|

MAIN PAGE

> Back to contents

Finance and Management

Reference:

Korotin K.V.

Prospects of cooperation of the Russian Federation with friendly countries in the framework of investment activities.

// Finance and Management.

2023. № 2.

P. 1-14.

DOI: 10.25136/2409-7802.2023.2.40856 EDN: UDVHEQ URL: https://en.nbpublish.com/library_read_article.php?id=40856

Prospects of cooperation of the Russian Federation with friendly countries in the framework of investment activities.

Korotin Kirill Vladimirovich

Postgraduate Student, Department of Economics, Nizhny Novgorod Institute of Management – Branch of RANEPA

603950, Russia, Nizhny Novgorod region, Nizhny Novgorod, Prospekt Gagarina str., 46

|

korotinkirill28@gmail.com

|

|

|

Other publications by this author

|

|

|

DOI: 10.25136/2409-7802.2023.2.40856

EDN: UDVHEQ

Received:

28-05-2023

Published:

06-06-2023

Abstract:

The object of the study is investment activity in the Russian Federation. The subject of the study is the implementation of investment activities in relation to friendly foreign states. The purpose of the work is to assess the possible prospects and risks of the orientation of the economy of the Russian Federation on cooperation with friendly countries in the field of investment. Tasks of the work: • To assess the regulatory framework for the orientation of the economy of the Russian Federation to friendly countries; • Analyze economic indicators in relation to friendly countries; • To assess the prospects for cooperation with unfriendly countries in the medium term. The main method of research is analysis. The author analyzes the regulatory framework in the sphere of orientation of the economy of the Russian Federation to strengthen partnership with friendly countries, provides analysis of various indicators of friendly countries and companies belonging to the jurisdiction of friendly countries. Based on the analysis, the author identifies the problem points, relying on the methods of logic. Today, the economy of the Russian Federation is reorienting towards building relations with friendly states. Such a decision is an atypical measure of economic regulation, and there are a small number of examples of similar examples of actions by state bodies. The decision causes an active discussion in the Russian society, which confirms the relevance of this study. The key problem points directly related to the restriction of access to investments in companies of unfriendly foreign states and current investment opportunities in companies of friendly states are identified. The author puts forward several recommendations that can reduce the level of uncertainty in the financial market and reduce risks in the field of investments.

Keywords:

Investments, Economic regulation, Friendly countries, Sanctions, Financial market of the Russian Federation, Central Bank of the Russian Federation, Hostile countries, Tax incentives, Developed countries, Investment security

This article is automatically translated.

You can find original text of the article here.

Introduction. March 5 , 2022 The Government of the Russian Federation at the legislative level has fixed the list of foreign states and territories that commit unfriendly actions against the Russian Federation, Russian legal entities and individuals – unfriendly foreign states [2]. After the creation and approval of the list of unfriendly foreign states, regulatory legal acts, as well as programs of government departments and institutions, show a tendency to encourage interaction with friendly foreign states and complicate the process of interaction with unfriendly foreign states. Starting from March 2022, a special procedure has been established for carrying out economic activities related to unfriendly foreign states. In particular, transactions may require coordination with the Central Bank of the Russian Federation, the Ministry of Finance of the Russian Federation, the Government Commission for the Control of Foreign Investment in the Russian Federation [1]. At the moment, the course of encouraging interaction with friendly countries can be traced in all areas of state regulation of the economy, including in the field of regulation of credit institutions, the securities market and investment activities. In this paper, the prospects of cooperation between the Russian Federation and friendly countries in the framework of investment activities are analyzed. The paper provides an assessment of the course of the Central Bank of the Russian Federation in relation to the development of cooperation with friendly countries. The current position of the scientific community in relation to the development of economic relations with friendly countries is carried out in the work. Statistical information on various indicators characterizing the prospects of investing in friendly countries was also analyzed, and a list of measures to resolve the existing contradictions was determined. The course of the Bank of Russia on the development of cooperation with friendly countries. The course of cooperation with friendly foreign states can be traced in the strategy of the financial market of the Russian Federation until 2030. In the paragraph "Principles of the development of the Russian Financial Market" of section I "General Provisions", the development of mutually beneficial partnerships with friendly countries is highlighted as one of the principles. A similar statement is contained in section II "The main trends in the development of the Russian Financial Market in previous years". The item "Development of International cooperation" of section III "Conditions and long-term priorities for the development of the Russian financial market" contains the intention to create tax and other conditions for investors and issuers from friendly foreign states, admission of financial organizations from friendly foreign states to carry out activities on the territory of the Russian Federation [3]. As part of the analysis of the strategy for the development of the financial market in the short term – until 2025, the course for cooperation with foreign friendly states is also clearly traced. The improvement of interaction with friendly countries is highlighted at the level of prerequisites, mechanisms, tasks, such as the development of corporate relations, increasing the protection of consumers of financial services, the development of international payments and settlements, the configuration of currency regulation and others [4]. The combination of intentions to reduce administrative barriers, tax benefits and other methods of encouraging the development of relations with financial market entities of friendly foreign states with increased control and limited opportunities for interaction with financial market entities of unfriendly foreign states demonstrate the current course of development of the financial sector in the Russian Federation. It can be noted that due to the unprecedented pressure on the financial sector of the Russian Federation, external and internal economic factors, at the moment there is an objective need for state regulation of the financial sector. Before analyzing the prospects for cooperation with friendly countries, it is necessary to provide theoretical information on the regulation of the economy, and, in particular, the financial sector, as well as to analyze the position of the scientific community regarding the development of cooperation with friendly countries. The position of the scientific community regarding the development of cooperation with friendly countries. Today, representatives of the Russian scientific community suggest a decrease in the effectiveness of traditional methods of monetary regulation. In particular, the exhaustion of the potential of the traditional interest rate policy of central banks is noted. Kudrin A.L. notes that during the COVID-19 pandemic, central banks were forced to apply non-standard solutions to regulate the economy. For example, in developing countries, asset repurchase programs were launched for the first time, which were previously implemented only by the monetary authorities of developed countries [5]. The accumulated experience in regulating the financial sector during the COVID-19 pandemic was useful for state regulation of the financial sector in 2022, including for reorienting the economy and building a trend towards developing relations with friendly countries. In accordance with the position of the state bodies of the Russian Federation described earlier, the intention to strengthen cooperation with the economies of friendly foreign states is primarily related to ensuring the security of economic activity and protecting the interests of investors. Special attention should be paid to the position of the scientific community in relation to the development of cooperation with friendly countries. At the moment, there is a scientific gap in the analysis of cooperation with friendly countries. Many works are devoted to specific aspects of the current situation – strengthening strategic partnership with China, India, Belarus and other states, mainly within the real sector of the economy. There are no scientific papers devoted to the development of cooperation with friendly countries in the field of investment, analysis of the general problems of developing cooperation with friendly countries and the establishment of restrictions for cooperation with unfriendly countries.

As an example of the development of cooperation with friendly countries, it should be noted the position of Yampolskaya D. O. in relation to the development of cooperation between Russia and China and India in the field of electronic industry. Despite the common position of experts that China and India should become Russia's main partners in the supply of electronic industry products. At the same time, the author notes the existence of many sanctions against the Chinese electronics industry. Thus, cooperation between Russia and China in the field of electronic industry supplies may lead to an increase in the number of sanctions by the United States. In the case of Chinese manufacturers, when selling products to the Russian Federation, in addition to general market indicators, an analysis of sanctions risks will be carried out, which complicates the supply process. On the other hand, the author puts forward a thesis according to which the largest equipment manufacturers have the opportunity to avoid sanctions, including by increasing production capacity outside the United States. In conclusion, the author notes that there are economic prerequisites for cooperation in terms of return on investment in joint projects, bypassing political aspects [6]. At the same time, "getting past the political aspects" is a very difficult task for the Russian government, the final result, which depends on many external factors, including those independent of the actions of the Russian Federation. Analyzing the financial support of Russian exports in modern conditions, Sakharov D.M. notes the need to deepen financial cooperation with friendly countries and the development of public-private partnership. The author describes in detail the conditions for creating settlements in the national currencies of friendly countries, and mentions the importance of insurance instruments to promote the growth of Russian exports to friendly countries [7]. In this case, the benefit of this study is to evaluate the insurance tool to ensure economic interaction with friendly countries. On the other hand, at the moment there is an important problem of providing insurance opportunities not only to Russian market participants, but also to representatives of friendly countries. In the case of investment activities, the problem of insurance to representatives of friendly countries is particularly relevant, since the risk of sanctions is a complex risk for insurance companies from the point of view of risk assessment. For example, if sanctions are applied against a counterparty from a friendly country, the amount of risk for a Russian investor will be equal to the amount of investment. For a legal entity from a friendly country, sanctions can have a direct impact on all operational activities, and the amount of risk will be significantly greater. This fact puts investors from the Russian Federation and from friendly countries in an unequal position in the event of counter-sanctions. When assessing external threats to the economic security of the Russian Federation, the authors define high integration with the economies of unfriendly countries as a problem in the field of economic security [8]. This thesis should be analyzed from the point of view of logic – if the economy of the Russian Federation depends on integration with the economies of unfriendly countries, then there is an inverse relationship. Further analysis will include an analysis of the assets of existing credit institutions, including with shareholders from unfriendly countries. In the case of the relations of the Russian Federation with unfriendly countries, each case is a separate event with its own introductory data. It should be noted that in some cases it is possible to apply the dependence of specific subjects of unfriendly countries on the economy of the Russian Federation to ensure their own economic development, instead of spending the state on building new economic relations. Economic integration can be not only a threat, but also an opportunity to minimize current risks. When analyzing possible formats for the development of investment in the national economy, Chernenko V.A., Voronov A.A. and Reznik I.A., there is a position on the need for import substitution, including through the speedy replacement of non-residents as a result of refusal to work in Russia - for Russian investors and reliable foreign investors from friendly countries [9]. This position is correct in the context of ensuring economic security. Appropriate measures will significantly increase the state of security of the Russian economy, in particular investors. But at the same time, the concept of full import substitution is initially incorrect. In many areas, in particular in the production of low-margin products and investments in the relevant areas, the payback period of investments can be measured in tens of years, in the absence of prospects in terms of profit margins. On the other hand, the development of some high-tech and innovative industries is associated with making a profit and satisfactory payback periods for projects, but subject to the availability of a finished product on the market, even if the product belongs to residents of unfriendly countries, it is necessary to conduct an additional analysis of each specific project. When analyzing the assessment and prospects for the development of the economy of the Russian Federation, E.K., Karpunina and other authors note a significant share of the foreign trade of the Russian Federation with unfriendly countries, both in terms of imports and exports. The authors propose to pursue a consistent policy of transferring exports from unfriendly countries to countries such as the UAE, Egypt, Mexico, Algeria, Saudi Arabia, Singapore and other countries [10]. The authors justify this thesis by reducing the risks of introducing restrictions with unfriendly countries. In the context of investment activity, an increase in exports to friendly countries can serve as a basis for creating investment conditions. Thus, most studies at the moment are devoted to interacting with friendly countries in the real economy sector. The issues of investment prospects in friendly countries are not mentioned as a subject of research within the framework of scientific papers, which confirms the relevance of the research. With regard to current research, several problematic points should be highlighted. Firstly, the authors of the works often do not mention the risk of counter-sanctions, which significantly hinders partnership with friendly countries. Secondly, the proposal for the use of import substitution, which is often found in ongoing studies, does not imply specifying the sectors of the economy to which import substitution should be directed. Analysis of statistical and economic indicators of friendly countries.

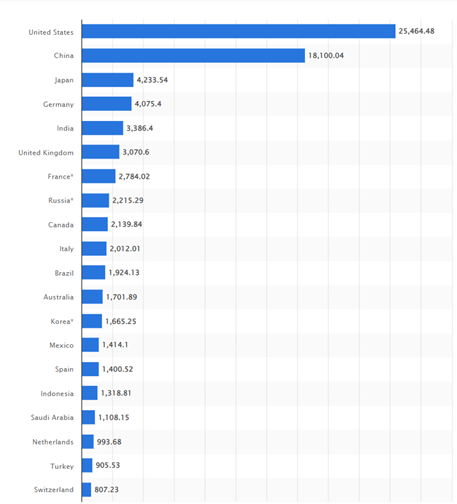

The first economic indicator by which it is customary to evaluate the country's economy is the GDP indicator. Among the 20 largest countries in terms of GDP in 2022, 12 states belong to unfriendly foreign states, 7 states belong to friendly foreign states. According to the statistical agency Statista, Russia ranks 8th in terms of GDP in 2022. On the other hand, China, which is not an unfriendly foreign state, is in second place, and has an accumulated GDP of 18,100.04 Billion US dollars, which exceeds the cumulative accumulated GDP of nine unfriendly states located in positions from 6 to 20 of the rating and is clearly shown in Figure 1. The GDP indicator allows noting, among other things and the need of the economy for new products. The higher the GDP, the higher the level of production and the higher the need for purchased products or services.

Figure 1. GDP in billions of US dollars for 2022 Source: 11[11] The assessment of potential trading partners based on the GDP indicator is more representative if trade cooperation is related to the export of raw materials. Since this work analyzes the financial sector, it is necessary to focus on other indicators as well. The United Nations Development Program calculates the Human Development Index (HDI), which estimates life expectancy, literacy rate and standard of living based on gross national income. People living in more favorable conditions will be willing to invest more, so it is also advisable to evaluate countries for the presence of potential investors through the HDI indicator. Among the 20 countries with the highest HDI index, only 1 country is friendly towards the Russian Federation – China 1[12]. In this case, statistics show that a large number of potential investors – individuals and legal entities - are limited in their opportunities to invest in the economy of the Russian Federation. In 2021, a rating of the 10 most attractive countries for investment was published. Similarly with HDI statistics, only China is a friendly foreign country that is included in this rating [These countries are the most attractive for investors after the COVID-19 pandemic // Forbes [13]. These statistics show that Russian investors are also limited in investment opportunities with the opportunity to get the highest return. Based on the data companiesmarketcap.com for this work, the statistics of companies in terms of capitalization, operating profit, revenue and assets were analyzed. These indicators have an impact on investment decisions. We selected the largest 50 companies within each indicator, and divided the companies by jurisdiction into companies from friendly (or neutral) countries and companies from unfriendly countries.

Fig. 2. The number of companies from friendly countries according to various indicators, % of the top 50 companies according to the corresponding indicator. Source: 1[14] The share of friendly or neutral companies in relation to the Russian Federation among the 50 largest companies in terms of indicators does not exceed 30% in all analyzed groups, which is clearly demonstrated in Fig. 2. By analogy with the indicators analyzed earlier, the low share of companies from the top 50 in terms of market capitalization, operating profit, revenue and the amount of assets indicates the existing restrictions for Russian investors. It should be noted that in addition to the problems of investment prospects in companies of friendly countries, there is also the fact of the continuation of the activities of foreign companies from unfriendly foreign countries. As an example, we should consider the banking sector. In the rating of banks by the amount of assets as of February 2022, among the largest 50 banks, 4 banks have a total amount of assets of 3,705,360,512 thousand rubles. The shareholders are companies from unfriendly countries: Raiffeisen Bank, UniCredit Bank, Citibank, ING Bank 1[15]. Despite the existence of precedents for the transfer of bank assets to Russian investors, as in the case of Rosbank 1[16] or Home Credit Bank 1[17], banks with owners from unfriendly countries continue to operate on the territory of the Russian Federation. In the statements of representatives of state bodies, such as the Central Bank of the Russian Federation, as well as representatives of the State Duma, there is a tendency to maintain economic relations with unfriendly countries. According to the head of the Central Bank of the Russian Federation, the current task for the Russian economy is to attract foreign investment, including from unfriendly countries 1[18]. A similar thesis is put forward by the head of the State Duma Committee on the financial market [19]. Potential investors, in addition to restrictions on access to assets from unfriendly foreign states, also have uncertainty about the duration of the course of state policy for the development of economic relations with friendly foreign states. Investors can analyze a possible change in the course of state policy and reorientation towards the resumption of economic relations with unfriendly foreign states, including the abolition of currently existing restrictions, which will lead to an increase in the state of uncertainty in the market. Ways to solve the existing problems

The current situation with the division of countries into friendly and unfriendly is explained, first of all, by the political situation that has developed in 2022. To resolve the existing contradictions described earlier in the work, a number of measures should be taken. First, it is necessary to identify the most promising sectors of the economies of friendly countries in order to carry out tax incentives and reduce restrictive factors in specific areas. Directing efforts to reorient investments to specific sectors of the economy of friendly countries will reduce government spending on the development of the financial sector of the Russian Federation. Secondly, it is necessary to continue working to minimize the risks of counter-sanctions. At the moment, for potential investors, both Russian and foreign, one of the key problems is the risk of counter-sanctions. In this situation, the risk of counter-sanctions significantly increases the state of uncertainty in the financial market. To solve this problem, it is possible to develop an insurance institution, define interstate cooperation within specific sectors of the economy. With the development of the insurance institute, it is necessary to resolve the previously identified contradiction, in which the risks of counter-sanctions for an investor from the Russian Federation and a legal entity from a friendly foreign state are disproportionate. In 2023, special administrative districts (SAR) are becoming particularly relevant, in which by the end of 2023, according to the estimates of the Ministry of Economic Development, a total of 250 organizations are expected to be registered. In accordance with the statements of the Ministry of Economic Development, it is proposed to increase the period of exclusion of international companies from the foreign register to 5 years, expand the range of foreign legal entities to create an international company "from scratch" in the SAR, reduce the size of assets transferred to the international personal fund from 5 billion. 500 million rubles each . Such measures will give the business sufficient time to exclude the "double" registration of the company and will increase the attractiveness of creating an international personal fund in the SAR [20]. It should be noted that this measure is effective if the potential partner is not interested in further conducting activities with unfriendly countries, that is, the risk of counter-sanctions will not affect its operational activities. Thirdly, it is necessary to regularly assess the possibility of resuming relations in the financial sector with unfriendly foreign states, since restrictions on the freedom of investment in the future may have a negative impact on the state of the financial sector of the Russian Federation. Assessment of the possibility of resuming relations with unfriendly countries should be made in connection with a number of circumstances: · The dependence of the Russian economy on unfriendly countries is at a very high level, and the facts of the continuation of the activities of large credit institutions with shareholders from unfriendly countries, together with statements by representatives of government agencies, indicate the prospects for maintaining economic relations with unfriendly countries; · Full import substitution and the transfer of all investments to friendly countries is an economically unjustified decision. In the current conditions of uncertainty, any decision on the development of the economy, including in the field of investment, must be evaluated in terms of potential budget expenditures of the Russian Federation; · A reduction in economic and investment cooperation with friendly countries means a reduction in diplomatic ways to resolve the existing contradictions. Trade relations can be one of the reasons for maintaining and establishing relations between states. Conclusion The adoption of concrete measures to stimulate economic relations with companies from friendly countries, the gradual lifting of restrictions on access to assets from unfriendly countries in the foreseeable future will improve the investment climate in the Russian Federation. Today, investment activity in the Russian Federation is in a state of uncertainty due to a number of problems. First of all, it cannot be unequivocally stated that the development of issued and received investments in unfriendly countries is a negative factor for the economy of the Russian Federation, which should be reduced to a zero level of activity. On the other hand, the development of investment relations with friendly countries is also associated with a number of difficulties – the risks of counter-sanctions, the difference in the estimated amount of risk, the presence of institutions and legal norms that provide advantages for investments in friendly countries.

References

1. On Additional Temporary Economic Measures to Ensure the Financial Stability of the Russian Federation: Decree of the President of the Russian Federation dated 01.03.2022 No. 81 (as amended by 03.03.2023)//Access from the Reference Legal System Consultant Plus URL: https://www.consultant.ru/document/cons_doc_LAW_410578/ (accessed: 19.05.2023)

2. On Approving the List of Foreign States and Territories Performing Hostile Actions against the Russian Federation, Russian Legal Entities and Individuals: Directive of the Government of the Russian Federation dated 05.03.2022 No. 430-r (as amended by 29.10.2022)//Access from the Legal Reference System Consultant Plus URL: https://www.consultant.ru/document/cons_doc_LAW_411064/e8730c96430f0f246299a0cb7e5b27193f98fdaa/ (accessed: 19.05.2023)

3. On Approving the Development Strategy of the Financial Market of the Russian Federation to 2030: Directive of the Government of the Russian Federation dated 29.12.2022 No. 4355-r//Access from the Legal Reference System Consultant PLUS URL: https://www.consultant.ru/document/cons_doc_LAW_411064/e8730c96430f0f246299a0cb7e5b27193f98fdaa/ (accessed: 19.05.2023)

4. Main areas of development of the financial market of the Russian Federation for 2023 and the period 2024 and 2025: Information of the Bank of Russia dated 6 December 2022//GARANT: information and legal system URL: https://www.garant.ru/products/ipo/prime/doc/405940527/ (accessed: 10.05.2023)

5. Economics and Economic Policy in the Context of a Panemics/Under Review Dr. Econ. Kudrina A.L. - M.: Publishing House of the Gaidar Institute, 2021. — 344 pages, page 139

6. Yampolskaya Diana Olegovna ELECTRONIC INDUSTRY: PROSPECTS FOR THE DEVELOPMENT AND COOPERATION OF THE RUSSIAN FEDERATION WITH FRIENDLY COUNTRIES//VESTN. Volume. State un. chk Economics. 2022. №60. URL: https://cyberleninka.ru/article/n/elektronnaya-promyshlennost-perspektivy-razvitiya-i-sotrudnichestva-rf-s-druzhestvennymi-stranami (accessed: 01.06.2023).

7. Sakharov Dmitry Mikhailovich DEVELOPMENT OF INSTRUMENTS OF STATE FINANCIAL SUPPORT FOR RUSSIAN EXPORTS IN MODERN CONDITIONS//World of the New Economy. 2022. №4. URL: https://cyberleninka.ru/article/n/razvitie-instrumentov-gosudarstvennoy-finansovoy-podderzhki-rossiyskogo-eksporta-v-sovremennyh-usloviyah (accessed: 01.06.2023)

8. Irina Nikolaevna Medical, Oksana Alexandrovna Chepinoga, Irina Valerievna Derevtsova EXTERNAL THREATS TO THE ECONOMIC SECURITY OF RUSSIA//Baikal Research Journal. 2022. №3. URL: https://cyberleninka.ru/article/n/vneshnie-ugrozy-ekonomicheskoy-bezopasnosti-rossii (accessed: 01.06.2023)

9. V.A. Chernenko, A.A. Voronov, I.A. Reznik INVESTMENT OF THE NATIONAL ECONOMY: NEW FORMAT OF DEVELOPMENT//EV. 2022. №2 (29). URL: https://cyberleninka.ru/article/n/investirovanie-natsionalnoy-ekonomiki-novyy-format-razvitiya (accessed: 01.06.2023)

10. Foreign economic activity as a determinant of the economic security of Russia: assessment of threats and development prospects under sanctions restrictions/E.K. Karpunina, A.Yu. Usanov, S.A. Trufanova, N.N. Guberatorov//Gazptiya of Southwestern State University. Series: Economics. Sociology. Management. 2022. T. 12, No. 5. Page 10‒26. https://doi.org/10.21869/2223-1552-2022-12-5-10-26

11. Companies with the largest GDP in 2022, USD billion US//Statista [Electronic Resource]. URL: https://www.statista.com/statistics/268173/countries-with-the-largest-gross-domestic-product-gdp/ (accessed: 21.05.2023)

12. Human Development Index. Data for 2021//HDR [Electronic resource]. URL: https://hdr.undp.org/data-center/human-development-index #/indicators/HDI (accessed: 21.05.2023)

13. These countries are the most attractive for investors after the COVID-19//Forbes URL: https://www.forbes.com/sites/iese/2021/07/08/these-are-the-most-attractive-countries-to-investors-post-covid/?sh=6acdcab02698 (accessed: 21.05.2023)

14. Largest companies by various indicators//Companiesmarketcap [Electronic resource]. URL: https://companiesmarketcap.com/ (accessed: 21.05.2023)

15. Financial rating of banks by assets// Banki.ru [Electronic resource]. URL: https://www.banki.ru/banks/ratings/ (accessed: 22.05.2023)

16. Societe Generale completed the sale of Rosbank and the insurance business in Russia to Interros//Rossiyskaya gazeta [Electronic resource]. URL: https://rg.ru/2022/05/18/societe-generale-zavershila-prodazhu-rosbanka-i-strahovogo-biznesa-v-rossii-interrosu.html (accessed: 22.05.2023)

17. Home Credit Bank is no longer part of Home Credit. Now the Bank is half owned by//Rambler [Electronic Resource]. URL: https://finance.rambler.ru/business/49248513/?utm_content=finance_media&utm_medium=read_more&utm_source=copylink (accessed: 22.05.2023)

18. "It's not trendy to say": Nabiullina called for "hostile" investors to be retained// Forbes.ru [Electronic resource]. URL: https://www.forbes.ru/finansy/489390-eto-ne-modno-govorit-nabiullina-prizvala-sohranit-nedruzestvennyh-investorov (accessed: 23.05.2023)

19. The Russian authorities need investors from hostile countries//IBC [Electronic resource]. URL: https://www.mbk.ru/news/vlastiam-rf-nuzny-investory-iz-nedruzestvennyx-stran (accessed: 21.05.2023)

20. Ilya Torosov: expect 250 companies in Russian SAR//Ministry of Economic Development of the Russian Federation [Electronic resource] by the end of 2023. URL: https://www.economy.gov.ru/material/news/ilya_torosov_ozhidaem_k_koncu_2023_goda_250_kompaniy_v_rossiyskih_sar.html (accessed: 06.02.2023)

First Peer Review

Peer reviewers' evaluations remain confidential and are not disclosed to the public. Only external reviews, authorized for publication by the article's author(s), are made public. Typically, these final reviews are conducted after the manuscript's revision. Adhering to our double-blind review policy, the reviewer's identity is kept confidential.

The list of publisher reviewers can be found here.

The subject of the study. The manuscript presents the results of a study of Russia's interaction with friendly countries. The main strategic documents are described, which indicate the importance of such interaction. The tools that Russia uses to strengthen such interaction are named, and the prospects for this cooperation are analyzed. The authors identified a number of contradictions that arise as a result of ongoing interaction with unfriendly countries. Research methodology. The research is based on the authors' application of general scientific research methods – analysis, synthesis, generalization, analogy, comparative analysis. Tabular and graphical methods of data representation were used in the work. The relevance of the issues discussed in the manuscript is beyond doubt. Currently, Russia is under the yoke of sanctions pressure from unfriendly countries, but an analysis of the current situation allows us to conclude that despite this, cooperation in certain sectors of the economy with these states continues. The presented work focuses on the need to increase cooperation with foreign friendly states, using the tools of state regulation, including tax incentives. The issues raised in the manuscript are "topical" and deserve discussion. The authors analyzed the GDP indicators of friendly and unfriendly countries and conducted a comparative analysis of the data obtained, also analyzed the statistics of companies in terms of capitalization, operating profit, revenue and assets from friendly and unfriendly countries, and drew conclusions. The scientific novelty in the manuscript seems insignificant, the authors very briefly described the measures aimed at overcoming the existing contradictions. Also, the position of the authors regarding interaction with unfriendly countries is not clear from the manuscript, the authors noted that "it is necessary to regularly assess the possibility of resuming relations in the financial sector with unfriendly foreign countries." This thesis is insufficiently reasoned in the context of the work. The authors also do not describe specific measures that are being taken at the state level to strengthen cooperation with friendly countries. The author should have focused on these tools, for example, to describe the mechanism of ATS. There are no independent conclusions of the authors based on the results of the study. Style, structure, and content. The style of presentation is scientific. The content of the article corresponds to the formulated topic. The manuscript corresponds to the subject of the journal. The conceptual framework is correct, as it is based on the study of terminology used in Russian literature. Generally accepted scientific terms are used in the presentation of the material, the work is written in an accessible language. It should be noted that the authors should structure the manuscript. Add sections such as: introduction, main part (subsections), conclusions and conclusion. The bibliography consists of 19 sources, some of which are not peer-reviewed scientific publications and should be arranged in the form of footnotes. Textbooks reviewed by the authors should be excluded from the list of sources, and relevant scientific articles should be added. Appeal to opponents. The manuscript does not contain a scientific discussion, despite the presence of a list of sources. When finalizing the article, it is recommended to compare the results of research by other scientists in the field of interaction with friendly and unfriendly countries. Conclusions, the interest of the readership. Taking into account all the above, it should be noted that the manuscript needs to be finalized. The topic under consideration is relevant in view of the current economic agenda and may be of interest to a wide range of people. It seems that with the qualitative elimination of the comments indicated in the review and the successful completion of the re-review, the article can be published.

Second Peer Review

Peer reviewers' evaluations remain confidential and are not disclosed to the public. Only external reviews, authorized for publication by the article's author(s), are made public. Typically, these final reviews are conducted after the manuscript's revision. Adhering to our double-blind review policy, the reviewer's identity is kept confidential.

The list of publisher reviewers can be found here.

The subject of the study. Taking into account the generated title, the article should be devoted to determining the prospects for cooperation between the Russian Federation and friendly countries in the framework of investment activities. The content of the article corresponds to the stated topic. The research methodology is based on the analysis and synthesis of numerical data and textual information. It is especially valuable that the author's individual results are presented graphically. When finalizing the article, the author is recommended to build a drawing in the form of a diagram or draw a table showing the ratio of the identified problems and ways to solve them. The relevance of the study of issues related to the assessment of the prospects of socio-economic cooperation of the Russian Federation with friendly countries is beyond doubt, as it fully meets the tactical and strategic goals and objectives of the development of the Russian Federation. Of particular interest to the scientific community, experts and analysts, as well as officials of state authorities of the Russian Federation and subjects of the Russian Federation, are specific practical recommendations for solving existing problems, including in the context of accelerating the process of achieving the national development goals of the Russian Federation, defined in the Decree of the President of Russia dated July 21, 2020. There is a scientific novelty in the peer-reviewed scientific article. In particular, the author substantiates the existing problems and presents ways to solve the problems. In order to improve the quality of the article, it is necessary to develop these areas to more specific activities. Style, structure, and content. The style of presentation is scientific. The structure of the article by the author is built quite concretely, contributes to the consistent presentation of the author's position and the argumentation of the judgments given. Familiarization with the content allows us to conclude about a fairly original approach to identifying problems and determining directions for their solution, but in order to ensure a qualitatively high level of developed recommendations, they should be formulated more specifically. For example, it is argued that it is necessary to identify the most promising sectors of the economies of friendly countries, but which sectors belong to them? The author also argues that it is necessary to regularly assess the possibility of resuming relations in the financial sector with unfriendly foreign countries, but it is not specified who should carry it out and on the basis of what criteria. Bibliography. The author has compiled a bibliographic list consisting of 20 sources. However, the design of the list of references is done carelessly: the names of the articles are indicated exclusively in capital letters, the pages on which the scientific article is published are not given. Moreover, the author uses the abbreviation "RF", which is not acceptable in scientific texts. Appeal to opponents. The author analyzes the opinions of the scientific community on the issues considered in the text of the scientific article. When finalizing the article, it is recommended to compare the results obtained by the author of the article with the results of scientific research presented in the bibliographic list. This will strengthen and clearly substantiate the presence of scientific novelty. Conclusions, the interest of the readership. Taking into account all of the above, it should be noted the great work of the author on the collection, systematization and other processing of data that provide justification for the author's position in terms of evaluating the existing one. In order to meet the existing demand from the readership, the author is recommended to strengthen the depth of the author's recommendations by defining specific recommendations within the designated areas.

Link to this article

You can simply select and copy link from below text field.

|

|