|

MAIN PAGE

> Back to contents

Theoretical and Applied Economics

Reference:

Savina O.N., P'yanova M.V.

Tax Incentives of Individual Sectors of the Russian Economy: Current Status and Areas for Improvement

// Theoretical and Applied Economics.

2016. № 4.

P. 79-93.

DOI: 10.7256/2409-8647.2016.4.19741 URL: https://en.nbpublish.com/library_read_article.php?id=19741

Tax Incentives of Individual Sectors of the Russian Economy: Current Status and Areas for Improvement

Savina Ol'ga Nikolaevna

PhD in Economics

PhD in Economics, assistant professor of the Department of the Taxes and Taxation at Financial University under the Government of the Russian Federation.

109001, Russia, g. Moscow, ul. Leningradskii Prospekt, 49

|

osavina-v@rambler.ru

|

|

|

Other publications by this author

|

|

|

P'yanova Marina Vladimirovna

PhD in Economics

associate professor of the Department of Taxes and Taxation at Financial University under the Government of the Russian Federation

125993, Russia, Moscow, Leningradsky prospect 49

|

marinapyanova@mail.ru

|

|

|

Other publications by this author

|

|

|

DOI: 10.7256/2409-8647.2016.4.19741

Received:

14-07-2016

Published:

24-01-2017

Abstract:

The article is devoted to identifying problems that complicate monitoring using tax credits and other tax incentives and tools to assess their effectiveness. Questions of impact assessment tools, tax incentives for the real sector of the Russian economy in general, and agricultural production in particular are relevant throughout the entire period of operation of the Russian tax system. They got especially acute under conditions of imposed sanctions on Russia causing instability of the economy and the need to develop effective mechanisms for the promotion of domestic producers. Existing tools for agricultural production tax incentive in the tax system of the Russian Federation is not a great variety. Tax benefits are the main tool and their efficiency is evaluated only by assessing the amount of budget losses incurred by the government. Analysis of current evaluation tools used to assess efficiency of tax benefits allows to define peculiarities of their practical implementation in municipal units and constituents. The authors concludes that there is no objective evaluation method to assess efficiency of tax benefits that would be legally fixed in current regional methods. There is a need to improve existing methodologies and develop a unified, containing a single system performance criteria not just tax breaks but tax incentives and other instruments; not only for states but also for business. For this purpose the authors have tested the method to assess the efficiency of tax privileges and preferences developed by the Ministry of Economic Development and Trade of the Russian Federation in 2014 together with the Ministry of Finance of the Russian Federation, for example, instruments such as the single agricultural tax and bonus depreciation. Despite the fact that this technique has not yet received a practical implementation, the authors analyze the effect of this technique with a view to identifying its usefulness and drawbacks. It is concluded that there is a need to further improve the methodology.

Keywords:

performance evaluation, tax benefits, tax incentive tools, tax regulation, import substitution, bonus depreciation, single agricultural tax, social efficiency, cost-effectiveness, business

This article written in Russian. You can find original text of the article here

.

Сельское

хозяйство необходимо развивать и стимулировать

Вопросы

оценки эффективности инструментов налогового стимулирования реального сектора

экономики, и аграрного сектора в частности, являются актуальными на протяжении

всего периода функционирования налоговой системы Российской Федерации. Особую

значимость они приобретают сегодня, в условиях глобальной нестабильности и

политических рисков международного масштаба [1].

Сельскохозяйственные

угодья занимают 2/3 территории России, в аграрном секторе экономики заняты 37

млн. человек, это около 26% населения страны [2]. По оценкам международных и

российских научных центров, эти цифры свидетельствуют о возможности

агропромышленного комплекса России, при определенных условиях, обеспечить

продовольственную независимость государства [3]. Критерии обеспечения

продовольственной безопасности определяются удельным весом отечественной

продукции в общем объеме товарных ресурсов внутреннего рынка [4]. Эти

показатели по разным видам продукции различны, и должны составлять не менее:

80% – в отношении сахара, растительного масла, рыбы; 85% – в отношении мяса;

90% – в отношении молока и молочных продуктов; 95% – в отношении зерна,

картофеля. В настоящее время только по зерну и хлебопродуктам Россия достигла

этих показателей. Зависимость от импорта сильнее всего проявляется на рынке

мяса и мясной продукции. В целом по отечественному продовольственному рынку

«импортозависимость» составляет около 40% [5].

Зависимость

отечественного рынка от импортных продуктов питания приобрела особую остроту к

середине 2014 года, когда глобальная политическая нестабильность и

экономические санкции, применяемые к Российской Федерации со стороны ряда

государств, поставили под угрозу продовольственную безопасность страны.

По

оперативным данным Федеральной таможенной службы, в январе-августе 2014 г. в

Российскую Федерацию ввезено продовольственных товаров и сельскохозяйственного

сырья на 1,1% меньше, чем за соответствующий период 2013 г. Такое

незначительное, на первый взгляд, сокращение объемов импорта объясняется резким

уменьшением ввоза отдельных товаров, и существенным увеличением ввоза других.

По сравнению с 2013 г. на 16,3% возросли физические объемы импортных закупок

сливочного масла, на 42,7% - сахара-сырца, в 4,2 раза – белого сахара, в 2,1 раза

- изделий

и консервов из мяса, на 14% - кофе.

По данным

Федеральной таможенной службы, сократился на 19,0% ввоз свежего и мороженого

мяса, на 11,1% - мяса птицы, на 1,3% - рыбы, на 24,4% - сгущенных молока и сливок, на 3,9% -

цитрусовых и чая, на 28,6% - зерновых культур, на 19,1% - продуктов, содержащих

какао, в 1,7 раза – масла подсолнечного.

По некоторым позициям произошел рост

средних контрактных цен. Наибольший рост контрактных цен отмечен на свежее и

мороженое мясо – 5,8%, мясо птицы – 3,2%, сгущенные молоко и сливки – 11,4%,

сливочное масло – 14,1%, белый сахар – 7,3%, и прочие.

Примечательно,

что рост цен и существенное сокращение ввоза наблюдается в отношении именно тех

продовольственных товаров, по которым зависимость России от импорта проявляется

сильнее всего.

Налоговый

инструментарий поддержки сельхозпроизводителей в условиях действующего

законодательства

Налоговое

стимулирование сельскохозяйственного производства в настоящий момент не

является ключевым инструментом государственной поддержки [6]. Действующие

преференции для сельскохозяйственных производителей можно условно разделить на

три направления:

1. Поддержка

крупных сельскохозяйственных товаропроизводителей, применяющих общую систему

налогообложения.

2.

Поддержка мелких форм предпринимательства в аграрном

секторе, применяющих специальные налоговые режимы.

3.

Формы налогового стимулирования, доступные всех

налогоплательщиков – сельскохозяйственных товаропроизводителей.

В рамках первого направления предусмотрены

льготы по ряду налогов для отдельных категорий налогоплательщиков. Так, главой

25 НК РФ предусмотрено отнесение к расходам организации затрат на приобретение

прав на земельные участки; нулевая ставка налога на прибыль организаций для

сельскохозяйственных товаропроизводителей, отвечающих критериям ст. 346.2 НК

РФ. Для целей налогообложения прибыли сельскохозяйственные производители также

могут применять нелинейный метод начисления амортизации; в отношении основных

средств, принятых на учет до 1 января 2014 года возможно применение повышающих

коэффициентов к норме амортизации; налогоплательщики также могут включать в

состав расходов отчетного или налогового периода от 10 до 30% первоначальной

стоимости основных средств в случае, если приобретено новое оборудование или

модернизировано уже действующее.

В отношении НДС предусмотрено освобождение от

налогообложения ряда операций [7]: реализации продукции собственного

производства в счет натуральной оплаты труда, а также для общественного питания

работников, привлекаемых на сельскохозяйственные работы; ввоза на территорию РФ

племенного крупного рогатого скота, племенных свиней, овец и коз, лошадей и

т.д.; ввоза технологического оборудования, комплектующих и запасных частей к

нему, аналоги которого не производятся в России; ввоза продукции морского

промысла, выловленной или переработанной отечественными рыбопромышленными

организациями; и прочие.

Второе направление предусматривает сокращение

налоговой и административной нагрузки. В российском налоговом законодательстве

предусмотрен ряд специальных режимов, которые могут быть использованы

организациями и предпринимателями, занятыми в сельском хозяйстве, например,

система налогообложения для сельскохозяйственных товаропроизводителей (ЕСХН)

или упрощенная система налогообложения (УСН). Преимуществом специальных

налоговых режимов является сокращение налоговой нагрузки на

сельскохозяйственных товаропроизводителей по сравнению с общей системой

налогообложения без учета имеющихся льгот [8].

Третье направление подразумевает налоговое

стимулирование эффективного землепользования и использования имущества

сельскохозяйственного назначения. Земельные участки, используемые для

сельскохозяйственного производства, облагаются земельным налогом по пониженной

ставке – не более 0,3%, в соответствии со ст. 394 НК РФ. Кроме того,

представительные органы муниципальных образований вправе снижать ставку

земельного налога для отдельных категорий налогоплательщиков. Например, в ряде муниципальных образований

Московской области для земельных участков сельскохозяйственного назначения

ставки земельного налога снижены до 0,2% и 0,1%. Вместе с тем, в соответствии с

решением Минфина России, в целях контроля за целевым использованием земель,

недопустимо применение пониженных ставок земельного налога для земельных

участков, которые не используются или используются не по назначению.

Законами субъектов РФ для аграриев также могут быть

предусмотрены определенные преимущества по налогу на имущество организаций.

Например, в Республике Марий Эл для производителей сельскохозяйственной техники

применяется ставка налога на имущество организаций в размере 1,1%; в Республике

Башкортостан для сельскохозяйственных товаропроизводителей не предусмотрены

отчетные периоды по налогу. По транспортному налогу предусмотрено освобождение

от налогообложения специализированной сельскохозяйственной техники, тракторов,

комбайнов и т.д. при условии, что эти транспортные средства зарегистрированы на

сельскохозяйственных товаропроизводителей.

Несмотря на

значительное количество преференций, налоговая система не выполняет в полной

мере стимулирующую функцию в отношении сельского хозяйства. По данным Росстата,

около 20% сельскохозяйственных организаций в 2012 году были убыточными. Кроме того, возможность использования отдельных

налоговых льгот затруднена в связи с неоднозначной трактовкой статуса

сельскохозяйственного товаропроизводителя.

Методики

оценки эффективности налоговых льгот для сельхозпроизводителей: текущее

состояние

Наблюдения показывают, что многие субъекты хозяйствования

налоговыми льготами не пользуются, плохо о них осведомлены и строят свою работу

на оптимизации финансовых потоков с целью уменьшения размеров основного

налогообложения. К тому же, перечень документов, подтверждающих право

налогоплательщиков на применение льгот и не закрепленный положениями Налогового

кодекса РФ, приводит к определенным сложностям при подтверждении данной льготы

в налоговых органах. В связи с необходимостью проверки представленных в

налоговые органы данных растут затраты на администрирование. Все это, в

конечном итоге, отражается на их эффективности.

Предоставление

налоговых льгот отрицательно сказывается на конкуренции. Крупные фирмы со

значительными налоговыми обязательствами получают большие выгоды, чем менее

крупные инвесторы. Появляются дополнительные возможности для концентрации

активов в рамках более крупных фирм, поскольку у них возникает стимул к

приобретению более мелких фирм в целях получения налоговых выгод. Крупные фирмы

могут использовать выгоду, предоставляемую в результате введения налоговых

стимулов, в то время, как более мелкие фирмы, не аффилированные с крупным

бизнесом, получают от них гораздо меньшую выгоду или не получают ее вовсе, в

частности потому, что для малого предприятия относительно велики затраты, связанные

с налоговым планированием, подготовкой документов, подтверждающих

обоснованность применения льгот и пр.

Официальное

вступление России во Всемирную торговую организацию подразумевает, что объемы

прямых дотаций и субсидий в сельское хозяйство должны быть постепенно

сокращены, как малоэффективные [9,10]. Представляется целесообразным, что

помимо выделения бюджетных средств на выполнение различных государственных

программ, необходимо развитие мер действенной косвенной поддержки, в связи с

чем, вопросам оценки эффективности льготного налогообложения уделяется гораздо

большее внимание, чем несколько лет назад [11].

Так, в “Основных направлениях налоговой политики

Российской Федерации на 2011 и на плановый период 2012 – 2013 гг.». был сделан

акцент на анализ практики применения и администрирования налоговых льгот. Именно в этот период на

всех уровнях власти начали разрабатываться методики оценки эффективности

налоговых льгот, содержащие критерии и порядок расчета их эффективности.

Принятие решений по вопросам сохранения действующих льгот было признано

осуществлять по их соответствию таким критериям. Также Федеральной налоговой

службой Российской Федерации в формы налоговых деклараций были внесены дополнительные показатели,

позволяющие рассчитывать выпадающие доходы по каждому виду предоставляемых

«налоговых преимуществ». Необходимость такого нововведения была продиктована

повышением качества контроля за налогоплательщиками – пользователями

льгот. Однако это значительно усложнило

процесс заполнения листов налоговых деклараций, отражающих суммы каждой из

льгот и сделало его трудоемким. К примеру, в Налоговом кодексе РФ насчитывается

более двух сотен льгот и преференций и почти половина из них – это механизмы

снижения налогового бремени по налогу на добавленную стоимость, треть – по

налогу на прибыль организаций.

Сложности

администрирования налоговых льгот, выявили проблемы обеспечения их адресности,

а также злоупотребления ими и уклонения от уплаты налогов за счет недостаточно

продуманного механизма предоставления и

оценки их эффективности.

Годом позже,

в «Основных направлениях налоговый политики Российской Федерации на 2012 год и

на плановый период 2013-2014 гг.» было отмечено важное направление работы по

осуществлению анализа эффективности предоставляемых и вновь введенных

налоговых льгот. К этому времени методики оценки эффективности налоговых

льгот были разработаны и приняты к действию нормативными актами субъектов РФ и

муниципальных образований во всех регионах России. Поскольку использование льгот

является законным способом уменьшения налоговых обязательств налогоплательщиков

и ведет к бюджетным потерям, оценка их эффективности была объявлена необходимой

составляющей в принятии решений об их пролонгации или о целесообразности

введения новых. В этот период

государством была поставлена задача – проанализировать действующие методики

оценки эффективности налоговых льгот с целью выявления недостатков и

дальнейшего их совершенствования.

В «Основных

направлениях налоговый политики Российской Федерации на 2015 год и на плановый

период 2016-2017 гг.» большое внимание уделялось рискам государства, возникающим

в связи с предоставлением налоговых льгот. Усилия органов власти всех уровней

были направлены на решение вопросов по созданию механизмов, позволяющих

оптимизировать налоговые риски государства и разработке мер, компенсирующих

бюджетные потери.

Наконец, в

«Основных направлениях налоговый политики Российской Федерации на 2016 год и на

плановый период 2017-2018 гг.» большое внимание уделено вопросам оптимизации

налоговых льгот и преференций по результатам обязательной оценки их

эффективности и влияния на формирование налоговых доходов бюджетов субъектов

Российской Федерации и муниципальных образований. При этом налоговые льготы в

контексте документа трактуются расширительно: как инструменты налогового

стимулирования приоритетных для государства направлений (отраслей). Таким образом, к инструментам налогового

стимулирования следует отнести собственно льготы, преференции и прочие

инструменты налогового стимулирования.

Исследуя

вопросы результативности инструментов налогового стимулирования в действующей

практике налогообложения, нами был сделан вывод, что методики оценки их эффективности принятые и

действующие в регионах и муниципальных образованиях Российской Федерации,

реализуются не в полной мере.

Для

подтверждения наших выводов рассмотрим особенности функционирования действующих

методик в региональном разрезе. Так, во всех субъектах и муниципальных

образованиях Российской Федерации разработаны и приняты региональные методики

оценки эффективности для всех (действующих и вновь вводимых) льгот. Однако их

практическая реализация, зачастую, затруднена. Есть регионы, которые проводят

оценку только отдельных видов льгот. Так, в Московской области проводится оценка

только по действующим льготам, а в Ленинградской области и Якутии – только по

планируемым к предоставлению.

В

Ярославской, Сахалинской и Волгоградской областях оценка эффективности

налоговых льгот на региональном уровне проводится по налогу на прибыль

организаций (в части, поступающей в региональный бюджет), налогу на имущество

организаций, транспортному налогу и, редко, - по упрощенной системе

налогообложения. В ряде регионов методики разработаны, но реально эффективность налоговых льгот оценивается только в

отдельных муниципальных образованиях и только по местным налогам и сборам. К

таким муниципальным образованиям относятся: г. Барнаул, Хабаровск, Киров,

Пенза, Пермь, Ульяновск, Ярославль.

В Ненецком

автономном округе оценка эффективности проводится перед принятием нормативных

актов о предоставлении льгот. В Мурманской области оценка ограничивается только

бюджетной эффективностью налоговых льгот, в Новосибирской области – проверкой

условий и обоснований предоставления льгот. В муниципальном образовании «г.

Пенза» действует методика оценки бюджетной и социальной эффективности налоговых

льгот, предоставляемых муниципальным унитарным предприятиям. В муниципальном

образовании «г. Ижевск» проводится оценка лишь социальной эффективности и

только по местным налогам.

В Псковской,

Ленинградской областях, Республике Дагестан порядок оценки эффективности

регламентирован, однако детальная методика, раскрывающая механизм оценки

конкретных показателей эффективности, в нормативных документах отсутствует. В

Республике Татарстан, Ярославской, Кировской, Волгоградской областях

предусмотрены специальные методики для организаций-инвесторов.

Перечисленные

примеры свидетельствуют о фрагментарном, бессистемном и эпизодическом подходе к

проведению оценки эффективности налоговых льгот в различных регионах России. К

тому же отсутствуют единые формы отчетности результатов оценки. Это значительно

усложняет получение объективной информации для принятия экономически грамотных

решений по сохранению эффективных льгот или их отмене в случае неэффективности.

Невозможность

получения достоверной информации о результатах эффективности инструментов

налогового стимулирования объясняется также отсутствием доступа к информации о

суммах предоставленных налоговых льгот и прочих преференций по региональным и

местным налогам. Решение данной проблемы усложняется тем, что в соответствии со

ст. 102 Налогового кодекса РФ данные о налоговых льготах по конкретным

налогоплательщикам являются налоговой тайной и органы государственной власти и

местного самоуправления не имеют к ним доступ. Проявляется это в невозможности

возложения на льготополучателей

дополнительных обременений в виде предписаний по использованию

финансового эффекта от льготного налогообложения на реализацию тех или иных

целей, либо в виде обязанности предоставлять отчетность о размерах полученных

льгот и преференций и путях их фактического использования. Таким образом,

получив налоговую льготу, налогоплательщик фактически не несет за нее

ответственности.

Еще одной

причиной, усложняющей проведение оценки эффективности налоговых льгот и прочих

преференций, выступает несистематический характер информации, представленной в

пояснительных записках к проектам федеральных законов о федеральном бюджете.

Так, статьей 184.2 Бюджетного кодекса РФ установлен перечень документов и

материалов, представляемых одновременно с проектом бюджета, включающих

пояснительную записку. Вместе с тем состав информации, которая должна

содержаться в данной записке, действующим бюджетным законодательством не регламентирован.

Кроме того, даже если при прогнозировании доходов бюджетной системы учитывается

величина потерь бюджетных доходов от всех действующих льгот по налогам,

зачисляемым (в том числе частично) в федеральный бюджет, данные о таких потерях

лишь фрагментарно включены в пояснительные записки к проектам бюджетов. При

этом часто приводятся оценки влияния на доходную базу бюджета не налоговых

льгот и преференций, а изменений налогового законодательства (например,

введение амортизационной премии, индексации ставок акцизов, повышения ставок

госпошлины и др.). Одновременно отсутствуют оценки влияния таких изменений

налогового законодательства, как введение повышающего коэффициента при

начислении амортизации для хозяйствующих субъектов, осуществляющих инновационную

деятельность, введение налоговых каникул субъектов малого бизнеса,

предоставление налоговых кредитов и пр. [12].

Существующие

методики оценки эффективности налоговых льгот основаны на статистических

данных, собираемых из форм налоговой отчетности. Следует отметить, что

представленные в этих формах данные не могут являться репрезентативным

инструментом анализа эффективности инструментов налогового стимулирования в

силу своей неполноты: отсутствует детальная классификация потерь за счет

применения налоговых льгот и комплексный анализ выпадающих доходов бюджетов от

предоставления налоговых льгот.

Другим

существенным недостатком существующих методик является ограниченный подход к пониманию самого механизма

налогового стимулирования, как уменьшения налоговых обязательств

налогоплательщика посредством снижения налоговых ставок, предоставления скидок и налоговых вычетов,

освобождений от уплаты налогов.

Немаловажно также обеспечение унифицированного подхода, обеспечивающего качество и результативность

оценки эффективности инструментов налогового стимулирования: установление

единых критериев и показателей эффективности, применения единых способов и

методов проведения оценки, разработку рекомендаций, способствующих повышению

качества оценки эффективности, и, наконец, обязательный характер оценки всех

действующих инструментов налогового стимулирования.

Решая

поставленные задачи, в 2014 году Министерством экономического развития РФ

совместно с Министерством финансов РФ был разработан проект единой комплексной

оценки эффективности всех видов налоговых льгот и иных инструментов налогового

стимулирования, предусмотренных Налоговым Кодексом РФ. Цель создания данной методики заключалась в

создании единой системы оценки инструментов налогового стимулирования и

нивелирования субъективных подходов к их оценке на региональном уровне.

Предусматривалось, что оценка будет производиться специалистами по финансам и

экономике администраций муниципальных образований или субъектов Российской

Федерации.

Данная

Методика не получила практической реализации в 2015 году, однако авторами она

апробирована с целью выявления недостатков,

а также полезности и необходимости ее реализации в будущем на примере

специального налогового режима «Единый сельскохозяйственный налог» (глава 26 НК

РФ) и повышающего коэффициента к расходам на НИОКР (глава 25 НК РФ).

Новая

методика оценки эффективности налоговых льгот и результаты ее апробации на

примере сельхозпроизводителей

В

законодательстве о налогах и сборах в настоящий момент существует несколько

инструментов налогового стимулирования сельскохозяйственных производителей в

части налогообложений прибыли. Основные из них: единый сельскохозяйственный

налог (ЕСХН), упрощенная система налогообложения (УСН) и нулевая ставка налога на прибыль

организаций. По нашему мнению, существование этих инструментов не является

оправданной мерой. Безусловно, с точки зрения бюджетонаполняемости, выгодной

является ликвидация нулевой ставки по налогу на прибыль организаций, однако по

данным российского зернового союза на долю производителей применяющих ЕСХН

приходится менее трети товаров и около

35 млрд. рублей экспортного НДС к возмещению, из которых более 30 млрд. рублей

являются потерями бюджета из-за использования схем с участием фирм-однодневок

[13]. Министерство финансов также выступает за отмену либо реформирование ЕСХН

для уменьшения бюджетных потерь от противоправной деятельности

налогоплательщиков, применяющих данный налоговый режим.

В рамках

задачи совершенствования инструментов налогового стимулирования для развития

малого и среднего предпринимательства целесообразным является увеличение

предельного значения доходов для применения специального налогового режима либо

существенное увеличение коэффициента-дефлятора. С этой точки зрения одним из

наиболее удачных инструментов налогового стимулирования является УСН, однако и

здесь сдерживание предельного размера получаемых доходов до 60 млн. руб., даже

с учетом его ежегодной корректировки на индекс-дефлятор, усложняет развитие, в

том числе сельскохозяйственной отрасли, особенно в городах федерального

значения. Стоит обратить внимание на то, что по итогам 2014 года инфляция в

стране составила 11,4% , а коэффициент дефлятор в 2015 году составил 1,147.

Значение коэффициента предоставляет только 3%-ный рост для субъектов малого и

среднего предпринимательства, что не соответствует решению задач по развитию

малого и среднего бизнеса, для которых, собственно, и предназначены эти

налоговые режимы. Возможным решением, по нашему мнению, является увеличение

норматива по выручке до 100 млн. руб. за налоговый период с осуществлением

дальнейшей его индексации и мониторингом добросовестности применения

налогоплательщиками.

Согласно

«методике 2014» оценка эффективности налоговых льгот проводится по четырем

направлениям: социальная, экономическая, бюджетная, комбинированная – в

зависимости от того, какую группу целей преследует оцениваемый налоговый

инструмент. Учитывая, что целями анализируемых инструментов является

стимулирование развития приоритетных видов деятельности (проектов, отраслей),

их эффективность определяется на основе оценок уровня и динамики изменения

социально-экономических, демографических и других показателей соответствующих

видов деятельности (проектов, отраслей). Предположительно, для ЕСХН подобным

показателем может являться объем производства продукции [14], а для повышающего

коэффициента к расходам на НИОКР - количество созданных передовых технологий,

объем инновационных товаров, работ и услуг.

В рамках

анализа эффективности повышающего коэффициента к расходам на НИОКР так же

необходимо присвоение весовых коэффициентов показателям эффективности. В

соответствии с «методикой 2014», присвоение весовых коэффициентов производится

на основе экспертных оценок (в качестве экспертов в данном случае выступили

авторы). Из представленных в методике показателей, наиболее важным, по мнению

экспертов, является объем созданных передовых технологий: данному показателю

присвоен коэффициент 0,65. Объем инновационных товаров, работ и услуг, с точки

зрения экспертов, является менее важным, соответственно данному показателю,

согласно «методике 2014», присвоен весовой коэффициент 0,35.

Следующим

шагом выступает темповый метод присвоения баллов: производится сравнение темпов

роста выбранного показателя за два периода. Согласно «методике 2014» в случае,

если рост показателя положительно влияет на оценку налоговой льготы, то ему

присваивается индекс «П» , если отрицательно - «Н».

Выбранные

для анализа показатели, по мнению экспертов, положительно влияют на оценку

эффективности налоговых льгот, соответственно всем показателям присвоен индекс

«П».

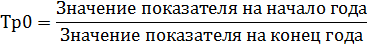

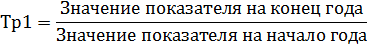

Темпы роста

показателей с индексом «П» рассчитываются в долях по формулам:

и и

, ,

где Тр0-темп

роста показателя в базовом году, а Тр1- темп роста показателя в

отчетном году.

Рассчитаем

указанные показатели для выбранных льгот. Объем производства сельскохозяйственной

продукции в 2012 году составил 3261,7 млрд. р., в 2013 году он составил 3190,4

млрд. р. по данным Росстата. Для расчёта

эффективности данной льготы будут применяться значения Тр0=1,022 и

Тр1=0,978.

Таким же

образом произведем расчёт данных показателей для второй рассматриваемой

льготы. Для большей наглядности

сформируем таблицу 1 по данным Росстата:

Таблица 1.

Сравнение темпов роста выбранного показателя за два

периода

|

Год

|

Кол-во

созданных передовых технологий

|

Объем

инновационных ТРУ, млн. р.

|

|

2012

|

1323

|

2 872 905,1

|

|

2013

|

1429

|

3 507 866,0

|

Значение Тр0

и Тр1 для показателя количества созданных технологий равны 0,93 и

1,08 соответственно. Для показателя объема инновационных товаров, работ, услуг,

значение показателя Тр0 составит 0,81 а Тр1- 1,22.

Следующим

шагом выступает присвоение баллов

показателям. Один балл присваивается в случае, если Тр1>Тр0.

Так, если значение Тр1 меньше значения Тр0 то

присваивается минус один балл, для всех остальных значений присваивается нулевое

значение. По итогам произведенных действий сформируем таблицу 2 с присвоенными

балами.

Таблица 2

Балльная оценка

показателя объема инновационных товаров, работ, услуг

|

Объем производства

сельскохозяйственной продукции

|

-1

|

|

Кол-во

созданных производственных технологий

|

1

|

|

Объем инновационных ТРУ

|

1

|

Далее

произведем расчёт коэффициентов эффективности по формуле:

Э -

коэффициент эффективности налоговой льготы

Б - балл,

присвоенный определенному показателю

V - весовой коэффициент, определенный

экспертом

В случае,

если значение Э составляет более 0,6, льгота по данному направлению оценивается

как высокоэффективная. Если значение Э составляет от 0,2 до 0,6, эффективность

льготы оценивается как средняя. Если значение Э составляет от -0,2 до 0,2,

эффективность льготы оценивается как низкая, и если значение менее -0,2

эффективность льготы оценивается как крайне низкая.

Согласно

данной методике, значение Э для льготы,

предоставляемой в виде ЕСХН для сельскохозяйственных товаропроизводителей

оценивается как крайне низкая.

Коэффициент эффективности льготы, предоставляемой в виде повышающего

коэффициента к расходам на НИОКР, в

разрезе показателя создания передовых производственных технологий оценивается

как высокоэффективная (0,65), в разрезе показателя объема инновационных

товаров, работ, услуг, коэффициент эффективности равен 0,35, соответственно в

разрезе данного показателя эффективность льготы является средней. Наряду с расчетно-аналитическими

методами, эффективность различных инструментов налогового стимулирования

оценивается с помощью экспертного метода опросов. Респондентам предоставляется

опросный лист с возможностью выбора

ответа на поставленные вопросы. Каждому из ответов присваивается определенное

значение от -1 до 1 и показателем эффективности инструмента налогового

стимулирования является соотношение набранных баллов с максимально возможным их

числом. Далее полученное значение сопоставляется со шкалой эффективности,

предложенной в «методике 2014» и делается вывод об эффективности исследуемого

инструмента. Субъективный характер исследования здесь очевиден, однако еще

более он проявляется в действующих региональных методиках.

Преимущества

и недостатки новой методики оценки эффективности налоговых льгот

Позиция

Министерства финансов по вопросам характеристики и оценки эффективности налоговых льгот,

отраженная в действующих региональных методиках, отличается от позиции

Министерства экономического развития РФ. Механизм оценки эффективности

налоговых льгот с точки зрения Минфина, в первую очередь, направлен на

определение величины выпадающих доходов бюджета в результате предоставления

налоговых льгот, при этом влияние на бизнес не учитывается. Минэкономразвития оценивает налоговые льготы

с точки зрения их эффективности в работе бизнеса. Достоинством «методики 2014»

является учет обеих позиций ведомств. Подход Минфина предлагается использовать

для прогноза бюджетных доходов и оценки эффективности государственных программ.

Позицию Минэкономразвития – для определения экономической целесообразности

инструментов налогового стимулирования в деятельности хозяйствующих субъектов.

Новая

методика Минэкономразвития поделила все существующие на сегодняшний день льготы

по налогам на две крупные категории. В одну из них попали элементы базовой

структуры налогов, по которым предоставляются льготы, а во вторую - преференции

для отдельных категорий налогоплательщиков. Одним словом, перечень инструментов

налогового стимулирования для оценки их эффективности расширен за счет

преференций. В то же время не учтены такие инструменты, как: налоговый кредит,

управление налоговым потенциалом и налоговыми базами (региона, муниципального

образования) и др. Таким образом, также как и действующие, «методика 2014» не

обеспечивает оценку эффективности всех инструментов налогового стимулирования в

полной мере. Кроме того, по мнению авторов, она носит формальный характер и в

ее практическом применении могут возникнуть определенные сложности, поскольку

она является громоздкой в расчетах, и ее

применение не решило проблем, связанных с

трудовыми и временными затратами ее реализации, а также сложностью в подборе

статистического материала.

Известно,

что чаще всего льготы имеют «затяжной» во времени эффект, приводят к

постепенному увеличению капитала налогоплательщика и, следовательно, к

увеличению налоговых поступлений в бюджетную систему в будущем [15]. Поэтому целесообразно

встроить в механизм оценки эффективности совокупный накопленный эффект от

налоговых льгот, положив в основу критериальные показатели сопоставления

выпадающих бюджетных доходов во взаимосвязи с финансово-экономической

деятельностью хозяйствующих субъектов.

По итогам

исследования существующих методик оценки эффективности налоговых льгот можно

сформулировать ряд заключений:

1. Под механизмом налогового стимулирования в

большинстве случаев понимается уменьшение налоговых обязательств.

2. Статистические

данные, используемые для оценки, не являются репрезентативным инструментом, так

как представляются не систематически, недостаточно подробно и оперативно.

3. В

отдельных регионах России существует бессистемный и фрагментарный подход к

оценке эффективности льгот, в ряде регионов такая оценка не проводится.

4.

Отсутствует возможность возложить на получателей льгот ответственность за

использование финансового эффекта не по назначению.

5. Несмотря

на значительное количество льгот и преференций, налоговая система РФ не в

полной мере выполняет стимулирующую функцию, в частности – в отношении

аграрного сектора экономики.

6. “Методика

2014”, апробированная авторами, также не обеспечивает оценку эффективности

налогового стимулирования в полной мере.

Очевидно,

что работа по усовершенствованию механизмов оценки эффективности инструментов

налогового стимулирования должна продолжаться в направлении устранения

выявленных недостатков, упрощения и повышения объективности оценки с целью

дальнейшей возможности планирования бюджетных поступлений и осуществления

налогового бюджетирования на будущие периоды, без учета неэффективных налоговых

льгот и прочих инструментов налогового стимулирования.

References

1. Tkachuk V.A. Sotsial'no-ekonomicheskie determinanty kachestva zhizni sel'skogo naseleniya // European journal of economics and management sciences. East West Association for Advanced Studies and Higher Education GmbH. Vena, 2015. № 3. S. 47-56.

2. Kukhtin P.V. Rol' zemel'nykh resursov v gosudarstvennoi ekonomicheskoi sisteme // The Genesis of Genius. Mezhdunarodnoe nauchnoe ob''edinenie ekonomistov. Zheneva, 2014. № 1-1. S. 37-44.

3. Krylatykh E.N. Obespechenie prodovol'stvennoi bezopasnosti Rossii i mira: vozmozhnosti, riski, ugrozy // [Elektronnyi resurs] http://www.viapi.ru/publication/full/detail.php (data obrashcheniya 25.03.2016).

4. Gubina V.S. Investitsii kak vazhneishii faktor razvitiya sel'skokhozyaistvennoi otrasli// Aktual'nye voprosy ekonomicheskikh nauk. 2013. № 35. S. 147-153.

5. Lapina M.A. Problemy i perspektivy investirovaniya sel'skogo khozyaistva Rossii // Niva Povolzh'ya. 2014. № 2(31). S. 130-135.

6. P'yanova M.V. Nalogovoe stimulirovanie sel'skogo khozyaistva v usloviyakh ugrozy prodovol'stvennoi bezopasnosti // Simvol nauki: Mezhdunarodnyi nauchnyi zhurnal. M., 2015. № 3. S. 115-118.

7. Pinskaya M.R., Tikhonova A.V. Garmonizatsiya NDS i edinogo sel'skokhozyaistvennogo naloga // Belorusskii ekonomicheskii zhurnal. 2015. № 3(72). S. 72-78.

8. Savina O.N., Savina E.O. Aktual'nye voprosy sovershenstvovaniya normativno-pravovoi bazy v tselyakh stimulirovaniya investitsionnoi aktivnosti v Rossiiskoi Federatsii // Nalogi i nalogooblozhenie. 2015. № 9. S. 725-739.

9. Altukhov A.I. Agropromyshlennyi kompleks Rossii v usloviyakh formirovaniya evraziiskogo ekonomicheskogo soyuza i chlenstva v VTO // Mezhdunarodnyi nauchno-proizvodstvennyi zhurnal "Ekonomika APK". 2015. № 1(243). S. 88-95.

10. Golubina Zh.I., Baskakova L.V. Osnovnye riski prisoedineniya k VTO dlya prodovol'stvennoi bezopasnosti strany i ee sel'skogo khozyaistva // Nauchnoe obozrenie. Ser. 1: Ekonomika i pravo. 2014. № 3. S. 81-86.

11. Mochalina O.S. Indikatory agrarnogo proizvodstva i ikh svyaz' s investitsionnymi potokami // Ekonomika razvitiya. Khar'kovskii natsional'nyi ekonomicheskii universitet. Khar'kov, 2011. № 3(59). S. 34-37.

12. Shekhovtsova Yu.A. Ispol'zovanie nalogovykh instrumentov obespecheniya investitsionnoi bezopasnosti v Rossiiskoi Federatsii // Nalogi i nalogooblozhenie. 2013. № 3. S. 165-178.

13. Zhavoronkova I. Minfin podderzhit otmenu edinogo sel'khoznaloga dlya bor'by s «odnodnevkami»/ RBK [Elektronnyi resurs] http://www.rbc.ru/business/17/02/2015/54dcc0b69a794757362e399b (data obrashcheniya 18.02.2015)

14. Kireeva E.F. Finansirovanie innovatsionnoi deyatel'nosti i primenenie nalogovykh l'got: sovremennoe sostoyanie v Respublike Belarus' // Voprosy sovremennoi ekonomiki. 2014. № 1. S. 29-40.

15. Giraev V.K. Problemy nalogovogo regulirovaniya i stimulirovaniya ekonomiki Rossii // Nalogi i nalogooblozhenie. 2015. № 4. S. 277-288.

16. Gashenko I.V. Sushchnost', printsipy i spetsifika nalogovogo regulirovaniya APK v Rossii // Nalogi i nalogooblozhenie. 2015. № 1. C. 44-51. DOI: 10.7256/1812-8688.2015.1.14298.

Link to this article

You can simply select and copy link from below text field.

|

|