|

DOI: 10.7256/2409-7802.2016.2.16993

Received:

16-11-2015

Published:

23-06-2016

Abstract:

The subject of the research is the tax burden of agricultural producers in the Russian Federation regions. As a result of the import substitution strategy, a Russian agricultural procuder is viewed as the provider of the basic products to the population. Based on different references, today Russian agricultural producers can provide 40% - 65% of the country's level of consumption. In order to avoid possible deficit, it is necessary to expand capacities and volumes of agricultural producers. The level of tax impact plays an important role in the development of this sphere. The purpose of the present resaerch is to define the level of the tax burden for each Russian Federation constituents and define regions with the greater tax burden. In the coruse of the research the authors have applied the methods of statistical and historical analysis of data presented on the website of the Federal Tax Service of the Russian Federation and Federal State Statistics Service of the Russian Federation. The novelty of the research is caused by the fact that the authors divide 83 Russian Federation constituents into 7 groups depending on their level of tax burden. As a result of the research the authors make a conclusion that the greater part of the Russian Federation constituents lie the average level of tax burden on agricultural producers, however, there are 10 Russian regions that suffer from increased tax burden.

Keywords:

sector, Federal Tax Service of the Russian Federation, tax rate, targeted politics, Russian Federation constituents, agricultural producers, tax, tax exemptions, variation coefficient, tax burden

This article written in Russian. You can find original text of the article here

.

После введения санкций Евросоюза в отношении Российской Федерации основное место в продовольственном обеспечении населения страны занимают собственные производители, в том числе сельскохозяйственные. На данный момент собственные силы данной отрасли способны обеспечить до 65% всего потребления страны. Для устранения возможного дефицита, некомпенсируемого внешними поступлениями, необходимо наращивание мощностей и объемов сельхозпроизводителей.

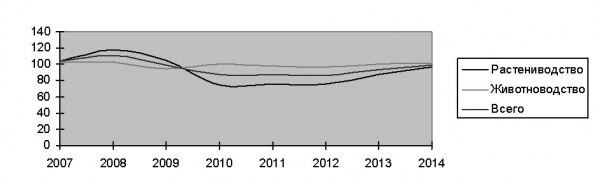

Согласно данным сайта государственной статистики РФ на данный момент индекс сельскохозяйственного производства имеет тенденцию к снижению. [1]

Рис.1. Индекс производства сельскохозяйственной продукции (%)

По данным диаграммы видно, что после существенного снижения объемов выпуска продукции в среднем на 17%- 20% к 2009 году, с 2010 началось постепенное выравнивание ситуации и приращение объемов. На 2015 год представлены плановые значения согласно ожиданиям, однако реальное значение будет выяснено только по итогам окончания текущего года. [6]

Для улучшения динамики развития сельскохозяйственной отрасли в РФ уже принят ряд мер в области налогообложения:

1) давно существующие меры по применению специальных налоговых режимов, упрощающих ведение налогового учета и снижения налоговой нагрузки на предприятия (ЕСХН – единый сельскохозяйственный налог);

2) 10% налоговая ставка по НДС при реализации определенных видов продукции;

3) установление нулевой ставки по налогу на прибыль для производителей, удовлетворяющих условиям п.2 ст. 346.2 НК РФ.

Если применение первых двух налоговых льгот достаточно отработано на законодательном уровне и реально упрощает ведение налогового учета в отрасли, то третий пункт на данный момент вызывает вопросы:

1) производители могут использовать такую ставку, если доля выручки от реализации продукции сельского хозяйства более 70%;

2) большая часть внереализационых доходов подлежит налогообложению;

3) ведение раздельного учета деятельности, облагаемой по разным ставкам;

4) субсидии, полученные предприятием, если они не связаны с деятельностью сельскохозяйственного товаропроизводителя, не попадают под льготу.

Например, полученные средства для компенсации расходов, связанных со строительством дороги и газопровода, необходимо учитывать при формировании налоговой базы, к которой применяется ставка налога на прибыль организаций в размере 20 процентов. [2] А вот если предприятием получены бюджетные средства по областной целевой программе «Развитие сельского хозяйства и регулирование рынков сельскохозяйственной продукции, сырья и продовольствия» субъекта Федерации, на развитие семейной животноводческой фермы, то они облагаются по льготной ставке, в целях возмещения затрат, совершенных в процессе ликвидации последствий ущерба. [4]

Все данные виды налоговых льгот существенно снизили налоговую нагрузку на сельскохозяйственную отрасль.

Рис.2. Налоговая нагрузка на отрасль сельского хозяйства в РФ (%)

По данным диаграммы видно, что налоговая нагрузка за 6-летний период снизилась, в цифрах на 16,85%.

Такое снижение определяется при расчете по формулам налоговой нагрузки, установленным в директивах Евросоюза: [9]

`TB=(Tf+Ti+Td)/(I-C)` (1)

TB – налоговое бремя;

Tf – сумма налогов на предприятие;

Ti – сумма налогов, удержанных с сотрудников;

Td – сумма налогов, удержанных с учредителей;

I – выручка (доход);

C – материальные затраты.

При расчете согласно методике Министерства финансов РФ, налоговое бремя определяется исходя из суммы годовых налогов по отношению к сумме общих доходов предприятия сельскохозяйственной отрасли. [9]

При подобном подходе уменьшается числитель и увеличивается знаменатель, что обеспечивает общее снижении относительного показателя бремени.

Рис.3 Налоговая нагрузка на отрасль сельского хозяйства в РФ (%) по методике Министерства финансов

Согласно рисунку 3 снижение произошло почти на 20%, при изначальном значении в 39.7%, что ниже значения, рассчитанного согласно общепринятым мировым стандартам, в 46,5%.

Налоговая нагрузка по субъектам РФ также различается, что представлено в таблице 1. Для иллюстрации выбрано 11 субъектов с наибольшими различиями в размере налоговой нагрузке за 2014 год.

Таблица 1.

Налоговая нагрузка по субъектам РФ, 2014 г. (%)

|

№п/п

|

Субъект РФ

|

Налоговая нагрузка

|

|

1

|

Нижегородская область

|

37,9%

|

|

2

|

Московская область

|

41,2%

|

|

3

|

Краснодарский край

|

46,5%

|

|

4

|

Ямало-Ненецкий автономный округ

|

24,3%

|

|

5

|

Республика Коми

|

26,5%

|

|

6

|

Тверская область

|

36,5%

|

|

7

|

Республика Карелия

|

22,89%

|

|

8

|

Ханты-Мансийский округ

|

30,02%

|

|

9

|

Саратовская область

|

37,5%

|

|

10

|

Республика Бурятия

|

25,3%

|

|

11

|

Забайкальский край

|

27,8%

|

Для классификации всех исследуемых субъектов РФ по размеру налоговой нагрузки была произведена группировка, т.е. выявлены группы с наибольшими, средними и низкими значениями. Оптимальное количество групп можно определить согласно формуле Стерджесса [5]:

`nopt=1+3.322LgN`

n opt– оптимальное число интервалов (групп);

N – количество анализируемых данных.

Отсюда оптимальное число групп для 83 субъектов равно:

`nopt=1+3.322Lg83=7,35`

Получается, используя правила округления – 7.

Ширина каждого интервала X определяется по формуле:

`X=(V)/(nopt)`

V - размах вариации.

`Vi=(sigmai)/(TBi)`

TBi - среднее значение значений налоговой нагрузки,

σi – стандартное отклонение значений налоговой нагрузки,

Vi – коэффициент вариации по субъектам РФ.

`sigmai=sqrt((sum_(n=1)^oo(TB-TBi))/(n))`

TB - анализируемый показатель по конкретному субъекту,

TBi - среднее значение показателя,

n – количество значений в анализируемой совокупности данных.

В результате выделены следующие группы субъектов РФ по уровню налогового бремени на сельскохозяйственную отрасль.

Таблица2.

Группы субъектов РФ по уровню налоговой нагрузки, 2014г.

|

№п/п

|

Группа

|

Уровень нагрузки (%)

|

Субъекты

|

|

1

|

Минимальное налоговое влияние

|

До 23%

|

Республика Карелия, республика Тыва, Архангельская область, Иркутская область, республика Калмыкия

|

|

2

|

Сниженное налоговое влияние

|

23,1% - 27,4%

|

Ямало-Ненецкий автономный округ, Республика Коми, Республика Бурятия , Амурская область, республика Марий-Эл, Еврейская автономная область, республика Адыгея,

|

|

3

|

Умеренное налоговое влияние

|

27,5% -31,9%

|

Забайкальский край, Ханты-мансийский округ, Хабаровский край, Волгоградская область, Брянская область, Смоленская область,

|

|

4

|

Средний уровень

|

32% - 36,3%

|

Иркутская область, Алтайский край, Тюменская область, Калужская область, Пермский край, Приморский край,

|

|

5

|

Повышенный

|

36,4% -40.7%

|

Тверская область, Нижегородская область, Тверская область, Саратовская область, Ростовская область, Курская область, Ярославская область, Кемеровская область

|

|

6

|

Максимальный уровень

|

40,8% - 44,1%

|

Московская область, республика Карачаево-Черкесская, республика Саха.

|

|

7

|

Запредельный уровень

|

Свыше 44,2%

|

Краснодарский край, Воронежская область

|

В таблице приведены примеры субъектов, имеющие определенный уровень налоговой нагрузки. Большая часть субъектов имеет средний уровень налоговой нагрузки (группы 2-4), однако около 10 субъектов РФ, в основном в центральной части РФ имеют повышенное, а в некоторых регионах и запредельное налоговое бремя. В связи с этим финансовые органы РФ в первую очередь должны обратить внимание на субъекты РФ, относящиеся к группам 5-7. Субъекты РФ, входящие в 1 группу налоговой нагрузки могут продолжать развитие сельскохозяйственной отрасли в рамках действующей налоговой политики.

В целом же, государственным органам стоит проводить точечную политику в области налогообложения в зависимости от специфики деятельности сельхозпроизводителей в разных регионах.

Стоит отметить, что в РФ в последние годы (3-4 года) наблюдается положительная тенденция снижения налоговой нагрузки. В условиях обострившейся внешнеэкономической ситуации, в том числе продовольственной, это является стимулом для увеличения объемов производства.

В таких условиях с учетом снижения доли иностранного инвестирования сельскохозяйственных производителей проведение разумной налоговой политики является приоритетным направлением.

Приоритетными направлениями налоговой политики на 2015 и плановые 2016 -2017 гг. уже установлено, что ставка в 0% по налогу на прибыль пока не будет отменена, хотя изначально планировалось ее действие только до 2015 года.

Так же планируется расширение налоговых льгот по НДС, увеличению субсидирования.

Аналогично налоговым льготам развитых стран при текущей экономической ситуации было бы допустимым введение льготного срока по отсутствию налогообложения для всех сельхозпроизводителей; применение налоговой ставки в 0% для всех видов доходов, грантов и субсидий; понижение ставок по ЕСХН, увеличению количества признаваемых расходов и отмене нормирования расходов, упрощение процедуры налогового учета лизинговых платежей при учете имущества на балансе лизингополучателя (сельскохозяйственной организации).

References

1. Rossiiskaya Federatsiya. Zakony. Nalogovyi Kodeks Rossiiskoi Federatsii [Tekst]: [Prinyat Gosudarstvennoi Dumoi 16 iyulya 1998 goda]-v redaktsii ot 24 noyabrya 2014 g. N 366-FZ

2. Pis'mo Minfina Rossii ot 23 noyabrya 2012 g. № 03-03-06/1/611

3. Pis'mo Minfina Rossii ot 15 oktyabrya 2012 g. № 03-03-06/1/550

4. Pis'mo Minfina Rossii ot 27 maya 2011 g. № 03-03-06/1/313

5. Balinova V.S. Statistika v voprosakh i otvetakh: Ucheb. posobie. – M.: TK.Velbi, Izd-vo Prospekt, 2004.-344s.

6. Shul'ga I.N. Nulevaya stavka naloga na pribyl' dlya sel'khozproizvoditelei // Uchet v sel'skom khozyaistve.-№3. – 2014.

7. Byulleteni o sostoyanii sel'skogo khozyaistva-URL: http://www.gks.ru (data obrashcheniya: 08.11.2015).

8. Ofitsial'nyi sait Federal'noi nalogovoi sluzhby-URL: http://www.nalog.ru (data obrashcheniya: 10.11.2015).

9. Rossiya – metody rascheta nalogovoi nagruzki. – Elektronnyi resurs. – URL: http://wonderties.com/rossiya-metody-rasheta-nalogovojnagr/ (data obrashcheniya: 10.11.2015)

10. Giraev V.K. Metodologiya stimuliruyushchego upravleniya nalogooblozheniem khozyaistvuyushchikh sub''ektov // Nalogi i nalogooblozhenie. - 2014. - 11. - C. 970 - 986. DOI: 10.7256/1812-8688.2014.11.13668.

11. Nikitina A.Kh. Nalogovye l'goty dlya rossiiskikh

sel'khoztovaroproizvoditelei // Nalogi i nalogooblozhenie. - 2013. - 8. - C. 566 - 571. DOI: 10.7256/1812-8688.2013.8.9406.

12. I.V. Orobinskaya Evolyutsiya stanovleniya i razvitiya sistemy

nalogooblozheniya sel'skokhozyaistvennykh

predpriyatii v Rossii i zarubezhnykh stranakh // Nalogi i nalogooblozhenie. - 2012. - 8. - C. 54 - 63.

13. Orobinskaya I.V. Osnovy optimizatsii nalogooblozheniya sel'skokhozyaistvennykh tovaroproizvoditelei v Rossii // Nalogi i nalogooblozhenie. - 2013. - 11. - C. 807 - 817. DOI: 10.7256/1812-8688.2013.11.9584.

Link to this article

You can simply select and copy link from below text field.

|