|

MAIN PAGE

> Back to contents

Finance and Management

Reference:

Dorokhov E.V.

Organization of effective management of the stock market on the basis of researching the processes of formation of the value of shares of the issuer companies

// Finance and Management.

2023. ¹ 4.

P. 68-88.

DOI: 10.25136/2409-7802.2023.4.44026 EDN: QQILQM URL: https://en.nbpublish.com/library_read_article.php?id=44026

Organization of effective management of the stock market on the basis of researching the processes of formation of the value of shares of the issuer companies

Dorokhov Evgenii Vladimirovich

ORCID: 0000-0001-7869-4530

PhD in Economics

Postgraduate Student, Lomonosov Moscow State University, Faculty of Economics

119991, Russia, Moscow, Leninskie Gory str., 1, p. 46

|

e.v.dorokhov@mail.ru

|

|

|

Other publications by this author

|

|

|

DOI: 10.25136/2409-7802.2023.4.44026

EDN: QQILQM

Received:

14-09-2023

Published:

18-01-2024

Abstract:

The global economic crisis and the socio-economic consequences of the COVID-19 pandemic have a significant impact on the increase in volatility and risks of manipulation of stock asset quotes. The subject of the study is the organization of management of the investment fund process, taking into account non-market mechanisms for manipulating the value of shares of issuing companies. The purpose of the article is to improve the efficiency of managing the stock process based on the stock market model and procedures for fuzzy valuation of the value of shares of issuing companies within this model. The research methodology is based on the application of methods for analyzing economic phenomena and processes, a systematic approach to studying the development of issuing companies and stock markets. Modeling of fund processes is based on fuzzy logic theory and efficiency theory. The principles of stock market idealization and the principles of stock market management in a manipulated information environment are formulated. A model of the stock market is presented, which includes: an ideal model of the stock market, a model of fundamental disturbing factors and a model of stock market manipulation. Within the framework of the stock market model, an economic and mathematical model for estimating the value of shares of issuing companies has been developed, in which the uncertainty of parameters is described by fuzzy numbers. The novelty of the research lies in the formulated concept of factor psychodynamics (including a list of factors, functions of factors, the strength of factors and inertia of factors), which serves as the basis for the stock market model; as well as in the developed methodology for fuzzy valuation of shares of issuing companies. Participants of the stock market, potential investors, owners and acquirers of companies on the basis of the presented model of the stock market have the opportunity to obtain additional information about ongoing stock processes. Fuzzy procedures for estimating the value of shares of issuer companies make it possible to calculate the value of their shares in accordance with various forecast scenarios for the development of companies.

Keywords:

stock market, stock asset, stock asset manipulation, issuing company, company stock value, stock market model, stock market management, forecast scenario, fuzzy numbers, fuzzy value estimation

This article is automatically translated.

You can find original text of the article here.

Introduction The formation of the value of issuing companies and the mechanisms of stock market management, taking into account current trends in the manipulation of stock information, are of considerable interest as a subject of scientific research. This issue is related to determining the influence of factors of various nature on the share price of individual issuing companies and on the capitalization of the stock market as a whole. Stock market management processes are understood as a set of targeted impacts (informational, financial, economic, political, etc.) of a management entity on stock market participants to stimulate their joint activities aimed at forming the target value of shares of issuing companies (stock assets). The subject of management can be a specific individual or legal entity, individual or collective person — a participant in the stock market. The global economic crisis and the socio–economic consequences of the COVID-19 pandemic have a significant impact on financial and stock markets. The result of this influence is an increase in the volatility of stock asset quotations and an increase in the risks of manipulating them. Such significant speculative movements of stock assets and indices often lead to financial and economic crises. Under the current conditions, the problem of effective management of the stock market based on its assessment, taking into account the fundamental indicators of issuing companies in terms of manipulation of stock assets is relevant. The purpose of the study is to improve the efficiency of investment process management by taking into account non-market mechanisms of manipulation of stock assets. To achieve the stated goal, tasks are solved: 1. Development of a stock market model that includes an ideal stock market model, a model of fundamental disturbing factors and a model of manipulation of the stock market (a model of mythologization of the issuer, a model of distortion of reporting, a model of manipulation of internal and external risks of the issuer). 2. The study of the processes of formation of the value of shares of issuing companies. 3. Development of a fuzzy economic and mathematical model for estimating the value of shares of issuing companies. 4. Valuation of stock assets using the developed fuzzy economic and mathematical model. The research methodology is based on the application of methods of analysis of economic phenomena and processes, a systematic approach to the study of the development of issuing companies and stock markets. The modeling of stock processes is based on the theory of fuzzy logic and the theory of efficiency. The current issue under consideration is being very actively investigated by the scientific community, whose interests lie in the field of analysis of processes in stock markets. Recently, characterized by the development of information technologies based on the use of the Internet space, the information impact on stock market participants has increased significantly. Many scientific papers have been devoted to the study of targeted information impacts on stock market investors and on stock quotes of issuing companies. The article [1] shows the relationship between the tone of news and quotes of the stock index of the oil and gas industry of the Russian Federation. The so–called sentiment analysis based on the tone and significance of the news is proposed, which explains the role of financial news and its impact on the quotes of the Russian stock market. Within the framework of the concept of an "effective market" formulated in [2], the influence of information on the behavior of investors and on the quotations of individual shares traded on the Moscow Stock Exchange is investigated. It is shown that certain information factors stimulate investors to buy certain securities, and for each individual financial instrument there is a unique set of information factors that affect the dynamics of its quotations. Based on the proposed concept of the "information field" of the Russian stock market, the articles [3, 4] investigate the impact of information received from various categories of media on the Russian stock market. At the same time, the Russian stock market is considered as a kind of social space of the information field, an integral part of which are: fields of power — organization of internal and external borrowings; fields of economics — raising funds; investment fields — expansion of investment opportunities. The influence of market news on the activity and behavior of investors, which leads to changes in various market indicators (turnover, number of transactions or share prices), is the subject of a study [5]. It was found that the change in indicators due to the aggregated volume of news during the trading week has a different sensitivity to the dynamics of certain trading indicators. Among the recent scientific papers devoted to financial, economic and political impacts on the stock prices of Russian issuing companies, which are carried out through sanctions, the following can be distinguished. The article [6] analyzes the assessment of the impact of sanctions on the determinants of the value of the 40 most liquid shares of Russian companies. It is shown that, taking into account the fall in oil prices, anti-Russian sanctions led to a statistically significant increase in the risk-free rate and the premium for market risk, as well as a decrease in expected cash flows. According to the discounted cash flow model, all these factors have an impact on changes in the internal value of companies. The financial risks from the sanctions are analyzed in the article [7]. It is noted that the restriction of the Russian Federation on access to global capital markets has a more moderate impact on the level of risks in comparison with other negative factors. It is noted that in the long term, the risk associated with technological sanctions is systemically significant for the stability of the Russian economy. Currently, methods of modeling and forecasting prices on the stock market based on the use of software platforms with elements of neural networks and artificial intelligence are widely used [8-15]. The methods of modeling financial systems and stock asset management based on probabilistic and fuzzy multiple descriptions of uncertain processes are considered in the study [16]. The evaluation of information efficiency and clustering of forecasting volatility in financial markets is carried out in [17-20]. With the help of various modifications of ARCH and GARCH models widely used for financial data analysis, stock market volatility forecasting models have been developed. The article [21] examines the impact of the COVID-19 pandemic on the efficient market hypothesis. In particular, the impact of COVID-19 on the US stock market is assessed and conclusions are drawn about the availability of information to stakeholders and its impact on their profitability and the purchasing potential of securities. The article is devoted to the study of the processes of manipulation of stock asset prices using the example of shares of American high-tech companies Facebook, Google and Nasdaq [22]. It formulates the concept of manipulation of stock assets, as well as presents the signs of manipulation and the method of their identification.

The presented review of the scientific literature demonstrates that quite intensive scientific research is currently underway on topics related to the information, financial, economic and political impact on FR participants, as well as forecasting and valuation of stock assets. However, the problems of stock market management processes based on formal models, especially in terms of its assessment taking into account the fundamental indicators of issuing companies in terms of manipulation of stock assets, remain not fully understood. Principles of idealization and management of the stock market The globalization of the world economy and the exhaustion of the potential for extensive development of many issuing companies contribute to the transition from purely economic goals associated with a structured redistribution of investments from a less efficient stock asset to a more efficient one, to politico–economic, transnational and manipulative goals when choosing investments on global stock exchanges. Such goals reflect the economic interests of new global stock market participants with access to significant information, financial, economic and political resources. The resources available to these stock market participants, together with the methods, methods and technologies they use to influence stock information, allow them to be classified as potential stock manipulators. The main purpose of such stock manipulators is to constantly extract profits based on a purposeful distortion of the risky view of stock assets in comparison with the real picture. The created financial and economic conditions and increased risks of manipulation contribute to the transformation of elements of the stock market system, which leads to certain problems of their current state: · increasing monopolization, media dependence, and transnationalization of stock markets; · decrease in the accuracy of stock valuations and methods of determining the objective price of securities; · an increase in the number of instability factors in the functioning of the stock market; · The opacity of the real institutional structure and the regulatory system of stock markets. Due to the increasing intensity of actions of agents manipulating stock information, whose goals differ from traditional economic behavior (identifying the strongest economic entity for the purpose of its subsequent investment), it becomes necessary to develop principles of idealization of the stock market in order to carry out undistorted manipulation of valuation of stock assets. The main content of the principles of stock market idealization is as follows: · decomposition of stock information into two components — fundamentally economic (idealized) and manipulated; · formulation and justification of requirements for the identification of idealized information; · development of methods for the decomposition of stock information into fundamentally economic and manipulated information at the stages of modeling, valuation and management of stock assets. Idealizing the stock market means interpreting current stock valuations that would be adequate to the real state of fundamental economic factors. The set of participants in stock processes is heterogeneous and can be conditionally divided into two categories: investors–users of stock information and investors–manipulators who exert hidden non-economic influences (informational, political, etc.). The process of managing a stock asset in a manipulated stock environment has a number of features: · accounting and assessment of the current state of a stock asset is possible only on the basis of an integral assessment in the form of its value, and the decomposition of this assessment is associated with the development and constant updating of models of the influence of various factors on the specified integral indicator; · the planning of the impact on the stock asset should be carried out taking into account the possible changing actions of the center for manipulating stock information; · in order to achieve maximum effectiveness of anti-manipulation measures, a prerequisite is the full development and practical application of the methodology of the work of the governing bodies of the stock market. The principles of stock market management, taking into account the specifics of the stock asset management process in a manipulated information environment, are as follows: · the object of management is a publicly available information image of a stock asset; · the subject of management is a specific individual or legal entity, a single or collective person — a participant in the stock market; · information technology capabilities that determine the state of the control object act as control tools; · the methodological apparatus presented in this article, based on the principles (concepts) of idealization and models of the stock market, is accepted as methods and methods of management. The formulated principles of idealization and management of the stock market make it possible to solve the issues of purposeful movement of the information public image of a managed stock asset to achieve a given state. These principles summarize and complement (in a manipulated information environment) various aspects of information impacts on stock market participants presented in scientific papers [1-5]. The stock market model

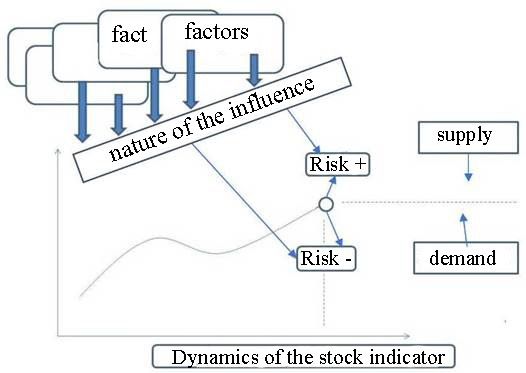

The stock market model includes: an ideal stock market model, a model of fundamental disturbing factors, and a model of stock market manipulation. The stock market manipulation model includes three models: mythologization of the issuing company, distortion of reporting, manipulation of internal and external risks of a stock asset. The ideal stock market model. The essence of an ideal stock market model is the reflection of the entire spectrum of factors actually acting on its participants, as well as key market categories that set the ratio of supply and demand. The ideal model of the stock market represents a mechanism adequate to real financial and economic conditions (processes) for the formation of stock behavioral dynamics of stock market participants, depending on the factors acting on them. Among the factors taken into account by stock market participants in the development and implementation of their own market investment decisions and strategies, it is possible to include: · microeconomic facilities for issuing companies (financial, economic, management excellence, technology excellence and production organization, raw materials, marketing); · market macroeconomic indicators for the stock market (market elasticity, market saturation, level of competition, monetary policy indicators, investment); · regional for the stock market and issuing companies (sectoral, political, systemic, monetary, competitive, investment); · global for the stock market (sectoral, political, systemic, transnational, competitive, investment). The factors acting on stock market participants form their feelings of risk for a potential (in the future) movement of the exchange rate of a stock asset. In accordance with these feelings of risk, they implement their trading decisions. The ratio of supply and demand determines the level of potential movement of the stock asset exchange rate, as well as the very possibility of including a stock market participant in the exchange process (and therefore its impact on this process). The effect of factors and the ratio of supply and demand is different. The general characteristics of the active factors are shown in Fig. 1.

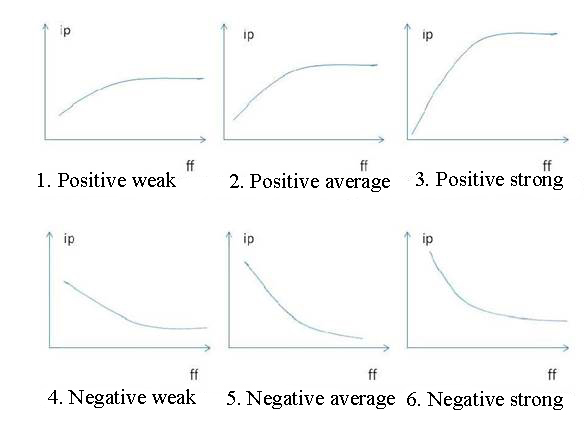

Fig. 1. General characteristics of the action of factors affecting stock market participants Source: developed by the author based on the research materials. The ideal stock market model is based on the concept of factor psychodynamics, which includes a list of factors, factor functions, factor strength and factor inertia. The anthropometric terminology in the name of the concept is explained by the primary role of mass psychological assessments of acting factors by stock market participants in shaping the exchange rate of stock assets. We formalize an ideal stock market model. Let  there be a complete set of factors influencing stock processes. The general characteristics of the factors acting on stock market participants are shown in Fig. 1. Let's define the functions of factors (FF) in the form of a set of functional dependencies reflecting the correspondence between the change in factors from the set F and the investment attractiveness of the ip of a certain stock asset, characterized by this change in the influencing factor. there be a complete set of factors influencing stock processes. The general characteristics of the factors acting on stock market participants are shown in Fig. 1. Let's define the functions of factors (FF) in the form of a set of functional dependencies reflecting the correspondence between the change in factors from the set F and the investment attractiveness of the ip of a certain stock asset, characterized by this change in the influencing factor. The specific functional dependence ff from the set FF can be characterized by direction, force and inertia. Typical types of ff factor dependencies can be the dependencies shown in Fig. 2.

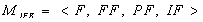

Fig. 2. Typical functional dependencies of the investment attractiveness of a stock asset on changes in influencing factors Source: developed by the author based on the research materials. The characteristic features of the psychological aspects of the behavioral tendencies of stock market participants are the following: · the non-linear nature of the dependence of the investment attractiveness of an ip stock asset on the level of the ff factor; · the presence of a limiting asymptote of an increase/decrease in investment attractiveness with an increase/decrease in the positive/negative influence of the ff factor. In accordance with the concept of factor psychodynamics, the ideal model of the stock market for one participant is represented as a tuple of four elements:  . (1) . (1)

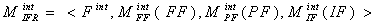

Here F is a set of different factors affecting a stock market participant; FF is the function of factors; PF is the strength of factors; IF is the inertia of factors. The strength of the PF factor reflects the relative increase in investment attractiveness in monetary units under the action of a factor from the set of F in the entire area of investment opportunities of a particular investor. The inertia of the IF factor determines the ability of the dynamics of the factor to influence the investment attractiveness of the stock asset associated with this influence, taking into account the change in time that has elapsed after this change in the factor.

The elements of the presented concept of factor psychodynamics have different effects on the process of forming an ideal stock market model. The scheme of interaction of these elements can be explained as follows. The processes taking place with the assets of the stock market, to one degree or another, become available to all participants of the stock market or part of them. According to the developed concept of factor psychodynamics, the stock information available to investors is clearly structured according to a sequential scheme: factors, functions of factors, strength of factors, inertia of factors. The dependence of the investment attractiveness of a stock asset on the new value of a factor affecting stock market participants creates a new risky idea of the trend in the movement of quotations of the stock asset itself. This dependence is shown in Figure 2 by typical functions of the investment attractiveness of a stock asset from changes in influencing factors. This determines the basis for the formation of a trading decision by a specific investor. However, for the final adoption of a new trading decision, the factor dynamics of a stock asset is not enough. This requires taking into account and coordinating the new risk presentation with changes in the specific stock market and the investment opportunities of the investor himself. The new risk concept, obtained taking into account the investment opportunities of the investor himself and the state of the market as a whole, defines the basis for a new trading solution. The content of this decision is not only the target value of the stock asset value. The investor's trading decision is a new investment volume, the amount of risk and the duration of the investment. It is this vector of indicators that underlies the ideal model of the stock market. New trading decisions made by all investors at each moment of the stock market process determine the range of integral forecasts of the stock market movement. It is under the influence of the implementation of such forecasts through new trading decisions that the real stock process is formed. To move from model (1) to a model for all stock market participants, it is necessary to perform an aggregation operation of the elements of this local model, which includes: synthesis of a variety of influencing factors —  ; construction of an integral (for all assets and investors of the stock market) model of factor functions — ; construction of an integral (for all assets and investors of the stock market) model of factor functions —  ; construction of an integral (for all assets and investors of the stock market) models of the strength of factors — ; construction of an integral (for all assets and investors of the stock market) models of the strength of factors —  ; building an integral (for all assets and stock market investors) model of inertia of factors — ; building an integral (for all assets and stock market investors) model of inertia of factors —  . In its final form, the ideal stock market model is represented as a tuple of four elements: . In its final form, the ideal stock market model is represented as a tuple of four elements:  (2) (2)

The developed ideal model of the stock market differs from the generally accepted view in the presence of components reflecting the risk, investment volume and duration of trading decisions made by all participants in the stock process. A model of fundamental disturbing factors. Modeling of fundamental disturbing factors is carried out taking into account several aspects: the nature of changes in the values of factors (continuous, discrete); the type of function of disturbing factors (increasing, decreasing, stepwise); the nature of the impact on investment attractiveness (functional, blocking, resolving, stepwise). The continuous nature of the change is inherent in factors that are characterized by continuous values (for example, microeconomic indicators — the amount and rate of profit, the amount of profit per share, tax penalties, etc.). The discrete nature of the change is inherent in factors such as the refinancing rate, bank interest, etc. The increase/decrease in the investment attractiveness of a stock asset is associated, for example, with factors such as earnings per share, an increase in the tax burden or administrative expenses. An example of a stepwise type of the function of disturbing factors is the dependence of investment attractiveness on the level of management or technological equipment. The functional nature of the influence is inherent in all disturbing factors of an economic nature, for which certain values of factors correspond to certain values of investment attractiveness, i.e. express a certain functional dependence. The blocking nature of influence can be discussed in relation to such factors, in which a certain threshold of their possible values determines the situation of the impossibility of doing business. On the contrary, the permissive nature of influence determines the conditions for the possibility of doing business. The stepwise nature of the influence is the multi—level preference of the appropriate business conditions. A model of stock market manipulation. The manipulation of the stock market, which arose almost from its inception, is most often carried out in order to make a profit. Initially, the stock market was conceived as an ideal mechanism for increasing the competitiveness of issuing companies at all levels through the natural selection of the most powerful and efficient enterprises leading an open and transparent economic competition for investors' funds. In practice, market information about the issuer is often manipulated, reflected in the reports of firms and auditors, the values of possible risks of the issuer are distorted, as well as the building of a public image and economic mythology. The increased mobility of capital associated with the globalization of the world economy, the advanced development of financial and stock markets in comparison with the real sector allow for an unprecedented concentration of fictitious capital, primarily in the United States and other developed countries. All these factors increase the risks of manipulating market information about the issuing company in order to make a profit. The model of stock market manipulation includes: a model of mythologization of the issuer, a model of distortion of reporting and a model of manipulation of internal and external risks of a stock asset.

The model of mythologization of the issuing company. One of the most common ways of manipulating the stock market is the mythologization of the issuing company, carried out through the use of various mythological technologies. The mythological technologies used by the relevant stock analysts and analytical groups influence investors in the media space. Through these sources of information, "necessary" information leaks and rumors about the status of the issuing company are spread. These informational "interventions" and "stuffing" form the mythological image of one or another issuer necessary for the manipulator. Based on this mythological image, which does not correspond to reality, investors make decisions about buying/selling securities of this issuer at a distorted price. At the same time, the ultimate goal of using mythological technologies is to change the price of the selected issuer by the beneficiary (manipulator) performing the manipulation. The reporting distortion model. Distortions and falsifications in the reporting of companies are used in order to achieve their changed economic and financial image, which would meet only the interests of the subjects engaged in manipulation. To increase/decrease the exchange value of shares of a manipulated issuer, its key economic and financial indicators (earnings, cash earnings, EBITDA, net cash flow (free cash flow), net cash flow from operating activities (free operating cash flow), net cash flow of the company (free cash flow to the firm), net cash flow of shareholders (free cash flow to the equity), etc.). In pursuit of their goals, manipulators can also appropriately distort the balance sheet data, on the basis of which the company's liquidity and financial stability indicators are calculated. A model for manipulating the internal and external risk of a stock asset. The following types of risks of the issuing company that arise in the process of its development are distinguished: strategic, financial, design, environmental, software, technological, operational, personnel, legal, reputational, etc. The internal risks of the issuing company include risks under its control that arise in the company itself in the course of its activities (strategic, operational, financial and reputational risks). External risks include financial risks in terms of country risks and risks from external financial markets, as well as socio-political, legal and reputational risks. The listed external risks practically do not depend on the company's activities and can only be managed in some cases by lobbying procedures. The proposed model of the stock market as part of an ideal model, a model of fundamental disturbing factors and a model of stock market manipulation, as well as the concept of factor psychodynamics, allows us to formalize and structure various aspects of the impact on stock prices described in scientific papers [1-9, 21]. An economic and mathematical model for estimating the value of issuing companies Within the framework of the presented stock market model, an economic and mathematical model for estimating the value of shares of issuing companies is considered. The valuation of the shares of issuing companies takes into account two aspects. On the one hand, these are objective financial and economic indicators of the company related to profit and cash flows generated. On the other hand, the uncertainty and irrationality of internal and external risks are taken into account when forming the market price of a company's shares on the stock market, which are subjective in nature. At the same time, as noted earlier, in order to make a profit, FR participants can carry out various manipulations in their interests that affect the share prices of companies. The internal and external risks of the issuing company are of a forward–looking nature, therefore, to describe them, it is advisable to use procedures that include various ways of modeling the information uncertainty of the forecast parameters characterizing the evolution of the company. For the mathematical description of such uncertain parameters, either fuzzy numbers characterized by membership functions [23] or probability distribution functions are usually used. The application of probability distribution functions in this case is difficult due to the impossibility in practice to obtain statistical estimates of these variables. Therefore, the most appropriate description of these parameters is their representation in the form of fuzzy numbers. Stock market participants generally use investment multipliers to assess the level of risk, calculated as the ratio of the market price of a share to income (profit) or to various cash flows generated by the company per share per year. These investment multipliers have a similar meaning for companies similar to this stock market. The investment multiplier has become the most widespread:  , (3) , (3)

where P is the market price of the stock, E is the profit or cash flows generated by the company for the year per share. The multiplier (3) is usually used to compare companies operating in the same sector of the stock market. The value of the investment multiplier M can be interpreted as follows: stock market participants in the process of forming the market price of a share P are mostly confident that this company will generate income (cash flow) per share for a year of at least the value of E over the next M years. All investment multipliers represent the ratio of the market price of a stock, formed on the basis of the balance of supply and demand by stock market participants (subjective value), to the objective financial and economic characteristics of the company. If we accept the rational hypothesis that the objective financial and economic characteristics of a company in a stable economy mainly determine the market price of its shares, then the considered multipliers for certain economic conditions and taking into account the degree of development of economic relations for each country and branch of the economy should have some optimal values (value intervals). Deviations from these values will mean that the stock in question is not valued by the market according to its fundamental indicators, i.e. in this case, its market price may be manipulated.

Let's consider a fuzzy economic and mathematical model for describing risks in the formation of the value of shares of issuing companies. Within the framework of this model, the uncertainty of forecast parameters (profit or cash flows generated by the company for the year per share, discount rate) is modeled by fuzzy numbers. Such numbers are characterized by their membership function, the domain of definition of which is a universal set containing all the results of observations — predictive parameters, and the domain of values is a single interval [0,1]. The higher the value of the membership function, the higher the degree of membership of an element of a universal set to a fuzzy set is estimated [16]. In accordance with the well–known procedures for calculating net discounted income [24] and according to expression (3), the valuation of the share of the issuing company P in fuzzy numbers can be written as:  , (4) , (4)

. (5) . (5)

In equation (4), the uncertainty of the occurrence of projected cash flow or earnings per share at stage k is expressed in fuzzy numbers ?K, the fuzzy number rk determines the forecast discount rate, N is the number of stages of the issuer's operation, E(M) is an integer part of the multiplier value M. The fuzzy indicators of the issuing company are set on the basis of expert assessments, taking into account its historical financial and economic indicators and current values obtained as a result of statistical observations. For expert assessments of these indicators, it is advisable to use data on factors affecting stock market participants (Fig. 1) and data on the investment attractiveness of a particular issuing company, depending on changes in these factors (Fig. 2). If the investment multiplier M in formula (4) is approximately equal to the values of investment multipliers for companies similar to this stock market, then such an assessment of the value of the issuing company's shares will be considered optimal for the selected scenario of its development. The deviation of the current value of the issuing company's share from its optimal valuation means that the stock in question is not valued by the market according to its fundamental indicators, i.e. in this case, its market price may be manipulated. The economic and mathematical model of the value of issuing companies allows using formulas (4, 5) to carry out a vague assessment of their value in accordance with various variants of forecast scenarios for the development of these companies. The forecast scenarios for the development of issuing companies are set by fuzzy parameters ?K and rk. based on expert analysis. The methods of forecasting and modeling prices on the stock market based on the use of software platforms with elements of neural networks and artificial intelligence in research [10-15], as well as the methods considered in [16-20], are highly specialized and are mainly used by stock analysts and specialized organizations. The presented fuzzy economic and mathematical model for estimating the value of shares of issuing companies includes procedures for calculating net discounted income and a method for comparative evaluation of issuing companies using investment criteria. These techniques are among the most common and easy to apply in practice. The proposed model for estimating the value of shares of issuing companies, in contrast to these methods, makes it possible to assess the inherent degree of risk in the current quotations of shares of issuing companies and the presence of manipulations with their market prices. Fuzzy scenarios are the most adequate way to describe the forecast development of issuing companies in accordance with their historical and current quotes, financial and economic indicators, as well as trends in the development of internal and external economic conditions. Valuation of the shares of Exxon Mobil Corporation based on a model fuzzy scenario of its development Using the example of a model scenario for the development of the largest company in the US oil and gas sector, Exxon Mobil Corporation (Exxon Mobil), and using the developed methodology, estimates of the value of its shares are made. The choice of Exxon Mobil is based on the fact that currently the companies of the American Federal Republic are least exposed to the actions of various kinds of risks related to geopolitics. Historical statistics of the company's financial and economic data show that its average annual profit per share from 2012 to 2022 inclusive is US$ 5.15, and for the first half of 2023 this figure is US$ 4.73 [25].

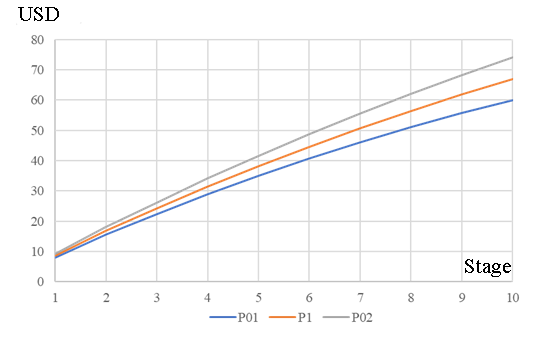

The forecast model scenario for the development of Exxon Mobil assumes that in 2023 annual earnings per share are expected in the range of 8-10 USD (the trend of the first half of 2023 will continue), then in the next 5 years, starting from 2024, the forecast profit is expected to be higher by about 1.5–2% per year. In the following years, annual earnings per share are projected to grow by 1-1.5% per year. It is assumed that the average annual discount rate in the next three years will increase from 5-6% in 2023 to 6-8% in 2025. In the following years, the rate will remain at the level of 6-8% per annum. The forecast for the discount rate is based on the stages of raising the refinancing rate in the United States after quantitative easing, effective since 2008, and inflation expectations. As of July 2023, the refinancing rate in the United States is 5.25–5.50% per annum [26]. The average value of the investment multiplier M of the four largest oil and gas companies in the United States (ExxonMobil, Chevron, ConocoPhillips, EOG Resources) according to the results of 2022 is 10.4 [27]. Therefore, it is advisable to consider the model forecast scenario for the development of Exxon Mobil for the next 10 stages (years), starting from 2023. Based on the generated forecast scenario for the development of Exxon Mobil, the forecast annual earnings per share are modeled using fuzzy triangular numbers (E01, E1, E02) [28]. The values E01, E1, E02 uniquely characterize the membership function of a triangular number, where E01 and E02 are, respectively, the left and right boundaries of the zero confidence level of a fuzzy triangular number, and the value E1 determines the value of its unit confidence. It is assumed that the fuzziness (blurriness) of the range of the interval (E01, E02) of the predicted values of E1 of this parameter increases by 1.5% with each forecasted year. The forecast data of annual earnings per share based on the model forecast scenario for the development of Exxon Mobil are presented in Table 1. Table 1. Forecast data in the form of fuzzy triangular profit numbers per share of Exxon Mobil | Stage | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | | E01 | 8,37 | 8,53 |

8,69 | 8,85 | 9,01 | 9,12 | 9,22 | 9,33 | 9,42 | 9,51 | | E1 | 9,00 | 9,18 | 9,36 | 9,55 | 9,74 | 9,89 | 10,04 | 10,19 | 10,34 | 10,49 | | E02 | 9,63 |

9,83 | 10,04 | 10,25 | 10,48 | 10,66 | 10,85 | 11,05 | 11,26 | 11,48 | Source: compiled by the author based on the forecast scenario for the development of Exxon Mobil The forecast data in Table 1 show that the model scenario under consideration represents a very moderate annual growth in earnings per share of Exxon Mobil after the company's strong economic performance in 2022. (the possibility of recession is taken into account). Table 2 shows the data for calculating the optimal value of Exxon Mobil shares according to formula (4) in accordance with the forecast scenario under consideration. Table 2. Estimated estimates in the form of fuzzy triangular numbers of the optimal value of Exxon Mobil shares | Stage | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 |

10 | | P01 | 7,90 | 15,51 | 22,40 | 28,90 | 35,01 | 40,72 | 46,07 | 51,06 | 55,70 | 60,03 | | P1 | 8,53 | 16,78 | 24,32 | 31,47 | 38,25 | 44,66 | 50,71 |

56,42 | 61,81 | 66,91 | | P02 | 9,16 | 18,06 | 26,26 | 34,10 | 41,59 | 48,73 | 55,53 | 62,03 | 68,24 | 74,18 | Source: formed by the author based on the calculation of the forecast scenario for the development of Exxon Mobil Figure 3 shows a graph of fuzzy values for estimating the optimal value of Exxon Mobil shares, based on the data in Table 2, depending on the values of the forecast stages.

Fig. 3. Dynamics of parameters P01, P1, P02 characterizing fuzzy triangular numbers of estimates of the optimal value of Exxon Mobil shares Source: constructed by the author based on the data in Table 2 Comparison of the closing value of the market price of Exxon Mobil shares at the end of 2022 (USD110.30) [29] with the calculated data obtained in the table. 2 shows a significant deviation in the market value of the stock from its optimal fuzzy valuation. I.e., the stock in question was valued by the market at the end of 2022 not according to its fundamental indicators. Thus, investing in shares of Exxon Mobil at the prices of the end of 2022, when implementing forecast scenarios close to the presented scenario of its development, is a rather risky financial event. Conclusion In order to improve the efficiency of the management of the investment stock process, the principles of idealization and management of the stock market in a manipulated information stock environment are formulated. The concept of factor psychodynamics is also formulated, which includes a list of factors, the functions of factors, the strength of factors and the inertia of factors acting on stock market participants in the process of their investment decision.

Based on the principles of idealization and management of the stock market, as well as the concept of factor psychodynamics, a stock market model has been developed, which includes: an ideal model, a model of fundamental disturbing factors and a model of stock market manipulation (as part of models of mythologization, distortion of reporting and manipulation of internal and external risks of the issuing company). The stock market model allows investors to obtain information about ongoing stock processes, including the effect of fundamental disturbing factors on stock assets and stock market manipulation. Within the framework of the stock market model, an economic and mathematical model for estimating the value of shares of issuing companies is presented, in which the uncertainty of forecast parameters is formalized by fuzzy numbers. The procedures of the economic and mathematical model allow for a vague assessment of the value of shares of companies depending on the expert assignment of their forecast parameters. At the same time, with the help of forecast parameters, you can set various forecast scenarios for the development of the company. Using the example of a model forecast scenario for the development of the largest company in the US oil and gas sector, Exxon Mobil Corporation, calculations of the valuation of its shares are carried out using the developed methodology. Stock market participants, potential investors, owners and purchasers of companies, as well as stock market organizers, based on the presented stock market model, have the opportunity to obtain additional information about ongoing stock processes. The method of fuzzy valuation of the shares of issuing companies makes it possible to calculate the optimal value of these stock assets in accordance with their objective financial and economic indicators. The results of the article can be used as a theoretical basis for further research in the field of stock processes in a manipulated environment.

References

1. Fedorova E.A., Rogov O.Yu., Klyuchnikov V.A. (2018). The impact of news on the MICEX Oil and Gas Industry index: text analysis. Vestnik Moskovskogo universiteta. Economics, 4, 79–99.

2. Charakhchyan K.K., Charakhchyan V.K. (2018). Some aspects of the impact of news information on the stock valuation of issuers. Theory and practice of social development, 1(10). Retrieved from https://doi.org/10.24158/tipor.2018.1.10

3. Podgorny B.B. (2018). Information field of the Russian stock market. The Review of Economy, the Law and Sociology, 1, 205–209.

4. Podgorny, B. (2017). The Russian stock market as a social space: a theoretical basis. Economic Annals XXI, 3–4, 20–24.

5. Kriksciuniene, D., Sakalauskas, V. (2012). The impact of public information on stock market fluctuations. Transformations in Business and Economics, 11(1), 84–99.

6. Galkin A.S., Gurov I.N. Studnikov S.S. (2020). Impact of sanctions on determinants of russian companies share prices. Innovation & Investment, 161–166.

7. Mirkin Ya. M. (2015). Influence of sanctions on financial risks of the Russian economy. Banking services, 8, 17–24.

8. Aldhyani, T., & Alzahrani, A. (2022). Framework for Predicting and Modeling Stock Market Prices Based on Deep Learning Algorithms. MDPI, 11, 1–19. doi:10.3390/electronics11193149

9. Bansal, M., Goyal, A., & Choudhary, A. (2022). Stock market prediction with high accuracy using machine learning techniques. Procedia Computer Science, 247–265. doi.org/10.1016/j.procs.2022.12.028

10. Daradkeh, K. (2022). A hybrid data analytics framework with sentiment convergence and multi-feature fusion for stock trend prediction. MDPI Journal of Electronics, 11, 1–20. doi.org/10.3390/electronics11020250

11. Ghosh, P., Neufeld, A., Sahoo, J. (2023). Forecasting directional movements of stock prices for intraday trading using LSTM and random forests. Financial Research Letters, 1–8. doi.org/10.48550/arXiv.2004.10178

12. Kulshreshtha, S., Vijayalakshmi, A. (2020). An ARIMA-LSTM hybrid model for stock market prediction using live data. Journal of Engineering Science and Technology Review, 13(4), 117-123. doi:10.25103/jestr.134.11

13. Shah, A., Gor, M., Meet, S., Shah, M. (2022). A stock market trading framework based on deep learning architectures. Multimedia Tools and Applications, 81, 14153–14171. doi.org/10.1007/s11042-022-12328-x

14. Vijh, M, Chandola, D., Tikkiwal, V., Kumar, A. (2020). Stock Closing Price Prediction using Machine Learning Techniques. Procedia Computer Science, 167, 599–606. doi:10.1016/j.procs.2020.03.326

15. Zaheer, S., Nadeem, A., Hussain, S., & Algarni, A. A. (2023). Multi Parameter Forecasting for Stock Time Series Data Using LSTM and Deep Learning Model, MDPI-Mathematics, 1–24. doi.org/10.3390/math11030590

16. Nedosekin A. O. (2003). Ôîíäîâûé ìåíåäæìåíò â ðàñïëûâ÷àòûõ óñëîâèÿõ [Stock management in vague conditions]. SPb: Tipografiia Sezam.

17. Bera, A., Higgins, & M. Lee, S. (1992). Interaction between autocorrelation and conditional heteroskedasticity: a random-coefficient approach. Journal of Business & Economic Statistics, 10, 133–142.

18. Nelson, D. (1991). Conditional heteroskedasticity in asset returns: a new approach. Econometrica, 2(59), 347–370. Retrieved from https://doi.org/0012-9682(199103)59:22.0.CO;2-V

19. Sentana, E. (1995). Quadratic ARCH models. Review of Economic Studies, 4(62), 639–661. doi:10.2307/2298081

20. Samuel, Tabot. (2023). Exploring Volatility Clustering Financial Markets and Its Implication. Journal of economic and social development, 10(2). 81–85.

21. Yunhao, Gu. (2023). Efficient Market Hypothesis during COVID-19 Pandemic. AEMPS, 26, 301-307. doi:10.54254/2754-1169/26/20230588

22. Dorokhov, E.V. (2023). Research of Manipulation of Stock Assets on the Example of Shares of American High-Tech Companies of the Nasdaq Stock Exchange. Finance and Management, 1, 50–68. doi:10.25136/2409-7802.2023.1.37548 EDN: WBBLRZ Retrieved from https://en.nbpublish.com/library_read_article.php?id=37548

23. Zadeh, L.A. (1965). Fuzzy sets. Information and Control, 3(8), 338–353.

24. Damodaran, A. (2008). Èíâåñòèöèîííàÿ îöåíêà: èíñòðóìåíòû è ìåòîäû îöåíêè ëþáûõ àêòèâîâ [Investment valuation: tools and methods for valuing any assets]. Moscow: Al'pina Biznes Buks.

25. Official website of Exxon Mobil Corporation (XOM). Financial results. Electronic resource. Retrieved from https://investor.exxonmobil.com/earnings/financial-results

26. Official website of the Federal Reserve System. Federal Reserve Board – The Federal Reserve publishes the FOMC statement. Electronic resource. Retrieved from https://www.federalreserve.gov/newsevents/pressreleases/monetary20230726a.htm

27. Íåôòåãàçîâûå êîìïàíèè ÑØÀ, àêòóàëèçàöèÿ îöåíêè [US oil and gas companies, updating the assessment]. Electronic resource. Retrieved from https://sinara-finance.ru/upload/iblock/755/vh4ja3k9aoqjvrw46on05iprsto7q7ff.pdf

28. Nedosekin, A.O. (2003). Stock management in vague conditions. Saint Petersburg: Sesame Printing House.

29. Official website of the NYSE. Exxon Mobil Corporation XOM. Electronic resource. Retrieved from https://www.nyse.com/quote/XNYS:XOM

First Peer Review

Peer reviewers' evaluations remain confidential and are not disclosed to the public. Only external reviews, authorized for publication by the article's author(s), are made public. Typically, these final reviews are conducted after the manuscript's revision. Adhering to our double-blind review policy, the reviewer's identity is kept confidential.

The list of publisher reviewers can be found here.

The reviewed material is devoted to improving the organization of effective management of the stock market based on the study of the processes of formation of the value of shares of issuing companies. The research methodology is based on the use of the modeling method, a powerful modern tool of scientific knowledge. The authors attribute the relevance of the work to the fact that the problems of stock market management processes based on formal models, especially in terms of its assessment taking into account the fundamental indicators of issuing companies in terms of manipulation of stock assets, remain not fully studied. The scientific novelty of the reviewed study consists in the stock market model proposed by the authors, which includes: an ideal model, a model of fundamental disturbing factors and a model of stock market manipulation (as part of models of mythologization, distortion of reporting and manipulation of internal and external risks of the issuing company), a developed economic and mathematical model for evaluating the value of shares of issuing companies, in particular in which the uncertainty of the forecast parameters is formalized by fuzzy numbers. Structurally, the following sections are highlighted in the article: Introduction, Principles of stock market idealization, Stock market model, Economic and mathematical model of valuation of issuing companies, Conclusion, Bibliography. The article examines the risks of manipulation in the stock market, outlines the principles of idealization of the stock market and its management, presents an ideal model of the stock market, a model of fundamental disturbing factors and a model of stock market manipulation. The text of the article is illustrated with two figures, which present a general description of the action of factors influencing stock market participants, as well as typical functional dependencies of the investment attractiveness of a stock asset on changes in influencing factors. The publication contains five formulas reflecting the models under consideration. The bibliographic list includes 24 sources – scientific publications in Russian and English on the topic of research for the period from 1965 to 2023, as well as online resources. The text contains targeted references to the bibliography, which indicates that there is an appeal to opponents. Of the reserves for improving the presented materials, the following should be noted. Firstly, the presented materials do not formulate the purpose and objectives of the study, nor do they specify the methods of its implementation. Secondly, the issues of organizing effective management of the stock market, included in the title of the article, remained insufficiently covered, since the main focus of the work is on modeling the stock market, respectively, the content of the publication does not fully correspond to its name. Thirdly, the symbolic models presented in the article are not accompanied by any calculations or analysis of modeling results, which casts doubt on the expediency and practical applicability of the results of the work done by the authors, and the final part of the publication does not reflect the economic effect of using models. The reviewed material discusses topical issues, the article may be of interest to readers, contains elements of scientific novelty and practical significance, but, in the opinion of the reviewer, needs to be improved in accordance with the comments made.

Second Peer Review

Peer reviewers' evaluations remain confidential and are not disclosed to the public. Only external reviews, authorized for publication by the article's author(s), are made public. Typically, these final reviews are conducted after the manuscript's revision. Adhering to our double-blind review policy, the reviewer's identity is kept confidential.

The list of publisher reviewers can be found here.

The subject of the study. Based on the headline formed by the author, it seems possible to conclude that the article should be devoted to the organization of effective management of the stock market based on the study of the processes of formation of the value of shares of issuing companies. The content of the article corresponds to the stated topic, but some elements require clarification (this is discussed below in the relevant sections of the review). The research methodology is based on the use of both general scientific methods and special ones. In particular, the author used the analysis and synthesis of data (including numerical ones), as well as modeling. The author has estimated the value of shares of Exxon Mobil Corporation based on a model fuzzy scenario of its development. It is valuable that the author provides a significant part of the obtained results in graphical form. This has a positive effect on the perception of familiarization with the materials submitted for review. The relevance of the study of issues related to the organization of effective management of the stock market is beyond doubt, as it is of great importance for both organizations and the state. But due to the specificity of the topic, the potential readership does not cover the entire pool of organizations and not all representatives of public authorities, but only individual representatives of these groups. The scientific novelty in the materials submitted for review is contained and consists, at least, in a graphical interpretation of theoretical arguments on the action of factors affecting stock market participants, as well as in determining the typical functional dependencies of the investment attractiveness of a stock asset on changes in influencing factors. Style, structure, content. The style of presentation is scientific. The structure of the article is built by the author. In general, the chosen structure allows you to reveal the stated topic. Familiarization with the content of the article allows us to draw a number of conclusions. Firstly, the author has done a lot of work on collecting numerical material. Secondly, the processing of numerical data, by and large, is carried out in a mathematical plane. The author is recommended to draw specific economic conclusions based on the results of the calculations performed in the context of the stated topic. It should also be noted that some theoretical arguments, including those presented graphically, do not find their further development in the practical part of the article. For example, Figure 1 provides a general description of the action of factors affecting stock market participants. However, this author's development does not find further development. It is recommended to eliminate this misunderstanding, as this not only ensures the logical consistency of the article, but also is in the focus of attention of a potential readership. Bibliography. The bibliographic list consists of 29 sources. It is valuable that the author used both domestic and foreign publications. This article is also positively characterized by the fact that electronic resources containing official data are available in the list of references. Appeal to opponents. Despite the generated list of references, there was no scientific discussion in the text. At the same time, it would be very interesting to compare the results of the author of the article with those contained in other scientific papers. Conclusions, the interest of the readership. Taking into account all the above, the article requires a little substantive revision, after which it can be published. Taking into account the specificity of the topic and at the same time the high quality of execution, the article will have an average level of demand from the readership.

Third Peer Review

Peer reviewers' evaluations remain confidential and are not disclosed to the public. Only external reviews, authorized for publication by the article's author(s), are made public. Typically, these final reviews are conducted after the manuscript's revision. Adhering to our double-blind review policy, the reviewer's identity is kept confidential.

The list of publisher reviewers can be found here.

A scientific article submitted for review on the topic: "The organization of effective management of the stock market based on the study of the processes of formation of the value of shares of issuing companies" is devoted to an urgent problem for the modern stock market. The reviewed article is structured and contains an introduction, a methodological section, the main part of the study and a conclusion. The authors of the article set the goal of scientific work, in accordance with it, the tasks to be solved and the scientific results obtained are presented in detail. It should be positively noted that the authors of the article make a certain contribution to the development of the theory of modern economics through the development and operationalization of the concept of an "efficient market". At the same time, the article is also practical in nature, as it, in particular, examines the impact of information on investor behavior and on the quotations of individual shares traded on the Moscow Stock Exchange. The relevance of the study is justified, primarily due to the need to develop and implement effective management of the stock market based on its assessment, taking into account the fundamental indicators of issuing companies in terms of manipulation of stock assets. When preparing a scientific article, the authors used a significant amount of scientific literature and sources. This circumstance, in turn, allowed the authors of the article to develop a full-fledged scientific discussion within its framework and to make an in-depth analysis of some scientific papers on the problem under study. Various positions and approaches of researchers to the problem under consideration are presented, including problems and issues of using software platforms with elements of neural networks and artificial intelligence, information efficiency and clustering of forecasting volatility in financial markets, financial, economic and political impact on stock market participants. The transformation of the elements of the stock market system, leading to certain problems of their current state, the peculiarities of the process of managing a stock asset in a manipulated stock environment, etc. are shown. The authors analyze, in particular, the factors influencing the quotations of the Russian stock market. The article presents the main concepts that represent the categorical apparatus of research. The principles of idealization and management of the stock market, the stock market model, the economic and mathematical model of valuation of issuing companies, the valuation of shares of Excon Mobil Corporation based on a model fuzzy scenario of its development are considered. The article presents visualized material, including graphs, diagrams, and tabular material. The reviewed article is written in understandable language and is able to arouse the reader's interest. The scientific and informational material is presented logically. Thus, based on the above, we believe that the peer-reviewed scientific article "Organization of effective management of the stock market based on the study of the processes of formation of the value of shares of issuing companies" meets all the requirements for this type of scientific work and can be recommended for publication in the desired scientific journal.

Link to this article

You can simply select and copy link from below text field.

|

|