|

MAIN PAGE

> Back to contents

Finance and Management

Reference:

Zemskova I.

Approaches towards management of market capitalization of stock companies

// Finance and Management.

2019. № 4.

P. 1-13.

DOI: 10.25136/2409-7802.2019.4.30826 URL: https://en.nbpublish.com/library_read_article.php?id=30826

Approaches towards management of market capitalization of stock companies

Zemskova Irina

Docent, the department of Financial Markets and Banks, Financial University under the Government of the Russian Federation

129164, Russia, Moskva, g. Moscow, ul. Kibal'chicha, 1

|

irisze@mail.ru

|

|

|

|

DOI: 10.25136/2409-7802.2019.4.30826

Received:

16-09-2019

Published:

23-09-2019

Abstract:

The subject of this research is the approaches towards management of market capitalization of stock companies. The market capitalization is defined as company’s outstanding shares multiplied by the current market price of one share. The object of this research is the management of market capitalization of stock companies. The author meticulously examines such aspects of the topic as the management of market capitalization on the basis of controlling the price of a share and quantity of outstanding shares. Special attention is given to the theoretical approaches towards management developed by the foreign and Russian economists. The article also underlines methods of assessing capitalization management, based on market data and internal company data. A conclusion is made that there are three forms of capitalization management: within the framework of cost control on the company level; on the basis of share value control; on the basis of adjusting the quantity of outstanding shares, which in some research is attributed to cost control. Leaning on the analysis of the concepts of capitalization management, external and internal methods of capitalization management can be outlined. The author’s contribution consists in determination and synthesis of the key approaches towards management of market capitalization of stock companies.

Keywords:

Market capitalization, Market capitalization management, Value-based management, Stock price, Market coefficients, Stock buyback, Stock split, Reverse stock split, Methods of management of market capitalization, Shares outstanding

This article written in Russian. You can find original text of the article here

.

Подходы к управлению рыночной капитализацией акционерных компаний

Рыночная капитализация (произведение количества акций в обращении на стоимость акции) является важным рыночным индикатором. Рост и снижение рыночной капитализации зависит от действий инвесторов. В целом, как отмечено в статье Х. Шамимул, О. Б. Норман (2015), на действия инвесторов влияет позитивная (или негативная) информация о компании.[13]

При наличии совокупности необходимых условий для создания и функционирования акционерной формы собственности и свободного обращения ее акций, рынок способен сам оценить стоимость бизнеса, учитывая весь информационный фон, через котировки этих акций. На российском рынке в основном присутствуют спекулятивные операции, прежде всего day-trading (внутридневная торговля) и статистический арбитраж [14], а для компаний важны инвесторы, предоставляющие капитал на долгосрочную перспективу. В связи с этим управление рыночной стоимостью компании позволяет управлять стоимостью и прогнозировать ее изменение с определенной вероятностью. Целенаправленное управление рыночной стоимостью акций позволяет увеличивать благосостояние акционеров. Рыночной стоимость определяется как рыночная капитализация компании.

Под управлением капитализацией мы понимаем процесс управления рыночной стоимостью компании, для достижений целей компании, посредством управления ценой акции и количеством акций в обращении. Таким образом, мы проанализируем три вида управления капитализацией:

· на основании управления стоимостью, где стоимость определяется как капитализация;

· на основании управления ценой акции;

· на основании управления количеством акций в обращении.

Разберем подробно каждый метод управления капитализацией.

1. Управление капитализацией на основании управления стоимостью.

Можно выделить три подхода к управлению капитализацией на основании управления стоимостью:

· подход Т. Коупленда, Дж. Муррина и Т. Коллера (предполагает изучение процедуры реструктуризации компании и последующий переход на ценностно-ориентированное управление стоимостью компании. В рамках данной модели предполагается возможность количественного измерения различных механизмов создания стоимости: внутренних преобразований, отделения структурных подразделений, новых возможностей роста); [2]

· подход И. В. Ивашковской [16] (пентаграмма управления стоимостью акционерного капитала. Данный подход определяет управление стоимостью как процесс, нацеленный на превращение возможностей создания экономической прибыли для акционеров в реальность. Данный процесс рассматривается как набор параметров, которые учитываются в управлении стоимостью компании);

· подход Дж. Пол, Э. Гари (в рамках концепции Value Based Management) (VBM часто воспринимается как система, которая строится на одном или двух финансовых показателей, например на экономической прибыли или суммарной доходности акционеров. Дж. Пол, Э. Гари отмечают, что компании должны добиваться минимального уровня доходности (дохода) на весь капитал компании, доходность должна превышать стоимость капитала (cost of equity) [19]. У компании должно оставаться необходимое количество денег для вознаграждения акционеров после выплат по заемному капиталу. Доход акционеров может принимать форму выплаченных дивидендов и роста цен их акций. Для настройки внутренних процессов компании на создание ценности, нужна система из трех частей: управление инвестиционным сообществом, разработка стратегии для создания оптимальной ценности, обеспечение ценности путем управления интегрированными показателями деятельности (IPM);

· подход Т.В. Ващенко, Р.О Восканяна (в рамках концепции VBM) (управление стоимостью компании является длительным процессом и включает следующие этапы: 1)Определение точки отсчета – оценка текущей рыночной стоимости компании; 2)Разработка системы показателей VBM, ориентированных на создание стоимости; 3)Выявление ключевых факторов (драйверов) стоимости, выбор метода их анализа и учета; 4)Анализ и оценка вклада различных подразделений компании в итоговую стоимость; 5)Разработка эффективной системы контроля над деятельностью компании, вознаграждения и поощрения менеджеров с позиции роста стоимости. Авторы выделяют два инструмента в управлении стоимостью компании – дивидендная политика и опционы (например, опционов эмитента, для повышения мотивации сотрудников).

Модели и метрики измерения стоимости компании для акционеров

В рассматриваемой целевой функции компании главными стейкхолдерами являются акционеры, то есть рассматривается максимизация стоимости в первую очередь для акционеров. В связи с этим, необходимо проанализировать инструментарий для измерения стоимости для акционеров.

Существует два подхода к измерению стоимости для акционеров.

· для торгуемых компаний метрики измерения стоимости базируются на рыночной информации (цена акции, дивиденды) и отражают, произошел ли прирост стоимости за рассматриваемый период.

· вторая группа показателей базируется на данных бухгалтерского учета, денежных потоках компании и ожиданиях в отношении результатов деятельности компании. Мы обозначим данные показатели как внутренние показатели стоимости. Предполагается, что стоимость, создаваемая для акционеров на финансовом рынке, является производной от внутренней стоимости, создаваемой руководством компании.

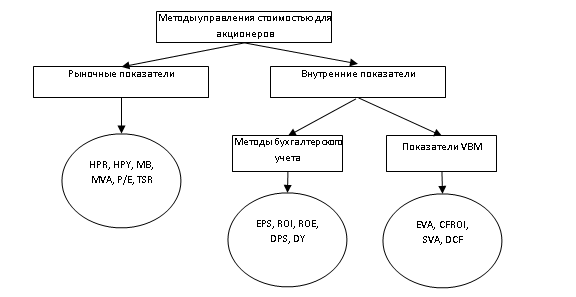

Различные меры, обычно используемые для измерения прибыли акционеров, приведены на рисунке 1.

Рис. 1. Классификация показателей акционерной стоимости

Рыночные показатели:

1) Внутренние показатели

Внутренние показатели подразделяются на две группы:

· методы бухгалтерского учета;

· показатели VBM

1) Методы бухгалтерского учета.

Традиционные меры, используемые для измерения акционерной стоимости, основаны на данных аудированной бухгалтерской отчетности компании.

А. Эрбар и Б. Стюарт III (1999) критикуют показатели, основанные на данных бухгалтерского учета, с точки зрения генерального директора, в частности, обоснование связи бонусов генерального директора или финансового директора с показателями ROE, ROI, ROA. [4] A. Эрбар и Стюарт (1999) делят недостатки ROE, ROI, ROA на два типа: бухгалтерские и финансовые недостатки. Если перед менеджментом стоит задача увеличить ROE, то менеджер может принять плохой проект, который финансируется за счет долга, и отклонить хороший, если он финансируется за счет собственного капитала. Сравнение показателей представлено в Таблице 1.

Таблица 1. Сравнение показателей, основанных на бухгалтерском учете

|

Критерий

|

EPS

|

ROI

|

ROE

|

DPS/DPY

|

|

Простота в использовании

|

+

|

+

|

+

|

+

|

|

Не влияет финансовый рычаг

|

-

|

+

|

-

|

+

|

|

Включает стоимость капитал

|

-

|

-

|

-

|

-

|

|

Учитывает стоимость денег во времени

|

-

|

-

|

-

|

-

|

|

Применяется в разных отраслях

|

-

|

-

|

-

|

-

|

Источник: L. Chari and R. P. Mohanty Understanding Value Creation: The Shareholder Value Perspective // LBS Journal of Management & Research, P. 20

Традиционные показатели стоимости, основанные на бухгалтерском учете, перестают быть актуальными в изменяющихся условиях, поскольку они не учитывают факторы, определяющие акционерную стоимость.

2) Показатели VBM

В концепции управления, ориентированного на стоимость, применяется три ведущих модели, которые названы согласно названиям компаний, предлагающих их:

· модель экономической добавленной стоимости / рыночной стоимости (EVA, MVA, Stern Stewart & CO);

· модель денежной рентабельности инвестиций (CFROI, The Boston Consulting и HOLT Value Associates);

· модель свободного денежного потока (SVA, McКinsey & Co, LEK/Alcar).

Несмотря на то, что данные модели представляются как новые разработки, все три метода опираются на популярную модель дисконтирования денежных доходов. В большинстве случаев разработка этих мер основывается на широко распространенной критике общепринятых мер, связанных с прибылью, таких как доходность инвестиций, доходность активов, прибыль до уплаты процентов, налоги и амортизация гудвилла или прибыль на акцию (Т. Гуентер 1997 [5], Р. Милс 1998 [8]). Некоторые из мер, основанные на управления стоимостью, были разработаны недавно, другие существовали в течение десятилетий или были выведены из теории рынка капитала для использования в рамках управления подразделениями.

Рассмотрим сравнение шести основополагающих методов в концепции VBM.

Таблица 2. Сравнение подходов в VBM

|

|

SternStewart & Co

|

Marakon Associates

|

McKinsey & Co

|

|

Главная идея

|

Компании максимизируют стоимость для акционеров

|

|

С чем связана максимизация стоимости

|

Признание права собственности

|

Лучшая цель в рамках принципа “going concern” – действующее предприятия

|

Процветание бизнеса

|

|

Философия по отношению к стейкхолдерам компании

|

Теория стейкхолдеров, на первом месте акционеры

|

|

Метрики

|

MVA, EVA

|

Спред Акционерного капитала (Equity Spread), Экономическая прибыль

|

DCF, Экономическая прибыль

|

|

Инвестиционные решения и распределение ресурсов

|

Оценка основана на подходе EVA

|

Внимание сосредоточено на выполнении стратегических требований подразделения

Четыре принципа распределения ресурсов

|

Внимание на методах оценки:

DCF

Метод опционов

|

|

|

|

|

|

|

|

Price Waterhouse Coopers

|

L.E.K. Consulting

|

HOLT Value Associates

|

|

Главная идея

|

Компании максимизируют стоимость для акционеров

|

|

С чем связана максимизация стоимости

|

Процветание бизнеса

|

Процветание бизнеса

|

Процветание бизнеса

|

|

Философия по отношению к стейкхолдерам компании

|

Теория стейкхолдеров, на первом месте акционеры

|

|

Метрики

|

CFROI, SVA, FCF (свободный денежный поток)

|

SVA, Изменение в оставшемся доходе, изменение в EVA, главные индикаторы стоимости

|

CFROI, бухгалтерские показатели

|

|

Инвестиционные решения и распределение ресурсов

|

Внимание на создание стоимости для акционеров и соблюдение стратегии

|

Внимание на рыночных сигналах, связанных с DCF и методом реальны опционов

|

DCF в двух частях, существующие активы против будущих инвестиций

|

Источник: Ameels A., Bruggerman W., Scheipers G. Value-Based Management control processes to create value through integration. A literature review, P. 27-29

В статье Т. Коупленда, Т. Коллера и Дж. Муррина отмечается, что лишь в одной трети компаний, которые начали переход на управление, ориентированное на стоимость, показатели доходности акций превысили индекс компаний соответствующего сектора более чем на 5%. [17] Такой результат имел место на протяжении вплоть до десяти лет и представляется достаточно низким. Авторы отмечают, что это может быть связано с тем, что многие компании рассматривают переход на новую идеологию управления больше как разовый проект, а не как долгосрочный. В связи с этим, результат преобразований не показателен.

В научной литературе существует ряд подходов к сравнению показателей оценки акционерной стоимости с точки зрения результативности. Например, Р. Морин и Ш. Джaрелл (Morin, Jarell, 2001) предлагают распределение показателей результатов по их сложности (complexity) и точности (accuracy). [9] Самыми простыми и менее точными являются бухгалтерские показатели эффективности, а самым точным и сложным является показатель SVA.

Более сложное сопоставление показателей результатов по тем же параметрам (точность против сложности) представлено, в частности, Дж. Найтом (Knight, 1998) [7]. Наиболее сложными являются показатели CVA и CFROI. Скорректированный подход по Дж. Найту применила Т. Теплова [21].

Сравнивая подходы Морина–Джарелла и Дж. Найта следует отметить закономерность, что показатели, пропагандирующиеся авторами, находятся в верхнем правом углу системы координат (SVA, CFROI). Также стоит отметить, что сопоставления проводятся исключительно на основе логического анализа с учетом идеи, что показатели, базирующиеся на результатах бухгалтерского учета сами по себе непоказательны. Д. Л. Волков (2005) отмечает, что такой подход является «порочным» и что степень точности должна быть обоснована не логически, а соответствующими эконометрическими исследованиями. [15]

В итого стоит отметить, что можно сравнить показатели, основанные на рыночных данных с внутренними показателями. Поскольку цена акций компании на фондовом рынке отражает ожидания его участников в части долгосрочных результатов создания стоимости компанией, нельзя ожидать прямого соответствия между результатами создания стоимости (показатели, основанные на внутренних данных) и фондовой оценкой показателей акционерного капитала, выраженной в изменении курса акций. В таблице 3 показаны существующие возможности зависимости показателями, основанными на внутренних данных, и показателей, основанных на рыночных данных.

Таблица 3. Зависимость показателей основанных на внутренних данных, и показателей, основанных на рыночных данных

|

|

Показатели, основанные на внутренних данных (создание стоимости)

|

|

Низкий

|

Высокий

|

|

Показатели, основанные на рыночных данных (создание благосостояния)

|

Низкий

|

Низкий показатель создания благосостояния отражает продолжающиеся ожидания низкой способности создания стоимости

|

Хотя текущий показатель создания стоимости превосходный, рынок ожидает более низкий показатель в будущем

|

|

Высокий

|

Хотя текущий показатель создания стоимости превосходный, рынок ожидает более низкий показатель в будущем

|

Высокий показатель создания благосостояния отражает высокий показатель создания стоимости — как в настоящий момент, так и в будущем.

|

Вышеперечисленные категории показателей способны отразить сущность результатов создания стоимости. Показатели создания стоимости отражают результат создания стоимости от операционной деятельности, в то время как показатели благосостояния показывают периодическое изменение стоимости в результате ожидания рынка относительно принятых управленческих решений. Таблица выше, таким образом, связывает операционную деятельности компании и ожидания рынка относительно такой деятельности, что позволяет определить влияние операционных решений на цену акции и как следствие капитализацию. Высокий показатель добавленной рыночной стоимости говорит о том, что ожидаемые высокие результаты создания стоимости будут «вознаграждены» более высокой рыночной стоимостью компании.

Большинство компаний находятся в секторах «низкий-низкий» и «высокий-высокий». Однако если компании входят в другие два сектора, разумно предположить, что положение, в котором они находятся, временно. В таких ситуациях инвесторы смотрят «дальше» существующего значения экономической стоимости и делают предположение о том, что текущая стоимость скоро изменится в силу долгосрочных рыночных тенденций.

2. Управление капитализацией на основании управления ценой акции

Управление ценой акции смежно с управлением инвестиционной привлекательностью акций. Выделяется два подхода к управлению ценой акции:

· подход О.Ю. Минасова;

· подход Е.Ю. Розановой.

Подход О. Ю. Минасова [18]

О.Ю. Минасов выделяет внутренние и внешние методы управления рыночной стоимостью акций. Внутренние методы направлены на управление эффективностью работы акционерного капитала компании и роста прозрачности деятельности компании, а внешние методы подходят для поддержания рынков акций через операции на финансовом рынке, роста имиджа компании и ее привлекательности среди инвестиционного сообщества.

Автор выделяет два внутренних метода:

· мероприятия по повышению прозрачности бизнеса компании;

· мероприятия по оптимизации финансово-хозяйственной деятельности компании.

О.Ю. Минасов выделяет два внешних метода:

· PR-мероприятия;

· мероприятия, проводимые на фондовом рынке.

Управление рыночной стоимостью акций включает мероприятия как стратегического, так и тактического характера. Стратегические мероприятия ориентируются на исследование, анализ и улучшение производственной и хозяйственной деятельности, реализации продукции, системы планирования, корпоративной структуры, системы управленческого учета. Тактические мероприятия направлены на постоянное отслеживание, аудит и контроль сегментов управления компанией после реализации стратегических мероприятий с целью сохранения и улучшения результатов.

Процесс осуществления стратегических и тактических мероприятия должен быть ориентирован:

· на рост потока денежных средств компании;

· снижение себестоимости, административных и коммерческих расходов;

· повышение показателей эффективности деятельности компании целом.

В целом, управление рыночной стоимостью акций компании основано на управлении денежными потоками настоящей и будущей прибыли, что достигается за счет рост продаж, роста рентабельности прибыли и акционерного капитала компании.

Подход Е. Ю. Розановой [20]

Е. Ю. Розанова рассматривает управление ценой акции с целью оказания воздействия на инвестиционную привлекательности акции, с целью минимизации риска инвестора и роста его дохода. Управление ценой акции, по мнению автора, предусматривает следующие направления:

· Улучшение собственного финансового состояния эмитента и оптимизация дивидендной политики.

· Оказание воздействия на рыночные параметры акций (ценовые характеристики – абсолютные уровни, спрэд между покупкой и продажей, объемы сделок, ликвидность).

· Улучшение инвестиционных качеств акций посредством максимизации объема прав, предоставляемых акционеру и неукоснительное соблюдение этих прав.

· Раскрытие информации о состоянии, деятельности и планах эмитента, позволяющей инвестору адекватно оценить инвестиционные качества акций.

Проанализировав два подхода, можно сделать следующие выводы:

· оба подхода к управлению ценой акции схожи в том, что учитывают помимо внутренних преобразований, направленных на улучшение показателей деятельности компании, отношения инвесторов и взгляд инвесторов на цену акции;

· подход О.Ю. Минасов более целостный, в то время как подход Е.Ю. Розановой уделяет больше внимания отношениям с инвесторами.

3. Управление капитализацией на основании управления количеством акций в обращении

К методам управления капитализацией на основе управления количеством акций в обращении относятся следующие мероприятия:

· увеличение количества акций в обращении за счет новой эмиссии;

· консолидация;

· дробление;

· осуществление выкупа у инвесторов напрямую, без участия посредников.

Данные мероприятия оказывают непосредственное влияние на цену акции и поэтому в некоторых работах могут рассматриваться в рамках управления ценой акции, как например в подходе Е.Ю. Розановой.

Проанализируем влияние данных мероприятий на цену акции и как следствие на рыночную капитализацию.

Увеличения количества акций в обращении за счет новой эмиссии

IPO обыкновенных акций приносят большую положительную аномальную доходность (abnormal return) в раннем периоде послепродажного обслуживания для инвесторов. Занижение цены IPO широко документировано и, как представляется, является распространенным. [6] Исследователи также отмечают, что IPO, как правило, не приносят ожидаемой доходности (underperform) в долгосрочной перспективе. Однако международные научные работы о долгосрочной эффективности IPO менее обширны, чем данные о недооценке акций, и менее единодушны. Кроме того, предприниматели понимают, что покупатели могут оказывать большее давление на компанию и склонять собственников к ценовым уступкам при сделках слияния и поглощения, по сравнению с внешними инвесторами. Став публичными, предприниматели таким образом имеют возможность продать компанию инвесторам за более высокую стоимость, чем ту, что они получили бы от прямой продажи. В отличие от этого, Блэк и Гилсон (1998) отмечают, что в ходе IPO часто акционерами становятся опять венчурные капиталисты, что характерно для компаний, поддерживаемых венчурным капиталом. [1]

Первоначально были предложены такие объяснения для занижения цен в ходе IPO, как модель проклятия победителя, избежание судебных исков, динамическое получение информации, теория перспектив и эффект победы [10]. В 1990-х годах поведенческие и агентские объяснения занижения цен были более приемлемыми при объяснении занижения цен. С другой стороны, Дэрриен (2005) показал, что IPO может демонстрировать положительную первоначальную прибыль, даже если она завышена, из-за того, что он называет "бычьим" настроением инвесторов относительно внутренней стоимости компании. [3]

Можно отметить общие идеи в исследованиях – занижение цен в ходе IPO, что предполагает рост цен и повышение благостояния инвестора в начале IPO, и возможное снижение доходности в долгосрочном периоде, что менее документировано в исследованиях. Таким образом, в долгосрочном периоде компании стоит больше внимание уделять поддержанию доходности акционеров.

Консолидация акций

Консолидация акций или обратное разделение акций (reverse stock split, stock consolidation, stock merge or share rollback) – корпоративное действие, которое объединяет количество существующих акций в меньшее количество. Процесс включает в себя компанию, сокращающую общее количество своих акций, находящихся в обращении на открытом рынке, и часто сигнализирует о бедственном положении. Обратные разделения акций обычно являются результатом того, что акции корпорации потеряли значительную стоимость.

В исследованиях отсутствует единый взгляд на результаты консолидации для цены акции. Дж. Робертсон [12] отмечает, что на первый взгляд отсутствует влияние на рыночную стоимость акции кроме незначительной положительной выгоды от снижения затрат на регистрацию акций и коммуникацию с инвесторами. Автор проанализировал 41 мероприятие по консолидации акций. Акции 18 компаний были в месяце сразу после консолидации акций по крайней мере на том же уровне, что и прямо перед мероприятием по консолидации акций. Еще акции 6 компаний в период в течение месяца сразу после консолидации акций были на уровне цены акции до консолидации. Чуть больше половины акций компаний показали позитивную доходность в период после консолидации акций, а почти половина компаний показала отрицательную доходность акций.

Данные на других рынках, а именно в работе Д. Петерсон и П. Петерсон (1992) [11], указывают на то, что в тех случаях, когда консолидация может быть обусловлена порогом цены исключения из листинга, влияние на цену акций имеет тенденцию быть гораздо более положительным (чем при так называемой «добровольной» консолидации).

Подводя итог, даже в тех случаях, когда консолидация снижает уровень рыночной капитализации, можно предположить, что реорганизация все еще должна быть обусловлена определенными предполагаемыми выгодами. Одним из них может быть увеличение ликвидности, другим - возобновление доступа на первичные рынки (где сокращение капитала сосуществует с консолидацией).

Дробление акций

Общее понимание таковое, что дробление акций, воспринимаемые многочисленными участниками рынка как позитивный сигнал, не меняют ни требований акционеров, ни будущих денежных потоков компании. В целом, дробление акций считается хорошей новостью относительно фундаментальной стоимости фирмы по разделению акций. Исследования о результатах дробления акций отмечают, что это положительный сигнал для инвесторов, однако рынок недооценивает эту информацию.

Осуществление выкупа у инвесторов напрямую, без участия посредников

Как и увеличение дивидендов, обратный выкуп акций указывает на уверенность компании в своих будущих перспективах. В отличие от повышения дивидендов, обратный выкуп сигнализирует о том, что компания считает свои акции недооцененными и представляет собой лучшее использование своих денежных средств. В большинстве случаев оптимизм компании относительно своего будущего окупается со временем.

Выкуп акций становится все более распространенным явлением как в США, так и во всем мире. Можно выделить четыре направления изучения влияния обратного выкупа в научной литературе: анализ обратного выкупа с точки зрения сигнальной теории; подтверждение гипотезы о недооценки акций; анализ краткосрочного влияния на цену акции; анализ долгосрочного влияния на цену акции.

В целом, сразу можно отметить, что обратный выкуп акций – это положительное явление сточки зрения инвестора, причем положительное сразу в нескольких аспектах.

Как итог, можно сказать, что обратный выкуп акций, это положительный процесс для инвесторов, который так же сказывается положительно и на котировках акций компаний. Причем эффект тут может быть, как в краткосрочной перспективе, если акции выкупаются с рынка и при этом объем выкупа значительный, а предложение по акциям небольшое, так и в долгосрочной перспективе, за счет увеличения дивидендной доходности и развития непосредственно самой компании.

Выводы:

Существует три формы управления капитализацией: в рамках управления стоимостью – на уровне целой компании, на основе управления ценой акции, на основе изменений количества акций в обращении. Причем управление количеством акций в обращении относится в некоторых работах к управлению ценой акции.

На основе анализа концепций управления можно выделить внешние и внутренние методы управления капитализацией:

Внутренние методы:

· повышение прозрачности бизнеса;

· оптимизация бизнес-процессов;

· изменение дивидендной политики;

· изменение системы мотивации – корпоративного управления;

· действия из методов слияния и поглощения.

Внешние методы:

· улучшение отношений с инвесторами;

· поддержание уровня акций посредством управления ценой акции и количеством акций в обращении.

Автор выражает благодарность и глубокую признательность своему научному руководителю – доценту департамента финансовых рынков и банков Финансового университета при Правительстве РФ кандидату экономических наук Людмиле Николаевне АНДРИАНОВОЙ за советы и ценные замечания в ходе работы над этой статьей

References

1. Black, B. S., Gilson, R. J. ‘Venture capital and the structure of capital markets: banks versus stock markets’, Journal of Financial Economics, 1988, Vol. 47, pp.243–277.

2. Copeland T., Koller T., Murrin J. Valuation. Measuring and Managing the Value of Companies. Third Edition. McKinsey&Company Inc. John Wiley & SONS, Inc. 2000, p. 38

3. Derrien F. IPO Pricing in "Hot" Market Conditions: Who Leaves Money on the Table? Journal of Finance, 2005, 60 (1), P. 487-521.

4. Ehrbar A. and Stewart III B. (1999), "The EVA Revolution." Journal of Applied Corporate Finance, 12 (Summer 1999), P. 18-31.

5. Guenther T. Value-based performance measures for decentral organizational units, Dresden University, paper presented at the European Accounting Association Meeting in Graz, 1997, P. 24

6. Kanja J. N. The effect of initial public offerings on the stock returns of companies listed at the Nairobi securities exchange, 2014, October

7. Knight J. 1998. Value-Based Management: Developing a Systematic Approach to Creating Shareholder Value. McGraw-Hill: N. Y.

8. Mills R., Rowbotham S. and Robertson Using Economic Profit in Assessing Business Performance, Management Accounting UK, November, 1988, P. 34-38.

9. Morin R., Jarell S. 2001. Driving Shareholder Value: Value-Building Techniques for Creating Shareholder Wealth. McGraw-Hill: N. Y.

10. Pemenang S. Winner's Curse, Size Effect and Bandwagon Effect in Explaining the Under-Pricing Phenomenon of Malaysian IPOs CREAM-Current Research in Malaysia Vol.2, No. 1, January 2013: 101-120

11. Peterson D. R. and Peterson P. P.A Further Understanding of Stock Distributions: The Case of Reverse Stock Splits, The Journal of Financial Research, 1992, 15(3), P. 189-205.

12. Robertson J. Companies do better after share consolidation Mining journa,. 2005, September, 11.

13. Shamimul H., Norman B. O. The Impact of Firm's Level Corporate Governance on Market Capitalization // The Journal Of Investment Management, August 2015, p. 119-131

14. Andrianova L.N. Semenkova E.V. Strategicheskoe razvitie rossiiskogo finansovogo rynka: initsiativy megaregulyatora // Ekonomika. Nalogi. Pravo. Mezhdunarodnyi nauchno-prakticheskii zhurnal. Tom 9, № 4, 2016 g. – S. 12-20.

15. Volkov D.L. Pokazateli rezul'tatov deyatel'nosti organizatsii v ramkakh VBM // Rossiiskii zhurnal menedzhmenta, 2005, №2 [Elektronnyi resurs]. URL: https://www.cfin.ru/management/finance/valman/performance_measures_vbm.shtml (Data obrashcheniya: 15.08.2019)

16. Ivashkovskaya I.V. Upravlenie stoimost'yu kompanii: vyzovy rossiiskomu menedzhmentu // Rossiiskii zhurnal menedzhmenta. 2004. № 4. S. 113-132

17. Kouplend T., Koller T. i Murrin Dzh. Upravlenie stoimost'yu kompanii // Vestnik Makkinzi. C. 83-111

18. Minasov O.Yu. Formirovanie rynochnoi stoimosti aktsii rossiiskikh predpriyatii: dis. … kand. ekon. nauk, M., 2002, S. 21

19. Pol Dzh., Gari E. Menedzhment, osnovannyi na tsennosti: kak obespechit' tsennost' dlya aktsionerov.: Per. s angl, M.: INFRA-M, 2009, C. 16

20. Rozanova E. Yu. Upravlenie investitsionnoi privlekatel'nost'yu aktsii / Menedzhment v Rossii i za rubezhom, 2000, №1 [Elektronnyi resurs] URL: https://www.cfin.ru/press/management/2000-1/06.shtml (Data obrashcheniya: 15.08.2019)

21. Teplova T. M. Investitsionnye rychagi maksimizatsii stoimosti kompanii. Praktika rossiiskikh predpriyatii [Elektronnyi resurs]. URL: https://marketing.wikireading.ru/342 (Data obrashcheniya: 15.08.2019)

Link to this article

You can simply select and copy link from below text field.

|

|