|

MAIN PAGE

> Back to contents

Historical informatics

Reference:

Muraveva A.

Statistical Analysis of Saint-Petersburg Exchange Rate Dynamics in Relation to the Leading European Financial Centers in 1801-1839

// Historical informatics.

2020. № 2.

P. 88-99.

DOI: 10.7256/2585-7797.2020.2.33484 URL: https://en.nbpublish.com/library_read_article.php?id=33484

Statistical Analysis of Saint-Petersburg Exchange Rate Dynamics in Relation to the Leading European Financial Centers in 1801-1839

Muraveva Anastasia

PhD Candidate, Section of Historical Informatics, History Department, Lomonosov Moscow State University

117335, Russia, Moskva, g. Moscow, ul. Vavilova 93, 8, of. Vavilova 93 kv 8

|

asia7088@yandex.ru

|

|

|

Other publications by this author

|

|

|

DOI: 10.7256/2585-7797.2020.2.33484

Received:

18-07-2020

Published:

30-07-2020

Abstract:

The article studies the monetary policy of the Russian state in the second half of the 18th - the first half of the 19th centuries, in particular, the dynamics of exchange rates. The exchange rate is actually the currency rate and demonstrates the purchasing power of a country’s money in relation to that in another country. On the basis of primary data of the Russian press, the author has collected data on quotes for the subsequent statistical analysis and used correlation matrices and regression models to identify factors that influenced the analysis as well as internal dependencies. The main research method is the statistical one accompanied by the inductive approach. The issue of the Russian exchange rate dynamics in the early 19th century has not been properly studies in historiography. The article demonstrates that exchange rates do not depend much on the volume of international trade or, more precisely, on the balance of foreign trade. Exchange rates have weak correlation with the foreign trade balance and statistically insignificant one with the balance of trade with particular countries. The explanatory power of regression models with economical characteristics being independent factors has R² not more than 20-25 %. It must be noted that no reliable dependence of exchange rates on wheat export from Russia has been found while their dependence on gold import was statistically significant as far as Amsterdam and Hamburg are concerned (at the same time the correlation of gold import with wheat export is significant and positive).

Keywords:

exchange rate, statistical model, Regression toward the mean, Correlation, Promissory note, Monetary policy, Budgetary policy, International trade, foreign exchange market, St. Petersburg exchange

This article written in Russian. You can find original text of the article here

.

Изучение финансовых аспектов внешнеэкономических связей России в первой половине XIX века включает вопросы вексельного обращения, возникшего в России в начале XVIII века в ходе развития торговых отношений с немецкими княжествами. В начале XIX века в России, как и в других странах, переводный вексель (или тратта) являлся основным расчетным средством международной торговли, определявшим, по сути, валютный курс, который понимался в XIX веке как «меновая ценность иностранных коммерческих векселей, обращающихся в данной стране и служащих орудием международного обмена, вместо денег» [1, С. 105]. В литературе есть устойчивое представление, что тратты по своей сути являются платежными обязательствами экономики одной страны по отношению к экономике другой [2, С. 4] и по определению Милля [3] показывают степень силы денег одной страны в покупке денег другой страны.

В процессе интеграции Российской империи в международную систему безналичных расчетов основная роль принадлежала Санкт-Петербургу, ставшему в XVIII веке главным вексельным рынком России. Свидетельством этого является тот факт, что котировки векселей из Санкт-Петербурга на Лондон, Амстердам, Париж и Гамбург регулярно публиковались в периодическом издании гамбургской биржи «Hamburger Borsenhalle» [4].

Цель данной статьи – построить динамику вексельных курсов на Санкт-Петербургской бирже и выявить роль факторов, влиявших на характер этой динамики в 1801 – 1839 гг. Выбор данного периода определяется тем, что он охватывает годы наполеоновских войн и последующего экономического восстановления стран – участниц военных действий. Верхняя граница периода связана с денежной реформой Е.Ф. Канкрина (1839-1843 гг).

Отметим, что в работах немецкого исследователя М. Денцеля проведена работа по систематизации данных о зарубежных котировках векселей на Санкт-Петербург [5]; [6]; в нашей же работе, наоборот, изучаются вексельные курсы из Санкт-Петербурга на ведущие европейские финансовые центры.

Аналогичная по используемой методике работа по реконструкции динамики курсов акций российских компаний на Санкт-Петербургской бирже в конце XIX – начале ХХ вв. и статистическому анализу факторов, влиявших на эту динамику, проводилась ранее Л.И. Бородкиным и А.В. Коноваловой (Дмитриевой) [7]. Однако подобных исследований динамики вексельных курсов по данным ежедневных котировок для первой половине XIX века до сих пор не проводилось. Данная работа восполняет этот пробел.

* * *

В качестве источников для построения динамических рядов вексельных курсов мы использовали материалы газеты «Московские ведомости» [8], публиковавшей биржевые прейскуранты Московской биржи, а также «Санкт-Петербургских ведомостей» [9] и «Коммерческой газеты» [9], публиковавших биржевые прейскуранты Санкт-Петербургской биржи. Более подробная характеристика этих источников дается в нашей статье «О динамике вексельных курсов на Санкт-Петербургской бирже в первой трети XIX века и факторах, влиявших на нее» [10].

Анализ материалов указанных газет позволил собрать данные по вексельным курсам из Санкт-Петербурга и Москвы в период с 1800 по 1839 гг. В этих газетах печатались ежедневные вексельные курсы на Амстердам, Лондон, Гамбург, Париж и Вену. В каждом выпуске могли быть указаны не все пять курсов. При этом в «Московских ведомостях» курсы печатались до 1824 г., после чего их публикация прекратилась. В «Санкт-Петербургских ведомостях» вексельные курсы публиковались до 1825 г. включительно, а затем, с 1826 г. они публиковались в «Коммерческой газете». До 1825 г. включительно курсы публиковались дважды в неделю (104 или 105 выпусков в год), а с 1826 г. в «Коммерческой газете» они стали появляться в трех выпусках еженедельно (156 выпусков в год).

На основании собранных данных о публикации вексельных курсов нами была составлена базовая сводная таблица Excel, представленная в виде тематического цифрового ресурса на сайте кафедры исторической информатики исторического факультета МГУ [11]. Она была разбита на листы по годам (всего 39 таблиц), строки каждой таблицы расположены в хронологическом порядке - с первого января по 31 декабря соответствующего года. Столбцы каждой таблицы содержат следующие 14 показателей: пять вексельных курсов из Санкт-Петербурга на Амстердам, Лондон, Гамбург, Париж, Вену; пять вексельных курсов из Москвы на те же города, а также курсы серебра и золота в ассигнационных копейках в Москве и Санкт-Петербурге, они нам необходим для установления серебряного курса векселей.

Пропуски в таблицах нашего цифрового ресурса означают, что в соответствующий день либо не вышел номер газеты, либо номер был опубликован, но он не содержал данных о том или ином вексельном курсе (это чаще касается курсов на Вену). Отметим, что курсы унифицированы. Если за день было опубликовано несколько значений курса, мы подсчитывали их среднее арифметическое.

В данной работе мы исследуем вексельные курсы из Санкт-Петербурга на Амстердам, Лондон, Гамбург, Париж (курсы из Москвы здесь не рассматриваются). Базовая таблица используется нами для расчетов погодовой динамики курсов, построения соответствующих графиков и их анализа при детальном рассмотрении изменения курса. Вексельный курс публиковался в ассигнационных рублях, но, учитывая нестабильность внутреннего курса ассигнаций, для дальнейшей работы мы анализируем данные о вексельных курсах, переведенные в серебряные копейки.

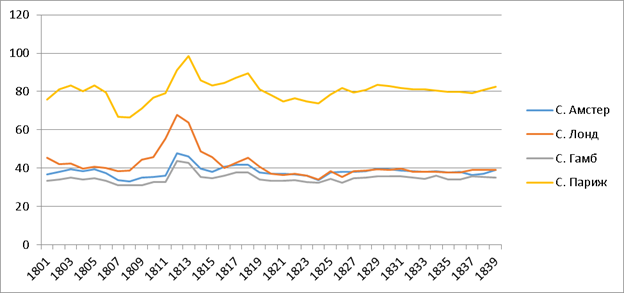

Рис. 1. Вексельные курсы на зарубежные рынки из Санкт-Петербурга в 1800-1839 гг. (в серебряных копейках).

Источник: Динамика курсов рассчитана автором на основе собранных данных по вексельному курсу, представленных на цифровом ресурсе http://www.hist.msu.ru/Departments/Inf/activity.htm и данных курса ассигнационного рубля в серебре, приведенных в статье автора [12].

Рис. 1 показывает большую волатильность вексельных курсов в первой половине рассматриваемого периода и снижение волатильности в конце его. Для лучшего понимания природы этой волатильности была изучена степень однородности курсов, подсчитаны среднеквадратические отклонения для всех курсов и коэффициенты вариации. Это позволило выявить низкую степень отклонения курсов от среднего уровня (значения коэффициентов вариации равны: для Амстердама 8%, для Гамбурга и Парижа 7% и только для Лондона 17%). Естественно предположить, что такие невысокие показатели объясняются самой природой вексельного курса, так как в первой половине XIX в. валюты имели и чисто металлический курс (или паритетный), т.е. постоянное соотношение металла между денежными единицами, и они могли заметно отклоняться от него, лишь пока переслать серебро или золото физически не становилось более выгодно.

Что касается заметных колебаний вексельных курсов первых полутора десятилетий XIX в., то их причиной являются в основном политические и военные потрясения начала века, которые затрагивали всю хозяйственную, экономическую жизнь Европы. Наполеоновские войны, с одной стороны, мешали свободному обороту товаров, но они же во многом способствовали и интеграционным процессам. Это не могло не отражаться на вексельных курсах.

Однако остается невыясненным вопрос, является ли относительная стабильность вексельных курсов во втором периоде внутренне обусловленной или она детерминировалась государственным регулированием и/или соответствующими международными соглашениями.

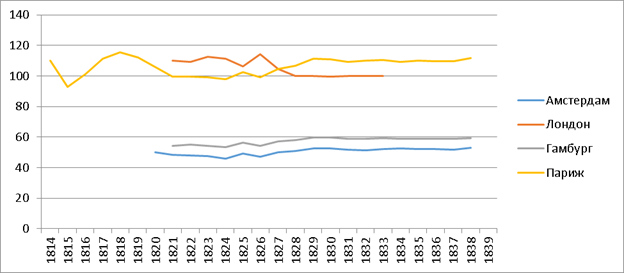

Наша рабочая гипотеза исходит из того, что вексельный курс должен быть стабилен по своей природе, и только экстраординарные события (шоки) начала XIX в. могли усилить его волатильность. Для проверки нами был проведен компаративный анализ вексельных курсов из иностранных городов на Санкт-Петербург. Мы предположили, что если бы курсы из Санкт-Петербурга подвергались в России внутренним ограничениям, они были бы достаточно стабильными, а курсы из европейских городов обладали бы более высоким уровнем волатильности; но, как мы видим из рис. 2, европейские курсы на Санкт-Петербург были даже более стабильными. Конечно, необходимо учитывать, что данные о курсах на Санкт-Петербург доступны только с 1814 г., а данные о курсах из Санкт-Петербурга на европейские города приведены на рис. 1, начиная с 1801 года, что ограничивает возможности сравнения динамики вексельных курсов, представленных на рис. 1 и 2.

Рис. 2. Вексельные курсы из зарубежных городов на Санкт-Петербург в 1814-1839 гг. (в серебряных копейках).

Источник: Российский рубль в системе европейских валют: вексельные курсы 1814—1914 гг. // Экономическая история. Обозрение. Выпуск 11 / Под ред. Л.И. Бородкина М., 2005. С. 51-97.

Обратимся к статистическому анализу факторов, влиявших на динамику вексельных курсов из Санкт-Петербурга на Амстердам, Лондон, Гамбург и Париж. Применяя методы корреляционно-регрессионного анализа, мы предварительно извлекаем из динамических рядов линейные тренды.

* * *

Вексельный курс из Санкт-Петербурга на Амстердам

Для выявления наличия статистической связи вексельного курса на Амстердам (курс А-м) с рядом экономических факторов была получена корреляционная матрица (см. табл. 1). В качестве таких факторов используются следующие показатели (они же используются ниже и при изучении курсов на Лондон, Гамбург и Париж):

• курс ассигн. – курс ассигнаций к серебряному рублю [13]

• металл. – объем металлической монеты в обращении [14]

• асссигнации – объем ассигнаций в обращении [15, С. 822]

• дефицит – дефицит государственного бюджета Российской империи [16]

• внешнеторг – объем внешнеторгового баланса Российской империи [17]

• хлеб – вывоз хлеба из Российской империи [18]

• золото - привоз золота в Российскую империю [19]

Таблица 1. Корреляционная матрица связи вексельного курса из Санкт-Петербурга на Амстердам с экономическими факторами (1801 - 1839 гг.)*

|

Показатели

|

курс А-м

|

курс ассигн.

|

металл.

|

асссигнации

|

дефицит

|

внешнеторг.

|

|

курс А-м

|

1.00

|

0,35

|

-0,21

|

0,33

|

-0,21

|

0,41

|

|

курс ассигн.

|

0,35

|

1,00

|

-0,77

|

0,90

|

-0,37

|

0,29

|

|

металл.

|

-0,21

|

-0,77

|

1,00

|

-0,85

|

0,69

|

-0,19

|

|

асссигнации

|

0,33

|

0,90

|

-0,85

|

1,00

|

-0,49

|

0,42

|

|

дефицит

|

-0,21

|

-0,37

|

0,69

|

-0,49

|

1,00

|

0,05

|

|

внешнеторг.

|

0,41

|

0,29

|

-0,19

|

0,42

|

0,05

|

1,00

|

*Здесь и далее курсивом отмечены статистически значимые коэффициенты

(при P=0,95).

Как видно из Табл. 1, вексельный курс на Амстердам имеет статитически значимую корреляцию с курсом ассигнаций (0,35) и внешнеторговым балансом Российской империи (0,41). Корреляции положительные, но невысокие. Это подтверждает наше представление о прямой, но невысокой зависимости вексельного курса от объемов внешней торговли. К сожалению, в рамках расматриваемого периода затруднительно провести корреляционный анализ данных о торговле России с разными странами, так как сведения об объемах российского экспорта и импорта стали детализироваться по странам только с 1827 г. Отметим также наличие относительно слабой положительной связи между вексельным курсом на Амстердам и объемом ассигнаций в обращении (0,31), что неудивительно, учитывая тесную связь курса ассигнаций к серебряному рублю и объема ассигнаций в обращении (0,90).

Проверки требует и гипотеза относительно влияния на вексельный курс экспорта зерна и ввоза золота; мы рассмотрим именно ввоз золота, так как статистика вывоза начинается только с 1812 г. и не дает нам возможности изучить в этом аспекте интереснейший период Наполеоновских войн и его влияния на курсы. Влияние этих показателей изучается и по отдельности, вследствие отсутствия данных за 1808-1811 гг. (эти годы - часть периода Континентальной блокады). Мы посчитали некорректным провести линейную интерполяцию динамики этого нестабильного периода, и в итоге точки разрыва были «сшиты» в ходе дальнейшего анализа. Поскольку эти два показателя имееют лакуны в очень значимый для анализа период, они выводятся далее в отдельные таблицы. Как видно из Табл. 2, вексельный курс на Амстердам коррелирует статистически значимо (0,50) только с показателем ввоза золота в страну.

Таблица 2. Корреляционная матрица связи показателей ввоза золота и вывоза хлебов с вексельным курсом на Амстердам. (1801-1807 и 1812-1839 гг.)

|

Показатели

|

курс А-м

|

хлеб

|

золото

|

|

курс А-м

|

1.00

|

0,26

|

0,50

|

|

хлеб

|

0,26

|

1,00

|

0,77

|

|

золото

|

0,50

|

0,77

|

1,00

|

Для проверки нашей гипотезы был проведен также корреляционный анализ по объему экспорта товаров из России в Голландию, хотя и только с 1827 г. Коэффициент корреляции является в этом случае статистически незначимым (-0,15), что может указывать на большее значение для вексельного курса на Амстердам расчетов по русским международным заимствованиям, чем профицит торгового баланса России по отношению к Голландии.

Для определения совместного влияния экономических факторов на вексельный курс обратимся к построению регрессионной модели (табл. 3). В качестве результирующего (зависимого) признака возьмем вексельный курс на Амстердам, а в качестве независимых - внешнеторговый баланс России и курс ассигнаций. Остальные факторы в модель не включаются, чтобы избежать эффектов мультиколлинеарности (см. табл. 1).

Таблица 3. Регрессионная модель: зависимость курса на Амстердам от курса ассигнаций и внешнеторгового баланса Российской империи (1801-808, 1812-1839 гг.)

|

|

B

|

Std.Err. of B

|

t(36)

|

p-level

|

|

Свободный член уравнения

|

-0,078

|

1,12

|

-0,07

|

0,94

|

|

Курс ассигнац.

|

0,029

|

0,02

|

1,85

|

0,07

|

|

Внешнеторг.

|

0,000080

|

0,000035

|

2,29

|

0,03

|

|

|

R2 = 0,199

|

Из регрессионного уравнения (табл. 3) видно, что эта модель может объяснить изменение курса векселей на Амстердам только на 20%, что недостаточно для понимания основных механизмов образования курсов (хотя оба учтенных фактора являются значимыми при значении p-level = 0,07). Для уточнения была построена модель с включением показателя ввоза золота и серебра в Российскую империю. Но его добавление практически не увеличило объяснительную силу модели. Невысокое значение R² позволяет предполагать, что курс векселей на Амстердам зависел и от других факторов, в частности - количества ежегодных выплат Российской империи по государственным займам. К сожалению, пока не удалось проверить эту гипотезу, так как постоянные отчеты стали доступными с 1862 г., когда бюджет начали публиковать.

Обратимся к корреляции вексельных курсов из Санкт-Пеиербурга на другие финансовые центры Европы, т.е. проверим гипотезу о том, что при установлении вексельного курса рынок во многом определялся не внутренними факторами, а экзогенными (см. Табл. 4).

Таблица 4. Корреляционная матрица вексельных курсов (1801-1839 гг.)

|

Показатели

|

Курс А-м.

|

Курс Л.

|

Курс Г.

|

Курс П.

|

|

Курс А-м.

|

1.00

|

0,65

|

0,91

|

0,89

|

|

Курс Л.

|

0,65

|

1.00

|

0,76

|

0,64

|

|

Курс Г.

|

0,91

|

0,76

|

1.00

|

0,88

|

|

Курс П.

|

0,89

|

0,64

|

0,88

|

1.00

|

Здесь приняты следующие обозачения вексельных курсов:

• курс А-м. – вексельный курс на Амстердам

• курс Л. – вексельный курс на Лондон

• курс Г. – вексельный курс на Гамбург

• курс П. – вексельный курс на Париж

Как следует из Табл. 4, все взаимосвязи вексельных курсов являются положительными и статистически значимыми, что говорит о наличии общих для них тенденций развития рынка. Средние по силе взаимосвязи наблюдаются между вексельным курсом на Лондон и остальными курсами, что может объясняться влиянием периода Континентальной блокады - более заметным падением объема торговых связей с Англией.

Остальные курсы взаимосвязаны так сильно, что отражают, очевидно, действия общего макро-фактора, свидетельствуя о том, что рассматриваемый период можно связать с формированием общеевропейского денежного рынка, в который включается и российский рынок.

Вексельный курс на Лондон

Вексельный курс на Лондон (курс Л.) анализировался по тому же принципу: сначала были вычислены коэффициенты корреляции вексельного курса на Лондон с указанными выше показателями, затем строилась регрессионная модель.

Так же, как и выше, сначала проводился корреляционный анализ для первых пяти показателей, не имеющих пропусков в своих временных рядах.

Таблица 5. Корреляции вексельного курса на Лондон с экономическими показателями (1801-1839 гг.)

|

Показатели

|

курс ассигн

|

металл

|

асссигнации

|

дефицит

|

внешнеторг

|

|

курс Л.

|

0,35

|

-0,57

|

0,45

|

-0,58

|

0,18

|

Из Табл. 5 следует, что вексельный курс на Лондон коррелирует с четырьмя другими показателями: курсом ассигнаций, количеством ассигнаций и металлической монеты в обращении и размером бюджетного дефицита Российской империи. У всех этих признаков сила связи с курсом на Лондон средняя, хотя статистически значимая, при этом количество ассигнаций и их курс имеют положительную корреляцию, а количество металлических денег в обращении и дефицит бюджета - отрицательную.

Обратимся теперь к матрице корреляции, отражающей связи вексельного курса на Лондон с экспортом зерна и ввозом золота.

Таблица 6. Матрица корреляции вексельного курса на Лондон с экспортом зерна и ввозом драгоценных металлов. (1801-1808, 1827-1839 гг.)

|

Показатели

|

курс Л.

|

хлеб

|

золото

|

|

курс Л.

|

1.00

|

0,04

|

0,21

|

|

Хлеб

|

0,04

|

1,00

|

0,77

|

|

Золото

|

0,21

|

0,77

|

1,00

|

Табл. 6 содержит неожиданный результат: оба фактора не дают статистически значимой корреляции с вексельным курсом на Лондон. Это удивительно, особенно учитывая то, что Англия была главным импортером российских товаров, и отсутствие такой корреляции говорит о наличии более глубинных причин колебаний курса, не связанных напрямую с основными внешнеэкономическими показателями.

Введение в рассмотрение показателя, характеризующего внешнеторговое сальдо [20] с Англией, ничего не добавляет: коэффициент корреляции этого показателя с вексельным курсом на Лондон равен всего -0,10, что подтверждает отсутствие прямой связи внешней торговли с волатильностью данного вексельного курса.

Обратимся теперь к регрессионной модели с вексельным курсом на Лондон в качестве зависимой переменной и дефицитом государственного бюджета в качестве независимой. Мы выбрали только один зависимый признак, так как из корреляционной матрицы (Табл. 1) мы видим, что факторные признаки сильно коррелируют между собой. Поэтому мы берем только один фактор, который имеет наиболее сильную связь с курсом на Лондон. Как следует из Табл. 7, данная модель объясняет около 32% изменений результирующего признака, при этом коэффициент регрессии обдадает высоким уровнем значимости..

Таблица 7. Регрессионная модель: зависимость вексельного курса на Лондон от дефицита государственного бюджета Российской империи.

|

|

B

|

Std.Err. of B

|

t(36)

|

p-level

|

|

Свободный член

|

-0,25

|

2,51

|

-0,08

|

0,93

|

|

Дефицит.

|

-0,0003

|

0,000068

|

-4,32

|

0,0001

|

|

|

R2 = 0,32

|

Вексельные курсы на Гамбург и на Париж

Эти вексельные курсы рассмотрим в одном разделе, так как их взаимосвязь очень высока: коэффициент их корреляции равен 0,88 (см. табл. 4)

Таблица 8. Корреляции вексельного курса на Гамбург экономическими показателями (1801-1839 гг.)

|

Показатели

|

курс ассигн

|

металл

|

ассигнации

|

дефицит

|

внешнеторг

|

|

курс Г.

|

0,43

|

-0,29

|

0,39

|

-0,33

|

0,41

|

Для курса на Париж получена очень похожая структура корреляций. И там, и там наблюдаются небольшие положительные связи вексельного курса с курсом ассигнаций и их количеством, а также с внешнеторговым балансом России (см. Табл. 8). Причины этого уже рассматривались выше.

По связям вексельных курсов с вывозом зерна и привозом золота для двух рассматриваемых курсов имеются некоторые отличия. Вексельный курс на Париж не коррелирует значимо ни с одним из этих показателей, а курс на Гамбург имеет статистически значимую положительную корреляцию с привозом золота в страну, хотя и не очень большую (0,51). Это может говорить о меньшей интенсивности торговых отношений с Парижем в сравнении с Гамбургом и поэтому о большем влиянии на вексельный курс на Париж не базовых внешнеторговых, а случайных и (возможно) спекулятивных составляющих курса.

Обратимся к регрессионным моделям, где зависимыми переменными являются вексельные курсы на Париж и Гамбург, а независимой - курс ассигнаций, имеющий более тесную связь с обоими вексельными курсами (табл. 9 и 10). Курс ассигнаций в качестве единственной независимой переменной был выбран во избежание эффекта мультиколлинеарности.

Динамика курса на Гамбург объясняется этим показателем только на 10%, а на Париж - 14%. Это ниже, чем у Лондона и Гамбурга и может говорить о том, что колебания этих куров слабо зависели от основных макропоказателей российской экономики того времени.

Таблица 9. Регрессионная модель зависимости вексельного курса на Гамбург

от курса на ассигнаций. (1801-1839 гг.)

|

|

B

|

Std.Err. of B

|

t(36)

|

p-level

|

|

Свободный член уравнения

|

0,52

|

0,89

|

0,59

|

0,56

|

|

Курс ассигнаций

|

-0,199

|

0,087

|

-2,29

|

0,03

|

|

|

R2 = 0,10

|

Таблица. 10. Регрессионная модель зависимости вексельного курса на Париж

от курса на ассигнации. (1801-1839 гг.)

|

|

B

|

Std.Err. of B

|

t(36)

|

p-level

|

|

Свободный член уравнения

|

0,78

|

1,12

|

0,69

|

0,493

|

|

Курс ассигнаций

|

-0,297

|

0,11

|

-2,698

|

0,01

|

|

|

R2= 0,14

|

Курс ассигнаций в обеих моделях является статистически значимым.

Заключение

Реконструкция динамики вексельных курсов из Санкт-Петербурга на основные финансовые центры Европы, проведенная на основе созданного нами цифрового ресурса, показала, что в течение рассматриваемого периода вексельные операции не прерывались даже в годы Континентальной блокады. Как свидетельствуют результаты корреляционно-регрессионного анализа, динамика вексельных курсов из Санкт-Перербурга в 1801-1839 гг. зависела в определенной мере от объема внешней торговли (или, точнее, от внешнеторгового сальдо) России и курса ассигнаций, слабо зависела от торговых балансов с рассматриваемыми странами. И хотя объяснительная сила построенных регрессионных моделей не превышает 32%, были выявлены и статистические значимые факторы. Так, регрессионные модели для курсов на Гамбург и Париж выявили статистически значимую (и отрицательную) их связь с курсом ассигнаций, а для курса на Амстердам – еще и с объемом внешнеторгового баланса Российской империи (положительная корреляция). Курс векселей на Лондон имел специфику (связанную, в частности, с последствиями Континентальной блокады) и имел статистически значимую отрицательную связь с показателем дефицита государственного бюджета Российской империи.

Интересно, что не обнаружилась значимая зависимость вексельных курсов от вывоза хлеба из России, в то время как их зависимость от ввоза золота оказалась статистически значимой в случае курсов на Амстердам и Гамбург (при том что корреляция привоза золота с вывозом хлеба значимая и положительная).

Сильные положительная корреляция вексельных курсов из Санкт-Петербурга подтверждает гипотезу о процессе интеграции денежного рынка в ведущих странах Европы в первой трети XIX века и включенности России в этот процесс.

Выявленное отсутствие сильных связей с экзогенными экономическими факторами побуждает продолжить исследования влияния эндогенных факторов курсовой динамики на микроуровне, а также влияние на вексельные курсы политических событий неспокойного периода первых десятилетий XIX века.

References

1. Entsiklopedicheskii slovar' Brokgauza.105 F.A. i Efrona I.A., Spb., 1896, T 17 – 519 s.

2. Sementkovskii R. Nash veksel'nyi kurs // «Severnyi Vestnik», mai, 1891, №75. S. 183-219

3. Mill' D. Osnovaniya politicheskoi ekonomii, M., 1980-1981.-1040 s.

4. Dentsel' M. Mezhdunarodnaya sistema beznalichnykh raschetov i vklad Rossiiskoi imperii v formirovanie mirovoi ekonomiki // Ekonomicheskaya istoriya. Obozrenie / Pod red. L.I. Borodkina. Vyp. 10 M., 2005. S. 186.

5. Denzel M.A. Handbook of World Exchange Rates, 1590–1914, Routledge, 2017, 766 s.

6. Rossiiskii rubl' v sisteme evropeiskikh valyut: veksel'nye kursy 1814—1914 gg. /Pod red. Borodkina L.I. // Ekonomicheskaya istoriya. Obozrenie. Vypusk 11, M., 2005. S. 51-97

7. Borodkin L.I., Konovalova A.V. Rossiiskii fondovyi rynok v nachale KhKh v.: faktory kursovoi dinamiki. SPb., Aleteiya, 2010-296 s.

8. Moskovskie vedomosti, 1800-1839.

9. Sankt-Peterburgskie vedomosti, 1800-1824.

10. Kommercheskaya gazeta., 1825-1839.

11. http://www.hist.msu.ru/Departments/Inf/activity.htm

12. Murav'eva A.G. K voprosu o prekrashchenii razmena assignatsii v Rossiiskoi imperii // Istoricheskii zhurnal: nauchnye issledovaniya. — 2019.-№ 2.-S.116-127.

13. Murav'eva A.G. K voprosu o prekrashchenii razmena assignatsii v Rossiiskoi imperii // Istoricheskii zhurnal: nauchnye issledovaniya. — 2019.-№ 2.-S.116-127.

14. Kaufman I. I. Serebryanyi rubl' v Rossii ot ego vozniknoveniya do kontsa XIX veka SPb., 1910-268 s.

15. Shtorkh P. Materialy dlya istorii gosudarstvennykh denezhnykh znakov v Rossii s 1653 po 1840 god // Zhurnal Ministerstva narodnogo prosveshcheniya ¬ 1868, chast' № 137, S. 772-847

16. Ministerstvo finansov. 1802-1902. Ch.I. SPb., 1902. S.616-619, 622 s. (http://hist.msu.ru/Dynamics/13_stt.htm).

17. Ministerstvo finansov. 1802-1902. Ch.I. SPb., 1902. S.616-619, 622 s. (http://hist.msu.ru/Dynamics/Foreign_trade.htm).

18. Ministerstvo finansov. 1802-1902. Ch.I. SPb., 1902. S.616-619, 622 s. (http://hist.msu.ru/Dynamics/Foreign_trade.htm).

19. Ministerstvo finansov. 1802-1902. Ch.I. SPb., 1902. S.616-619, 622 s. (http://hist.msu.ru/Dynamics/Foreign_trade.htm).

20. Ministerstvo finansov. 1802-1902. Ch.I. SPb., 1902. S.616-619, 622. (http://hist.msu.ru/Dynamics/Foreign_trade.htm).

Link to this article

You can simply select and copy link from below text field.

|

|