structure is described, and the concept of economic corruption is introduced. The third paragraph applies a descriptive approach to the study of economic corruption, the fourth paragraph describes the application of the optimization method, and the fifth paragraph describes the impact of economic corruption on the system consistency of the model. The sixth paragraph presents the conclusions and general results of the study, in particular recommendations on combating economic corruption. 2. Building a model. SOCHI is a model and economic corruption in it. The models of the combination of public and private interests described earlier in [1] (SOCHI models) have the following form. There are n agents who distribute their available resources r i between general interests (in the amount of u i) and private interests (in the amount of r i ? u i). That is, the agent's task:  (1) (1)

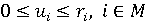

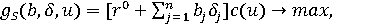

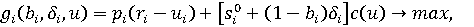

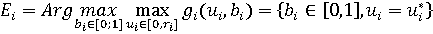

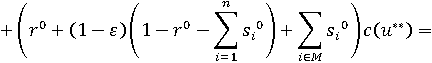

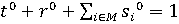

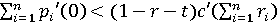

Here c(u) is a function of total income; s i is the share of the i-th agent in total income; p i(r i ? u i) is the private interest function of the i-th agent, M = {1,...,n} is the set of agents. The functions p i, c are assumed to be continuously differentiable and concave over all arguments. The interests of the top-level Principal is to maximize the utilitarian function of public welfare  (2) (2)

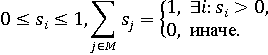

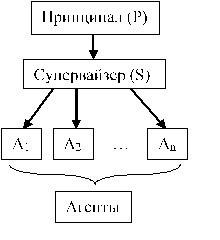

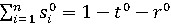

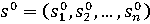

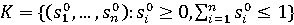

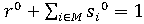

In the case of an economic management mechanism, the principal assigns the participation shares of agents in the total income s i under natural constraints 0?s i?1, . . The principal is not trying to improve his position by introducing corruption mechanisms. Its purpose is only to maximize the function of public welfare. But he delegates his management functions to the middle level – the supervisor (see Figure 1), who, in exchange for a bribe from agents, can improve the economic situation of agents. Accordingly, economic corruption arises as a feedback of economic management in terms of the amount of a bribe.

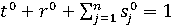

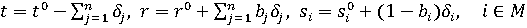

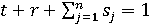

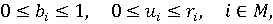

Figure 1. Three-level hierarchical management system Two approaches have been applied to the analysis of this type of corruption: descriptive and optimization. As part of the descriptive approach, we will consider the type of the bribery function to be known, then the optimization task arises for the agent, and the supervisor selects the optimal function parameters for himself, which he can influence. In the case of an optimization approach, the function of bribery is optimal from the supervisor's point of view, which allows you to choose methods to combat economic corruption. Suppose that in the absence of corruption, public income c(u) in the model (1) – (2) is distributed between the upper, middle and lower level elements in the ratio t 0, r 0,  , where , where  . In exchange for a bribe , the supervisor increases the share of agents in public income at the expense of the principal according to the following scheme . In exchange for a bribe , the supervisor increases the share of agents in public income at the expense of the principal according to the following scheme  . (3) . (3)

for new shares of the distribution of public income (3) must be performed again (n+2) conditions  , ,  . Here ? i is an increase in the agent's share of the total income in exchange for a share of b i from her. . Here ? i is an increase in the agent's share of the total income in exchange for a share of b i from her. Then the SOCHI model (1) - (2), taking into account economic corruption, takes the form  (4) (4)

(5) (5)

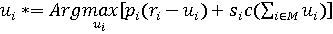

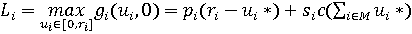

where g S, g i are the target functions of the supervisor and the i-th agent, respectively. 3. Descriptive approach Consider the model in general, namely, the target functions of agents:  , where the functions p i(x), c(x) are increasing concave ones satisfying the properties of p i(0) = 0, c(0) = 0, and the functions i(x) increasing ones satisfying the property i(0) = 0. Here the agent's controls are the values u i (the amount of resources directed by the agent to the realization of private interests) and b i (the share of the increase in the agent's participation in total income). In this case, we will assume that the principal has already assigned the participation shares of each agent in the total income of s i and does not participate in the supervisor and agent's further participation in the game. The supervisor also assigned the function of bribery i(b i), after which the outcome of the game now depends only on the agent's decision. , where the functions p i(x), c(x) are increasing concave ones satisfying the properties of p i(0) = 0, c(0) = 0, and the functions i(x) increasing ones satisfying the property i(0) = 0. Here the agent's controls are the values u i (the amount of resources directed by the agent to the realization of private interests) and b i (the share of the increase in the agent's participation in total income). In this case, we will assume that the principal has already assigned the participation shares of each agent in the total income of s i and does not participate in the supervisor and agent's further participation in the game. The supervisor also assigned the function of bribery i(b i), after which the outcome of the game now depends only on the agent's decision.

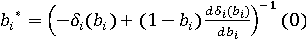

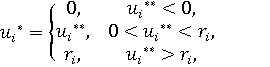

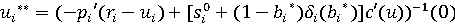

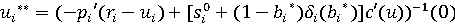

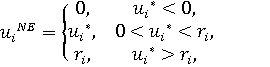

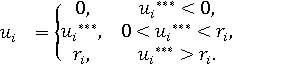

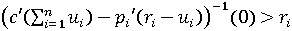

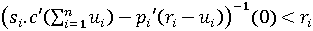

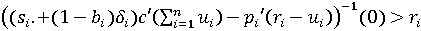

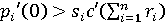

Theorem 1. Optimization problem of agent (5) under conditions of increasing continuous concave functions p i(x) and c(x) and an increasing continuous doubly differentiable function ? i(x), i(0) = 0, i(x)’ ? 0 has a unique solution  , ,

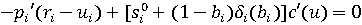

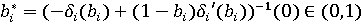

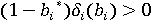

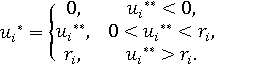

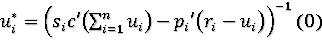

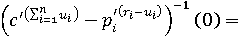

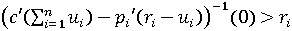

where  . . Proof. The first - order conditions have the form:  , , . .

By the form of the function g i, it can be seen that for any 0 < b i < 1  , which means that it only increases the function g i compared to g i(0,0,u i). Therefore, the resulting point is (b i* ,u i*) the maximum point. , which means that it only increases the function g i compared to g i(0,0,u i). Therefore, the resulting point is (b i* ,u i*) the maximum point. From here

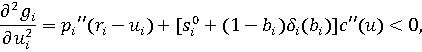

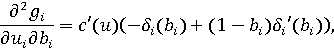

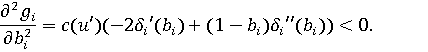

where Note that the condition (? i(bi) + (1 ? bi)i’(bi))?1(0) < 0 does not hold under conditions of increasing i(x) and i(0)=0, since the condition ? i must be satisfied for this(bi) + (1 ? bi)i’(bi) < 0. Taking into account i(0) = 0 the inequality turns into  , which contradicts the condition of increasing i(x). , which contradicts the condition of increasing i(x). Find the second derivatives:

The Hesse matrix at the point (b i* ,u i*) is negatively defined, therefore, the resulting point is the maximum point. This also indicates the uniqueness of the solution. The statement is proven. Corollary 1. The mechanism of corruption in the distribution of the share of participation in the total income with a given function of bribery is always beneficial to the agent.

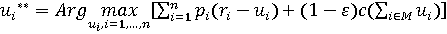

It means that, unfortunately, the agent is unprofitable in the case of the absence of a bribe b i = 0. To combat economic corruption, it is necessary to limit the supervisor's ability to increase the share of participation in total income at the expense of the principal, i.e. to make the value of t 0 as small as possible. 4. Optimization approach We define the objective function of the principal as a utilitarian function of public welfare, which is determined by the sum of the objective functions of all agents.  (6) (6) With the optimization approach , the function i(b i) is defined as the optimal guaranteeing strategy (control mechanism) of a supervisor in a type 2 game with agents. Let's apply an optimization approach to the study of economic corruption. Consider the model (5) – (6). The system matching condition in this model has the form u* = u max, where u = (u 1,...,u n), u* is the Nash equilibrium in the game of agents (5), g P(umax) = maxugP(u). In this case, the principal acts on the agent's objective function, namely, assigns the value s i — the share of total income going to the agent. We apply an optimization approach to the study of economic corruption in SOCHI-models (4)–(6). There are n+2 participants in the model: a principal with an objective function g P(u) (6), supervisor with objective function g S(b,?,u) (4) and n agents with objective functions g i(b i,? i,u i) (5). The agent's controls are still the values u i and b i with constraints u i ? [0,r i] and b i ? [0,1]. Moreover , the value u i is the response to the control of the principal s i 0 , which satisfies the constraints  , ,  . Then the supervisor intervenes in the game of the principal and the agent, who offers the agent an increase of i to the value of s i 0 in exchange for a "rollback" from the increase of b i. i is a fraction, so 0 ? i ? 1. This "interaction" of the agent with the supervisor may prompt the agent to increase its u i value. . Then the supervisor intervenes in the game of the principal and the agent, who offers the agent an increase of i to the value of s i 0 in exchange for a "rollback" from the increase of b i. i is a fraction, so 0 ? i ? 1. This "interaction" of the agent with the supervisor may prompt the agent to increase its u i value. So, there is a hierarchical game of (n+2) persons defined by the following parameters: 1. The set of participants – players N = {P,S,1,2,...,n} is given. Subsets {P}, {S} and M = {1,2,...,n} define the upper (Principal), middle (Supervisor) and lower (agents) levels of the hierarchy. The principal has the right of the first move, i.e. he is the first to choose and inform the agents (players with numbers i) of his strategy. The supervisor has the right of the second move, choosing and informing the agents of his strategy.

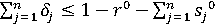

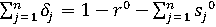

2. The pair <u i,b i> defines the control parameters of the i-th player, which can be selected from compact sets, u i ? U i =r[0;r i], b i ? [0,1], i ? M. Let , therefore, <u i,b i>? U ? [0,1]n. , therefore, <u i,b i>? U ? [0,1]n. Vector defines the control parameters of the Principal from a compact set defines the control parameters of the Principal from a compact set  . . The vector of functions = ( 1,...,? n) defines the control parameters of the Supervisor, where i : [0,1] ? [0,1] are the functions of bribery, which are selected from the space ?i of increasing functions satisfying the property i(0)=0, i.e.  . . 3. On the set U K, the winning functions of agents g i (5), Supervisor g S (4) and Principal g P (6) are defined. 4. For each player with number i, rules of behavior are defined that allow players P and S to evaluate the set of rational responses of players with numbers i: - striving to maximize the winning function for your choices; - striving to achieve a Nash-balanced situation. 5. The available game is a game with complete information, except that the Principal may not know about the supervisor's objective function. The principal may or may not use feedback from the management agent. The following rules are introduced: Rule 1. The supervisor relies on information and will have it about the choice of b i ? B i, i ? M. Rule 2. The second move is made by the Supervisor, choosing and informing the players i ? M of his strategy i ? ?i. Rule 3. Each agent, having received the information o i, tries to maximize its objective function by the appropriate choice <u i,b i>? U i ? [0,1]. Rule 4. In the formulated conditions, the Supervisor maximizes his guaranteed result. That is, games (5)–(6) and (4) - (5) are considered separately, since the principal and the supervisor do not interact directly. The purpose of the study of the model (4) — (5) is to evaluate the supervisor's influence on the equilibrium in the model (5) – (6). The algorithm for investigating the model is as follows: 1. Solve the problem of matching interests, if not in a strong, then at least in a weak form, find the corresponding values u *, u max and values s i 0. This study was conducted in [1].

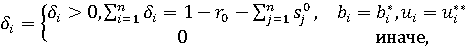

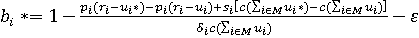

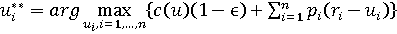

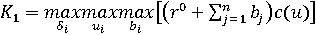

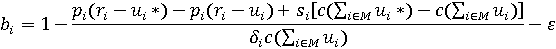

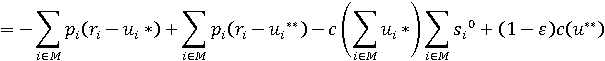

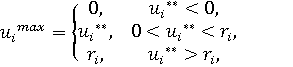

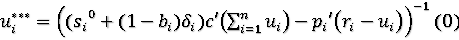

2. Find a balance in the game of 2 supervisors and an agent. Theorem 2. In the game ? 2 (4) – (5) under the condition of increasing concave functions p i(x), c(x) there is a single management mechanism that meets the interests of the supervisor:  , ,

where , ,  . .

Proof. The strategy of punishment  (when punishing, there is no surcharge to the share of total income, thereby the supervisor deprives the agent of the opportunity to bribe him and increase the share of total income), and the set (when punishing, there is no surcharge to the share of total income, thereby the supervisor deprives the agent of the opportunity to bribe him and increase the share of total income), and the set  (the optimal reaction of the agent to the punishment strategy is to do as prompted by the Principal), where (the optimal reaction of the agent to the punishment strategy is to do as prompted by the Principal), where  — the gain in the case of the supervisor of the punishment strategy is equal — the gain in the case of the supervisor of the punishment strategy is equal  to - the optimal gain of the agent in the punishment strategy, to - the optimal gain of the agent in the punishment strategy,

– the supervisor's gain with zero agent's bribe, and nothing depends on the supervisor's strategy in this case.  with natural restriction with natural restriction

– the maximum income of the supervisor, provided that the gain of the agent's income is greater than with the punishment strategy. From the last inequality we find the dependence of b on u:

and substitute this value in  , we get the maximization problem for 2 n variables u i and i: , we get the maximization problem for 2 n variables u i and i:

on condition . . The optimized function increases with i, so each i should be as large as possible, which indicates that the solution is still on the boundary of the domain . . From here,

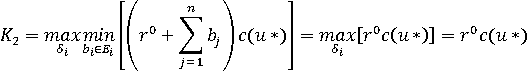

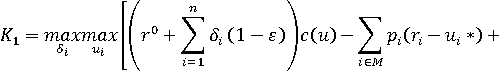

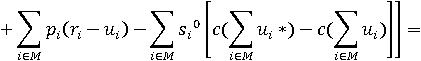

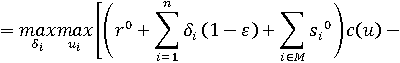

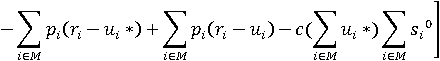

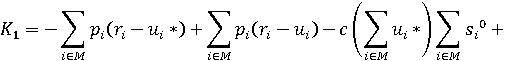

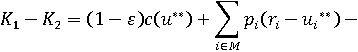

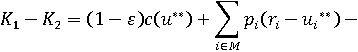

where . . We prove that K 1? K 2. To do this, find their difference:

. .

Since , ,

. .

By virtue of arbitrariness and by virtue of the fact that u** is the maximum, then and by virtue of the fact that u** is the maximum, then

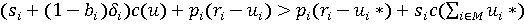

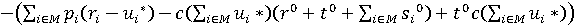

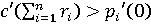

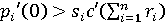

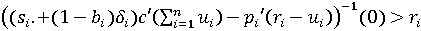

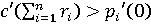

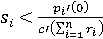

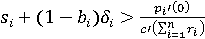

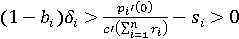

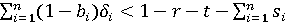

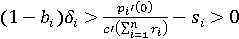

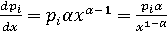

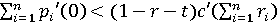

That is, K 1? K 2. Moreover, equality is achieved either at t 0 = 0 (i.e. the supervisor cannot make an allowance at the expense of the principal) or if all agents are individualists (an agent who allocates all resources available to him only for private purposes), i.e. all u i * = 0. The statement is proven. Corollary 2. The only way to fight corruption in the distribution of the share of participation in the total income is to reduce the supervisor's ability to do this at the expense of the share attributable to the principal, that is, to reduce, if possible, the value of t 0 to zero (or, which is the same thing, distribute the participation shares in the total income in such a way that the condition is met). is met). Corollary 3. By  . . That is, if the premium of the share of participation in the total income could not force the agent to increase the initial value equal to the Nash equilibrium, then almost all of the premium goes to the supervisor. equal to the Nash equilibrium, then almost all of the premium goes to the supervisor. 5. The influence of the mechanism of economic corruption and corruption in the allocation of resources on the system consistency of the model Theorem 3. The mechanism of economic corruption can increase the consistency of the SOCHI model (5) - (6) to a systematic agreement when performing for each agent: , , and a condition common to all agents, where t, r and s and a condition common to all agents, where t, r and s  i are the shares of participation in the total income of the principal, supervisor and agent, respectively. i are the shares of participation in the total income of the principal, supervisor and agent, respectively. These conditions are necessary, i.e. if all three of them are met, this does not mean that the model is systemically consistent. But if at least one condition is violated, then the model is definitely not consistent.

Proof. As was established in [1]:

where , ,

where . . Taking into account the surcharge offered by the supervisor to the agent in exchange for a bribe,

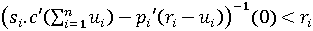

where . . Note that u i > u i NE , which means that theoretically it can be equal to u i max. In the case of u i max= 0, there is a system consistency initially and the supervisor will not be able to influence it. If there is a Pareto-optimal solution inside the segment under consideration, the condition must be met

, ,

which can be done only when s i+(1?b i) i = 1. But this situation is possible only if the principal himself has allocated all public income to only one agent. In this case, the supervisor is deprived of the opportunity to apply the corruption mechanism. That is, the supervisor can change the consistency in the system only if u i max = r i, which is possible if the condition  is met. In this case, for system consistency, it is performed is met. In this case, for system consistency, it is performed , but , but , which corresponds to the fact that without giving a bribe, it is not profitable for the agent to spend all resources on common goals, and in the case of giving a bribe, it becomes profitable. Consider these three conditions. , which corresponds to the fact that without giving a bribe, it is not profitable for the agent to spend all resources on common goals, and in the case of giving a bribe, it becomes profitable. Consider these three conditions. The condition  assumes that assumes that  . (7) . (7) The condition  assumes that assumes that  . (8) . (8)  It follows from the condition that It follows from the condition that

, ,

or taking into account (8)  . .

But the limitation condition  is satisfied only if is satisfied only if  or or  , (9) , (9) that was what needed to be proved. Note that theoretically it is possible to increase the consistency of the model. But empirically, the probability of simultaneous fulfillment of all conditions (7) – (9) is negligible, although condition (8) is easiest to fulfill — assign all s i to sufficiently small numbers, let's say s i = 0, and then with a sufficiently large premium  to the share of participation in the total income, it becomes profitable for the agent to bribe the supervisor. But it is very difficult to provide a large enough allowance to the supervisor, and most often it is impossible. to the share of participation in the total income, it becomes profitable for the agent to bribe the supervisor. But it is very difficult to provide a large enough allowance to the supervisor, and most often it is impossible. Consequence 4. In the case of a power-law concave function of private income(note that it is this function that most often describes economic processes)pi = pixa it is impossible to increase the value of the public welfare function by introducing a mechanism of economic corruption. The proof is obvious due to the fact that , and, consequently, p i’(0) = ?, which makes it impossible to fulfill the conditions of the principal's interest (7) and the conditions of the supervisor's capabilities (9). , and, consequently, p i’(0) = ?, which makes it impossible to fulfill the conditions of the principal's interest (7) and the conditions of the supervisor's capabilities (9). 6. Conclusion In the model of the combination of general and private interests, the mechanism of economic corruption is investigated using two approaches: descriptive and optimization. The following conclusions were obtained. 1. A descriptive approach to the study of economic corruption in the SOCHI model has shown that the optimal bribe is determined by the type of bribery function, but not by the economic effect of the realization of common and honest interests of agents. Economic corruption with both specified and synthesized functions of bribery is always beneficial for the agent. It is possible to fight economic corruption only by reducing the initial share of the Principal, due to which the corruption surcharge to the agent occurs. If economic corruption cannot induce an agent to change his strategy for allocating resources to common goals, then almost all of the increase in the agent's share of public income goes as a bribe to the supervisor. 2. Economic corruption can increase system consistency in the model under consideration, but this is unlikely, since this requires the fulfillment of the (2n+1) th condition: conditions   for all agents and a condition common to the whole system for all agents and a condition common to the whole system . Moreover, with an increase in n, the probability of joint fulfillment of all conditions decreases. It is also proved that these conditions are not met for the most commonly used in economics function of describing economic processes – concave power ones. . Moreover, with an increase in n, the probability of joint fulfillment of all conditions decreases. It is also proved that these conditions are not met for the most commonly used in economics function of describing economic processes – concave power ones.

References

1. Gorbaneva O.I., Ugol'nitskii G.A. Staticheskie modeli soglasovaniya obshchestvennykh i chastnykh interesov pri raspredelenii resursov // Matematicheskaya teoriya igr i ee prilozheniya. 2015. ¹8:2. S. 28—57.

2. Rybasov E.A., Ugol'nitskii G.A. Matematicheskoe modelirovanie ierarkhicheskogo upravleniya ekologo-ekonomicheskimi sistemami s uchetom korruptsii // Komp'yuternoe modelirovanie. Ekologiya. Vyp.2. M.: Vuzovskaya kniga. 2004. S.46-65.

3. Mal'sagov M. Kh., Ugol'nitskii G. A., Usov A. B. Bor'ba s ekonomicheskoi korruptsiei pri raspredelenii resursov // Komp'yuternye issledovaniya i modelirovanie. 2019. ¹ 11:1. S. 173–185.

4. Gorbaneva O. I., Ugol'nitskii G. A. Modeli raspredeleniya resursov v ierarkhicheskikh sistemakh upravleniya kachestvom rechnoi vody // Upravlenie bol'shimi sistemami. 2009. ¹ 26. S. 64–80.

5. Gorbaneva O. I., Ugol'nitskii G. A. Statisticheskie modeli ucheta faktora korruptsii pri raspredelenii resursov v trekhurovnevykh sistemakh upravleniya // Upravlenie bol'shimi sistemami. 2013. ¹42. S. 195–216.

Link to this article

You can simply select and copy link from below text field.

|