|

DOI: 10.7256/2306-4595.2013.1.809

Received:

15-02-2013

Published:

1-3-2013

Abstract:

The article is devoted to increasing disparity between regions. Over the years of reforms, many Russian regions have started to lose their benefits and preferences. Volumes of investments in different regions start to vary greatly, too. The author of the present article describes the structure of investment financing including state financing and defines the most preferred activities to invest into. In the course of this reseach, the author has defined problems of inequality of regional investment attractiveness which leads to different socio-economical levels in these regions. This creates a threat for the common economic space and intergrated regional system. Integrity of a region as a complex socio-economic system is shaken when there is a significant capital outflow, let it be finances, human resouces or finances. When a region becomes inattractive for investors, the capital and assets of such a region flow to stronger regions and make the problem of spatial inequality even worse. Such inequality is defined by the economical strucure in many ways. Only progressie changes and shifts in the structure of regional economy can raise the competitive ability of a region. But first it requires investments into manufacturing activities (because the majority of such regions do not have their own manufacturing sector). On the other hand, manufacturing sector has lost its competitive position under the conditions of open economy.

Keywords:

corporate bonds, spatial inequality, economical structure, financing sources, financial system, regional disparity, regional development, investments, ecoomic dilemma, technological progress

This article written in Russian. You can find original text of the article here

.

Введение

Проблема расслоения общества по доходам обсуждается гораздо чаще, чем проблема неравенства регионов, существенно отличающихся друг от друга по размерам произведенного валового регионального продукта, а соответственно, по уровню и качеству жизни населения: экономическая динамика определяет динамику социальную [1]. Темпы экономического роста в регионах настолько разнятся, что отдельные территории в своем развитии многократно опережают аутсайдеров, в числе которых оказалась значительная часть "региональной России". Лишь на узкий круг регионов-лидеров приходится основная доля доходов, инвестиций, финансовых институтов. Отставание или лидерство определяют самые разные факторы: отраслевая структура производства, географическое положение региона, доля занятых в промышленности, сельском хозяйстве, бюджетной сфере, уровень безработицы, финансовый потенциал, состояние инфраструктуры и другие. Но ключевым фактором, выводящим на траекторию роста и стимулирующим положительную экономическую динамику, являются инвестиции в основной капитал. При сравнении регионов обнаруживается глубокая дифференциация по уровню инвестиционной активности, порождающей с течением времени все больший и больший разрыв между регионами по среднедушевому показателю инвестиций в основной капитал.

Инвестиционная активность, в понятие которой мы вкладываем интенсивность процессов инвестирования в рамках страны или региона, в свою очередь зависит от реакции корпоративного сектора на стимулы к инвестированию, возникающие в разных секторах экономики в результате воздействия ряда факторов. Основным стимулом является возможность получения прибыли не в краткосрочном периоде, а в долгосрочной перспективе, поскольку капитальные вложения могут быть связаны с длительными сроками окупаемости. Инвестиции в промышленный сектор и сельское хозяйство в большинстве своем рассчитаны на окупаемость в 5-10 лет, но без долгосрочных вложений поднять их конкурентоспособность невозможно. Кроме того, важным фактором является способность корпоративного сектора к накоплению инвестиционных ресурсов. При их недостаточности на первый план выдвигается роль финансовой системы страны, региона. Также важна государственная поддержка инвестиционной деятельности. В рамках данного исследования проанализирована структура инвестиций по источникам финансирования и по видам экономической деятельности. На основе анализа выявлены проблемы развития приоритетных секторов общественного хозяйства.

В разработку теории и методологии исследования инвестиционной деятельности и её влияния на эффективность социально-экономической системы внесли многие отечественные ученые: В.М. Аньшин, И. Г. Белинский, И.И. Балацкий, В.А. Богомолов, С.В. Валдайцев, В.А. Волконский, А.Г. Гранберг, А.Ю. Егоров, Б.С. Жихаревич, О.Б. Казакова, Н. В. Кисилева, В.И. Кушлин, В. Г. Лебедев, В. Н. Лексин, М. А. Лемитовский, Н. Н. Матиенко, А. М. Мухамедьяров, В. В. Мыльник, Н. Н. Некрасов, П. П. Пилипенко, М. И. Ример, Н. З. Солодилова, С. А. Суспицын и др. В последние годы особое внимание в исследованиях данного направления стало уделяться мотивационным аспектам инвестиционных решений.

Мотивационная модель инвестиционного поведения хозяйствующих субъектов рассматривается в работах В.И. Перцухова. Предложенные им модели инвестиционного поведения хозяйствующих субъектов содержат следующие основные элементы [5]:

- мотивация накопления собственных инвестиционных ресурсов;

- мотивация использования накопленного капитала в инвестиционном процессе;

- мотивация альтернативного осуществления реальных или финансовых инвестиций;

- мотивация осуществления внутренних и внешних инвестиций;

- мотивация альтернативного осуществления инвестиций на отечественном или зарубежном рынках.

Таким образом, от мотивации зависит выбор страны, региона, отрасли, мотивация определяет движение инвестиционных ресурсов по конкретным секторам экономики, дающим (или предполагающим) больший прирост капитала на вложенные средства.

Многие авторы при исследовании проблем и состояния инвестиционного рынка ссылаются на уровень развития финансовой системы. Экономическую динамику также рассматривают под воздействием таких факторов, как рост инвестиций и развитость финансовой системы, являющейся тем механизмом, который обеспечивает производственный сектор инвестиционными ресурсами. Роль финансовой системы во все времена оценивалась в качестве приоритетной. Ещё Й. Шумпетер утверждал, что высокий уровень развития финансовых институтов служит залогом быстрого экономического роста.

Для понимания процесса экономической динамики на мезо- и микроуровнях важны предпринимательские теории. В основу экономического развития в предпринимательских теориях заложено наличие на территории различных форм экономической деятельности, часто с опорой на её традиционные для данной местности виды. Наиболее ярким представителем данного направления является предпринимательская теория Й.Шумпетера, в рамках которой предприниматель - главный субъект экономического развития. Предпринимательская активность осуществляет технический прогресс, и экономика начинает активно развиваться. Действия предпринимателя-новатора нарушают «привычный» кругооборот. Под инновации предприятиями-новаторами берутся кредиты, создается инвестиционный спрос. Инвестиции направляются в новые сферы, постепенно вовлекая в процесс «новую волну» участников. Возникают «колебания, задающие общий тон деловой жизни: в начале этих перемен происходит оживление инвестиций и наступает процветание…». Накопление как неустойчивый, циклический процесс связано с освоением новых инвестиционных процессов. Динамика национального продукта видится в виде скачков и рывков. С инновациями Шумпетер связывает и циклическое развитие экономики, причем происходит это во взаимосвязи коротких, средних и длинных циклов, а инновации воздействуют на каждый из данных циклов [7]. Основная часть Исследование инвестиционной активности по видам экономической деятельности показывает, что больший объем инвестиций наблюдается по тем видам, которые обеспечивают и больший вклад добавленной стоимости в ВВП. Они же являются приоритетными для инвесторов, поскольку приносят достаточный доход на вложенные средства (рис.1).

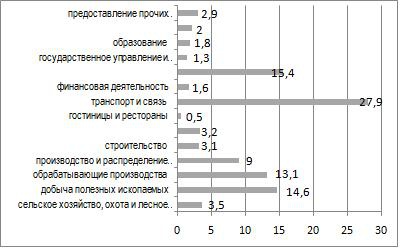

Рисунок 1 - Структура инвестиций в основной капитал в России по видам экономической деятельности в 2011 г [3].

В порядке убывания это следующие виды: транспорт и связь (27,9%), операции с недвижимым имуществом, аренда и предоставление услуг (15,4 %), добыча полезных ископаемых (14,6%), обрабатывающие производства (13,1%), производство и распределение электроэнергии, газа и воды (9%). Очень низкой остается доля инвестиций в такие значимые отрасли как здравоохранение и предоставление социальных услуг, образование – для этих секторов важны государственные финансы.

Анализ структуры инвестиций в основной капитал по источникам финансирования показывает, что государственные финансы остаются приоритетными (после собственных средств организаций), в то время как роль банковских кредитов, хотя и повысилась с 2000 г., все ещё остается несущественной. Анализируя региональный срез по уровню инвестиционной активности во взаимосвязи влияния на неё различных источников финансовых ресурсов, направляемых на инвестиции, выявлена явная недостаточность участия финансовых институтов в инвестиционном процессе. Слабое влияние сбережений на инвестиции выражается в том, что доля банков в финансировании инвестиционных проектов в отдельных регионах остается очень низкой. Так, Мурманская область и Республика Карелия (в первом полугодии 2012 г. доля банков составила соответственно 0,2 и 2%, тогда как в целом в Российской Федерации – 8,4%), как и многие другие северные регионы, существенно отстают от российского уровня. Анализ структуры инвестиций по источникам финансирования в Северо-Западном федеральном округе (за первое полугодие 2012 г.) показал, что более половины инвестиционных ресурсов приходится на собственные средства – 52,8%, на привлеченные – 47,2%, из которых кредиты банков составляют 5,9%. В СЗФО существенную долю в привлеченных источниках составляют средства бюджета – 21,8% (в 2009 г. – 29,8%, в 2010 – 24%), причем преимущественно федерального. Таким образом, для северных регионов государственные инвестиционные ресурсы остаются на втором месте после собственных средств предприятий (таблица 1).

В целом по России структура источников финансирования обнаруживает практически те же тенденции: доля бюджетных средств остается значительной. Также следует отметить слабое влияние фондового рынка как инструмента формирования инвестиционных ресурсов: средства от выпуска корпоративных облигаций составляют всего лишь 0,01% от общего объема источников. При этом корпоративный сегмент представляется более мощным по аккумулированию инвестиционных ресурсов, так как доля средств вышестоящих организаций в источниках финансирования достаточно высока – 20,2%.

Таблица 1.

Структура инвестиций в основной капитал в РФ

по источникам финансирования

(без субъектов малого предпринимательства и объема инвестиций,

не наблюдаемых прямыми статистическими методами) [3]

|

|

2011 г.

|

Справочно

в % к итогу

|

|

млрд. рублей

|

в % к итогу

|

2000 г.

|

2005 г.

|

2010 г.

|

|

Инвестиции в основной капитал

|

7701,2

|

100

|

100

|

100

|

100

|

|

в том числе по источникам финансирования:

собственные средства

|

3284,8

|

42,7

|

47,5

|

44,5

|

41,0

|

|

из них:

прибыль, остающаяся в распоряжении

организаций

|

1328,3

|

17,2

|

23,4

|

20,3

|

17,1

|

|

амортизация

|

1663,3

|

21,6

|

18,1

|

20,9

|

20,5

|

|

привлеченные средства

|

4416,4

|

57,3

|

52,5

|

55,5

|

59,0

|

|

в том числе:

кредиты банков

|

594,2

|

7,7

|

2,9

|

8,1

|

9,0

|

|

из них кредиты иностранных банков

|

119,0

|

1,5

|

0,6

|

1,0

|

2,3

|

|

заемные средства других организаций

|

388,3

|

5,0

|

7,2

|

5,9

|

6,1

|

|

бюджетные средства

|

1448,7

|

18,8

|

22,0

|

20,4

|

19,5

|

|

из них:

из федерального бюджета

|

757,5

|

9,8

|

6,0

|

7,0

|

10,0

|

|

из бюджетов субъектов Российской

Федерации

|

610,2

|

7,9

|

14,3

|

12,3

|

8,2

|

|

средства внебюджетных фондов

|

16,5

|

0,2

|

4,8

|

0,5

|

0,3

|

|

прочие

|

1968,7

|

25,6

|

15,6

|

20,6

|

24,1

|

|

из них:

средства вышестоящих организаций

|

1558,7

|

20,2

|

...

|

10,6

|

17,5

|

|

средства, полученные на долевое участие

в строительстве (организаций и населения)

|

146,9

|

1,9

|

...

|

3,8

|

2,2

|

|

из них средства населения

|

84,1

|

1,1

|

...

|

...

|

1,2

|

|

средства от выпуска корпоративных

облигаций

|

0,01

|

0,00

|

...

|

0,3

|

0,01

|

|

средства от эмиссии акций

|

76,6

|

1,0

|

0,5

|

3,1

|

1,1

|

|

Из общего объема инвестиций в основной

капитал - инвестиции из-за рубежа

|

235,4

|

3,1

|

4,7

|

6,5

|

3,8

|

Имея разный потенциал, регионы существенно отличаются по уровню инвестиционной деятельности. Анализ инвестиционных процессов в России и Северо-Западном федеральном округе выявил тенденцию все большего расслоения регионов. В 2011г. более 50% всех инвестиций в основной капитал освоено в Центральном, Уральском и Приволжском федеральных округах (соответственно 21,9%, 17,4% и 15,6% всех инвестиций). Половина от объема инвестиций в основной капитал в 2011г. осуществлена на территории 12 субъектов Российской Федерации. Серьезный разрыв по уровню инвестиций наблюдается в СЗФО. Lифференциация регионов СЗФО начала нарастать ещё до кризиса 2008 г., и еще более усилилась после него: так разрыв по среднедушевому показателю инвестиций между Республикой Коми и Псковской областью в 2011 г. был 6-кратным, в 2008 г. – 3,8 раза. Первые позиции по объему инвестиций в основной капитал в расчете на душу населения в 2011г. в СЗФО занимали Республика Коми и Ленинградская область. Данный показатель по Республике Карелия, занимающей выгодное географическое положение и имеющей самую большую протяженность границы с Евросоюзом (и, казалось бы, лучшие возможности привлечения иностранного капитала), в 1,9 раза ниже общероссийского, в 2,2 ниже, чем в СЗФО и 4,6 раза меньше показателя по Ленинградской области. Доля Республики Карелия в общем объеме инвестиций в основной капитал в СЗФО составляет около 2%, в то время как в 2000 г. она составляла 5,5%, в 2005г. – 3,1%.

Инвестиционное неравенство тесно взаимосвязано с экономическими показателями, прежде всего с ВРП. Были проанализированы среднедушевые показатели валового регионального продукта и проведено сравнение регионов. К примеру, в СЗФО Республика Коми в 3,1 раза превышает Псковскую область по ВРП на душу населения. Разрыв между российскими регионами (самые сильные в сравнении со слабыми) в 2011 г. по данному показателю составил 19,5 раза (в 1998 г. – 17,5). Не изменилось с 1998 г. соотношение наиболее высокого ВРП на душу населения и среднероссийского – остался прежним отрыв сильных регионов в 3,8 раза. Однако отставание отдельных регионов Северо-Кавказского федерального округа от среднероссийского уровня увеличилось: в 1998 г. в 4,5 раза, а в 2011 г. в 5,1 раза. Это отставание создает не только экономические проблемы, но и провоцирует социальные и межнациональные конфликты. Также отстающим регионам становится все сложнее адаптироваться к быстро меняющейся внешней среде и отвечать на вызовы процесса глобализации.

В ходе исследования роли финансового сектора выявлено улучшение за десятилетие показателей, характеризующих финансовые условия инвестиционной деятельности в России: средневзвешенная ставка по рублевым кредитам нефинансовым организациям уменьшилась с 24,4 в 2000 г. до 10,8 процентов в 2010 г. Ставка рефинансирования (на конец года) за этот период также имела тенденцию к уменьшению с 25 до 7,75 процентов. Сократились темпы инфляции: индекс потребительских цен снизился со 120,2 до 108,8 %, индекс цен производителей промышленных товаров со 131,9 до 116,7%, индекс цен строительной продукции со 135,9 до 109,1% [2]. При этом демонстрировали рост макроэкономические показатели. Увеличивается доля вкладов физических лиц на более длительные сроки (таблица 2).

Таблица 2.

Данные об объемах привлеченных кредитными организациями

вкладов (депозитов) физических лиц (млрд. руб.)*

|

|

01.01.07

|

01.12.07

|

01.01.09

|

01.12.09

|

01.01.11

|

01.12.11

|

01.11.12

|

|

Всего

|

3 809, 7

|

4 828, 3

|

5 907,0

|

6 998,75

|

9 818,05

|

11 061,4

|

13 196,5

|

|

До востребования

|

583,9

|

719,6

|

838,1

|

854,7

|

1 540,0

|

1 658,2

|

2179,1

|

|

на срок от 181 дня до 1 года

|

460,8

|

578,1

|

471,1

|

643,95

|

1 007,0

|

1 293,1

|

2290,4

|

|

на срок от 1 года до 3 лет

|

1 706,2

|

2 371,9

|

2 506,3

|

2 922,7

|

4 381,7

|

4 709,7

|

6755,7

|

|

Структура вкладов на соответствующие даты (в процентах к итогу)

|

|

Всего

|

100

|

100

|

100

|

100

|

100

|

100

|

100

|

|

До востребования

|

15,3

|

14,9

|

14,1

|

12,2

|

15,6

|

14,9

|

16,5

|

|

на срок от 181 дня до 1 года

|

12,1

|

12,0

|

8,0

|

9,1

|

10,3

|

11,7

|

17,4

|

|

на срок от 1 года до 3 лет

|

44,8

|

49,1

|

42,5

|

41,8

|

44,6

|

42,5

|

51,2

|

*Расчеты сделаны по данным ЦБР:

Результаты исследования показали в целом улучшение инвестиционного климата в России, однако, при этом возможности привлечения инвестиций в регионы неравные. Исследования других авторов подтверждают углубление данной проблемы, поскольку дифференциация регионов по инвестициям в основной капитал влечет за собой дифференциацию в территориальном развитии, а «ключевым моментом в понимании территориальной дифференциации выступает понятие целостности региональной системы» [6]. Целостность региона как сложной социально-экономической системы нарушается, когда происходят значительный отток капитала: финансового, человеческого, ресурсного. Если регион становится инвестиционно непривлекательным, из него капитал мигрирует в более сильные регионы, обостряя проблему пространственного неравенства. Во многом эти неравенства определяются структурой экономики. Только прогрессивные сдвиги в структуре региональной экономики могут повлиять на повышение конкурентоспособности региона, вывести его на траекторию роста. Но для этого необходимы инвестиции, прежде всего, в обрабатывающие производства, поскольку среди депрессивных регионов доминируют те, в которых отсутствует экспортоориентированный сырьевой сектор, а обрабатывающая промышленность, составлявшая основу экономики, утратила свои конкурентные преимущества в условиях открытой экономики.

References

1. Zubarevich N. Sotsial'naya differentsiatsiya regionov i gorodov Rossii// http://gtmarket.ru/laboratory/expertize/527820. Opublikovana 12.2012. 21:05

2. Investitsii v Rossii. 2011: Stat.sb./ Rosstat.-M., 2011. – 303 s.

3. Investitsii v osnovnoi kapital v Rossiiskoi Federatsii v 2011godu //http://www.gks.ru/bgd/regl/B12_04/IssWWW.exe/Stg/d03/1-inv.htm

4. Investitsii v osnovnoi kapital v Rossii po vidam ekonomicheskoi deyatel'nosti v pervom polugodii 2012 g. // http://www.gks.ru/wps/wcm/connect/rosstat/rosstatsite/main/enterprise/investment/nonfinancial

5. Pertsukhov V.I. Investitsionnyi klimat: modelirovanie investitsionnoi situatsii v usloviyakh territorial'nogo razdeleniya truda. Monografiya. Krasnodar: Izd-vo OOO «Rizograf», 2010.-212 s.: il.

6. Shil'tsin E.A. Voprosy otsenki regional'noi asimmetrii (na primere Rossii)// http://do.gendocs.ru/docs/index-169523.html

7. Shumpeter I. Teoriya ekonomicheskogo razvitiya (Issledovanie predprinimatel'skoi pribyli, kapitala, kredita, protsenta i tsikla kon''yunktury): per.s angl. — M.: Progress, 1982. — 455 s.

8. Tsyganov V.V. Rossiiskie tsentry kapitala // NB: Natsional'naya bezopasnost'. - 2013. - 1. - C. 290 - 346. URL: http://www.e-notabene.ru/nb/article_241.html

9. Lityagin N.N. Znachenie investitsii

kak faktora sotsial'no-ekonomicheskogo

razvitiya // LEX RUSSICA (RUSSKII ZAKON). - 2012. - 1. - C. 67 - 80.

10. Shugurov M.V. Mirovaya finansovaya sistema i perspektivy global'nogo innovatsionno-tekhnologicheskogo razvitiya: mezhdunarodno-pravovoi aspekt // Administrativnoe i munitsipal'noe pravo. - 2012. - 4. - C. 71 - 89.

11. Kovaleva M.A., Dmitrieva G.K. Otdel'nye aspekty

pravovogo regulirovaniya

investitsionnoi deyatel'nosti

v usloviyakh chlenstva Rossii v VTO // Aktual'nye problemy rossiiskogo prava. - 2013. - 2. - C. 194 - 199.

12. N. N. Man'ko Metodologiya stimulirovaniya gosudarstvenno-chastnogo

partnerstva s tsel'yu povysheniya investitsionnoi

privlekatel'nosti sub''ekta Rossiiskoi Federatsii // Natsional'naya bezopasnost'. - 2011. - 5. - C. 71 - 76.

Link to this article

You can simply select and copy link from below text field.

|