|

MAIN PAGE

> Back to contents

Theoretical and Applied Economics

Reference:

Tikhonova A.V.

Prospects for the development of taxation of individuals in Russia, taking into account advanced foreign experience

// Theoretical and Applied Economics.

2023. № 3.

P. 64-84.

DOI: 10.25136/2409-8647.2023.3.43890 EDN: YWMIBE URL: https://en.nbpublish.com/library_read_article.php?id=43890

Prospects for the development of taxation of individuals in Russia, taking into account advanced foreign experience

Tikhonova Anna Vital'evna

ORCID: 0000-0001-8295-8113

PhD in Economics

Associate Professor, Leading Researcher, Department of Taxes and Tax Administration, Financial University

127083, Russia, Moscow, Verkhnyaya Maslovka str., 15, room 507

|

samozvanka_89@bk.ru

|

|

|

Other publications by this author

|

|

|

DOI: 10.25136/2409-8647.2023.3.43890

EDN: YWMIBE

Received:

23-08-2023

Published:

05-10-2023

Abstract:

This study is devoted to the search for advanced foreign experience in differentiating the tax burden of individuals and determining the directions for its implementation in Russia. The article consists of three thematic blocks: the first is devoted to assessing the tax burden of individuals in the Russian Federation, the second contains a description of foreign experience in taxing the population, and the third contains directions for improving domestic taxation. Based on the analysis of foreign experience in taxing individuals, methodological tools have been identified to ensure the differentiation of the tax burden (diversification of fiscal units; the use of a progressive scale; new fiscal institutions; tax deductions and tax credits; taxes on inheritance and gift; taxes on wealth and luxury). The tools that can be implemented in domestic practice have been identified: taxation of inheritance and donation; expanded application of elements of family taxation for socially oriented tax deductions; differentiated approach to tax administration of property and income taxes levied on individuals. In addition, methodological approaches to the administration of taxes from the population have been formed, based on the following criteria: calculation of tax liabilities; source of information on tax liabilities; the moment of granting tax benefits (preferences); frequency of payment of taxes; the possibility of hiding the object of taxation. The practical significance of the study lies in the possibility of using its results in the development of tax policy measures.

Keywords:

income taxes, PIT, social stratification, tax burden, individuals, diversification of fiscal units, property taxation, inheritance tax, the wealth tax, lump-sum tax

This article is automatically translated.

You can find original text of the article here.

Introduction. Problem statement

Taxation of individuals is not only an essential element of the country's tax system, but also a significant component of the state's social policy. In the scientific research of the last and current century, quite a lot of attention was paid to the issues of social stratification [1-4]. At the same time, the role of tax regulators was assigned, as a rule, to progressive taxation on personal income tax [5-9]. However, this position of the authors seems to be debatable. Firstly, social stratification is a very common phenomenon for most economies of both developed and developing countries. In today's world, it is difficult to imagine a country in which "everyone is equal", moreover, this is objectively impossible and not justified in a market economy where there is work of different skill levels, experience and character. The defined indicators of social inequality in Russia are lower than many developed countries of the world and tend to decrease (Table 1).

Table 1 - Indicators of social inequality in Russia

|

Indicator

|

2019

|

2020

|

2021

|

2022

|

Normative value

|

|

Funds ratio

|

15,4

|

14,5

|

15,1

|

13,8

|

Not higher than 10

|

|

Gini Coefficient

|

0,411

|

0,403

|

0,409

|

0,396

|

not higher than 0.42

|

|

Average growth rate of per capita income of the population, %

|

106,4

|

101,9

|

111,1

|

111,5

|

Not below the inflation rate. The official inflation rate in 2019 is 3%, in 2020 – 4.9%, in 2021 – 8.39%, in 2022 – 11.94%.

|

|

Decile coefficient

|

7,1

|

6,9

|

7

|

6,5

|

Not developed. In developed European countries it is 3-4.

|

Source: compiled by the author according to Rosstat.

Secondly, no progressive scale (even the most differentiated in the Scandinavian countries) is able to solve the problem of social inequality globally. In this regard, the following question will be most correct: what is the contribution of each social group to the formation of the country's budget and how is this tax burden distributed? The answer to this question requires not only a quantitative assessment of statistical data and an analysis of advanced foreign experience in differentiating the tax burden of the population to identify areas for improving tax policy in Russia.

Analysis of the tax burden on individuals in Russia

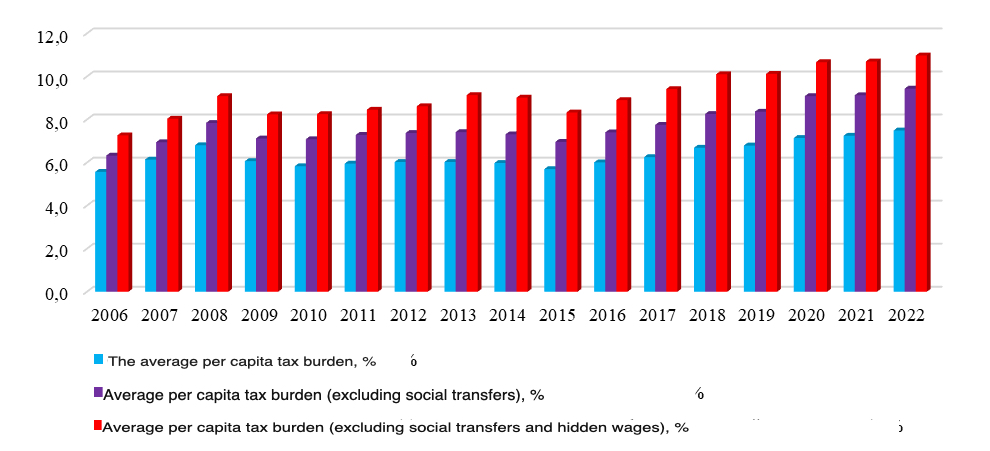

The tax burden of individuals is one of the most important characteristics of fairness, uniformity and compliance of modern tax policy in the field of population with the socio-economic objectives of the country. Data on the total tax burden on the population, defined as the ratio of the average per capita amount of taxes paid by individuals and the average per capita monetary income, are presented in Figure 1.

Source: compiled by the author according to Rosstat and the Federal Tax Service of Russia.

Figure 1. Dynamics of the total tax burden on the population

The results of the analysis show a general trend of growth of the tax burden on the population, including during the sanctions period. It is important to note that its level, excluding non-taxable social transfers, is significantly lower even than the nominal personal income tax rate (9.4% vs. 13% in 2021), a similar trend is evident after adjusting for the share of hidden wages determined annually by Rosstat (11% in 2022). Thus, it is not possible to make an adequate assessment of the total tax burden on the population based on open statistical data, nevertheless, calculations allow us to note the general dynamic trend of the growth of the tax burden. The structure of the tax burden on individuals for 2006 and 2022 is presented in Table 2.

Table 2 – Structure of the tax burden on individuals

|

Taxes

|

Structure of the tax burden

for individuals, 2006

|

Structure of the tax burden

for individuals, 2022

|

|

thousand rubles .

|

%

|

thousand rubles .

|

%

|

|

Personal property tax (NIFL)

|

6 440 781

|

0,69

|

128 041 129

|

2,10

|

|

Land tax

|

4 172 985

|

0,45

|

50 997 074

|

0,84

|

|

Transport tax

|

30 053 378

|

3,21

|

169 248 119

|

2,78

|

|

Personal income tax

|

895 136 635

|

95,65

|

5 746 696 695

|

94,29

|

|

Total

|

935 803 779

|

100,00

|

6 094 983 017

|

100,00

|

Source: compiled by the author according to the statistical reports of the Federal Tax Service of Russia.

The percentage assessment of structural load shifts over 16 years according to the Ryabtsev and Spearman indices showed no differences. Consistently, the main tax that forms the burden on the population is personal income tax (its share in different years ranges from 94-96%). The transition from inventory taxation to cadastral value allowed to slightly increase the share of personal property tax (NIFL), however, in comparison with personal income tax, it is consistently small despite the fact that NIFL and land tax increased 20 and 12 times over the analyzed period, respectively, while transport tax and personal income tax – only in 6. Such an insignificant contribution of property taxes to the tax burden of individuals significantly reduces their regulatory potential.

The social injustice of taxation of individuals in Russia lies in its uneven distribution between population groups, while the bulk of it falls not on the rich population, but on the middle class. To take into account the level of consumption and savings of the population, it is proposed to use the following approach, combining the methods of the World Bank [10] and Rosstat [11]: the middle class includes citizens who have an average per capita monetary income above 1.5 times the subsistence minimum, as well as forming savings (in the amount of at least 2 PM per family member).

The assessment of the redistribution of the tax burden between the population with different income levels is complicated by the lack of adequate statistical data on income for different population groups. The fact is that the official data of Rosstat on the stratification and distribution of income are based on the results of sample surveys of households in which the wealthiest citizens practically do not participate. Thus, the problem of the "legal tail" in the series of income distribution manifests itself. In turn, the data of the Federal Tax Service is characterized by the problem of the "left tail", which consists in not accounting for significant amounts of social transfers that are not subject to personal income tax, and therefore not declared in official reports. This significantly underestimates the statistics of the Federal Tax Service on the incomes of the least affluent segments of the population [12].

To assess the conditional tax burden for decile groups of the population, Rosstat data on the structure of income of the population (income and expenses by decile groups) [13], the study of the Central Bank of the Russian Federation "Finances of Russian households in 2022" (in terms of the structure of income by decile groups) [14], Form 1-DDK of the Federal Tax Service of Russia (in part of the declaration of income by the richest citizens) [15]. The comparability of the data of Rosstat and the Central Bank of the Russian Federation is justified by the consistency of the results of the distribution of the population by the level of inequality obtained by the two departments [16].

Table 3 – Distribution of the tax burden by decile groups, 2021

|

Indicator

|

Decile groups (in order of increasing income)

|

|

First

|

Second

|

Third

|

Fourth

|

Fifth

|

Sixth

|

Seventh

|

Eighth

|

Ninth

|

Tenth

|

|

Expenditures per capita, RUB.

|

6941

|

9838

|

11914

|

13787

|

15755

|

18490

|

21595

|

25691

|

32236

|

55302

|

|

Income per capita, RUB.

|

9225

|

16052

|

21274

|

26599

|

32508

|

39480

|

48316

|

60500

|

80568

|

147284

|

|

Savings per capita, RUB.

|

2284

|

6214

|

9359

|

12812

|

16754

|

20990

|

26722

|

34808

|

48332

|

91983

|

|

The share of social transfers in income, %

|

39,3

|

29,2

|

27,2

|

32,6

|

27,9

|

18,6

|

21,2

|

14,7

|

10,1

|

7,8

|

|

Per capita taxable income, RUB.

|

5602

|

11359

|

15493

|

17932

|

23454

|

32151

|

38067

|

51589

|

72444

|

135797

|

|

Conditional effective personal income tax rate, %

|

7,9

|

9,2

|

9,5

|

8,8

|

9,4

|

10,6

|

10,2

|

11,1

|

11,7

|

12,0

|

Source: compiled by the author according to Rosstat, the Central Bank of the Russian Federation and the Federal Tax Service of Russia.

Taking into account the relatively small average income of the 10th decile group, all Rosstat distribution data will be included in the middle class (average incomes above 1.5 PM – 17,480 rubles, savings exceed 2 PM - 23,300 rubles). Thus, approximately half of the population (group 6-10) falls into this category of citizens in Russia, which owns 73.8% of the taxable income determined by sample surveys of Rosstat. To calculate the final share of taxable income, the minimum estimated amount of declared income by citizens in whose declaration the taxable income exceeded 100 million rubles has been determined. The amount of income is adjusted for the declaration deduction coefficient of 0.67, calculated in proportion to the number of declarants of the "right tail" and the contribution of each group of declarants [17]. Thus, the conditional calculation of the share of taxable income of the middle class was approximately 70%.

The tax burden is unevenly distributed between deciles. Taking into account social transfers, a number of deciles with higher incomes have a lower tax burden (for example, the fourth and seventh). The calculated effective personal income tax burden in the "right tail" was 14.1%, which is not significantly different from the load of other middle class groups. Analysis of the structure of the "legal tail" showed that more than 80% of it are individuals who are not engaged in entrepreneurship and receive income from passive sources.

Taken together, the circumstances noted above make it possible to determine the insignificance of the fiscal and regulatory role of property taxes, the uneven and unfair distribution of the tax burden between population groups with different income levels. The lion's share of tax payments falls on the middle class, the general trend of increasing the tax burden does not reduce the burden of the middle class. The progressive tax rate adopted in 2021 has not solved the problem of unfair distribution of the tax burden, nor can property taxation solve this problem. In this regard, it is necessary to transform approaches, first of all, to the mechanism of application of income taxes, the regulatory potential of which is much higher in Russia.

Analysis of the best foreign experience of differentiation of the tax burden

Currently, the issues of transformation of the income tax system in terms of its improvement are relevant for most developing countries. At the same time, the existing directions for the development of taxation of individuals are very diverse: from establishing the form of the tax scale (progressive or proportional) to strengthening the social justice of income through the development of tax deductions and non-taxable minimum, depending on the social status of a citizen. Let's analyze the sources by which countries manage to achieve such differentiation and redistributive effect.

Source 1. Diversification of fiscal units. In the context of this study, the diversification of fiscal units is understood as the possibility of choosing the category of taxpayer to which an individual will be treated with individual income taxation. At the same time, such categories are formed, as a rule, on the basis of his marital status and social status: for example, exclusively an individual, two working spouses, spouses with children, a working spouse and a non-working spouse, a widower with children, etc. In other words, the diversification of fiscal units reveals the potential for the development of family taxation.

The proper family tax regime was the main issue in the development and introduction of the taxation system in many States where direct taxation of individuals is applied. In a number of Territories, including the United States of America, it is allowed to divide income between family members in one form or another, which is usually justified by differences in the financial and social status of families of different sizes. At the same time, many countries rely on a person rather than a family as the main unit of account when taxing individuals. For example, among the OECD countries, only French tax legislation provides for mandatory joint declaration of family income as a fiscal unit. Important examples of countries where family taxation is represented are Canada, Australia, Germany, Japan and the Netherlands. However, a distinctive feature of this group of states is the possibility of choosing the category of fiscal unit.

The diversification of fiscal units has several types of consequences, which, for the most part, are associated with a more even distribution of the tax burden and an increase in social justice of taxation. For example, back in 2006, Bargain and Orsini proved using mathematical modeling tools that an income tax policy that takes into account the institution of the family is better suited to a social goal. The effectiveness of tax benefits under it is much higher, and this is achieved by increasing the targeting of fiscal incentives [18]. Later, S. Avram, studying the financial and redistributive effect of tax benefits and tax deductions, noted that the redistributive effect of these tax components is small; other features of the tax system, such as the scale of tax rates and the diversification of tax units, as a rule, have a much greater redistributive effect [19]. In the United States, husbands and wives are allowed to combine their income and file a joint tax return, as a result of which income tax is levied in such a way as if each of them earned half of the total family income. The classic argument in favor of such a division of income is that husbands and wives usually divide their total income equally. In fact, despite the seeming fairness of this approach, nevertheless, it has a distorting effect: the same tax rate for spouses leads to an equalization of the cost of work and leisure time (or labor and non-labor employment, if one of the spouses is employed, and the other earns various forms of freelancing). In this aspect, economists have repeatedly noted the need for structural differentiation of the approach tax rate within the family due to a relatively less elastic labor supply, so that the marginal rate of the spouse earning more is higher. That is why it is necessary to treat with a certain degree of skepticism the division of the tax burden on the basis of total family income, regardless of the source of its occurrence.

In this aspect, the experience of Germany is interesting, the income tax system in which is based on the application of a progressive tax scale with a complexly differentiated system of tax deductions, depending on the social status of a citizen. From the point of view of diversification of fiscal units, individuals in Germany are divided into six special "tax classes". The "tax class" (Lohnsteuerklasse or Steuerklassen) is important in determining the amount of withheld (income) tax deductible from wages, as well as in determining the value of a number of social benefits that a taxpayer can claim. A certain tax class is assigned to an individual by the authorities on the basis of marital status and a number of other criteria (Figure 2).

Source: compiled by the author according to [20].

Figure 2. Tax classes of individuals in Germany

In some cases, the taxpayer has the right to choose a certain tax class. There may be various family models and permutations of tax classes [21]. Confirmation of the tax class of an individual is carried out using special tax cards (Lohnsteuerkarte) issued by the local registration bureau (Rathaus, Einweermeldeamt, Finanzamt) on an annual basis. Such cards are sent automatically before the start of the tax period to the registration address of an individual.

Another promising experience of diversification of fiscal units is presented in France. For the purposes of calculating tax liabilities, the French tax authorities determine for each taxpayer the so-called family factor (quotient familial), which means the presence of dependents, the size and composition of the household.

The general approach in the taxation of individuals is as follows:

1) at the first stage, the household (family) is divided into parts (or shares);

2) further, the gross income of all household members is divided by this number of shares;

3) after determining the amount of income attributable to one part, the so-called conditional amount of tax that is levied on this one part is determined;

4) the received amount of tax is multiplied by the number of parts, thus the final tax payable to the budget by the household (family) is determined.

At the first glance at the taxation system of France, there is an assumption about its similarity with Germany, but the gross income of a family is not divided in equal proportions relative to the number of its members. There is a complex set of rules for calculating the parts (shares) in each household, depending on the role in the family and the availability of dependents (Table 4).

Table 4 – Rules for determining the parts for taxation of gross family income in France

|

Dependents (children, disabled)

|

Married / Partnership

|

Widowers

|

Divorced/divorced (lives alone)

|

Single

|

|

no

|

2

|

1

|

1

|

1

|

|

1

|

2,5

|

2,5

|

2

|

1,5

|

|

2

|

3

|

3

|

2,5

|

2

|

|

3

|

4

|

4

|

3,5

|

3

|

Source: compiled by the author.

Thus, with the general approach, an adult capable citizen is recognized as one part, while the first and second child are 0.5 parts, and the third and all subsequent ones are 1 part. For example, in a family (husband and wife) without children, income is divided into 2 parts, and in a family with two parents and three children – into 4 parts. This approach makes it possible to strengthen the progressive nature of taxation for families without children and significantly reduce the tax burden on large families. Disabled persons or persons with disabled dependents are provided with an additional half (0.5) share in each case.

In addition, this system takes into account, for example, the reasons for having a single parent in the family. If a parent lives alone with a child (or in an unregistered marriage or partnership), the number of shares for him will be 1.5; if he is divorced and has one child – 2 parts; if he became single as a result of the death of the second spouse (widower) – 2.5 parts. If a divorced couple has joint custody of the children, then the rate of the part for each parent is reduced to 0.25 for each child.

Thus, a distinctive feature of the diversification of fiscal units in France is an approach based on the category of "household" rather than "family", which includes a broader list of persons actually living together and having common social interests.

The difference between civil partnerships in Ireland and all other countries is that not only officially registered partners can be recognized as such, but also those recognized as similar under the legislation of other countries (the list of such cases is approved by the Ministry of Justice of Ireland and is valid for registration of the partnership until 01.01.2016). Individuals in Ireland have the right to choose the category of fiscal unit to which they could refer themselves. Irish legislation provides for 3 categories of fiscal units, according to which the assessment of tax liabilities is carried out in different ways:

1) assessment of one person – everyone is taxed at their own tax rates, claims only their own tax benefits and credits, the non-taxable minimum is used independently; thus, all income tax preferences cannot be alienated in favor of the other spouse;

2) self–assessment - this form differs from the previous one in that some types of tax benefits can be distributed equally among family members (partnerships);

3) joint assessment is a convenient option for family taxation, in which family members (partnerships) can independently choose how taxable and non–taxable income, tax benefits and credits, and a non-taxable minimum will be distributed among them. It is possible that only one of the spouses will act as a taxpayer (he is called "assessed"), in the absence of a corresponding application, the person whose income is greater becomes the assessed person.

Being in an officially registered marriage, spouses can choose whether they will be taxed as independent fiscal units or as a married couple. Moreover, if the tax burden for personal taxation turns out to be higher than if the income of the husband and wife were taxed as income of the family as a whole, each of them has the right to reimburse the specified amount of overpayment from the budget.

The experience of diversification of fiscal units for individual income tax in Canada is also interesting, where the amount of tax liabilities of an individual directly depends on his marital status. Moreover, the concept of "marital status" of a citizen does not come from the concept of "family", but from "household", since not all categories of payers are required to have official registration as spouses:

1) married – a person who is officially married;

2) living under civil law – a person living with a person who is not officially the taxpayer's spouse, but with whom he has a marital relationship and to whom at least one of the following situations applies: live together in a marital relationship for at least 12 months in a row; are parents or guardians of one child;

3) not living together – payers living separately from a spouse or partner in civil law due to a breakup of the relationship for at least 90 days;

4) the widower;

5) divorced;

6) idle – selected if none of the previous 5 categories is suitable.

The role of diversification of fiscal units in this complex system is that, depending on the category of the payer, various coefficients used in calculating the non-taxable amount of tax are applied to him. These coefficients also depend on the availability of the payer's dependents: children, grandparents, etc. (Table 5).

Table 5 – Examples of calculating the amounts of personal non-taxable deductions depending on the status of a taxpayer in Canada

|

Taxpayer status

|

Dependents

|

Calculation of non-taxable deductions

|

|

Married or living under civil law

|

The spouse or partner in civil law is dependent due to mental or physical infirmity

|

$10,527 + $2,150 – income of a spouse or partner in civil law

|

|

Married or living under civil law

|

Missing

|

$10,527 – income of a spouse or partner in civil law

|

Source: compiled by the author.

It is important to note that such diversification applies not only to labor income, but also to capital income. For example, Norwegian law provides that spouses and a registered partnership can independently distribute capital gains among themselves, as well as expenses for tax purposes. The chosen distribution usually does not affect the total amount of tax payable by the spouses, but affects which of them will be taxed on capital and income or will receive a deduction for the corresponding expenses. This approach allows for tax planning and budgeting of the family, optimizing its fiscal burden.

Closely related to fiscal issues is the issue of determining the residence of individuals, which in some cases determines the amount of tax obligations of citizens to states (Figure 3).

Source: compiled by the author.

Figure 3. Approaches to the recognition of the residence of individuals

The latter approach is the most reasonable according to several criteria, because it allows taking into account not only the physical location of the taxpayer, but also the center of his economic interests.

Source 2. Application of the progressive tax scale. The diversification of fiscal units is successfully combined with the use of a progressive income tax scale, which also makes it possible to realize social and regulatory fiscal potential.

US tax legislation provides for the presence of federal and state income income from the population. The US government has traditionally avoided the policy of "taxing the rich." However, over time, the progressiveness of the federal income tax has decreased. Successive reforms have led to the fact that in recent years the states have begun to compensate for this by increasing the progressiveness of their own income tax systems - a trend that has become known as the "millionaire tax" movement. This is the process of restoring progressivity by transferring it from the federal level to the state level [22].

As noted earlier, the general principle of income taxation of citizens in Germany is that income is divided between married couples to calculate income tax obligations. At the same time, a progressive scale of rates is applied, which for 2021 are:

0% - for income not exceeding 9,744 euros per year;

14-42% - for income from 9,744 to 57,918 euros per year;

42% - for income from 57,919 to 274,612 euros per year;

45% - for income exceeding 274,612 euros per year.

In addition to the actual tax class of an individual, there are also differentiated conditions for the formation of the income tax base, which are the source of significant differences in the amount of the fiscal burden of an individual. For example, when calculating the taxable income of pensioners (citizens over 64 years old), an amount of 1,900 euros annually is excluded from it, which is equivalent to an old-age allowance. Similarly, single parents who have the right to claim tax-free child benefit exclude from the tax base the amount of 1,308 euros per year as a support tool for this category of taxpayers. Table 6 below shows the calculation of the tax burden when assigning the payer to a different class, for comparison, the load for classes I and III in the absence of children is estimated.

Table 6 – Calculation of the tax burden on an individual living in Germany, when referring him to different classes

|

|

Tax amount

|

Amount of contributions

|

Tax rate

|

Contribution rate

|

Amount of income (net)

|

|

Class I

|

Salary 15,000 euros per year

|

0

|

2 733,75

|

0%

|

18,23%

|

12 266,25

|

|

Salary 25,000 euros per year

|

951

|

4 556,25

|

3,8%

|

18,23%

|

19 440,44

|

|

Salary 50,000 euros per year

|

10 022

|

9 112,50

|

20,04%

|

18,23%

|

30 314,29

|

|

Salary 75,000 euros per year

|

16 909

|

12 940,55

|

22,55%

|

17,25%

|

44 220,46

|

|

Class III

|

Salary 15,000 euros per year

|

0

|

2 733,75

|

0%

|

18,23%

|

12 266,25

|

|

Salary 25,000 euros per year

|

1 902

|

4 556,25

|

7,61%

|

18,23%

|

18 437,14

|

|

Salary 50,000 euros per year

|

13 161

|

9 112,50

|

26,32%

|

20,04%

|

27 002,65

|

|

Salary 75,000 euros per year

|

32 947

|

12 940,55

|

43,93%

|

17,25%

|

27 300,37

|

Source: compiled by the author.

As the data in Table 6 show, the tax status of an individual in Germany affects the size of the taxpayer's tax rate. Moreover, the higher the level of his income, the stronger this influence: with an annual income of 25,000 euros, the difference in rates for the 1st and 3rd class was 3.81%, while with an income of 75,000 euros – 21.38%. On the other hand, separate tax calculation for family members with this class-based approach is a priority compared to the US approach, since it takes into account not only social status, but also the individual contribution of each family member to gross income.

The mechanism of gradation of taxpayers presented above in France allows differentiating the tax burden depending on the category of taxpayers in such a way that a single citizen who does not have dependents in his care will pay income tax at a higher rate than a family of three with the same gross income, since in the latter case the tax is calculated on a partial share of the income of each a member of the household. To do this, a progressive scale of tax rates has been established in the country (data are given for 2021):

0% - for income up to 10,084 euros;

11% - for income from 10,085 to 25,710 euros;

30% - for income from 25,711 to 73,516 euros;

41% - for incomes of 73,517 euros to 158,222 euros;

45% - for incomes over 158,222 euros.

A distinctive feature of the income tax system in Canada is that there are 2 taxes in the country: federal (with a maximum rate of 33%) and provincial (with a maximum rate of 21%). The tax rate for both taxes is complex and progressive: it contains 4 gradations for federal tax and a different number of gradations of scales for provincial tax (for example, New Brunswick - 2 gradations; Ontario – 5; Alberta – 1; the province of Quebec has its own unique taxation system). All provinces of Canada, except one (Albertino), use progressive taxation of personal income [23]. The tax rate depends on the status of the Canadian payer, for example, for the passive income of minor children, the highest tax rate is applied – 54%, to which personal tax deductions are not applied (in Canada, this is called the "child tax").

It is important to note that the progression in taxation involves not only income taxes. Traditionally, the system of taxation of property of individuals abroad is also based on the application of a progressive tax scale. Most countries in the real estate taxation system choose a progressive scale (whether it is a single property tax or separate property and land taxes). At the same time, as a rule, a value close to the market, but not exceeding it, is used as the basis of taxation. In particular, in most EU countries it is customary to set the cadastral value of objects 10-15% lower than their market value. The exception is property taxation in France, based on the forecasted value of rental income.

Source 3. New fiscal Institutions. This source of differentiation and redistributive effect in individual income taxation is of particular importance in the context of modern global economic transformations and the transformation of taxation systems of individuals.

The institution of a controlling person is currently used in the tax practice of a large number of countries around the world. The main fiscal purpose is to assign tax liability for the obligations of a controlled company directly to the individuals controlling it (in the context of the taxation system of individuals). Thus, this mechanism allows you to simultaneously protect the interests of the state from illegal activities of legal entities (in the form of dilution of the tax base and the withdrawal of profits abroad) and assign subsidiary responsibility to the actual beneficiary of the profit (in most cases, an individual who is the founder of the company – directly or indirectly). The formation of such institutions is aimed at the return of capital to the territory of the source country according to the current taxation rules, thus the fairness of taxation is achieved and there is an opportunity for the implementation of redistributive fiscal policy. Today's wealthy citizens are increasingly adept at investing their finances to avoid the negative effects of redistributive policies, often positioning themselves outside the jurisdiction of nation States (for example, using tax loopholes in offshore havens, including the Cayman Islands, Channel Islands and Luxembourg).

There are other reasons for the institutional development of taxation of individuals. In particular, special institutional regulation affecting foreign workers is present in Swiss tax legislation. The usual income tax rates in Switzerland vary in 26 cantons and approximately 2,500 municipalities. Foreigners whose annual gross income is below 120,000 Swiss francs (about 130,000 US dollars) are subject to a special tax regime (Quellenbesteuerung) until they receive a permanent residence permit, for which an application is submitted after five years of stay in Switzerland. For taxpayers in a special tax regime, income tax rates do not differ between municipalities within the canton. The definition of a special income tax rate leads to two types of municipalities: high-tax, where the usual tax rate is higher than the special tax rate, and low-tax, where the usual tax rate is lower than the special tax rate. Such an institutional mechanism creates a deterministic threshold of five years of stay, which, in turn, leads to a change in the individual's local tax rates. This threshold and the resulting local randomization explain not only the causal effects of income redistribution, but also the effects of individuals' decisions about location and mobility.

Source 4. Tax deductions and tax credits. The tools used by various countries to reduce the burden on the population is a clear example of the manifestation of the social function of the tax, which is understood as their manifestation as an element of the unified social policy of the state in the form of tools for tax regulation of individual groups of the population (identified by material, socio-cultural, historical and geographical criteria); social institutions; business, which is an integral part of the social system of the state.

A review of the foreign practice of using tax deductions allowed us to draw a number of conclusions.

Firstly, in many developed countries of the world there is a non-taxable minimum of income, sometimes referred to as a tax deduction or non-refundable loan (China, Australia, Great Britain, Belgium, Finland, Austria, France, Germany). Most often, the minimum non-taxable amount of tax is correlated with the minimum subsistence minimum. In the UK, wages of about 9,000 pounds per year are not subject to income tax. In France, the income of a citizen in the amount of 5,875 euros per year (the income of a married couple in the amount of 11,750 euros) is exempt from income tax. In Finland, the annual income of a citizen within 10,000 euros is not subject to taxation, and in Spain – within 22,000 euros [24]. In the United States, individual tax benefits are deducted from the amount of a citizen's net income, primarily the non–taxable minimum income: from $ 3,000 for married people filing separately, and up to $15,650 for married people filing jointly. In addition, there is a standard deduction, which is differentiated by different types of payers: for singles – $ 4150; for heads of families with dependents – $ 6050; for a married couple – $ 6150; elderly people, disabled people are entitled to an additional tax deduction from $ 800 to $ 2000 [25].

Secondly, the items of expenditure for the group of social deductions are mostly identical, they include expenses for education, treatment, housing, charity, etc. At the same time, deductions are often divided into refundable and non-refundable. The first ones assume the possibility of receiving them at any time. The latter can be received by the taxpayer only before the actual payment of the amounts of tax liabilities. It is worth noting separately the fact that, for example, in the USA and the UK, the amount of deductions and the non-taxable minimum inversely depends on the amount of income of an individual. According to the author, this condition makes it possible to implement the principle of fairness in income taxation to a greater extent.

Thirdly, the level of establishment and provision of tax deductions differs. For example, in Canada there are federal non-refundable tax credits and provincial and territorial credits specific to the province in which the individual resides. The use of this approach is promising, since it allows us to better take into account, on the one hand, the interests of local social policy, the specifics of the level and quality of life, on the other, the financial capabilities of the budgets of the territory and municipalities.

There is an interesting foreign practice in the administration of individual income tax deductions in order to reduce abuse by taxpayers. For example, the legislation of Mexico assumes that an individual can claim a tax deduction only if he paid expenses in a non-cash way. Cash payment does not imply receiving tax deductions.

Another, no less interesting example of the implementation of the social function of taxes is presented in Canada. The legislation of this country assumes that if an individual has volunteered in fire and search and rescue operations for at least 200 hours a year, then he can receive a federal tax deduction in the amount of 3,000 Canadian dollars to his taxable income. Additionally, a number of provinces (Quebec, Nova Scotia, Newfoundland and Labrador) have established local tax deductions for volunteers. Thus, the presented tax instrument stimulates volunteer activity and is an element of the country's social policy.

Source 5. Inheritance and gift taxes, wealth and luxury. Extensive literature, both empirically and theoretically, shows that the transfer of physical and human capital from parents to children is a very important factor determining the welfare of households in the economy. Traditionally, inheritance tax is recognized as one of the elements of the fiscal redistributive system, since its justification for its expediency is reduced to the fact that inheritance is property not acquired by labor, "having the character of something undeserved and accidental", and therefore it is subject to taxation [26]. As a rule, inheritance taxes simplify the administration of income and property taxes and provide additional revenue to the budget. According to OECD statistics for 2019, the share of inheritance and gift taxes in budget tax revenues in Korea was 1.6%, Belgium – 1.5%, France – 1.4%, Finland, Great Britain, Ireland – 0.7%.

However, the practice of its application is ambiguous. Many states do not establish it in their tax system, assuming that inheritance tax negatively affects capital outflow and generates a huge number of evasion schemes. A number of foreign practices have an identical tendency with Russia to abolish inheritance and gift taxes (Canada – abolished in 1972, Australia – abolished since 1990, Austria – abolished in 2008, New Zealand – abolished in 1992, India – abolished in 1986). For example, in Sweden, inheritance tax was first abolished for spouses from January 1, 2004, and then completely from January 1, 2005. In the early 2000s, an inheritance worth more than 70,000 Swedish kronor (approximately 11,000 US dollars) it was taxed at a progressive tax rate from 10% to 30%.

Another differentiating tool is the various options for wealth and luxury taxes. A striking example of such taxes are "lump-sum" payments. For example, a lump-sum tax currently exists in Switzerland. In fact, in the country it performs the function of collecting for obtaining a residence permit for foreigners, and also when paying it, an individual is entitled to the conditions of taxation of Swiss residents. For non-residents of Switzerland, an additional reservation applies: if a foreign person permanently resides in the territory of this state for more than 3 months, he is automatically obliged to pay taxes, regardless of whether he has an official place of work or not. If a non-resident is not an employee, but carries out entrepreneurial activity, the aforementioned three-month period for him is reduced to 30 days.

In this situation, the tax can hardly be called income based on the purposes of its collection and purpose. Rather, it is a luxury tax. According to official data, at the beginning of 2017, 5,046 foreigners pay a lump-sum tax in Switzerland with a total amount of about 48.5 billion rubles (about 9.6 million rubles per taxpayer) [27]. Thus, a lump–sum tax in Switzerland is an element of protecting the national economy.

A completely opposite mechanism of the lump-sum tax operates in Italy, where it performs the function of attracting wealthy foreigners for business development. In fact, such citizens can move to Italy for permanent residence, while paying a lump-sum tax of 100 thousand euros per year on income earned abroad (to this amount should be added another 25 thousand euros for each family member who is dependent on the taxpayer). In this way, Italy is trying to attract wealthy entrepreneurs and their family members, becoming an important competitor for countries where the accord type of taxation has been in effect for a long time, such as Switzerland or the United Kingdom.

In some provinces of Canada, legislation allows the use of lump-sum taxes. For example, in the province of Newfoundland, there is a local tax in some municipalities. Regulations allow for the possibility of a kind of payment in the municipality from residents over the age of 18 who either live permanently on its territory or temporarily (at least 3 months during one fiscal year), but are not property tax payers within this municipality. This is a kind of way to encourage citizens who do not own property in the territory, but actually use the services of the municipality, to participate in the formation of municipal income. This is of particular relevance for the northern regions, where a significant part of the population does not live all year, but only for a few months, for example, working on a shift basis [23].

Another example of a fixed tax is Japan, a country with a huge overpopulation, whose legislation obliges all citizens living in cities to pay such a lump-sum payment. At the same time, the amount of tax is directly proportional to the population of the city.

Conclusions and suggestions

Today, Russia is characterized by an uneven distribution of the tax burden between population groups by income levels, which significantly violates the implementation of the principle of fairness in the taxation of individuals. A review of foreign experience in differentiating the tax burden allowed us to identify a number of priority areas, the implementation of which in domestic practice will improve the national tax policy.

1. Diversification of fiscal units is the basis of the income tax system of many developed countries of the world. The high regulatory potential of diversification of fiscal units is manifested in solving the problem of social justice of the system of individual approach taxation, since the division of taxpayers into groups distributes the tax burden more evenly to all family members, takes into account their functional role, social status, the presence of dependents and a number of other important factors. At the same time, it is important to take into account that the rationality of family taxation has always been determined by scientists based on the cooperative nature of family behavior, in which decisions on income distribution are made jointly. However, there are a number of studies that prove the opposite. Thus, according to econometric estimates by Bock and Flynn, about a quarter of households behave uncooperatively [28]. Similarly, Z. Gia concludes that more than half of households behave in accordance with a non-cooperative model of family decision-making [29]. It is no coincidence that several countries, such as Austria, Denmark, Italy and Sweden, have recently switched to an individual as a unit of account, abandoning traditional family taxation. In most of the countries where family taxation arose in the 50s of the last century, dramatic changes in the size and composition of families took place [30]. This leads to a widespread transition to taxation of one individual.

In connection with the above, it seems impractical to switch to a full transition to family taxation, but nevertheless it seems effective to switch to the "family" provision of tax deductions according to the following scheme (Figure 4).

Source: compiled by the author himself.

Figure 4. Information flows for the purposes of obtaining tax deductions

A new approach to the provision of socially directed personal income tax deductions based on the family status of the taxpayer, its implementation is possible only with a modified approach to the control of their provision.

2. The review of the characteristics of inheritance and gift taxation is justified in modern economic conditions, the expediency of returning to the inheritance and gift tax, which was in effect in Russia until 2006. The development of interstate cooperation, the exchange of information in the tax sphere, the digitalization of tax control are largely able to solve the issues of tax evasion and capital outflow. At the same time, it is necessary to establish relatively low tax rates (within 10%), non-taxable amounts in the event of a taxable object between close relatives, this will increase the controllability of the entire taxation system of individuals, implement the principle of fair taxation in practice and will not significantly affect capital outflow.

3. Taking into account the best practices in the administration of income and property taxes, it is advisable to use a differentiated approach based on the following criteria:

1) calculation of tax liabilities (for property taxes – only tax authority, for income taxes – tax agent, tax authority, taxpayer);

2) the source of information on tax obligations (for property taxes – data of state registrars of property objects, for income taxes – data of the taxpayer, tax agent and other participants in tax legal relations);

3) the moment of granting tax benefits (for property taxes – before tax, for income taxes – during tax payment or after it);

4) frequency of payment of taxes (for property taxes – at a time, for income taxes – as income is received, one-time at the end of the tax period);

5) concealment of the object of taxation (for property taxes – extremely rare due to its physical form and mandatory registration, for income taxes – possibly as a result of direct concealment (shadow income), retraining of income and other methods).

References

1. Laperdin, V.B. (2020). Property stratification and social differentiation of collective farmers of the West Siberian Territory in the 1930s. Historical Courier, 3(11), 198-211.

2. Shkaratan, O.I., & Tikhonova, N.E. (1996). Employment in Russia: social stratification in the labor market. World of Russia. Sociology. Ethnology, 5, 1, 94-153.

3. Khachaturova, E.E., & Khutinaeva, E.B. (2021). Stratification and social stratification of society in Russia. Humanitarian and socio-economic sciences, 3(118), 51-53.

4. Alekseev, L.V., & Egorin, N.O. (2023). Actual directions of increasing the income of the population and reducing social stratification. Waste and resources, 10, 1.

5. Solovieva, V.A. (2014). Taxation and the growth of social stratification in modern Russia. Intellectual potential of the XXI century: stages of knowledge, 23, 172-175.

6. Pugachev, A.A. (2022). On the impact of personal income tax on social and territorial stratification in Russia. Finance, 1, 26-31.

7. Pugachev, A.A. (2023). The relationship of taxation with regional and social differentiation in Russia: an approach to assessment based on tax indicators. Problems of territory development, 27, 1, 76-91.

8. Zvereva, T.V. (2018). Evaluation of the proposed model of income taxation in the Russian Federation. Innovative development of the economy, 4(46), 182-187.

9. Panskov, V.G. (2017). Progressive or proportional taxation: which is fairer and more efficient? Economy. Taxes. Right, 10, 2, 105-112.

10. Middle class in Russia. Retrieved from https://journal.tinkoff.ru/middle-class/

11. In Russia, 11.5% of families can be classified as middle class. Retrieved from https://riarating.ru/regions/20220725/630226163.html

12. Kapelyushnikov, R.I. (2019). Economic inequality-a universal evil? Issues of Economics, 4, 91-106.

13. Official website of Rosstat. Access mode: https://rosstat.gov.ru/folder/13723 (date of access: 08/12/2023).

14. Bessonova, E., & Tsvetkova, A. (2022). Analytical note of the Central Bank of the Russian Federation "Finance of Russian households in 2022". Retrieved from https://www.cbr.ru/Content/Document/File/146276/analytic_note_20230419_dip.pdf?utm_source=Rambler&utm_medium=finance&utm_campaign=transition

15. Official website of the Federal Tax Service of Russia. Access mode: https://www.nalog.gov.ru/rn77/related_activities/statistics_and_analytics/forms/ (date of access: 08/13/2023).

16. Official website of the Central Bank of the Russian Federation. Retrieved from https://cbr.ru/Content/Document/File/145947/presentation_31-03-2023.pdf

17. Kapelyushnikov, R.I. (2020). T. Piketty's team on inequality in Russia: a collection of statistical artifacts. Questions of Economics, 4, 67-106.

18. Bargain, O., & K. Orsini. (2006). In-Work Policies in Europe: Killing Two Birds with One Stone. Labor Economics, 136), 667–693.

19. Avram, S. (2018). Who Benefits from the ‘Hidden Welfare State’? the Distributional Effects of Personal Income Tax Expenditure in Six Countries. Journal of European Social Policy, 28(3), 271–293. doi:10.1177/0958928717735061

20. Like in Germany. [electronic resource]. Retrieved from https://www.howtogermany.com/pages/germantaxes.html

21. Zotikov, N.Z. (2020). Features of the taxation of individuals in Germany. Bulletin of the Eurasian Science, 12, 4, 40.

22. Young, C., & Varner, C. (2011). Millionaire migration and state taxation of top incomes: evidence from a natural experiment. Natl. Tax J., 64(2), 255-284.

23. Lykova, L.N., & Bukin, I.S. (2015). Tax systems of foreign countries: a textbook for undergraduate and graduate studies. Moscow: Yurayt Publishing House, 429.

24. Dzhebko, V.I. (2014). On the issue of establishing a non-taxable tax minimum in the Russian Federation. Actual problems of Russian law and legislation: collection of materials of the VII All-Russian scientific and practical conference of students, graduate students, young scientists (March 27, 2014). Krasnoyarsk: NOU VPO SIBUP, 6.

25. Taxes and taxation. US income tax. Retrieved from http://vnaloge.ru/podohodnij-nalog-usa/

26. Musgrave, R.A., & Musgrave, P.B. (2009). Public finance: theory and practice. Moscow, Business Atlas.

27. Official website of the Swiss Department of Finance. Retrieved from https://www.efd.admin.ch/efd/en/home/themen/steuern/steuern-national/lump-sum-taxation/fb-besteuerung_nach_aufwand.html

28. Del Boca, Flinn (2012). Endogenous household interaction. J. Economet, 166(1), 49-65. Retrieved from https://doi.org/10.1016/j.jeconom.2011.06.005

29. Jia, Z. (2005). Labor supply decisions of retiring couples and heterogeneity in household decision-making structure. Rev. Eco. Household, 3 (2), 215-233. Retrieved from https://doi.org/10.1007/s11150-005-0711-3

30. Boskin, M., & Sheshinski, E. (1983). Optimal tax treatment of the family: married couples. J. Public Econ., 20, 281.

Peer Review

Peer reviewers' evaluations remain confidential and are not disclosed to the public. Only external reviews, authorized for publication by the article's author(s), are made public. Typically, these final reviews are conducted after the manuscript's revision. Adhering to our double-blind review policy, the reviewer's identity is kept confidential.

The list of publisher reviewers can be found here.

The subject of the study. The subject of the study is the relations arising in the process of taxation of income of individuals. The research methodology used by the author is based on the following methods of scientific cognition: comparison, analysis, synthesis of theoretical material. Relevance. The topic proposed by the author seems to be very relevant. First of all, this is due to the fact that the personal income tax is the main source of regional budgets and the behavioral model of taxpayers and the amount of tax revenues depend on the vector of orientation of changes in legislation regarding the taxation of this tax. Scientific novelty. The scientific component of the study consists in analyzing the legislation of foreign countries regarding the taxation of personal income and the possibility of applying the studied norms (best practices) in our country. Bibliography. The analysis of the bibliography allows us to conclude that the author has studied scientific works on the subject under study. There are foreign sources, legislation of foreign countries, in general, the list of references consists of 30 titles. Appeal to opponents. The article contains targeted links to research, and their critical assessment is given. Style, structure, content. The style of the article is scientific and meets the requirements of the journal. The article highlights the structural sections according to the semantic principle. The author analyzes the total tax burden on the population at a good theoretical level, paying special attention to its structure. The necessity of transformation of existing approaches to taxation of income of individuals is substantiated. The author's analysis of the best foreign experience in differentiating the tax burden is of interest. The author's proposal on the refund of inheritance and gift tax is controversial. The author's conclusions are justified. The research tasks have been completed. As comments and recommendations, I would like to note the following. The article should formulate the elements of scientific novelty more specifically. What is the difference from similar studies (the issues of studying the foreign experience of income taxation of individuals have been repeatedly raised in research, including on the pages of the journal "Taxes and Taxation")? What is the author's new contribution (compared to numerous other researchers who recommend switching to family/partially family taxation)? How can the results obtained in the article be used? It would be necessary to disclose in more detail the approach proposed by the author to the provision of socially oriented personal income tax deductions (Figure 4). Conclusions, the interest of the readership. The presented material may open up new perspectives for further research. It will be of interest to those who study the problems of taxation of personal income. The article partially meets the requirements of the journal "Theoretical and Applied Economics" for this kind of work, and is recommended for publication taking into account the comments of the reviewer.

Link to this article

You can simply select and copy link from below text field.

|

|