|

MAIN PAGE

> Back to contents

Finance and Management

Reference:

Popova E.M., Mezentseva I.V.

Tax incentives of China’s investments in Zabaykalsky Krai: implementation of behavioral economic models

// Finance and Management.

2020. № 2.

P. 69-84.

DOI: 10.25136/2409-7802.2020.2.33353 URL: https://en.nbpublish.com/library_read_article.php?id=33353

Tax incentives of China’s investments in Zabaykalsky Krai: implementation of behavioral economic models

Popova Evgeniya Mikhailovna

Senior Educator, the department of World Economy, Entrepreneurship and Humanities, Chita Institute (Branch) of Baikal State University

672000, Russia, Zabaikal'skii krai, g. Chita, ul. Anokhina, 56

|

p_e_m_2013@mail.ru

|

|

|

Other publications by this author

|

|

|

Mezentseva Irina Vitalevna

PhD in History

Docent, the department of World Economics, Entrepreneurship and Humanitarian Disciplines, Chita Branch of Baikal State University

672000, Russia, Zabaikal'skii krai, g. Chita, ul. Anokhina, 56

|

iv_mezenseva@mail.ru

|

|

|

Other publications by this author

|

|

|

DOI: 10.25136/2409-7802.2020.2.33353

Received:

02-07-2020

Published:

02-08-2020

Abstract:

Currently, the Russian regions apply a vast array of tools for regulating the investment process, including tax incentives. Active use of tax preferences is dictated by the fact that in the conditions of regional budget deficit, tax incentives, unlike subsidies, do not require direct budget expenditures for stimulating investment activity. However, the world experience demonstrates that tax incentives do not fall under the group of factors that strongly affect investment decisions. For determining the degree of preference of tax incentives in relation to other measures of regional support, a survey was carried among Chinese investors, who implement investment projects on the territory of Zabaykalsky Krai. The survey was based on a method of hierarchical analysis based on the special matrices by filed in by the investors. The acquired results displayed that out of ten measures of state support, tax incentives hold the eighth place. The calculated coefficient of the significance of tax incentives testifies to the low attractiveness of fiscal stimuli for the Chinese investors. The authora attempted to find the reasons for tax incentive not being in demand. The scientific novelty of this work consists in conducting the analysis of regional legislation that regulates the order of granting investment tax incentives based on the concept of behavioral economics. In the course of application of the provisions of behavioral economics, emphasis was made on the subjective aspect of the mechanism of preferential taxation. The reasonableness of considering such peculiarities of human mind as cognitive inertia and relativity is substantiated with regards to arranging the structure of tax incentives that would allow increasing the importance of tax incentives in formation of investment climate on the territory of Zabaykalsky Krai. The authors make recommendations on increasing the attractiveness of tax incentives among Chinese investors based on the concept of reference point and the effect of loss aversion.

Keywords:

tax incentives, tax compliance costs, Chinese investors, region, Zabaikalsky region, hierarchy analysis method, marginal investors, passivity of thinking, relativity of thinking, reference point

This article written in Russian. You can find original text of the article here

.

Введение. Значимость

инвестиций для экономики заключается в том, что перспективы ее развития во

многом определяются теми тенденциями, которые наблюдаются в инвестиционной

сфере сегодня. Инвестиционные процессы в Забайкальском крае протекают

достаточно вяло: за 2012–2019 гг. средний темп прироста инвестиций в основной

капитал составил 4,3%. При этом динамика регионального инвестиционного процесса

характеризуется неравномерностью. Традиционно наибольшая доля инвестиций

приходится на транспорт и связь – 42,2%, в то время как доля капиталовложений в

добычу полезных ископаемых, которая выступает для региона отраслью

специализации, составляет всего 6,3%. Крайне сложная ситуация складывается в

обрабатывающих производствах, где наблюдается серьезный недостаток инвестиций, удельный

вес которых не превышает 1,3%. В экономику края привлекаются иностранные

инвестиции, преимущественно из КНР, однако их отраслевая структура не

способствует развитию производств с высокой добавленной стоимостью. Одним из

сдерживающих факторов привлечения иностранных инвестиций в не сырьевые активы выступает

низкая инвестиционная привлекательность территории. Забайкальский край

относится к числу 10 субъектов РФ с наименее благоприятными условиями для

осуществления инвестиционной деятельности: по данным Национального рейтингового

агентства в 2019 г. край вошел в группу регионов с умеренным уровнем

инвестиционной привлекательности — третий уровень (IC8).

В настоящее время Забайкальский край, как

и другие российские регионы, активно использует налоговые льготы, рассматривая

их в качестве инструмента, повышающего инвестиционную привлекательность

территории [1, 2, 3]. Однако несмотря на то, что налоговые льготы вошли в

широкую практику государственной поддержки как отечественных, так и иностранных

инвестиций, вопрос об их стимулирующем потенциале остается предметом острых

дискуссий в научном сообществе. При этом результаты зарубежных исследований показывают,

что способность налоговых льгот оказывать влияние на инвестиционные решения зависит

не только от величины пониженной эффективной налоговой ставки, но и от размера

издержек налогового согласования [4, 5].

Таким образом, актуальность настоящего

исследования продиктована существованием негативных тенденций в инвестиционной

сфере российских регионов, что требует реализации комплексного и научно

обоснованного подхода к выбору инструментов стимулирования инвестиционной

деятельности. Принцип научной обоснованности подразумевает проведение

стимулирующей политики в соответствии с современными научными концепциями.

Одним из таких направлений экономической теории, получившим признание не только

в российском научном сообществе, но и в зарубежной практике государственного

управления, выступает поведенческая экономика. Разработанные в ней модели и

эффекты позволяют провести анализ региональной законодательной базы по

предоставлению инвестиционных налоговых льгот с позиции учета психологических

феноменов и их влияния на процесс принятия решений [6]. Цель настоящего

исследования – выяснить причины низкой привлекательности налоговых льгот для

китайских инвесторов, реализующих инвестиционные проекты на территории Забайкальского

края, и предложить рекомендации по совершенствованию действующего механизма с

учетом положений поведенческой экономики.

Методология исследования. Одним из

способов оценки востребованности налоговых льгот непосредственными

бенефициарами является проведение опроса. Результаты большинства социологических

опросов свидетельствуют о том, что налоговые льготы не являются решающим

фактором в процессе выбора инвестиционных альтернатив. В 2011 г. ЮНИДО

проводила опрос, который охватывал около 7000 фирм в 19 странах мира.

Результаты опроса показали, что из 12 факторов, оказывающих влияние на

инвестиционные решения, налоговые льготы находятся на 11 месте [7]. В то же

время Л. Джонсон, П. Толедано, И. Штраус отмечают, что степень значимости налогового фактора во

многом зависит от мотивов прямых иностранных инвестиций. Так из четырех

основных типов инвестиций – ресурсоориентированных инвестиций, инвестиций,

нацеленных на поиск рынка сбыта и стратегических активов и инвестиций,

осуществляемых с целью повышения эффективности (снижения издержек) – только

последние, как правило, демонстрируют высокую чувствительность к налоговому

фактору.

Привлекаемые в Забайкальский край

иностранные инвестиции характеризуются сырьевой направленностью. Традиционно в

рамках инвестиционного сотрудничества Китай остается главным партнером, хотя вследствие

неблагоприятного инвестиционного климата инвесторы сталкиваются с рядом

серьезных проблем (в частности, отсутствием инфраструктуры и кадровым дефицитом).

Региональным инвестиционным законодательством предусмотрена государственная

поддержка иностранных инвестиций в различных формах, одной из которых является

предоставление налоговых льгот.

С целью

определения степени приоритетности налоговых льгот при содействии Министерства

международного сотрудничества и внешнеэкономических связей Забайкальского края проводился

опрос среди китайских инвесторов, реализующих на территории края инвестиционные

проекты.

В опросе приняли участие 30 китайских инвесторов, в частности, инвесторы,

реализующие такие проекты как «Создание лесопромышленного комплекса ООО «ЦПК

«Полярная» в северо-восточных районах Забайкальского края» (инвестор — Хэйлунцзянская международная инвестиционная корпорация по

освоению ресурсов «Синбан», стоимость проекта составляет 28 млрд руб.) и

«Освоение Нойон-Тологойского полиметаллического месторождения» (инвестор — Среднеазиатская Серебряная Полиметаллическая группа,

стоимость проекта составляет 8,6 млрд руб.). По данным Министерства

международного сотрудничества и внешнеэкономических связей Забайкальского края

за последние два года объем инвестиций, приходящийся на эти проекты, составил

около 49% от совокупного объема иностранных инвестиций, поступивших в экономику

края. Кроме того, проведенный опрос охватил владельцев корпорации «Си Ян», которая

реализует проект «Освоение Березовского железорудного месторождения», и

представителей государственного лесного управления

района Синьлинь округа Большой Хинган провинции Хэйлунцзян КНР, данное

управление финансирует проект «Комплексное освоение

лесных ресурсов западных районов Забайкальского края».

При проведении опроса использовался метод

анализа иерархий (далее — МАИ). Выбор в пользу данного метода продиктован

такими его преимуществами как обеспечение высокой степени согласованности

экспертных суждений и возможность не просто выстроить иерархию анализируемых

альтернатив, но и определить, насколько одна альтернатива предпочтительнее другой.

Особенность МАИ состоит в применении процедуры попарных сравнений двух

вариантов (факторов) для того, чтобы выяснить их вклад в достижение целей

предшествующего уровня [8, 9]. Заполнение матриц и расчет векторов приоритетов осуществлялся

в соответствии с упрощенным вариантом формирования матрицы, предложенным в

работе В. Д. Ногина, который позволяет избежать несогласованности в суждениях

экспертов и получить совместную матрицу [10].

Упрощенная процедура формирования матрицы

предполагает получение от эксперта данных не обо всех элементах, расположенных

выше (ниже) главной диагонали, а только о некоторых «базисных» элементах, на

основе которых находятся остальные элементы и весовой вектор. При этом особое

внимание уделяется выбору базисного набора элементов, который должен

соответствовать схеме сравнения объектов, обеспечивающей получение наиболее

надежных сведений от эксперта. Один из способов выбора базисного набора

элементов называется схемой сравнения с образцом, которым выступает первый

элемент. Согласно этой схеме, эксперт сравнивает вес первого объекта с весами

всех остальных, и таким образом формируется первая строка матрицы, элементы

которой и будут составлять базовый набор. Для оценки степени важности одной

формы государственной поддержки по сравнению с другой использовалась

специальная балльная шкала, разработанная Т. Саати.

Рисунок 1. Иерархия мер

государственной поддержки иностранных инвестиций Рисунок 1. Иерархия мер

государственной поддержки иностранных инвестиций

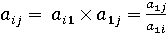

Остальные элементы матрицы можно

однозначно вычислить с помощью равенства:

, (1) , (1)

где aij – элемент i-ой строки и j-ого столбца матрицы.

Вектор приоритетов w вычисляется по формуле:

i

= 1, 2, … n (2) i

= 1, 2, … n (2)

Однако весовой вектор, вычисленный по

данной формуле, не является нормированным, в то время как, согласно МАИ, вектор

приоритетов – это нормированный собственный вектор матрицы. То есть, сумма

весовых коэффициентов рассматриваемых альтернатив в итоге должна составлять

единицу. Для получения нормированного вектора необходимо каждую его компоненту

разделить на их сумму. Выше представлена иерархия, на основе которой были

построены матрицы и рассчитаны векторы приоритетов (рис. 1).

Оценка степени предпочтительности мер

поддержки осуществлялась в два этапа: на первом этапе определили, какие из трех

групп стимулов, а именно фискальные стимулы, организационные меры поддержки и

содействие в обеспечении ресурсной базы представляют для инвестора наибольший

вес. На втором этапе оценивалась степень важности отдельного инструмента по

каждой группе. Для того чтобы получить итоговые оценки весов и составить общий

рейтинг значимости мер государственной поддержки необходимо найти произведение

весовых коэффициентов конкретного инструмента и группы стимулов, к которой он

относится.

Обсуждение

результатов.

По результатам опроса для каждой формы государственной поддержки были определены

коэффициенты значимости. Затем на основе рассчитанных коэффициентов инструменты

стимулирования инвестиционной деятельности были проранжированы по степени

предпочтительности для китайских инвесторов. В итоге составленный рейтинг

позволил определить место налоговых льгот в действующей системе стимулов:

налоговые льготы занимают восьмую позицию (табл. 1).

Таблица

1

Коэффициенты

значимости мер государственной поддержки, предусмотренных региональным

законодательством, для китайских инвесторов

|

№

|

Мера государственной поддержки

|

Значение коэффициента

|

|

1

|

Обеспечение

объектами инженерной и транспортной инфраструктуры

|

0,2561

|

|

2

|

Инвестиции

в основной капитал

|

0,229

|

|

3

|

Решение

кадровой проблемы

|

0,2111

|

|

4

|

Снижение

бюрократических барьеров

|

0,1003

|

|

5

|

Институт

государственного кураторства инвестиционных проектов

|

0,0808

|

|

6

|

Льготы

по аренде имущества, являющегося собственностью субъекта

|

0,0403

|

|

7

|

Субсидирование

затрат

|

0,0302

|

|

8

|

Налоговые

льготы

|

0,0209

|

|

9

|

Создание

Совета инвесторов при профильных министерствах

|

0,0204

|

|

10

|

Предоставление

государственных гарантий

|

0,0109

|

Источник:

составлено авторами по результатам обработки матриц

Как показало исследование, в процессе

принятия решения относительно выбора территории для осуществления прямых

зарубежных инвестиций китайские инвесторы, в первую очередь, обращают внимание

на такие формы государственной поддержки как обеспечение объектами инженерной и

транспортной инфраструктуры, инвестиции в основной капитал и оказание

содействия в решении кадровой проблемы (в частности, предоставление квот на

привлечение иностранной рабочей силы). Такой набор приоритетов во многом

объясняется спецификой современной инвестиционной политики Китая в отношении

зарубежного инвестирования: ключевыми сферами приложения капитала являются

высокие технологии и сырьевые проекты, что связано с поиском резервов для ускорения

экономического роста. Так инвесторы, вкладывающие

свой капитал в экономику Забайкальского края, являются резидентами

северо-восточных провинций КНР, таких как Ляонин и Хейлунцзян, где с 2007 г.

реализуется программа по возрождению старой промышленной базы [11]. Данный факт

объясняет заинтересованность китайских инвесторов в получении доступа к

источникам сырья, потребность в котором увеличивается в связи с активизацией

промышленного развития.

Как инновационные проекты, так и проекты

по приобретению сырьевых активов требуют значительных капитальных вложений и

характеризуются длительными сроками окупаемости [12, 13]. Именно поэтому выше

обозначенные формы государственной поддержки находятся в приоритете у китайских

инвесторов: отсутствие инфраструктуры еще больше удорожает реализацию

капиталоемких проектов, наличие трудовых ресурсов необходимо для своевременной

реализации долгосрочных проектов, а финансирование государством долей в

уставном капитале предприятий создает предпосылки для снижения бюрократических

издержек.

Полученные результаты показывают, что

налоговые льготы не пользуются высоким спросом у китайских инвесторов. Следовательно,

китайские инвесторы, реализующие инвестиционные проекты на территории

Забайкальского края, не являются маржинальными инвесторами. В зарубежной

литературе инвесторов, дополнительные инвестиции которых сопряжены с

предоставлением налоговых льгот, называют маржинальными. Понятие «маржинальный»

подчеркивает высокую значимость налоговых льгот в процессе принятия решений

относительно выбора инвестиционных альтернатив [14]. При формировании

эмпирической базы настоящего исследования, кроме заполнения матриц, инвесторов

просили ответить на вопрос «Осуществили бы Вы инвестиции, изначально зная, что

налоговые льготы не будут предоставлены?» В ста процентах случаев был дан

положительный ответ. Теоретическая ценность и практическая польза выявления

причин низкой привлекательности налоговых льгот обусловила необходимость

проведения дальнейшего исследования, методологическую базу которого составили

теория трансакционных издержек и концепции поведенческой экономики.

Применение

концепций поведенческой экономики для анализа регионального законодательства. Налоговые льготы

представляют собой инструмент реализации государственных программ, направленный

на временное высвобождение у налогоплательщиков финансовых ресурсов для решения

социально-экономических задач, установленных данными программами. Соответственно,

предоставление налоговых льгот сопряжено с выполнением ряда условий и требует

подтверждения права на их получение [15]. Именно поэтому даже при нулевой

налоговой ставке, экономические агенты несут издержки налогового согласования,

связанные с изучением предоставляемого льготного налогового режима и

подготовкой необходимой отчетности. При этом нередко издержки налогового

согласования в случае предоставления льгот оказываются выше тех издержек,

которые несут экономические агенты при их отсутствии.

Последние исследования, инициированные

Всемирным Банком, показали, что издержки следования налоговому законодательству

составляют значительную долю в фактических налоговых обязательствах, в среднем

до 25% [16]. Таким образом, инвестиционная активность зависит не только от

величины законодательно установленной налоговой ставки, но и от издержек,

связанных с организацией и ведением налогового учета. Исследования, проведенные

современным американским экономистом Р. Четти, обеспечивают доказательную базу данному

тезису [17]. Издержки налогового согласования также включают временные и

финансовые затраты, которые приходится нести инвестору, чтобы изучить

действующие нормы налогового законодательства, а главное правильно их понять,

ведь неточная трактовка имеет своим следствием инициирование в отношении

инвестора налоговых проверок и снижение качества планирования

финансово-экономических результатов.

Полагаем, что при проектировании

конструкции налоговых льгот, нацеленных на привлечение инвесторов, необходимо

учитывать ограниченность аналитических способностей человека, а также такие

особенности человеческого восприятия и мышления как принцип относительности и

инертности [18, 19]. Феномен

ограниченности аналитических способностей обусловлен существованием огромного

потока информации, который, как правило, достаточно сложно своевременно

обработать и систематизировать в силу его асимметричного распределения на

рынке. Дополнительные барьеры (культурные, языковые) возникают при трактовке

иностранными инвесторами норм национального или регионального законодательства,

касающихся предоставления налоговых льгот, что неминуемо имеет своим следствием

рост издержек налогового согласования. Инертность

мышления в контексте настоящей статьи подразумевает, что необходимость осуществления

множества переходов-переключений от одного источника информации к другому

вызывает психологический дискомфорт и требует значительных затрат времени и

усилий для обработки полученной информации (издержек налогового согласования)

[20]. Такие переходы-переключения почти неизбежны при изучении условий

льготного налогообложения, если положения, относящиеся к одной льготе,

находятся в разных статьях одного нормативно-правового акта или даже в разных актах.

Согласно законодательству Забайкальского

края, для получения налоговых льгот необходимо наличие статуса приоритетного

инвестиционного проекта. Условия, которым должен соответствовать инвестиционный

проект для получения данного статуса перечислены в законе «О

государственной поддержке иностранных инвестиций в экономику Забайкальского

края и о внесении изменения в Закон Забайкальского края «О государственной

поддержке инвестиционной деятельности в Забайкальском крае». В этом же законе, но в

другой статье прописано, что инвестор при получении налоговых льгот обязан

ежеквартально предоставлять в налоговый орган сведения о фактических суммах

произведенных инвестиций. Краевая

государственная поддержка осуществляется в соответствии с инвестиционным

договором, порядок заключения которого утверждается уже другим

нормативно-правовым актом – Постановлением Правительства Забайкальского края,

где для инвестора предусмотрена обязанность два раза в год предоставлять в

Министерство экономического развития отчетность о динамике инвестиций,

финансово-экономических показателях, сумме уплаченных налогов и полученных

налоговых льгот. Размер

пониженной налоговой ставки, а также порядок и сроки уплаты налогов содержатся в

Налоговом кодексе РФ и отдельных региональных законодательных актах, в

частности, в законе «О налоге на имущество организаций» и законе «Об установлении пониженных ставок налога на прибыль

организаций отдельным категориям налогоплательщиков в части сумм налога на

прибыль организаций, зачисляемых в бюджет Забайкальского края».

Принцип

относительности мышления означает,

что люди, как правило, осуществляют выбор, руководствуясь не абсолютными

категориями, а на основе сравнения одного объекта с другим [21]. Так для

инвестора точкой отсчета, относительно которой он будет определять ценность

налоговой льготы, является законодательно установленная ставка: по налогу на

прибыль организаций она составляет 17% (в части зачисления в региональный

бюджет), по налогу на имущество организаций – 2,2%. При прочих равных условиях

льготные ставки 13,5% и 1,65% по соответствующим налогам в сравнении с общей

налоговой ставкой не способны оказать значительное влияние на инвестиционные

решения.

Кроме того, принцип относительности мышления

предполагает то, что человек всегда оценивает те или иные вещи и явления с

учетом их окружения и связи с другими вещами или явлениями [22]. Учитывая, что

при оценке налоговых льгот в качестве меры государственной поддержки инвесторы

обращают внимание не только на финансовые выгоды, но и на издержки налогового

согласования, полагаем, что законодательство Забайкальского края, регулирующее

порядок предоставления льготного налогового режима для иностранных инвесторов,

создает значительные издержки налогового согласования. Поскольку для того чтобы

сформировать более или менее полное представление о налоговых льготах,

инвестору придется обратиться как минимум к пяти нормативно-правовым актам,

которые обязывают его собрать внушительный перечень документов для

подтверждения права на получение налоговых льгот и впоследствии шесть раз в год

предоставлять отчетность в два ведомства. В итоге к несущественным финансовым

выгодам добавляются трансакционные издержки, сопровождающие получение налоговых

льгот, которые еще большие снижают их привлекательность для инвесторов.

Эффект

«якоря» означает, что человеку

свойственно зацикливаться на своем первоначальном выборе (прошлом опыте), а

затем принимать решения, согласующиеся с этим выбором [23]. Зачастую такой подход служит своего рода

защитой от осознания того, что было принято ошибочное решение. С принципом

относительности человеческого мышления тесно связана концепция о существовании точки отсчета (reference point), на которую человек ориентируются при рассмотрении альтернативных

вариантов. Исходя этого полагаем, что для иностранного инвестора точкой отсчета

(«якорем») в процессе оценки выгодности налоговых льгот будет либо уровень

льготного налогообложения, который действовал в других странах, где он ранее

реализовывал инвестиционные проекты, либо (при отсутствии таких проектов)

величина налоговых стимулов в стране происхождения.

Так в Китае ставка налога на корпоративный

доход составляет 25%, в то время как для проектов в сфере лесоперерабатывающей

промышленности налоговая ставка снижается до 12,5%. При этом налоговая льгота

предоставляется на весь период реализации проекта. В Забайкальском крае

китайская компания «Синбан» реализует инвестиционный проект по созданию лесопромышленного комплекса ООО

«ЦПК «Полярная». Как упоминалось выше, льготная ставка по налогу на прибыль

устанавливается в размере 13,5% на срок не более 7 лет с начала финансирования

проекта. Стоит подчеркнуть, что срок пользования льготой оказывается меньше чем

7 лет, в связи с тем, что налоговая база (прибыль) формируется далеко не с

начала финансирования проекта.

Таким образом, можно

сделать вывод, что инвестиционные налоговые льготы имеют весьма ограниченный

стимулирующий потенциал, и поэтому китайские инвесторы дают низкую оценку их

значимости как меры государственной поддержки инвестиций. Подобное восприятие налоговых льгот можно также объяснить

действием эффекта неприятия потерь.

Согласно теории перспектив, эффект неприятия потерь заключается в том, что

переживания людей, вызванные потерями, оказываются более сильными, чем

переживания из-за аналогичного выигрыша. Поэтому люди готовы нести

дополнительные расходы во избежание более крупных потерь, но в гораздо меньшей

степени склонны идти на подобные траты, чтобы достичь большего выигрыша [24].

Возникновение такого феномена как неприятие

потерь связано с особенностями конструкции инвестиционных налоговых льгот. В

результате изучения механизмов их предоставления в различных регионах было

выяснено, что в большинстве своем они схожи. Так во многих субъектах РФ,

включая Забайкальский край, действующая конструкция налоговых льгот не предполагает

дифференциацию налоговой нагрузки в зависимости от фактического объема инвестиций.

А в тех регионах, где все же применяется дифференцированный налоговый режим, снижение налоговой ставки (увеличение

налоговых периодов) при росте капиталовложений обладает слабым стимулирующим

эффектом в силу незначительных фискальных выгод. Например, в Ставропольском

крае при осуществлении дополнительных инвестиций в объеме от 500 млн руб. до 1

млрд руб. налоговая ставка по налогу на прибыль снижается только на 0,5%. Как показывают многочисленные исследования,

люди не склонны повышать свои расходы и идти на больший риск, чтобы получить дополнительные выгоды, особенно, когда

эти выгоды чрезвычайно малы. Таким образом, инвесторы не рассматривают налоговые

льготы в качестве значимого фактора, побуждающего к осуществлению

дополнительных инвестиций, поскольку сумма экономии на налоговых выплатах стремится

к нулю.

Еще одним общим элементом в

практикуемой конструкции налоговых льгот является положение о том, что в случае

утраты статуса приоритетного инвестиционного проекта, инвестор обязан уплатить в

бюджет ранее полученные налоговые льготы в полном объеме. При этом «утрата

статуса» означает, что были нарушены обязательства по инвестиционному договору

или не выполнены законодательно установленные требования, в соответствии с

которыми присваивается статус приоритетного инвестиционного проекта. В

Забайкальском крае к таким требованиям относятся, например, выплата заработной

платы в размере не менее среднемесячной номинальной начисленной

заработной платы по соответствующему виду деятельности и привлечение

иностранной рабочей силы не более чем на 50%. Однако в Забайкальском крае среднемесячная

начисленная заработная плата в сфере добычи полезных ископаемых находится на

уровне 56 тыс. руб., в то время как на проектах средняя заработная плата не превышает

40 тыс. руб. Почти на всех проектах доля привлеченной иностранной рабочей силы

более 50%.

Поскольку в Забайкальском крае китайские

инвесторы в основном осуществляют инвестиции в сфере добычи полезных

ископаемых, то здесь необходимо выделить два важных обстоятельства. Во-первых,

финансовые показатели проекта во многом определяются конъюнктурой мирового

рынка сырьевых ресурсов, который является очень волатильным [25]. Во-вторых, на

региональном рынке труда складывается крайне напряженная ситуация в связи с

недостатком квалифицированных рабочих, именно поэтому привлекается иностранная

рабочая сила. Таким образом, привлекательность налоговых льгот снижается тем,

что законодательством предусмотрена обязанность вернуть ранее полученные льготы

в случае несоблюдения определенных условий. В то время как соответствие данным

требованиям существенно осложняется действием независимых от инвестора факторов

внешней среды (конъюнктура мировых сырьевых рынков и ситуация на региональном

рынке труда).

Выводы

и рекомендации. В целях повышения

эффективности государственного регулирования регионального инвестиционного

процесса необходимо исключить формальный подход к выбору и проектированию

инструментов стимулирования. Инвестиционный климат Забайкальского края не создает

предпосылок для роста капиталовложений. Инвесторы сталкиваются с такими

проблемами как отсутствие инфраструктуры надлежащего состояния, в том числе в

пунктах пропуска, недостаток квалифицированных трудовых ресурсов. Налоговые

льготы располагают низким потенциалом с точки зрения компенсации этих слабых

мест, в связи с чем не рассматриваются инвесторами в качестве конкурентного

преимущества Забайкальского края. Это можно объяснить тем, что конструкция

инвестиционных налоговых льгот разработана не в пользу иностранных инвесторов,

поскольку условия их предоставления игнорируют отраслевую структуру иностранных

инвестиций в Забайкальском крае, проблемы, с которыми сталкиваются инвесторы, и

психологические аспекты процесса принятия инвестиционных решений. В связи с чем

предлагаются следующие рекомендации по повышению привлекательности налоговых

льгот для иностранных инвесторов.

Первая рекомендация основывается на

концепции точки отсчета. Так следует внести изменения, касающиеся сроков

предоставления налоговых льгот: право на использование льготы должно возникать

не с начала финансирования проекта, а с момента получения первой прибыли, то

есть, когда сформируется налоговая база. Поскольку федеральным

законодательством устанавливаются пределы для снижения регионами налоговых

ставок, повысить привлекательность налоговых льгот можно за счет увеличения

налоговых периодов, в течение которых будет действовать преференциальный режим

[26]. Полагаем, что данное предложение имеет рациональное зерно, поскольку

инвесторы при оценке выгодности налоговой льготы ориентируются на некоторую точку

отсчета, которой выступает, прежде всего, величина налогового бремени в Китае. Преференциальный

режим, действующий в Забайкальском крае, уступает по объему предоставляемых

фискальных выгод режиму, установленному в КНР в отношении тех отраслей, в

которые китайские инвесторы осуществляют вложения на территории края.

Следующая

рекомендация связана с такой особенностью мышления как инертность. Для снижения

выявленных издержек налогового согласования предлагается на Инвестиционном

портале Забайкальского края в разделе «Региональная поддержка» вначале дать

списком готовый перечень нормативно-правовых актов, регулирующих льготный режим

налогообложения, а после изложить пошаговую инструкцию по получению

региональных налоговых льгот с указанием ссылок на соответствующий

законодательный акт на каждом этапе. Такого рода предварительная систематизация

информации из различных источников нацелена на избежание ошибочного понимания

порядка предоставления налоговых льгот, поскольку изучение налоговых норм

сопряжено с необходимостью совершения переходов-переключений от одного

законодательного акта к другому. Более

того, выбор формы представления информации в виде единого списка (по пунктам)

позволит ее структурировать и поможет сформировать у инвестора целостное

понимание действующего механизма налоговых льгот, что в конечном итоге сократит

трансакционные издержки, возникающие в процессе разбора норм налогового

законодательства.

Еще одна рекомендация основана на эффекте

неприятия потерь. Так как капитальные вложения в добычу полезных ископаемых характеризуются

высоким риском, а реализация проектов удорожается из-за отсутствия

инфраструктуры и квалифицированной местной рабочей силы имеет смысл

пересмотреть требования к проектам для получения налоговых льгот. Тем более,

как волатильность цен на сырьевые товары, так и дефицит квалифицированной

рабочей силы на региональном рынке труда – это независимые от инвестора

факторы. Принимая во внимание социально-экономические условия Забайкальского

края, целесообразно переформулировать в законе условия, касающиеся

среднемесячной заработной платы и соотношения российских и иностранных работников.

Предлагаем размер среднемесячной

заработной платы и долю иностранных работников устанавливать в индивидуальном

порядке инвестиционным договором, заключаемым между Правительством

Забайкальского края и иностранным инвестором. Данный инвестиционный договор

подлежит пересмотру в части требований для получения государственной поддержки

на ежегодной основе. Так, например, во время инвестиционной фазы и в первые

годы выхода предприятия на проектную мощность можно снизить требования по

уровню средней заработной платы на проекте. Кроме того, при определении средней

заработной платы следует принимать во внимание прогнозы по динамике цен на

соответствующем рынке. В свою очередь, при утверждении максимальной доли

иностранных работников на очередной год целесообразно учитывать возможности

замещения иностранной рабочей силы местными трудовыми ресурсами. Это позволит на

ежегодной основе производить необходимые согласования с инвестором, своевременно

вносить соответствующие корректировки, а самое главное, ослабить влияние эффекта

неприятия потерь, поскольку снижается риск несоблюдения установленных

законодательством условий, а значит, и обязательства вернуть ранее полученные

льготы.

Практическая ценность рекомендаций

заключается в том, что они опираются на результаты опроса, проведенного среди

иностранных инвесторов. При этом в опросе приняли участие китайские инвесторы,

которые уже воспользовались налоговыми льготами, то есть, имеют определенный

опыт, а также инвесторы, которые еще не получали налоговые льготы, но знакомы с

порядком их предоставления. Таким образом, субъективная оценка

привлекательности налоговых льгот непосредственными бенефициарами дает хороший

материал для пересмотра действующего механизма с целью повышения

востребованности налоговых стимулов среди иностранных инвесторов.

References

1. Shchukina T.V., Loznaya A.V. Razvitie nalogovogo potentsiala regiona v sovremennykh usloviyakh // Aktivizatsiya intellektual'nogo i resursnogo potentsiala regionov : materialy 4-i Vseros. nauch.-prakt. konf. V 2 chastyakh. Ch. 2 (17 maya 2018 g.). – Irkutsk: Izd-vo BGU, 2018. – S. 450-457.

2. Samarukha V.I., Krasnova T.G. Vliyanie nalogovoi sistemy na investitsionnuyu aktivnost' // Izvestiya Irkutskoi gosudarstvennoi ekonomicheskoi akademii (Baikal'skii gosudarstvennyi universitet ekonomiki i prava). – 2009. – № 4. – S. 72–75.

3. Goncharenko L.I., Mel'nikova N.P. O novykh podkhodakh k politike primeneniya nalogovykh l'got i preferentsii v tselyakh stimulirovaniya razvitiya ekonomiki // Ekonomika. Nalogi. Pravo. – 2017. – №2. – S. 96-104.

4. Bondonio D., Greenbaum R. Do Tax Incentives Effect Local Economic Growth? What Mean Impacts Miss in the Analysis of Enterprise Zone Policies // Regional Science and Urban Economics. – 2007. – № 37 (1). – P. 121–136. – DOI: 10.1016/j.regsciurbeco.2006.08.002.

5. Mankiw N., Weinzierl M., Yagan D. Optimal Taxation in Theory and Practice // Journal of Economic Perspectives. – 2009. – Vol. 23, № 4. – P. 147–174. – DOI: 10.1257/jep.23.4.147 [Elektronnyi resurs]. URL: https://docviewer.yandex.ru/view/640246996/?page=&lang=en (data obrashcheniya: 15.08.2019).

6. Kaneman D., Slovik P., Tverski A. Prinyatie reshenii v neopredelennosti: pravila i predubezhdeniya. – Khar'kov: Izd-vo Institut prikladnoi psikhologii «Gumanitarnyi Tsentr», 2005 – 632 s.

7. Johnson L., Toledano P. Background Paper on Investment Incentives: the Good, the Bad and the Ugly: Assessing the Costs, Benefits and Options for Policy Reform. Columbia University Academic Commons. – 2013. – 126 p. – DOI:10.7916/D87D2S3Z. [Elektronnyi resurs]. URL: http://ccsi.columbia.edu/files/2014/01/VCC_conference_paper_-_Draft_Nov_12.pdf (data obrashcheniya: 01.05.2019).

8. Saati T. Prinyatie reshenii. Metod analiza ierarkhii. – M.: Radio i svyaz', 1993. – 278 s.

9. Titov V.A., Khairulin I.G. Vliyanie soglasovannosti ekspertnykh suzhdenii na prinyatie resheniya o vybore investitsionnykh proektov po metodu analiza ierarkhii // Sovremennye problemy nauki i obrazovaniya. – 2013. – № 5. [Elektronnyi resurs]. URL: https://science-education.ru/ru/article/view?id=10648 (data obrashcheniya: 10.08.2019).

10. Nogin V.D. Uproshchennyi variant metoda analiza ierarkhii na osnove nelineinoi sverstki kriteriev // Zhurn. vychislit. matem. i matematich. fiz. – 2004. – № 7. – S. 1259–1268.

11. Tsvigun I.V., Sukhodolov Ya.A. Tendentsii razvitiya vneshneekonomicheskoi deyatel'nosti KNR // Izvestiya Irkutskoi gosudarstvennoi ekonomicheskoi akademii (BGUEP). – 2010. – № 2. – S. 135-140.

12. Samarukha V.I. Regional'naya ekonomika: ucheb. posobie BGU.-Irkutsk: Izd-vo BGU, 2018.-170 s.

13. Kokushkina I.V. Region v sisteme sovremennykh investitsionnykh protsessov. – SPb.: Izd-vo Spetsial'naya Literatura, 2014. – 256 s.

14. Tax Expenditures in OECD Countries. – OECD Publishing, 2010. – 242 p.

15. Orlova E.N. Nalogovye l'goty: otlichitel'nye priznaki i printsipy ustanovleniya // Izvestiya Irkutskoi gosudarstvennoi ekonomicheskoi akademii (Baikal'skii gosudarstvennyi universitet ekonomiki i prava). – 2013. – № 6.

16. James S. A Handbook for Tax Simplification. – Washington, DC. : International Finance Corporation, 2009. – 242 p.

17. Shaviro D. Rethinking Tax Expenditures and Fiscal Language // SSRN Electronic Journal. – 2004. – № 2 (57). – 69 p. – DOI: 10.2139/ssrn.444281. [Elektronnyi resurs] URL: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=571223 (data obrashcheniya: 15.10.2019).

18. Ariely D. Predictably Irrational: the Hidden Forces that Shape Our Decisions. – New York, 2008. – 308 p.

19. Tomer J. Advanced Introduction to Behavioral Economics. – Cheltenham: Edward Elgar Publishing, 2017. – 192 p. [Elektronnyi resurs]. URL: https://www.e-elgar.com/shop/advanced-introduction-to-behavioral-economics (data obrashcheniya: 18.09.2019).

20. Thaler R. Mental Accounting and Consumer Choice // Marketing Science. – 1985. – № 3. – P. 199-214.

21. Thaler R. Misbehaving. The Making of Behavioral Economics. – New York; London: W.W.Norton & Company, 2015. – 415 p.

22. Thaler R., Sunstein C. Libertarian Paternalism // American Economic Review. – 2003. – Vol. 93, № 2. – P. 175-179. – DOI: 10.1257/000282803321947001 [Elektronnyi resurs]. URL: http://nrs.harvard.edu/urn-3:HUL.InstRepos:12876718 (data obrashcheniya: 21.07.2019).

23. Belyanin A.V. Richard Taler i povedencheskaya ekonomika: ot laboratornykh eksperimentov k praktike podtalkivaniya (Nobelevskaya premiya po ekonomike 2017 goda) // Voprosy ekonomiki. – 2018. – № 1. – S. 5-25. – https: // doi.org/10.32609/0042-8736-2018-1-5-25.

24. Chorvat T. Perception and Income: The Behavioral Economics of the Realization Doctrine // SSRN Electronic Journal. – 2003. – № 03-23. – 69 p. – DOI: 10.2139/ssrn.407460 [Elektronnyi resurs]. URL: http://dx.doi.org/10.2139/ssrn.407460 (data obrashcheniya: 12.09.2019).

25. Gusev S.N. Investitsionnyi protsess v otechestvennoi ekonomike i puti povysheniya effektivnosti gosudarstvennogo regulirovaniya natsional'nogo nakopleniya. – Kazan': Izd-vo Artifakt, 2014. – 204 s.

26. Atanov A.A. Osnovanie ekonomicheskikh struktur // Finansovo-kreditnye problemy regiona: sb. st. – Irkutsk: Izd-vo BGU, 2000. – S. 19-22

Link to this article

You can simply select and copy link from below text field.

|

|