|

MAIN PAGE

> Back to contents

Finance and Management

Reference:

Golikova E.I.

Inflation in Russia: revealing the causes and the path of decline (on the strategic management platform)

// Finance and Management.

2022. ¹ 2.

P. 44-78.

DOI: 10.25136/2409-7802.2022.2.37406 EDN: XMIHFN URL: https://en.nbpublish.com/library_read_article.php?id=37406

Inflation in Russia: revealing the causes and the path of decline (on the strategic management platform)

Golikova Ekaterina Igorevna

Candidate of Economic Sciences

115582, Russia, g. Moscow, ul. Domodedovskaya, 24, korp. 4,, kv. 98

|

ekt-g@mail.ru

|

|

|

Other publications by this author

|

|

|

DOI: 10.25136/2409-7802.2022.2.37406

EDN: XMIHFN

Received:

26-01-2022

Published:

06-07-2022

Abstract:

In this study, it is proposed to conduct an experimental monetary reform in one of the regions of Russia. To carry out monetary reform by introducing a fee for the use of funds in the balance at the end of the month of each of the participants in economic relations. The purpose of the new monetary reform is to achieve the reduction of inflation to zero. This study is based on observations and practical experience of European countries, China. In this paper, the author believes that monetary inflation is caused by money added during distribution in different ratios. As the root cause of inflation, interest is singled out as one of the components added during the distribution of money, which generates a social conflict regarding the redistribution of public wealth. The experimental monetary reform may be the beginning of other reforms and a component of Russia's economic development within the framework of strategic management. The advantages of monetary reform of the natural economic order in combination with other reforms are as follows: reduction of inflation (almost to zero), which is caused mainly by a significant percentage component of the distributed funds; exclusion of percentages from the cost components and, as a consequence, prices as an instrument of income redistribution in an unfair way, i.e. accumulation of most of the income from a small group of individuals, and in amounts larger than they need; prevention of social catastrophe, prevention of social unrest and social clashes, reduction of the level of aggressiveness in society and the onset of social justice; reduction of prices for goods and services up to 50%; the emergence of a stable nationally-oriented quality economy; the possibility of updating physically and morally worn out fixed assets of public infrastructure; GDP growth.

Keywords:

inflation, percent, monetary reform, redistribution of income, distribution of money, added money, economic development, tax, unemployment, strategic management

This article is automatically translated.

You can find original text of the article here.

Introduction. The relevance of this study lies in the fact that for a number of years inflation in Russia has been a socio-economic problem and a brake on Russia's economic development. The most acute inflationary issue in the current period arises after the statement of the Bank of Russia on the key rate on March 18, 2022 in connection with its increase to the level of 20% per annum on February 28, 2022. E.S. Nabiullina stated that the Russian economy is entering a phase of large-scale structural adjustment, which will be accompanied by a temporary but inevitable period of increased inflation; the monetary policy pursued by the Bank of Russia will create conditions for gradual adaptation of the economy to new conditions and the return of annual inflation to the target of 4% in 2024 (Official website. The Central Bank of the Russian Federation [1]). In addition, Russia has been under severe economic sanctions in recent months. The problems that inflation in Russia has generated and is currently generating especially acutely are seemingly unsolvable. The purpose of this study is to show the main hidden causes of inflation, its essence and to offer an experimental experimental way for its possible reduction and (or) disappearance in the conditions of the current economic situation in our country. The scientific novelty of this research work lies in a new approach to the consideration of inflation, inflationary money and the proposed solution to problems related to inflation, in particular, in conducting an experimental monetary reform, which will entail other reforms, within the framework of state strategic management. The author believes that the socio-economic conflict and the slowdown in economic development in Russia is caused by interest as the main component of inflationary money and the redistribution of wealth. The author's reasoning is based on historical data, statistical data, observations and practical experience of the USSR, European countries, the USA and China, analytical studies of the problem. To reduce or completely eliminate inflation, it is necessary to understand what inflation is and what are the main hidden causes of its occurrence. In this article, an unconventional approach to determining the causes of inflation is considered, the mechanism of the emergence and withdrawal of inflationary money and its components is revealed; an experimental way for the Russian economy to approach inflation to zero or its complete disappearance is proposed on the basis of: successfully conducted experiments in a number of European countries at the beginning of the last century; a systematic approach to economic development in China, which combines state strategic planning and regulation of the market economy, which gives a positive result of the Chinese economy with prospects for long-term development. The experimental way for the disappearance of inflation involves a number of reforms and, first of all, monetary reform. At the same time, the author understands that the most effective reforms will manifest themselves if their implementation in Russia is preceded by: introduction of a system of state strategic management, including strategic planning, management of NTP, price regulation and providing for collective and personal responsibility for the results of (non) implementation of plans, for the work and coordination of the system, for determining the conditions of strategic planning, etc.; coordination of the work of the system of state strategic management and planning with the work of economic entities of the market economy. The coordinated work of the system of forming the goals of economic policy at the macro level, monetary policy, fiscal policy in the framework of state strategic management is paramount. Research results, inflation assessment and conclusions.

Russian researchers believe that "the essence of inflation is determined through the excess of nominal values over the real content of economic indicators. A social conflict over the redistribution of public wealth is singled out as the root cause of the existence of inflation" [2]. "Inflation in the Russian economy at the beginning of the XXI century is a decrease in the purchasing power of the ruble, expressed in an increase in prices for the bulk of goods and services, as well as in the excess of nominal indicators of economic activity over their real content, and is a consequence of redistributive processes in the Russian economy initiated by monopolistic associations and the state. These processes are aggravated by structural imbalances in the economy and the presence of inflationary expectations among economic entities" [2]. "The main cause of inflation is a violation of the commodity-monetary equilibrium caused by the overflow of the sphere of monetary circulation," notes E.O. Bryskina [3]. Systemic inflation covers the entire economic system and is characterized by an increase in inflation expectations, developing by the mechanism of a price spiral. Examples of systemic inflation are inflation in Russia throughout the history of post-Soviet development. The features of pricing in economic sectors are comparable to the points of price growth or decline in these sectors of the economy. Balanced (homogeneous) inflation is inflation that occurs when the growth rates of the price of the final product and the growth rates of the prices of its components are equal. Unbalanced (heterogeneous) inflation, respectively, occurs when these components are unequal. Balance has a close connection with the intensity of inflationary processes. The higher the rate of inflation, the higher the heterogeneity of prices. A manifestation of the price imbalance is the situation of "price scissors", which is reflected primarily in agriculture. This conclusion was made in their study by Gordievich T.I., Ruzanov P.V. [4]. Inequality in consumption and inflation by socio-economic groups of the population depends primarily on the structure of consumption, as noted by Gordievich T.I., Ruzanov P.V. [5]. One of the most common causes of inflation is the imbalance between the main elements of the market mechanism – supply and demand, as concluded by Efanova L.D., Shmukler S.A. [6]. Based on the cost approach of E.A. Perevyshina, D.A. Egorov, the following inflation factors were identified: "prices of agricultural producers, prices for housing and communal services, the ruble exchange rate against the US dollar and adaptive inflation expectations" [7]. Taking into account inflation expectations, economic entities make decisions on consumption, savings and investments, set interest rates, wages and prices. Inflationary expectations of the population largely determine the dynamics of consumer demand, which ultimately affects prices for goods and services, according to Gordievich T.I., Ruzanov P.V. [8]. At the same time, V.K. Burlachkov, in his research on inflation targeting, suggests considering inflation expectations as "a form of adaptation of economic entities to the prevailing inflationary process" [9]. Foreign researchers have confirmed the close relationship between the prices of raw materials, the possibility of an increase in domestic inflation and monetary policy. The rise in oil prices contributes to the growth of the money supply in dollar-ruble equivalent, which orients domestic prices to growth and forces the Central Bank of the Russian Federation to pursue a restraining policy (S.Szilagyiova. A study of bilateral relations between commodities and the UK economy in the context of inflation targeting: Doctoral dissertation. - University of Huddersfield, 2014. [10]). Sinelnikova-Muryleva E.V., Grebenkina A.M. investigated the threshold level of inflation in comparison with the targeted level of inflation and concluded that "the choice of the target is at the level of 4%" [11]. Historical data show that developed countries set a target (target level) for inflation at 2%, and developing countries set a target of 3% or higher. The problems of using inflation targeting are highlighted in the works of foreign researchers [12-16].The history of this form of monetary policy dates back to 1989 in New Zealand. For the first time in the world, there was an attempt to counteract inflation by legal rather than economic methods. A law was approved that established as the main goal of the central bank, ensuring the stability of the price level; it was about zero inflation. The powers between the Reserve Bank and the government were divided so that all economic policy goals related to the rate of economic growth, the unemployment rate, and the volume of investments were within the competence of the government, but were not considered as priorities in comparison with the inflation target [9]. As a result of scientific research by V.K. Burlachkov, paradoxes of the theoretical foundations of inflation targeting were revealed. Their essence lies in the assumption of the influence of the legislative framework on the inflationary expectations of economic entities and the application of the central bank's key rate on reserve money to influence aggregate demand and price dynamics, in fact determined by the dynamics of deposit money created by commercial banks in the lending process [9]. From which Burlachkov V.K. concludes that the key rate, being the rate on the reserve money of the central bank used for settlements between commercial banks, does not affect aggregate demand and price dynamics [9]. F.S. Kartaev, answering the question in his scientific work whether the choice of monetary policy regime affects inflation, came to the conclusion that "the money supply targeting regime is an inefficient way to reduce inflation, both in developed and developing countries" [17].In his other work, F.S. Kartaev comes to the conclusion that "the rates of long-term economic growth depend on many factors, among which monetary factors are not decisive and are inferior in importance, for example, to competent institutional reforms." [18].

The trend of the Russian economy, which has been stagnating for decades, has divided researchers into two groups. One group of researchers (A.Kudrin, V.Trunin, E.Goryunov, etc. [19-23]) over the past decades has seen a way out of the critical situation of the Russian economy in targeting inflation and free exchange rate policy. Interesting in this regard is the work of Goryunov E.L., Drobyshevsky S.M., Mau V.A., Trunin P.V., in which they conclude about the possible weakening of the effectiveness of monetary policy in Russia in the foreseeable future and the expediency of using hybrid fiscal and monetary instruments [24]. Another group of researchers (A.Agangebyan, M.Ershov, S.Andryushin, S.Glazyev, etc. [25-28]) for a number of years proposed:to abandon the regime of free floating of the ruble; to use targeted preferential loans to certain industries; to introduce restrictions on foreign exchange transactions; to abandon inflation targeting with a reorientation to economic development; to severely limit the growth of tariffs of natural monopolies. Proponents of inflation targeting consider it as a fulcrum of price stability. It is believed that price stability contributes to the preservation of the purchasing power of the national currency, is a condition for reducing economic uncertainty and increasing the welfare of economic entities. Serious analysis with a proposal to take practical measures to allow Russia to avoid the collapse of economic and state institutions in the face of opposition to the West was made by Academician S. Glazyev of the Russian Academy of Sciences in 2015 at a meeting of the interdepartmental commission of the Security Council of the Russian Federation [28]. It was noted that "in our conditions of demonetization and monopolization of the economy, they are accompanied not by a decrease, but by an increase in inflation. The second gross mistake of the Central Bank, as mentioned above, was the transition to the free floating of the ruble exchange rate. There is no scientific proof of the need for such a transition when targeting inflation." "The combination of these two mistakes led to the fact that by announcing the transition to inflation targeting in 2014, the Central Bank achieved exactly the opposite results: instead of a decrease from 6.5% to the announced 5%, it exceeded 11%. The question arises: what do monetary authorities mean by inflation targeting if they cannot not only achieve the target parameters set by them, but even predict the direction of their movement?". "In English, targeting is goal–setting (target-goal, target). In other words, inflation targeting means that the Central Bank subordinates its policy to inflation reduction. But reducing inflation has always been the main priority in the activities of the Bank of Russia, which set its targets for the planning period" [28, pp.27-28]. "It follows from the above that the Central Bank's policy of targeting inflation does not correspond to the semantic meaning of these words" [28, p.31]; "the Russian economy is artificially driven into a stagflationary trap. The ongoing contraction of the money supply aggravates these processes and entails a breakdown of the entire system of reproduction and monetary circulation" [28, p.33]. "To ensure expanded reproduction, the Russian economy needs a significant increase in the level of monetization, expansion of credit and the capacity of the banking system. The necessary level of money supply to boost investment and innovation activity should be determined by the demand for money from the real sector of the economy and state development institutions with the regulatory value of the refinancing rate. Real inflation targeting is impossible without the implementation of other macroeconomic policy goals, including ensuring a stable ruble exchange rate, investment growth, production and employment" [28, p.33]. Almost seven years have passed since the announcement of the report of Academician S.Y. Glazyev in 2015. Nothing has changed fundamentally, including with regard to monetary policy. Thus, the key rate of the Central Bank of the Russian Federation, starting from March 2021, increased again and, a year later, i.e. in March 2022, during the period of economic sanctions, reached the level of 20%.An increase in the key rate will once again lead to the devaluation of the ruble, which will cause another inflationary wave, since such a measure does not provide a long-term effect of stabilizing consumer prices. In the near future, we should expect a decrease in lending, "investment hunger", a reduction in production, mass bankruptcy of enterprises in the manufacturing sector of the economy and not only, technical degradation and mass unemployment. Academician of the Russian Academy of Sciences S.Y. Glazyev called the strategy of raising the key rate a "ruinous" strategy; "the damage from such a policy will amount to 30 trillion rubles of unproduced GDP, as well as over 15 trillion rubles of undeveloped investments" [29]. December 2014, during the introduction of economic sanctions against Russia, appeared in the dynamics of economic development as a bifurcation point in inflation expectations. The consequences of economic sanctions were clearly shown in the study Gordievich T.I., Ruzanova P.V. in the matrix of inflation factors [30]. After the 2008 financial crisis, many central banks around the world adopted unconventional monetary easing measures to stimulate the economy. Short-term nominal interest rates reached zero, and central banks poured money through purchases of long-term government bonds (M.Z.Mulkaman. The influence of monetary policy and the macroeconomic environment on Islamic banking operations in the dual banking system of Malaysia: Doctoral dissertation. - Durham University, 2016 [31]). The normal development of a market economy is possible only with a creeping form of inflation, i.e. with an average annual price increase of 5-10% [32]. At the end of 2021, researchers noted that real inflation was already higher than can be assumed based on official figures. The overall price increase does not fully reflect the actual level of inflation. There is "deficitflation" – the simultaneous occurrence of price inflation and suppressed inflation, accompanied by a deficit [33]. In the conditions of economic sanctions at the beginning of 2022, the factors determining inflation in our country, in particular, are mainly those that have taken place for decades:

-the rise in the cost of imports as a result of the devaluation (depreciation) of the Russian national currency, i.e., the so-called imported inflation; -strong monopolistic elements in the market structure of the economy, leading to the monopolistic practice of raising prices; -increased pressure on the prices of production costs, the increase of which exceeds the average price increase [32]; -tax maneuvers in significant sectors of the economy (for example, the replacement of export duties with mineral extraction tax); -acute shortage of certain goods and resources (under conditions of economic sanctions); -deformation of external (global) and internal transport and logistics chains (under conditions of economic sanctions). "In the current conditions, priority should be given to the growth of production and investment within the limits of the established restrictions on inflation and the ruble exchange rate. At the same time, to keep inflation within the established limits, a comprehensive system of measures on pricing and pricing policy, currency and banking regulation, and the development of competition is necessary. In our conditions, the source of financing for these investments from backwardness and poverty to the advanced standard of living and technical development can only be a targeted credit issue organized by monetary authorities in accordance with centrally established priorities" [28, pp.44-45]. Based on a study of 211 countries for the period from 1990-2019, the researchers found that in the least developed and poorest countries, the outpacing dynamics of both consumer lending and lending to real sector companies positively affects economic growth. As GDP per capita reaches US$ 4700-7000 in 2010 prices, advanced consumer lending begins to negatively affect economic growth, and the positive impact of lending to real sector companies persists. With an increase in GDP per capita, lending to the latter also begins to negatively affect economic growth, while the threshold value of GDP per capita is 6-42 thousand dollars in 2010 prices. In the most developed and rich countries, advanced lending to real sector companies has a negative impact on economic growth [34]. Thus, the main course of Russia's modern economic policy is still the fight against inflation. Even in the government's program for 1995-1997, it was indicated that "it is necessary to build a bridge between the inflationary past and the investment future" [35]. To overcome high inflation, N.Ya. Petrakov proposed to carry out a soft monetary reform in a few years, which was based on the introduction of a parallel currency as a means of protecting investment costs from inflation, which would serve investment activities and, as the economy revived, would be able to displace the soft ruble. It is enough to refer to the experience of monetary reform in Russia in 1922-1924, which led through parallel currencies to a single convertible currency in just two years [35]. The ideal value of inflation is zero, which corresponds to a stable/unchanged price level.As practice shows, inflation can actually grow to infinite values, or it can either approach zero, or decrease to zero, that is, disappear. The average annual inflation rates (for 15 years (1970-1985)) in the Soviet economy were as follows: in industry +0.37%, in mechanical engineering and metalworking – 1.5%, in the food industry +0.83%. The transition to market relations in Russia was accompanied by a sharp aggravation of the problem of inflation in all industries, which led to significant difficulties in the reproduction of fixed assets. During the beginning of the development of the market economy in Russia, the price indices of producers of products have changed dramatically. Prices and average annual inflation rates (2004 to 1994) for the decade were by industry, respectively: in industry +40.5%, in mechanical engineering and metalworking 51.7%, in the food industry +37.2% (Golikova, Ekaterina Igorevna. The mechanism of intensification of the reproductive function of depreciation: abstract of the dissertation of the Candidate of Economic Sciences: 08.00.05 / Moscow State University of Food Production (MGUPP). - Moscow, 2006. - 28 p.). The methods and methods proposed by the government and the Bank of Russia to combat inflation have not yet led to a reduction in inflation in the long term and in practice do not give the proper result on the scale of the Russian market economy. The Russian government system does not put into practice the proposals of scientists on the transformation of approaches to the consideration of inflationary processes and the adoption of a comprehensive system of measures on pricing and pricing policy, banking regulation. In the near future, in the context of tightening economic sanctions in 2022, a so-called stagflationary crisis may arise, when a decline in production is combined with inflationary growth. A prolonged period of high inflation with a decrease in the growth of real incomes of the population may eventually lead to socio-political tension and instability. And the regions will have the hardest time, especially in which the so-called city-forming enterprises are located. This also applies to strategic enterprises, which, first of all, include military-industrial complex enterprises, taking into account that "hopes for the decentralization of the Russian management system during the pandemic were not justified, in inter-budgetary relations the degree of dependence of regions on federal authorities has increased" [36]. When assessing the structural levels of regional inflation, such factors of regional inflation heterogeneity as the volume of lending to individuals, the level of price rigidity, inflation expectations and the nominal effective ruble exchange rate showed the greatest importance [37].

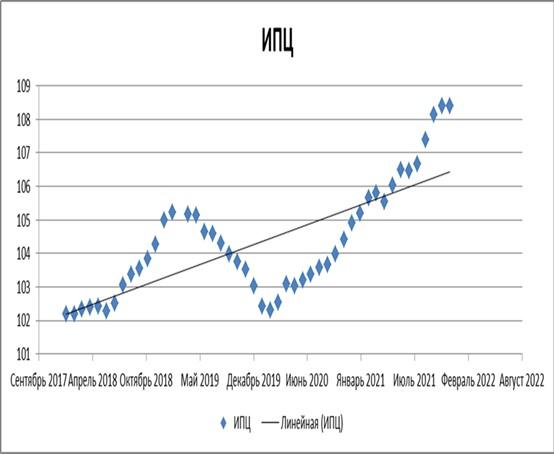

Inflation: statistical data from previous years and forecasts for the future. The purpose of this article is not a comparative analysis of inflation indicators from different countries of the world with inflation indicators in Russia, therefore, the dynamics of inflation in other countries of the world is not given in this article. According to the Rosstat of Russia, the consumer price index (hereinafter referred to as the CPI) has not tended to decrease in recent years, unfortunately, as evidenced by the data on Chart 1 of the CPI for 2018-2021. And it's no secret that this state of affairs has been observed in Russia for a long period of time, more than one decade. Graph 2 shows the inflation rate in Russia by year over the past ten years.  Graph 1.CPI for 2018-2021 Data source: Rosstat of Russia [Electronic resource]. URL: https://rosstat.gov.ru /(accessed 10.01.2022). Graph 1.CPI for 2018-2021 Data source: Rosstat of Russia [Electronic resource]. URL: https://rosstat.gov.ru /(accessed 10.01.2022).

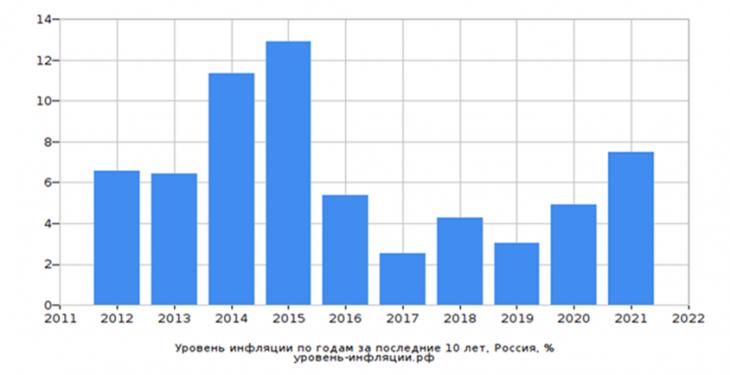

Schedule 2.The inflation rate by year over the last ten years in Russia. Data source: Statistics. Inflation in Russia. [electronic resource]. URL: https://óðîâåíü-èíôëÿöèè .RF/charts-inflation (accessed 10.01.2022). Schedule 2.The inflation rate by year over the last ten years in Russia. Data source: Statistics. Inflation in Russia. [electronic resource]. URL: https://óðîâåíü-èíôëÿöèè .RF/charts-inflation (accessed 10.01.2022).

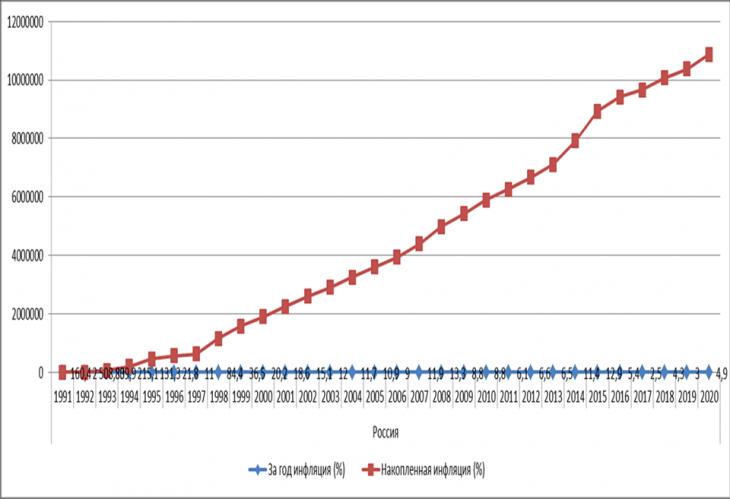

Graphs 1 and 2, the linear trend of increasing inflation in recent years clearly show that the anti-inflationary policy tools used do not lead to a long-term steady decline in the inflation rate over the past decade, including the pandemic period, which indicates deep structural and institutional inflationary problems in the Russian economy and the need for a radical change in approaches to solving it. Let's pay attention to the data of the inflation calculator according to Rosstat. Price change due to inflation: at the beginning of 1991 – 1000,00, at the end of 2020 – 108,774,130.52.Accumulated inflation in Russia for three years (2018, 2019, 2020) amounted to 12.73%.Accumulated inflation for the selected period (1991-2020) – 10,877,313.05%. The dynamics of inflation for the year (%) and accumulated inflation (%) for the period beginning of 1991 – end of 2020 is shown in Graph 3. Graph 3 makes it possible to compare current (annual) inflation and accumulated inflation for the period from the destruction of the USSR to the present and analyze inflationary withdrawals of money from Russian consumers in historical perspective events that took place in our country and in the world during this period.

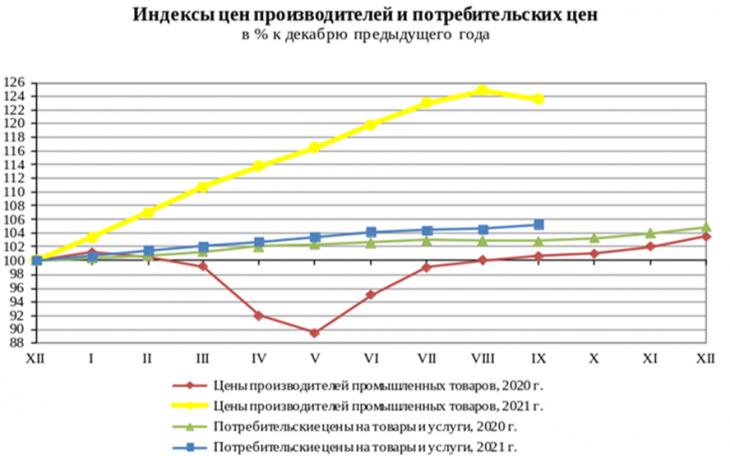

After the collapse of the Soviet Union, hyperinflation began, prices were not controlled by anyone; the shortage of goods led to a catastrophic increase in prices. In 1991, inflation was 160.4% at the end of the year. At the end of 1993, inflation decreased from 2508.8% (at the end of 1992) to 840%. The decline continued until 1998. In the crisis year of 1998, there was a sharp jump in inflation from 11% to 84.4%. And this jump played a decisive role in the rapidly increasing linear trend of the accumulated inflation indicator.Russia was not spared by the crisis of 2008-2009, which broke out in the United States and showed the vulnerability of the Russian economy and its dependence on the global conjuncture in the conditions of integration and globalization. By 2011, the Russian economy had recovered. The crisis of 2014-2015 was caused not only by the collapse of oil prices, but also by economic sanctions after the annexation of Crimea. Inflation in these years was 11.4%-12.9%, respectively. Inflation was at a record low in 2017 (2.5%) and in 2019 (3.0%). In 2017 and 2019, inflation was subdued.There was a decrease in consumer and investment demand during these years and economic growth was 2%.The crisis of 2020 as a crisis of a special nature revealed the anomalies of the Russian economic system and showed that the existing model of the economy in Russia is morally outdated and unable to continue to adequately respond to the challenges of the XXI century and function in the conditions of global economic turbulence.  Graph 3. Dynamics of inflation for the year (%) and accumulated inflation (%) for the period beginning of 1991 – end of 2020. Data source: Country statistics. [electronic resource].URL: https://svspb.net / (accessed 10.01.2022). Graph 3. Dynamics of inflation for the year (%) and accumulated inflation (%) for the period beginning of 1991 – end of 2020. Data source: Country statistics. [electronic resource].URL: https://svspb.net / (accessed 10.01.2022). Graph 4 shows the dynamics of a comparative analysis of the producer price index and consumer prices in % compared to December of the previous year. As shown in Graph 4, the growth of consumer prices for goods and services at the beginning and in the middle of the crisis year 2020 outstripped the growth of prices for industrial goods, but by the end of 2020 the advance almost disappeared and in 2021 the picture changed exactly the opposite. Prices for manufactured goods increased by 24.5% in 2021 compared to 2020, according to Rosstat of Russia. The largest growth was observed in the field of mining, by 46.2% in 2021. Manufacturing goods have risen in price by 21.8% over the year. In the field of electricity, gas and steam supply, the growth was 5.3%, in the field of water supply, waste collection and disposal - 3.2%. Using the principle of dynamic pricing in order to maximize profits, manufacturers raised prices for building materials and rolled metal to a record level (from 40% to 50%), which was due to the expected shortage of the latter due to the pandemic. As Graph 4 shows, the prices of manufacturers of industrial goods in 2021 are more dynamic than prices in the consumer market, which is evidence of an aggravation of the economic situation.  Schedule 4.Producer and consumer price indices in % compared to December of the previous year.Data source: Rosstat of Russia. [electronic resource].URL: https://rosstatgov.ru (accessed 10.01.2022). Schedule 4.Producer and consumer price indices in % compared to December of the previous year.Data source: Rosstat of Russia. [electronic resource].URL: https://rosstatgov.ru (accessed 10.01.2022).

The inflation boom in Russia continues. According to Rosstat, inflation in Russia in 2018 was 4.26%, in 2019 – 3.04%, in 2020 -4.91, in 2021 – 8.39%. The annual inflation rate in three weeks of the new year increased from 8.39% to 8.64%. The Bank of Russia has raised its inflation forecast by the end of 2022 to 5-6%. This forecast was given in the statement of the Bank of Russia on the results of February 11, 2022. At the same time, the Bank of Russia maintained its forecast for annual inflation in 2023-2024 at 4%, stating that in mid-2023, annual inflation will return to the target. Inflation in February 2022, according to the Bank of Russia, was 9.2%. In January 2022, the inflation expectations of Russians decreased to 13.7%. Note.Demand inflation and cost inflation in the context of economic sanctions in 2022 act simultaneously, which complicates the implementation of anti-inflationary policy without a system of strategic management and planning. Inflation: a new look at the causes and mechanisms. The state in a broad sense is arranged in the form of a set of basic systems: authoritative, administrative, security, content and custody. Each such system produces a property of its own type [38].

Inflation is interesting in its substantial essence. The reasoning is based on the English word "to inflate", which means "to inflate" and the special significant position of some subjects of economic activity unknown to a wide range, including in the power system, for example, foreign investors of various investment directions, bankers, monopolists, to whom the state grants priority to conduct economic activities on the territory of Russia. The basis for the formation of initial capital back in the early 90s was the distribution of money, and most of it in relative shares to significant entities with a special position. The distribution of money increased both from the beginning of the year relative to the distribution in the previous year, and during the year relative to the previous distribution in the time interval chosen by the power system independently. Moreover, each time money was distributed, money was added based on the relative importance of economic entities. It should be noted that there is no need to talk about fair competition in a market economy, within the framework of such an approach to the formation of initial and subsequent capital. The money added during the distribution causes monetary inflation, and therefore it is quite fair to call them inflationary money. After a certain time lag, inflationary money is withdrawn through an increase in bank rates, prices, taxes, tariffs, duties in order to repeat the circulation of money distribution and add them at each subsequent distribution to significant entities with a special position. The mechanism of price withdrawal of inflationary money is interesting. It is based on information interaction between the system of power managers and large manufacturers of finished products and suppliers of goods, works, services; within the framework of such interaction, the permission of the system of power managers to change (increase) prices to one entity has a chain character in relation to other entities. As a result of this mechanism, prices gradually rise, and at the same time there is a redistribution of income, as a result of which the rich get richer and the poor get poorer. The redistribution of income takes place strictly within the boundaries of the additionally distributed money to significant economic entities. Thus, there is an invisible relationship between significant entities with a special position (foreign investors, banks, monopolists, etc.) and inflationary processes. Significant economic entities in their number can both increase and decrease. The money supply, which is growing due to the "blowing in" of additional money like a snowball, may also cause the appearance of more banknotes with a large face value, and, accordingly, a reduction in banknotes with the lowest face value. In the end, sooner or later monetary inflation leads to the need for denomination. Denomination is the end of the cycle of distribution of additional (inflationary money). After the denomination, a new cycle of monetary inflation begins [38]. If the indicators of significance change radically (for example, as during perestroika in the USSR and Russia), then in order to take into account these changes, the system of power managers can create and introduce completely different money, i.e. again resort to "blowing" money. From what has been said, it follows that inflation, i.e. the injection of money, is rather weakly related to the ratio between the amount of money and the amount of goods, as representatives of classical and neoclassical theories relentlessly narrate [38]. Since, as mentioned above, the withdrawal of funds is carried out in different forms, different components are put into the inflationary funds distributed, for example, interest, tax, duty, tariff, price and others; their share varies depending on the economic situation. To imagine at least an approximate cost estimate of the components of the added (inflationary) money to significant entities, let's turn to one of these components, which is withdrawn after the distribution of money in the form of interest on a loan (loans). Interest as the main component of inflationary money. Interest on loans (loans) are, according to the American expert on the history of economics John L. King, "an invisible machine of destruction" in the so-called free market economy. The problem is that money can slow down the exchange of goods and services if they accumulate from those who have more money than they need and do not enter circulation. And the rapid accumulation of funds from significant entities with a special position (for example, bankers) is carried out by charging compound interest, which leads to a doubling of the monetary state at regular intervals, i.e. capital accumulation is carried out due to the exponential dynamics of compound interest. The impact of the exponential dynamics of compound interest on the monetary system is so great that for a long period of time, the payment of interest when it is economically necessary to repay obligations becomes mathematically impossible, which causes an insoluble contradiction and ultimately leads to the collapse of the entire monetary system. The formula of exponential dynamics of compound interest:  where where

V is the current value of the starting point subject to exponential growth, S is the initial value, x is the interest rate, t is the number of elapsed periods; on the graph, the curve starts slowly, remains almost flat for a while, and then increases rapidly and becomes almost vertical. According to the Bank of Russia, the debt of the population as of January 2021 amounted to 20.08 trillion rubles, including overdue 913.9 billion rubles (for comparison: expenditures of the federal budget of Russia in 2019 amounted to 18.2 trillion rubles).

As of 01.12.2020, the debt of Russian citizens on housing loans issued amounted to 8.943 trillion rubles (Graph 5 debt of resident individuals on housing loans issued in rubles as of 01.12 (for 2006 – 2008 as of 01.10), trillion rubles).  Graph 5. Debt of resident individuals on housing loans issued in rubles as of 01.12 (for 2006 – 2008 as of 01.10), trillion rubles. Source: Bank of Russia. [electronic resource].URL: https://cbr.ru / (accessed 10.01.2022). Graph 5. Debt of resident individuals on housing loans issued in rubles as of 01.12 (for 2006 – 2008 as of 01.10), trillion rubles. Source: Bank of Russia. [electronic resource].URL: https://cbr.ru / (accessed 10.01.2022).

The curve in graph 5 is interesting because it has an exponential trend and resembles a graphical description of a mathematical function, an exponential function whose derivative is equal to the function itself, of the form: y(x)=e x, where e is an Euler number with an infinite number of digits after the decimal point; transcendental (does not satisfy any algebraic equation) and irrational (it cannot be represented as a fraction m/n, where n is not zero). In other words, it resembles an exponent that increases monotonically. The exponential increase in housing loan debt, as shown in Graph 5, only confirms the occurrence and increase over time of the contradiction described above. Note.The Swiss mathematician Jacob Bernoulli (1655-1705) deduced the number e when he was trying to solve a financial problem. The mathematician was trying to understand how interest should be accrued on the amount of the deposit in the bank, so that it would be most profitable for the owner of the money. In addition, J. Bernoulli tried to understand whether there is a limit to the income received as a percentage, or it increases indefinitely. The weighted average rate on residential mortgage loans in rubles in 2016 was 12.7%, in 2019 it varied from 10.55% to 9.19%. In previous years, the stakes were higher. Thus, the population annually pays to credit institutions only interest and only on mortgage loans hundreds of billions of rubles. Mortgage interest is calculated according to the formula of compound interest, mortgage loans are provided for long periods and therefore, based on the contradiction described above (economic and mathematical), the number of non-payments will increase from year to year, which will eventually develop into a collapse of the entire monetary system. In the USSR, the interest rate for HBC was 0.5% [39]. In Russia, mortgage lending has been counting since 1999 – 35% and loans are only in US dollars. The preferential rate of 6.5% introduced in 2020 led to a sharp increase in housing prices, i.e., thus, there was a redistribution in the components of the withdrawal process: the percentage component of the withdrawal decreased, and the price component of the withdrawal increased. This is a vivid example of the fact that each time inflationary funds are added, when withdrawn, they can be redistributed depending on the need for the flow to move in one direction or another. The dynamics of debt on loans granted to legal entities and individual entrepreneurs in rubles and foreign currencies is shown in the graphs below (in Graph 6, the annual growth rate of debt as a percentage and in Graph 7, debt on loans to insurance and financial, as well as other organizations and individual entrepreneurs).  Graph 6.Annual debt growth rate, %. Data source: Bank of Russia. [electronic resource].URL: https://cbr.ru/statistics/bank_sector/sors/1021 / (accessed 10.01.2022). Graph 6.Annual debt growth rate, %. Data source: Bank of Russia. [electronic resource].URL: https://cbr.ru/statistics/bank_sector/sors/1021 / (accessed 10.01.2022).

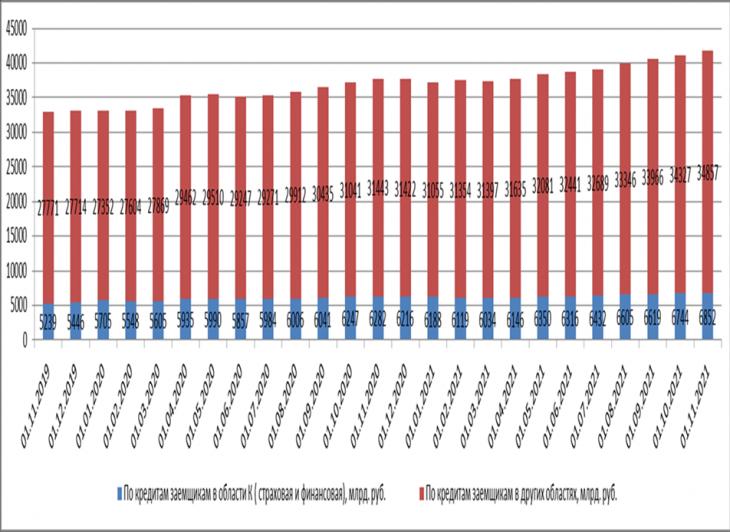

The debt on loans granted to legal entities and individual entrepreneurs in rubles and foreign currencies totaled as of 01.11.2019 - 33010 billion rubles, as of 01.11.2020 - 37725 billion rubles, as of 01.11.2021 - 41709 billion rubles. These are the amounts that organizations of different sectors of the economy will have to return; in other words, which should be withdrawn from them along with interest. As can be seen from Graph 6 and Graph 7, the debt on loans is increasing from year to year, which, according to the above, are prerequisites for a subsequent monetary collapse. The conditions prevailing outside Russia and inside Russia at the beginning of 2022 only contribute to its approach.

Graph 7. Dynamics of debt on loans granted to legal entities and individual entrepreneurs in rubles and foreign currencies. Data source: Bank of Russia. [electronic resource].URL: https://cbr.ru/statistics/bank_sector/sors/1021 / (accessed 10.01.2022). Graph 7. Dynamics of debt on loans granted to legal entities and individual entrepreneurs in rubles and foreign currencies. Data source: Bank of Russia. [electronic resource].URL: https://cbr.ru/statistics/bank_sector/sors/1021 / (accessed 10.01.2022).

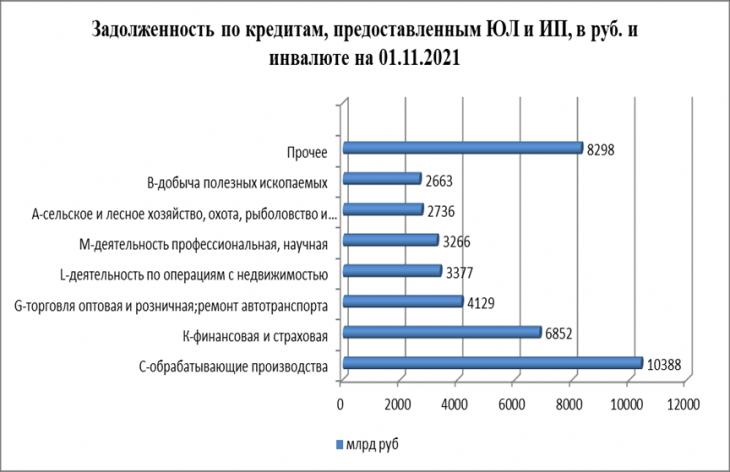

Inflationary money added to the economy is distributed unevenly to different sectors of the economy, and they are unevenly withdrawn from different sectors of the economy, as shown in Graph 8 with respect to debt on loans granted to legal entities and individual entrepreneurs in rubles and foreign currency as of 01.11.2021.  Schedule 8. Debt on loans granted to legal entities and individual entrepreneurs in rubles and foreign currency as of 01.11.2021 Data source: Bank of Russia. [electronic resource].URL: https://cbr.ru/statistics/bank_sector/sors/1021 / (accessed 10.01.2022). Schedule 8. Debt on loans granted to legal entities and individual entrepreneurs in rubles and foreign currency as of 01.11.2021 Data source: Bank of Russia. [electronic resource].URL: https://cbr.ru/statistics/bank_sector/sors/1021 / (accessed 10.01.2022).

In the presentation above, an attempt is made to determine the valuation of the added (inflationary) funds in various sectors of the Russian economy. So, when distributing inflationary money, a percentage component is laid in them, which will be withdrawn after a certain time lag. However, it is also important to understand from whom this percentage component will be withdrawn and in what form: in pure percentage or in price (as part of the price of a product or service). According to the regulatory documents on accounting (Decree of the Government of the Russian Federation of 05.081992 No. 552 "On approval of the Regulations on the composition of costs for the production and sale of products (works, services) included in the cost of products (works, services), and on the procedure for the formation of financial results taken into account in the taxation of profits" (as amended since 01.01.2002, it has become invalid, except for certain provisions)), the Order of the Ministry of Finance of the Russian Federation dated 06.05.1999 No. 33n with subsequent revisions "On approval of the Accounting Regulations "Expenses of the organization" PBU 10/99") interest is included in other expenses and when forming the tax base for income tax after 2002 in the composition of non-operating expenses when calculating corporate income tax (the Tax Code of the Russian Federation Part 2, approved by Federal Law No. 117-FZ of 05.08.2000, with amendments and additions). Thus, one way or another, interest indirectly affects the formation of the price of goods and services. It turns out that, in the end, the percentage component of the previously added money is withdrawn from the final consumer (people) not only directly by banks in case of borrowing money from them by the population, but also through price withdrawal, since the producers of the goods, before producing the goods, paid for all components of the cost of this product at the expense of credit funds; the price of almost any good or service includes a percentage of inflationary funds previously added to the economy, and a percentage is included in each component of the price, which, in turn, causes a multiplicative effect of inflation. Thus, interest is a means of hidden redistribution of money; a deterrent to economic development and the exchange of goods and services. The redistribution of money in this case is based not on labor participation, but on the importance of economic entities involved in their distribution; there is an outflow of money from those who have less than they need to those who have more money than they need. In order to preserve such a redistribution, inflation actually exists, and interest is one of the components of the entire process of economic (inflationary) growth according to the following scheme: blowing money into the economy – distribution of money to significant entities with a special position – economic growth /withdrawal of money in various forms and their redistribution – blowing money into the economy -...denomination. It is possible that with inflation increasing in Russia from month to month, our country, according to the scheme described above, is on the threshold of denomination. Let us note once again that such a scheme stimulates economic growth, but not economic development in any way. After the distribution of funds, significant entities, depending on the state of affairs in the economy (on a profitable basis exclusively for themselves), either hold the funds or put them into circulation; the benefit for significant entities is the absence of obligations to the state and society for the use of distributed funds and the use of distributed funds without any expenses; the period of time for the use of distributed funds is in no way limited by legislative norms; significant entities with a special position are only waiting for the moment of "liquidity benefits". Payment for free ("dead") money as a natural economic order.

To reduce inflation to zero, it is necessary to release funds from interest encumbrances and assign a fee for the "deadening" of free funds for all participants in economic activity, including credit institutions, thereby establishing a natural economic order [40]. A successful businessman Silvio Gesell, back in the nineteenth century, working in Germany and Argentina, noticed that goods were sold quickly and at a high price exclusively during a period of low interest rates; the activity of buying goods increased with a decrease in interest rates and decreased with an increase in interest rates. From which he concluded that the sales of goods depend on the price of money in the money market and do not depend on either demand or the quality of the goods themselves. Entrepreneur Silvio Gesell in 1890 formulated the idea of a "natural economic order" [40] in relation to the payment for the "deadening" of money. The essence of this idea is very simple, clear and pursued quite a good goal: to exclude the negative impact of interest on money circulation and the economy as a whole. In order to abolish the special significant position of any subject of economic activity, that is, to equalize all subjects in economic relations and in monetary circulation, it is necessary to introduce a fee for unjustified retention of free funds. Such a fee is a fee for the "deadening" of free cash, that is, a fee for using cash for a longer period than is necessary for the purposes of exchange. At the same time, the fee for the "deadening" of free cash was considered as an expression of public profit, therefore it should be put into monetary circulation to maintain a balance between the volume of monetary circulation and the volume of economic activity; this fee was considered exclusively as a source of public income. The introduction of such a fee in Russia at the same time could solve the socio-economic problems of modern Russian society, including with regard to the reduction or disappearance of inflation and the reduction of unemployment growth. As you know, practice is the best criterion of the truth, the truth of an idea embodied in life. Followers of S. Gesell moved from his theoretical idea to practice and conducted several successful experiments with free money (unencumbered interest) in countries such as Austria, France, Germany, Spain, Switzerland and the USA. In the 30s of the last century, experiments with free cash (unencumbered interest) were carried out in these countries in order to eliminate unemployment. Currently, unemployment is a big problem in Russia. Official statistics on this indicator do not seem to change only because of the increased natural population loss. According to official statistics, the number of unemployed aged 15-72 years (according to sample surveys of the labor force), thousand people: The number of unemployed aged 15 - 72 years (according to sample surveys of the labor force) by districts, thousand people Table 1 | District/Period | Aug.-Oct. 2020 | Dec.2020-Feb.2021 | Jan. - March 2021 | Aug.-Oct. 2021 | | russian federation | 4755,7 | 4327,8 |

4202,2 | 3296,3 | | Central Federal District | 961,8 | 878,4 | 856,3 | 677,6 | | North-Western Federal District | 437,9 | 363,9 | 339,9 | 260,0 | | Southern Federal District | 522,9 | 476,5 | 463,3 | 395,6 | | North Caucasus Federal District | 681,0 |

679,0 | 666,6 | 516,9 | | Volga Federal District | 821,0 | 734,0 | 713,9 | 544,3 | | Ural Federal District | 384,8 | 338,0 | 327,4 | 234,1 | | Siberian Federal District | 669,0 | 587,8 | 574,8 | 440,3 | |

Far Eastern Federal District | 277,3 | 270,2 | 260,0 | 227,5 | Data source: Rosstat of Russia. [electronic resource].URL: https://rosstat.gov.ru/storage/mediabank/trud3_15-72.xls (accessed 17.01.2022). According to official statistics, the number of unemployed aged 15-72 years (according to sample surveys of the labor force) by year, thousand people: The number of unemployed aged 15-72 years (according to sample surveys of the labor force) by year, thousand people Table 2 | District/Period | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | | russian federation | 6283,7 | 5544,2 | 4922,4 |

4130,7 | 4137,4 | 3889,4 | 4263,9 | Continuation of Table 2 | District/Period | 2016 | 2017 | 2018 | 2019 | 2020* | Aug.-Oct. 2020* | Aug.-Oct. 2021 | | russian federation | 4243,5 | 3966,5 | 3657,0 | 3461,2 | 4316,0 |

4755,7 | 3296,3 | * - discrepancy of official statistics data Data source: Rosstat of Russia. [electronic resource]. URL: https://rosstat.gov.ru/storage/mediabank/trud3_15-72.xls (accessed 17.01.2022). As can be seen from official statistics, unemployment in Russia is not directly related to special periods of late 2019 – early 2020, mid-2021. In fact, there are many times more unemployed. The problem of unemployment in Russia has a long-term dynamic character, and in the case of active introduction of artificial intelligence (robotics) into the economy, as evidenced by the signing in 2021 of a memorandum on the establishment of a Center for the Fourth industrial revolution in our country, in the next two or three years, unemployment may take on the character of a social catastrophe. Unemployment is an unnatural economic disorder. A practical example of the economic miracle of S. Gesell's idea. The idea of S. Gesell's monetary reform in 1932-1933 was successfully implemented as an experiment in the Austrian city of Vergl [40]. As part of the monetary reform, 5,000 "free shillings" were issued, i.e. unencumbered with interest money, which was covered by the same amount of ordinary Austrian shillings in the bank. Trade organizations and entrepreneurs accepted unencumbered free shillings as payment for goods and services from the residents of the city, and the latter received these shillings as payment for their labor. The fee for using unencumbered interest with free money was 12% per year (1% per month). The payment had to be made by those who had a banknote at the end of the month. The payment was made in the form of a stamp, which was glued to the banknote, with a nominal value of 1% of the value of the banknote; without a stamp, the banknote was invalid. A small fee for the "deadening" of funds, i.e. the balance of funds in a person's hands for the horses of the month led to the fact that during the year 5,000 free shillings were converted 463 times, goods and services were produced in the amount of about 2,300,000 shillings (5,000 shillings x 463 times). An ordinary shilling has been in circulation only 213 times. Anyone who received interest-free shillings as payment tried to spend them as quickly as possible before switching to paying with ordinary money, which was also in circulation. The residents of the town repaid their tax obligations in advance, so as not to pay for the rest of the "free shillings" at the end of the month on their hands. That is, at first the residents paid with banknotes with stamps on the back of the banknotes ("free shillings") and only then with ordinary money. The results of such an experiment in the city of Vergl led to the following results: the unemployment rate decreased by 25% over the year, structures (a bridge) were built, the condition of roads was improved, investments in public services increased. All the "free" shillings were spent on public, and not on personal, wealth augmentation, for the public needs of the city and its inhabitants. And, most importantly, there is almost no inflation. This was the proven economic miracle of S. Gesell's idea of the natural economic order. Monetary reform in Russia as an experimental way to reduce inflation. An experiment of monetary reform similar to the one that was successfully carried out in the Austrian city of Wergl can be implemented in any city or region of Russia in order to reduce inflation and unemployment, as well as the beginning of economic development. At the same time, when testing the monetary reform of the natural economic order in any region of Russia, free money (unencumbered by interest) can be used in this particular region to exchange goods and services produced in the region where the experiment is being conducted; ordinary money pays for everything that is purchased outside this region. Wages for residents of the region can also be paid with free money. Thus, two monetary systems will operate in parallel in the tested region of Russia. The test region for the period of the experiment of monetary reform of the natural economic order is equated to a free trade zone, where production and trade are not taxed. The technical aspects of the implementation of monetary reform within the framework of the currently modern settlement system are very simple, namely: the fee for the use of free funds after the introduction is charged by taxing cash deposits on accounts at the end of the month or cash at the end of the month from any subjects of economic relations. Such monetary reform does not cancel lending in the bank. However, within the framework of the natural economic order, it will be natural not to pay interest on the loan, but to pay only the risk premium and the fee for administrative and technical operations on the loan, which are currently included in the costs of a bank loan and amount to no more than 2-3% of all expenses. It is assumed that all economic entities, including credit organizations, will be involved in the monetary reform. Thus, the latter will be more interested in issuing a loan, since if there is more money in the accounts of a credit institution at the end of the month than it needs, then it will have to pay the state a fee for using the free money unreasonably withheld by it. The essence of the experimental monetary reform, which significantly reduces the inflation rate (almost to zero) and reduces the unemployment rate, stimulating economic development, is that the payment for the use of money is a regulator of social justice; the percentage embedded in the money added during the distribution and generating inflationary processes and unemployment is a regulator of the distribution and redistribution of wealth and economic growth exponentially.

Currently, under the conditions of severe economic sanctions, all prerequisites have been created in Russia for the introduction of a system of state strategic management as a platform for more effective application of monetary reform in Russia (on the scale of a city, region or country as a whole). The planned results and advantages of the monetary reform in Russia through the introduction of fees for the use of unencumbered free cash. The reforms carried out within the framework of monetary reform, in aggregate, will prevent a social catastrophe, prevent, i.e. reduce the intensity of social unrest in our country and gently lead Russia out of the global crisis. The advantages of monetary reform of the natural economic order in combination with other reforms are as follows: -reduction of inflation (almost to zero), which is caused mainly by a significant percentage of the distributed funds; -exclusion of percentages from the cost components and, as a consequence, prices as an instrument of income redistribution in an unfair way, i.e. accumulation of most of the income from a small group of individuals, and in amounts larger than they need; -prevention of social catastrophe, prevention of social unrest and social clashes, reduction of the level of aggressiveness in society and the onset of social justice; -reduction of prices for goods and services up to 50%; - the emergence of a stable nationally-oriented quality economy; -the possibility of updating physically and morally worn out fixed assets of public infrastructure; - GDP growth. The disappearance of the percentage component for capital investments and in the production process will lead to lower prices for goods and services in the region conducting an experiment within the framework of monetary and other reforms, the profitability of production will increase and there will be an opportunity to diversify production aimed at meeting the needs of Russian citizens. The proposed system of payment for the use of unencumbered free money within the framework of the natural economic order and within the framework of an experiment in one region, if successful, can be extended to other regions and to the Russian economy as a whole. It's time to move on to economic experiments of a natural order, gently motivating to real actions, with the expectation of economic development. Further research may continue to explore other reforms that will be aimed at reducing socio-economic conflicts. Their implementation is possible in parallel or sequentially with the introduction and implementation of experimental monetary reform. The most effective monetary reform will manifest itself on the platform of state strategic management (planning).

References

1. Retrieved from www.cbr.ru/press/event/?id=12764 (date of the address: 18.03.2022)

2. Kotsofana, T.V. (2014). Essence of inflation and its maintenance in the modern Russian economy. The NIU ITMO Scientific magazine. The "Economy and Ecological Management" series, 1(16). (in Russ.). Retrieved from http://economics.ihbt.ifmo.ru/ru/article/8893/article_8893.htm (date of the address: 16.01.2022)

3. Bryskina, E.O. (2020). The analysis and assessment of inflationary processes in Russia. The International research magazine, 4 (94), Part 2, April, 6-10. DOI: https://doi.org/10.23670/IRJ.2020.94.4.023. (in Russ.). Retrieved from https://research-journal.org/wp-content/uploads/2020/04/4-2-94-1.pdf#page=6 (date of the address: 16.01.2022)

4. Gordiyevich, T.I., & Ruzanov, P.V. (2017). Structural aspects of inflationary processes. Messenger of SibADI, release 6 (58), 163-174. (in Russ.). Retrieved from http://cyberleninka.ru/article/n/strukturnye-aspekty-inflyatsionnyh-protsessov/viewer (date of the address: 16.03.2022)

5. Gordiyevich, T.I., & Ruzanov, P.V. (2018). Inflation and inequality in consumption in 2012-2017. The Omsk scientific bulletin. It is gray. Society. History. Present, 4, 87-93. DOI:10.25206/2542-0488-2018-4-87-93. (in Russ.). Retrieved from http://cyberleninka.ru/article/n/inflyatsiya-i-neravenstvo-v-potreblenii-v-2012-2017-gg/viewer (date of the address: 16.03.2022)

6. Efanova, L.D., & Shmukler, S.A. (2019). Features of inflation in Russia. The Bulletin of the University, 4, 96-99. DOI: 10.26425/1816-4277-2019-4-96-99. (in Russ.). Retrieved from https://cyberleninka.ru/article/n/osobennosti-inflyatsii-v-rossii-3/viewer (date of the address: 16.01.2022)

7. Perevyshina, E.A., & Egorov, D.A. (2015). The inflation reasons in Russia. The Russian business, volume 16, 23, 4261-4270. DOI: 10.18334/rp.16.23.2160. (in Russ.). Retrieved from https://creativeconomy.ru/lib/34680 (date of the address: 18.01.2022)

8. Gordiyevich, T.I.,&Ruzanov,P.V.(2019). Monetary policy: main modes and transmission mechanism. Omsk scientific bulletin. It is gray. Society. History. Present, T.4, 2, 122-130. DOI: 10.25206/2542-0488-2019-4-2-122-130. (in Russ.). Retrieved from http://cyberleninka.ru/article/n/denezhno-kreditnaya-politika-osnovnye-rezhimy-i-transmissionnyy-mehanizm/viewer (date of the address: 18.03.2022)

9. Burlachkov, V.K. (2018). Paradoxes of inflation targeting and a determinant of price dynamics in Russia and the world. Finance and the credit,T.24,10,2163-2174. DOI: https://doi.org/10.24891/fc.24.10.2163. (in Russ.). Retrieved from https://cyberleninka.ru/article/n/paradoksy-inflyatsionnogo-targetirovaniya-i-determinanty-tsenovoy-dinamiki-v-rossii-i-mire/viewer (date of the address: 05.03.2022)

10. Retrieved from http://eprints.hud.ac.uk/23483/1/sszilagyiovafinalthesis.pdf (date of the address: 18.02.2022).

11. Sinelnikova-Muryleva, E.V., & Grebenkina, A.M. (2019). Optimum inflation and inflation targeting: country experience. FINANCE: THEORY AND PRACTICE, Volume 23, 1, 49-65. DOI: 10.18334/grfi.3.4.37184. (in Russ.). Retrieved from https://cyberleninka.ru/article/n/optimalnaya-inflyatsiya-i-nflyatsionnoe-targetirovanie-stranovoy-opyt/viewer (date of the address: 18.01.2022)

12. El-Erian, M.A. (2012). Farewell to Inflation Targeting? Project Syndicate, December 20. Retrieved from https://www.project-syndicate.org/commentary/monetary-policy-s-risky-new-paradigm-by-mohamed-a-el-erian?barrier=accesspaylog (date of the address: 14.03.2022)

13. Cillitzer, C., & Simon, J. (2015).Inflation Targeting: A Victim of Its Own Success. International Journal of Central Banking, vol.11, no. S1, 259-287. Retrieved from https://www.ijcb.org/journal/ijcb15q4a8.pdf (date of the address: 18.03.2022)

14. Francesco Bianchi, Leonardo Melosi and Matthias Rottner. (2021). Hitting the elusive inflation target. Journal of Monetary Economic, vol.124, issue C, 107-122. DOI:https://doi.org/10.1016/j.jmoneco.2021.10.003.Retrieved from https://www.sciencedirect.com/science/article/abs/pii/S0304393221001148 (date of the address: 16.03.2022)

15. Bai, Y., Kirsanova, T. and Leith, C. (2017) Nominal targeting in an economy with government debt. European Economic Review, 94, 103-125. doi:10.1016/j.euroecorev.2017.02.011.Retrieved from https://www.gla.ac.uk/schools/business/staff/tatianakirsanova/#publications,articles (date of the address: 16.03.2022)

16. Istiak, K., Tiwari, A.K., Husain, H., & Sohag, K. (2021). The Spillover of Inflation among the G7 Countries. Journal of Risk and Financial Management,14 (8), [392]. DOI: https://doi.org/10.3390/jrfm14080392. Retrieved from https://science.urfu.ru/ru/pubications/the-spillover-of-inflation-among-the-g7-countries (date of the address: 15.03.2022)

17. Kartayev, F.S.(2016). Targeting of inflation and economic growth. Vestn. Mosk. Un-ta. It is gray.6. Economy,5,39-51. (in Russ.). Retrieved from https://cyberleninka.ru/article/n/vliyaet-li-vybor-rezhima-monetarnoy-politiki-na-inflyatsiyu/viewer (date of the address: 16.02.2022)

18. Kartayev, F.S.(2015). Whether the choice of the mode of monetary policy influences inflation? Vestn. Mosk. Un-ta. It is gray.6. Economy, 3, 26-40. (in Russ.). Retrieved from https://cyberleninka.ru/article/n/targetirovanie-inflyatsii-i-ekonomicheskiy-rost/viewer (date of the address: 16.02.2022)

19. Kudrin, À., Goryunov, E., Trunin, P. (2017). Stimulative monetary policy: Myths and reality. Voprosy Ekonomiki, 5, 5-28. (in Russ.).DOI: https://doi.org/10.32609/0042-8736-2017-5-5-28.Retrieved from https://www.vopreco.ru/jour/article/view/301; https://akudrin.ru/news/statya-stimuliruyschaya-den-kred-politika-mify (date of the address: 30.03.2022)

20. Kudrin, À. (2007). Inflation: Recent trends in Russia and in the world. Voprosy Ekonomiki, 10, 4-26. DOI: https://doi/org/10.32609/0042-8736-2007-10-4-26. (in Russ.). Retrieved from https://www.vopreco.ru/jour/article/view/1657;https://akudrin.ru/uploads/attachments/file/4/inflynciaya-tendencii.pdf?ysclid=l1f3u0nw6 (date of the address: 30.03.2022)

21. Goryunov, E., Drobyshevsky, S., Trunin, P. (2015). Monetary policy of Bank of Russia: Strategy and Tactics. Voprosy Ekonomiki, 4, 53-85. DOI: https://doi.org/10.32609/0042-8736-2015-4-53-85. (in Russ.). Retrieved from https://www.vopreco.ru/jour/article/view/69; https://www.iep.ru/files/text/nauchnie_jurnali/goryunov_trunin_drobyshevsky_vopreco_4-2015.pdf (date of the address: 30.03.2022)

22. Goryunov, E., Trunin, P. (2013). Bank of Russia at the Cross-roads: Should Monetary Policy Be Eased? Voprosy Ekonomiki, 6, 29-44. DOI: https://doi.org/10.32609/0042-8736-2013-6-29-44. (in Russ.). Retrieved from https://www.vopreco.ru/jour/article/view/544;https://www.iep.ru/ files/RePEc/gai/wpaper/134Trunin.pdf (date of the address: 30.03.2022)

23. Drobyshevsky, S., Kadochnikov, P., Sinelnikov-Murylev, S. (2007). Some issues of monetary and ex-change rate policy in Russia in 2000-2006 and in the shortterm outlook. Voprosy Ekonomiki, 2, 26-45. DOI: https://doi.org/10.32609/0042-8736-2007-2-26-45. (in Russ.). Retrieved from https://www.vopreco.ru/jour/article/view/1566;https://www.iep.ru/files/persona/sinelnikov/vopreco-02.07.pdf (date of the address: 30.03.2022)

24. Goryunov, E.L., Drobyshevsky, S.M, Mau, V.A., Trunin, P.V. (2021). What do we (not) know about the effectiveness of the monetary policy tools in the modern world? Voprosy Economiki, (2):5-34. (in Russ.). DOI: https://doi/org/10.32609/0042-8736-2021-2-5-34. Retrieved from (date of the address: 18.03.2022)

25. Aganbegyan, A., Ershov, M. (2013). On interconnections between mone¬tary and industrial policy in Russian banking system operations. Dengi i Kredit, 6, 3–11. (In Russ.). Retrieved from https://ershovm.ru/files/publications_document_157.pdf (date of the address: 30.03.2022)

26. Andryushin, S. (2015). Arguments for the ruble exchange rate management. Voprosy Ekonomiki,12, 51–68. DOI: https://doi.org/10.32609/0042-8736-2015-12-51-68. (In Russ.). Retrieved from https://www.vopreco.ru/jour/article/view/147/0 (date of the address: 30.03.2022)

27. Aganbegyan, A.G. (2016). A new model of economic growth in Russia. Management consulting,1,31-46. (In Russ.). Retrieved from URL:http://cyberleninka.ru/article/n/novaya-model-ekonomicheskogo-rosta-rossii/viewer (date of the address: 30.03.2022)

28. Glazyev, Yu. (2015). About urgent measures for strengthening of economic security of Russia and a conclusion of the Russian economy to a trajectory of the advancing development. Report. (in Russ.).Retrieved from http://glazev.ru (date of the address: 16.02.2022)

29. Retrieved from https://shraibikus.com/1136394-568521136394.html (date of the address: 18.02.2022).

30. Gordiyevich, T.I., & Ruzanov, P.V. (2017). Evolution of factors of inflation in the conditions of economic sanctions. Vestn. Ohm. un-that. It is gray. "Economy", 4 (60), 14-25. DOI: 10.25513/1812-3988.2017.4.14-25 (in Russ.). Retrieved from http://cyberleninka.ru/article/n/evolyutsiya-faktorov-inflyatsii-v-usloviyah-ekonomicheskih-sanktsiy/viewer (date of the address: 05.03.2022)

31. Retrieved from http://etheses.dur.ac.uk/11640/ (date of the address: 01.03.2022)

32. Nikitin, S., & Stepanova, M. (2008). Inflation and anti-inflationary policy: foreign and domestic experience. World economy and international relations, 4, 16-20. (in Russ.).Retrieved from https://naukarus.com/inflyatsiya-i-antiinflyatsionnaya-politika-zarubezhnyy-i-otechestvennyy-opyt (date of the address: 16.02.2022)

33. Kolodko, G.W. (2021).Shortageflation 3.0: War economy – state socialism – pandemic crisis. Voprosy Ekonomiki, (10):5-26. (in Russ.). DOI: http://doi.org/10.32609/0042-8736-2021-10-5-26. Retrieved from https://www.vopreco.ru/jour/article/view/3687 (date of the address: 15.03.2022)

34. Gurov, I.N., & Kulikova, E.Y. (2021).The impact of a countrys level of development on the nexus between bank leading structure and economic growth. Voprosy Ekonomiki, 10, 51-70.(in Russ.).DOI:http://doi.org/10.32609/0042-8736-2021-10-51-70.Retrieved from https://www.vopreco.ru/jour/article/view/3469 (date of the address: 15.03.2022)

35. Soyfiyeva, S.N. (2014). Features of the Russian inflation: historical aspect.//Regional problems of transformation of economy,6, 24-30. (in Russ.).Retrieved from https://cyberleninka.ru/article/n/osobennosti-rossiskoy-inflyatsii-istoricheskiy-aspekt/viewer (date of the address: 16.02.2022)

36. Zubarevich, N.V. (2021).Possibilities of decentralization in a year of a pandemic: what shows the budgetary analysis? Regional research,1, 46-57. DOI: 10.5922/1994-5280-2021-1-4. (in Russ.). Retrieved from https://istina.msu.ru/publications/article/383914557 / (date of the address: 18.03.2022).

37. Semiturkin, O.N., Shevelev, A.A., Kvaktun, M.I. (2021).Analysis of the heterogeneity factors and assessment of the structural levels of inflation in Russian regions. Voprosy Ekonomiki, (9):51-68. (in Russ.). DOI: http://doi.org/10.32609/0042-8736-2021-9-51-68. Retrieved from https://www.vopreco.ru/jour/article/view/3299 (date of the address: 15.03.2022)

38. Zakharov, V.K. (2017). This new old world. The future from the past. (In Russia), Moscow: Kislorod publishing house.

39. Kalabekov, I.G. (2010). The Russian reforms in figures and the facts. (The edition second processed and added). (In Russ.), Moscow. RUSAKI. Retrieved from http://refru.ru (date of the address: 10.01.2022)

40. Gesell, S. (1892). The National Economic Order (translated by Philip Pye M.A.) [This is a document from the site gasfin.com]. Retrieved from Gesell_en.pdf - Yandex.Documents (date of the address: 22.11.2021)

41. Retrieved from http://www.stats.gov.cn/english/ (date of the address: 16.03.2022 ã.).

42. Glazyev, S.Yu.(2021). Strategic planning as an integrative element in a control system of development. Materials of the "Planning in Market Economy …" conference. Economic revival of Russia,3 (69),14-19.DOI: 10.37930/1990-9780-2021-3-69-14-19. (in Russ.).Retrieved from https://cyberleninka.ru/article/n/strategicheskoe-planirovanie-kak-integrativnyy-element-v-sisteme-upravleniya-razvitiem/viewer (date of the address: 16.03.2022)

43. Aganbegyan, A. (2020).Restarting national projects as a condition for economic growth. Scientific works of WEO of Russia, Ò.225,5,49-64. DOI: 10.38197/2072-2060-2020-225-5-49-64. (In Russia). Retrieved from http://cyberleninka.ru/article/n/perezapusk-natsionalnyh-proektov-kak-uslovie-ekonomicheskogo-rosta/viewer (date of the address: 30.03.2022)

44. Retrieved from http://www.strategplan.com/publications/4/ (date of the address: 18.03.2022).

45. Veduta, E.N. (2016). Interindustry and intersectoral balance: a mechanism for strategic economic planning. (In Russia), Moscow: Academic project.

46. Veduta, N.I. (1999).Socially Efficient Economy/Under the General Editorial Dr. Economy. Veduta E.N. (In Russia), Moscow: REA Publishing House. Retrieved from https://www.studmed.ru/veiw/veduta-ni-socialno-effectivnaya-economika_4b5e678.html (date of the address: 30.03.2022)

47. Veduta, N.I.(1971). Economic cybernetics. Minsk: Science and Technology.

First Peer Review

Peer reviewers' evaluations remain confidential and are not disclosed to the public. Only external reviews, authorized for publication by the article's author(s), are made public. Typically, these final reviews are conducted after the manuscript's revision. Adhering to our double-blind review policy, the reviewer's identity is kept confidential.

The list of publisher reviewers can be found here.

The subject of the article is the mechanisms that generate inflation, in particular, in the economy of the Russian Federation, as well as the problems of a macroeconomic nature associated with it. Recently, the problem of accelerating inflation has seriously concerned the country's monetary authorities, and the Central Bank has consistently pursued a policy of increasing the refinancing rate in order to bring down this wave. There is no doubt that the unwinding of the inflationary spiral has a negative impact on business, investment, and to a large extent on the population, whose incomes already lag behind changes in consumer prices. In addition, a significant increase in the dollar exchange rate is taking place even against the background of, albeit slowly, but still rising oil prices. The research methodology is based on the analysis of statistical data directly or indirectly related to inflation, on the analysis of existing theories of monetary circulation, as well as the works of domestic authors analyzing various causes of inflationary susceptibility of the Russian economy. The author covers the classical theoretical aspects of inflation in sufficient detail, which, in our opinion, is unnecessary within the framework of a scientific article, and they could well be shortened for a better perception of the material. The relevance of the study of inflationary processes in the Russian economy is due to the high degree of dependence on foreign investments, bank capital, technologies and consumer goods, the price of which is determined by the exchange rate. This is accompanied by a high level of risks generated by the sanctions regime and the pandemic, which also makes foreign investments expensive, and in order to return them, domestic producers need to raise the price of their products, thereby accelerating the inflationary spiral. Therefore, the key question is to what extent the policy of the monetary authorities of the Russian Federation is generally capable of radically influencing inflation by changing the refinancing rate. The scientific novelty of the study boils down to the proposal to conduct an experiment with the introduction of the so-called Gezzel money, which, according to the author's idea, should eliminate the problem of inflation altogether. As we have already noted, the nature of Russian inflation and inflation is by no means rooted solely in the problems of monetary circulation, but is generated by many other reasons, primarily a high degree of dependence on commodity exports. Here we can also cite a variant of the Soviet monetary circulation system, where money serving consumption was separated from investment money, which solved the problem of keeping low interest on capital much more successfully. Unfortunately, the article suffers from unjustified length, excessive deviations from the outline of the logical presentation, which makes it difficult to perceive the material. In addition, the scientific style of presentation is not always sufficiently sustained, the author uses journalistic phrases that have no place in scientific research. In our opinion, the article would only benefit if the author found it possible to shorten it, as well as to present the logic of the study more consistently. The bibliography includes 32 sources, but not all of them are equivalent even in scientific terms, since the list of references includes publications on popular Internet platforms of a journalistic nature. Very few scientific studies have been mentioned in recent years devoted to this problem, including foreign ones. We believe that the bibliography should be finalized taking into account these comments. In general, we believe that the article can be published, but it needs to be finalized. The article is devoted to an urgent problem, contains relevant statistical data, and the author's proposals can be considered in the course of scientific controversy as one of the options for the monetary policy of the Russian Federation.

Second Peer Review

Peer reviewers' evaluations remain confidential and are not disclosed to the public. Only external reviews, authorized for publication by the article's author(s), are made public. Typically, these final reviews are conducted after the manuscript's revision. Adhering to our double-blind review policy, the reviewer's identity is kept confidential.

The list of publisher reviewers can be found here.