|

DOI: 10.7256/2409-7543.2015.4.17314

Received:

16-12-2015

Published:

23-12-2015

Abstract:

The article considers the problem of the irregular structure of Russian export, describes the possible threats to economic safety and proposes taxation measures, favouring the transformation of the resource-based economy into an innovative and a high-tech one. The subject of the study is the role of taxation instruments in export regulation. The authors consider the range of obstacles in the structuring of Russian export be means of taxation instruments, including the problems of harmonization of tax systems of the Customs Union member-states and the implementation of a tax maneuver by the Russian government. Special attention is paid to the necessity to orient the tax policy of the state to the stimulation of import substitution. The authors analyze and compare the dynamics of particular foreign-trade statistical figures for the period of 2001 – 2015. In the result of the study the authors come to the conclusion about the intensification of the crisis, conditioned by the dependence of the Russian economy on energy resources. The authors substantiate the need for export diversification by means of creation of an effective taxation mechanism which would regulate all the branches of the economy with the aim to develop innovative import substitution as a precondition of a new model of economic development. The novelty of the research lies in the proposals of use of the existing, but requiring modernization, taxation instruments affecting export relations.

Keywords:

export structure, resource model, threats, fiscal instruments, tax incentives, customs duties, importozemeschenie, high-tech production, diversification of the economy, economic security

This article written in Russian. You can find original text of the article here

.

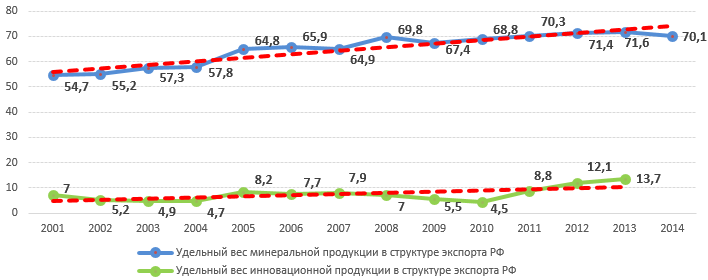

Актуальность и задачи исследования Одной из самых актуальных проблем в российских экспортно-импортных отношениях и в целом российской экономики, можно по праву назвать неравномерную структуру экспорта и отсутствие эффективного механизма ее регулирования, в том числе налоговыми инструментами. На протяжении всего периода существования в России рыночной экономики в структуре экспорта преобладает и неуклонно растет доля минеральной продукции (рис.1).

Составлен авторами по данным Федеральной таможенной службы. Режим доступа: http://www.customs.ru/

Рис. 1. Динамика вклада минеральных и инновационных продуктов в экспорт продукции РФ, %

На данной диаграмме видно, что за последние 15 лет объём экспорта минеральной продукции в общем объёме экспортируемых товаров из России стремительно растёт. При этом удельный вес высокотехнологичной инновационной продукции стал расти только в последние годы и остаётся на низком уровне. Это подчёркивает линия тренда, изображённая пунктирной линией.

Однако, небольшие положительные тенденции в структуре экспорта наблюдаются в текущем году (табл.1).

Таблица 1 – Товарная структура экспорта Российской Федерации со всеми странами январь-октябрь 2015 г.

|

Наименование товарной отрасли

|

Сумма тысяч долларов США

|

В % отношении к аналогичному периоду

|

Уд. Вес, %

|

|

| |

| |

|

ВСЕГО:

|

473611048,70

|

65,61

|

100,00

|

|

|

Продовольственные товары и сельскохозяйственное сырье (кроме текстильного)

|

12930653,90

|

83,34

|

2,73

|

|

|

Минеральные продукты

|

187570638,20

|

61,86

|

39,60

|

|

|

Топливно-энергетические товары

|

184898709,10

|

61,81

|

39,04

|

|

|

Продукция химической промышленности, каучук

|

21439554,50

|

88,56

|

4,53

|

|

|

Кожевенное сырье, пушнина и изделия из них

|

263491,70

|

72,06

|

0,06

|

|

|

Древесина и целлюлозно-бумажные изделия

|

8078840,90

|

83,01

|

1,71

|

|

|

Текстиль, текстильные изделия и обувь

|

717363,40

|

79,64

|

0,15

|

|

|

Драгоценные камни, драгоценные металлы и изделия из них

|

6842391,70

|

66,72

|

1,44

|

|

|

Металлы и изделия из них

|

28058450,10

|

82,37

|

5,92

|

|

|

Машины, оборудование и транспортные средства

|

19119893,00

|

95,66

|

4,04

|

|

|

Другие товары

|

3691062,20

|

81,56

|

0,78

|

|

Как видно, в 2015 году доля экспорта сырья значительно сократилась по сравнению с аналогичным периодом в прошлом году. Но, не смотря на это, в структуре экспорта так же преобладают минеральные продукты и топливно-энергетические товары. К тому же, на наш взгляд, сокращение больше связано с общим сокращением экспорта из России. Это говорит о сохранении сырьевой направленности российского экспорта и указывает на проблему нерационального использования ресурсов. А так же ставит перед нашей страной энергетические угрозы будущего, так как полезные ископаемые не вечны. Поэтому, можно говорить о значительной грядущей угрозе для экономической безопасности страны в целом.

Решение проблем сырьевой направленности сопряжено с тем, что об этом много говорят, но не предлагают конкретных мер по диверсификации экономики. Начиная с 2000 года, в ежегодных посланиях Президента РФ отмечается необходимость модернизации российской экономики и становления на путь высокотехнологичного производства и экспорта [9]. Однако, при этом, первенство России на мировом топливно-энергетическом рынке отмечается как позитивное достижение проводимой внешнеэкономической политики.

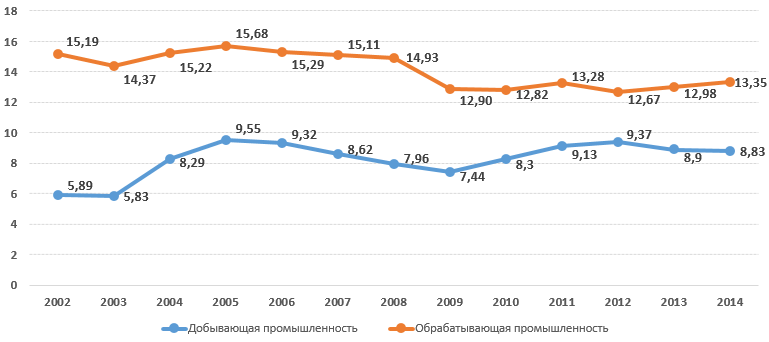

Да, это позволило России задать значительный темп роста экономики за последние 15 лет, но это экстенсивный путь развития. Так называемый «рост без развития». В подтверждение чему можно привести данные по вкладу добывающих и обрабатывающих производств в ВВП (рис.2.).

Составлен авторами по данным Федеральной службы государственной статистики. Режим доступа: http://www.gks.ru/

Рис. 2. Динамика вклада добывающей и обрабатывающей промышленности в ВВП России, %

В ходе анализа мы выяснили, что вклад добычи полезных ископаемых в ВВП за 12 лет вырос с 5,9% до 8,8%. Доля обрабатывающих производств за это время сократилась с 15,2% до 13,4%. И эта динамика хорошо прослеживается на графике (рис.2.).

И уже сегодня, когда запасов углеводородов ещё достаточно, наша страна сталкивается с угрозой, что «сырьевой пузырь» может лопнуть в связи с падением цен на нефть. Так, экономисты Центра развития ВШЭ подсчитали, что продолжение падения цен на энергоносители может отбросить страну дальше, чем она была 10 лет назад.

В связи с этим, основной задачей данного исследования является предложение мер, направленных на решение сырьевой зависимости России. Налоговые инструменты для структурирования экспорта и проблемы их применения в России Ключевую роль в регулировании внешнеторговой деятельности России играют НДС и акцизы, так как именно эти паратарифные меры внешней торговли призваны, с одной стороны, защитить российский внутренний рынок от иностранной конкуренции и поддержать отечественное производство. С другой стороны, необходимы для регулирования ввоза продукции, которая не производится на территории российского государства, не имеет отечественных аналогов, а также необходима для удовлетворения в полной мере потребностей покупателей на внутреннем рынке России [7].

Кроме этого, ещё одним эффективным инструментом влияния на процессы внешней торговли являются таможенные пошлины. Так, в глубокой переработке нефти, российскими компаниями, в последние годы наблюдается значительный прирост, и это благодаря масштабной программе модернизации, главным стимулом для которой послужило обещание введения 100-процентной пошлины на мазут.

Таблица 2 – Поступления в бюджет по НДС от экспортно-импортных операций и Таможенным пошлинам, % ВВП

|

НалогГод

|

2008

|

2009

|

2010

|

2011

|

2012

|

2013

|

2014

|

|

НДС

|

2,7

|

2,3

|

2,5

|

2,7

|

2,7

|

2,5

|

2,5

|

|

Таможенные пошлины

|

8,5

|

6,5

|

6,9

|

8,25

|

8,2

|

7,51

|

7,74

|

Таким образом, налоговая политика представляет собой прямую меру воздействия на экономику и является действенным механизмом регулирования структуры экспорта. Однако, ее использование в целях модернизации российской экономики должно сопровождаться реформированием всей институциональной среды, образующей базис для производства, обмена и распределения, а также основополагающих юридических, финансовых, экономических, политических правил, норм и законов, которыми определяются отношения между участниками рынка [12].

При этом, стоит учитывать, что вывоз из страны нефтепродуктов поощряется нулевой процентной ставкой НДС, установленной с 2012 года, во избежание двойного налогообложения. С одной стороны, это конечно привлекает в страну капитал, но с другой – это стимулирует не ту отрасль, которую нужно России в стратегическом плане, а также не только не увеличивает собираемость налогов, но и уменьшает их. Это объясняется тем, что при 0% ставке экспортёр имеет право на налоговый вычет, если представит все необходимые документы в налоговую службу. А принимающие страны, облагая наши ввозимые нефтепродукты налогом, лишь пополняют свой бюджет.

Ситуацию усугубляет решение российского правительства провести в 2014 году большой «налоговый манёвр»: существенно снизить экспортные пошлины на нефть и нефтепродукты и повысить при этом НДПИ, чтобы компенсировать бюджету выпадающие доходы. Одновременно были изменены соотношения между пошлинами на различные нефтепродукты и нефть, скорректированы акцизы для сохранения внутренних цен на бензин и другие нефтепродукты.

Минфин обосновывал манёвр, в том числе тем, что нужно снизить риски при создании Евразийского экономического союза (ЕАЭС) России, Белоруссии и Казахстана. До 2015 года из-за беспошлинной продажи нефти и нефтепродуктов в эти страны Россия несла потери в размере около $8 млрд в год, это так называемая «плата за дружбу». После создания ЕАЭС риски, связанные с возможными потерями бюджета при реэкспорте российских углеводородов через эти страны, значительно возросли из-за прекращения межправительственных соглашений, регулировавших объемы поставок. Для их минимизации пошлину на нефть нужно было снизить примерно вдвое, до уровня казахской.

Однако цены на нефть в конце прошлого года сильно упали, и это несколько изменило эффекты налогового манёвра. Компании потеряли как от снижения цен на нефть, так и от некоторого ухудшения налоговых условий в новых ценовых реалиях. Доходы же бюджета в долларовом выражении уменьшились, но в рублевом — практически не изменились.

В 2015 году был достигнут тот эффект, который предполагалось получить еще при введении в 2011 году системы 60-66-90. Это общая проблема проведенных налоговых манёвров — высокая чувствительность «точки равновесия» интересов бюджета, потребителей и отрасли к изменениям рыночных цен.

И не смотря на то, что налоговый маневр приносит некоторые положительные результаты, к примеру ситуация с мазутом, но в целом, он в очередной раз обнажил сложность всей российской налоговой системы. Использование скользящей шкалы НДПИ и пошлин с «привязкой» к нефти приводит к системной проблеме: нужно все время «угадывать» будущую цену нефти, чтобы задавать адекватные стимулы и для добычи, и для переработки, и невозможно нормально откалибровать систему, когда реальная цена на нефть сильно отклоняется от прогноза. Даже после налогового манёвра из-за разницы пошлин на нефть и нефтепродукты сохраняется достаточно высокая субсидия нефтепереработке.

Также в 2015 году Министерство финансов России предложило продолжить увеличение ставки НДПИ для нефтедобывающих компаний. Это может привести, в лучшем случае, к увеличению ориентации на экспорт нефтепродуктов и сохранению прежнего уровня пополняемости бюджета, и в худшем случае так же может вызвать рост цен на внутреннем рынке.

К счастью, предложение Минфина было пока отложено правительством РФ, но вместо этого принято решение о продолжении снижения экспортных пошлин на нефтепродукты. Это, в свою очередь, так же стимулирует вывоз нефти и нефтепродуктов из страны, но, тем не менее, не ставит угрозы резкого повышения внутренних цен.

Как видно, проблема сырьевой направленности российской экономики не только представляет энергетическую угрозу, но и показывает зависимость экономики и бюджета страны от экспорта сырья. В связи с чем, на наш взгляд, Россия с такой политикой не сможет иметь стабильную экономику и соответственно состоять в числе стран-мировых лидеров пока не сменит сырьевую направленность на более современные и технологичные решения. Для чего нужно разработать реальный механизм воздействия на структуру экспорта, который бы стимулировал производить и экспортировать высокотехнологичные готовые продукты, и в перспективе уйти с дороги «сырьевого придатка». Рекомендации по совершенствованию применения налоговых инструментов для регулирования экспортно-импортной торговли и сопряжённые с ними сложности Мы считаем, что в качестве инструментов механизма регулирования внешнеторговых отношений можно использовать уже действующие налоговые и таможенные платежи, такие как НДПИ, НДС, акцизы и таможенные пошлины.

На наш взгляд, альтернативой сырьевого экспорта может стать, особо актуальная в последнее время в связи с санкциями, потребность в импортозамещении. Для осуществления которого необходимо что бы условия для экспорта готовой продукции были более привлекательными, чем для экспорта сырья. Иными словами, правительство России должно проводить политику, направленную, на значительное улучшение условий для экспорта высокотехнологичной продукции и постепенно снижать выгоды для сырьевого экспорта.

В частности, мы считаем, что привлечь внимание к производственной сфере возможно, во-первых, если установить в ней такие ставки налогов, при которых они будут минимально отягощать деятельность, но находится на приемлемом уровне для пополнения бюджета. Во-вторых, следующим, наиболее важным, шагом является применение льготных условий и снижение таможенных сборов для экспорта готовой продукции. Всё это касается прежде всего производства и экспорта высокотехнологичной и инновационной продукции, а также создания и развития в России производств новых видов продукции, замещающих импорт из-за рубежа. Кроме того, улучшить условия для собственного производства можно посредством налоговых каникул, специальных ставок, и т. д.

И даже несмотря на то, что это может сказаться негативно на собираемости бюджета в краткосрочном периоде, эти меры могут увеличить ВВП России за счёт увеличения выпуска готовой продукции и появления новых инновационных производств. В свою очередь, рост ВВП несомненно сопряжён с ростом доходов бюджета, что в перспективе не только сможет восполнить потери от подобного рода импортозамещающей политики, но и принести заметный прирост. Кроме этого, к положительным моментам, в результате можно будет отнести рост зарплат в стране, продвижение на мировые рынки высоких технологий, рост конкурентоспособности и другое.

Снизить риск «резкого провала» бюджетного сектора, в случае значительного стимулирования производства и его экспорта, можно с помощью НДС на внутреннем рынке, а также за счёт повышения таможенных сборов на экспорт сырья. Здесь следует подчеркнуть, именно экспорт сырья. Потому что нужно стремится не к уменьшению добычи и производства сырьевой базы, а к стимулированию её переработки внутри страны.

Касательно НДПИ, мы думаем, повышение ставок на нефть является не разумным, особенно в сочетании с понижением экспортных пошлин, что демонстрирует налоговый манёвр правительства РФ. Так как у нефтедобывающих компаний сейчас и так трудное время, цены на нефть сильно упали, разведанных запасов все меньше и меньше, нужны деньги на поиск и разработку новых месторождений. Однако, у нас в стране кроме нефти есть еще и газ. А в газовой сфере последнее время наблюдается более благоприятная ситуация. Поэтому в целях пополнения собираемости бюджета возможно увеличение НДПИ на газ. Однако, всё должно быть в разумных границах, чтобы не вызвать резкого роста цен на газ в пределах внутреннего рынка.

При всё этом, мы не считаем НДПИ эффективным инструментом налогового регулирования, так как оперирование им представляет сложности. Так, увеличение НДПИ без корректировок акцизов ведёт к повышению цен на внутреннем рынке. А с корректировкой только развивает сырьевой экспорт.

Что касается повышения таможенных пошлин, то здесь помехой являются условия таможенного союза России с Белоруссией и Казахстаном, которые стали одной из причин снижения пошлин. Однако, на наш взгляд, для России этот союз больше приносит убытков, чем прибыли. Тем не менее, заключение союза имеет место быть, когда каждая из стран-участниц заинтересована в поставках товаров от своих партнёров. Здесь вывод упирается так же в необходимость импортозамещения. Будет собственное молоко, бытовая техника, электроэнергия – не придётся терять миллионы долларов на уступках партнёрам по союзу.

Поэтому, если не брать во внимание подобные ограничения, то применение таможенных пошлин для структурирования российского экспорта несомненно может быть плодотворно. Подтверждением этому является пример с мазутом, упомянутый ранее. По аналогии с ним, можно постепенно повышать таможенные пошлины и на другие виды экспорта сырья, оставляя при этом низкие пошлины на готовые товары и особенно на инновационную продукцию.

Самым «мощным» налоговым сбором, позволяющим значительно воздействовать не только на внешнюю торговлю, но и на экономику страны в целом, мы считаем, является НДС. Однако, этот инструмент является самым не динамичным, так как его корректировка может вызвать значительные последствия. Так, в контексте регулирования структуры экспорта ставка НДС играет ключевую роль. Например, нулевая ставка на экспорт нефти имеет определяющее значение в предоставлении возможности экспорта нефти и нефтепродуктов для нефтедобывающих компаний, так как это позволяет им избегать двойного налогообложения. Поэтому установить её выше нуля, на наш взгляд, не представляется возможным, так как это противоречит интеграции России в мировое хозяйство.

Но нам видится реальным косвенный путь стимулирования нефтедобывающих компаний создавать и развивать проекты импортозамещающих производств через регулирование НДС через повышение тарифов на импорт готовых товаров, реализацию производства которых возможно построить у нас в стране. И при этом снизить внутренний НДС на эти же группы товаров. Иными словами, разбить экспортно-импортные товары на группы, к каждой, из которых, применять индивидуальные условия налогообложения. Это приведёт к росту цен на импортные товары, а соответственно увеличит спрос на отечественные, что создаст благоприятную атмосферу для реализации проектов импортозамещения на всех уровнях производства. А выпадающие доходы от внутреннего НДС компенсируются импортным.

Однако, данные предложения противоречат принципам ВТО, что ещё раз доказывает сложность существующей проблемы. Тем не менее, в условиях санкций, Россия оказывается в крайне невыгодном положении и все недостатки вхождения во всемирную торговую организацию перевешивают её преимущества. При этом, перед нашей страной встала очевидная необходимость импортозамещения, которое на наш взгляд, в любом случае будет в какой-то степени идти в разрез с принципами ВТО. Поэтому, мы считаем, что сегодня актуален вопрос: «Нужна ли России ВТО?». Так, например, если отечественная экономика реально сможет заменить импортные товары собственными аналогами, то она станет мало зависимой от экономик других государств и экономические санкции против России будут бесполезны.

Кроме стимулирования производства и экспортирования импортозамещающих товаров с помощью налоговых инструментов, возможно так же применять меры ограничения поступления импортных товаров из-за рубежа. Так, Рожкова Ю. В. описывает как зарубежные страны с помощью нетарифных методов регулирования ограничивают поступления российских товаров в их страны. В частности, такие методы как антидемпинговая, специальная защита, квоты, налоги и сборы, технические и административные барьеры и т. д [10]. Аналогичные методы, мы считаем, возможно применять и со стороны России.

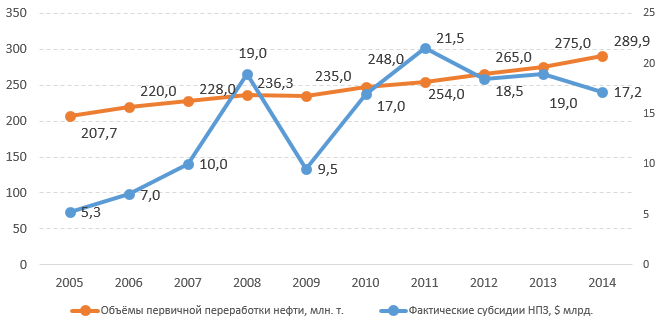

Одновременным способом снижения стимулов к экспорту сырья и в частности, топливно-энергетических ресурсов, а также вариантом увеличения прироста налоговых доходов является сокращение льгот нефтепереработке, так как львиная доля бюджета недополучается из-за субсидий нефтяникам (рис.3). В частности, обязательным на наш взгляд, является запрет на запрос налоговых возмещений по реализации экспорта при 0% ставке.

Рис. 3. Динамика субсидий нефтедобывающим компаниям

Тем не менее, перед осуществлением, предложенных нами мер может встать сложность под названием «временной лаг». Под этим понятием в экономике принято считать разницу во времени между принятием мер и реакцией рынка на эти меры (в нашем случае подразумевается именно положительная реакция). Очевидно, что смена сырьевой модели на высокотехнологичную в перспективе открывает перед российской экономикой широкие границы развития и имеющийся потенциал нашей страны может позволить достигнуть высоких результатов. Однако, сложно подсчитать на сколько это быстро произойдёт. Выводы Для структурирования российского экспорта необходима диверсификации экономики в целом. При этом особую роль здесь, на наш взгляд, играют налоговые инструменты, правильное оперирование которыми будет стимулировать высокотехнологичный и инновационный путь развития. К таким инструментам мы относим НДС, НДПИ, акцизы и таможенные пошлины. Именно они являются регуляторами экспортно-импортных отношений, модернизировав которые можно получить работающий механизм структурирования экспорта. Однако, кардинальная смена модели развития вполне может привести к кризису, но, выбравшись из которого, Россия встанет на новую ступень развития. К тому же, сегодня мы уже подошли к пониманию того, что сырьевая модель является тупиковой и несомненно приведёт к коллапсу, поэтому лучшим вариантом будет плавная смена модели развития. Пусть это даже вызовет искусственный кризис, но он будет не значительным по сравнению с грядущим, и более того – придаст нашему государству новые силы и позволит повысить ему уровень экономической безопасности.

Однако, добиться решения проблемы структурирования экспорта России только налоговыми методами невозможно. Необходимо проводить комплексную политику, включающую экономические, политические и правовые аспекты. Основной путь для развития России, по нашему виденью – стимулирование импортозамещения, расширения инвестиций и инновационных проектов. Только в случае системных преобразований в экономике, возможно «отвязать» нашу экономику от нефти, а также снизить зависимость от других полезных ископаемых.

References

1. Gurvich E. T., Suslina A. L. Dinamika sobiraemosti nalogov v Rossii: makroekonomicheskii podkhod // Finanasovyi zhurnal. 2015.-№4 – S.22

2. Karavaev, A. V. Rossiiskie sanktsii kak element importozameshcheniya: vliyanie na EAES i ZST SNG // Mir peremen.-2015.-№ 2.-S. 35-50.

3. Kormishkina L. A. O problemakh i perspektivakh kachestva ekonomicheskogo rosta v sovremennoi Rossii. // Upravlenie ekonomicheskimi sistemami: elektronnyi nauchnyi zhurnal.-2013.-№ 9 (57). S. 4.

4. Kormishkina L. A., Koroleva L. P. Otsenka nalogovogo manevra s pozitsii paradigmy neoindustrial'nogo razvitiya Rossii // Natsional'naya bezopasnost' / nota bene.-2015.-№ 3. S. 427-441.

5. Koroleva L. P. Antikrizisnoe nalogovoe regulirovanie real'nogo sektora ekonomiki v kontekste paradigmy neoindustrial'nogo razvitiya. / Novaya industrializatsiya i umnaya ekonomika: vyzovy i vozmozhnosti: Materialy Permskogo kongressa uchenykh-ekonomistov. Permskii gosudarstvennyi natsional'nyi issledovatel'skii universitet.-2015.-S. 123-131.

6. Koroleva L. P., Vasyaeva E. S. Problemy pravovogo regulirovaniya nalogooblozheniya rezidentov osobykh ekonomicheskikh zon v Rossii // Finansovoe pravo. 2011.-№ 8.-S. 26-29.

7. Korol'kova A. E. Nalogovoe regulirovanie vneshnei torgovli v Rossiiskoi Federatsii // Sovremennye tendentsii v ekonomike i upravlenii: novyi vzglyad.-2013.-№ 20.-S. 8-12.

8. Meshcheryakov D. A. Formirovanie ekonomicheskoi politiki importozameshcheniya dlya ekonomicheskoi bezopasnosti sovremennoi Rossii // FES: Finansy. Ekonomika. Strategiya.-2015.-№ 5.-S. 38-41.

9. Poslaniya Prezidenta RF Federal'nomu Sobraniyu [Rezhim dostupa-http://kremlin.ru/]

10. Rozhkova Yu. V. Rol' netarifnykh ogranichenii pri eksporte tovarov v sovremennykh usloviyakh // Izvestiya orenburgskogo gosudarstvennogo agrarnogo universiteta.-2015g.-№3 s.292-295

11. Safina D. I., Konovalova M. I. Dinamika i struktura postuplenii tamozhennykh platezhei v byudzhet Rossiiskoi Federatsii s momenta vstupleniya Rossii v VTO // Vestnik tomskogo politekhnicheskogo universiteta.-№ 1.-2014.-S. 262-267.

12. Yagunova N. A., Gubanov D. V., Udalov O. F. i Kulikova Yu. N. Modernizatsiya ekonomiki kak glavnyi faktor strategicheskogo razvitiya Rossii// Sbornik statei VII Mezhdunarodnoi nauchno-prakticheskoi konferentsii. Penza,-2015g. s.91-95

13. Savina O.N. Otsenka effektivnosti nalogovykh l'got

v usloviyakh deistvuyushchego rossiiskogo

nalogovogo zakonodatel'stva

i napravleniya ee sovershenstvovaniya // Nalogi i nalogooblozhenie. - 2013. - 8. - C. 579 - 598. DOI: 10.7256/1812-8688.2013.8.6580.

14. A.V. Belousova, M.M. Potanin, A.Yu. Kolesnikova Eksportnyi sektor ekonomiki Dal'nego Vostoka:

vektor innovatsionnogo razvitiya // Natsional'naya bezopasnost' / nota bene. - 2012. - 6. - C. 44 - 54.

15. Shemyakina M.S. Otsenka nalogovogo potentsiala v sisteme obespecheniya nalogovoi bezopasnosti regiona // Natsional'naya bezopasnost' / nota bene. - 2015. - 2. - C. 304 - 311. DOI: 10.7256/2073-8560.2015.2.14575.

Link to this article

You can simply select and copy link from below text field.

|