MAIN PAGE

> Back to contents

Finance and Management

Reference:

Afanasyeva O.N.

Monetary policy instruments and the achievement of three macroeconomic goals in the USA and Japan

// Finance and Management.

2022. ¹ 2.

P. 1-14.

DOI: 10.25136/2409-7802.2022.2.37788 URL: https://en.nbpublish.com/library_read_article.php?id=37788

Monetary policy instruments and the achievement of three macroeconomic goals in the USA and Japan

Afanasyeva Oxana Nikolaevna

ORCID: 0000-0001-8949-2117

PhD in Economics

Associate Professor, Department of Financial Management, Russian Customs Academy

, Doctoral Student, Department of Theory and Methodology of Public and Municipal Administration, Lomonosov Moscow State University

140015, Russia, Moskovskaya oblast', g. Lyubertsy, ul. Komsomol'skii Prospekt, 4

|

o.afanasyeva@me.com

|

|

|

|

DOI: 10.25136/2409-7802.2022.2.37788

Received:

29-03-2022

Published:

05-04-2022

Abstract:

Currently, the issues of the implementation of monetary policy, the use of its tools to achieve economic growth and other macroeconomic goals are particularly relevant. It is of great importance to identify the results of using various transmission channels in achieving the main macroeconomic targets. The use of monetary policy instruments can have both a stabilizing character and the opposite of what is expected, which must be taken into account when implementing monetary policy.The purpose of the study is to select monetary policy instruments to influence the achievement of such macroeconomic goals as: GDP growth, inflation, unemployment in the United States and Japan. The study develops the principle of "goals-tools" in relation to monetary policy. The possibility of achieving three macroeconomic goals simultaneously is being considered. Â The methodology of the study is represented by the theory of economic policy of Ya. Tinbergen. To assess the possibility of achieving three macroeconomic goals simultaneously (GDP growth, inflation, unemployment rate) in the USA and Japan due to changes in the use of monetary policy instruments, the toolkit of a system of independent equations has been implemented. The overall result of the study is to determine the impact of monetary policy instruments in order to achieve a combination of three macroeconomic goals in the United States and Japan. The analysis of the countries presented showed that each of them has a specific impact of instruments, even with a similar impact, its strength differs in different countries, which must be taken into account when using the same type of monetary policy instruments to achieve macroeconomic goals.

Keywords:

systems of independent equations, monetary policy, key bid, the rate of mandatory reserves, money supply, credits, gross domestic product, inflation, CPI, unemployment rate

This article is automatically translated.

You can find original text of the article here.

Introduction Recently, economists have often discussed which monetary policy instrument is the best to achieve macroeconomic goals, whether the central bank should manipulate the interest rate or use monetary aggregates… The basis of research on the impact of economic policy instruments on its goals is the work of Ya.Tinbergen [15],[16]. Some modern works are devoted to the study of J. Tinbergen's rule. Thus, it is discussed whether monetary policy should "rely on the wind" [9], that is, whether central banks should respond to the increase in financial imbalances, which, for example, are associated with unstable credit expansion; it is confirmed that the Tinbergen rule is alive. For decades, foreign studies have been discussing the impact of monetary policy instruments on achieving certain macroeconomic targets and their impact on credit markets. So, back in 1990, a study was published [13] on the relationship between monetary policy instruments and the rate of unorganized credit, which resulted in the conclusion about the importance of the rate as one of the channels through which a change in the policy instrument is transmitted to real activity. Also, foreign works consider the following issues: translation of monetary policy in the United Kingdom, the impact of monetary policy shocks on financial and macroeconomic variables in the United Kingdom [6], which results in determining the relationship between tightening monetary policy and a decrease in economic activity and CPI, an appreciation of the pound sterling and a reduction in bank credit; macroeconomic stabilization and the effectiveness of monetary policy in conditions of low interest rates [8], which shows that the effective lower bound in the ECB model can lead to a significant deterioration in macroeconomic indicators, which is reflected in negative shifts in economic activity and inflation, and an increase in macroeconomic volatility; the macroeconomic consequences of monetary policy in Japan [12], with the determination in assessing the periods of traditional and non-traditional monetary policy that the restraining shock of monetary policy leads to a decrease in output and inflation rates even with an effective lower bound; the impact of monetary policy on income and wealth inequality in the United States [5], as a result of which it was determined that the expansionary shock of monetary policy does not significantly affect income inequality, increases property inequality through the portfolio channel. Foreign authors conduct research on the application of fiscal and monetary policy: - stabilization at the zero lower bound and its consequences [16], with the conclusion that coordinated monetary and fiscal policies can achieve more than either of them individually, and also that a higher level of well-being is possible if both monetary and fiscal authorities pursue policies during the period after the disappearance of the financial turmoil causing the binding of the lower bound; - measuring the impact of monetary and fiscal policy shocks on domestic investment in China [11], where the authors conclude that, firstly, government spending shocks do not have a significant impact on total investment, and secondly, shocks in the base interest rate on loans have little effect on total investment, while how money supply shocks have a positive and significant effect on aggregate investments, but only during periods of expansion. The result of the study is the conclusion that government spending and monetary policy have limited impact on the increase in domestic investment in China; - optimal monetary policy in the context of the liquidity crisis in the euro area [10] with the result that monetary policy regimes such as full targeting or nominal GDP targeting work well only when they are complemented by optimal countercyclical fiscal policy; Of interest is the study of the monetary policy rule within the framework of an approach based on the theory of chaos management [7], which examines the relationship of Taylor's monetary policy rule with the theory of chaos management; Taylor's rule is presented in the interpretation of dynamic management to stabilize a fixed target of inflation and unemployment. Russian scientists are actively researching the use of monetary policy instruments to achieve macroeconomic goals. "When setting goals for scientific and technological development, support for certain industries, sectors and types of activities, it is important to understand how certain instruments affect the economic structure and goals in different ways" [4], - notes O.S. Sukharev. The scientist also points out that "instruments of monetary and fiscal policy They are institutional in themselves, that is, they represent the rules of lending, providing the economy with money, regulating the work of banks, fixing tax and other budgetary standards. Therefore, rule corrections modify the capabilities of these types of policies..." [3]. Previously, the author conducted research on monetary policy and the impact of its instruments on various economic indicators [1],[2]. In this article, we explore the possibility of simultaneously achieving three macroeconomic goals using a set of monetary policy instruments in the United States and Japan. Research methodology The calculations in the framework of the study were performed using the econometric EViews 10 application software package, which is focused on working with time series.

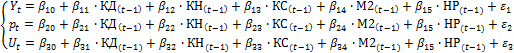

Since monetary policy instruments simultaneously affect macroeconomic indicators, which in turn arise simultaneously, an assessment of systems of equations was carried out to identify the impact of changes in monetary policy instruments on target indicators. Due to the fact that at this stage of the study there was no task to assess the influence of tools on each other, systems of independent equations were evaluated. Each equation includes the same composition of lag values of monetary policy instruments. The composition of the regressors is selected taking into account the economic meaning of the variables and reducing the effect of multicollinearity. The evaluation of a system of independent equations (seemingly unrelated, externally unrelated) was implemented by a conventional MNC. Hypotheses about the statistical significance of the coefficients were tested using the t-test. With this method of evaluation, the significance of the equations as a whole is not tested. The models were tested using the Darbin-Watson criterion for the presence of autocorrelation. To eliminate the impact of possible general trends on the result, models are built for these targets, reduced to a stationary form. The stationarity of the time series implies the absence of a deterministic or stochastic trend in it. Therefore, the series of targets were first tested for the presence of single roots (that is, for non-stationarity) using the extended Dickey-Fuller test. The test allows you to test for the presence of single roots of the levels of the series, the first and second differences. Also, during testing, a constant or a constant and a linear trend can be included. The null hypothesis of the test consists in the presence of a single root (that is, the non-stationarity of the series), therefore, the conclusion about stationarity is made when the significance level is less than 0.1. The check is performed by iteration: first, the levels of the series are tested, if they are non-stationary, a constant is turned on, then a constant and a linear trend. If the series is non-stationary in all such variants, the first differences (absolute increments) are tested in a similar sequence. The table with the results shows the final values of the t-statistics of the Dickey-Fuller test, indicating under what conditions the series is stationary. An attempt to test and transform the values of instruments also turned out to be unsuccessful: if you bring the series of dynamics of instruments to a stationary form, almost all existing connections disappear (at least for those variables where transformations are necessary to bring them to a stationary form). On the one hand, only formally, this could be interpreted as the absence of links between the series, with the exception of general trends. However, on the other hand, such a conclusion contradicts the initial hypotheses and common sense. Also, this result may be due to the length of the time series (the series is long and trends change at different intervals). Therefore, from the point of view of economic sense, the series of dynamics of instruments were left in their natural form. As a result, we have obtained an assessment of the impact of a set of monetary policy instruments on a set of macroeconomic targets. Models of the impact of a set of monetary policy instruments on a set of macroeconomic indicators. Since in our study it is of interest to assess the possibility of achieving several macroeconomic goals simultaneously when changing the values of monetary policy instruments, the most suitable tools for this are systems of independent equations. Monthly data for two countries, the USA and Japan, for the period from January 2000 to October 2020 were used for modeling. The following monetary policy instruments influencing macroeconomic targets were selected for the study: - loans to households in billions of US dollars. (CD); - loans to non-financial organizations in billions of US dollars (KN); - key rate in % (CS); - money supply M2 for the USA in US dollars, M3 for Japan in yen (M2, M3); - the rate of mandatory reserves in % (HP). Macroeconomic targets used in the model: - Nominal GDP in millions of US dollars; - increase in CPI (compared to the same period last year) in %; - the unemployment rate in %. The sources of statistical indicators were data from the websites of the Federal Reserve System, the Bank of Japan, Globaleconomy, Ceicdata, Bis statistics. The type of the estimated systems of equations can be represented as follows (1):  (1) (1)

where  is the GDP, is the GDP,

– consumer price index, – consumer price index,

– the unemployment rate, at time t; – the unemployment rate, at time t;

is a free term of the kth equation; is a free term of the kth equation;

– coefficients for lag values of instruments; – coefficients for lag values of instruments;

– lag values of loans to households; – lag values of loans to households;

– lag values of loans to non-financial organizations; – lag values of loans to non-financial organizations;

– lag values of the key rate; – lag values of the key rate;

– lag values of the money supply M2 for the USA, M3 for Japan – lag values of the money supply M2 for the USA, M3 for Japan

– lag values of the required reserves rate; – lag values of the required reserves rate;

– error of the kth equation. – error of the kth equation.

Since each of the equations on the right side of the equation does not contain targets , the equations are evaluated as externally unrelated. , the equations are evaluated as externally unrelated. To eliminate the impact of general trends, all targets were tested for the presence of single roots, modeling was implemented for indicators with eliminated deterministic or stochastic trends. To determine the type of each of the studied time series, before the start of modeling, the time series of indicators were tested using the extended Dickey-Fuller test, the results are presented in Table 1. Table 1 – Results of the Dickey-Fuller test for the stationarity of time series of target macroeconomic indicators in the USA and Japan. | Indicator | A country | t-statistics | Result | | GDP | USA | -4,287369 (0,0039) | stationary with a linear trend | | Japan | -3,315669 (0,0152) | stationary in the first differences |

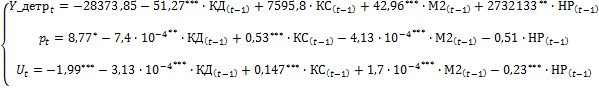

| CPI | USA | -2,901144 (0,0467) | stationary | | Japan | -3,043344 (0,0324) | stationary | | Unemployment rate | USA | -2,993310 (0,0369) | stationary | | Japan | -2,811365 (0,0581) | stationary in the first differences | The values of confidence probability levels are in parentheses Source: compiled by the author The factors were included in the model based on the following principle: the monetary policy instrument remains part of the system of equations if it has a statistically significant effect on at least one of the macroeconomic goals. All monetary policy instruments are taken with a 1-month lag. The factors are selected in the model taking into account minimizing the potential manifestation of the multicollinearity effect. The system of equations for the dependence of targets on indicators of US monetary policy is as follows (2). To eliminate the deterministic trend in the GDP dynamics series, the data are presented after the linear trend is eliminated. In the first equation, all coefficients are statistically significant, except for the coefficient at the key rate. In the second equation – everything except the coefficient at the rate of mandatory reserves. In the third equation, the coefficients for all variables are statistically significant. The first equation is not statistically significant, the second and third are statistically significant according to the Fisher criterion. The values of the adjusted coefficients of determination are 0.057 for the first equation, 0.326 for the second and 0.392 for the third, respectively.

(2) (2)

where *** is the parameter significant at the significance level 1%, ** - 5%, * - 10%; where  is the gross domestic product in the current month with the linear trend eliminated; is the gross domestic product in the current month with the linear trend eliminated;  – consumer price index for the current month; – consumer price index for the current month;

– the unemployment rate in the current month; – the unemployment rate in the current month;

– loans to households in the previous month; – loans to households in the previous month;

– the key rate in the previous month; – the key rate in the previous month;

– money supply M2 in the previous month; – money supply M2 in the previous month;

– the rate of mandatory reserves in the previous month. – the rate of mandatory reserves in the previous month.

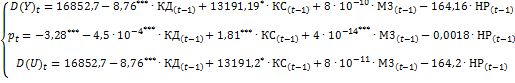

The system of equations for Japan is as follows (3). The GDP and unemployment targets are presented in the form of the first differences (absolute increments) to eliminate stochastic trends in the data series. In the first and third equations, the coefficients for household loans and the key rate are statistically significant, in the second – for all instruments except the required reserves rate. At the same time, according to the Fisher criterion, the first and third equations are not statistically significant The values of the adjusted coefficients of determination are respectively 0.034 for the first equation, 0.212 for the second and 0.034 for the third.  (3) (3)

where *** is the parameter significant at the significance level 1%, ** - 5%, * - 10%; where  is the absolute increase in gross domestic product in the current month; is the absolute increase in gross domestic product in the current month;  – consumer price index for the current month; – consumer price index for the current month;

– the absolute increase in the unemployment rate in the current month; – the absolute increase in the unemployment rate in the current month;

– loans to households in the previous month; – loans to households in the previous month;

– the key rate in the previous month; – the key rate in the previous month;

– M3 money supply in the previous month; – M3 money supply in the previous month;

– the rate of mandatory reserves in the previous month. – the rate of mandatory reserves in the previous month.

Thus, as a result of applying a system of independent equations, within the framework of the obtained models for countries such as the United States and Japan, it is determined which set of monetary policy instruments can simultaneously achieve several macroeconomic goals when changing the values of monetary policy instruments. Statistical verification of the models for each of the two countries is presented in Appendix 1 of Table 1-2. 3. Discussion of the results. Comparative analysis of monetary policy in the USA and Japan. To conduct a comparative analysis of the United States and Japan, based on models of the relationship between monetary policy instruments and macroeconomic goals, we introduce two criteria: impact on the goal and achievement of the goal. In the United States, monetary policy instruments have an impact on two macroeconomic goals combined (inflation and unemployment).. Inflation is collectively influenced by: household loans, the key rate, the M2 money supply, and there are no instruments according to the criterion of "achieving the goal". The unemployment rate is collectively influenced by: loans to households, the key rate, the M2 money supply, the rate of mandatory reserves, and according to the criterion of "achieving the goal" - loans to households and the key rate. In Japan, monetary policy instruments do not have an impact on all three macroeconomic objectives combined. We can only consider the inflation target separately. Inflation is collectively influenced by: household loans, the key rate, the M3 money supply, and according to the criterion of "achieving the goal" - only the M3 money supply. The general results of the models used are reflected in Table 2. Table 2 – Comparative analysis of the impact of monetary policy instruments on macroeconomic goals in the United States and Japan

| Countries/Development goals | GDP growth | Inflation (according to the consumer price index) | Unemployment rate | | USA | | (-) Loans to households (+) Key rate (-) Money supply M2 | (-)Loans to households (+) Key rate (+) Money supply M2 (-) The rate of mandatory reserves | | Japan | | (-) Loans to households (+) Key rate (+) Money supply M3 | | In parentheses (+) means the influence of a monetary policy instrument that increases the macroeconomic target, (-) - reduces the value of the macroeconomic target Source: compiled by the author Thus, as follows from the analysis and table 2 summarizing it, the impact of monetary policy on the main macroeconomic goals varies from country to country. Conclusion The constructed and tested econometric models, represented by systems of independent equations, made it possible to identify monetary policy instruments that affect the achievement of macroeconomic goals by conducting a comparative analysis of the United States and Japan. The study attempts to identify the possibility of simultaneously achieving several macroeconomic goals as a result of the use of monetary policy instruments. Thus, various combinations of monetary policy instruments in the United States have an impact on two macroeconomic goals in combination (inflation and unemployment), according to the criterion of achieving the goal - only on the unemployment rate, in Japan they have an impact on one goal, and according to the criterion of achieving the goal – on inflation. Appendix 1 Table 1. Results of the evaluation of the system of equations, USA |

Evaluation method: Externally unrelated regression | | Sample: February 2000-October 2020 | | Observations included: 249 | | A total of 747 (balanced) observations | | Linear estimates after one-step weighting | | | Ratio | St. error | t-statistics | P | | Dependent variable: GDP is delineated | | Constant | -28373.85 | 171824.9 | -0.165132 | 0.8689 | | Household loans (-1) | -51.26717 |

12.60075 | -4.068582 | 0.0001 | | Key rate(-1) | 7595.760 | 11161.31 | 0.680544 | 0.4964 | | M2(-1) | 42.96399 | 10.64699 | 4.035317 | 0.0001 | | The rate of mandatory reserves (-1) | 2732133. | 1248734. | 2.187922 |

0.0290 | | Dependent variable: inflation rate | | Constant | 1.152642 | 0.601659 | 1.915772 | 0.0558 | | Household loans (-1) | 9.14E-05 | 4.41E-05 | 2.070576 | 0.0387 | | Key rate(-1) | 0.328881 | 0.039082 | 8.415101 | 0.0000 |

| M2(-1) | -9.98E-05 | 3.73E-05 | -2.677652 | 0.0076 | | The rate of mandatory reserves (-1) | 1.883400 | 4.372548 | 0.430733 | 0.6668 | | Dependent variable: unemployment rate | | Constant | 14.48337 | 0.603504 | 23.99882 | 0.0000 | | Household loans (-1) |

0.000437 | 4.43E-05 | 9.866912 | 0.0000 | | Key rate(-1) | -0.811965 | 0.039202 | -20.71230 | 0.0000 | | M2(-1) | -0.000624 | 3.74E-05 | -16.68869 | 0.0000 | | The rate of mandatory reserves (-1) | -69.99691 | 4.385950 |

-15.95935 | 0.0000 | | Residual covariance | 7.83E+10 | | | | Statistics of the equations of the system | | Equation: The dependent variable of GDP is delineated | | Observations: 249 | | R-square | 0.072243 | The average value of the dependent variable | -748.8461 | | The adjusted R-square | 0.057034 | The standard deviation of the dependent variable | 298775.4 |

| The standard error of the equation estimation | 290130.2 | The sum of the squares of the residuals | 2.05E+13 | | Durbin-Watson statistics | 0.353256 | | | Equation: Dependent variable inflation rate | | Observations: 249 | | R-square | 0.336754 | The average value of the dependent variable | 2.133434 | | The adjusted R-square | 0.325881 | The standard deviation of the dependent variable | 1.237341 |

| The standard error of the equation estimation | 1.015915 | The sum of the squares of the residuals | 251.8284 | | Durbin-Watson statistics | 0.189540 | | | Equation: Dependent variable unemployment rate | | Observations: 249 | | R-square | 0.742065 | The average value of the dependent variable | 5.989157 | | The adjusted R-square | 0.737837 | The standard deviation of the dependent variable | 1.990219 |

| The standard error of the equation estimation | 1.019029 | The sum of the squares of the residuals | 253.3744 | | Durbin-Watson statistics | 0.101036 | | Table 2. Results of the evaluation of the system of equations, Japan | Evaluation method: Externally unrelated regression | | Sample: February 2000-October 2020 | | Observations included: 249 | | A total of 747 (balanced) observations | | Linear estimates after one-step weighting | | | Ratio | St. error | t-statistics |

P | | Dependent variable: absolute GDP growth | | Constant | 16852.74 | 17084.17 | 0.986453 | 0.3242 | | Household loans(-1) | -8.760843 | 3.136506 | -2.793185 | 0.0054 | | Key rate(-1) | 13191.19 | 7963.229 | 1.656513 | 0.0980 | |

M3(-1) | 8.21E-12 | 1.03E-11 | 0.799476 | 0.4243 | | The rate of mandatory reserves(-1) | -164.1602 | 218.5197 | -0.751238 | 0.4528 | | Dependent variable: inflation rate | | Constant | -3.277711 | 0.951091 | -3.446267 | 0.0006 | | Household loans(-1) |

-0.000452 | 0.000175 | -2.586751 | 0.0099 | | Key rate(-1) | 1.812814 | 0.443320 | 4.089175 | 0.0000 | | M3(-1) | 4.07E-15 | 5.72E-16 | 7.127607 | 0.0000 | | The rate of mandatory reserves (-1) | -0.001750 | 0.012165 |

-0.143852 | 0.8857 | | Dependent variable: absolute increase in unemployment | | Constant | 16852.74 | 17084.17 | 0.986454 | 0.3242 | | Household loans(-1) | -8.760843 | 3.136506 | -2.793186 | 0.0054 | | Key rate(-1) | 13191.19 | 7963.227 | 1.656514 |

0.0980 | | M3(-1) | 8.21E-12 | 1.03E-11 | 0.799476 | 0.4243 | | The rate of mandatory reserves(-1) | -164.1602 | 218.5196 | -0.751238 | 0.4528 | | Residual covariance | 0.000000 | | | | Statistics of the equations of the system | | Equation: Dependent variable absolute GDP growth | | Observations: 249 |

| R-square | 0.049967 | The average value of the dependent variable | 283.8314 | | The adjusted R-square | 0.034392 | The standard deviation of the dependent variable | 16815.42 | | The standard error of the equation estimation | 16523.73 | The sum of the squares of the residuals | 6.66E+10 | | Durbin-Watson statistics | 0.573558 | | | Equation: Dependent variable: inflation rate | | Observations: 249 |

| R-square | 0.225049 | The average value of the dependent variable | 0.075888 | | The adjusted R-square | 0.212345 | The standard deviation of the dependent variable | 1.036498 | | The standard error of the equation estimation | 0.919892 | The sum of the squares of the residuals | 206.4729 | | Durbin-Watson statistics | 0.184037 | | | Equation: Dependent variable absolute increase in unemployment | | Observations: 249 |

| | | R-square | 0.049967 | The average value of the dependent variable | 283.8314 | | The adjusted R-square | 0.034392 | The standard deviation of the dependent variable | 16815.42 | | The standard error of the equation estimation | 16523.73 | The sum of the squares of the residuals | 6.66E+10 | | Durbin-Watson statistics | 0.573558 |

References

1. Afanasyeva O.N. Influence of monetary base as a tool of monetary policy on inflation in different countries. Business. Education. Law. 2021. ¹2 (55). Ñ. 177-185. https://doi.org/10.25683/V0LBI.2021.55.276

2. Afanasyeva O.N. Instruments of monetary regulation of the Central Bank of Norway: features of influence on interest rates of commercial banks on deposits. Banking. 2019. ¹12. Ñ. 30-33. https://doi.org/10.36992/2075-1915_2019_12_30

3. Sukharev O.S. Institutional corrections in management: theoretical and methodological approach. Upravlenets. 2022. Vol. 13. ¹1. Ñ. 37-48. DOI: 10.29141/2218-5003-2022-13-1-3

4. Sukharev O.S. Formation of Economic Policy on the Basis of Concepts of Technological Structures. Economic Policy and Resource Potential of the Region. Collection of articles of the IV All-Russian Scientific and Practical Conference. Bryansk State Engineering and Technological University. Bryansk, 2021. Ñ. 139-146.

5. Albert J.-F., Peñalver A., Perez-Bernabeu A. The effects of monetary policy on income and wealth inequality in the U.S. Exploring different channels. Structural Change and Economic Dynamics. Volume 55, December 2020, Pages 88-106. https://doi.org/10.1016/j.strueco.2020.07.002

6. Cesa-Bianchi A., Thwaites G., Vicondoa A. Monetary policy transmission in the United Kingdom: A high frequency identification approach. European Economic Review. Volume 123, April 2020, 103375 https://doi.org/10.1016/j.euroecorev.2020.103375

7. Chaparro Guevara G., Escot L. Monetary policy rules: An approach based on the theory of chaos control. Results in Control and Optimization. Volume 4, September 2021, 100038 https://doi.org/10.1016/j.rico.2021.100038

8. Coenen G., Montes-Galdón C., Schmidt S. Macroeconomic stabilisation and monetary policy effectiveness in a low-interest-rate environment. Journal of Economic Dynamics and Control. Volume 132, November 2021, 104205 https://doi.org/10.1016/j.jedc.2021.104205

9. De La Peña R. Should monetary policy lean against the wind in a small-open economy? Revisiting the Tinbergen rule. Latin American Journal of Central Banking. Volume 2, Issue 1, March 2021, 100026 https://doi.org/10.1016/j.latcb.2021.100026

10. Filiani P. Optimal monetary–fiscal policy in the euro area liquidity crisis. Journal of Macroeconomics. Volume 70, December 2021, 103364 https://doi.org/10.1016/j.jmacro.2021.103364

11. Min F., Wen F., Wang X. Measuring the effects of monetary and fiscal policy shocks on domestic investment in China. International Review of Economics & Finance. Volume 77, January 2022, Pages 395-412. https://doi.org/10.1016/j.iref.2021.10.010

12. Nagao R., Kondo Y., Nakazono Y. The macroeconomic effects of monetary policy: Evidence from Japan. Journal of the Japanese and International Economies. Volume 61, September 2021, 101149 https://doi.org/10.1016/j.jjie.2021.101149

13. Shanin W.N. Unorganized loan markets and monetary policy instruments. World Development. Volume 18, Issue 2, February 1990, Pages 325-332. https://doi.org/10.1016/0305-750X(90)90056-4

14. Tinbergen J. (1956). Economic Policy: Principles and Design Nortn-Holland. — 1956. — 276 p.

15. Tinbergen J. (1995). The Duration of Development. Journal of Evolutionary Economics. 1995. — Vol 5 (3). — P. 333–339.

16. Woodford M., Xie Y. Fiscal and monetary stabilization policy at the zero lower bound: Consequences of limited foresight. Journal of Monetary Economics. Volume 125, January 2022, Pages 18-35 https://doi.org/10.1016/j.jmoneco.2021.11.003

Link to this article

You can simply select and copy link from below text field.

|

|

| | |

|