|

MAIN PAGE

> Back to contents

Finance and Management

Reference:

Vasiukov E.A.

Comparative analysis of the factors of attractiveness for foreign direct investments in the developing and developed countries

// Finance and Management.

2020. № 1.

P. 38-52.

DOI: 10.25136/2409-7802.2020.1.31832 URL: https://en.nbpublish.com/library_read_article.php?id=31832

Comparative analysis of the factors of attractiveness for foreign direct investments in the developing and developed countries

Vasiukov Evgenii Aleksandrovich

Postgraduate student, the department of World Economy, M. V. Lomonosov Moscow State University

119234, Russia, Moskva oblast', g. Moscow, ul. Leninskie Gory 1, 1

|

vasyukov.e@gmail.com

|

|

|

|

DOI: 10.25136/2409-7802.2020.1.31832

Received:

23-12-2019

Published:

09-04-2020

Abstract:

With the cooling of global economic and exhaustion of internal sources of finance, the countries need to attract foreign investment in form of foreign direct investments (FDI) to stimulate economic growth. The subject of this research is the factors defining the inflow of foreign direct investments into national economies, as well as comparison of the factors impacting attracting of foreign capital into developing and developed countries. For comparison of the inflow of FDI, the work utilizes the following factors: openness of trade, wages, size of the market, development of infrastructure, and tax policy. In the next few years, developing countries will continue to maintain an edge in size of wages, but due to drastic difference in the quality of labor resources, developed countries will be more preferable from the investment perspective. In absence of the necessary infrastructure and without additional support or stimulus of the receiving state, decisions on investments will lean towards the more accessible markets of developed countries. As a result of limited business environment, high level of expenses for starting a company, and inefficiency of the market, the state needs to provide clear communication regarding the vector of government policy in the area of investments and refrain from inconsistency in passing measures. If companies would not be certain in the future of the political course, their profit expectations would rise significantly, while investment activity would drop.

Keywords:

economic development, foreign direct investment, human capital, investment attraction, developing countries, competition, growth factors, openness of the economy, return on investment, risks

This article written in Russian. You can find original text of the article here

.

Сравнительный анализ факторов привлекательности для ПИИ в развивающихся и развитых странах

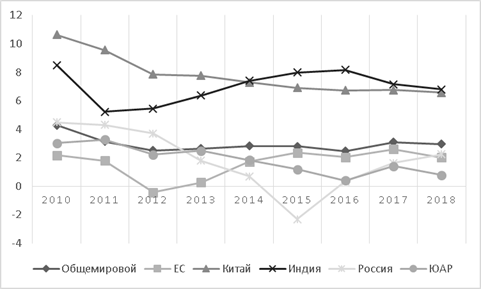

В соответствии с прогнозом Всемирного банка, темп роста мировой экономики в 2020 году составит примерно 3%. Такой низкий прогноз обусловлен сохранением жестких условий для получения финансирования, геополитической напряженностью и высокой волатильностью стоимости нефти и, как следствие, удорожанию импорта для ключевых мировых производителей товаров и услуг. [21]

Рисунок 1.Темп роста ВВП, %

Источник: данные Всемирного банка

Приток капитала в форме прямых иностранных инвестиции (ПИИ), может ускорить экономический рост как за счет финансирования крупных проектов, так и за счет повышения эффективности [10]. В конце XX века ПИИ сыграли ключевую роль в содействии росту и экономическим преобразованиям в развивающихся странах. Кроме того, ПИИ стали крупнейшим источником внешнего финансирования для развивающихся стран; это важнейший механизм передачи технологий из передовых стран, стимулирующий местные капиталовложения и способствующий улучшению человеческого капитала и институтов принимающих стран. [2]

Ожидается, что внешние условия для инвестиций в компании развивающихся стран станут менее благоприятными в среднесрочной перспективе. Но потребность стимулирования и поддержки индустриализации, диверсификации экономик и структурных преобразований как никогда велика. Кроме того, постоянные опасения инвесторов относительно возможных дальнейших протекционистских торговых действий могут снизить привлекательность новых инвестиционных проектов. [8]

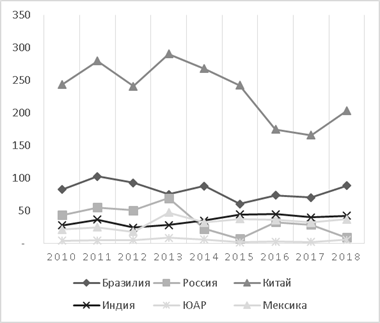

Рисунок 2. Чистый приток ПИИ, млрд долларов США

Источник: данные Всемирного банка

Для купирования этих эффектов правительствами развивающихся стран используют исключительно методы прямого воздействия, а именно упрощение законодательства для иностранных компаний. При этом не учитываются особенности внутреннего рынка, а также те факторы, которые интересуют конкретного инвестора: это могут быть налоговые льготы, возможность ведения совместного бизнеса с государством через механизм ГЧП, совершенствование материальных условий инвестиционного процесса, таких как развитие местной инфраструктуры, социальной политики и т.д. Учитывая, что большинство стран предлагают сразу несколько различных стимулов, возникает необходимость сопоставлять или даже превосходить предложения конкурирующих стран по компенсации неблагоприятного географического положения, небольшого размера или расстояния до рынков, чтобы оставаться привлекательными для иностранных инвесторов. [7]

Для проведения сравнения с развитыми экономиками были выбраны страны БРИКС, одни из крупнейших реципиентов ПИИ за последние 20 лет среди развивающихся стран, которые также находятся в топ-20 экономиках мира по различным экономическим показателям. Также, в связи с тем, что анализ будет произведен с позиции инвестиционной привлекательности для группировки также был учтен размер купонных ставок по 10-летним гособлигациям, который отражает мнение рынка относительно инвестиционной привлекательности той или иной страны. Для группы БРИКС данный диапазон составил от 6.78% (Бразилия) до 8.25% (ЮАР), для развитых стран от 0.1% (Япония) до 1.6% (США). К странам БРИКС для рассмотрения была добавлена Мексика в связи с географической близостью к крупнейшему мировому инвестору (ставка – 7.01%). Также отражения эффекта отдельных факторов (оплата труда, качество человеческого капитала) для сравнения были добавлены Малайзия и Сингапур как примеры развивающихся экономик, которым удалось добиться успеха в достижении высокого качества человеческих ресурсов и прозрачности политических институтов за счет привлечения ПИИ в последние 20 лет.

Данный вопрос не является новым для научного сообщества, построением и анализом моделей взаимодействия ПИИ и экономик различных регионов, а также анализом ключевых детерминант направления финансовых потоков посвящены работы Хекшера Э., Бернанке Б, Маркусена Д., Даннинга Д и др. Вместе с тем в отечественной литературе пока не достаточно внимания уделено вопросу сравнения преимуществ развитых и развивающихся стран с точки зрения привлечения ПИИ после кризиса 2008 года.

Объект исследования — привлечение иностранного капитала в развитые и развивающиеся страны.

Предмет исследования — факторы, присущие национальным экономика, определяющие приток прямых иностранных инвестиций.

Научная новизна исследования определяется результатами сравнительного анализа факторов, усиливающих приток ПИИ для развитых и развивающихся стран, с учетом не только инвестиционной политики, но и прочих экономических факторов. А также разработкой комплексных рекомендаций по купированию негативных эффектов национальных рынков.

Многие страны, которым требовались иностранные инвестиции, претерпели структурные реформы и изменения в целях усиления конкуренции путем создания дружественной для ТНК внутренней инвестиционной политики, обеспечения более высокой степени защиты прав и предоставления различных стимулов, чтобы сделать свои страны привлекательными для потенциальных инвесторов [16]. Исследования выделяют несколько ключевых факторов, которые влияют и определяют объем прямых иностранных инвестиций (ПИИ): открытость торговли, оплата труда, размер рынка, развитость инфраструктуры, налоговая политика.

Согласно исследованиям, открытость торговли отражает общий объем торговли экономики конкретной страны. Другими словами, она представляет собой общую сумму экспорта и импорта в ВВП, и влияет на характер и уровень притока ПИИ. Факторы, влияющие на открытость, включают как внешние торговые барьеры, так и торговые ограничения, введенные принимающими странами. Начиная с 1980 года развивающиеся рынки были открыты в меньшей степени, чем страны с развитой экономикой. Учитывая неопределенность в отношении устойчивости притоков капитала, правительства некоторых стран использовали защитную тактику, накапливали резервы и ограничили открытие своих счетов для операций с капиталом, в том числе, прибегая в некоторых случаях к «ручному» управлению потоками капитала. Длительное использование подобных мер приводят к необходимости привлекать международный капитал, чтобы заполнить пробелы в инвестициях в не самые эффективные сектора экономики (инфраструктура, медицина, социальная сфера). [15]

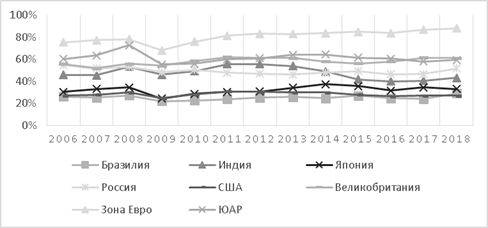

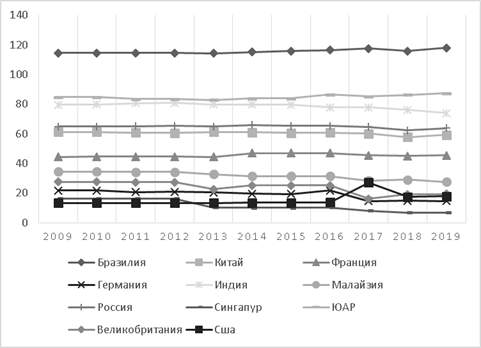

Рисунок 3. Объем торговли, % ВВП

Источник: данные Всемирного банка

Однако открытость торговли воспринимается ТНК по-разному и зависит от типа инвестиций, в которых они планируют участвовать. В то время как некоторые фирмы предпочитают более либерализованные рынки с минимальными торговыми барьерами для снижения операционных издержек. Для инвестиций, связанных с экспортом, наличие ограничений на импорт конкурентов, наоборот, рассматриваются положительно с точки зрения максимизации возможной прибыли на внутреннем рынке [6]

При этом как показано на графике выше, объем торговли в последние 10 лет составляет значительный объем относительно ВВП как развитых, так и в развивающихся странах, что говорит о высокой степени интеграции этих стран (особенно сырьевых экспортеров) в мировую экономку. Тем не менее, основным риском для открытости торговли и, соответственно, привлечения инвестиций будут возможные торговые барьеры из-за политических причин (санкции, торговые ограничения). В подобной ситуации важным фактором станет открытость коммуникации с потенциальными инвесторами. Так, принятие законов аналогичных китайском Закону о совместных предприятиях, и обеспечение правительствами принимающих стран разработки и принятии политик «открытых дверей», переход к обозначению ранее «закрытых» секторов в статус «разрешенных» или «поощряемых» может сигнализировать инвесторам о желании привлечь иностранный капитал. [12]

Следующий важный фактор при принятии инвестиционных решений – оплата труда и качество человеческого капитала. Эффект размера оплаты труда стал основной движущей силой притока инвестиций в конце XX века в азиатские страны. Дешевая рабочая сила стимулирует ТНК инвестировать на зарубежных рынках для сокращения производственных затрат. Для сравнения, более высокие затраты на оплату труда имеют тенденцию вызывать противоположные эффекты [3]

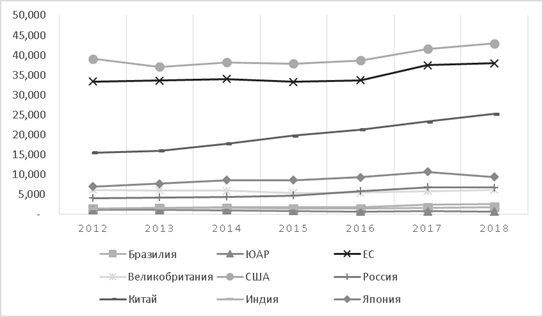

Рисунок 4. Средний ежемесячный размер оплаты труда, долл. США

Источник: trading economics (https://tradingeconomics.com/)

Можно отметить, что уровень оплаты труда в развивающихся странах все еще значительно ниже, чем в развитых. На протяжении последних 10 лет в Китае и Индии продолжается рост минимального размера оплаты труда на 3-5% в год. То есть расходы компаний на персонал (зарплаты, обучение, отчисления в фонды, профсоюзы) растут еще больше, что значительно снижает ожидаемую доходность от инвестиций и ставит под сомнение целесообразность вложений.

Тем не менее, уровень заработной платы в регионе является не единственным фактором, влияющем на приток ПИИ, качество или квалифицированность рабочей силы влияет на распределение инвестиций: более развитые страны, как правило, привлекают ПИИ в высокооплачиваемые услуги, в то время как менее развитые страны привлекают ПИИ в трудоемкие отрасли, отрасли с низким уровнем квалификации и низкой заработной платой. [9]

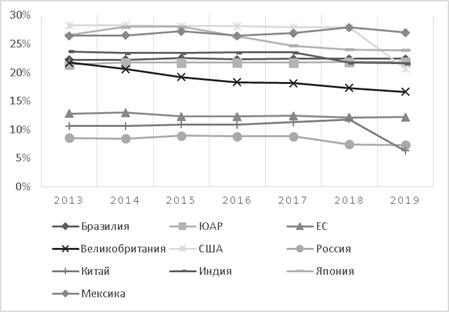

Рисунок 5. Средний рейтинг по качеству человеческого капитала

Источник: Legatum prosperity index (https://www.prosperity.com/rankings)

На графике выше показана динамика индекса Legatum prosperity index по качеству человеческого капитала, в расчет которого принимаются такие факторы как производительность труда, уровень образования взрослого населения, доступ к качественному образованию, уровень навыков выпускников вузов, наличие квалифицированных рабочих и др. В развитых странах среднее значение этих показателей значительно выше развивающихся, что подтверждает характер инвестиций. Высококвалифицированная рабочая сила более склонна адаптироваться к новым изменениям и, следовательно, более продуктивна по сравнению с низкоквалифицированными работниками. [18]

В то время как компании, выходящие на рынок, могут не беспокоиться о качестве рабочей силы, компании, ищущие эффективность, нацелены на рынки с изобилием квалифицированной рабочей силы из-за характера их деятельности. Другими словами, производители, работающие в швейной промышленности, которые стремятся достичь эффекта масштаба, не заботятся о качестве, в отличие от высокотехнологичных отраслей. [4]

Правительства развивающихся стран выделяют значительное количество ресурсов для привлечения ПИИ в надежде на то, что это создаст новые перспективы трудоустройства, при этом данный процесс проходит неравномерно. Позитивное влияние иностранных компаний на деятельность на рынке труда часто связано с той эффективностью, которую они привносят, соответственно при разработке политики, нацеленной на привлечение иностранных инвестиций следует учитывать особенности национального рынка труда (барьеры мобильности рабочей силы, ограничения на размер заработной платы и тп). [9]

Таким образом, несмотря на то, что в ближайшие несколько лет развивающиеся страны все еще будут обладать преимуществом по размеру оплаты труда, но из-за высокой разницы в качестве трудовых ресурсов и условий труда, развитые страны будут предпочтительнее с точки зрения инвестиций.

Следующие два фактора -размер рынка и перспективы роста рынка. Размер рынка можно определить на основе показателя ВВП на душу населения, который является одним из наиболее важных факторов, определяющих приток ПИИ для ТНК, которые стремятся расширить свою деятельность на зарубежных рынках. Следовательно, крупные рынки обязаны привлекать большее количество иностранных фирм и, таким образом, повышать конкурентоспособность. Чем больше рынок, тем больше у ТНК возможностей для достижения эффекта масштаба и снижения затрат, связанных с производством [3].

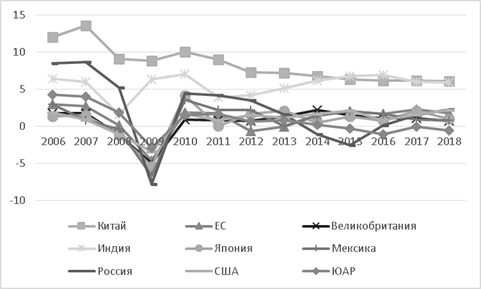

Рисунок 6. Динамика роста ВВП на душ населения, % годовых

Источник: данные Всемирного банка

Тем не менее, ТНК могут инвестировать, чтобы получить доступ к другому промежуточному рынку для целей экспорта. Кроме того, учитывая актуальность государственной политики в отношении стимулирования притока ПИИ в принимающей стране, размер рынка может иметь потенциал для роста, если внутренняя институциональная структура и макроэкономическая среда не противоречат краткосрочным и долгосрочным стратегическим целям ТНК. Такие страны, как Сингапур и Малайзия, несмотря на свою небольшую экономику по сравнению с Аргентиной, Бразилией и Индией, по-прежнему способны сильно конкурировать из-за более дружественной политики в области ПИИ [23]. Положительное влияние размера рынка в отношении внутренних ПИИ было подтверждено многочисленными исследованиями различных стран независимо от их размера [20].

Качество инфраструктуры является важным фактором, который может определять темпы развития производства и темпы роста экономики [11]. Если ТНК стремятся использовать рынок конкретной страны, как базу для выхода на другие рынки, наличие инфраструктуры, а именно состояние транспортных сетей, телекоммуникаций, водоснабжения и энергоснабжения выходит на первый план. Часто развитым экономикам удается привлекать большие суммы ПИИ по сравнению с менее развитыми странами именно из-за преимуществ в инфраструктуре [17].

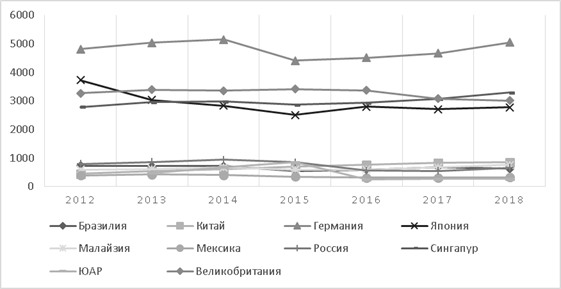

Рисунок 7. Объем авиа перевозок, млн тонн-км

Источник: данные Всемирного банка

В случае, если сфера бизнеса ТНК связана с торговлей, производством, добычей полезных ископаемых и тп, логистические издержки будут иметь большой вес в себестоимости продукции. Чем более развита инфраструктура в принимающей стране, тем проще для компании будет оптимизировать издержки. Так, исследования показали, что инфраструктура сыграла ключевую роль и оказала огромное влияние на приток ПИИ в китайскую экономику в начале XXI века [20]

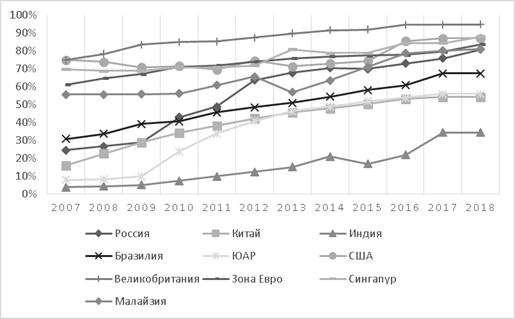

Рисунок 8. Доля населения, имеющая доступ в интернет, %

Источник: данные Всемирного банка

Как уже было рассмотрено описано ранее, ТНК рассматривают рынки для возможных инвестиций с точки зрения не только количества, но и качества человеческих ресурсов. Несмотря на значительное улучшение за последние 10 лет, в развивающихся странах доля населения с доступ к сети интернет достигает всего лишь 50%. Это означает, что проблемы с инфраструктурой в стране не позволяет значительному количеству населения улучшать свое положение на рынке труда за счет доступа к новой информации и навыкам. Таким образом, при отсутствии необходимой инфраструктуры и без дополнительной поддержки или стимулов от принимающего государства, решение об инвестициях будет приниматься в пользу более доступных рынков развитых стран. [14]

Налоговая политика принимающей страны также влияет на уровень притока ПИИ. Компании обычно ищут рынки с более низкими налоговыми ставками по сравнению со странами собственного происхождения. Структура налоговых ставок (будь то корпоративный налог, налог на прибыль или имущество) и их влияние на размер прибыли тщательно рассматриваются до принятия любого инвестиционного решения. [22]

Рисунок 9. Динамика ставки налога на прибыль компаний

Источник: данные Всемирного банка

По данному показателю невозможно выявить четкого лидера, тк как развивающиеся, так и развитые страны стремятся привлечь капитал за счет низких налоговых ставок. Правительства соответствующих принимающих стран стремятся найти баланс между ставками налоговых льгот и необходимостью собирать желаемую сумму доходов, доступную с точки зрения ТНК, для обеспечения конкурентной среды. Как показали исследования, когда фирмы не уверены в будущем политическом курсе принимающей страны, их ожидаемая доходность с поправкой на риск значительно возрастает, а стоимость инвестиционных активов снижается, что сдерживает инвестиции [1]

Большинство инвесторов сталкиваются с макроэкономическими, политическими и регуляторными рисками при планировании и реализации инвестиционных предложений. Снижение риска инвестиций в конкретную страну может привести к улучшению показателя риск-доходность проекта и помочь привлечь инвестиции. В противном случае, коммерчески выгодные и экономически привлекательные проекты могут не состояться. Правительства как в развивающихся, так и в развитых странах используют различные стимулы для снижения рисков для иностранных инвестиций, чтобы привлечь больше ПИИ.

Там, где компании мотивированы доступом к внутренним рынкам или природным ресурсам, стимулы, как правило, имеют ограниченную ценность. Однако в секторах, где ПИИ в основном ориентированы на поиск эффективности (например, производство информационных технологий и электроники, машин и оборудования, космических аппаратов, биотехнологий и фармацевтики), конкуренция за ПИИ высока и в развивающихся странах часто предлагают стимулы для конкуренции. Это также показывает, что, хотя стимулы могут быть более важной частью ценностного предложения для инвесторов, стремящихся к эффективности, они не являются достаточным условием для поступления ПИИ, поскольку ПИИ, ориентированные на повышение эффективности, имеют тенденцию концентрироваться географически в относительно небольшом количестве мест, несмотря на широкую доступность стимулов. [5]

|

Страна

|

2018

|

2017

|

2016

|

2015

|

2014

|

2013

|

2012

|

|

Сингапур

|

85

|

84

|

84

|

85

|

84

|

86

|

87

|

|

Германия

|

80

|

81

|

81

|

81

|

79

|

78

|

79

|

|

Великобритания

|

80

|

82

|

81

|

81

|

78

|

76

|

74

|

|

Япония

|

73

|

73

|

72

|

75

|

76

|

74

|

74

|

|

Франция

|

72

|

70

|

69

|

70

|

69

|

71

|

71

|

|

США

|

71

|

75

|

74

|

76

|

74

|

73

|

73

|

|

Малайзия

|

47

|

47

|

49

|

50

|

52

|

50

|

49

|

|

ЮАР

|

43

|

43

|

45

|

44

|

44

|

42

|

43

|

|

Индия

|

41

|

40

|

40

|

38

|

38

|

36

|

36

|

|

Китай

|

39

|

41

|

40

|

37

|

36

|

40

|

39

|

|

Бразилия

|

35

|

37

|

40

|

38

|

43

|

42

|

43

|

|

Россия

|

28

|

29

|

29

|

29

|

27

|

28

|

28

|

Рисунок 10.Индекс восприятия коррупции

Источник: данные Transparency International (transparencyinternational.com)

Более целенаправленное, прозрачное и экономически эффективное использование инвестиционных стимулов может улучшить их воздействие. Направляя стимулы на тех инвесторов, которые с наибольшей вероятностью отреагируют на них, развивающиеся страны могут сократить ненужные налоговые потери в результате стимулов, предоставленных фирмам, которые все равно инвестировали бы в данный регион. Это требует глубокого понимания типа и мотивации для ПИИ в стране, а также измеримых целей политики. В то же время, улучшения в дизайне, прозрачности и администрировании стимулов могут помочь снизить косвенные затраты и непредвиденные последствия, включая экономические искажения, бюрократизм и коррупцию. Такие политические реформы могут значительно улучшить соотношение затрат и выгод для стимулов [13]

Таким образом, в качестве рекомендаций можно отметить, что в первую очередь, правительствам принимающих государств необходимо проанализировать характер и источники ПИИ, которые смогут внести наибольший вклад в экономическое развитие государства. Несмотря на то, что еще в начале 20 века стремление к значительному сокращению издержек на персонал перекрывало все остальные факторы, то с переходом большинства международных компаний к интенсивному способу производства с применением высоких технологий и роботизации, более высокие требования к качеству персонала в принимающих экономиках. Особое внимание на этот аспект стоит уделить государствам, желающих диверсифицировать экономику (например, Россия и Бразилия).

Компании, основной мотив которых достижение эффективности, будут учитывать качество имеющегося человеческого капитала. Для улучшения данного показателя потребуется проанализировать текущую модель рынка труда с целью выявления ключевых слабых мест в квалифицированных специалистах. Как пример- создание профессиональных программ совместно с крупными корпорациями будет способствовать закрытию потребности в конкретных специалистах в кратчайшие сроки на базе уже имеющихся учебных заведений.

Для стран, принимающих капитал компаний, стремящихся к снижению издержек, на первый план выйдет увеличение предложения труда, что может быть достигнуто благодаря улучшению демографической ситуации (в том числе за счет миграции), улучшение качества медицинского обслуживания и снижение издержек для движения человеческих ресурсов.

Принятие мер по стимулированию развития и улучшению качества инфраструктуры (усиление контроля качества, совместные программы в форме ГЧП), прежде всего авто/ ж.д транспортных сетей, портовой и авиа инфрастуктуры позволит не только снизить издержки транспортных компаний, но и в долгосрочном плане получить новые рынки сбыта и новых пользователей продукции за счет расширения доступа продукции. Также это позволит увеличить темп роста потенциального ВВП.

Эффект от подобных преобразований может быть нивелирован за счет излишне жестких протекционистких мер и закрытия рынков для международных сделок. При принятии решения следует учитывать не только политический контекст и интересы внутренних производителей, но и эффект принимаемых мер на потенциальный рост и долгосрочный эффект на все сферы экономики. Если рассматривать ситуацию в целом, то наличие каких-либо ограничений (товарных, финансовых) негативно сказывается на притоке и препятствует интеграции экономики конкретной страны в международное пространство, снижая возможность получить иностранное финансирование

Институциональные реформы играют ключевую роль в создании условий, способствующих привлечению инвестиций. Соответствующие реформы могут устранить препятствия, характерные для конкретной страны, такие как ограничения в бизнес среде, высокие затраты на запуск бизнеса, неэффективность рынка труда и продукции и низкое качество человеческого капитала. В странах, где финансовое развитие является слабым, финансовое углубление может стимулировать инвестиции, хотя необходимо следить за показателями риска во избежание финансовой нестабильности. [19]

Со стороны государства необходимы четкие коммуникации относительно направления государственной политики в области инвестиций и воздержание от непоследовательности принятия мер. Участие в торговых и интеграционных соглашениях может помочь улучшить деловой и инвестиционный климат и ускорить рост инвестиций, особенно если такие соглашения стимулируют интеграцию в глобальные производственно-сбытовые цепочки и помогают снизить стоимость торгуемых инвестиционных товаров, например, машин и оборудования. В долгосрочной перспективе сырьевым экспортерам необходимо будет диверсифицировать экономику, чтобы снизить уязвимость инвестиций к изменчивости цен на природные ресурсы. [22]

Мировой экономический кризис 2008 года выявил дисбалансы в экономиках как развитых, так и развивающихся стран. За более чем 10 лет мировые темпы роста так и не достигли предкризисных значений. Многие мировые экономики находятся на грани исчерпания внутренних ресурсов для поддержания роста и развития. В этих условиях особое внимание обращается на внешние источники получения финансирования, в частности на ПИИ. Данные инвестиции являются важным фактором для движения в сторону индустриализации и модернизации. Имеющееся технологическое отставание как в промышленности, так и в объектах инфраструктуры требует значительного объема капитальных вложений в развивающихся странах.

Объем привлеченного капитала зависит не только от наличия благоприятного инвестиционного законодательства, а также и от адаптации его исходя из особенностей конкретной принимающей стороны (степень развития человеческого капитала, инфраструктуры и тп). Для сохранения конкурентоспособности развивающихся стран, необходимые реформы выходят за рамки простого упрощения инвестиционных режимов. Роль правительства будет иметь решающее значение в структурировании отношений с потенциальными инвесторами и регулировании позиции государства в отношении иностранных инвестиций и экономического роста.

Учитывая актуальность проблемы, в данной статье дана сравнительная характеристика основных аспектов национальных экономик развитых и развивающихся стран как получателей ПИИ: открытость торговли, оплата труда, размер рынка, развитость инфраструктуры, налоговая политика. Раскрыты преимущества и недостатки экономик развивающихся стран с акцентом на странах БРИКС, Таиланде, Мексике. Предложены комплексные меры и общие рекомендации по улучшению инвестиционного климата в развивающихся экономиках. Для устойчивого роста в условиях глобализации и растущей конкуренции, развивающимся странам потребуется больше открытости и дальнейшего ослабления ограничительных инвестиционных режимов. Для достижения желаемого результата входящие потоки капитала должны быть направлены в различные сектора в зависимости от потребности конкретной экономики.

Список использованной литературы.

1. Andersen M., Kett B., Corporate Tax Incentives and FDI in Developing Countries. Global Investment Competitiveness Report 2017/2018, 2018 c.73-99

2. Bernanke B. The Global Saving Glut and the U.S. Current Account DeOcit. The Federal Reserve Board Speech, 2005 c.5

3. Cohen S. D. Multinational Corporations and Foreign Direct Investment: Avoiding Simplicity, Embracing Complexity. Oxford University Press. 2007 c.18-36

4. Dunning, J., Lundan, S. Multinational Enterprises and the Global Economy. Edward Elgar Publishing, 2008 c.39

5. Gonzalez A, Qiang C, Kusek P. Global Investment Competitiveness Report 2017/2018, 2018 c.185

6. Huchet M., Le Mouel C., Vijil M. The relationship between trade openness and economic growth: Some new insights on the openness measurement issue. The World Economy, Wiley, 2017, c.32

7. International Monetary Fund. World Economic Outlook, Global Manufacturing Downturn, Rising Trade Barriers. 10.2019 c.208

8. International Monetary Fund Global Financial Stability Report, October 2019: Lower for Longer. IMF. 10.2019 c.109

9. Iwai N., Thompson S. R. Foreign Direct Investment and Labor Quality in Developing Countries. Review of Development Economics, 16 (2), 2012 c.42

10. Jadhav P., Determinants of foreign direct investment in BRICS economies: Analysis of economic, institutional and political factor, Procedia - Social and Behavioral Sciences 37, 2012 c.10

11. Kirkpatrick C., Parker D., Zhang Y. Foreign Direct Investment in Infrastructure in Developing Countries: Does Regulation Make a Difference? Transnational Corporations, 15(1),2006

12. Latham&Watkins. China Introduces New Foreign Investment Law, Negative Lists, and Encouraged Industries Catalogue. Latham&Watkins, #2531 08.2019 c.3

13. Laudicina P, Peterson E., McCaffrey C. Global Business Policy Council Research Report, A.T. Kearney 2019 c.5

14. Mumtaz S. The significance of infrastructure for FDI inflow in developing countries. Journal of Life Economics #2, 2014 c.16

15. Osakwe P., Santos-Paulino A., Dogan B. Trade dependence, liberalization and exports diversification in developing countries., UNCTAD Research Paper No. 2, 08.2019 c.22

16. Paez L. Liberalizing Finance Services and Foreign Direct Investment. Basingstoke: Palgrave Macmillan, 2011 c.276

17. United Nations. World Investment report 2019. United Nations publications. 10.2019 c.49

18. United Nations. World Population Prospects. United Nations publications. 01.2019 c.46

19. Vashakmadze E., Regional dimensions of recent investment weakness: Facts, investment needs and policy responses, Journal of Infrastructure, Policy and Development 01.2018, c.30

20. Vijayakumar N., Sridharan P., Rao K. Determinants of FDI in BRICS Countries: A Panel Analysis. International Journal of Business Science & Applied Management, 5(3). 2010, c.13

21. World Bank. 2020. Global Financial Development Report 2019/2020 : Bank Regulation and Supervision a Decade after the Global Financial Crisis. Washington, DC: World Bank. 11.2019 c.155

22. World Bank. Doing Business 2020 : Comparing Business Regulation in 190 Economies. Washington, DC: World Bank, 10.2019 c.149

23. World Bank. Heightened Tensions, Subdued Investment. Global Economic Prospects. 06.2019 c.51

References

1. Andersen M., Kett B., Corporate Tax Incentives and FDI in Developing Countries. Global Investment Competitiveness Report 2017/2018, 2018 c.73-99

2. Bernanke B. The Global Saving Glut and the U.S. Current Account DeOcit. The Federal Reserve Board Speech, 2005 c.5

3. Cohen S. D. Multinational Corporations and Foreign Direct Investment: Avoiding Simplicity, Embracing Complexity. Oxford University Press. 2007 c.18-36

4. Dunning, J., Lundan, S. Multinational Enterprises and the Global Economy. Edward Elgar Publishing, 2008 c.39

5. Gonzalez A, Qiang C, Kusek P. Global Investment Competitiveness Report 2017/2018, 2018 c.185

6. Huchet M., Le Mouel C., Vijil M. The relationship between trade openness and economic growth: Some new insights on the openness measurement issue. The World Economy, Wiley, 2017, c.32

7. International Monetary Fund. World Economic Outlook, Global Manufacturing Downturn, Rising Trade Barriers. 10.2019 c.208

8. International Monetary Fund Global Financial Stability Report, October 2019: Lower for Longer. IMF. 10.2019 c.109

9. Iwai N., Thompson S. R. Foreign Direct Investment and Labor Quality in Developing Countries. Review of Development Economics, 16 (2), 2012 c.42

10. Jadhav P., Determinants of foreign direct investment in BRICS economies: Analysis of economic, institutional and political factor, Procedia-Social and Behavioral Sciences 37, 2012 c.10

11. Kirkpatrick C., Parker D., Zhang Y. Foreign Direct Investment in Infrastructure in Developing Countries: Does Regulation Make a Difference? Transnational Corporations, 15(1),2006

12. Latham&Watkins. China Introduces New Foreign Investment Law, Negative Lists, and Encouraged Industries Catalogue. Latham&Watkins, #2531 08.2019 c.3

13. Laudicina P, Peterson E., McCaffrey C. Global Business Policy Council Research Report, A.T. Kearney 2019 c.5

14. Mumtaz S. The significance of infrastructure for FDI inflow in developing countries. Journal of Life Economics #2, 2014 c.16

15. Osakwe P., Santos-Paulino A., Dogan B. Trade dependence, liberalization and exports diversification in developing countries., UNCTAD Research Paper No. 2, 08.2019 c.22

16. Paez L. Liberalizing Finance Services and Foreign Direct Investment. Basingstoke: Palgrave Macmillan, 2011 c.276

17. United Nations. World Investment report 2019. United Nations publications. 10.2019 c.49

18. United Nations. World Population Prospects. United Nations publications. 01.2019 c.46

19. Vashakmadze E., Regional dimensions of recent investment weakness: Facts, investment needs and policy responses, Journal of Infrastructure, Policy and Development 01.2018, c.30

20. Vijayakumar N., Sridharan P., Rao K. Determinants of FDI in BRICS Countries: A Panel Analysis. International Journal of Business Science & Applied Management, 5(3). 2010, c.13

21. World Bank. 2020. Global Financial Development Report 2019/2020 : Bank Regulation and Supervision a Decade after the Global Financial Crisis. Washington, DC: World Bank. 11.2019 c.155

22. World Bank. Doing Business 2020 : Comparing Business Regulation in 190 Economies. Washington, DC: World Bank, 10.2019 c.149

23. World Bank. Heightened Tensions, Subdued Investment. Global Economic Prospects. 06.2019 c.51

Link to this article

You can simply select and copy link from below text field.

|

|