|

MAIN PAGE

> Back to contents

Finance and Management

Reference:

Goleva O.I., Martyanov N.S., Melnikov A.E.

The discount rate in calculating the budgetary efficiency of investment projects: approaches and methods

// Finance and Management.

2023. № 4.

P. 1-20.

DOI: 10.25136/2409-7802.2023.4.69223 EDN: RNMODE URL: https://en.nbpublish.com/library_read_article.php?id=69223

The discount rate in calculating the budgetary efficiency of investment projects: approaches and methods

Goleva Ol'ga Ivanovna

ORCID: 0000-0002-0846-4913

PhD in Economics

Associate professor of Finance, Credit and Exchange Department, Perm State University; Senior researcher, Federal Scientific Center for Medical and Preventative Health Risk Management Technologies

614990, Russia, Perm Krai, Perm, Bukireva str., 15

|

OlgaGoleva@psu.ru

|

|

|

Other publications by this author

|

|

Martyanov Nikolai Sergeevich

PhD in Economics

Associate professor of Finance, Credit and Exchange Department, Perm State University

614990, Russia, Perm Krai, Perm, Bukireva str., 15

|

mart@psu.ru

|

|

|

|

Melnikov Aleksei Evgenevich

PhD in Economics

Associate professor of Finance, Credit and Exchange Department, Perm State University

614990, Russia, Perm Krai, Perm, Bukireva str., 15

|

melnikov-ae@yandex.ru

|

|

|

|

DOI: 10.25136/2409-7802.2023.4.69223

EDN: RNMODE

Received:

04-12-2023

Published:

17-12-2023

Abstract:

The question of discounting (and justifying the discount rate) in relation to the effects on the budget of a country or region arises not only in connection with "classic" investment projects implemented by businesses in a certain territory, but also in connection with any management decisions requiring budget expenditures and/or implying an analysis of alternative solutions. The purpose of the work is to analyze and systematize normative and/or author's scientifically based methodological approaches to the selection and justification of the discount rate for evaluating the budgetary effectiveness of investment projects (and other management decisions). The subject of the study is the selection and justification of the discount rate for the purpose of evaluating deferred effects in calculating the budgetary efficiency of investment projects, taking into account the time value of money. Based on the analysis and systematization of available approaches and methods for constructing the discount rate in assessing deferred effects of budget efficiency based on domestic and foreign materials of normative, methodological and scientific literature, an algorithm for constructing and justifying the discount rate is proposed. The analysis of normative, methodological and normative literature has shown that today all the main approaches to the construction and justification of the discount rate when assessing deferred effects in calculating budget efficiency can be grouped by areas of application and the following can be distinguished: assessment of the effectiveness of investment projects with state participation (budget financing); assessment of the effectiveness of public-private partnership projects and municipal-private partnerships (including special economic zones); assessment of the effectiveness of tax benefits/ tax expenditures (and other changes in tax legislation); assessment of the effectiveness of various non-tax measures and measures to support and stimulate the development of certain industries and categories of economic entities; assessment of the effectiveness of projects in the public sector of the economy (provision of public goods, including regulatory impact assessment (when adopting and subsequent analysis of government regulatory measures), assessment of measures and technologies for managing risks to life and health of the population. The proposed algorithm for selecting and justifying the discount rate for calculating the budgetary efficiency of investment projects will allow taking into account the industry' specifics of projects.

Keywords:

discount rate, discounting rate, budget efficiency, economic efficiency, project effectiveness, investment project, priority investment project, evaluation of effectiveness, discounting, budget impact analysis

This article is automatically translated.

You can find original text of the article here.

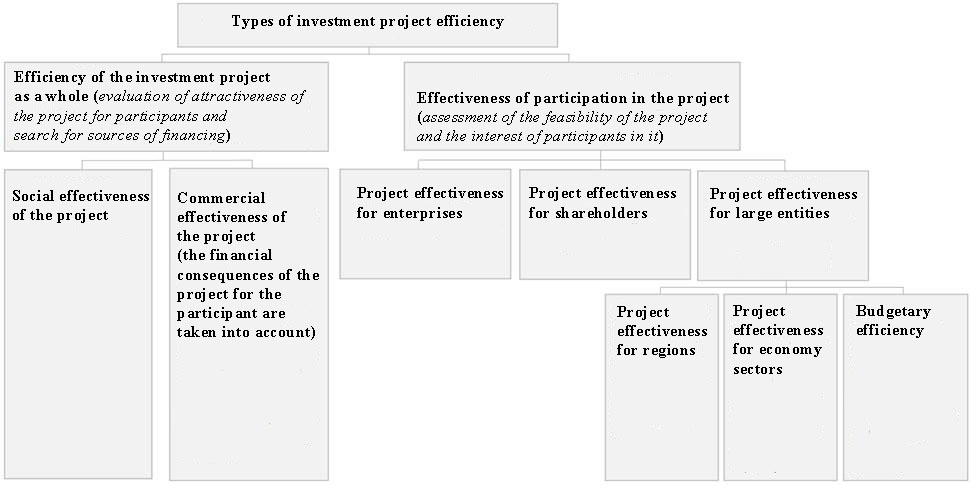

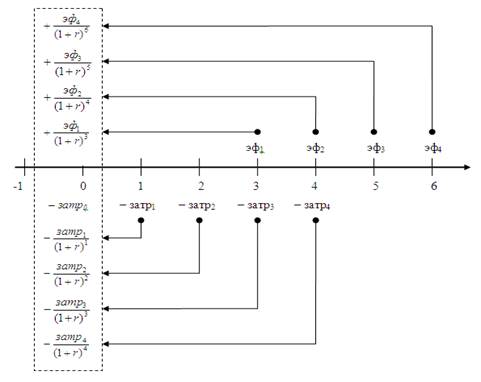

Introduction In economic practice, the analysis of the effectiveness of investment projects uses general approaches reflected in the methodological recommendations for evaluating the effectiveness of investment projects No. VK 477 dated 06/21/1999 approved by the Ministry of Economy of the Russian Federation, the Ministry of Finance of the Russian Federation, the State Committee of the Russian Federation for Construction, Architectural and Housing Policy I. These Recommendations are intended for enterprises and organizations of all forms of ownership involved in the development, examination and implementation of investment projects. Within the framework of this document, it is proposed to evaluate several types of effectiveness: - the overall effectiveness of the project (public and commercial); - the effectiveness of participation in the project (the effectiveness of the investment project for participating enterprises; efficiency for shareholders of joint-stock enterprises participating; the effectiveness of participation in the project of higher-level structures in relation to enterprises participating in the investment project - regional and national economic efficiency, sectoral efficiency, budgetary efficiency). The subordination of these types of efficiency of investment projects is shown in Figure 1. - Figure 1 – Types of effectiveness of investment projects (in accordance with the methodological recommendations for evaluating the effectiveness of investment projects No. VK 477 dated 06/21/1999) A lot has been said about how to conduct an economic assessment of the effectiveness of investment projects: approaches, methods, key indicators, etc. The term efficiency itself is interpreted in different ways. In GOST R ISO 9000 – 2008 "Quality management systems. The main provisions and vocabulary" are highlighted as the category of efficiency ("The relationship between the achieved result and the resources used") and effectiveness II ("The degree of implementation of planned activities and achievement of planned results") III. As a rule, efficiency is understood as the relative effect of a process, operation, project, defined as the ratio of the effect, result to the costs, expenses that caused and ensured its receipt. In this regard, the comparison of effects and costs (investments) should be carried out taking into account that both effects and costs are distributed over time, and take into account the concept of the time value of money, which provides for discounting cash flows to correctly compare effects and costs (investments). Then, the general scheme for evaluating the effectiveness of an investment project can be presented in Figure 2.

Figure 2 – A general scheme for evaluating the effectiveness of an investment project, taking into account the time value of money It is worth noting that the figure shows the basic model, whereas there are approaches that provide for more complex options: different discount rates for effects and costs, as well as different rates for the forecast and post-forecast periods in the evaluation of the project. This scheme is applicable for evaluating both commercial and budgetary efficiency (for calculating the indicators of which the corresponding cash flows and discount rates must be estimated and justified). But, if a large number of works are devoted to the calculation of commercial efficiency (including fundamental ones on classical finance theory, investment valuation theory, financial management, etc.), which include a detailed description of the construction of cash flows and investments, the choice and justification of the planning horizon and discount rates; then budget efficiency is often only mentioned, and the calculation of the main parameters is left to the expert/ analyst. At the same time, the issue of discounting in relation to the effects on the budget of a country or region arises not only in connection with "classic" investment projects implemented by businesses in a certain territory, but also in connection with any management decisions requiring budget expenditures and/or implying an analysis of alternative solutions. Analysis of regulatory documents and author's methods for determining the discount rate when evaluating deferred effects in calculating budget efficiency Among the areas where the issue of assessing budget efficiency (and assessing deferred effects on the budget) has been worked out to a greater or lesser extent, the following can be noted: - assessment of the effectiveness of investment projects with the participation of the state (budget financing), - evaluation of the effectiveness of public-private partnership and municipal-private partnership projects (including special economic zones), - assessment of the effectiveness of tax benefits/tax expenses (and other changes in tax legislation),

- assessment of the effectiveness of various non-tax measures and measures to support and stimulate the development of certain industries and categories of economic entities, - evaluation of the effectiveness of projects in the public sector of the economy (provision of public goods, including meritorious ones), - assessment of the regulatory impact and assessment of the actual impact of regulations (when adopting and subsequent analysis of government regulation measures), - assessment of measures, measures and technologies for managing risks to the life and health of the population (primarily within the framework of pharmacoeconomics). That is, the need to assess budget efficiency may be due to both the content of projects/activities and the mechanism of their implementation. In some cases, an appropriate assessment is mandatory. The need to assess delayed effects arises with a significant duration of the events themselves and the remoteness of the expected effects. That is, in order to determine the need to calculate the discount rate and apply the discounting procedure in general, it is important to understand the planning horizon for the project and its features (social, environmental significance, etc.). Thus, in foreign practice, within the framework of BIA (Budget Impact Analysis), one of the approaches to analyzing the impact of the use of medical technologies and drugs on the budget (typical for pharmacoeconomics), in the last decade there has been a change in views on discounting and its necessity (in relation to cash flows for the budget of a country or region) from denial of necessity [1] to discussion and analysis of the nuances of the application of models and methods of discounting [2]. Thus, it can be seen that even to solve similar issues and justify the effectiveness of similar projects (measures, measures), discounting may not be applied at all or applied at different discount rates (built within the framework of different approaches), which, of course, affects the evaluation result [3]. An overview of the available approaches and methods for justifying and constructing discount rates for the purpose of evaluating budget efficiency is presented in table 1. In the table, both normative documents at the level of the Russian Federation and individual subjects of the Russian Federation, as well as author's methods, are proposed for consideration and comparison. Table 1 – Overview of approaches and methods for determining the discount rate for the purpose of evaluating budget efficiency | Scope of application | Name/source | Approach/method | Comment | | Assessment of the effectiveness of investment projects (including those involving the state) | "Methodological recommendations for evaluating the effectiveness of investment projects" (approved by the Ministry of Economy of the Russian Federation, the Ministry of Finance of the Russian Federation, Gosstroy of the Russian Federation dated 06/21/1999 N VK 477)I

| The need to take into account the time value of money is indicated. No approach to the definition has been proposed. | As an example, the rate of 20% is considered. There is no justification. | | "Methodological recommendations for evaluating the effectiveness of investment projects: second edition" [4] | The need to take into account the time value of money is indicated. No approach to the definition has been proposed. | — |

| "Methodological recommendations for evaluating the effectiveness of investment projects: third edition"IV

Not approved! | The need to take into account the time value of money is indicated. No approach to the definition has been proposed. | — | | "Methodology for calculating indicators and applying criteria for the effectiveness of regional investment projects applying for state support from budgetary allocations of the Investment Fund of the Russian Federation" (Order of the Ministry of Regional Development of the Russian Federation dated October 30, 2009 No. 493)V

It has lost its power! | It is established annually by the authority. ("The required return on investment from the Fund's funds is calculated annually by the Ministry of Finance of the Russian Federation in coordination with the Ministry of Regional Development of the Russian Federation") | A single rate for applicants for budget support puts everyone in the same conditions. | | "Methodological guidelines for the preparation of strategic and comprehensive justifications of an investment project, as well as for the evaluation of investment projects applying for financing from the National Welfare Fund and (or) pension savings held in trust by a state management company on a refundable basis" (Order of the Ministry of Economic Development of the Russian Federation dated 12/14/2013 No. 741)VI | "The discount rate is assumed to be equal to the average for the half-year preceding the half-year in which it is planned to evaluate the comprehensive justification of the investment project, published on the official website of PJSC Moscow Exchange MICEX-RTS on the Internet information and telecommunications network, corresponding to the maturity of 25 years, the value of the G curve (dependence of the coupon-free yield of government obligations on their duration)". "When determining the expected (constant) growth rate of budget cash flows in the post-forecast period (g b), this indicator is recognized as equal to the projected inflation value for the last year of the forecast period." | It is proposed to use one discount rate to calculate the commercial efficiency and budgetary efficiency of the project (taking into account the assessment in the post-forecast period). For the post–forecast period, the discount rate is adjusted for the constant growth rate of cash flows (r-g b). Along with the calculation of budgetary efficiency, it is proposed to calculate socio-economic efficiency, for which the social discount rate is used. | | "Methodological guidelines for the development of the concept of an investment project in the field of forest development, applying for inclusion in the list of priority investment projects in the field of forest development" (Order of the Ministry of Industry and Trade of the Russian Federation dated 05/15/2018 N 1870)VII | The need to take into account the time value of money in calculating budget efficiency is not indicated (there is no mention of the discount rate in calculating budget efficiency). | The budget efficiency in the document is specified as tax revenues, taxes. It seems that in this case, efficiency is replaced by efficiency, and relative indicators are absolute. At the same time, there are no restrictions on the use of established approaches in science and practice to assess budget efficiency. | | |

On approval of the procedure for providing state guarantees on a competitive basis at the expense of the development budget of the Russian Federation and the regulations on evaluating the effectiveness of investment projects when placing centralized investment resources of the development budget of the Russian Federation on a competitive basis VIII (Decree of the Government of the Russian Federation dated 11/22/1997 No. 1470)IX | The discount rate (d i) excluding project risk is defined as the ratio of the refinancing rate (r) set by the Central Bank of the Russian Federation and the inflation rate announced by the Government of the Russian Federation for the current year (i):  | To date, it seems possible to use the key rate of the Central Bank of the Russian Federation (instead of the refinancing rate). | | A methodological approach to assessing budget efficiency in the development of hard-to-reach mineral deposits (Leonidova Yu.A., 2021) [5] | r is the rate of time preferences, which shows the value of next year's consumption in relation to the current one. | A reference is given to the construction of a social discount rate using the method of intertemporal preferences. | | Evaluation of the effectiveness of investment projects with state participation (M.E.Kosov, 2017) [6] | The need to take into account the time value of money is indicated. No approach to the definition has been proposed. | — | | Calculation of the discount rate based on risk premiums (Kovalevskaya N. Yu., Molokova D. M., 2021) [7] | The discount rate is determined using a cumulative method based on a risk-free rate and the introduction of a risk premium adjusted for inflation. | The approach is similar to the classical method of constructing a discount rate for evaluating the commercial effectiveness of investment projects. | | Cumulative method (Aleksanov D. S., Koshelev V. M., Chekmareva N. V., 2022) [8] | The algorithm recommended by the instruction of the Russian Agricultural Bank X was used, which is applied to projects as a whole (without indicating budgetary efficiency). | The discount rate without taking into account the risk of the project is determined similarly Resolution IX, with subsequent risk adjustment with a premium in the range of 6-20%. | | | Assessment of the budgetary efficiency of socially significant facilities (taking into account industry and specific risks) (Veresova S. I., Semeykina N. M., 2014) [9] | The discount rate is determined by the cumulative construction method, taking into account industry and specific risks. |

An expert assessment model developed by the World Bank was used to assess the risks of investments. An example of the application is presented in [9]. | | Evaluation of the effectiveness of public-private partnership and municipal-private partnership projects (including special economic zones) | "Methodology for evaluating the effectiveness of a public-private partnership project, a municipal-private partnership project and determining their comparative advantage" Order of the Ministry of Economic Development of the Russian Federation dated 11/30/2015 N894 XI | The discount rate of expenditures and receipts of funds from the budgets of the budgetary system of the Russian Federation during the implementation of the project is determined as follows:

If there is no need to spend funds from the budgets of the budgetary system of the Russian Federation on the creation and (or) operation and (or) maintenance of an object during the implementation of the project, then the discount rate for expenses and receipts from the budgets of the budgetary system of the Russian Federation is calculated using the formula:

| The discount rate is calculated as the weighted average price of attracted capital for the relevant investor (including the level of the budget system) in terms of the amount of funds invested in the project or in terms of revenue (if budget investments are not provided). | | "Methods for evaluating the effectiveness of investment mechanisms, including public-private partnership mechanisms" (Rosavtodor Order No. 1714-r dated 09/08/2014)XII | "The discount rate is selected based on the current level of the key rate of the Bank of Russia." | The wording allows you to take into account the current level of the key rate, but does not define a clear equality. | | Assessment of the effectiveness of tax benefits/tax expenses (and other changes in tax legislation) | (project) Methodological recommendations for assessing the effectiveness of tax benefits (tax expenditures) of the subjects of the Russian Federation and municipalities (2018)XIII Not approved! | r is the estimated cost of medium–term market borrowings of a constituent entity of the Russian Federation: r = i inf + p + c where: i inf is the target inflation rate (proposed 4%)XIV; p is the real interest rate, determined at 2.5%; c is the credit risk premium. The credit risk premium takes values from 1 to 3% (depending on the ratio of the state debt to tax and non-tax revenues of the budget of the subject of the Russian Federation). | "The cost of medium-term market borrowings of a particular subject of the Russian Federation, selected as a discount rate, does not reflect the profitability of an alternative investment option" [10]. | | Methodology for assessing tax expenditures of the Russian Federation (2019, as amended by 2023)XV

| r is the estimated cost of medium–term market borrowings of the Russian Federation, assumed at 7.5 percent XVI. |

The assessment of the cost of medium-term market borrowings can be carried out for any period of time for the Russian Federation (and for the subject of the Russian Federation in the presence of regional bonds). | | Assessment of the effectiveness of various non-tax measures and measures to support and stimulate the development of certain industries and categories of economic entities | Methodology for calculating the budgetary efficiency of economic incentives for organizations attracting investments using stock market instruments at the expense of the budget of Moscow XVII | d is the budget discount rate, set in the amount of ? of the minimum refinancing rate of the Central Bank of the Russian Federation for the last 12 months preceding the month when the organization submitted an application for the competition. | To date, it seems possible to use the key rate of the Central Bank of the Russian Federation (instead of the refinancing rate). | | Assessment of the effectiveness of regional investment policy by cost-benefit analysis (Melnikov R.M., 2007) [11] | The rate in accordance with the methodological recommendations for evaluating the effectiveness of investment projects 1 | As an example, the rate of 20% is considered. There is no justification. | | Evaluation of the effectiveness of programs and projects in the public sector of the economy (provision of public goods, including meritorious ones) | The concept of the social discount rate in cost–benefit analysis (CBA – cost – benefit analysis) - an approach to evaluating the effectiveness of programs and projects in the public sector of the XVIII economy [12, 13, 14] | 1) the approach of the social rate of intertemporal preferences (SRTP – social rate of time preference), SRTP = ? + ?g, where p is the rate of intertemporal preferences; ? is the elasticity of marginal utility of consumption; g is the expected growth rate of consumption per capita; 2) the social alternative cost of capital approach (SOC – social alternative cost of capital), 3) an approach based on the definition of the shadow price of capital (SPC – shadow price of capital). | It is used for projects and programs to solve socially significant tasks of the state. | | Assessment of the regulatory impact and assessment of the actual impact of regulations (when adopting and subsequent analysis of government regulation measures) | "Classical" (for a commercial rate) methods of constructing a discount rate [15] | The need to take into account the time value of money is indicated. A cumulative approach and/or fixed rates for a number of macroeconomic indicators are proposed. | There was no unified approach. | |

Fixed rate [15, 16] | Fixed rate (according to a number of macroeconomic indicators). | The complexity of the application is associated with changing economic conditions, for which a fixed rate may not always be correct. | | Methods of constructing a social discount rate [16] | - the approach of the social bet of intertemporal preferences, - the approach of social alternative cost of capital. | In some cases, fixed rates or methods of estimating the social discount rate are used. | | Assessment of measures, measures and technologies for managing risks to life and health of the population (including within the framework of pharmacoeconomics) | Approaches of pharmacoeconomics and health risk management [17] | - fixed rate value (with reference to WHO), - a fixed value for the country's macroeconomic indicators, - cumulative construction method. | There is no unified approach, but there is a lot of practice in applying various methods, including the use of different discount rates for costs and benefits, as well as for different planning intervals. | Note that for the construction and justification of the discount rate (for any purpose), two components are characteristic, on the basis of which the calculation (construction) is performed Bids: - the required rate of return for the investor (project participant), which is the minimum rate to which the investor agrees, taking into account the existing risks and features of the project, - the alternative cost of capital for the investor (project participant), taking into account the capabilities of this investor in terms of investment options and sources of capital attraction (cost of capital). Thus, the general logic of the discount rate is based either on a risk analysis or an analysis of alternatives. From table 1, it can be seen that different discount rates can be used for the same purposes in the same economic conditions. Various fields of application have developed their own approaches to substantiating discount rates, in some cases these approaches are fixed in methodological recommendations adopted at the federal, regional and local levels. Among the most popular options for setting discount rates for the purpose of evaluating budget efficiency are the following: - fixed rate (numeric value), - fixed rate (with reference to the values of macroeconomic indicators: key rate, inflation rate, yield on government loans, etc.), - cumulative construction method (risk-free rate and risk premiums), - methods of constructing a social discount rate (in some cases). The choice of methods for calculating the discount rate for evaluating budget efficiency The considered approaches and methods of constructing and justifying the discount rate for the purpose of evaluating budget efficiency are numerous and diverse. That is, the possible range of possible discount rate values is wide, which can significantly affect the results of evaluating the budgetary effectiveness of the project/event, etc.

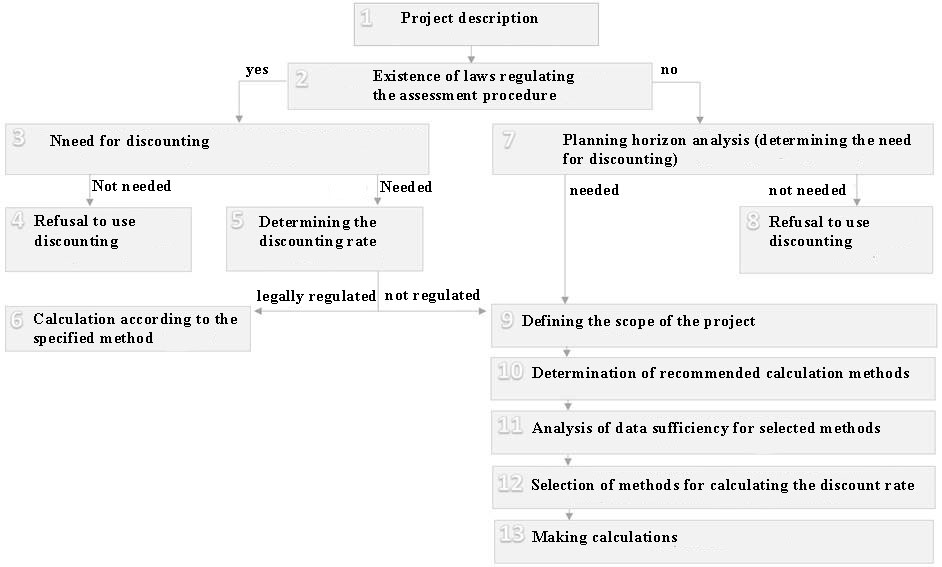

The sequence of actions in determining the discount rate when evaluating deferred effects in calculating the budgetary effectiveness of priority investment projects is shown in Figure 3.

Figure 3 – Algorithm for determining the discount rate when evaluating deferred effects in calculating budget efficiency The selection and justification of the bid involves several steps. - Description of the project, definition of its main characteristics (which largely determine the further choice). The main characteristics include the following: purpose, volume and structure of financing, scale, territory of implementation, main investors and stakeholders, deadlines and stages of implementation, project effects and externalities, types of efficiency that require assessment (commercial, socio-economic, budgetary, etc.).

- Determination of the availability of regulatory documents regulating the evaluation procedure (availability of relevant requirements of investors and/or stakeholders).

- In the event that there is a valid regulatory document with methodological recommendations for evaluating budget efficiency, then you should adhere to the approaches and values recommended by it [steps 5 and 6] or abandon the use of the discounting procedure, if this follows from the methodology [step 4].

- Refusal to use discounting in calculations (if there are methodological recommendations). The refusal to take into account the time value of money may be justified when evaluating the effectiveness of short-term projects or the high complexity of calculations, but it should be understood that the evaluation result does not take into account the time factor, which will be important not only when determining efficiency in accordance with the stated criteria, but also when comparing projects with different planning horizons.

- Determination of the method for calculating the discount rate. Methodological recommendations may provide several options for estimating and justifying the discount rate. The choice should be based on the principles of objectivity and sufficiency of data.

- Implementation of the calculation according to the presented method. The data for the calculation should be taken from official sources of information, supported by links to sources.

- In the absence of regulatory documents regulating the evaluation procedure, the planning horizon should be analyzed. Short–term projects, as a rule, do not require taking into account the time value of money (it is advisable to abandon discounting - step 8). In the analysis of medium- and long-term projects, the planning horizon (the presence of one or more intervals) and the need for evaluation in the post-forecast period should be determined. The assessment in different planning intervals and the post-forecast period may be accompanied by the use of different rates.

- Refusal to use discounting in calculations (in the absence of methodological recommendations). The risks are the same as when implementing step 4.

- Defining the scope of the project. Currently, the following areas of project implementation have been formed, which may have features in assessing budget efficiency and methods of calculating the discount rate: evaluating the effectiveness of investment projects (including those involving public financing or support), evaluating the effectiveness of public-private partnership and municipal-private partnership projects (including special economic zones), assessment of the effectiveness of tax benefits/tax expenditures (and other changes in tax legislation), assessment of the effectiveness of various non-tax measures and measures to support and stimulate the development of certain industries and categories of economic entities, assessment of the effectiveness of projects in the public sector of the economy (provision of public goods, including meritorious ones), assessment of the regulatory impact and assessment of the actual impact of regulations (in the adoption and subsequent analysis of government regulation measures), assessment of measures, measures and technologies for managing risks to life and health of the population.

- Determination of recommended methods for calculating the discount rate. The scope of the project dictates the main approaches that have developed in assessing budget efficiency and, accordingly, building a discount rate. In some cases, projects can be assigned to several fields of application.

- Data sufficiency analysis for the selected methods. The data for the calculation should be taken from official sources of information, supported by links to sources. If there are contradictions according to data from different sources of information of the same level (in terms of significance), priority is given to the option based on the principle of economic expediency and reasonableness.

- The choice of available methods for calculating the discount rate according to the criteria of objectivity and sufficiency of data.

- The implementation of the calculation. The calculation is carried out for all intervals of the forecast period and the post-forecast period, if it is provided.

Conclusion The variety of approaches and methods for calculating discount rates in general, and for evaluating budget efficiency in particular, dictate the need for systematization for the purposes of their application in practice. The variability in the choice of the method of constructing the rate, on the one hand, and the importance of this parameter in calculations, on the other, make the question of constructing and justifying the discount rate for the purpose of evaluating budget efficiency relevant and in demand. The analysis of normative, methodological and normative literature has shown that today all the main approaches to the construction and justification of the discount rate in assessing deferred effects in calculating budget efficiency can be grouped by application areas and the following can be distinguished: - assessment of the effectiveness of investment projects with the participation of the state (budget financing), - evaluation of the effectiveness of public-private partnership and municipal-private partnership projects (including special economic zones),

- assessment of the effectiveness of tax benefits/tax expenses (and other changes in tax legislation), - assessment of the effectiveness of various non-tax measures and measures to support and stimulate the development of certain industries and categories of economic entities, - evaluation of the effectiveness of projects in the public sector of the economy (provision of public goods, including meritorious ones), - assessment of the regulatory impact and assessment of the actual impact of regulations (in the adoption and subsequent analysis of government regulation measures), - assessment of measures, measures and technologies for managing risks to the life and health of the population (primarily within the framework of pharmacoeconomics). Taking into account the specifics of each of the fields of application of projects/activities in science and practice, approaches and methods for constructing discount rates (sometimes contradictory) are proposed. The range of proposed values ranges from risk-free levels (inflation rate, government securities rate) to rates taking into account premiums for various types of risk. Based on the results of the analysis of existing approaches and methods for constructing and justifying the discount rate when evaluating deferred effects in calculating budget efficiency, an algorithm for making a decision regarding the justification of the discount rate for the projects being evaluated is proposed. The algorithm provides for situations where there is no regulatory regulation of this issue and/or there is no regulation of this issue in the available regulatory documents. The proposed algorithm for selecting and justifying the discount rate for calculating the budgetary efficiency of investment projects will allow taking into account the specifics and industry specifics of projects. The results of the study can be used to evaluate the effectiveness of investment projects (including priority investment projects) for different industries and scenarios. _____________________________ I "Methodological recommendations for evaluating the effectiveness of investment projects" (approved by the Ministry of Economy of the Russian Federation, the Ministry of Finance of the Russian Federation, Gosstroy of the Russian Federation dated 06/21/1999 N VK 477) II It is worth noting that in some cases there is a confusion between the concepts of efficiency and effectiveness, when "efficiency" does not provide for a comparison of effects (including deferred ones) with spent resources. Nevertheless, for the purposes of this study, it is important to consider the procedure itself for evaluating deferred effects, even in cases where they are not compared with investments. III "GOST R ISO 9000-2008. Quality management systems. Basic provisions and dictionary" (approved by the Order of Rostec Regulation dated 12/18/2008 N 470-st) IV Methodological recommendations for evaluating the effectiveness of investment projects (Third edition, revised and supplemented). [electronic resource]. URL: http://www.isa.ru/images/Documents/metod.zip (accessed 08/15/2023). V Order of the Ministry of Regional Development of the Russian Federation dated 10/30/2009 No. 493 "On approval of the Methodology for calculating indicators and applying criteria for the effectiveness of regional investment projects applying for state support from budgetary allocations of the Investment Fund of the Russian Federation" VI Order of the Ministry of Economic Development of the Russian Federation dated 12/14/2013 No. 741 (as amended on 12/24/2021) "On approval of methodological guidelines for the preparation of strategic and comprehensive Justifications for an investment project, as well as for the evaluation of investment projects Applying for financing from the National Welfare Fund and (or) pension Savings held in trust by a State management Company, on a returnable basis based on" VII Order of the Ministry of Industry and Trade of the Russian Federation dated 05/15/2018 No. 1870 "On approval of methodological guidelines for the development of the concept of an investment project in the field of forest development, applying for inclusion in the list of priority investment projects in the field of forest development" VIII In some cases (currently) is the basis for regional and municipal legislation in matters of competitive selection of investment projects in the territory. For example, the Ivanovo region (https://invest-ivanovo.ru/investment-climate /) , Sayansk (https://www.admsayansk.ru/pub/files/QA/7050/17.11.21.doc ) and others. IX Decree of the Government of the Russian Federation dated 11/22/1997 No. 1470 (as amended on 09/03/1998) "On approval of the Procedure for Providing State Guarantees on a Competitive basis at the expense of the Development Budget of the Russian Federation and Regulations on evaluating the effectiveness of investment projects when Placing centralized investment Resources of the Development Budget of the Russian Federation on a competitive basis" X Appendix to the Procedure for Interaction between JSC "Rosselkhoznadzor" and accredited persons. [Electronic resource]. URL: https://www.rshb.ru/download-file/214 XI Order of the Ministry of Economic Development of the Russian Federation dated 11/30/2015 No. 894 "On approval of the Methodology for evaluating the effectiveness of a public-private partnership project, a municipal-private partnership project and determining their comparative advantage" XII Order of Rosavtodor dated 08.09.2014 N 1714-r "On approval of the Methodology for structuring an investment project for the possibility of using various investment mechanisms, including public-private partnership mechanisms, Methods for evaluating the effectiveness of investment mechanisms, including public-private partnership mechanisms, Methods for choosing optimal investment mechanisms, including mechanisms public-private partnership, implementation of investment projects"

XIII Methodological recommendations for assessing the effectiveness of tax benefits (tax expenditures) of the subjects of the Russian Federation and municipalities. URL: https://minfin.gov.ru/common/upload/library/2018/04/main/Pismo_ot_28.04.2018_23-05-07_29126_v_subekty_RF.pdf (accessed 08/22/2022). XIV Actual values are given for 2018. XV Resolution of the Government of the Russian Federation dated 04/12/2019 No. 439 (as amended on 04/08/2023) "On approval of the Rules for the formation of a list of tax expenditures of the Russian Federation and assessment of tax expenditures of the Russian Federation" XVI The actual values are given for 2019. XVII Decree of the Government of Moscow dated 04/29/2004 No. 838-RP "On approval of the methodology for calculating the budgetary effectiveness of economic incentives for organizations attracting investments using Stock Market Instruments at the expense of the budget of the city of Moscow" XVIII OECD (2018), Cost-Benefit Analysis and the Environment: Further Developments and Policy Use, OECD Publishing, Paris, https://doi.org/10.1787/9789264085169-en.

References

1. Garattini, L., & van de Vooren, K. (2011). Budget impact analysis in economic evaluation: a proposal for a clearer definition. The European Journal of Health Economics, 12(6), 499-502.

2. Attema, A. E., Brouwer, W. B., & Claxton, K. (2018). Discounting in economic evaluations. Pharmacoeconomics, 36, 745-758.

3. Luo, Z., Ruan, Z., Yao, D., Ung, C. O. L., Lai, Y., & Hu, H. (2021). Budget impact analysis of diabetes drugs: a systematic literature review. Frontiers in Public Health, 9, 765999.

4. Kosov, V.V, Livshic, V.N. and Shahnazarov, A.G. (2000) Methodological recommendations for evaluating the effectiveness of investment projects. Moscow: Ekonomika Publ.

5. Leonidova Yu.A. (2021). Methodological approach to the assessment of budget efficiency in the development of hard-to-reach mineral deposits. Russian Economic Bulletin, 4(4), 249-255.

6. Kosov, M. E. (2017). Evaluation of efficiency of investment projects with state support. Bulletin of Udmurt University. Series Economics and Law, 27(6), 31-40.

7. Kovalevskaya, N. Yu., & Molokova, D. M. (2021). Budget efficiency as the main criterion for selecting projects for integrated development of the territory. “Problems of economics and construction management in the context of environmentally oriented development”: Proceedings of the Seventh International Scientific and Practical Online Conference, 253-259.

8. Aleksanov, D. S., Koshelev, V. M., & Chekmareva, N. V. (2022). On the assessment of the budget efficiency of investment projects. Management Accounting, 7-2, 181-192.

9. Veresova, S. I., & Semeikina, N. M. (2014). Budget effectiveness evaluation of socially important facilities by example of water sports complex in irkutsk. Proceedings of Irkutsk State Technical University, 5(88), 169-177.

10. Popova, E. M. (2019). Analysis of methods on estimation of investment tax incentives effectiveness in russian regi. Global and Regional Research, 1(2), 143-151.

11. Melnikov, R. M. (2007). Assessing the effectiveness of regional investment policy using cost-benefit analysis. Region: Economics and Sociology, 3, 176-193.

12. Sheluntsova, M. A. (2010). Problem questions in the analysis of costs and benefits. Problems of modern economics, 3, 237-240.

13. Kossova, T. V., & Sheluntsova, M. A. (2012). A social discount rate for russia: methodology, appraisal, regional differences. Economics of Contemporary Russia, 3(58), 16-27.

14. Emelyanov, A. M. (2007). Assessment of the value of the social discount rate for Russia and conducting cross-country comparisons. Finance and credit, 46, 63-71.

15. Pobedin, A. A., & Fedulov, D. V. (2016). Economic methods to assess the regulatory impact of normative-legal acts. Management Issues, 4(22), 128-135.

16. Boldesova, A. V. (2021). Economic methods for regulatory impact assessing of legal acts. Economic Bulletin of the Scientific Research Economic Institute of the Ministry of Economy of the Republic of Belarus, 2(284), 24-34.

17. Yagudina, R. I., Kulikov, A. Yu., & Serpik, V. G. (2009). Discounting for pharmacoeconomic evaluation. Farmakoekonomika. Modern Pharmacoeconomics and Pharmacoepidemiology, 4, 10-13.

Peer Review

Peer reviewers' evaluations remain confidential and are not disclosed to the public. Only external reviews, authorized for publication by the article's author(s), are made public. Typically, these final reviews are conducted after the manuscript's revision. Adhering to our double-blind review policy, the reviewer's identity is kept confidential.

The list of publisher reviewers can be found here.

The scientific article submitted for review on the topic: "The discount rate in calculating the budgetary effectiveness of investment projects: approaches and methods" is an actual study aimed at improving the methodological tools for evaluating the budgetary effectiveness of investment projects. The authors of the reviewed article have defined the tasks and methods of research. The significant research interest in the problems of economic assessment of investment projects - approaches, methods, key indicators, etc. - is emphasized. The relevance of the study is substantiated. In particular, the problems of the research field are investigated and identified - paying significant attention to the problem of calculating commercial efficiency (including in the framework of fundamental works on classical finance theory, investment valuation theory, financial management, etc.), which include a detailed description of the construction of cash flows and investments, the choice and justification of the planning horizon and discount rates, and acute insufficiency of work on the problems of budgetary efficiency of investment projects. The work clearly uses the author's approach to the study of the problem posed, which consists in comparing effects and costs (investments), taking into account the fact that both effects and costs are distributed over time, taking into account the concept of the time value of money, which provides for discounting cash flows for the correct comparison of effects and costs (investments). The corresponding scheme is presented. A detailed overview of the available approaches and methods for justifying and constructing discount rates for the purpose of evaluating budget efficiency is presented in text and tabular form. The reviewed article also provides a detailed analysis of regulatory documents and author's methods for determining the discount rate when evaluating deferred effects in calculating budget efficiency. An algorithm for determining the discount rate when evaluating deferred effects in calculating budget efficiency (visualization) is presented. An assessment is given of the choice of methods for constructing the discount rate to assess budget efficiency. The analysis of the existing approaches and methods for constructing and justifying the discount rate in assessing deferred effects in calculating budget efficiency is carried out. Foreign practice is shown in the framework of BIA (Budget Impact Analysis), one of the approaches to analyzing the impact of the use of medical technologies and drugs on the budget (typical for pharmacoeconomics). The article also develops and presents a scientific result - an algorithm for making a decision regarding the justification of the discount rate for the evaluated projects. The algorithm provides for situations of lack of regulatory regulation of this issue and/or lack of regulation of this issue in existing regulatory documents. Scientific works of domestic and foreign researchers, methodological materials on the research problem were used in the preparation of the peer-reviewed scientific article. The article failed to develop a full-fledged scientific discussion, however, this circumstance, in general, does not affect its scientific character, the depth of the research concept and the scientific result. We believe that the reviewed scientific article meets the necessary requirements for this type of scientific work. It is capable of arousing reader interest and is recommended for publication in the desired scientific journal.

Link to this article

You can simply select and copy link from below text field.

|

|