|

MAIN PAGE

> Back to contents

Finance and Management

Reference:

Tikhonova A.V.

Identification of priority mechanisms for tax regulation of individual entrepreneurs by the method of laboratory experiment

// Finance and Management.

2023. № 2.

P. 37-51.

DOI: 10.25136/2409-7802.2023.2.43692 EDN: TZOWFB URL: https://en.nbpublish.com/library_read_article.php?id=43692

Identification of priority mechanisms for tax regulation of individual entrepreneurs by the method of laboratory experiment

Tikhonova Anna Vital'evna

ORCID: 0000-0001-8295-8113

PhD in Economics

Associate Professor, Leading Researcher, Department of Taxes and Tax Administration, Financial University

127083, Russia, Moscow, Verkhnyaya Maslovka str., 15, room 507

|

samozvanka_89@bk.ru

|

|

|

Other publications by this author

|

|

|

DOI: 10.25136/2409-7802.2023.2.43692

EDN: TZOWFB

Received:

28-07-2023

Published:

04-08-2023

Abstract:

One of the national goals of Russia, the implementation of which is scheduled for 2030, is to reduce the level of poverty by half - to 6.6% of the population, or by 9.5 million people. A significant source of poverty reduction is the development of individual entrepreneurial initiatives and the promotion of self-employment. This circumstance determined the purpose of this study - to identify the importance of individual fiscal factors in starting one's own business and developing entrepreneurship. As a methodological basis of the article, a laboratory experiment was used, conducted in a student environment and additionally tested on existing entrepreneurs and self-employed. The paper describes the results of a laboratory experiment, which is aimed at determining the priority mechanisms for tax regulation of individual entrepreneurs. The scientific novelty of the research is presented in two directions. 1. Improved methodological approach to the implementation of laboratory experiments in the tax area. In particular, the objectivity of the results obtained from the data of the student sample is substantiated. 2. Priority areas of tax incentives for entrepreneurial initiatives have been identified. The Government of the Russian Federation, the Ministry of Finance and the Federal Tax Service of the Russian Federation, the Ministry of Economic Development of the Russian Federation, other interested bodies of state power and administration can use the results of the study in determining ways to develop the tax policy of the Russian Federation in terms of improving the taxation of individual entrepreneurship.

Keywords:

experimental economics, laboratory experiment, PIT, tax holidays, tax incentives, entrepreneurship, behavioral economics, the tax burden, business, questionnaire

This article is automatically translated.

You can find original text of the article here.

Introduction Entrepreneurship, according to the European Commission, is the ability of a person to transform a business idea into a real effective economic activity. This process involves creativity, initiative, innovation and risk-taking. Entrepreneurial competencies are understood as abilities along with knowledge in the field of activity. Thus, in general, entrepreneurship should be considered as a state of consciousness that offers a basis for human social and economic activity [1, 2]. Identification of the entrepreneurial abilities of individuals, as well as the factors preventing this, is one of the relevant areas of research in domestic and foreign practice. At the same time, a laboratory experiment is often used as a method of study, which allows to study both behavioral and financial and administrative aspects of entrepreneurship. This gave the justification to conduct their own laboratory experiment. The purpose of the study is to identify the importance of certain fiscal factors in starting your own business and developing entrepreneurship. Research methods The experiment presented in this study is compiled in the form of a conjugate paired profile, which is used by domestic and foreign scientists to conduct a laboratory experiment. More details about the feasibility of using such a questionnaire form and its compliance with the objectives of the experiment are written in the Research Report "Application of the methodology of tax experiments in the educational process to determine the optimal level of tax burden on individuals" (ruk. Tikhonova A.V.) [3]. When forming a sample for the experiment, we used the results of the scientific work of Romanian scientists A. Muntean and I. Gavrila-Paven, who justified the need to implement a database of graduates and obtain information from them about their professional life [4]. The authors' research is the starting point for a long-term project to determine the professional development of graduates, especially in the first years after graduation. For this reason, students of 3-4 courses with professional knowledge were included in the study to identify their entrepreneurial motives, as well as graduates who graduated from university a year or two ago to monitor their professional trajectory in the first years after graduation. The questionnaire for these two groups is located at the link: http://simpoll.ru/run/survey/86dd3c09 . In addition to this, the third group of subjects are active self–employed and individual entrepreneurs who will answer only that part of the questions of the experiment that allows you to assess the priority of tax instruments. The questionnaire is located at the link: http://simpoll.ru/run/survey/d86ebdd5 . Such a selective approach is justified by the fact that the third group are people who have already shown their entrepreneurial abilities in practice, comparing the result of their survey with the answers of the first two groups will allow us to correlate people's expectations from the tax system and the real attitude of business. Participation in a laboratory experiment involves passing four elements of the questionnaire in one stage. The first part of the questionnaire includes 7 closed questions on the entrepreneurial abilities and aspirations of respondents. It allows the subjects to immerse themselves in the atmosphere of "entrepreneurship" and is aimed at obtaining more specific and reliable answers about the role of tax instruments in the development of small businesses. The first question "Would you like to engage in entrepreneurial activity (your business)?" was asked to students to divide the sample into those who have entrepreneurial goals and those who do not. Students and entrepreneurs who answered "yes" were accepted as potential entrepreneurs. The second part is an experimental element of the survey, in which the subjects are immersed in 4 abstract situations. Situations differ from each other in only one feature, this will allow us to assess the role of this feature in making a decision to open an entrepreneurial business. It is important to note that the simplest formulations were used in the situations and questions of the questionnaire, as it is passed by laymen in the field of economics and taxation. The second part of the questionnaire allows you to analyze the entrepreneurial bricolage. In the first situation, the respondent is asked to dive into the following situation: imagine that you are an individual who, while working for hire, has deposited an amount of 3 million rubles to a bank account. You live in Moscow. You don't have your own place (you rent an apartment). You live in a country under sanctions restrictions (correspond to the current economic conditions). Consistently, in 2-4 situations, the following signs changed in turn: the presence of their own housing (since this factor can significantly affect the direction of investing their own funds by individuals) and economic conditions (the presence or absence of sanctions). It should also be noted that the initial investment amount – 3 million rubles – was also not chosen by chance. According to a study conducted in 2021 by Tinkoff Bank [5], 3 million rubles is the most expensive way to buy a ready-made small business (in the field of car repair). Other ways of investing (creating an independent business "from scratch" without employees and with hired labor) in other industries will require significantly less financial resources. On the other hand, according to official information provided by Sberbank of Russia, the average mortgage payment for an apartment in the same period amounted to 1.9 million rubles. [6]. Thus, for those who are inclined to entrepreneurship, even in the absence of their own housing, it will be possible to direct part of the funds (from the proposed 3 million rubles) to their own business. According to the results of each of the four situations, respondents must answer two questions sequentially: 1. Are you ready to open your own business in the current situation (type of activity – any one you choose): A) yes B) no C) I don't know 2. How much of the deferred 3 million rubles are you ready to invest in your business (specify the amount in rubles from 0 to 3000000)? The third part of the laboratory experiment is devoted to identifying the role of tax factors in the development of entrepreneurship. We deliberately placed it in the second half of the experiment, since the respondents at this moment find themselves as immersed as possible in experimental conditions. The questionnaire of the third part included general questions about tax administration, registration and registration as an entrepreneur, tax benefits for small and medium-sized businesses, as well as some other incentive tools. As a basis, a tool developed by American economists, representatives of Cleveland State University Spicer M. W. And Becker L. A. [7], and called the "tax resistance scale" is used. The data for the third part of our study were collected using questionnaires applied to primary sources. The questionnaire, consisting of twenty-one (21) statements, was developed to assess the attitude of taxpayers to taxes. To indicate agreement in principle or disagreement with the proposed statements, a five-point Likert scale was proposed (from 1 with complete disagreement to 5 with complete agreement): 5 points - I completely agree,

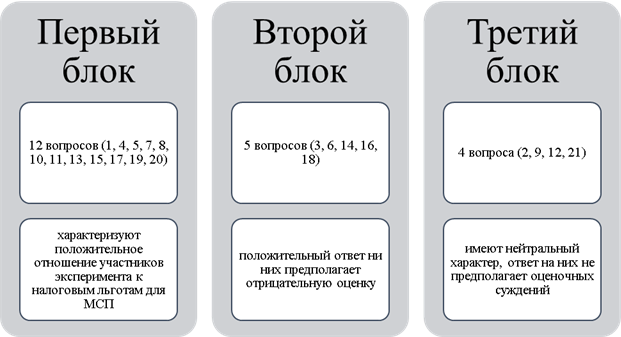

4 points - I agree, 3 points - I find it difficult to answer, 2 points - disagree, 1 point - I completely disagree. The questionnaire consisted of three types of questions (Figure 1).

Source: compiled and finalized by the author on the basis of [8]. Figure 1 – Structure of the third part of the questionnaire of the laboratory experiment The structure of the questionnaire is based on the works of A.P. Vyatkin and has been finalized taking into account a number of author's assumptions in the behavioral motives of taxpayers. The questions of different blocks are mixed together, which is aimed at increasing the veracity of the answers of the subjects to the questions. The presence of such a questionnaire allows you to get an idea of the level of the respondent's tax culture, which is valuable when summarizing the results of the experiment [9]. In addition, a number of questions do not contain a direct reference to taxes, but allows you to assess the effectiveness of tax regulation of small and medium-sized businesses. For example, question 21 of the third part of the questionnaire, "I think it is more difficult for an individual entrepreneur to find large partners," allows us to assess the role of VAT exemption in the interaction of entrepreneurs with large businesses. The last group of questions is presented in the third part of the questionnaire in order to relieve the emotional tension of the participants. It does not involve evaluating "good" or "bad" behavior. For this reason, we have replaced the questions of A.P. Kireenko of the third block with similar ones that are neutral in essence and content, but allow us to identify a number of behavioral motives of taxpayers. After evaluating all the previous survey elements, participants were asked to fill out a short questionnaire with information about them (the fourth part of the experiment). It is necessary to give some explanations on the structural content of the questionnaire. Firstly, in order to assess the role of tax regulators in stimulating entrepreneurship, a preliminary assessment of the presence of entrepreneurial initiatives among respondents is mandatory in principle. In this connection, the first two parts of the questionnaire are aimed at identifying an entrepreneurial initiative as such, and the third – at assessing the role of tax instruments. At the same time, 16 of the 21 questions in the third part of the questionnaire are directly related to taxes, 2 (9 and 13) allow determining the place of taxes among other instruments, 1 (15) determines institutional trust in the state and 2 (2 and 17) reveal the respondents' attitude to registering themselves as a business entity. Results The laboratory experiment was carried out from April 18, 2022 to July 25, 2022. The survey has already been attended by students, as well as former graduates of the Financial University, RGAU-MSHA named after K.A. Timiryazev in Moscow, students of the regions of Russia (Yaroslavl, Vladivostok, Krasnodar). In total - 234 students of 3-4 courses and 34 graduates. 109 individual entrepreneurs and self-employed took part in the experiment. To collect information from the last group, the questionnaire was posted on social networks, on the pages of regional associations of young entrepreneurs of students and graduates, as well as at the entrepreneurial business forum. It is important to note that students of economic (Taxes and taxation, Customs regulation and tax Control, State and Municipal Finance, etc.) and non-economic specialties (Applied Informatics in Economics, Information Systems and Technologies in business Analytics, Agronomy) participated in the experiment. The sample considered is representative of the university's specialties, but not representative at the regional level. This research is a step in creating a database with all Russian university students and their motivation to become entrepreneurs or follow their career in time. The author of the study considered the analysis of students of economic and non-economic profile for their potential in the development of their own business to be a good starting point. The sample structure is presented in more detail in Table 1. Table 1 – Structure of respondents participating in the laboratory experiment | | Current students | Graduates | Sole proprietors and self-employed | Total | | Total | 234 |

34 | 109 | 377 | | By education profile | | 1. Tax or customs | 81 | 8 | 14 | 103 | | 2. Economic (finance, banking, accounting, insurance, audit, etc.) | 94 | 8 | 48 | 150 | | 3. Technical (information systems, applied computer science, engineering, electrical engineering, etc.) | 58 | 16 |

32 | 106 | | 4. Other (sociology, advertising, political science, medicine, art) | 1 | 2 | 15 | 18 | | By age | | 1. Up to 20 years old | 18 | 0 | 6 | 24 | | 2. 20-30 years inclusive | 216 | 33 | 58 | 307 | |

3. 30-40 years inclusive | 0 | 1 | 17 | 18 | | 4. Over 40 years old | 0 | 0 | 28 | 28 | | By having experience of hired work | | 1. I don't have | 87 | 1 | 11 | 99 | | 2. I have up to 1 year | 81 |

4 | 27 | 112 | | 3. I have from 1 to 5 years | 65 | 25 | 38 | 128 | | 4. I have over 5 years | 1 | 4 | 33 | 38 | Source: compiled by the author himself. The laboratory experiment contained in the study aims to determine the role of tax instruments in stimulating entrepreneurial activity (rather than supporting an existing entrepreneurial business). In this regard, the main respondents are the student audience, not entrepreneurs. The validity of the application of the student environment is also presented in more detail in the R&D Report "Application of the methodology of tax experiments in the educational process to determine the optimal level of tax burden on individuals" [3]. Entrepreneurs and the self-employed were added to the category of respondents only in order to compare the opinion of potential entrepreneurs with the current ones, and to assess expectations from tax incentives with their real assessment of the current ones. Thus, the low proportion of entrepreneurs surveyed does not affect the results of the experiment. A detailed analysis of the composition and structure of the sample in various categories allowed us to assess the "truthfulness" of a number of control questions. For example, to correlate the respondent's age, work experience and his status (student, graduate or entrepreneur / self-employed). In general, the analysis showed that the respondents' answers are truthful, and therefore can be subjected to quantitative and qualitative processing. With further data processing by intellectual analysis tools, the main calculations will be carried out on a training sample of current students (234 people), and then additionally checked according to the data of the two remaining samples. It is important to note that the division of respondents according to the profile of education and work experience is thorough (according to the number of respondents), which later will allow us to assess the impact of these factors on the presence of entrepreneurial initiative. The characteristics of the general desire for entrepreneurship are presented in Table 2. Table 2 – Structure of students and graduates by common desire for entrepreneurship

| | Current students | Graduates | Total | | Total | 234 | 34 | 268 | | The desire to do business: | | - there is | 177 | 19 | 196 | | - no | 21 | 11 | 32 | | - doubt |

36 | 4 | 40 | | The desire to do business in the absence of sanctions: | | - there is | 184 | 17 | 201 | | - no | 17 | 11 | 28 | | - doubt | 33 | 6 | 39 | | Readiness for an irregular working day: | | - there is | 118 |

28 | 146 | | - no | 9 | 0 | 9 | | - doubt | 107 | 6 | 113 | | Willingness to study regulatory documents on entrepreneurial activity: | | - there is | 194 | 27 | 221 | | - no | 40 | 7 |

47 | Source: compiled by the author himself. As the data in Table 2 show, in general, most of the respondents have a desire to engage in entrepreneurial business, regardless of the presence or absence of sanctions. At the same time, the latter have a different impact on the behavior of current students and graduates: the former are more willing to do their business under sanctions than in their absence, while the latter lose such an aspiration. Having your own business often, especially in the first years of its existence, leads to irregular working hours, so it was important to assess the respondents' readiness for this. The experiment showed that graduates are more ready for an irregular schedule, while current students, if they have a desire for entrepreneurship, do not always want to work in such a rhythm (only 118 people out of 184). Due to the fact that the main purpose of the experiment was to determine the priority mechanisms of tax regulation of individual entrepreneurs, it is necessary to initially determine the place and significance of these mechanisms in the system of state regulation. To do this, respondents were asked to assess the importance of state support tools for the development of entrepreneurial initiative. The results of such a survey are shown in table 3. Table 3 – Results of evaluation of instruments of state support of entrepreneurial initiative (1 – the most significant, 4 – the most insignificant) | Evaluation | Current students | Graduates | Sole proprietors and self-employed | Total | | | Total | 234 | 34 | 109 | 377 | | | Number of estimates of the rental value of the property | | 1 |

58 | 13 | 23 | 94 | | | 2 | 69 | 6 | 21 | 96 | | | 3 | 60 | 9 | 38 | 107 | | | 4 | 47 | 6 | 27 |

80 | | | Number of tax benefit assessments | | 1 | 75 | 11 | 44 | 130 | | | 2 | 55 | 13 | 29 | 97 | | | 3 | 60 | 6 | 18 | 84 |

| | 4 | 44 | 4 | 18 | 66 | | | Number of ratings of available credits | | 1 | 64 | 8 | 25 | 97 | | | 2 | 74 | 12 | 32 | 118 | | |

3 | 46 | 9 | 25 | 80 | | | 4 | 50 | 5 | 27 | 82 | | | The number of assessments of the possibility of receiving budget money | | 1 | 61 | 9 | 28 | 98 | | | 2 |

49 | 7 | 21 | 77 | | | 3 | 48 | 10 | 22 | 80 | | | 4 | 76 | 8 | 38 | 122 | | Source: compiled by the author himself. If we evaluate the aggregate assessment of the proposed tools for supporting entrepreneurs, the respondents arranged them as follows (in order of decreasing importance): tax benefits, available loans, the cost of renting property, receiving budget money (subsidies, grants and other forms). At the same time, unanimity was achieved only with regard to available loans, to which all three categories of respondents gave the 2nd place in importance. At the same time, current students and entrepreneurs put tax benefits in the first place, and graduates gave greater preference to the preferential cost of renting property. There were no discrepancies in the positions of other support tools. For the subsequent assessment of tax factors affecting the entrepreneurial initiative, the respondents were divided into three categories: 1) entrepreneurs are participants who, in the given situations, were ready to invest all 3 million rubles in their business.; 2) non–entrepreneurs are participants who were not ready to invest any available funds in their business within the framework of the proposed situations; 3) undecided entrepreneurs – respondents who, depending on different conditions, were ready to invest different amounts of financial resources in their own business. In more detail, this distribution by current students is presented in Table 4.

Table 4 – Distribution of entrepreneurs and non-entrepreneurs depending on the given situations by current students | The described situation | Respondent category | Willingness to open your own business | | Businessman | Non - entrepreneur | yes | no | don't know | | | There is no housing, there are sanctions | 9 | 69 | 86 | 101 | 47 | | | No housing, no sanctions | 14 |

32 | 166 | 40 | 28 | | | There is housing, there are sanctions | 19 | 43 | 145 | 48 | 41 | | | There is housing, there are no sanctions | 41 | 15 | 204 | 14 | 16 | | Source: compiled by the author himself.

First of all, we note that the number of undecided current students is significant in all 4 situations (varies from 156 to 188 people or from 67 to 80%, respectively). At the same time, economic sanctions and the general economic situation in the country affect the entrepreneurial initiative to varying degrees, depending on the availability of housing for an individual or his absence. So, if you have your own housing, 17 more people agreed to invest in your business in a favorable economic situation than in its absence. The improvement of housing conditions under the current sanctions general economic conditions influenced the positive desire to invest in 36 respondents, while 44 people had a favorable economic situation. 86 people agreed to invest in entrepreneurship additionally when two factors change (improving housing conditions and the economic situation in the country). A similar distribution was implemented for graduates, its results are presented in Table 5. Table 5 – Distribution of entrepreneurs and non-entrepreneurs depending on the given situations by graduates | The described situation | Respondent category | Willingness to open your own business | | Businessman | Non - entrepreneur | yes | no | don't know | | | There is no housing, there are sanctions | 1 | 15 | 11 | 16 | 7 | |

| No housing, no sanctions | 0 | 11 | 15 | 11 | 8 | | | There is housing, there are sanctions | 5 | 12 | 15 | 11 | 8 | | | There is housing, there are no sanctions | 6 | 6 | 23 | 6 |

5 | | Source: compiled by the author himself. First of all, we note that the number of undecided graduates is significant in all 4 situations, on average it was 20 people out of 34. Other trends and conclusions supported by the data in Table 4.4 are also confirmed by the results of the graduate survey. To select specific mechanisms for stimulating entrepreneurial activity using a pair correlation (between the responses to the desire to open a business and the estimates of the statements of the third part of the questionnaire), the statements with the highest coefficients (at least 0.1 – on the Cheddock scale) were identified. The results are presented in table 6. Table 6 – Correlation evaluation of the parameters of the third part of the questionnaire | | Students | Graduates | Who evaluates (students, graduates) | | Sanctions | Without sanctions | Sanctions | Without sanctions | | In Russia, it is easy for an entrepreneur to find detailed information about what taxes a business (businessman) pays and what there are preferential tax regimes for small businesses (OR for startups) | -0,06 | -0,05 | -0,14 | -0,15 | Graduates | | I know exactly how to register a business and I don't you will need the help of a specialist. | -0,06 | -0,03 | -0,36 | -0,34 | Graduates | | Small business and individual entrepreneurs practically they are not subject to inspections by the tax authorities. | -0,05 | 0,00 | -0,34 | -0,21 | Graduates | | Information about who and how you can contact for clarification of complex tax legislation, it is publicly available and easily located. | 0,00 | 0,04 | -0,13 | -0,14 | Graduates | | I am ready to start a business, provided that within the first 3 years I won't have to pay any taxes. | -0,21 | -0,18 | -0,16 | -0,13 | All | | When choosing a tax regime for my business, I I will ask for advice (help) to friends or parents

(to relatives who already have their own business). | -0,02 | -0,10 | -0,27 | -0,16 | Graduates | | I know what special tax regimes can apply as an individual entrepreneur. | -0,07 | -0,11 | -0,16 | -0,24 | Graduates | | I am ready to give up personal income tax deductions in order to work on special tax regimes. | -0,07 | -0,13 | -0,20 | -0,13 | Graduates | | I am ready to run my own business if I am sure that the state, if necessary, will protect me from fraudsters and bribe takers. | -0,14 | -0,19 | -0,35 | -0,20 | All | | The state knows about me, and I am important to the state. | 0,07 | -0,07 | 0,21 | 0,27 | Graduates | | I am ready for the fact that if something goes wrong in business, I could lose all my possessions. | -0,10 | -0,06 | -0,32 | -0,28 | Graduates | | If, when opening and running a business, I have any questions about the calculation and payment of taxes, I know where and to whom I can ask for help. | -0,06 | -0,09 | -0,63 | -0,50 | Graduates | | If I regularly pay taxes, and the tax authorities they will act as my guarantor for obtaining a loan from a bank, I am happy to take this opportunity. | -0,01 | -0,11 | -0,16 | -0,24 | Graduates | Source: compiled by the author himself.

The correlation matrix was built according to the assessment of the Likert scale of the third part of the questionnaire (where 5 is the most positive assessment, and 1 is the most negative) and answers about the readiness to open a business (1 – yes, 2 – no, 3 – I find it difficult to answer). Thus, the negative sign of correlation indicates the presence of a direct link between the willingness to entrepreneurship and the positive assessment of tax regulators. For the expediency of further use of the results of the experiment at sufficiently low values of the correlation coefficient in Table 6 (the presence of weak and moderate tightness of the connection), the results of the experiment are compared with the educational profiles of students (the coefficients are calculated separately for two groups – economists and non-economists). As a result, the correlation coefficients increased. It was revealed that students of economic training profiles, who generally evaluate tax instruments positively and show greater awareness of the business environment, nevertheless showed great caution when investing their own funds in business (as part of the experimental part of the survey). Students of non-economic profiles highly appreciated the same tools while increasing the volume of investments in business. In addition, non-economists appreciated the role of preferential lending and the possibility of surety of tax authorities on loans, stability of tax legislation, reduction of tax audits, explanatory policy of the Federal Tax Service of Russia, as well as the help of surrounding relatives and friends on tax advice (all at the level of moderate closeness of communication). Conclusions The experiment showed that the tools allocated by respondents (during sanctions and without them, taking into account the results of analysis within educational profiles) to stimulate entrepreneurial initiative are: - tax holidays (exemption from a number of taxes for three years); - state protection against fraud and bribery. Graduates also referred to the support tools that influence entrepreneurial decisions: - informing about the current tax conditions; - number of small business tax audits; - refusal of personal income tax deductions with the convenience of special tax regimes; - tax consulting (according to graduates' estimates, this is the most significant factor, but its role is much more highly appreciated in the sanctions conditions. This indirectly confirms the complexity of the procedures for obtaining tax preferences, as well as the need for further development of the institute of tax consulting); - the possibility of surety of tax authorities on loans. During the experiment, a number of other significant conclusions were obtained. Firstly, respondents have high hopes for credit sources of financing mainly in the absence of sanctions and the economic crisis. Secondly, they are afraid of the short-term nature of a number of tax benefits introduced in pandemic and sanctions restrictions. It turns out, on the one hand, such incentives support existing business structures, on the other, cause distrust among those individuals who are just planning to engage in entrepreneurship. It is important to note that the responses of current entrepreneurs and the self-employed corresponded to the responses of students (correlation coefficient 0.8) and graduates (correlation coefficient 0.87), which allows us to note the importance of the above tools and determine further vectors of development of tools for tax incentives of individual entrepreneurial initiative. In addition, the high degree of correspondence between the results of the survey of students and entrepreneurs justifies the objectivity of the results of laboratory experiments based on the student community, which has been repeatedly questioned, especially in the studies of foreign scientists [10-14].

References

1. Education and training in Europe. 2020 – the contribution of education and training to economic recovery, growth and jobs, European Commission, 2013. Retrieved from https://eur-lex.europa.eu/legal-content/EN/ALL/?uri=CELEX%3A52012XG1219%2802%29

2. European Framework for Key Competences, European Commission, 2006. Retrieved from https://eur-lex.europa.eu/LexUriServ/LexUriServ.do?uri=OJ:L:2006:394:0010:0018:en:PDF

3. Research report "Application of the methodology of tax experiments in the educational process to determine the optimal level of tax burden on individuals." 2021 Financial University. 106 p. Registration number CITIS 221070600060-0

4. Muntean A., & Gavrila-Paven I. (2012) Why Would Young Students Choose Entrepreneurship? Annals of the “Constantin Brâncuşi” University of Târgu Jiu, Economy Series, 4/2012, 180-186.

5. Research: how much does it cost to start a business in Russia. Tinkoff magazine. 28.05.2021. Retrieved from https://journal.tinkoff.ru/news/how-open-small-biz/

6. "Sberbank" called the average size of the down payment on the mortgage. Official website of RBC. 24.03.2021. Retrieved from https://realty.rbc.ru/news/605b1f4f9a79474f1e34ee54

7. Spicer M.W., & Becker L.A. (1980). Fiscal inequity and tax evasion: An experimental approach. National Tax Journal, 33(2), 171-175.

8. Kireenko A.P., Nevzorova E.N., Kireyeva A.F., Filippovich A.S., & Khoroshavina E.S. (2018) Lab experiment to investigate tax compliance: the case of future taxpayers’ behavior in Russia and Belarus. Journal of Tax Reform, 4, 3, 266–290.

9. Noor Hazlina Ahmad, Aizzat Mohd Nasurdin, Hasliza Abdul Halim, Seyedeh Khadijeh Taghizadeh (2014) The Pursuit of Entrepreneurial Initiatives at the “Silver” Age: From the Lens of Malaysian Silver Entrepreneurs. Procedia-Social and Behavioral Sciences, 129, 305-313.

10. Mayburov I.A. (2012) Mass opportunism of taxpayers as a consequence of the lack of tax morality in our society. Taxes and financial law, 9, 179–192.

11. Alm J. (2012) Measuring, explaining, and controlling tax evasion: lessons from theory, experiments, and field studies. International Tax and Public Finance, 19, 1, 54–77.

12. Torgler B. (2002) Speaking to theorists and searching for facts: Tax morale and tax compliance in experiments. Journal of Economic Surveys, 16, 5, 657–683.

13. Torgler B. (2007) Tax compliance and tax morale: a theoretical and empirical analysis. Cheltenham, UK.

14. Hite P.A. (1988) An examination of the impact of subject selection on hypothetical and self-reported taxpayer noncompliance. Journal of Economic Psychology, 9, 445–466.

Peer Review

Peer reviewers' evaluations remain confidential and are not disclosed to the public. Only external reviews, authorized for publication by the article's author(s), are made public. Typically, these final reviews are conducted after the manuscript's revision. Adhering to our double-blind review policy, the reviewer's identity is kept confidential.

The list of publisher reviewers can be found here.

One of the problems of scientific research in economics is the lack of direct connection with the real needs of economic entities. This problem is intended to be solved, among other things, by conducting laboratory experiments, sociological research, gemba, etc. Laboratory experiments open up a wide field in the field of research of small and micro businesses, where a large number of market participants does not always allow to obtain representative results based on individual studies. The development of digital technologies makes it possible to reduce the cost of conducting experiments compared to field research. Determining the priorities of small and micro businesses, identifying the most in-demand instruments of state support, financial services, etc. allows us to form directions for improving state support for the development of small businesses, which is very important for Russia as a country with a high potential for entrepreneurship development in the context of crisis phenomena in the economy. The presented article is devoted to the study of the possibilities of applying the methodology of a laboratory experiment – a survey of students as potential future entrepreneurs – to find ways to improve preferential taxation tools to support business. The title of the article corresponds to the content. The article highlights sections with subheadings, which meets the requirements of the journal "Finance and Management". The article highlights 4 sections: "Introduction", "Research methods", "Results", "Conclusions", which corresponds to the classical requirements for the structure of a scientific article. In the "Introduction", the author substantiates the importance and relevance of the chosen research direction, sets a goal. "The purpose of the study is to identify the importance of certain fiscal factors in starting your own business and developing entrepreneurship." We believe that the formulation of the goal can be improved, including by clarifying the research methodology, replacing the phrase "identify importance" with, for example, "identify relevance". In the section "Research methods", the author describes in detail the method of laboratory experiment with its limitations and possibilities of application and interpretation, as well as the structure of the questionnaire questions. The "Results" section is devoted directly to the description of the obtained results of the laboratory experiment. The substantiation of the significance of the sample of students as respondents of both economic and non-economic specialties increases its quality, with the determination of the possibilities of their comparison, as well as comparison with the results of the experiment on existing entrepreneurs. At the end of the article, the author records the conclusions based on the results of the study. Of the greatest interest is the ranking of state business support tools according to the degree of their demand by future entrepreneurs, as well as confirmation of the importance of the availability of borrowed capital for small and micro businesses. The methodological basis of the research is analysis, synthesis, ascent from the abstract to the concrete, logical and historical method, as well as other general scientific methods. Correlation-regression and structural analysis are used among the specific economic methods. The basis of the methodological base of the study was formed by the method of laboratory experiment. The experiment presented in the study is compiled in the form of a conjugate paired profile, which is used by domestic and foreign scientists to conduct a laboratory experiment. The author actively uses the possibilities of illustrating the research results in the article. The article presents 6 tables and 1 figure. We believe that this helps to increase the level of readers' perception of the results of the author's research. The relevance of the article is beyond doubt. Government support for business in conditions of uncertain economic development, geo-economic turbulence, sanctions pressure and market development restrictions is becoming particularly important, including for small businesses, on the one hand, vulnerable to such effects, and on the other hand, highly adaptive and ready for transformation. The article has practical significance, since the results obtained by the author can be used in the framework of improving the state policy of supporting small businesses. The article does not explicitly present the elements of scientific novelty. Despite the fact that the study itself, its results and interpretation are new, moreover, they open up wide prospects for continuing research and evaluating the dynamics of experimental results, we believe that the author needs to formulate and present the vision of novelty elements in the article in a formalized form. The presentation style is scientific and meets the requirements of the journal. The bibliography is presented by 14 sources: research by foreign and domestic scientists. All sources are referenced in the text of the article. It is necessary to expand the list of sources in accordance with the requirements of the journal. The article contains elements of scientific controversy in terms of "the objectivity of the results of laboratory experiments based on the student community, which has been repeatedly questioned, especially in the research of foreign scientists." At the same time, the justification of these doubts by the opponents of the author is not disclosed in the article. The advantages of the article include, firstly, the relevance and significance of the chosen research area. Secondly, the author's broad outlook and view on the scope of the issues under study. Thirdly, the completeness and detail of the description of the approach to sampling and interpretation of the results, as well as the transparency of the assessment of the degree of representativeness of the sample. The disadvantages include the following. First, there is the need to concretize and substantiate the scientific novelty of the conducted research. Secondly, the insufficient use of sources. Conclusion. The article is devoted to the study of the application of the methodology of a laboratory experiment – a survey of students as potential future entrepreneurs – to find ways to improve the instruments of preferential taxation of business support. The article is able to arouse the interest of a wide readership of the magazine and generally leaves a very favorable impression. It is recommended to accept for publication in the journal "Finance and Management", provided that the comments indicated in the text of this review are eliminated.

Link to this article

You can simply select and copy link from below text field.

|

|