|

MAIN PAGE

> Back to contents

Finance and Management

Reference:

Lyan Y.

Factors for improving the efficiency of mergers and acquisitions

// Finance and Management.

2023. № 2.

P. 27-36.

DOI: 10.25136/2409-7802.2023.2.40780 EDN: TYRLLV URL: https://en.nbpublish.com/library_read_article.php?id=40780

Factors for improving the efficiency of mergers and acquisitions

Lyan Yun'syao

Graduate Student, Lomonosov Moscow State University

121357, Russia, Moscow region, Moscow, Kremenchugskaya str., 11

|

yliyananan@yandex.ru

|

|

|

Other publications by this author

|

|

|

DOI: 10.25136/2409-7802.2023.2.40780

EDN: TYRLLV

Received:

18-05-2023

Published:

04-08-2023

Abstract:

Developed in modern conditions, such a new form of enterprise reorganization as mergers and acquisitions has many positive aspects for business, including savings on resources, market share growth and much more. However, not all mergers and acquisitions have high efficiency, some of them are unsuccessful. The reason for this is a variety of factors affecting the effectiveness of influence and acquisition transactions. This article is devoted to the study of these factors. The author discusses the essence and main characteristics of mergers and acquisitions. The dynamics of the volume and territorial representation of mergers and acquisitions in the world in 2015-2022 are analyzed. On the basis of foreign and domestic experience, the author identified and systematized factors that influence the level of efficiency of mergers and acquisitions and contribute to its improvement. The author identified two groups of factors contributing to the greatest efficiency of mergers and acquisitions: factors of efficiency improvement at the initial stage; factors of efficiency improvement at the stage of implementation and subsequent transaction support. Detailed study and planning of the factors included in these groups will contribute to the most effective implementation of the mergers and acquisitions transaction, as well as increase its efficiency in the future.

Keywords:

mergers, acquisitions of companies, merger deals, takeover deals, merger strategies, acquisition strategies, efficiency, economic efficiency indicators, transaction efficiency, joint ventures

This article is automatically translated.

You can find original text of the article here.

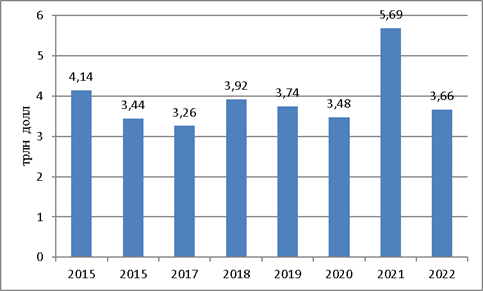

Introduction The desire to extract more benefits and extract it faster is becoming more and more relevant for modern companies. Mergers and acquisitions are used to achieve global success. The reliability of this study is provided by extensive empirical material and a system of its study. The research is based on the works of Russian and foreign economists devoted to evaluating the effectiveness of mergers and acquisitions, as well as factors contributing to the efficiency of such transactions. Research methods: logical and retrospective analysis, content analysis, comparison, description, systematization, comparison, evaluation, analysis and classification, graphical method. The essence and advantages of mergers and acquisitions. Trends in the world. Mergers and acquisitions (M & A transactions from the English Mergers & Acquisitions – mergers and acquisitions) involve several areas: the absorption of a competitor, the absorption of the chain of their business, portfolio strategy (creating a portfolio of companies). The advantages of mergers and acquisitions for companies are the following: growth of market share, strengthening of competitive position; high probability of achieving high performance in a short period of time due to the efforts of both parties; the possibility of buying undervalued assets, new technologies, experience; acquisition of a well-established sales system, the possibility of the company entering new geographical sales markets; reduction of production costs and profit growth, efficiency improvement due to economies of scale [2, 4, 11]. The most common reasons that stimulate the implementation of mergers and acquisitions are: 1. Access to resources – additional funds, intellectual property, new opportunities. 2. Market access – proximity to customers in foreign markets, regulatory approval for work. 3. Risk reduction – elimination of some risks as a result of joint work [11]. Despite the fact that this instrument has been around for a long time, it reached its record level in 2021, the amount of transactions amounted to $ 5.69 trillion (Fig. 1).

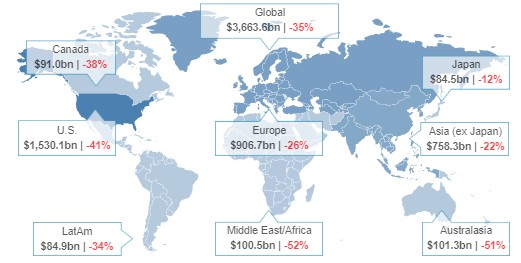

Figure 1 – Dynamics of the volume of mergers and acquisitions in the world in 2015-2022. Source: compiled according to [9, 10]. As you can see, in 2021 there was an unprecedented jump in the volume of mergers and acquisitions from $ 3.48 trillion to $5.69 trillion, that is, by 63.5%. This was facilitated by low interest rates, a sharp increase in the volume of attracting direct investment and the desire of companies to respond to broader changes in their industries. At the same time, the total number of transactions in 2021 increased by 22% to the level of 2020 and reached 59.75 thousand transactions [9]. In 2022, the amount of mergers and acquisitions significantly decreased to $3.66 trillion. The most active sector in the implementation of mergers and acquisitions in 2022, as in 2021, was the high-tech sector, which accounted for $894 billion. In addition, mergers and acquisitions in healthcare in the amount of $ 326 billion should be noted), transactions in the financial market in the amount of $ 284 billion and in real estate in the amount of $ 282 billion [8]. According to the distribution of mergers and acquisitions by region in the world, the largest volume of such transactions in 2022 fell on the United States, where the volume of mergers and acquisitions amounted to $ 1,530.1 billion (Fig. 2).

Figure 2 – Territorial distribution of mergers and acquisitions in 2022 in the world Source: [10]. It is also necessary to mention the European and Asian countries, which account for $906.7 billion and $ 758.3 billion of mergers and acquisitions. Thus, such a tool for the reorganization of companies as mergers and acquisitions was actively developed in 2021 and continues to develop to this day. Certain factors contribute to this. Factors contributing to improving the efficiency of mergers and acquisitions In the generally accepted interpretation, efficiency is an indicator expressing the ratio of the effect with the costs that contributed to obtaining this effect. In translation from a foreign language, efficiency is interpreted as a result achieved through the implementation of any efforts [3, p. 238]. Therefore, factors that have a positive impact on the effectiveness of mergers and acquisitions should include such factors that relate to achieving the goals of these transactions (effect), as well as the efforts (various types of resources) spent on their implementation.

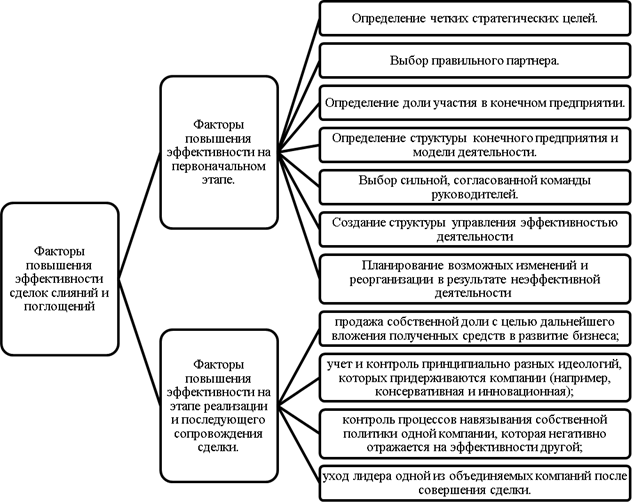

The most common indicators of the economic efficiency of any enterprise, including enterprises formed as a result of mergers and acquisitions, are absolute and relative performance indicators. Firstly, it is an absolute indicator of performance - a positive financial result – profit, and secondly, a relative indicator - profitability of activities [3, p. 239]. Therefore, first of all, the increase in the efficiency of mergers and acquisitions is expressed in the growth of profit and profitability indicators of enterprises formed as a result of such transactions. A review of foreign and domestic sources revealed the following factors to increase the efficiency of mergers and acquisitions, contributing to the growth of profits and profitability of enterprises. We consider it appropriate to divide these factors into two groups in accordance with the stage of the transaction: 1. Factors of increasing the effectiveness of the transaction at the initial stage. 2. Factors of efficiency improvement at the stage of implementation and subsequent transaction support. At the initial stage in the process of planning mergers and acquisitions, the following factors were identified to increase the efficiency of mergers and acquisitions. 1. Definition of clear strategic goals. 2. Choosing the right partner. 3. Determination of the share of participation in the final enterprise. 4. Determination of the structure of the final enterprise and the model of activity. 5. Choosing a strong, coordinated leadership team. 6. Creation of the performance management structure. 7. Planning of possible changes and reorganization as a result of inefficient activities. The following is a more detailed description of these factors. 1. Definition of clear strategic goals. Mergers and acquisitions can be used to achieve very different goals, for example, the same wide range of strategic goals as acquisitions and divestitures of shares, whether it is getting rid of non-core assets or stimulating innovation. Determining the desired end result of a merger and acquisition transaction allows each partner to assess the feasibility and strategic compliance of the activities of the final company with the initial goals [1, 5]. For example, during the merger process, two metal manufacturing companies created a joint venture for the joint construction and operation of an integrated plant. Company A focused on ore processing and the production of iron products, while Company B worked as an ore miner. As a result of the creation of the joint venture, Company A received guaranteed 20-year ore supplies and reduced the risk of ore price volatility. Company B received a guaranteed market and price for its ore, while simultaneously receiving high-quality and inexpensive iron products from Company A. The final venture as a result of the merger transaction was successful largely because both partners had previously identified and agreed on complementary strategic goals. 2. Choosing the right partner. A partner can change the trajectory of the final enterprise, so choosing the ideal partner is especially important after determining the strategy. In some cases, the choice of a suitable partner is determined by his ownership of a critical asset, such as market presence or intellectual capital [1, 6]. For example, if one partner wants to allocate assets for sale, then a financial partner with resources and a successful reputation may be the right choice. In this case, it is also necessary to pay attention to cultural factors, since they play an important role in the further activities of the final company. A clash of cultures does not necessarily have to stop a deal; however, knowledge of its existence indicates the need for more detailed preliminary negotiations and coordination of management and performance monitoring issues. The essential components must be agreed upon before signing the transaction. As practice shows, postponing these decisions will require more time and resources and often leaves both sides feeling that they have been deceived. On the other hand, the mismatch of cultures allows us to adopt the experience of a local company in sales, taking into account the needs and mentality of the population, which contributes to an unambiguous increase in the efficiency of the final enterprise [12]. 3. Determination of the share of participation in the final enterprise. Partners need to conduct an independent assessment at this stage, and then discuss the cost of initial contributions to the joint venture. To improve the efficiency of the implementation of transactions, it is necessary first to agree on a conceptual framework for assessing the contribution that each party will make to the transaction (for example, intellectual property, services provided, market relations) [2, 5]. 4. Determination of the structure of the final enterprise and the model of activity.

Joint venture partners should make decisions about structuring and operating model in advance, and not at the stage of transaction implementation. Part of this should be a plan to achieve the target operating model, specifying the target dates and financial obligations reflected in the partnership agreement. This serves as another check of the costs and expected cost associated with the transaction [5, 7]. 5. Choosing a strong, coordinated leadership team. The main problem faced by the executive team of an enterprise formed as a result of a merger or acquisition is the lack of consistency with the goals of the enterprise. This happens when team members come from the original companies and remain loyal to their organization, not to the newly created one. This is often compounded by the lack of a unified team identity – some joint ventures are formed very quickly, and the team gathers hastily, with virtually no way to determine an effective model of interaction. Potential solutions to this problem can be implemented at the initial stages of creating a joint venture: It is necessary to invest in the selection of a team so that the CEO can choose his direct subordinates from among internal and external candidates [1, 6]. Also in this case, it is necessary to stimulate the success of the final enterprise. For example, to link the remuneration of the executive team with the results of the activities of the final enterprise. In addition, it is necessary to invest in team building, conduct formal change management and team building initiatives, defining a career path. The management team of the final enterprise should be purposeful and have coordinated incentives aimed at achieving the goals of the newly created enterprise. 6. Creating a performance management structure Before launching a joint venture, it is extremely important to define detailed performance indicators and targets, as well as specify how they will be calculated and reported. The initial set of indicators can be determined at the strategic planning stage and can help in choosing a partner. For example, if one potential partner wants to focus on growth, while the other is focused on getting money, this will be reflected in the indicators and can help identify a mismatch of goals from the very beginning [5]. No less important than the definition of the initial set of indicators is the creation of a mechanism for changing indicators in accordance with the change of strategic priorities and changes in the market. In most cases, changes must be agreed and approved by the management board (with the participation of all partners). When determining partnership performance indicators, partners need to agree to monitor and report, as well as link remuneration to net income [6]. 7. Planning of possible changes and reorganizations as a result of inefficient activities. The most important factor distinguishing a joint venture from another merger and acquisition transaction is that the structure of the joint venture is designed to change. Joint ventures have been successfully operating for decades, and in most cases they are developing. For example, a partner sells his share or completely breaks off the relationship, having successfully achieved (or not achieved) strategic goals. In order for the joint venture and partners to respond promptly to changes in the market, the exit strategy must be defined in detail within the framework of the transaction agreements. A reliable exit strategy, as a rule, includes the following components: exit triggers (for example, a target date, a drop in performance indicators below the target level); exit scenarios (for example, transfer or interest rate, forced sale or IPO, winding down of activities); an approach to evaluation (for example, the use of a neutral third party to conduct estimates, appeal to the partner who defaulted) [2, 7]. The most successful partners in an enterprise created during a merger or acquisition will annually assess whether they continue to achieve their strategic goals and continue to make optimal use of invested assets. The second group of efficiency factors at the stage of implementation and subsequent transaction support should include such as [2, 5, 7]: - sale of its own share in order to further invest the funds received in business development; - accounting and control of fundamentally different ideologies that companies adhere to (for example, conservative and innovative); - control of the processes of imposing one company's own policy, which negatively affects the effectiveness of another; - the departure of the leader of one of the merged companies after the transaction. Summarizing the above, in Figure 3 we systematize the identified factors for improving the efficiency of mergers and acquisitions.

Figure 3 - Factors for improving the efficiency of mergers and acquisitions Source: compiled by the author Conclusion

The article discusses the essence and main characteristics of mergers and acquisitions. The dynamics of the volume and territorial representation of mergers and acquisitions in the world in 2015-2022 are analyzed. On the basis of foreign and domestic experience, the factors that influence the level of efficiency of mergers and acquisitions and contribute to its improvement are identified and systematized. The author identified two groups of factors contributing to the greatest efficiency of mergers and acquisitions: factors of efficiency improvement at the initial stage; factors of efficiency improvement at the stage of implementation and subsequent transaction support. Detailed study and planning of the factors included in these groups will contribute to the most effective implementation of the mergers and acquisitions transaction, as well as increase its efficiency in the future.

References

1. Volkova, A.D. (2022). The impact of mergers and acquisitions on the global economy in the XXI century / A.D. Volkova // Modern problems of linguistics and methods of teaching Russian at university and school. No. 37. pp. 756-758.

2. Zakharova, N. D. (2017). The impact of mergers and acquisitions on the value of companies / N. D. Zakharova, V. R. Kim, I. A. Yezangina // Young Scientist. № 2 (136). pp. 424-427.

3. Kriklivets, A. A. (2019). The concept of efficiency in economic science / A. A. Kriklivets, P. S. Sukhomyro // Young scientist. № 2 (240). p. 238-239.

4. Ovchinnikova, L.S. (2019). Features of mergers and acquisitions markets on the example of Russia and China // International trade and trade policy. №3 (19). pp. 83-102.

5. Stepanova, A. K. (2022). Mergers and acquisitions as an effective anti-crisis management tool in modern conditions of development of the Russian economy / A. K. Stepanova // Business strategies. No. 4. pp. 94-97.

6. Temukueva, J. H. (2023). Approaches to the analysis of the effectiveness of mergers and acquisitions: advantages and disadvantages / J. H. Temukueva // Competitiveness in the global world: economics, science, technology. No. 2. pp. 285-287.

7. Toguzova, I. Z. (2022). Analysis of mergers and acquisitions: Russian and world experience / I. Z. Toguzova, Z. G. Dryaeva // Topical issues of the modern economy. No. 2. pp. 186-191.

8. 10 largest deals of 2022 in the world (2023) // RBC. URL: https://www.rbc.ru/economics/08/01/2023/63a2ee429a794701251e8d78 (date of application: 15.04.2023).

9. Broughton, K. (2022). M&A Likely to Remain Strong in 2022 as Covid-19 Looms Over Business Plans // The Wall Street Journal. URL: https://www.wsj.com/articles/m-a-likely-to-remain-strong-in-2022-as-covid-19-looms-over-business-plans-11640255406?mod=article_inline (date of application: 15.04.2023).

10. Investment Banking Scorecard (2022) // Moneybeat. URL http://graphics.wsj.com/investment-banking-scorecard (date of application: 15.04.2023).

11. Ruggeri, Ch. (2022). Joint ventures and partnerships // Deloitte. URL: https://www2.deloitte.com/us/en/pages/mergers-and-acquisitions/articles/ma-joint-ventures-alternative-structure-transactions.html (date of application: 15.04.2023).

12. The importance of organizational culture in M&A (2022) // Deloitte. URL: https://www2.deloitte.com/us/en/pages/mergers-and-acquisitions/articles/importance-of-organizational-culture-in-m-and-a.html (date of application: 15.04.2023)

Peer Review

Peer reviewers' evaluations remain confidential and are not disclosed to the public. Only external reviews, authorized for publication by the article's author(s), are made public. Typically, these final reviews are conducted after the manuscript's revision. Adhering to our double-blind review policy, the reviewer's identity is kept confidential.

The list of publisher reviewers can be found here.

The subject of the research in the reviewed article is the Factors of increasing the efficiency of mergers and acquisitions. The research methodology is based on the generalization of extensive empirical material, analysis of statistical material and the results of studying the works of Russian and foreign economists devoted to evaluating the effectiveness of mergers and acquisitions, using methods such as logical and retrospective analysis, comparison, systematization and classification, data visualization and graphical representation of information. The authors attribute the relevance of the work to the fact that mergers and acquisitions are increasingly used in the modern world to achieve global success. The scientific novelty of the reviewed research, according to the reviewer, consists in identifying and systematizing factors that affect the level of efficiency of mergers and acquisitions in modern conditions. The following sections are structurally highlighted in the article: Introduction; Essence, advantages of mergers and acquisitions. Global trends; Factors contributing to improving the efficiency of mergers and acquisitions; Conclusion, Bibliography. The article analyzes the dynamics of the volume of mergers and acquisitions in the world in 2015-2022, examines the geographical distribution of mergers and acquisitions by region in the world; lists the reasons that stimulate the implementation of mergers and acquisitions. Further, the authors, based on foreign and domestic publications, consider the factors of increasing the efficiency of mergers and acquisitions that contribute to the growth of profits and profitability of enterprises, identify, firstly, the factors of increasing the effectiveness of the transaction at the initial stage (defining clear strategic goals, choosing the right partner, determining the share of participation in the final enterprise, determining the structure of the final enterprise and business models, the choice of a coordinated management team, the creation of an efficiency management structure, planning possible changes and reorganization as a result of inefficient activities), secondly, factors to increase efficiency at the stage of implementation and subsequent transaction support (sale of own shares in order to further invest the funds received in business development; accounting and control of fundamentally different ideologies which companies adhere to; control of the processes of imposing their own policies on one company, which negatively affects the effectiveness of another; the departure of the leader of one of the merged companies after the transaction). The bibliographic list includes 12 sources – publications of domestic and foreign scientists on the topic of the article, to which there are targeted links in the text confirming the existence of an appeal to opponents. A remark should also be made: figure 2 reproduces a previously published infographic – it is hardly worth duplicating this figure in the publication, it is enough to make a link to the original source, because there is no author's contribution in this part of the work. The article corresponds to the direction of the journal "Finance and Management", contains elements of scientific novelty and practical significance, may arouse interest among readers, and may be published after revision in accordance with the comment made.

Link to this article

You can simply select and copy link from below text field.

|

|