|

DOI: 10.25136/2409-7802.2018.2.26520

Received:

02-06-2018

Published:

09-06-2018

Abstract:

Efficient tax incentives are supposed to contribute to the economic growth in long-term and short-term perspectivbes. In this research Steshenko analyzes institutional constraints of tax incentives, in particular, susceptibility of an economic sector to tax incentives; the fact that tax incentives are constrained by budget losses as a result of falling out tax revenues ('tax expenses'); vertical (sectoral) orientation of tax incentives; competence of tax authorities to evaluate the final results when granting tax benefits. The author in detail describes each constraint from the point of view of the way it affects the economic growth. In the course of his research the author has applied economic statistical, historical logical, comparative and restrospective analysis methods as well as the systems approach to studying economic phenomena and processes. The author makes theoretical provisions about the essense and role of the motivating function of taxes in terms of institutional constraints of tax incentives that prevent the economic growth (susceptibility of an economic sector to tax incentives; the fact that tax incentives are constrained by budget losses as a result of falling out tax revenues ('tax expenses'); vertical (sectoral) orientation of tax incentives; competence of tax authorities to evaluate the final results when granting tax benefits) and makes recommendations regarding adapting of tax incentives to aforesaid constraints for the purpose of boosting the economic growth.

Keywords:

tax incentives, tax, tax break, economic growth, branches of national economy, institutional constraints, tax policy, tax mechanism, tax expenditures, tax administration

This article written in Russian. You can find original text of the article here

.

Налоговым стимулам принадлежит решающая роль в рыночной экономике, с фундаментальной точки зрения, именно они делают налоговую систему достаточно гибкой и мягкой и позволяют обеспечивать условия для экономического роста. В частности, стимулирование капиталовложений в отрасль создает позитивные внешние эффекты рынка, способствуя преодолению «провалов» рынка и повышению устойчивости к внешним шокам. Высвобождаемые средства могут использоваться налогоплательщиками, для целей, которые являются и приоритетными для государства. При этом налоговые льготы не вытесняют частные инвестиции, а напротив стимулируют их [23],[24],[25]. Несмотря на это, налоговые стимулы помимо достоинств имеют очевидные недостатки, о которых в свое время упоминал C. Сюррей, а именно: регрессивность, генерация неожиданных выгод, сложность в администрировании и контроле, искажение процесса принятия решений в рыночной экономике, перенос налоговой нагрузки на другие объекты налогообложения [1]. На наш взгляд, отмеченные недостатки не отражают отраслевые особенности налоговых стимулов. Хотя их выявление позволяет обеспечить четкое соответствие между налоговыми льготами и целями развития конкретной отрасли. Нам видятся следующие институциональные ограничения отраслевых налоговых стимулов, которые препятствуют экономическому росту:

1. Восприимчивость отрасли к налоговым льготам, зависящая от уровня налоговой нагрузки;

2. Ограниченность объема налоговых стимулов размером бюджетных потерь от выпадающих налоговых доходов (налоговых расходов);

3. Вертикальная (отраслевая) ориентированность налоговых льгот, под которой понимают поддержку определенных отраслей народного хозяйства;

4. Компетентность налоговых органов при оценке конечных результатов предоставления налоговых льгот в силу того, что в налоговом законодательстве не всегда присутствует (указывается) цель предоставления налоговой льготы и критерии ее достижения. Рассмотрим их более подробно.

1. Восприимчивость отрасли к налоговым льготам в зависимости от налоговой нагрузки. Для максимальной эффективности налоговые стимулы должны обеспечивать наибольшую выгоду для отраслей, которые наиболее чувствительны к стимулированию, создавая таким образом наибольшую предельную полезность. Применяемые в настоящее время элементы налогового стимулирования экономического развития в отраслях народного хозяйства не учитывают способность отрасли адекватно реагировать на установление соответствующих льгот, так как степень чувствительности определенной отрасли к элементам стимулирования и процессу в целом различна. Примером служит отрасль сельского хозяйства, которая является наиболее стимулируемой, по сравнению с другими, но экономический рост в данной отрасли идет низкими темпами, и величина налоговых расходов не сопоставима с эффектом от стимулирования. Так, налогоплательщики сельскохозяйственные производители, согласно п.1.3 ст. 284 НК РФ, вправе применять нулевую налоговую ставку по налогу на прибыль организаций. По данным статистической налоговой отчетности в 2015 г. величина недопоступления в бюджеты бюджетной системы Российской Федерации в связи с применением данного налогового стимула составила 55,7 млрд. руб., прирост сальдированного финансового результата в 2016 г. по сравнению с 2015 г. составил 9,75 млрд. руб. (по данным табл. 1.) Рассчитав отношение прироста сальдированного финансового результата в 2016 г. к величине недопоступления получим, что каждый миллиард рублей недопоступлений в связи с применением данного налогового стимула, обеспечил прирост 0,18 миллиарда рублей сальдированного финансового результата. Данный расчет не учитывает влияния данного налогового стимула на другие сферы деятельности отрасли, но наглядно показывает чувствительность предприятий отрасли к налоговой льготе.

Таблица 1 − Показатели деятельности отрасли сельского хозяйства

|

Показатель

|

2015 г.

|

2016 г.

|

Прирост, млрд. руб.

|

Расчет

|

|

Величина налоговой льготы в связи с применением нулевой налоговой ставки по налогу на прибыль организаций, согласно п.1.3 ст. 284 НК РФ, млрд. руб.

|

55,70

|

55,13

|

-0,57

|

0,18

|

|

Сальдированный финансовый результат организаций, занятых в отрасли сельского хозяйства, млрд. руб.

|

256,84

|

266,59

|

9,75

|

Идентичные элементы налогового стимулирования, применяемые в различных отраслях, могут приносить совершенно различный уровень полезности, что говорит о различной «способности к стимулированию». Степень чувствительности отрасли к определенным налоговым льготам напрямую влияет на результаты стимулирования в краткосрочном и долгосрочном периодах. Низкая восприимчивость отрасли к налоговым стимулам может проявляться в таких формах, как возникновение негативных предельных эффективных налоговых ставок, появление межотраслевых диспропорций при предоставлении льгот по налогу на прибыль и т.п.

Для максимальной эффективности проводимой налоговой политики, налоговые стимулы должны обеспечивать наибольшую выгоду для отраслей, которые наиболее чувствительны к налоговым стимулам, создавая наибольшую полезность. Применяемые в настоящее время налоговые стимулы в отраслях народного хозяйства не учитывают способность отрасли к стимулированию, так как степень восприимчивости каждой отрасли к определенным стимулам различна. Таким образом, необходимо определить степень влияния налоговых стимулов на отрасль народного хозяйства. Для этого разработаны принципы и методика отбора налоговых стимулов по конкретным налогам, позволяющие обеспечить достижение целевых ориентиров экономического роста посредством налогового стимулирования.

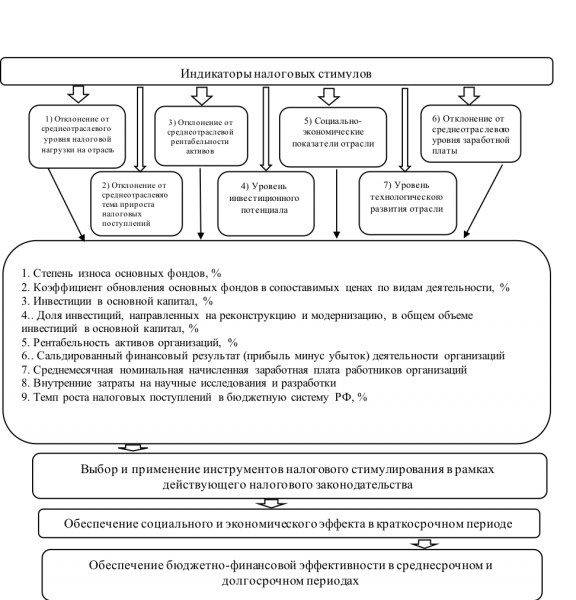

Индикаторами эффективности налоговых стимулов (рис.1) , позволяющими измерить степень достижения целевого назначения налоговой льготы с учетом критерия Парето-оптимальности применительно к выпадающим доходам бюджетов, могут выступить следующие: отклонение от среднеотраслевого уровня налоговой нагрузки на отрасль; отклонение от среднеотраслевого тема прироста налоговых поступлений; отклонение от среднеотраслевой рентабельности активов; уровень инвестиционного потенциала; социально-экономические показатели отрасли; отклонение от среднеотраслевого уровня заработной платы; уровень технологического развития отрасли. Данные индикаторы могут быть рассчитаны применительно ко всем отраслям, поэтому они позволяют обеспечить достаточный уровень значимости каждого индикатора в разрезе конкретной отрасли. В силу этого предложенные нами индикаторы являются универсальными. Представляется, что для отдельно взятых отраслей могут быть разработаны специальные индикаторы, позволяющие оценить степень достижения задач, приоритетных для конкретной отрасли (например, импортозамещение в сельском хозяйстве). Поскольку в силу специфики поставленной задачи такие индикаторы не могут носить универсального характера, оставим их разработку для дальнейшего исследования.

Рисунок 1 – Процесс налогового стимулирования отраслей экономики в рамках развития налоговой системы

Рассмотрим принципы отбора налоговых стимулов по конкретным налогам:

1. Наличие льготы в законодательстве подразумевает выбор и применение инструментов налогового стимулирования в рамках действующего налогового законодательства. Другими словами, выбор вида налоговой льготы должен осуществляться из перечня установленных в законодательстве Российской Федерации о налогах и сборах, законодательстве субъектов Российской Федерации и нормативных правовых актов представительных органов местного самоуправления, а установление новой налоговой льготы без соответствующего экономического обоснования не допускается.

2. Поддержание социально-экономической устойчивости предполагает обеспечение социального или экономического эффекта в краткосрочном периоде. Индикаторами выполнения данного принципа выступают показатели конкурентоспособности, отклонение от среднеотраслевой рентабельности активов, уровень технологического развития отрасли, отклонение от среднеотраслевого уровня заработной платы.

3. Достижение оптимальности бюджетно-финансовых направлений означает обеспечение бюджетно-финансовой эффективности в среднесрочном и долгосрочном периоде. Индикаторами выполнения данного принципа выступает отклонение от среднеотраслевого темпа прироста налоговых поступлений. При предоставлении налоговых льгот следует проверять их на соответствие критерию Парето, по которому любое изменение, никому не причиняющее убытков и, вместе с тем, приносящее некоторым бенефициарам пользу (по их собственной оценке), является улучшением. С учетом этого критерия появление выпадающих налоговых доходов в результате предоставления налоговых льгот следует рассматривать как своего рода отложенные налоговые платежи, аналогично механизму налогового инкрементального финансирования. Компенсация выпадающих налоговых доходов произойдет с некоторым лагом относительно начала периода действия льготы вследствие развития соответствующей отрасли экономики, получившей толчок от предоставления льготы.

4. Соотнесение с уровнем среднеотраслевой налоговой нагрузки, под которым понимается выбор вида налоговой льготы по конкретному налогу с учетом уровня среднеотраслевой налоговой нагрузки. Максимальный эффект от введения налоговой льготы будет в тех областях, где значения налоговой нагрузки близки или превышают средние показатели. Действительно, введение мер, направленных на сокращение налоговой нагрузки по тем налогам, где её размер не существенен, не даст ожидаемого эффекта, и наоборот. Индикатором выполнения данного принципа выступает отклонение от среднеотраслевого уровня налоговой нагрузки.

С учетом вышеизложенного, можно предложить следующую методику отбора налоговых стимулов по конкретным налогам (на примере налога на прибыль организаций).

Шаг 1. Расчет уровня совокупной отраслевой налоговой нагрузки и коэффициента налоговой нагрузки отрасли по налогу на прибыль организации, рассчитываемую как удельный вес поступлений по налогу на прибыль от отдельной отрасли в величине добавленной стоимости. Для расчета остальных показателей используются данные Федеральной службы государственной статистики.

Шаг 2. Рассчитывается среднее значение и медиана коэффициента налоговой нагрузки отрасли по налогу на прибыль организации, на основании которого осуществляется выборка отраслей при соблюдении четвертого принципа. Также рассчитываются средние значения и медианы остальных показателей исходя из фактических данных. На основании выборки определяется перечень отраслей, имеющих существенный потенциал для развития за счет применения элементов налогового стимулирования. В данных отраслях народного хозяйства будет достигнут экономический рост с наименьшей величиной потерь с учетом критерия Парето-оптимальности.

Шаг. 3. Исходя из выборки отраслей, с учетом критерия среднеотраслевой налоговой нагрузки по налогу на прибыль, определяются направления стимулирования на основании отклонения значений показателей от среднеотраслевых. Выбор элементов налогового стимулирования необходимо осуществлять с учетом первого принципа в тех отраслях, где зафиксированы отклонения.

Шаг 4. Применение элементов налогового стимулирования для выборки отраслей в рамках отобранных направлений, отвечающих принципам обеспечения социального или экономического эффекта, обеспечение бюджетно-финансовой эффективности с учётом Парето-оптимальности.

Апробация предлагаемой методики на примере налога прибыль организаций.

Таблица 2.1 − Исходные данные для проведения отбора налоговых стимулов (часть 1)

|

Отрасль

|

Уровень отраслевой налоговой нагрузки, %

|

Уровень налоговой нагрузки по налогу на прибыль (удельный вес налога на прибыль в ВДС)

|

Доля отрасли в формировании ВВП, %

|

Степень износа основных фондов

|

Коэффициент обновления основных фондов в Российской Федерации

|

Темп роста налоговых поступлений в бюджетную систему РФ

|

|

Сельское хозяйство, охота и лесное хозяйство

|

2,61

|

0,26

|

4,37

|

41,10

|

5,00

|

107,62

|

|

Рыболовство, рыбоводство

|

9,96

|

2,29

|

0,29

|

47,50

|

3,20

|

126,49

|

|

Добыча полезных ископаемых

|

51,56

|

5,38

|

9,55

|

54,90

|

8,30

|

88,64

|

|

Обрабатывающие производства

|

27,79

|

5,06

|

13,47

|

47,40

|

5,20

|

117,08

|

|

Производство и распределение электроэнергии, газа и воды

|

22,08

|

3,26

|

3,12

|

41,70

|

5,00

|

123,51

|

|

Строительство

|

13,71

|

2,39

|

6,37

|

47,80

|

6,00

|

112,42

|

|

Оптовая и розничная торговля; ремонт автотранспортных средств, мотоциклов, бытовых изделий и предметов личного пользования

|

14,07

|

4,24

|

14,66

|

64,20

|

5,10

|

105,10

|

|

Гостиницы и рестораны

|

13,69

|

1,19

|

0,90

|

31,20

|

5,00

|

114,86

|

|

Транспорт и связь

|

13,23

|

2,96

|

8,25

|

44,90

|

3,40

|

105,38

|

|

Финансовая деятельность

|

25,25

|

15,01

|

4,25

|

36,30

|

9,70

|

151,17

|

|

Операции с недвижимым имуществом, аренда и предоставление услуг

|

11,43

|

2,28

|

17,95

|

43,70

|

3,30

|

106,31

|

|

Государственное управление и обеспечение военной безопасности; обязательное социальное обеспечение

|

6,21

|

0,05

|

8,15

|

39,60

|

5,60

|

104,00

|

|

Образование

|

15,35

|

0,22

|

2,54

|

47,40

|

2,70

|

103,28

|

|

Здравоохранение и предоставление социальных услуг

|

8,50

|

0,20

|

3,75

|

52,60

|

2,40

|

103,32

|

|

Предоставление прочих коммунальных, социальных и персональных услуг

|

14,94

|

1,08

|

1,73

|

41,10

|

4,40

|

105,84

|

|

Среднее значение

|

16,69

|

3,06

|

6,62

|

45,43

|

4,95

|

111,67

|

|

Медиана

|

13,71

|

2,29

|

4,37

|

44,90

|

5,00

|

106,31

|

Таблица 2.2 − Исходные данные для проведения отбора налоговых стимулов (часть 2)

|

Отрасль

|

Инвестиции в основной капитал

|

Рентабельность активов

|

Салидированный финансовый результат

|

Внутренние затраты на научные исследования и разработки

|

Доля инвестиций, направленных на реконструкцию и модернизацию, в общем объеме инвестиций в основной капитал

|

Средняя номинальная начисленная заработная плата работников

|

|

Сельское хозяйство, охота и лесное хозяйство

|

4,20

|

6,80

|

266590,00

|

529,00

|

8,83

|

21445

|

|

Рыболовство, рыбоводство

|

0,10

|

29,30

|

83023,00

|

|

19,09

|

54449

|

|

Добыча полезных ископаемых

|

19,40

|

10,00

|

2185996,00

|

48,80

|

8,18

|

69688

|

|

Обрабатывающие производства

|

14,60

|

6,60

|

3190809,00

|

101296,60

|

19,57

|

34748

|

|

Производство и распределение электроэнергии, газа и воды

|

6,40

|

5,10

|

706585,00

|

30,60

|

34,88

|

39607

|

|

Строительство

|

3,00

|

1,90

|

130560,00

|

|

11,75

|

32188

|

|

Оптовая и розничная торговля; ремонт автотранспортных средств, мотоциклов, бытовых изделий и предметов личного пользования

|

4,30

|

6,40

|

2306404,00

|

662,70

|

19,05

|

29555

|

|

Гостиницы и рестораны

|

0,70

|

6,10

|

31675,00

|

|

14,60

|

22102

|

|

Транспорт и связь

|

18,60

|

5,30

|

1132681,00

|

560,80

|

12,44

|

41762

|

|

Финансовая деятельность

|

1,60

|

5,70

|

350281,00

|

|

11,33

|

78311

|

|

Операции с недвижимым имуществом, аренда и предоставление услуг

|

20,60

|

5,50

|

1133833,00

|

749581,70

|

17,10

|

44040

|

|

Государственное управление и обеспечение военной безопасности; обязательное социальное обеспечение

|

1,90

|

1,00

|

15074,00

|

|

12,14

|

43619

|

|

Образование

|

1,40

|

4,00

|

4644,00

|

82740,60

|

11,99

|

28094

|

|

Здравоохранение и предоставление социальных услуг

|

1,20

|

6,10

|

18963,00

|

3642,60

|

8,45

|

29845

|

|

Предоставление прочих коммунальных, социальных и персональных услуг

|

2,00

|

3,20

|

30588,00

|

3465,80

|

15,65

|

32294

|

|

Среднее значение

|

6,67

|

6,87

|

772513,73

|

94255,92

|

15,00

|

40116,47

|

|

Медиана

|

3,00

|

5,70

|

266590,00

|

2064,25

|

12,44

|

34748,00

|

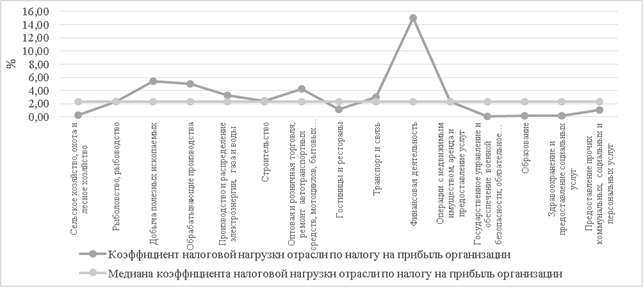

На основании исходных данных по 15 отраслям народного хозяйства, представленных в таблицах 2.1, 2.2, произведен расчет коэффициента налоговой нагрузки отрасли по налогу на прибыль организации, на основании значений которого был произведен отбор отраслей, наиболее чувствительных к элементам налогового стимулирования, согласно четвертому принципу. По нашим расчетам получается, что в 9 отраслях народного хозяйства коэффициент налоговой нагрузки отрасли по налогу на прибыль организаций выше медианного значения показателя. К таким отраслям, согласно рис. 2 относятся: рыболовство, рыбоводство, добыча полезных ископаемых, обрабатывающие производства, производство и распределение электроэнергии, газа и воды, строительство, оптовая и розничная торговля; ремонт автотранспортных средств, мотоциклов, бытовых изделий и предметов личного пользования, транспорт и связь, финансовая деятельность и операции с недвижимым имуществом, аренда и предоставление услуг.

Рисунок 2 – Отбор отраслей народного хозяйства с использованием методики

Следующим этапом является выявление отклонений показателей от среднеотраслевых, с целью выделения приоритетных направлений в рамках соблюдения принципов. Для наглядности полученных значений в таблице 2.12 представлены результаты, знак «-» - означает, что данный показатель для определенной отрасли должен быть рассмотрен, так как величина значения ниже среднеотраслевого (в случае с показателем коэффициент обновления основных фондов выше среднеотраслевого); знак «+» - что величина данного показателя выше среднеотраслевого значения (в случае с показателем коэффициент обновления основных фондов ниже среднеотраслевого).

Таблица 3 – Результат отбора показателей отраслей, исходя из отклонений от среднеотраслевых значений

|

№ показателя

Отрасль

|

1

|

2

|

3

|

4

|

5

|

6

|

7

|

8

|

9

|

|

Рыболовство, рыбоводство

|

-

|

-

|

-

|

+

|

+

|

-

|

+

|

-

|

+

|

|

Добыча полезных ископаемых

|

-

|

+

|

+

|

-

|

+

|

+

|

+

|

-

|

-

|

|

Обрабатывающие производства

|

-

|

+

|

+

|

+

|

-

|

+

|

-

|

+

|

+

|

|

Производство и распределение электроэнергии, газа и воды

|

+

|

-

|

-

|

+

|

-

|

-

|

-

|

-

|

+

|

|

Строительство

|

-

|

+

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

|

Оптовая и розничная торговля; ремонт автотранспортных средств, мотоциклов, бытовых изделий и предметов личного пользования

|

-

|

+

|

-

|

+

|

-

|

+

|

-

|

-

|

-

|

|

Транспорт и связь

|

+

|

-

|

+

|

-

|

-

|

+

|

+

|

-

|

-

|

|

Финансовая деятельность

|

+

|

+

|

-

|

-

|

-

|

-

|

+

|

-

|

+

|

|

Операции с недвижимым имуществом, аренда и предоставление услуг

|

+

|

_

|

+

|

+

|

-

|

+

|

+

|

+

|

-

|

|

Среднеотраслевое значение показателя

|

45,43

|

4,95

|

6,67

|

15,00

|

6,87

|

772513,73

|

40116,47

|

62837,28

|

111,67

|

В результате применения методики отбора налоговых стимулов можно сделать вывод, что, например, в отрасли рыболовства и рыбоводства необходимо применять инструменты налогового стимулирования по налогу на прибыль организаций, направленные на активизацию инвестиционной активности и НИОКР, так как данная отрасль чувствительна к налоговым стимулам по данному налогу. К таким стимулам можно отнести уменьшение налоговой базы по налогу на прибыль организаций на величину показателя капитальных вложений, предусмотренных законодательством, а также снижение налоговой базы за счет расходов на научные исследования и разработки. Данные налоговые стимулы отобраны с учетом принципов наличия льготы в законодательстве и соотнесения с уровнем среднеотраслевой налоговой нагрузки.

2. Ограниченность объема налоговых стимулов размером бюджетных потерь от выпадающих налоговых доходов (налоговых расходов). Необходимость установления пороговых значений величины выпадающих налоговых доходов в связи с применением налоговых стимулов обусловлено ограниченностью бюджетных ресурсов. Налоговые расходы, появляющиеся в следствии применения налоговых льгот и преференций, оказывают существенное влияние на фискальный эффект проводимой налоговой политики. Достижение ориентиров социально-экономического развития возможно посредством как использования налоговых льгот и преференций, так и применения мер прямого регулирования. В связи с эти возникает необходимость оценки результатов альтернативных инструментов [2], в рамках рассмотрения концепции «налоговых расходов». Термин «налоговые расходы» (tax expenditure) был впервые использован Стэнли Сюррей, и рассматривался как «убытки от доходов, связанные с положениями федерального налогового законодательства, которые допускают специальное исключение, освобождение или вычет из валового дохода или которые предоставляют специальный кредит, льготную ставку налога или отсрочку» [3]. В дальнейшем, С. Сюррей и П. Макдениэл [4] была сформулирована «концепция налоговых расходов», которая основывается на предположении, что налоговые ставки должны применяться к способному расширяться доходу налогоплательщика, чтобы максимизировать налоговые поступления по любой ставке налога. Налоговые положения, которые защищают компоненты этого широкого определения дохода, рассматриваются как лишение правительства его законных доходов; эти потерянные доходы считаются принадлежащими государству. Налоговые расходы рассматриваются как недополученные доходы, принадлежащие государству. По мнению Стэнли Сюррей, налоговые расходы «по существу настоящие налоговые стимулы или налоговые субсидии». Также, в зарубежной литературе рассматривается подход к определению «налоговых расходов» тождественно государственным расходам в рамках бюджетного процесса [5]. В Руководстве по обеспечению прозрачности в бюджетно-налоговой сфере Международного валютного фонданалоговые расходы представлены как доходы, упущенные в результате действия отдельных положений Налогового кодекса. Это льготы или освобождения относительно «нормальной» структуры налогов, которые ведут к снижению величины собираемых государством доходов, и, поскольку цели государственной политики могли бы быть достигнуты альтернативным способом через предоставление субсидий или осуществление иных прямых расходов, льготы рассматриваются как эквивалент бюджетных расходов [6].

Рассмотрим подходы к определению «налоговых расходов» в трудах отечественных ученых. По мнению И.А. Майбурова «налоговые расходы – это упущенные налоговые доходы бюджетной системы в связи с применением законодательством различных отклонений от нормативной структуры налогов, которые при этом обеспечивают какие-либо преимущества определенным видам деятельности или группам налогоплательщиков» [7]. Глубокий анализ теоретических положений определения налоговых расходов сделан Т.А. Малининой, которая рассматривает налоговые расходы как не просто упущенные доходы государства, а те доходы, от которых государство отказалось для достижения определенных целей социально-экономической политики [8]. По мнению Пинской М.Р. под налоговыми расходами следует понимать выпадающие налоговые доходы бюджетов бюджетной системы, обусловленные применением налоговых льгот [9]. В Основных направлениях налоговой политики Российской Федерации на 2016 год и на плановый период 2017 и 2018 гг. под налоговыми расходами для целей анализа понимаются выпадающие доходы бюджетов бюджетной системы Российской Федерации, обусловленные применением налоговых льгот и иных инструментов (преференций), установленных законодательством Российской Федерации о налогах и сборах [10].

Налоговые расходы, в большинстве, требуют существенных затрат со стороны бюджетной системы, а также не всегда являются экономически эффективными и равномерными. Только в тех случаях, когда экономические действия приносят преимущества для экономики в целом, можно говорить об использовании налогообложения для поощрения данных действий. Эффективность налоговых стимулов напрямую зависит от инструментария управления выпадающими бюджетными доходами, формирующимися вследствие предоставления налоговых льгот и преференций, который предусматривает разделение налоговой структуры на такие составляющие как: нормативная (базовая) структура налога и налоговые расходы. Нормативная (базовая) налоговая структура предусматривает положения действующего законодательства, формирующие структуру налога. ОЭСР под базовой структурой налога понимает структуру налоговых ставок, положения, позволяющие упростить налоговое администрирование, а также положения, относящиеся к международным обязательствам, наряду с бухгалтерским и налоговым учетом и вычетом обязательных платежей [11]. Под налоговыми расходами понимаются те налоговые льготы, которые не отвечают критериям отнесения к базовой структуре налогов.

В результате отсутствия единой концептуальной основы нормативной (базовой) структуры налогов, идентификация налоговых льгот при их отнесении либо к базовой структуре налога, либо к налоговым расходам затруднена. К налоговым льготам, относимым к элементам нормативной (базовой) структуры налогов, следует относить те льготы, без которых общая система налога, ввиду определенных социальных, политических, административных и других причин не может функционировать в реальной действительности. Введение этих льгот не должно приводить к нарушению общих принципов налогообложения (справедливости, нейтральности, простоты взимания). Такие льготы можно называть «стандартными». К налоговым льготам, относимым к налоговым расходам, следует относить те льготы (освобождения), которые одновременно отвечают следующим принципам: тождественности с налоговыми преимуществами, определенности льготируемой категории налогоплательщиков и законодательных способов снижения налогового бремени, дихотомии (не соответствия) в отношении к нормативной (базовой) структуре налогов [12].

Налоговые расходы напрямую связаны с таким понятием, как налоговые стимулы, так как предусматривают формирование определенных привилегий налогоплательщикам для достижения целей налоговой политики. Для максимальной эффективности налоговые расходы должны обеспечивать наибольшую выгоду для отраслей, которые наиболее чувствительны к налоговым стимулам, таким образом налоговые расходы будут создавать наибольшую полезность. Исходя их вышесказанного, для целей настоящего исследования, налоговые расходы будут рассматриваться нами как доходы бюджетов бюджетной системы, недополученные в результате применения особых условий налогообложения.

3. Вертикальная (отраслевая) ориентированность налоговых льгот. В современной экономической литературе вопрос налогового стимулирования отраслей является дискуссионным. Существуют два подхода к пониманию сущности отраслевого налогового стимулирования: вертикальный и горизонтальный. В рамках первого подхода, фискальные послабления для отраслей с низкими экономическими показателями способны нарушить баланс бюджетной и налоговой систем. Согласно второму подходу, стимулирование отдельных приоритетных отраслей для государства необходимо для соблюдения социальной и экономической стабильности не только в данной отрасли, но и в смежных видах деятельности. Государственная поддержка в виде налоговых льгот и других инструментов способна снизить налоговое бремя, повысить рентабельность и инвестиционную привлекательность вида деятельности.

Вертикальные инструменты отраслевого налогового стимулирования, в противовес горизонтальным, способны дискриминировать те отрасли и виды деятельности, которые не являются приоритетными для государства на современном этапе. Отнесение отрасли к приоритетной осуществляется на государственном уровне, что может привести к деформации налогового стимулирования и существенной величине издержек со стороны государства, не приносящих положительного эффекта. Как правило, поддержка осуществляется в неконкурентоспособные и низкорентабельные отрасли. Правительственные меры, направленные на защиту и поддержку отдельных отраслей, в том числе капиталоемких, которые не имеют сравнительных преимуществ по сравнению с другими видами деятельности, приводят к отставанию модернизации, замедляя накопление капитала [13]. Такое перераспределение бюджетных ресурсов приводит к низкому эффекту для экономики в целом, происходит рост диспропорции в распределении человеческих ресурсов, а также концентрация активов в определенных отраслях. Вертикальные инструменты налогового стимулирования усугубляют налогообложение для отраслей, не относящихся к приоритетным, тем самым усиливая неравенство. При вертикальной ориентированности налоговых стимулов государство выбирает отдельные конкретные отрасли, виды деятельности и создает условия для их развития, такие меры должны иметь детальное обоснование с анализом последствий применения и расчетом других возможностей использования финансовых или других ресурсов, альтернативой вертикальным выступают горизонтальные налоговые стимулы, воздействующие на экономических агентов в различных отраслях в зависимости от какого-либо признака (экспортоориентированность, капитало- или трудоемкость, рентабельность, социальная значимость, наукоемкость) [14]. Горизонтальная ориентированность подразумевает проведение политики без предвзятого списка секторов и инструментов, акцент делается на построении институциональной структуры [15].

4. Компетентность налоговых органов при оценке конечных результатов предоставления налоговых льгот. Для оценки состояния информационного и статистического учета и оценки налоговых расходов рассмотрим публикуемые данные по формам статистической налоговой отчетности в разрезе отдельных налогов и отраслей. Проведенный нами анализ позволил выявить следующие недостатки отчетности. В частности, форма №1-НДС [16] включает неполные данные о налоговых льготах по налогу на добавленную стоимость. Не во всех формах отражается информация об объемах денежных средств, подлежащих налоговому вычету в соответствии с применением льгот. Некоторые льготы публикуются в формах статистической налоговой отчетности ФНС на нерегулярной основе, имеют место также действующие льготы, отсутствующие в формах статистической налоговой отчетности ФНС.

Отчет по форме №5-НИО [17] содержит информацию о льготах по налогу на имущество организаций, за исключением: перечня организаций, не являющихся плательщиками налога на имущество организаций; перечня объектов, не подлежащих обложению налогом на имущество организаций; налогооблагаемых объектов, в отношении которых предусмотрено применение пониженной налоговой ставки или ставки налога в размере 0 процентов.

В налоговой отчетности по форме №5-ПМ[18] присутствуют данные о 240 налоговых льготах по налогу на прибыль организаций, в том числе о 232 действующих, из которых по 117 налоговым льготам информация отсутствует частично, а по 115 полностью, что существенно затрудняет мониторинг и оценку существующих налоговых стимулов.

Налоговая отчетность по форме №5-НДПИ [19] содержит информацию о суммах одиннадцати налоговых льгот по налогу на добычу полезных ископаемых, в том числе информацию о суммах льгот, связанных с применением «нулевых» налоговых ставок по полезным ископаемым за исключением углеводородного сырья. При этом расшифровка соответствующих строк приводится только по льготам, применяемым по отношению к нормативным потерям полезных ископаемых.

Отчет по форме №5-ТН [20] содержит общую информацию о льготах, установленных законодательством субъектов России и льготах, установленных международными договорами в разрезе категорий налогоплательщиков (организаций и физических лиц).

Отчет по форме №5-МН [21] в части Разделов I и II – Отчет о налоговой базе и структуре начислений по земельному налогу содержит информацию о льготах по налогу в разрезе категорий налогоплательщиков (юридических и физических лиц). В части Раздела I по налогоплательщикам-юридическим лицам отсутствует информация о величине расходов, приходящихся на освобождение от земельного налога резидентов ТОСЭР.

Отчет по Форме 5-ВН [22] содержит информацию о величине налога, не поступившего в бюджет в связи с применением пониженной ставки налога при заборе воды для водоснабжения населения. При этом ни в Реестре, ни в указанной форме отчета ФНС нет сведений о не признаваемых объектами налогообложения водных объектах.

На основании вышеизложенного, можно утверждать, что перечень налоговых льгот, включенных в отчетные формы статистической налоговой отчетности ФНС, не позволяет составить объективную и подробную картину о налоговых стимулах. Анализ форм статистической налоговой отчетности показал, что на современном этапе мониторинг отраслевых налоговых стимулов становится невозможен, так как данные о налоговых льготах и суммах выпадающих налоговых доходов в разрезе отраслей народного хозяйства не публикуются.

Администрирование налоговых льгот сопряжено с объективными ограничениями возможности налоговых органов контролировать достижение целевых показателей при введение налоговых льгот. Общим критерием эффективности налогового управления является степень достижения целей функционирования системы исходя из необходимости направления налоговых стимулов на обеспечение экономического роста. Однако выработка алгоритмов налогового контроля, позволяющего осуществлять мониторинг налоговых стимулов для выявления случаев отклонения от цели введения льготы (создание условий для экономического роста), представляется нам трудноразрешимой задачей даже в условиях рискоориентированной направленности налогового администрирования. Причиной тому: отсутствие положений о соответствующей целевой направленности налоговых льгот в нормах налогового законодательства, отсутствие массивов информации в формах статистической налоговой отчетности о связи налоговой льготы с экономическим ростом, универсальный характер налоговых льгот, обусловленный необходимостью упрощения и удешевления налогового администрирования и простотой исполнения налогового законодательства. Ежегодно перечень налоговых льгот растет, равно как и потери бюджета в виде выпадающих налоговых доходов. Также стоит отметить, что статистическая налоговая отчетность отражает недостаточную информацию и формируется исключительно для бюджетного планирования. Исходя из этого, актуальным является определение доли налоговых льгот, предназначенных непосредственно для обеспечения условий экономического роста и являющихся элементами налогового инструментария стимулирования отраслей экономики.

Таким образом, налоговый инструментарий стимулирования отраслей экономики, с одной стороны, должен позволять нарастить уровень экономического роста при одновременном сохранении объемов формирования налоговых доходов (доходной части бюджета). Это возможно только при условии обеспечении выполнения налогом как фискальной, так и стимулирующей функций. В силу того, что указанные ограничения являются институциональными и вытекают из природы налоговых стимулов, государство должно учитывать их при разработке налогового инструментария поддержки отраслей экономики.

References

1. Stanley S. Surrey Pathways to Tax Reform The Concept of Tax Expenditures // BUSINESS & ECONOMICS: Economics: General, – 1973. – P.418.

2. Shuleiko O.L. Nalogovye raskhody kak instrument byudzhetno-nalogovoi politiki // Belorusskii ekonomicheskii zhurnal – 2014. – №3 – S.86-95.

3. Stanley S. Surrey Pathways to Tax Reform The Concept of Tax Expenditures // BUSINESS & ECONOMICS: Economics: General, – 1973. – P.418.

4. Stanley S. Surrey, Paul R. McDaniel Tax Expenditures // BUSINESS & ECONOMICS: Economics: General, – 1985. – P.303.

5. Vice Chairman, Jim Saxton Joint Economic Committee United States Congress URL: https://www.jec.senate.gov/reports/105th%20Congress/The%201997%20Joint%20Economic%20Report%20(1698).pdf

6. Rukovodstvo po obespecheniyu prozrachnosti v byudzhetno-nalogovoi sfere (2007 god). Mezhdunarodnyi valyutnyi fond. https://www.imf.org/external/np/fad/trans/rus/manualr.pdf

7. Maiburov I. A. Otsenka nalogovykh raskhodov i effektivnosti nalogovykh l'got: metodologiya resheniya zadachi // Obshchestvo i ekonomika. –2013. – № 4. – S. 47-58.

8. Malinina T.A. Otsenka nalogovykh l'got i osvobozhdenii: zarubezhnyi opyt i rossiiskaya praktika // Nauch. tr. In-ta ekon. politiki im. E. T. Gaidara. M. : Izd-vo In-ta Gaidara, – 2010. – 212 c.

9. Pinskaya M. R. Otsenka effektivnosti nalogovykh l'got: analiz imeyushchikhsya podkhodov // Nalogovaya politika i praktika.-2014.-№ 8 (140).-S. 24-28.

10. Osnovnye napravleniya nalogovoi politiki Rossiiskoi Federatsii na 2016 god i na planovyi period 2017 i 2018 gg.

11. OECD. Best Practices for Budget Transparency 2002. URL: http://www.oecd.org/governance/budgeting/Best%20Practices%20Budget%20Transparency%20%20complete%20with%20cover%20page.pdf

12. Pinskaya M.R. Integratsiya nalogovykh raskhodov v byudzhetnyi protsess kak instrument povysheniya effektivnosti otsenki vliyaniya nalogovykh l'got i preferentsii na dokhody byudzhetov // Materialy k «kruglomu stolu» Soveta Federatsii Federal'nogo Sobraniya Rossiiskoi Federatsii na temu: «Nalogovye l'goty i preferentsii: ikh vliyanie na dokhody byudzhetov byudzhetnoi sistemy Rossiiskoi Federatsii» ot 21 iyunya 2016 g.

13. Chang H.J., Lin J. Should Industrial Policy in Developing Countries conform Comparative Advantage or Defy it? A debate between Justin Lin and Ha-Joon Chang // Development Policy Review. – 2009. – № 27(5). – 78 p.

14. Promyshlennaya politika Rossii v sovremennykh usloviyakh / G. Idrisov. – M.: Izd-vo In-ta Gaidara, 2016. – 160 s.

15. Rodrik D. Industrial Policy: don’t ask why, ask how // Middle East Development Journal. – 2009. – № 1(01). – P. 1–29.

16. Forma №1-NDS «Otchet o nalogovoi baze i strukture nachislenii po nalogu na dobavlennuyu stoimost'», godovaya.

17. Forma №5-NIO "Otchet o nalogovoi baze i strukture nachislenii po nalogu na imushchestvo organizatsii", godovaya.

18. Forma №5-PM "Otchet o nalogovoi baze i strukture nachislenii po nalogu na pribyl' organizatsii, zachislyaemomu v byudzhet sub''ekta Rossiiskoi Federatsii", godovaya.

19. Forma №5-NDPI "Otchet o nalogovoi baze i strukture nachislenii po nalogu na dobychu poleznykh iskopaemykh", godovaya.

20. Forma №5-TN "Otchet o nalogovoi baze i strukture nachislenii po transportnomu nalogu", godovaya.

21. Forma №5-MN «Otchet o nalogovoi baze i strukture nachislenii po mestnym nalogam», godovaya.

22. Forma №5-VN «Otchet o nalogovoi baze i strukture nachislenii po vodnomu nalogu», godovaya.

23. Goncharenko L.I., Mel'nikova N. P. O novykh podkhodakh k politike primeneniya nalogovykh l'got i preferentsii v tselyakh stimulirovaniya razvitiya ekonomiki // Ekonomika. Nalogi. Pravo. – 2017. – № 2. – S. 96-104.

24. Chaikovskaya L.A., Yakushev A.Zh. Nalogovoe regulirovanie kak instrument strategicheskogo upravleniya razvitiem innovatsionnogo sektora ekonomiki. // Nalogi i nalogooblozhenie . – 2016. – № 1. – S. 20-27. DOI: 10.7256/1812-8688.2016.1.17431

25. Panskov V.G. — Printsipy nalogooblozheniya i ikh otrazhenie v rossiiskom nalogovom zakonodatel'stve // Nalogi i nalogooblozhenie. – 2017. – № 10. – S. 17-26. DOI: 10.7256/2454-065X.2017.10.24450 URL: http:// nbpublish.com/library_read_article.php?id=24450

Link to this article

You can simply select and copy link from below text field.

|