|

DOI: 10.25136/2409-7802.2018.2.25876

Received:

29-03-2018

Published:

04-07-2018

Abstract:

Within the framework of the present research, Tishko examines the market mechanism of the relationship between the company value and approaches to managing the market capital structure in Russia. The researcher defines and explains the grounds for essential trends in the business value as a result of approaches that are used to manage the market capital on the stock market. The author gives recommendations and particular strategies that can be used to increase the transparency of the market pricing of emitter's equities through increasing and maintaining a stable high level of the share of freely negotiable equities as well as recommendations regarding securities portfolio building. Within the framework of this research, the author has carried out the qualitative and quantitative analysis (the latter being carried out using the MS Excel application) that demonstrate the dynamics of the aforesaid indicators for the period since 2008 till 2017. The results of this calculation completed with the further empirical analysis of the results conclusively prove that the methods of managing the market capital structure offered by the author of the article are quite applicable to predict both the investment profitability from the side of potential investors and current stockholders, and benefits an emitter may receive from equity financing in the long-term perspective.

Keywords:

Equity financing, Corporate finance, Stock market, Market capitalization, Public company, Individual Investor, Expected profitability, Economic crisis, MOEX Russia Index, Free – float

This article written in Russian. You can find original text of the article here

.

Период развития мировой экономики в наши дни приблизился к той стадии, когда ни одна страна самостоятельно не способна в полной мере реализовать свой потенциал без взаимодействия с внешним миром. Эта стадия носит название глобальная экономика, а процесс перехода в эту форму – глобализация. Глобализация является характерной чертой процессов изменения структуры мирового хозяйства, понимаемого как совокупность национальных хозяйств, связанных друг с другом системой международного разделения труда, экономических и политических отношений, путём включения в мировой рынок и тесного переплетения экономики на основе транснационализации и регионализации [6].

Важную роль в процессе мировой глобализации играет уровень развития фондового рынка, степень его прозрачности,и доступности работы на нем для инвесторов и эмитентов в рамках отдельно взятой национальной экономики. Её важность заключается в первую очередь в возможностях во первых, по привлечению дополнительного капитала на условиях долевого финансирования со стороны эмитентов и во вторых, по размещению свободных финансовых ресурсов со стороны инвесторов. В результате совершения подобных сделок национальная экономика получает дополнительный приток инвестиций для последовательного и непрерывного развития, а получаемая инвестором доходность от осуществленных вложений, позволяет покрывать как текущие потребности, так и реинвестировать часть прибыли, тем самым запуская новый цикл развития экономики. Однако достижение устойчивого роста потенциальных вложений и сохранение приемлемого уровня доходности на продолжительном временном промежутке требует взвешенного подхода и выработки определенной стратегии по управлению инвестиционным портфелем в быстроменяющихся условиях ведения бизнеса, высокой волатильности цен на ключевые ресурсы и подверженности мировой экономики внешним шокам [10]. Эти же факторы в совокупности с жесткой конкуренцией ставят достаточно высокую планку для публичной компании в вопросе выхода на фондовый рынок и борьбе за потенциального инвестора, что так же требует разработки определенной стратегии и дисциплины в ее реализации от самого эмитента.

В данной работе, проведенной на основе анализа изменения рыночной стоимости крупнейших представителей российской экономики за последние 10 лет, автором предлагается ряд стратегий с одной стороны по управлению структурой рыночного капитала эмитента с целью повышения его инвестиционной привлекательности и с другой стороны - по формированию растущих ожиданий рынка от вложений в соответствующие ценные бумаги. Эти же стратегии работы публичной компании, рассматриваются как определенные сигналы для инвестора, которые необходимо учитывать при формировании портфеля ценных бумаг.

Научная новизна настоящей работы (а так же предшествовавших [8,9] ей работ) автора заключается в отсутствии аналогичных исследований, касающихся взаимосвязи рыночной стоимости и доли свободно обращающихся ценных бумаг публичной компании. Полученные в работе выводы применимы, во-первых, для эмитентов с целью формирования стратегии эффективного вывода ценных бумаг на открытый рынок и, во-вторых, для инвестора с целью формирования портфеля ценных бумаг с доходностью, опережающей среднерыночные показатели.

Вертикальный анализ выпущенных акций эмитента, общее количество которых участвует в расчете рыночного капитала, позволяет выделить два базовых уровня формирующих его структуру. Первый уровень включает в себя ценные бумаги, принадлежащие основателям, государству, институциональным инвесторам (фонды, союзы, страховые компании, коммерческие банки) [7]. Второй уровень включает в себя ценные бумаги, имеющие неограниченное хождение и принадлежащие широкому кругу инвесторов. Разница заключается в том, что свободно и без ограничений на бирже торгуются только акции входящие во второй уровень, тогда как акции первого уровня поддерживаются институциональными инвесторами в значительных объемах и на определенном уровне. Доля акций, входящих во второй уровень, во всем объеме долевых бумаг эмитента, формирующих его рыночный капитал, обозначается биржевым коэффициентом free-float.

Проведенный анализ структуры рыночного капитала российских публичных компаний, акции которых котируются на Московской бирже и формируют «индекс МосБиржи» [5], позволил подвердить взаимозависимость исследуемых показателей – рыночной капитализации и доли свободно обращающихся ценных бумаг публичной компании.

Индекс МосБиржи представляет собой ценовой, взвешенный по рыночной капитализации (free-float) композитный индекс российского фондового рынка, включающий наиболее ликвидные акции крупнейших и динамично развивающихся российских эмитентов, виды экономической деятельности которых относятся к основным секторам экономики. На дату анализа1 в базу расчета индекса МосБиржи были включены 45 акций российских эмитентов, допущенных к обращению на бирже, а также акции и депозитарные расписки на акции иностранных эмитентов, осуществляющих экономическую деятельность преимущественно на территории Российской Федерации. В акции не входят акции, выпущенные акционерными инвестиционными фондами.

По правилам Московской Биржи в базу расчета индекса МосБиржи и/или в лист ожидания на включение могут войти наиболее ликвидные и регулярно торгуемые акции, соответствующие следующим требованиям2:

- значение коэффициента free-float составляет не менее 10%;

- доля торговых дней, в течение каждого из которых с данными акциями была совершена хотя бы одна сделка, от общего числа торговых дней за шесть месяцев, предшествующих дню формирования базы расчета Индекса МосБиржи, составляет не менее 99%;

- значение коэффициента ликвидности (LCi) составляет не менее 15% (1% для Акций иностранных Эмитентов и депозитарных расписок на Акции, при условии, что коэффициент ликвидности, рассчитанный по объему торгов на площадке первичного листинга составляет не менее 15%);

- эмитент акций раскрыл последнюю отчетность в международном формате с задержкой не более 8 месяцев, предшествующих дню формирования новой Базы расчета Индекса МосБиржи.

Датой анализа был выбран последний биржевой рабочий день 2017 года – 29 декабря. Для проведения исследования были отобраны 33 Эмитента, акции которых: во-первых, присутствовали в базе расчета индекса МосБиржи на дату анализа, что подтверждает их статус как первоклассной высоколиквидной бумаги. Во-вторых, бумаги отобранных эмитентов должны показывать результат соответствия требованиям включения в индекс не только на дату анализа, но так же не менее чем в четырех последовательных годах расчета индекса, что позволяет говорить об однородности ценных бумаг по своему классу (флагманы фондового рынка) не только в текущем моменте времени, но и в динамике. И, в-третьих, из объекта анализа исключены акции эмитентов, относящихся к финансовому сектору, т.к. их официальная отчетность и основные критерии проведения анализа финансово-хозяйственной деятельности не сопоставимы с компаниями прочих секторов экономики, что ограничивает применяемые инструменты сравнительного анализа.

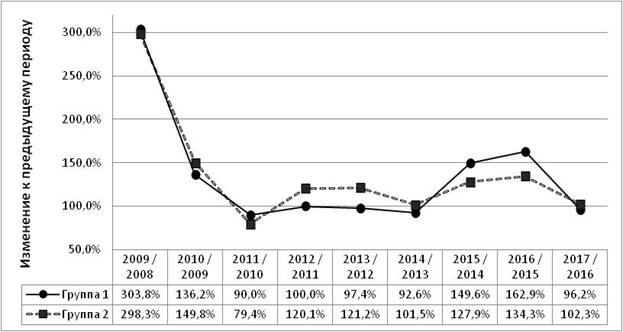

Акции эмитентов, соответствующие критериям отбора были отсортированы в соответствии с возрастанием показателя free-float соответствующей ценной бумаги. При этом в качестве значения free-float использовалась величина не на дату анализа, а среднеарифметическое значение за последние 10 лет (либо меньше, в зависимости от срока включения бумаги в котировальные списки Московской биржи). Следующим шагом акции компаний были разделены на 2 группы сходные по количеству ценных бумаг в выборке: в первую группу со значением free-float менее 0,30 вошли 19 компаний, а во вторую соответственно со значением free-float 0,30 и выше – 14 компаний. По каждой из анализируемых компаний был произведен расчет капитализации как произведение количества акций в обращении и цены 1 акции на дату анализа. Для возможности усреднения значений по группам, был произведен расчет изменения капитализации компаний по годам. Соответствующие относительные значения показателя капитализации по каждой компании в динамике были усреднены в разрезе выделенных групп. Глубина проводимого исследования составила 10 лет, начиная с 2008 по 2017 год включительно. Результаты проведенных расчетов капитализации в двух группах исследуемых компаний представлены на рисунке 1.

Рисунок 1. Динамика рыночной капитализации в анализируемых группах3

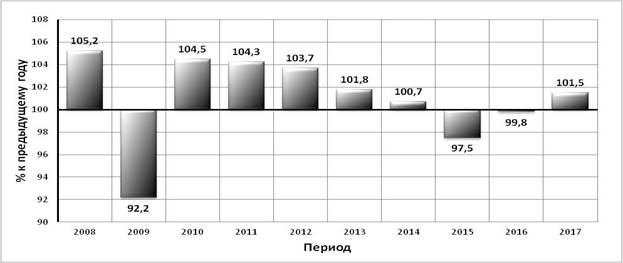

Хронологический период анализа исследуемых показателей несет важную информацию, необходимую для интерпретации полученных результатов. Так, начало этого периода приходится на конец 2008 года – год запомнившийся всему миру глобальным финансовым кризисом, который не обошел стороной и Россию [4]. Таким образом, результаты роста стоимости компаний в обеих группах в 2009 - 2010 годах обоснованы с учетом низкой базы предыдущего периода и восстановлением после кризиса. Однако бурный рост заканчивается уже в 2011 году, когда российская экономика переходит в стадию рецессии [2], не находя альтернативных источников роста, что так же подтверждается отрицательной динамикой роста ВВП (см. рисунок 2).

Рисунок 2. Динамика показателя ВВП РФ в % к предыдущему году4

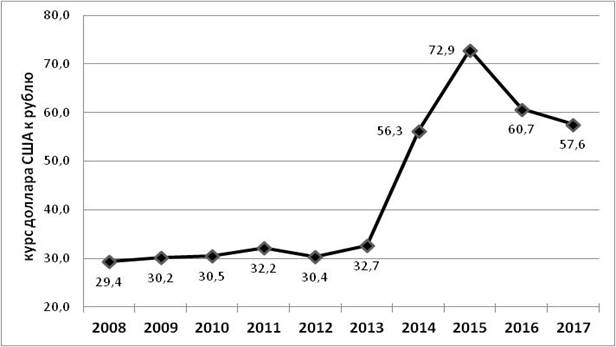

Далее мы наблюдаем существенную разницу на протяжении 2012 – 2013 годов в направленности динамики капитализации компаний в исследуемых группах. Так компании первой группы сохраняют негативный тренд 2011 года, тогда как представители второй группы несмотря на общий рецессионный фон в экономике показывают уверенный рост на 120,1% и 121,2% соответственно, что безусловно не может остаться незамеченным в глазах профессионального инвестора. Усиление рецессии 2011 года накладывается на обострение геополитической ситуации вокруг Украины в 2014 году [3], что влечет введение санкций в отношении Российской Федерации и резкое, почти двукратное обесценение национальной валюты по отношению к основным мировым валютам и непосредственно к доллару США (см. рисунок 3).

Рисунок 3. Динамика курса доллара США к рублю5

В данный временной период компании второй группы сохраняют незначительный рост стоимости в 1,5% к предыдущему году, тогда как компании первой группы продолжают дешеветь еще на 7,4%, причем отрицательная тенденция сохраняется четвертый год подряд. На протяжении 2015-2016 гг. происходит восстановление рынка, адаптация к новым условиям ведения бизнеса, и характеризуется ростом стоимости в обеих группах. Стоит отметить, что представители группы 1 растут в этот период более значительно чем компании группы 2 что частично может быть обусловлено низкой базой ретро периода для данных компаний, с учетом того что период отрицательной динамики капитализации для этой группы составил 4 года подряд. Последний 2017 год нашего анализа обозначается снижением ключевого показателя стоимости на 3,8% в первой группе и небольшим ростом на 2,3% во второй группе. Данный факт может быть своего рода сигналом о новом витке рецессии в экономике для одних компаний, на фоне продления режима санкций со стороны США и ЕС, усиления напряженности и увеличения конфликтов на ближнем востоке, в разрешении которых Россия принимает немаловажное участие, но так же и возможностью для роста других, готовых к структурным изменениям компаний [1].

В общем виде компании группы 2 выглядят более привлекательно для инвестора именно с точки зрения большей стабильности этапов роста стоимости бизнеса в периоде анализа, а так же меньшей подверженности обесценению в шоковые и переломные периоды в экономике. Простейший сравнительный расчет доходности от вложения в портфель бумаг компаний первой и второй группы (к примеру, 100 рублей) в конце 2009 года подтверждает данный вывод (см. рисунок 4). Портфель бумаг по компаниям первой группы показывает среднегодовую доходность на уровне 19,9%, тогда как по компаниям второй группы среднегодовая доходность составляет 26,1%.

Рисунок 4. Сравнение доходности от вложения в портфель акций группы 1 и 2

Описанная выше ситуация вложения 100 рублей в 2009 году (значения 2008 года не включались в расчет для нормализации полученных результатов) хорошо показывает ту разницу в прибыли, от инвестиций в разные портфели ценных бумаг в зависимости от средних значений показателя free-float. Однако она далека от реальности как минимум с учетом того что усреднение показателя free-float происходило за период 2009 – 2017, а вложения осуществлены в 2009. Таким образом, в 2009 году инвестор не мог знать, как сформируются портфели группы 1 и группы 2 через год, 3 года или 5 лет и мог опираться только на ретро данные, которые на тот момент были менее репрезентативны, чем сегодня.

Вопрос практического использования показателя free-float для формирования вложений в портфель ценных бумаг со стороны инвестора, а так же для построения структуры рыночного капитала, ориентированной на инвестора, со стороны эмитента этих ценных бумаг, был впервые затронут автором в работе посвященной анализу показателя free-float как фактора рыночной капитализации российских публичных компаний в посткризисный период [8].

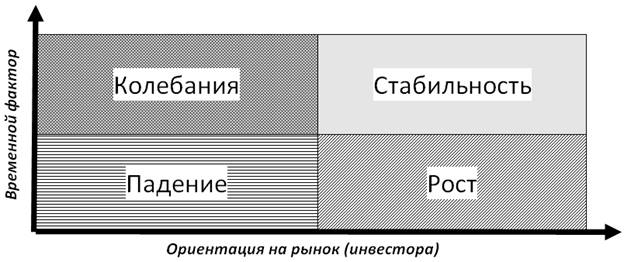

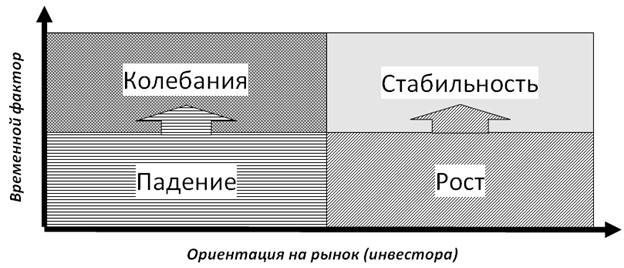

Выявленные в данном труде тенденции изменения стоимости компаний в зависимости от динамики показателя free-float в соответствующие периоды позволяют нам идентифицировать и предложить ряд стратегий по управлению, во-первых, портфелем инвестора, а во-вторых, структурой рыночного капитала эмитента. Данные стратегии основаны и напрямую взаимосвязаны с группами динамики free-float, которым соответствуют ценные бумаги, с одной стороны планируемые к приобретению в портфель потенциальным инвестором и с другой стороны планируемые к выпуску на фондовый рынок потенциальным эмитентом. Всего было выделено четыре группы: Рост, Падение, Колебания, Стабильность. Названия групп соответствуют динамике показателя free-float, входящих в соответствующую группу компаний, за анализируемый период времени.

Основой отнесения бумаги эмитента к одной из четырех групп является динамика уровня показателя free-float по этой ценной бумаге, которая анализируется не менее чем за два периода. Стандартный период анализа включает один календарный год. На основе выявленных ранее [9] тенденций и закономерностей динамики стоимости компаний в соответствующих группах, автором сформулирована матричная градация совокупности выделенных групп, представленная на рисунке 5.

По горизонтали группы расположены в зависимости от уровня ориентации компаний на потенциального инвестора: от низкого к высокому. Вертикальная ось разделяет группы в зависимости от продолжительности времени, в течение которого компании могут находиться в рамках обозначенных групп: от ограниченного промежутка времени до неограниченного периода времени.

Рисунок 5. Матрица динамики показателя free-float в разрезе соответствующих групп

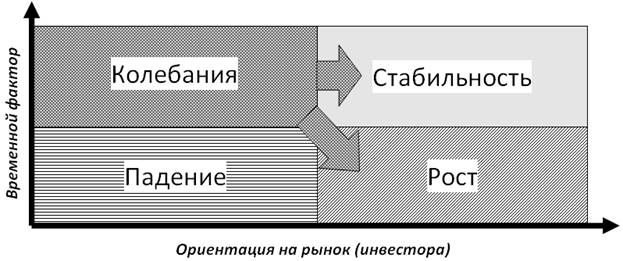

Ожидания от инвестиций в ценные бумаги компаний «ориентированных на рынок» то есть с высоким уровнем ориентации на инвестора – стабильно положительны, что выражается в уверенности участников рынка в будущих выгодах от вложения в соответствующие активы. При этом следует отметить, что невозможно постоянно наращивать долю бумаг, свободно торгуемых на рынке, так как всегда есть определенный предел в общем виде равный единице, то есть когда весь объем эмиссии будет находиться в свободном обращении. Однако на практике такого не встретишь по причине наличия мажоритарных и институциональных инвесторов, поэтому фактически данный предел будет находиться на уровне меньше единицы. В итоге, логическим продолжением стратегии «роста» показателя free-float, которая является при этом ограниченной во времени, будет являться переход в стратегию «стабильность» с поддержанием достигнутых результатов.

При этом по аналогии с компаниями, показывающими растущий уровень показателя free-float, существует так же предел и для компаний с сокращающимся уровнем данного показателя, который равен нулю, то есть когда весь объем эмиссии будет принадлежать мажоритарным и институциональным инвесторам при отсутствии бумаг в свободном обращении. Фактически нижний предел будет находиться выше нуля, иначе отсутствовала бы сама возможность приобретения таких активов на открытом рынке. При этом компании данной категории не могут постоянно снижать долю бумаг, свободно торгуемых на рынке. Достигнув нижнего «предела» эмитент в следующем анализируемом периоде автоматически попадает в группу «колебания», так как дальше снижать уровень FF уже нет возможности, но и напрямую в другие группы с учетом падения в ретро периоде такие бумаги не имеют возможности попасть, минуя группу «колебания» (см. рисунок 6).

Рисунок 6. Ограниченность времени нахождения в группах «рост» и «падение»

Последовательно достигнув верхнего «предела» в рамках стратегии «рост» для эмитента важно поддерживать этот уровень, таким образом, показывая стабильность, что будет являться сигналом для инвестора о высоком уровне ориентации компании на рынок и готовности к долгосрочному сотрудничеству в том числе в рамках долевого финансирования.

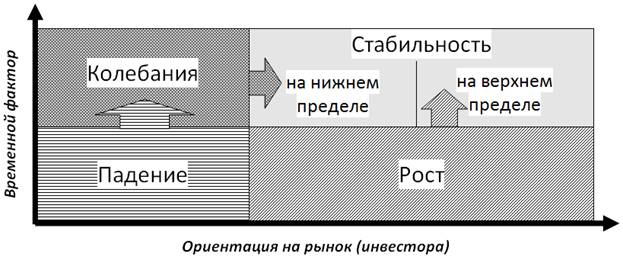

Компании в промежуточной группе «колебания» потенциально имеют три сценария дальнейшего развития - «рост», «стабильность», либо чередование данных подходов во времени. Потенциал роста стоимости бумаг в данных сценариях будет напрямую зависеть от выбранной стратегии при прочих равных условиях ведения бизнеса (см. рисунок 7).

Рисунок 7. Сценарии дальнейшего развития компаний в группе «Колебания»

При этом говоря о группе «стабильность» следует различать две ее подгруппы – «стабильность на нижнем пределе» и «стабильность на верхнем пределе» градаций free-float. Как уже обозначалось выше «стабильность» - залог уверенности инвестора в поддержании текущей стратегии развития взаимоотношений компании с рынком в перспективе. Однако потенциал развития компании и уровень уверенности инвестора в ней будет отличаться в подгруппах стабильность на нижнем пределе и на верхнем пределе. Обоснованием такого вывода будет служить стратегия эмитента, предшествующая входу компании в соответствующую подгруппу. Так при нахождении в группе «падение» и достижении нижнего предела, компания в следующем периоде автоматически, как уже писалось выше, попадает в группу «колебания». Далее логическим шагом при отсутствии положительной динамики показателя free-float в следующем периоде компания переместится в группу «стабильность» и соответственно подгруппу «нижний предел», что будет являться не столько заслугой, сколько вынужденным и естественным исходом в сложившейся ситуации.

Напротив, в результате реализации стратегии «рост» компания имеет возможность поддерживать достигнутый уровень взаимоотношений с рынком, что в полной мере будет выражаться в стратегии «стабильность на верхнем пределе» и в этом сценарии будет требовать целенаправленных усилий и определенных мер со стороны эмитента по сохранению имеющегося значения показателя free-float. Соответственно уровень ориентации на рынок, а так же потенциал дальнейшего удорожания ценных бумаг в обеих подгруппах будет значительно отличаться (см. рисунок 8).

Рисунок 8. Градации в группе «Стабильность» и сценарии их достижения

Потенциал удорожания компаний с растущим уровнем показателя free-float в краткосрочном периоде выше, чем у группы со стабильным уровнем free-float, что закономерно с учетом растущих ожиданий инвестора касательно соответствующих эмитентов и их стратегии работы на фондовом рынке. Напротив, бумаги эмитента со стабильно сокращающейся долей свободно торгуемых акций с высокой долей вероятности будут иметь негативный эффект в части изменения их стоимости в будущем. Тогда как потенциал роста в группе «колебания» при прочих равных в среднем равен 0 или находится в промежутке между растущим и падающим трендом, что может свидетельствовать об отсутствии понимания инвестора касательно долгосрочной стратегии компании на рынке.

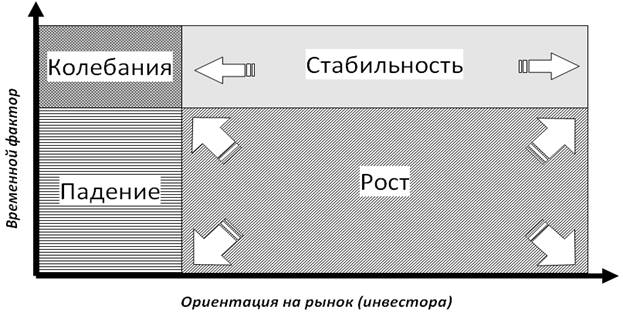

Максимизация в портфеле инвестора, во-первых, бумаг из категорий «рост», а во вторых - «стабильность» обеспечит наибольший прирост стоимости портфеля при прочих равных условиях: сохранение исходных предпосылок ведения бизнеса компаниями, входящими в анализируемую выборку (см. рисунок 9).

Рисунок 9. Формирование инвестиционного портфеля в разрезе групп

Безусловно, на практике термин «при прочих равных условиях» будет с трудом применим для формирования портфеля ценных бумаг с едиными предпочтениями для конкретного инвестора. Ведь стоимость конкретной компании зависит от множества факторов как количественного, так и качественного характера, которые проявляются в разное время в разном соотношении у каждой компании и оказывают специфичное воздействие. По этой причине верификация потенциальных претендентов на включение в инвестиционный портфель носит преимущественно индивидуальный характер с обязательным анализом индивидуальных особенностей эмитента. Тем не менее, общая закономерность опережающего роста стоимости компаний, ориентированных на инвестора в долгосрочной перспективе в большей или меньшей степени будет прослеживаться на рынке, и приносить свои результаты в виде роста стоимости портфеля бумаг для его собственника. Ориентация на инвестора в данном контексте подразумевает увеличение прозрачности в механизме формирования рыночных цен на акции эмитента посредством наращивания и поддержания на стабильно высоком уровне доли свободно обращающихся на рынке ценных бумаг, которая выражается в значении показателя free-float. Эмитент, придерживающийся такой стратегии, тем самым подтверждает свою готовность к дальнейшему взаимовыгодному сотрудничеству с рынком. Выгода самого эмитента от реализации подобной стратегии будет выражаться в росте ценности дополнительно привлекаемого долевого капитала. Тогда как инвестор с другой стороны получает необходимый уровень доходности, который в то же время менее подвержен колебаниям и воздействиям внешних факторов по сравнению с бумагами эмитентов не ориентированных на рынок.

В данном случае выигрывают не только формальные участники конкретной сделки в лице эмитента и инвестора, но и в более широком контексте – государство и национальная экономика. Выгода государства проявляется, во-первых, в стабильности положительной динамики развития рыночно ориентированных компаний и в более широком смысле - отраслей, следствием которой будет являться стабильный поток доходов бюджета, рост количества рабочих мест и удовлетворенности хозяйствующих субъектов. Во-вторых, стабильность уровня доходов инвесторов от вложения в бумаги, ориентированных на рынок компаний, будет в общем виде проявляться в росте благосостояния населения, формировании дополнительных свободных средств. При этом высвобожденные средства могут быть использованы для последующего реинвестирования либо увеличения потребления, что в свою очередь будет выражаться в увеличении спроса, ответном росте предложения и в конечном итоге - экономики в целом. Таким образом, при реализации ориентированной на рынок стратегии большинством компаний, экономика страны будет показывать циклический рост с максимальным удовлетворением потребностей всех хозяйствующих субъектов, что в текущих макроэкономических реалиях является жизненно необходимым для успешного функционирования в рамках усиливающейся международной конкуренции и нарастании внешнеполитических угроз.

1 Последний рабочий день биржи последнего завершенного календарного года (29.12.2017)

2 Методика расчета индексов московской биржи (с 27.11.2017). http://fs.moex.com/files/3344/24993

3 Разработано автором на основании данных Московской Биржи

4 Разработано автором на основании данных Федеральной службы государственной статистики

5 Разработано автором на основании данных Центрального банка Российской Федерации

References

1. Aganbegyan A.G. Ekonomika Rossii na rasput'e… Vybor postkrizisnogo prostranstva – M.: AST. Vladimir VKT, 2010. – 379 s.

2. Aganbegyan A. G. Ekonomika Rossii: ot stagnatsii k retsessii //Den'gi i kredit. – 2016. – №. 5. – S. 10-20.

3. Glaz'ev S. Yu. O neotlozhnykh merakh po ukrepleniyu ekonomicheskoi bezopasnosti Rossii i vyvodu rossiiskoi ekonomiki na traektoriyu operezhayushchego razvitiya //Rossiiskii ekonomicheskii zhurnal. – 2015. – №. 5. – 60 s.

4. Grigor'ev L., Salikhov M. Finansovyi krizis-2008: vkhozhdenie v mirovuyu retsessiyu //Voprosy ekonomiki. – 2008. – T. 12. – S. 27-45.

5. Moskovskaya birzha [Elektronnyi resurs]: krupneishii v Rossii i Vostochnoi Evrope birzhevoi kholding. – Elektron. dan. – M.: Moskovskaya birzha, 2011 – Rezhim dostupa: http://www.micex.ru/marketdata/indices/shares/composite (data obrashcheniya: 06.02.2018), svobodnyi. – Zagl. s ekrana.

6. Novikova I. V. Globalizatsiya, gosudarstvo i rynok: retrospektiva i perspektiva vzaimodeistviya //Mn.: Akad. upr. Pri Prezidente Resp. Belarus'. – 2009. – 218 s.

7. Rozhkova I. V., Azaryan N. A. Ekonomicheskaya sushchnost' deyatel'nosti institutsional'nykh investorov na rynke tsennykh bumag //Finansy i kredit. – 2013. – №. 9 (537). – S. 51-55.

8. Tishko R. V. Analiz faktorov rynochnoi kapitalizatsii rossiiskikh publichnykh kompanii v postkrizisnyi period //Internet-zhurnal «NAUKOVEDENIE». – 2016. – T. 8. – №. 5. – S. 62-62.

9. Tishko R. V. Podkhody k upravleniyu aktsionernym kapitalom rossiiskikh publichnykh kompanii //Upravlenie ekonomicheskimi sistemami: elektronnnyi nauchnyi zhurnal. – 2016. – №. 12 (94). – S. 55-55.

10. Shiller R. Irratsional'nyi optimizm: Kak bezrassudnoe povedenie upravlyaet rynkami. – Al'pina Pablisher, 2014. – 420 s.

Link to this article

You can simply select and copy link from below text field.

|