|

MAIN PAGE

> Back to contents

Finance and Management

Reference:

Zhang S.

Trend in development of the insurance market of China

// Finance and Management.

2020. № 2.

P. 85-94.

DOI: 10.25136/2409-7802.2020.2.33269 URL: https://en.nbpublish.com/library_read_article.php?id=33269

Trend in development of the insurance market of China

Chzhan Siyuan

PhD in Economics

Postgraduate student, the department of Risk Managament and Insurance, M. V. Lomonosov Moscow State University

119991, Russia, Moskovskaya Oblast' oblast', g. Moscow, ul. Leninskie Gory, 1, kab. 406

|

clara9zhang@mail.ru

|

|

|

|

DOI: 10.25136/2409-7802.2020.2.33269

Received:

20-06-2020

Published:

02-08-2020

Abstract:

The subject of this research is the trend in development of the insurance market of China in the context of digitalization of modern financial and economic sectors. China's insurance market is quite large and promising in comparison with the markets of other countries. The listed factors define the relevance of studying its development and key trends. A synoptic analysis is conducted on the situation in China’s insurance market, including its evolution, structure, and primary market indicators, status of the leading market actors, impact of digitalization on the market, and future trend. The novelty of this work consists in a new perspective upon evolution and current state of the insurance market of China, as well as in generalization of digital development and future trends. The conclusion is made that digital technologies presented by big data, artificial intelligence, blockchain, etc., brought profound changes to the image of China's insurance industry, as well as became a new driving force for the development of an entire sector. The wave of digitalization in financial and economic sphere would contribute to the development of insurance sector, create and broaden new demands in risk management, as well as provide technical support that turns challenges into opportunities for the insurance industry. Despite the fact that over the recent years China's insurance sector has faced multiple challenges, it demonstrates the long-term development prospects.

Keywords:

insurance market, China, digitalization, InsurTech, insurance premium, insurance payment, market concentration, overseas market, life insurance, property insurance

This article written in Russian. You can find original text of the article here

.

Введение

Страховой рынок Китая – один из крупнейших в мире и по объемам собираемой премии, и по количеству заключаемых договоров. Однако он начался развиваться поздно, и этап устойчивого развития насчитывается всего 30 лет.

Китайский страховой рынок все еще находится на ранней стадии своего развития и имеет большой потенциал для дальнейшего роста. По сравнению с уровнем проникновения от 5% до 10% на зрелых европейских и американских рынках, нынешний китайский страховой рынок имеет уровень проникновения всего около 4,5%, и еще есть много возможностей для его развития. Если смотреть в будущее, то с развитием экономики и повышением зрелости структуры общества величина выпуска продукции на душу населения и уровень проникновения страхования жизни будут увеличиваться одновременно, что также является движущей силой для энергичного развития рынка страхования жизни. Иностранные предприятия могут воспользоваться этой возможностью для инвестирования.

Страховая отрасль является одной из самых быстрорастущих отраслей в национальной экономике Китая, и ее успешная функциональная модель рынка привлекла специалистов и ученых страхованной индустрии со всего мир, чтобы её узнать, понять, проанализировать и использовать опыт КНР.

Развитие страхового рынка Китая

В 1685 г. Китай, который был закрыт в течение многих лет, решил открыть свой портовый город Гуанчжоу для международной торговли. В этом городе возникало множество деловых споров в бизнесе и грузовых морских перевозках. Чтобы удобно и справедливо урегулировать «претензии», в 1805 г. британцы создали Ассоциацию страхования Гуанчжоу. В китайской истории впервые появилась страховая организация. Однако из-за смены династии и продолжающихся гражданских и внешних войн, которые происходили на территории Китая в последние 200 лет, страховая отрасль не развивалась. После начала экономических реформ и принятия политики открытия страны в 1980 г. страховая отрасль вступила в стадию модернизации.

До 1986 г. на рынке страхования Китая действовала государственная страховая организация, являющаяся монополистом – PICC. Именно это привело к тому, что отрасль оказалась в застое. Развитие произошло только после того, как появилась конкуренция. Сильная экономика и влияние государства – это те два кита, на которых держится на данный момент рынок страхования в Китае.

Одновременно с развитием индустрии частного страхования Китай должен был разработать современную систему регулирования страхования. По этой причине в 1995 г. был принят «Закон о страховании КНР», который стал основным документом, регулирующим эту отрасль. С его принятием произошло создание Китайского комитета по надзору за страховой деятельностью. В его функции входило внедрение законов, выдача лицензий, контроль за страховщиками. С помощью принятия закона и создания регулятора, который стал контролировать отрасль, рынок страхования Китая стал стабилизироваться.

В 1998 г. регулирование страхования было отделено от регулирования банковской деятельности и ценных бумаг путем создания Китайской Комиссии по регулированию страхования (CIRC). Это положило начало созданию в стране комплексной системы регулирования страхования. Для иностранных страховых компаний китайский рынок стал открытым после 2001 г., когда страна вступила в ВТО. После этого события рынок страхования Китая стал более приближенным к мировому рынку страхования. В 2018 г. китайской правительство объединило Китайскую Комиссию по регулированию страхования и Китайскоую Комиссию по регулированию банков (CBRC) в один департамент, который управляет китайской банковской и страховой деятельностью. Китайское управление по регулированию страхового рынка, китайская Комиссия по регулированию банковского дела и страхования (CBIRC), осуществляют надзор за страховым рынком в соответствии с законами и нормативными актами, а также гарантирует законное и стабильное функционирование страховой отрасли.

Китай также усердно работает над открытием собственного страхового рынка. 11 декабря 2001 г. Китай официально стал членом Всемирной торговой организации (ВТО). Согласно соглашению о вступлении в ВТО, за два года после вступления страховая отрасль должна была, в качестве пионера китайской финансовой системы, постепенно открыться для внешнего мира. В тот день, когда Китай подписал договор и стал членом Всемирной торговой организации, американские компании New York Life Insurance и Metropolitan Life Insurance получили разрешение на создание совместной страховой компании в Китае. За три года, прошедшие с тех пор, в общей сложности 37 страховых компаний из 14 стран и регионов вышли на китайский страховой рынок. В 2012 г. Китай открыл бизнес по обязательному страхованию гражданской ответственности владельцев транспортных средств (ОСАГО) для иностранных инвесторов, не относящихся к страхованию жизни, а страховая индустрия Китая приняла участие в конкуренции и сотрудничестве на международном рынке страхования на более высоком уровне. По состоянию на начало 2018 г. иностранные страховые компании из 16 стран и регионов создали 57 компаний в Китае с более чем 1800 филиалами на разных уровнях. С дальнейшим раскрытием рынка это число, несомненно, будет продолжать расти. От большой до сильной страховой индустрии Китая еще предстоит пройти долгий путь.

Анализ нынешнего состояния страхового рынка Китая

Китайский страховой рынок в последние годы рос высокими темпами, опережая темпы роста ВВП КНР. Швейцарский институт Swiss Re Institute прогнозирует, что доля Китая в глобальных премиях увеличится с 11% в 2018 г. до 20% к 2029 г. и превзойдет долю Соединенных Штатов.[1] Сильная экономика Китая, высокий уровень государственных расходов, осведомленность потребителей и технологические инновации стимулируют рост национального страхового сектора.

В 2016 г. масштабы страхового рынка Китая превзошли рынок Германии, Франции, Великобритании и Японии, поднялись на второе место в мире. По состоянию на конец 2018 г. в Китае насчитывалось 235 страховых организаций, доход от премий 3,8 трлн юаней (0,54 трлн долларов США), плотность страхования 2724 юаней (389.14 долларов США) на человека, глубина страхования 4,22%, число страховых брокеров более 8 млн человек.[2] С января по ноябрь 2019 г. страховая отрасль Китая имела премии в размере 396,2 млрд юаней (56,6 млрд долларов США), выплат 114,98 млрд юаней (16,43 млрд долларов США) и предполагаемую чистую прибыль 2 433,4 млрд юаней, увеличившись за год на 15,6%.

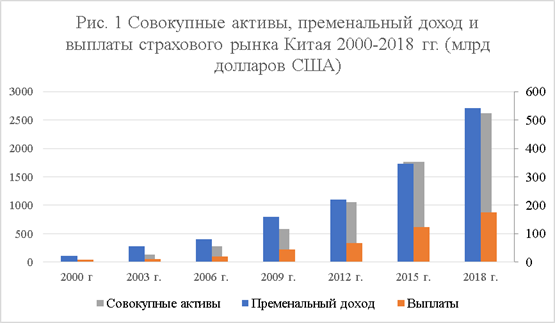

Рис. 1 составлен автором на основе данных Комиссии по регулированию банковской и страховой деятельности Китая. Рис. 1 составлен автором на основе данных Комиссии по регулированию банковской и страховой деятельности Китая.

За последние 20 лет страховые доходы китайской страховой отрасли в основном зависят от личного страхования и страхования жизни. Принимая в качестве примера 2019 г., самую высокую долю доходов премии занимает личное страхование, что составляет 41,71%. А страхование жизни – 30,62%. Доли страхования имущества и медицинского страхования составляют 15,68% и 9,51%. Однако, с точки зрения структуры расходов на выплаты, доля страхования имущества составляет 33,71%, что превосходит личное страхование и страхование жизни, занимая первое место. Выплаты медицинского страхования также занимают значительную долю, в 12,19%.

Что касается страхования имущества, то доля автострахования, которое когда-то занимало большую часть рынка страхования имущества, начала сокращаться. В 2006 г. в Китае начали внедрять закон обязательного страхования ответственности за дорожно-транспортные происшествия, что привело к большому росту доходов от премий по автострахованию, и доля рынка страхования имущества также выросла с 62% в 2003 году до 75% в 2012 г. С тех пор это состояние сохранялось до 2017 г. В 2018 г. доля автострахования снизилась до 66,64%, а в первой половине 2019 г. она снизилась до 59,14%. Причиной такого изменения является существенный рост бизнеса по добровольному страхованию имущества и страхованию от несчастных случаев за последние два года, в то же время бизнес по автострахованию несколько вырос, что привело к увеличению разрыва между ними. В 2017 г. темпы роста премий по автострахованию составили 10,04%, в 2018 г. – 4,16%, тогда как в тот же период темпы прироста добровольных страховых премий достигали 24,2% и 29,8%. В 2018 году. «разрыв в росте» между ними достиг 25 процентных пунктов.

Среди участников страхового рынка Китая число компаний страхования жизни увеличилось с 71 в 2014 г. до 91 в 2019 г., а компаний страхования имущества – с 65 до 88. Судя по типам новых утвержденных организаций, типы страховых учреждений становятся более диверсифицированными: 3 учреждения взаимного страхования, 4 интернет-страховых компаний и компаний страховании технологий, транспортных страховых компаний и т. д. Тем не менее, несколько крупных компании, таких как China Life Insurance, PICC, Ping An, CPIC и Taikang занимают более половины доли рынка и прибыльности. Говоря об этом, следует исследовать концентрацию китайского страхового рынка.[3]

В микроэкономике рынок делится на четыре категории в зависимости от степени конкуренции: совершенная конкуренция, монополистическая конкуренция, олигополия, чистая монополия. Степень конкуренции рынка зависит от доли рынка, степени дифференциации продуктов, наличия барьеров входа и выхода на рынке и жесткости контроля регулятора над ценами на рынке. Кроме того, развитие предприятий и отраслей, рыночные изменения и экономическое развитие также оказывают влияние на структуру рынка.

Рыночная концентрация является важным показателем структуры рынка. Рыночная концентрация относится к доле, которую занимает значение X (сумма продаж, объем продаж, выходная стоимость, объем производства, совокупные активы, количество сотрудников и т. д.) крупнейших компаний отрасли на самом рынке. CRn (concentration ratio) указывает степень рыночной концентрации (n обычно принимается от 4 до 8). Чем ближе значение к 100%, тем выше концентрация рынка в отрасли.

CRn рассчитывается следующей формулой:

; N>n. ; N>n.

– рыночная концентрация первых крупнейших компаний; – рыночная концентрация первых крупнейших компаний;

– объем продаж, выходная стоимость, совокупные активы, количество сотрудников и т. д. – объем продаж, выходная стоимость, совокупные активы, количество сотрудников и т. д.  -ой компании; -ой компании;

– количество первых крупнейших компаний в отрасли, обычно является целым числом от 4 до 8; – количество первых крупнейших компаний в отрасли, обычно является целым числом от 4 до 8;

N: количество компаний в отрасли.

Кроме того, в соответствии с классификационными стандартами рыночной концентрации, разработанными американским экономистом Джо С. Бейни (Bain J. S.) и использованными Министерством экономики, торговли и промышленности Японии, структура промышленного рынка условно делится на два типа: олигополистический ( ≥40%) и конкурентный (8 ≥40%) и конкурентный (8 <40%).[4] А олигополистический тип далее подразделяется на олигополистический тип с чрезвычайно высокой степенью ( <40%).[4] А олигополистический тип далее подразделяется на олигополистический тип с чрезвычайно высокой степенью ( ≥70%) и олигополистический тип (40%≤ ≥70%) и олигополистический тип (40%≤ <70%), конкурентный тип далее делится на конкурентный тип низкой концентрации (20% ≤ <70%), конкурентный тип далее делится на конкурентный тип низкой концентрации (20% ≤ <40%) и конкурентный тип децентрализации( <40%) и конкурентный тип децентрализации( <20%). <20%).

Рис. 2 Классификация рынка по степени концентрации Джо С. Бейни (Joe S. Bain)

|

Степень концентрации Рыночная структура

|

(%) (%)

|

(%) (%)

|

|

Олигополистический тип Ⅰ

|

≥85 ≥85

|

–

|

|

Олигополистический тип Ⅱ

|

75≤ <85 <85

|

≥85 ≥85

|

|

Олигополистический тип Ⅲ

|

50≤ <75 <75

|

75≤ <85 <85

|

|

Олигополистический тип Ⅳ

|

35≤ <50 <50

|

45≤ <75 <75

|

|

Олигополистический тип Ⅴ

|

30≤ <35 <35

|

40≤ <45 <45

|

|

Конкурентный тип

|

<30 <30

|

<40 <40

|

Рис. 2 составлен автором на основе классификации Джо С. Бейни (Joe S. Bain).

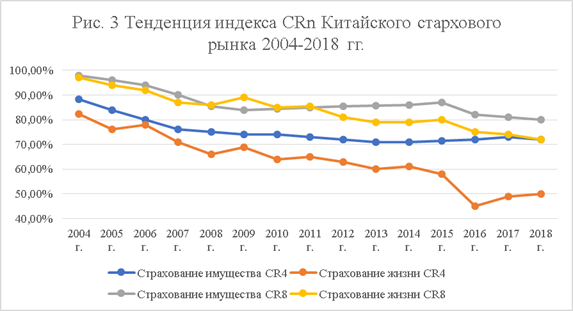

В данной статье отдельно рассмотрены данные о китайском страховании имущества и страховании жизни за период с 2004 по 2018 гг., Рисунок 3 демонстрирует о тенденцию изменения индекса CRn Китайского страхового рынка 2004-2018 гг.

Рис. 3 составлен автором на основе базы данных Wind Рис. 3 составлен автором на основе базы данных Wind

Рис. 3 показывает, что более десяти лет назад страховой рынок Китая был сильно консолидационный, а в 2004 г. индекс  страхования имущества и страхования жизни Китая составлял 88,4% и 82,30%, индекс страхования имущества и страхования жизни Китая составлял 88,4% и 82,30%, индекс  составляет 97,9% и 97,0%. Страхование имущества и жизни относилось к олигополистическому типу Ⅰ. Затем общая концентрация страховой отрасли демонстрировала тенденцию к снижению, и она быстро переходила от олигополии к конкурентной. В 2013 г. индекс составляет 97,9% и 97,0%. Страхование имущества и жизни относилось к олигополистическому типу Ⅰ. Затем общая концентрация страховой отрасли демонстрировала тенденцию к снижению, и она быстро переходила от олигополии к конкурентной. В 2013 г. индекс  страхования имущества и страхования жизни составил 72,7% и 61,0%, индекс страхования имущества и страхования жизни составил 72,7% и 61,0%, индекс  составил 85,6% и 80,2%. Это означает, что китайский страховой рынок вошел в олигополистический тип Ⅲ. С одной стороны, государственное регулирование и контроль играли позитивную роль, стимулируя снижение концентрации рынка. С другой стороны, с непрерывным развитием и совершенствованием страховой отрасли в целом, ограничения на вход и выход рынка из-за более высоких барьеров будут постепенно преодолеваться, и структура рынка постоянно развивается в направлении конкурентного рынка. составил 85,6% и 80,2%. Это означает, что китайский страховой рынок вошел в олигополистический тип Ⅲ. С одной стороны, государственное регулирование и контроль играли позитивную роль, стимулируя снижение концентрации рынка. С другой стороны, с непрерывным развитием и совершенствованием страховой отрасли в целом, ограничения на вход и выход рынка из-за более высоких барьеров будут постепенно преодолеваться, и структура рынка постоянно развивается в направлении конкурентного рынка.

Перспективы цифровизация страхования Китая

По мере роста страховой отрасли быстро развивается Интернет, и их общий продукт – интернет-страхование, в последние годы стал новым трендом на китайском страховом рынке. Согласно статистическим данным, в Китае доход от страховых премий 2018 г в Интернете достиг 188,9 млрд юаней (26,99 млрд долларов США). В сфере технологий продаж также произошли значительные изменения, в частности особое развитие получило онлайн-страхование. Количество граждан, которые приобрели страховку через Интернет по итогам 2018 г. составило свыше 222 млн. Именно на данный канал делается наибольший упор по развитию, так как количество интернет-пользователей в стране находиться на уровне 800 млн. человек. Эффективность онлайн-продаж страхования смогла доказать компания Zhongan Online P&C Insurance, рост прибыли которой по итогам 2018 г. составил 88%, хотя данная компания занимается только онлайн-продажами.

В Китае «цифровизация страхования» когда-то считали одним и тем же, что и понятие «интернет-страхование». Однако по мере углубления проникновения технологий и изменения моделей в цепочке страховой индустрии, цифровизация страхования Китая перешла от первой стадии «интернет-страхования» ко второй стадии «промышленность оживленная технологией». Так называемая «промышленность оживленная технологией» означает: интернет-каналы, облачные вычисления, большие данные, AI, блокчейн, IoT и другие цифровые технологии изменяют ключевую цепочку создания стоимости отрасли страхования. Ключевая цепочка создания стоимости страхования можно разделить на пять процессов: дизайн продукта, маркетинг, андеррайтинг, урегулирование претензий и управление активами. Судя по текущему фактическому прогрессу в самой отрасли, цифровизация страхования Китая сосредоточена на двух из этих процессов: «цифровизация андеррайтинга» и «цифровизация урегулирования претензий».

Цифровизация андеррайтинга отличается от интернет-страхования, поскольку основной формой интернет-страхования являются простые продажи страхования через онлайн-каналы без участия инновации продуктов и изменения в цепочке создания стоимости отрасли; а влияние цифровизации андеррайтинга на страховую отрасль отражается не только в каналах продаж, но и в применении цифровых технологий таких, как анализ больших данных и т. п. на реформирование дизайна продукта, продаж и андеррайтинга.

Урегулирование претензий и пресечение случаев мошенничества в страховании также начали демонстрировать тенденцию использования цифровых технологий. Одним из знаменательных событий является сотрудничество между технологической компанией Kaitaiming и автостраховой компанией Pingan Auto Insurance в 2018 г. В настоящее время индустрия автострахования Китая сталкивается с огромным давлением в связи с насыщением рынка транспортных средств и государственной корректировкой, и ограничениями взносов на коммерческое автострахование, которые начались в 2017 г. Kaitaiming – небольшая технологическая компания в Китае, бизнес-процесс автострахования которой действует следующим образом: страховая компания связывает поля данных о рисках аварий с системой контроля рисков Kaitaiming, возвращает результаты обнаружения в режиме реального времени и отмечает конкретные точки риска и причины для случаев высокого риска. Помочь страховым компаниям улучшить контроль и своевременность урегулирования претензий для страховых компаний, чтобы решить проблему мошенничества с претензиями, тем самым улучшая контроль и своевременность урегулирования претензий, а также помогая страховым компаниям снизить стоимость необоснованных претензий.

Особую роль в переформатировании китайского рынка страхования сыграло внедрение в 2016 г. «Риск-ориентированной системы платежеспособности» (далее C-ROSS – China Risk Oriented Solvency System) – китайского аналога европейской системы Solvency-II. Такая система позволяет увидеть в целом по рынку и по каждой страховой компании в отдельности, по каким рискам капитал избыточен и по каким имеет место недорезервирование, что в идеале должно привести к более рациональному использованию имеющихся финансовых ресурсов и появлению у компаний «свободы маневра» – например, в плане повышения капитализации или продвижения инновационных продуктов. В перспективе это должно также создать более благоприятные условия для инвестирования страховых резервов в реальный сектор экономики, что может вывести значимость C-ROSS далеко за рамки внутриведомственных задач.

Выводы

По мере роста экономики китайская страховая отрасль также вошла в эру всестороннего развития. Несмотря на то, что в последние годы она столкнулась со многими вызовами, судя по содержанию данной статьи страховая индустрия Китая все еще имеет долгосрочные перспективы роста. С точки зрения тенденций технологических изменений, лишь немногие отрасли в Китае испытывают такие быстрые изменения, как страховая отрасль. Цифровые технологии, представленные большими данными, искусственным интеллектом, блокчейном и т. д., глубоко изменили облик страховой отрасли Китая, а также стали новой движущей силой развития целой индустрии. Так называемая «Четвертая промышленная революция» будет придавать новый импульс развитию отрасли, создавать и расширять новые потребности в управлении рисками и предоставлять техническую поддержку, которая превращает вызовы в возможности для страховой отрасли.

От масштабной до сильной страховой отрасли Китая еще предстоит пройти долгий путь.

References

1. World Insurance: The Great Pivot East Continues. Swiss Re, Sigma No.3. p.9, 2019. URL: https://www.swissre.com/institute/research/sigma-research/sigma-2019-03.html

2. Otchet o finansovoi stabil'nosti Kitaya 2018 g., Tsentral'nyi bank KNR, 2018, st. 54

3. Dannye opublikovany na ofitsial'nom saite Ko-missii po regulirovaniyu bankovskoi i strakhovoi deya-tel'nosti Kitaya. URL: http://bxjg.circ.gov.cn/web/site0/

4. J. S. Bain, Market classifications in modern price theory. The Quarterly Journal of Economics, No. 56(4), p. 560-574, 1942,

5. I. B. Kotlobovskii, N. V. Sirichenko. Innovatsion-nye informatsionnye tekhnologii dlya strakhovoi otrasli // Finansy. – 2017. – № 9. – S. 38-44.

6. Obzor rynka strakhovaniya v Rossii, KPMG, 2019. URL: https://assets.kpmg/content/dam/kpmg/ru/pdf/2019/07/ru-ru-insurance-survey-2019.pdf

7. Yu. A. Spletukhov. Strakhovoi rynok Kitaya: realii, problemy i perspektivy // Strakhovoe delo. – 2019. – № 1 (310). – S. 25-32.

8. E. S. Alekseeva. Razvitie strakhovaniya v Kitae // Materialy mezhdunarodnoi nauchno-prakticheskoi kon-ferentsii molodykh uchenykh, aspirantov, magistrantov i studentov. otvetstvenyi redaktor Yu.P. Garmaev. – 2016. – S. 9-11.

9. Volkova M. V., Isachenko V. Yu., Zhilina L. N. Deya-tel'nost' inostrannykh strakhovykh kompanii v Kitae // Mezhdunarodnyi zhurnal prikladnykh i fundamental'nykh issledovanii. – 2016.-№ 7-2. – S. 261-264.

10. Yuan Zhigang, Economics of Pension Insurance: Under-standing the Challenges Faced by China, Shanghai People's Publishing House, 2005.

11. Luan Cuncun, Growth Analysis of Chinese Insurance Industry, China Academic Journal, 2004.

12. Zhao Ran, Overview on Development Prospects of Chi-nese Insurance Industry in Terms of opening the financial in-dustry, CITIC Securities, 2019.

13. Chen Yanhua, Study on the Relation of Chinese Insur-ance Mareket Structure, Efficiency and Performance. Shan'-dunskii universitet, 2007.

14. Song Changyao, Li Guoping, Li Yuanxi, Spatial Differen-tiation of China's Insurance Industry and Its Economic Per-formance – Analysis Based on Cities Above the Prefecture Level. Insurance Studies, No. 9, p. 30-43, 2019

15. Han LY, Li DH, Fariborz M, Insurance Development and Economic Growth. Geneva Papers on Risk and Insurance Theory, No. 35, p. 83-199, 2010.

16. Bain J S. Market classifications in modern price theory // The Quarterly Journal of Economics, No. 56(4), p. 560-574, 1942.

17. Martin Elinga, Michael Luhnenb, Frontier Efficiency Methodologies to Measure Performance in the Insurance In-dustry: Overview, Systematization, and Recent Develop-ments., No. 35, p. 217-265, 2010.

18. Azman-Saini W., Smith P., Finance and Growth: New Evidence on the Role of Insurance. South African Journal of Economics, No. 79, p.111-127, 2011.

19. Weiss M.A., International P/L insurance output, input, and productivity comparisons. Geneva Papers on Risk and Insur-ance Theory, No. 16, p.179–200, 2016.

Link to this article

You can simply select and copy link from below text field.

|

|