MAIN PAGE

> Back to contents

Theoretical and Applied Economics

Reference:

Karelina M.G.

Empirical research of the development of risk management in the corporate sector of Russia’s economy

// Theoretical and Applied Economics.

2019. № 4.

P. 111-121.

DOI: 10.25136/2409-8647.2019.4.31538 URL: https://en.nbpublish.com/library_read_article.php?id=31538

Empirical research of the development of risk management in the corporate sector of Russia’s economy

Karelina Mariya Gennad'evna

Doctor of Economics

associate professor of the Department of Economics and Marketing at Magnitogorsk State Technical University

455000, Russia, Chelyabinskaya oblast', g. Magnitogorsk, ul. Lenina, 38, of. 201

|

marjyshka@mail.ru

|

|

|

Other publications by this author

|

|

|

DOI: 10.25136/2409-8647.2019.4.31538

Received:

29-11-2019

Published:

06-01-2020

Abstract:

This article is dedicated to comprehensive research of the development of risk management in Russian companies. The multifacetedness of approaches towards studying the problems and prospects of risk management defines the complexity of examination of the concept of “risk” in order to form objective prerequisites for analysis of the risk management systems in the corporate economic sector of the Russian Federation. The provided overview of the key prerequisites of the establishment of corporate risk management in Russia demonstrates the fact that requirements in the area of improving corporate risk management continue to rise and are defined by international, as well as national risk management standards: COSO ERM, ISO 31000, Russian Code of Corporate Conduct of the Federal Commission on Securities Market of Russia, and others. The study of the development of risk management in Russian companies was conducted in accordance with methodology of the world leader in the area of risk management solutions Aon. Expert survey of the specialists in the area of risk management of Russia’s largest and organizations in 2018 allowed highlighting the key problems in risk management on the micro-, meso-, and macro-levels, as well as suggesting specific methods for support and regulation of Russian risk management. The results of this research carry practical significance, since properly structured risk management system contributes to achieving stability of business development, as well as increasing of economic efficiency and sustainability of development of Russian economy.

Keywords:

corporate governance, risk, risk management, risk management system, risk management standards, statistical analysis, expert survey, system analysis, structure, distribution of respondents

This article written in Russian. You can find original text of the article here

.

Введение

Риск-менеджмент является одним из наиболее динамичных научных направлений в области корпоративного управления. Теория и практика риск-менеджмента представлена различными технологиями, методиками и рекомендациями, применение которых достаточно трудоемко, затратно и требует дополнительного привлечения финансовых ресурсов, специалистов и времени. Тем не менее, внедрение риск-менеджмента в корпоративном секторе российской экономики свидетельствует о заинтересованности менеджмента в долгосрочном стратегическом развитии компании.

Исследование развития риск-менеджмента в корпоративном секторе российской экономики необходимо начать с уточнения описывающих его фундаментальных категорий. Без этого методологического шага не целесообразен дальнейший эмпирический анализ. Чтобы наиболее точно раскрыть категорию «риск», необходимо определить такие понятия, как «вероятность» и «неопределенность». Вероятность (probability) – это возможность получения определенного результата, что связано с опытным, практическим понятием частоты события. Неопределенность (uncertainty) – неполнота и неточность информации об условиях осуществления хозяйственной деятельности. В результате действия неопределенности поставленная цель может быть достигнута не в полной мере или не достигнута вообще [1-6]. Такое несовпадение полученного результата с намеченным в момент принятия решения характеризуется такой категорией как риск.

Обобщая различные трактовки, представленные в трудах Балабанова В.С., Верещагина В.В., Лобанова А.А., Юлдашева Р.Т. [7-10] и др., риск (risk) можно определить как категорию, которая характеризует поведение экономических агентов, функционирующих в условиях неопределенности для выбора наиболее приемлемых решений из совокупности альтернативных на основе оценки вероятности достижения желаемого результата и уровней отклонения от него. При этом в отличие от неопределенности риск является:

1. понятием субъективным – то что для одной из сторон является, существенным и негативным, то для другой стороны может быть несущественным и позитивным;

2. измеримой величиной – его количественной мерой служит вероятность неблагоприятного исхода.

Тогда в более узком смысле экономический риск можно определить как возможность возникновения события, которое может привести к негативным последствиям, к упущенной выгоде, нарушению функционирования бизнес-процессов и/или не достижению стратегических целей компании.

При этом понятие «риск» вне страхования до начала XX в. практически не использовалось [11]. Первым о риске как необходимом элементе бизнеса в 20-х гг. прошлого века заявил американский экономист, один из основоположников теории предпринимательства, неопределенности и прибыли Найт Ф., который ввел понятие риска как измеримой неопределенности и заявил, что бизнес существует только потому, что есть риск [12]. Следующий шаг сделал лауреат Нобелевской премии Марковиц Г., который связал понятия риска и доходности бизнеса, доказав, что доходность растет лишь вместе с риском [13].

К середине прошлого века управление рисками окончательно сформировалось как направление экономической теории и как практическая сфера деятельности. За точку отсчета можно принять 1955 г., когда американский экономист Снайдер У. [14] ввел в оборот понятие «риск-менеджмент». В России в отличии от западных стран в этот период, в виду командной экономики, риск не изучался. Можно сказать, что в России серьезно о риске заговорили после кризиса 1998 г., когда многие российские компании пересмотрели свою политику в части изучения и управления рисками.

Так сложилось, что исследование особенностей развития в России корпоративного риск-менеджмента и проблем социально-экономического развития страны ведутся в основном независимо друг от друга – разными учеными, экспертами и разными научно-исследовательскими, аналитическими структурами. Как результат – несмотря на то, что в последнее время было опубликовано достаточно много исследований, посвященных природе, причинам и видам риска (например, Качалов Р.М., Кунин В.А., Москвин В.А., Шапкин А.С. [15-18] и др.), вопросы построения комплексных систем управления рисками в рамках формирования устойчивости развития российской экономики в основном оставляют без внимания.

Таким образом, проблема совершенствования процесса управления рисками предприятий как фактор повышения устойчивости развития российской экономики приобретает для России особую актуальность. При чем исследования в этой области должны базироваться на первоначальном анализе основных предпосылок развития риск-менеджмента в России, поскольку с каждым годом требования в области совершенствования систем управления рисками становятся все более высокими.

Комплексный анализ основных этапов развития российского риск-менеджмента

В развитых западных экономиках качество систем управления рисками считается одной из важнейших составляющих корпоративного управления и оказывает непосредственное воздействие на рыночную стоимость компании, а ряд рейтинговых агентств, таких как Standard&Poor’s и Moody’s, учитывают это при оценке кредитного рейтинга. Сложились стандарты индустрии, такие как показатели VAR (Value-at-Risk) или RAROC (Risk-AdjustedReturnonCapital), возникли международные профессиональные организации риск-менеджмента – GARP и PRMIA, созданы сертификационные программы с регулярными экзаменами.

В настоящее время единого универсального определения риск-менеджмента не существует. Одно из распространённых определений приведено в стандарте ISO 73:2009. Согласно ему риск-менеджмент организации (risk management) – это скоординированные действия по управлению организацией с учетом риска. Необходимо отметить, что на современном этапе принято говорить не просто о мероприятиях по управлению рисками, а о создании и использовании систем управления рисками. Современные системы управления рисками комплексные и системные, поскольку рассматривают риски предприятия в тесной взаимосвязи и учитывают возможность их влияния друг на друга [19-22].

Стандарты управления рисками определяют концептуальные основы, цели и принципы корпоративного риск-менеджмента, общую терминологию, процесс управления рисками, а также дают указания и рекомендации, полезные при построении систем управления рисками [23-24]. В настоящее время в международной практике наибольшей популярностью пользуются общепринятые стандарты и концепции:

1. COSO Enterprise Risk Management Framework-Integrating with Strategy and Performance 2017 («Концепция COSО – Интеграция со стратегией и управлением деятельностью 2017», является обновленной версией документа 2004 г.);

2. FERMA Risk Management standard 2002 (FERMA Стандарты управления рисками 2002);

3. ISO 31000:2018 Risk management – Guidelines, являющийся обновленной версией документа ISO 31000:2009 Risk management – Principles and guidelines (ГОСТ Р ИСО 31000:2018 пока не утвержден, российский аналог предыдущей версии международного стандарта ГОСТ Р ИСО 31000:2010 «Менеджмент риска. Принципы и руководство»).

В России первые подразделения по управлению рисками стали создаваться в середине 90-х гг. XX в. в основном в организациях финансового сектора экономики. После кризиса 1998 г. риск-менеджменту стало уделяться более серьезное внимание и подразделения по управлению рисками стали создаваться в российских компаниях реального сектора экономики (например, Лукойл, Северсталь, Норильский Никель, Магнитогорский металлургический комбинат и др.).

Рассмотрим основные этапы развития риск-менеджмента в России.

1995 год. Одним из первых сигналов к развитию корпоративных систем управления рисками для российских компаний реального сектора экономики стало введение в действие Закона об акционерных обществах (от 26.12.1995 г. №208-ФЗ), в котором была указана необходимость подготовки разделов с описанием основных факторов риска деятельности общества в годовых и ежеквартальных (публичных) отчетах. Кроме того, в годовых отчетах должна была быть представлена политика эмитента в области управления рисками, сведения об организации системы управления рисками и внутреннего контроля. Раскрытие данной информации требовало от компаний как минимум понимания основных факторов риска, присущих их деятельности, наличия утвержденных нормативных документов по рискам, а также формализации ответственности совета директоров и менеджмента в части управления рисками.

2002 год. Важнейшим импульсом создания и развития риск-менеджмента в российских компаниях стало введение в действие Кодекса корпоративного поведения ФКЦБ России, согласно которому ответственность за построение и поддержание в эффективном состоянии систем управления рисками в акционерных обществах должен взять на себя совет директоров, уполномоченный рассматривать вопрос об учреждении комитета по управлению рисками.

В соответствии с Кодексом риски, с которыми сталкиваются компании при осуществлении своей деятельности, в конечном итоге вынуждены принимать на себя акционеры (собственники компаний). Потому важной функцией совета директоров, отвечающего за обеспечение прав акционеров, стал контроль за созданием системы управления рисками, позволяющей обществу своевременно реагировать на возникающие риски и представляющей собой совокупность организационных мер, предпринимаемых для достижения оптимального баланса между ростом стоимости компании, доходностью и рисками. При создании системы управления рисками было рекомендовано применять общепринятые международные концепции и стандарты работы в области управления рисками.

2009 год. Финансово-экономический кризис 2008-2009 гг. аналогично кризису 1998 г. показал практическую необходимость построения реально действующей системы риск-менеджмента не только в финансовых институтах, но и в компаниях реального сектора экономики. Отсутствие надлежащей организационной структуры, обеспечивающей раннее выявление, снижение и мониторинг рисков, создали основу для неверной интерпретации рисков и низкого уровня управления ими. Однако некоторые компании, которые сумели поставить риск-менеджмент на должном уровне, извлекли из этого вполне реальную пользу – сумели выжить в жестких условиях кризиса 2008-2009 гг.

Мировой экономический кризис заново вдохнул жизнь в российский риск-менеджмент. Если в периоды перегрева экономики, бесконечного перекредитования российских предприятий, консервативный голос рисков вызывал у акционеров снисходительное отношение, то кризис высветил необходимость ускоренного развития методологии и практики управления рисками [25].

2014 год. Следующим этапом развития российского риск-менеджмента можно назвать опубликованные требования Министерства экономического развития РФ (Минэкономразвития России) о подготовке стратегии и долгосрочной программы развития госкомпаний (раздел по рискам и внутреннему контролю). Требования, установленные в п.3.4 Методических рекомендаций по разработке долгосрочных программ развития стратегических акционерных обществ, определяют, что компании должны раскрывать информацию об анализе рисков и возможностей, связанных с реализацией программы, а также возможных механизмах управления рисками и возможностями. Данная оценка должна учитывать возможные изменения макроэкономических факторов, потребительских предпочтений, технических характеристик отрасли и прочих составляющих.

2015 год. Следующим важным шагом в развитии риск-менеджмента в российских компаниях стало поручение Президента РФ (Правительству РФ и далее Росимуществу) по повышению эффективности деятельности компаний с государственным участием. В рамках данного поручения Росимуществом совместно с консалтинговыми компаниями были разработаны Методические указания по подготовке положения о системе управления рисками (СУР), которые определяют структуру и содержание положения о системе управления рисками, а также порядок подготовки, утверждения и внесения изменений в положение о системе управления рисками. Интересным моментом в Методических указаниях является требование установления предпочтительного риска – максимально допустимого уровня риска, который определяется исполнительными органами и утверждается советом директоров.

Еще одним этапом развития риск-менеджмента в российских компаниях является выделение профессии риск-менеджера в качестве самостоятельной. В сентябре 2015 г. Министерство труда и социальной защиты утвердило профессиональный стандарт «Специалист по управлению рисками», в разработке которого принимали участие «Русское общество управления рисками», Российский союз промышленников и предпринимателей, Финансовый университет при правительстве РФ. В профессиональном стандарте отражены как текущие, так и перспективные требования, включающие значимые и типичные функции специалистов по управлению рисками на разных квалификационных уровнях.

Таким образом, несмотря на трудности в надлежащем восприятии важности и сложности функции риск-менеджмента, проблем в образовательном процессе и общем еще недостаточно высоком уровне корпоративной культуры в области управления рисками в России сделан огромный шаг вперед за очень короткий промежуток времени. При этом импульсов, направленных на развитие систем управления рисками становится все больше, что задает определенные стандарты зрелости корпоративного управления в рамках повышения конкурентоспособности российских компаний.

Статистическая оценка развития риск-менеджмента в российских компаниях

Статистический анализ развития риск-менеджмента в российских компаниях проводился на основе исследования мнения экспертов в данной области. В соответствии с методологией мирового лидера в области решений по риск-менеджменту Aon анализ базировался на опросе специалистов по риск-менеджменту, специалистов по страхованию и других специалистов, компетентных в области риск-менеджмента и принимающих активное участие в процессе управления рисками.

Исследование осуществлялось в 2018 г. путем изучения экспертного мнения специалистов (на основе рассылки анкет экспертам) в области управления рисками разных отраслей и регионов РФ. В результате необходимые данные были получены от 32 респондентов целого ряда крупнейших компаний и организаций из 15 субъектов РФ (Вологодская область, г. Москва, г. Санкт-Петербург, Новосибирская область, Свердловская область, Челябинская область и др.), являющихся крупнейшими промышленными центрами России, а также инвестиционными и бюджетными драйверами развития российской экономики. Анкета включала в себя 42 вопроса, из которых 24 были открытыми.

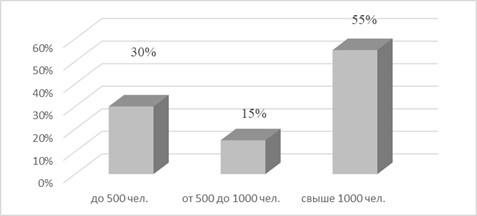

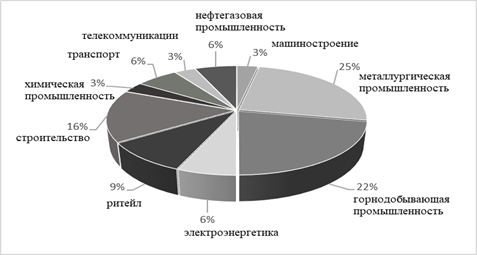

Распределение респондентов по размеру компании в зависимости от количества занятого персонала представлено на рис.1, которое подтверждает, что несмотря на то, что в последнее время средний и малый бизнес вовлекаются в процессы развития системных подходов к управлению рисками, все же развитие риск-менеджмента происходит в крупных (стратегических) компаниях. Отраслевое распределение респондентов представлено на рис.2.

Рис. 1. Распределение респондентов по размеру компании в соответствии с количеством занятого персонала

На основе полученных данных численность службы, отвечающей за функционирование риск-менеджмента в компаниях, колеблется от 2 до 7 человек. Необходимо отметить, что 82% респондентов имеют стаж в области управления рисками от 2 до 18 лет. При этом средний стаж специалистов по риск-менеджменту составляет 8,5 лет.

Рис. 2. Отраслевое распределение респондентов

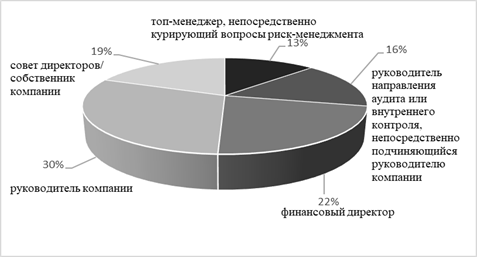

В большинстве компаний риск-менеджмент выделен в отдельную независимую функцию. На рис.3 представлено распределение подчинения риск-менеджмента в российских компаниях.

Рис. 3. Распределение подчинения структурного подразделения, ответственного за управление рисками в российских компаниях

На основе представленных данных можно сделать следующие выводы:

1. в 13% случаев структурное подразделение, отвечающее за управление рисками организации, подчиняется топ-менеджеру, непосредственно курирующему вопросы риск-менеджмента;

2. в 16% случаев руководителю направления аудита или внутреннего контроля, непосредственно подчиняющегося руководителю компании (генеральный директор, президент, председатель правления и др.);

3. в 22% – финансовому директору;

4. в 30% – напрямую руководителю компании;

5. в 19% – напрямую совету директоров или собственнику бизнеса.

Таким образом, риск-менеджмент в большинстве организаций независим, входит в сферу ответственности специального структурного подразделения по управлению рисками и подчиняется непосредственно руководителю компании или же находится в сфере ответственности финансового директора, службы внутреннего аудита или службы внутреннего контроля и подотчетен CFO.

Несмотря на принятый в 2014-2015 гг. ряд документов, призванных способствовать процессу построения систем управления рисками в российских организациях (Методические рекомендации по разработке долгосрочных программ развития стратегических акционерных обществ, Методические указания по подготовке положения о системе управления рисками и др.) 29% респондентов отметили неудовлетворительную степень развития корпоративных документов, регламентирующих деятельность структурных подразделений по управлению рисками. Это свидетельствует о том, что несмотря на достигнутые успехи в области корпоративного риск-менеджмента необходимо обратить более пристальное внимание на формализацию процесса управления рисками.

Для того чтобы ответить на основные вопросы исследования, касающиеся оценки состояния риск-менеджмента в России, вопросы данной части исследования были поделены на 2 блока:

1. проблемы и факторы развития российского риск-менеджмента на уровне отдельной организации (микроуровень);

2. проблемы и факторы развития риск-менеджмента на региональном и федеральном уровне (мезо- и макроуровень).

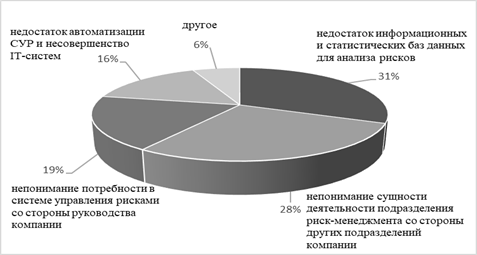

На основе проведенного анкетирования было выявлено, что одними из главных проблем риск-менеджмента в России на микроуровне являются недостаток в компаниях информационных и статистических баз данных для анализа рисков (31%), непонимание сущности деятельности подразделений риск-менеджмента со стороны других подразделений компаний (28%), непонимание потребности в системах управления рисками у руководства компаний (19%). Также отдельно респонденты отметили недостаток автоматизации и несовершенство IT-систем, отвечающих за администрирование систем управления рисками (см. рис.4).

Рис. 4. Проблемы развития российского риск-менеджмента на микроуровне

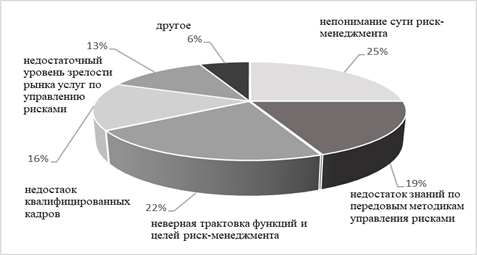

Проблемы развития российского риск-менеджмента в России на мезо- и макроуровне представлены на рис.5. Одними из главных проблем риск-менеджмента на макро- и мезоуровне являются:

1. непонимание сути риск-менеджмента (25%);

2. неверная трактовка функций и целей управления рисками (22%);

3. недостаточный уровень знаний по передовым методикам управления рисками (19%).

Рис. 5. Проблемы развития российского риск-менеджмента на мезо- и макроуровне

Интересно отметить, что несмотря на принятие в 2015 г. профессионального стандарта «Специалист по управлению рисками» и профессионального стандарта «Управление рисками (риск-менеджмент) организации» 16% респондентов отметили недостаток квалифицированных риск-менеджеров, т.е. специалистов, которые идентифицируют в деятельности компании всевозможные риски, оценивают степень их опасности, размер ущерба и вырабатывают рекомендации и меры по снижению негативных последствий риска. Рогов М.А. и Белоусова Л.В. в своих работах показали, что к специалисту в области управления рисками помимо требования знания лучших практик и методов в области управления рисками предъявляются также следующие требования:

1. знания и компетенции в области администрирования бизнес-процессов для выявления узких мест функционирования компании;

2. продвинутого уровня владения методами теории вероятностей, математической статистики, экономико-математического и эконометрического моделирования для разработки методик количественной оценки выявленных рисков.

Таким образом, статистический анализ развития риск-менеджмента в российских компаниях показал, что текущая экономическая ситуация еще более явно побуждает бизнес рассматривать вопрос аллокации ресурсов через призму рисков, с которыми сталкивается компания. Без оценки рисков на всех уровнях управленческой иерархии становится невозможным достигать базовые цели – извлечение прибыли и рост стоимости компании. Очевидно, что сегодня существует потребность в проактивном риск-менеджменте, подразумевающем совершенствование технологий управления рисками как со стороны государства, так и со стороны российских предприятий.

Выводы

Подводя итог, следует отметить, что в современной российской экономике внедрение риск-менеджмента началось сравнительно недавно, 15-20 лет назад. Однако такой непродолжительный период времени был ознаменован достаточно тяжелыми испытаниями для российской экономики и стал периодом проверки для многих промышленных и кредитно-финансовых структур. Он продемонстрировал, что риск-менеджмент играет все большую роль в эффективном развитии экономики российских регионов и приобретает репутационное значение. Для улучшения рискового имиджа нашей страны требуется консолидация усилий различных деловых, государственных и общественных структур для создания в нашей стране инфраструктуры и действенных инструментов управления рисками.

Обзор основных этапов развития риск-менеджмента в России показал, что в современной российской практике наблюдается систематизация рисков на основе международных и национальных стандартов, активное внедрение дисциплин риск-менеджмента в учебный процесс и выделение профессии риск-менеджера в качестве самостоятельной. Внедрение стандартов риск-менеджмента происходит на базе создания систем управления рисками, основная цель которых – это достижение максимальной эффективности и стратегических целей компании при осуществлении финансово-экономической деятельности во взаимосвязи и увязке со стратегией развития российских территорий.

Исследование развития риск-менеджмента в российских компаниях, базирующееся на экспертном опросе специалистов, позволило выделить основные проблемы управления рисками на микро-, мезо- и макроуровне, а также методы поддержки и регулирования российского риск-менеджмента. Одной из главных проблем на всех уровнях управленческой иерархии является непонимание сущности риск-менеджмента, что оказывает значительное влияние на внедрение культуры управления рисками. Однако в последнее время осознание собственниками и руководителями важнейшей роли рисков в деятельности компаний является толчком к их переходу на новый, более продвинутый уровень управления компанией в целом.

References

1. Kleiner G.B., Rybachuk M.A. Sistemnaya sbalansirovannost' ekonomiki Rossii. Regional'nyi razrez // Ekonomika regiona. — 2019. — №2. — S.303-323. — DOI: 10.17059/2019-2-1.

2. Kleiner G.B. Gosudarstvo – region – otrasl' – predpriyatie: karkas sistemnoi ustoichivosti ekonomiki Rossii (chast' 2) // Ekonomika regiona. — 2015. — №3. — S.9-17. — DOI: 10.17059/2015-3-1.

3. Bochko V.S. Uskoryayushchie i sderzhivayushchie faktory skoordinirovannogo i sbalansirovannogo razvitiya regionov // Ekonomika regiona. — 2015. — №1. — S.39-52. — DOI: 10.17059/2015-1-4.

4. Bochko V.S., Plyusnina L.M. Sistemnye riski predpriyatii i strategiya razvitiya territorii // Ekonomika regiona. — 2007. — №1. — S.40-45.

5. Glebova I.S., Rodnyanskii D.V. Integratsionnye protsessy kak faktor sotsial'no-ekonomicheskogo razvitiya regiona // Sovremennye problemy nauki i obrazovaniya. — 2013. — №1. — S.284-289.

6. Bernstein P.L. Against the Gods: The remarkable story of risk. — New York: John Wiley&Sons, 1996. — 364 p.

7. Balabanov V.S., Gordeeva V.V., Osokina I.E. Glossarii sovremennykh ekonomicheskikh terminov (russko-angliiskii). — M.: Nauka i obrazovanie, 2005. — 260 s.

8. Vereshchagin V.V. Risk-menedzhment v Rossii: sverka chasov (k itogam XII foruma RusRiska) // Ekonomicheskaya nauka sovremennoi Rossii. — 2014. — №3(66). — S.177-179.

9. Lobanov A.A., Chugunov A.V. Entsiklopediya finansovogo risk-menedzhmenta. — M.: Al'pina Biznes Buks, 2009. — 878 s.

10. Yuldashev R.T. Strakhovoi biznes. Slovar'-spravochnik. — M.: ANKIL, 2000. — 448 s.

11. Dionne G. Risk Management: History, Definition and Critique // Risk Management and Insurance Review. — 2013. — №2. — P.147-166.

12. Knight F.H. Risk, uncertainty and profit. — Boston and New York: Houghton Mifflin Company, 1921. — 381 p.

13. Markovitz H. Portfolio selection // Journal of Finance. — 1952. — №7. — P.77-91.

14. Snider W.H. Risk Management. — Homewood, Illinois: Richard D. Irwin, 1964. — 316 p.

15. Kachalov R.M. Upravlenie ekonomicheskim riskom: teoreticheskie osnovy i prilozheniya. — SPb.: Nestor-Istoriya, 2012. — 288 s.

16. Moskvin V.A. Riski investitsionnykh proektov. — M.: INFRA-M, 2016. — 320 s.

17. Kunin V.A. Upravlenie riskami promyshlennogo predprinimatel'stva (teoriya, metodologiya, praktika). — SPb.: Izd-vo Sankt-Peterburgskoi akademii upravleniya i ekonomiki, 2011. — 184 s.

18. Shapkin A.S., Shapkin V.A. Teoriya riska i modelirovanie riskovykh situatsii. — M.: Dashkov i K, 2017. — 880 s.

19. Karelina M.G. Kompleksnaya otsenka integratsionnoi aktivnosti biznes-struktur v rossiiskikh regionakh // Ekonomicheskie i sotsial'nye peremeny: fakty, tendentsii, prognoz. — 2016. — №5(47). — S.103-121.

20. Telenkov E.E. Osnovnye impul'sy razvitiya risk-menedzhmenta v Rossii. Lokomotiv — krupnye kompanii real'nogo sektora ekonomiki // Upravlenie riskom. — 2017. — №2. — S.48-51.

21. Drobot E.V., Klevleeva A.R., Afonin P.N., Gamidullaev S.N. Risk Management in Customs Control // Economy of Region. — 2017. — №13(2). — P.551-558. — DOI: 10.17059/2017-2-19.

22. Nilsen A.S., Olsen O.E. Different strategies equal practice? Risk assessment and management in municipalities // Risk Management. — 2005. — №7. — P.37-47.

23. Darwin B.C. An Organization Behavior Approach to Risk Management // The Journal of Risk and Insurance. — 1974. — №3. — P.435-450.

24. Palenchar M.J. and Heath R.Strategic risk communication: Adding value to society // Public Relation Review. — 2007. — №33. — P.120-129.

25. Tulenty D.S. Sovremennye kompleksnye sistemy upravleniya riskami // Upravlenie riskom. — 2017. — №4. — S.11-15.

Link to this article

You can simply select and copy link from below text field.

|