|

DOI: 10.25136/2409-8647.2020.3.33170

Received:

05-06-2020

Published:

12-06-2020

Abstract:

The subject of this research is the relations emerging between the participants of corporate management and control, such as board of directors, CEO, and employees of the organization. Special attention is given to such relations with regards to administration of internal and external corporate control, as well as dual position of CEO as an object and subject of corporate control and management. The author systematizes the concepts of corporate control, as well as reveals the factors of internal corporate control. The participants of corporate management are viewed from the perspective of agent theory; the relations “agent – principal” are clarified from the position of CEO. The author’s special contribution into this research consists in simultaneous consideration of CEO as an agent and a principal in relations between the participants of corporate management and control. Balance between the roles of CEO in the corporation – as a subject and/or object determines his capacity to influence the assessment of the effectiveness of management. The conducted research systematizes the measures on reduction of opportunistic behavior between the agents of the described relations. The scientific novelty consist in acknowledgement of CEO’s dual position in the corporate management and control based on the analysis of his status as an agent and a principal.

Keywords:

corporate governance, CEO, performance, dual position, corporate control, agent, principal, agent problem, object of corporate control, subject of corporate control

This article written in Russian. You can find original text of the article here

.

Введение.

Организация корпоративного типа обычно рассматривается как управляемая генеральным директором и контролируемая советом директоров от имени акционеров. Подобная структура управления предусматривает отделение принятия решений (генеральным директором и другими менеджерами) от контроля за решениями (советом директоров) и от инвестиций и рисков (акционеров компании). Предполагается, что данная структура является эффективной, если решения принимаются при максимизации стоимости капитала акционеров [1, 2].

Разделение функций управления и владения в совокупности с предпосылкой о индивидуализме как главной черте экономического агента, приводят к необходимости формирования контрольно-надзорных функций со стороны собственников и/или их представителей.

Понятие корпоративного контроля наиболее изучено в юридическом аспекте, когда рассматриваются вопросы, связанные с нарушением законодательства, о неправомерном переходе прав собственности в организации. Изучение экономических аспектов корпоративного контроля обусловлено одной из базовых функций менеджмента – информировать принимающего решения субъекта о параметрах среды, объектах управления и процессах относительно цели управления.

Корпоративный контроль

В целом под корпоративным контролем понимается контроль внешних и внутренних процессов корпоративного взаимодействия, направленных на ресурсное обеспечение корпорации в соответствии с ее стратегической целью [3, с.50].

Как отмечается в определении, контроль в корпоративном управлении может иметь внешний и внутренний векторы (таблица 1).

Таблица 1 – Виды корпоративного контроля

|

Уровень корпоративного контроля по отношению к организации

|

Субъект корпоративного контроля

|

Объект корпоративного контроля

|

Характеристика

|

Механизмы

контроля

|

|

Внешний

|

Государство

|

Организация корпоративного типа

|

Контроль соблюдения действующего законодательства

|

Корпоративное законодательство

|

|

Рынок слияний и поглощения

|

Организация корпоративного типа

|

Контроль, осуществляемый возможностью враждебного слияния или поглощения

|

Фондовый рынок, механизмы банкротства

|

|

Банк России

|

Торгуемые ПАО

|

Соблюдение кодекса корпоративного управления

|

Механизмы размещения акций на фондовом рынке

|

|

Внутренний

|

Акционеры

|

Совет директоров

|

Совет директоров избирается общим собранием и отчитывается перед общим собранием акционеров.

|

Проведение общего собрания акционеров, устав, ревизионная комиссия

|

|

Генеральный директор

|

Генеральный директор назначается и отчитывается перед общим собранием акционеров

|

Ревизионная комиссия

|

|

Совет директоров

|

Генеральный директор

|

Контроль соответствия действий руководителя интересам акционеров

|

Контракт

|

|

Генеральный директор

|

Подразделения организации

|

Контроль исполнения целевых показателей, заданных общим собранием акционеров, советом директоров и генеральным директором

|

Положения об отделах и службах, контракты, должностные инструкции

|

К внешним (косвенным) механизмам корпоративного контроля относят: законодательство о деятельности корпораций и рычаги его исполнения; контроль со стороны финансового рынка (снижение цен акций компании приводит к проблемам ее внешнего финансирования); переход контроля к кредиторам в случае банкротства; механизмы слияний / поглощений. Слабые механизмы внешнего корпоративного контроля позволяют «укоренившимся» менеджерам (генеральным директорам, в первую очередь) использовать ресурсы организации для собственной выгоды. В ряде работ исследовано влияние рынка корпоративного контроля на производительность, стоимость и доходность торгуемых компаний. Например, Gompers P. с соавторами [4] показывают прямую зависимость между количеством мер по борьбе с поглощением и прибыльностью и стоимостью организации. Core J. и другие [5] также обнаружили значительную связь между мерами против поглощения и доходностью акций.

Под внутренним корпоративным контролем понимается контроль за деятельностью менеджмента, осуществляемый советом директоров как наблюдательным и надзорным органом. В целом внутренний контроль направлен на оценку эффективности взаимодействия между внутренними стейкхолдерами – группами «совет директоров – генеральный директор», «генеральный директор – работники».

Внутренний корпоративный контроль стимулирует работников соблюдать действующее законодательство, придерживаться планов деятельности, производственно-сбытовой политики, внутренних регламентов, обнаруживать и снижать риски. Качество внутреннего контроля зависит от состава совета директоров, разделения ролей генерального директора и председателя совета директоров, структуры собственников, размера управленческих компенсаций.

Обеспечение надлежащего внешнего и внутреннего корпоративного контроля является вопросом первостепенной важности для компаний в странах с переходной экономикой. Во-первых, здесь существует серьезная проблема «агент-принципал», вызванная отсутствием защиты инвесторов и неудовлетворительным соблюдением прав собственности. Во-вторых, в таких странах развит рынок враждебных слияний и поглощений.

Согласно [6], акционеры полагаются на механизмы внутреннего и внешнего корпоративного контроля, чтобы решить агентскую проблему, возникающую из-за разделения собственности и контроля в современных корпорациях. В работе [7] проводился сравнительный анализ 1500 фирм, входящих в рейтинг S&P с целью оценки эффективности механизмов корпоративного управления. Результаты показывают, что высокая прибыль достигается при наличии как внутренних, так и внешних механизмов контроля. В то же время, эти механизмы комбинируются сложным образом, так что может быть замещение и/или взаимодополняемость между ними.

Генеральный директор является лицом, принимающим стратегические решения в отношении инвестиций, производства, распределения ресурсов, выхода на новые рынки, несёт ответственность за результаты деятельности организации. Одним из аспектов внутреннего корпоративного контроля является принятие решения о замене действующего руководителя. Смена руководителя в большинстве случаев является шоком для организации, особенно, если происходит незапланированно и связана с его преждевременной отставкой. Приход нового лидера может повлиять неоднозначно на внутрифирменные и рыночные показатели эффективности деятельности организации.

Под сменой руководителя понимается его увольнение, которое приводит к его уходу из организации или с должности генерального директора. Право увольнять генерального директора в коммерческих организациях в России находится в компетенции общего собрания акционеров, если оно не передается совету директоров, что должно быть прямо указано в уставе (последний случай редок). В России, также как в США, совет директоров традиционно играет решающую роль в обеспечении соответствия действий руководителей интересам акционеров [8].

Поскольку добровольные отставки не отражают эффективность корпоративного управления, ученые могут рассматривать только случаи принудительного (вынужденного) замещения [9]. Однако на практике причины сменяемости довольно сложно отследить. Часто отставка генерального директора формально объясняется его возрастом, сроками объявления об увольнении, его дальнейшей работой в совете директоров [10]. Такой подход может приводить к ошибочной классификации и снижению в расчетах случаев принудительной отставки. Поэтому многие исследователи пренебрегают выяснением причин смены директора, фиксируя факт его отставки как таковой.

Поскольку вопрос выяснения факторов сменяемости генерального директора в организации является принципиально важным, выделим несколько уровней этих факторов.

Первый уровень составляет традиционное деление причин смены руководителя на добровольные и вынужденные.

Второй уровень предполагает исследование вынужденных увольнений генеральных директоров организации. Ключевым фактором вынужденной смены руководителя является его результативность [11, 12]. Jenter D. и Lewellan K. [13] показали, что почти от 38% до 55% отставок могут быть напрямую связаны с показателями фирмы.

Coughlan A., Schmidt R. [14] и Warner J. С. с соавторами [15] доказывают, что финансовые результаты определяют решения относительно удержания топ-менеджеров в компаниях США, существует отрицательная связь между ценой акций и вероятностью увольнения генерального директора. Kaplan S. [16] иллюстрирует, что смена директора вызвана низкой прибылью, и, в меньшей степени, низкой доходностью акций компаний в Японии. Смена генеральных директоров в китайских компаниях также зависит от уровня рентабельности активов (ROA) и рентабельности продаж (ROS) [17].

Третий, глубинный, уровень факторов представляет наибольший интерес, поскольку объясняет причины того, насколько деятельность генеральных директоров компании можно считать результативной. Эти причины во многом связаны с процедурами и механизмами внешнего и внутреннего корпоративного контроля в организации. Особый интерес исследователей вызывают следующие факторы: характеристики совета директоров, структура собственности организации, показатели управленческого окапывания генерального директора. Баланс между ролями генерального директора в корпорации – как субъекта и/или как объекта определяет его возможности влияния на оценку результативности его управления.

Дуальная позиция генерального директора

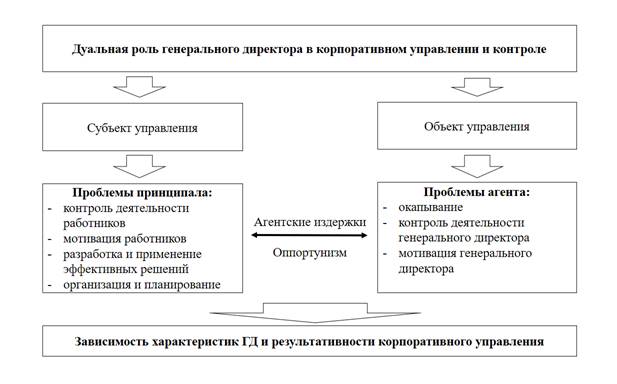

С одной стороны, генеральный директор является объектом корпоративного контроля, так как подчиняется общему собранию акционеров и совету директоров организации. Вместе с тем, генеральный директор является субъектом корпоративного контроля по отношению к организации, ее подразделениям и работникам. Такой дуализм позиции генерального директора затрудняет понимание его роли в достижении результативности управления и организационной эффективности в целом. Вместе с тем, сохранение неэффективного генерального директора представляется самым дорогостоящим проявлением проблем корпоративного управления, поскольку оно имеет длительные негативные последствия для результативности управления организацией. (рис.1).

Рисунок 1 – Дуализм роли генерального директора в корпоративном управлении и контроле

Определение степени взаимосвязи интенсивности и качества работы топ-менеджеров и эффективности деятельности организации является одной из проблем корпоративного управления и стратегического управления организацией в целом и зависит от различных факторов.

Во-первых, в связи с закрытостью информации о финансовых результатах деятельности некоторых компаний зачастую достаточно сложно измерить истинные финансовые результаты.

Во-вторых, результат деятельности организации зависит и от различных внешних факторов.

В-третьих, баланс между ролями генерального директора в корпорации – как субъекта и/или как объекта – определяет его возможности повлиять на то, как оценивают результативность его управления.

Теория «агент-принципал» (теория агентской проблемы) утверждает, что в классической корпорации (в которой пул акционеров достаточно широк), действия генерального директора (агента) по текущему управлению отличаются от тех, которые требуются для максимизации прибыли акционеров (принципалов) [18]. В результате этих действий могут возникнуть так называемые агентские издержки (agency costs) – снижение прибыли от суммы той, которую бы получали владельцы, если осуществляли контроль над корпорацией напрямую [19].

О. Уильямсон [20] выделил три уровня эгоистического поведения индивидов: сильную форму – оппортунизм, полусильную – простое следование личным интересам и слабую – послушание. Он определил оппортунизм как «преследование личного интереса с использованием коварства. Подобное поведение включает такие его более явные формы, как ложь, воровство и мошенничество, но едва ли ограничивается ими» [21, С.47].

Систематизация возможных схем оппортунизма генерального директора и механизмов их сглаживания представлены в таблице 2.

Таблица 2 – Возможные схемы оппортунизма генерального директора и механизмы их сглаживания

|

Оппортунистическое поведение ГД

|

Механизмы сглаживания оппортунизма

|

|

внутренние

|

внешние

|

|

Минимизация усилий ГД по управлению в связи с недостаточной осведомленностью собственников (асимметрия информации и неблагоприятный отбор)

|

- участие ГД в акционерном капитале компании;

- увязка вознаграждения ГД с результатами деятельности компании;

- наличие механизма отсроченного вознаграждения;

- контроль деятельности ГД советом директоров;

- наличие крупного акционера;

- механизм банкротства и контроль со стороны кредиторов.

|

- рынок акций: снижение котировок акций компании облегчает поглощение компании, после которого следует смена ГД;

- рынок капитала: ухудшение финансовых показателей может привести к ухудшению условий привлечения заемного капитала;

- рынок труда: ухудшение финансовых показателей компании на текущем месте работы может сказаться на возможности дальнейшего трудоустройства

|

|

Возможность ГД осуществлять действия, не направленные на повышение благосостояния компании в связи с неполнотой контрактов

|

|

Стремление к увеличению собственного благосостояния за счет компании и собственников, так называемые привилегии менеджмента

|

С другой стороны, роль генерального директора как субъекта управления предполагает контроль за эффективностью деятельности работников организации (исполнителей). В данном случае генеральный директор выступает в роли принципала, а работники – агентов. Известно несколько форм оппортунистического поведения исполнителя (таблица 3).

Таблица 3 – Возможные схемы оппортунизма работников и механизмы их сглаживания

|

Оппортунистическое поведение работников

|

Механизмы сглаживания оппортунизма

|

|

внутренние

|

внешние

|

|

Асимметричное распределение

информации относительно квалификации, неблагоприятный отбор

|

Проведение проверки знаний и умений при приеме на работу.

Прием на работу с испытательным сроком.

Рекомендации при приеме

|

Особенности рынка труда соответствующей специальности.

Уровень безработицы.

Государственная политика по защите прав работающих граждан.

Административно-правовая система.

|

|

Отлынивание, небрежность, использование

служебного положения

|

Контракт при приеме на работу с условиями выполнения должностных обязанностей.

Денежное стимулирование, нематериальная мотивация, наказания при невыполнении должностных обязанностей.

Корпоративная культура

|

Заключение

Таким образом, в рамках настоящего исследования были проанализированы понятия внешнего и внутреннего корпоративного контроля. Особое внимание уделено выявлению факторов внутреннего корпоративного контроля, которые обеспечивают взаимосвязь результативности управления и смены генерального директора. Доказана дуальная роль генерального директора в качестве объекта и субъекта корпоративного управления и контроля.

В качестве дальнейших направлений исследования планируется проведение эконометрической оценки влияния выявленных факторов корпоративного контроля на сменяемость генеральных директоров в организациях корпоративного типа по выборке российских акционерных обществ за десятилетний период. На сегодняшний день база данных сформирована, дескриптивная статистика базы данных приведена в публикации [22].

References

1. Fama E. F., Jensen M. C. Separation of ownership and control //The journal of law and Economics. – 1983. – T. 26. – №. 2. – S. 301-325.

2. Fama E. F., Jensen M. C. Agency problems and residual claims //The journal of law and Economics. – 1983. – T. 26. – №. 2. – S. 327-349.

3. Kirillova O. Yu. Formirovanie instituta korporativnogo kontrolya v ekonomicheskoi praktike Rossiiskoi Federatsii //BBK 65.290-2 N76 Otvetstvennye za vypusk: doktor ekonomicheskikh nauk, professor, zav. kafedroi korporativnoi ekonomiki i upravleniya biznesom I. N. Tkachenko. – 2017. – S. 49-52.

4. Gompers P., Ishii J., Metrick A. Corporate governance and equity prices //The quarterly journal of economics. – 2003. – T. 118. – №. 1. – S. 107-156.

5. Core J. E., Guay W. R., Rusticus T. O. Does weak governance cause weak stock returns? An examination of firm operating performance and investors' expectations //The Journal of Finance. – 2006. – T. 61. – №. 2. – S. 655-687.

6. Huson M. R., Parrino R., Starks L. T. Internal monitoring mechanisms and CEO turnover: A long‐term perspective //The Journal of Finance. – 2001. – T. 56. – №. 6. – S. 2265-2297.

7. Misangyi V. F., Acharya A. G. Substitutes or complements? A configurational examination of corporate governance mechanisms //Academy of Management Journal. – 2014. – T. 57. – №. 6. – S. 1681-1705.

8. Directors and top managers: allies or rivals. [Elektronnyi resurs]. – URL: https://www.pwc.ru/ru/corporate-governance/assets/russian-boards-survey-2017-rus.pdf. (data obrashcheniya 10.09.2018)

9. Hermalin B. E., Weisbach M. S. Endogenously chosen boards of directors and their monitoring of the CEO //American Economic Review. – 1998. – S. 96-118.

10. Parrino R. CEO turnover and outside succession a cross-sectional analysis //Journal of financial Economics. – 1997. – T. 46. – №. 2. – S. 165-197.

11. Kaplan, S. N., Klebanov, M. M., & Sorensen, M. (2012). Which CEO characteristics and abilities matter? //The Journal of Finance, 67(3), 973-1007.

12. Zhang P. et al. An empirical investigation on CEO turnover in IT firms and firm performance //Journal of International Technology and Information Management. – 2016. – T. 25. – №. 2. – S. 67-83.

13. Jenter D., Lewellen K. Performance-induced CEO turnover //Available at SSRN 1570635. – 2019.

14. Coughlan A. T., Schmidt R. M. Executive compensation, management turnover, and firm performance: An empirical investigation //Journal of accounting and economics. – 1985. – T. 7. – №. 1-3. – S. 43-66.

15. Warner J. B., Watts R. L., Wruck K. H. Stock prices and top management changes //Journal of financial Economics. – 1988. – T. 20. – S. 461-492.

16. Kaplan S. N. Top executive rewards and firm performance: A comparison of Japan and the United States //Journal of political Economy. – 1994. – T. 102. – №. 3. – S. 510-546. Kaplan S. N. Top Executives, Turnover, and Firm Performance in Germany //Journal of Law, Economics, and Organization. – 1994. – T. 10. – №. 1. – S. 142-142.

17. Kato T., Long C. CEO turnover, firm performance, and enterprise reform in China: Evidence from micro data //Journal of Comparative Economics. – 2006. – T. 34. – №. 4. – S. 796-817.

18. Pratt J. W., Zeckhauser R., Arrow K. J. Principals and agents: The structure of business. – Harvard Business Press, 1985.

19. Jensen M. C., Meckling W. H. Theory of the firm: Managerial behavior, agency costs and ownership structure //Journal of financial economics. – 1976. – T. 3. – №. 4. – S. 305-360.

20. Uil'yamson, O. Ekonomicheskie instituty kapitalizma. Firmy, rynki, «otnoshencheskaya» kontraktatsiya / O. Uil'yamson. SPb.: Lenizdat, 1996.

21. Williamson O. E. The economic institutions of capitalism. New York: Free Press. – 1985.

22. Kudin L. Sh. Smenyaemost' general'nykh direktorov rossiiskikh aktsionernykh kompanii //Upravlenets. – 2018. – T. 9. – №. 5.

Link to this article

You can simply select and copy link from below text field.

|