|

DOI: 10.7256/2409-7802.2015.1.14531

Received:

21-02-2015

Published:

23-02-2015

Abstract:

Abstract. The article considers tax revenues as an element of the tax capacity architectonic. The author proposes a 3-way approach to the category of "tax revenues": economic, financial and legal. The work sets out classification criteria for the investigated category as follows: form of appearance: explicit or implicit; type of budget receipts: credited or shortfall receipts; business entity’s territorial level: State, Federal District, region, municipalities; budget level: federal budget, regional budget, regional consolidated budget, local budget. The paper applies general research methods such as analysis, synthesis, induction, deduction, abstraction, formalization, and hierarchical classification method. Special contribution of the author in the area of the tax potential architectonic consists in the fact that the research lays grounds for the category "tax revenues", defines the criteria of its classification as well as establishes conditions enabling the transformation of the tax revenues into tax potential. The material presented in the study could open up new prospects for further research. It will be of interest to those who deal with tax administration

Keywords:

territory, potential tax revenues, tax revenues, revenue capacity, classification, tax potential of the region, tax , taxes, budget revenues, tax administration

This article written in Russian. You can find original text of the article here

.

Налоговый потенциал территории, на наш взгляд, представляет собой динамично развивающуюся совокупность налогооблагаемых ресурсов данной территории, которая при определенных условиях трансформируется в налоговые доходы бюджетной системы.

При этом архитектоника налогового потенциала представляет собой иерархичную систему взаимосвязанных и взаимообсуловленных элементов, из которых состоит налоговый потенциал. Одним из таких элементов является показатель «налоговые доходы».

Доходы выступают неотъемлемой частью любого государства, а необходимость их существования определяется для того, чтобы «образовывать силу и мощь, необходимую для власти Государя, покрывать затраты, вызванные осуществлением защитных функций, а также важных функций, выполняемых должностными лицами» [1]. Денежный доход- или поступления- от богатства, по мнению А. Маршалла, «представляет собой мерило процветания страны» [2].

Вопрос о структуре государственных доходов и сущности налоговых доходов как их части поднимался в работах отечественных ученых Э. Н. Берендтса, С. И. Иловайского, А. В. Лебедева, И. Х. Озерова, И. И. Янжула и др.

Так, Берендтс Э.Н. относил налоговые доходы к части государственных доходов, «носящих обязательный характер и состоящих из совокупности прямых и косвенных налогов, источниками которых служат частные доходы и имущество» [3].

Иловайский С.И. отмечал, что одним из источников получения государственных доходов является «взимание известной доли из доходов частных хозяйств. Эти производные доходы государственного хозяйства или налоги. Адольф Вагнер называет их публично-хозяйственными доходами, а Умпфенбах и Лебедев - органическими доходами, основываясь на том, что право взимать налоги зиждется на органической связи между публичным и частными хозяйствами» [4].

Янжул И.И. , рассматривая структуру доходов государства, писал, что они состоят из «частноправовых» и «общественно-правовых». К последним, «наиболее важным и существенным, фундаментальном источнике доходов, на котором покоится государственное хозяйство», он относил налоги [5].

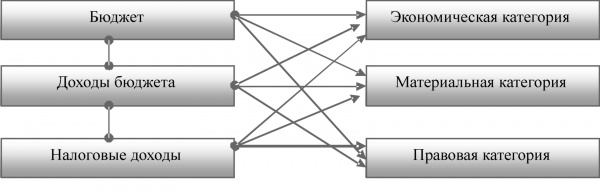

Современные исследователи отмечают, что налоговые доходы –достаточно сложная категория. Как структурный элемент доходной части бюджета налоговые доходы, на наш взгляд, необходимо рассматривать с трех точек зрения: материальной, экономической и правовой.

Рисунок 1. Подходы к определению категории «налоговые доходы».

Источник: разработано автором

В материальном аспекте налоговые доходы представляют собой часть централизованного денежного фонда государственного или административно-территориального образования, формируемого за счет обязательных платежей, взимаемых с физических и юридических лиц в соответствии с законодательством о налогах и сборах, необходимого для осуществления задач и функций соответствующих органов государственной власти или местного самоуправления.

Через регулирующую и контрольную функции реализуется сущность налоговых доходов как экономической категории. В экономическом аспекте налоговые доходы — это совокупность экономических (денежных) отношений, которые возникают между участниками налоговых правоотношений в связи с образованием части централизованных денежных фондов, формируемых за счет обязательных платежей, взимаемых с физических и юридических лиц в соответствии с законодательством о налогах и сборах.

В правовом смысле налоговые доходы –это закрепленные в законах (решениях) о бюджете показатели налоговых поступлений.

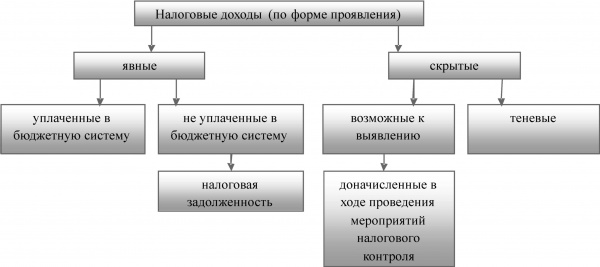

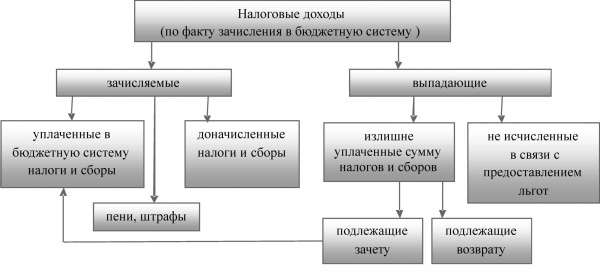

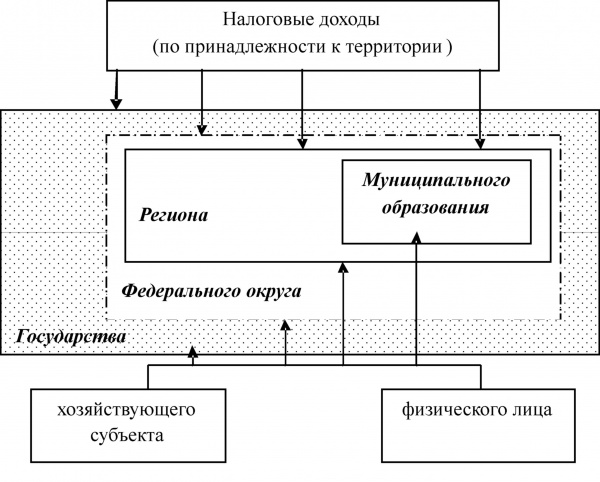

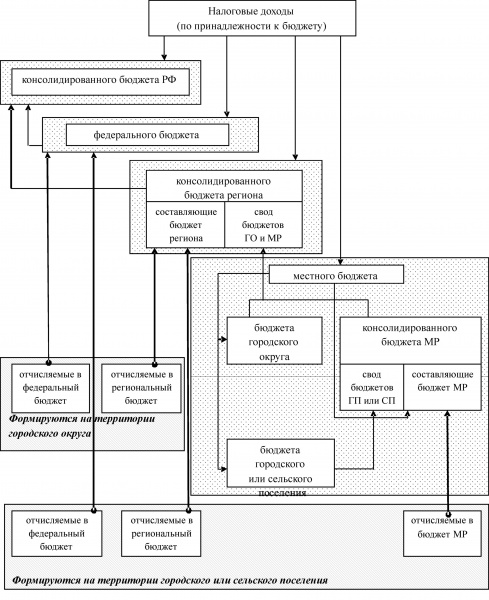

В зависимости от критерия классификации налоговые доходы можно разделить по форме проявления: явные, скрытые (рис. 2); по факту зачисления в бюджетную систему: зачисляемые, выпадающие (рис. 3); по принадлежности хозяйствующего субъекта к территории: государства, федерального округа, региона, муниципального образования (рис. 4); по принадлежности к бюджету: федерального, регионального, консолидированного бюджета региона, местного бюджета (рис. 5).

Рисунок 2. Налоговые доходы по форме проявления.

Источник: разработано автором

К явным налоговым доходам относятся налоги и сборы, исчисленные хозяйствующими субъектами. Данные платежи могут быть уплачены в бюджетную систему или в силу различных причин составлять налоговую задолженность.

Величина налоговой задолженности оказывает непосредственное влияние на налоговые доходы. При чем, данный показатель непосредственно демонстрирует, описанный нами процесс трансформации, т.к. величина задолженности при проведении таких мероприятий как реструктуризация, принудительное взыскание и др. может привести к увеличению фактических налоговых доходов.

Скрытые налоговые доходы следует рассматривать с точки зрения возможности их выявления. Эти возможности характеризуются результативностью мероприятий налогового контроля и отражаются в статистической отчетности налоговых органов по форме 2-НК «Отчет о результатах контрольной работы налоговых органов».

Следует отметить, что в последнее время охват налогоплательщиков выездными налоговыми проверками существенно снизился (в целом по России в 2014 г. на 44% к 2013 г.), тогда как доначисления на 1 проверку увеличились (с 6797,4 тыс. руб. в 2013 г. до 8942,7 тыс. руб. в 2014). Приведенные данные свидетельствуют о скрытых резервах по выявлению латентной налоговой базы (ресурсы, умышленно выведенные налогоплательщиком из–под налогообложения, до момента выявления данного факта налоговыми органами не формируют налоговую базу, хотя могли бы в условиях действующего законодательства,). Отсутствие возможности у администраций выявления таких видов доходов, а также иных, формируемых в «теневом» секторе экономики, влияет на мобилизацию налоговых доходов в бюджетную систему.

Рисунок 3. Налоговые доходы по факту зачисления в бюджетную систему.

Источник: разработано автором

Зачисляемые налоговые доходы– это исчисленные и уплаченные суммы налогов и сборов в бюджетную систему, а также доначисленные платежи по результатам контрольных мероприятий (сумма недоимки, пени, штрафы).

Выпадающие налоговые доходы представляют собой излишне уплаченные платежи и платежи, не исчисленные в связи с предоставлением льгот. Согласно ст. 218 БК РФ процесс возврата первых является исполнением бюджета по доходам. Вторые составляют возможные налоговые поступления от неиспользуемой налоговой базы, которая при изменении налогового законодательства трансформируется в зачисляемые налоговые доходы.

Рисунок 4. Налоговые доходы по принадлежности к территории.

Источник: разработано автором

Налоговые доходы определенной территории формируются в процессе осуществления налогоплательщиками финансово-хозяйственной деятельности. Согласно административно-территориальному делению к таким территориям относятся: муниципальное образование (муниципальный район, городское и сельское поселение, городской округ), регион. Рассматривая федеральный округ как некую территорию, ограниченную регионами входящими в его состав, можно утверждать, что существуют также и налоговые доходы федеральных округов.

Рисунок 5. Налоговые доходы по принадлежности к бюджету.

Источник: разработано автором

Согласно ст. 41 БК РФ налоговые доходы–это доходы от предусмотренных законодательством Российской Федерации о налогах и сборах федеральных налогов и сборов, в том числе от налогов, предусмотренных специальными налоговыми режимами, региональных и местных налогов, а также пеней и штрафов по ним [6]. В соответствии с данной дефиницией следует различать доходы федеральных, региональных, местных, а также консолидированных бюджетов.

В научной литературе дискуссионным остается вопрос о необходимости включения в структуру налогового потенциала величины штрафов и пени, полученных в бюджетную систему от нарушения законодательства о налогах и сборах. На наш взгляд, включение данных сумм неправомерно, т.к. согласно концепции исследования, данные платежи не являются налогооблагаемыми ресурсами и не участвуют в формировании налогового потенциала, однако, являются налоговыми доходами согласно бюджетному законодательству.

Таким образом, представленные в статье классификации категории «налоговые доходы» позволяют выделить следующие условия при которых показатель налоговый потенциал будет равен показателю налоговые доходы:

– отсутствие налоговой задолженности;

– отсутствие состава налогового правонарушения;

– отсутствие «теневого сектора экономики» ;

– возможность увеличения фактических налоговых доходов за счет использования выпадающих доходов при изменении налогового законодательства.

Идентификация одного из приведенных выше условий позволяет утверждать, что фактический налоговый потенциал территории (определяемый как объем налоговых доходов, поступивший в бюджетную систему) не был полностью реализован.

References

1. Fiziokraty: Fransua Kene, P'er Dyupon de Nemur, Zhak Tyurgo. Izbrannye ekonomicheskie proizvedeniya. M.: Eksmo, 2008. 1200 s.

2. Marshall A. Osnovy ekonomicheskoi nauki/V.I. Bomkin (per. s angl.) Dzh. M. Keins (predisl.) //M.: Eksmo. – 2007. S. 265-310

3. Berendts Eduard Nikolaevich Russkoe finansovoe pravo. – 1914. – 454 s.

4. Yanzhul I.I. Osnovnye nachala finansovoi nauki: Uchenie o gosudarstvennykh dokhodakh. – M.: «Statut», 2002. – 555 s.

5. Uchebnik finansovogo prava. Ilovaiskii S.I.-Odessa,-1904 g. (Glava 9)

6. Byudzhetnyi kodeks Rossiiskoi Federatsii [Elektronnyi resurs]–Rezhim dostupa: http://www.consultant.ru/popular/budget/56_8.html#p1127 (data obrashcheniya 21.01.2015)

7. Shemyakina M.S. Genezis kategorii «nalogovyi potentsial» // Nalogi i nalogooblozhenie. - 2013. - 9. - C. 689 - 704. DOI: 10.7256/1812-8688.2013.9.9654.

8. Aguzarova F.S. Rol' kosvennykh i pryamykh nalogov i sborov v formirovanii dokhodov byudzhetov byudzhetnoi sistemy Rossiiskoi Federatsii // Nalogi i nalogooblozhenie. - 2014. - 10. - C. 910 - 918. DOI: 10.7256/1812-8688.2014.10.13209.

9. Sugarova I.V. Nekotorye osobennosti formirovaniya dokhodnoi sostavlyayushchei federal'nogo byudzheta // Nalogi i nalogooblozhenie. - 2014. - 9. - C. 810 - 820. DOI: 10.7256/1812-8688.2014.9.13177.

Link to this article

You can simply select and copy link from below text field.

|