|

MAIN PAGE

> Back to contents

Theoretical and Applied Economics

Reference:

Zharikov M.V.

Conceptual approaches towards the development of payment system

// Theoretical and Applied Economics.

2019. № 3.

P. 98-110.

DOI: 10.25136/2409-8647.2019.3.30621 URL: https://en.nbpublish.com/library_read_article.php?id=30621

Conceptual approaches towards the development of payment system

Zharikov Mikhail Vyacheslavovich

Doctor of Economics

Docent, Professor, the department of World Economics and World Finances, Chief Scientific Associate, the Institute of Economics and International Finances of the Financial University under the Government of the Russian Federation

125993, Russia, g. Moscow, ul. Leningradskii Prospekt, 49, of. 241

|

michaelzharikoff@gmail.com

|

|

|

|

DOI: 10.25136/2409-8647.2019.3.30621

Received:

25-08-2019

Published:

30-09-2019

Abstract:

The goal of this article consists in solving an important scientific practical task – the assessment of beneficial effect obtained through creation of the single payment system within the framework of EAEU. The research is aimed at acquisition of new data and targets, the focus on which would allow a fairly smooth implementation of the universal principles of functionality of payment system in the context of EAEU, namely principles of the single monetary policy, single interest rate, and reaching convergence in the dynamics of economic development in accordance with the key macroeeconomic indicators. For determining the beneficial effect, the article applies the methods of quantitative and qualitative analysis of statistical data and expert opinions obtained from experience of operation of the electronic system for mediation of transactions in the European Union. Practical relevance of this work is defined by the possibility of using the model of payment system, which is capable of ensuring the process of optimal harmonization of finances of the EAEU member-states on the bases of gradualist approach. The research results may be valuable for economic science in development of the concept allowing to launch and ensure optimal performance of the electronic payment system in the EAEU.

Keywords:

common transfer system, digitalization, financial technologies, harmonization, standardization, common space, positive impact, interregional trade, monetary agreement, common currency

This article written in Russian. You can find original text of the article here

.

1. Постановка проблемы. Факторы стандартизации платежных систем

В соответствии с лучшей практикой и опытом функционирования других интеграционных систем, достижение общих целей финансовой интеграции может обеспечиваться на основе современных технологий цифровизации. В частности, есть идея ‒ создать стандартный план-проспект для осуществления денежных операций в рамках ЕАЭС через единую платежно-расчетную систему. Стандартный план-проспект представляет собой виртуальный документ, содержащий универсальные, общие требования к денежным переводам, комиссионным сборам, организации мониторинга движения средств между странами-членами.

Единая платежная система нескольких стран может быть сформирована только на основе стандартизации документов, норм, положений, существующих в странах ЕАЭС для регулирования расчетов с иностранными государствами. Процесс стандартизации потребует достаточно длительного времени. Это связано с тем, что финансовые системы к настоящему организованы в виде, который является результатом решений, принятых в прошлом. Они образовались под влиянием длительного законодательного или законотворческого процесса [4].

Однако интеграция секторов финансовых услуг проблематична не только для России и других стран ЕАЭС, но и для большинства стран мира, поскольку эта сфера остается сконцентрированной на национальном рынке. Например, в ЕС, несмотря на существование валютного союза, не существует бюджета, функционирующего по принципам суверенного государства, нет единых ставок налогообложения и распределения расходов. Для достижения интеграции финансовых технологий разных стран мира необходима всеобщая интернационализация финансовой деятельности.

Финансовые технологии и цифровизация имеют значительный потенциал для интеграции финансовых систем в мире в целом и ЕАЭС в частности. Эти тенденции позволяют, по крайней мере, создавать платежные системы, объединяющие страны с помощью виртуального пространства и инфраструктуры [1].

Концепция единой платежной системы в рамках ЕАЭС предполагает разработку модели, позволяющей укрепить и интенсифицировать интеграционные процессы стран-членов ЕАЭС. Одним из результатов такой интеграционной модели может стать впоследствии создание общего рынка капиталов, общей валютной системы, общей системы кредитования, общего рынка долговых отношений в рамках ЕАЭС [5].

Формирование единой системы платежей в ЕАЭС позволит углубить рынки капиталов стран-членов и обеспечить большую трансграничную интеграцию. Она дает как положительные, так и отрицательные результаты, содержит риски, о которых экономической науке известно по опыту ЕС.

Согласно опыту ЕС, одним из первоначальных материальных носителей валютно-финансовой интеграции в зоне евро стало создание соответствующей инфраструктуры для проведения взаимных расчетов в режиме реального времени, представленной системой ТАРГЕТ (TARGET ‒ Trans-European Real-time Gross-Settlement Express Transfer System – трансъевропейская система валовых расчетов и денежных переводов в режиме реального времени) [14].

Единая платежная система, такая как ТАРГЕТ, может функционировать только, если в ее рамках удовлетворяются все платежные и кредитные требования при всех обстоятельствах и на любой стадии экономического цикла, вне зависимости от условий кризиса ликвидности, преддефолтного состояния, дефицита бюджета, неплатежеспособности субъектов экономики и т.д., т.е. она должна работать всегда и круглосуточно [8].

Результаты концептуальной модели единой платежной системы ЕАЭС строятся исходя из гипотезы о том, что углубление этого направления развития в рамках интеграции ЕАЭС приведет к диверсификации финансовой системы и сокращению ее зависимости от традиционной банковской системы. Сокращение этой зависимости является основным фактором выхода национальной финансовой системы на пределы национальных границ и образования транснациональной финансовой архитектуры [6]. Получение такой системы позволит на практике создать экономически устойчивое пространство, менее подверженное рискам возникновения финансовых кризисов, благодаря солидарности, обеспечиваемой соглашениями о региональной валютно-финансовой интеграции, а также гарантирующее рост темпов производства, товарообмена, промышленной кооперации, взаимных инвестиций [9]. Трансграничная интеграция является материальным носителем приобретения выгод от увеличения размера рынка, создавая масштабные фонды ликвидных средств и производительности национальных экономических систем стран-членов. Такая система также позволит диверсифицировать риски, особенно при условии роста величины трансграничной акционерной собственности. Интегрированные системы платежей, движения капитала, товаров и услуг в целом могут играть существенную положительную роль в процессе страхования или минимизации рисков, характерных для функционирования того или иного государства, когда оно находится в изоляции от интеграционных процессов [15].

2. Модель единой оптимальной платежной системы

Концепция единой платежной системы стран ЕАЭС исходит из допущения о том, что количество денег в обращении в странах ЕАЭС при образовании единого валютного рынка и пространства может изменяться только на величину, которая не вызовет радикальных негативных последствий для национальных экономик интегрирующихся субъектов. В статье предполагается, что эта величина должна быть заключена в пределах обеспечения прироста валового продукта стран ЕАЭС.

Это следует из того, что для достижения сбалансированности развития экономики и поддержания стабильности цен изменение количества денег в обращении должно быть адекватным и пропорциональным изменению ВВП, т.е. если ВВП растет, денежная масса увеличивается на величину, достаточную для потребления приращенного объема товаров и услуг, и, наоборот, при падении ВВП, количество денег в обращении необходимо сократить на величину избытка. В основе этого положения лежит монетаристская концепция к организации денежного обращения и кредита в государстве. У монетаристской концепции есть свои преимущества и недостатки, но главная причина, по которой она применяется при создании единой платежной системы, заключается в необходимости элиминирования действия побочных факторов, препятствующих формированию модели, предполагающей ограниченный набор переменных [12].

Стимулом создания единой платежной системы является обстоятельство, в соответствии с которым, чтобы удовлетворить потребности в новых кредитных ресурсах по более выгодным условиям, страны ЕАЭС будут стремиться выходить на общий рынок денег, предполагающий наличие благоприятной равновесной ставки, устанавливаемой на основе универсальных законов спроса и предложения денег. Эта процентная ставка – ключевой вопрос в формировании потенциального валютного союза и общей валюты ЕАЭС в долгосрочном и сверхдолгосрочном периодах. Установление ее оптимальной величины приведет к созданию общего, единого центрального банка для проведения согласованной кредитно-денежной политики [11].

Современное положение дел в отношении единой системы расчетов и платежей в рамках ЕАЭС можно установить с зависимости от того, насколько оптимальной она бы являлся при нынешних показателях, демонстрирующих сближение стран-членов. Оптимальность функционирования единой платежной системы стран-членов ЕАЭС можно оценить по достаточности/недостаточности тесноты корреляции по фундаментальным макроэкономическим показателям (инфляции, процентных ставок, темпов роста ВВП, взаимозависимости внутрирегиональных потоков товаров и услуг, движению обменных биржевых котировок национальных валют) [3].

Понятие об оптимальности и целесообразности формирования единой платежной системы в рамках ЕАЭС позволяет получить, прежде всего, анализ взаимных торговых потоков, который позволяет установить степень корреляции товарных потоков с динамикой опосредования сделок в национальных валютах. Согласно анализу таможенной статистики, Россия является главным внешнеторговым партнером стран-членов ЕАЭС. Например, в 2012-2018 гг. в Казахстан, Армения и Киргизия импортировали из России до 20-30% всех товаров, а Белоруссия завозила из России более 50% продуктов как отношение к ВВП.

Однако страны ЕАЭС для российской внешней торговли имеют очень малое значение. Во время функционирования таможенного союза и после образования экономического союза, доля товаров из Белоруссии, Казахстана, Армении и Киргизии в российском ВВП оставалась неизменной. Если она и изменялась, то мало заметно. То же имеет отношение к экспорту. Так, процентная доля экспорта России в Казахстан изменялась в границах 2,7-3,0%, Армении – 0,1-0,2, Киргизии – 0,1-0,4.

Тем не менее, поскольку Россия ‒ главный торговый партнер для остальных стран ЕАЭС, то имеются предпосылки для организации единой платежной системы на базе российской национальной платежной инфраструктуры и российского рубля как перспектива для последующего введения единой валюты, которая, как в свое время ЭКЮ в Европе, будет коллективной, корзинной. Затем к ее курсу будут привязаны все валюты стран ЕАЭС по фиксированной ставке, и, в конечном счете, ее функционирование и расчеты в ней постепенно подготовят условия и среду для принятия новой валюты, освобожденной от признаков национальности [7].

Опасения стран-членов ЕАЭС в отношении потенциального формирования единой платежной системы связаны с тем, что это в результате может привести к непосредственному созданию валютного союза по образцу ЕС, а также эти опасения обусловлены кризисом в зоне евро, начавшемся в 2009 г. [13]. Кризис в зоне евро показал, что функционирование разных по социально-экономическому уровню стран в рамках одного валютного союза является губительным для наиболее слабых из них [10]. В связи с этим страны ЕАЭС будут стремиться к сохранению максимально возможного уровня независимости для проведения независимой кредитно-денежной политики, по крайней мере, на первоначальном этапе валютно-финансовой интеграции и формирования единой региональной валютно-финансовой архитектуры и инфраструктуры [2].

О текущей оптимальности и возможности функционирования платежной системы можно судить по уровню дивергенции стран-членов ЕАЭС по темпам инфляции, ставкам налогообложения и кредитования. По данным государственной службы статистики, в 2016-2018 гг. наблюдалось некоторое сближение стран-членов ЕАЭС по этим показателям, особенно в 2017 г., когда наметилась всеобщая стабилизация темпов инфляции в регионе, ставок налогообложения, за исключением Армении, ставок по кредитам. В частности, к 2017 г. показатели ИПЦ стран-членов ЕАЭС стремились друг к другу, однако несмотря на это построение стабильного тренда пока не представляется возможным, поскольку в условиях рыночной нестабильности, действия международных санкций и т.д. существует большое число вероятностей изменения конъюнктуры и соответствующих траекторий экономического развития. В таких условиях стабильность единой валютно-финансовой и платежно-расчетной системы достаточно трудно будет обеспечить ввиду значительной разнородности стран-членов.

Для оценки степени конвергенции показателей развития экономик стран ЕАЭС и доказательства положения о наличии потенциала создания единой платежной системы, в ходе исследования проводился корреляционный анализ базисных индикаторов ИПЦ, ставок налогообложения и ставок по кредитам. По данным авторских расчетов, было установлено, что корреляция по показателям ИПЦ стран ЕАЭС слабая и в некоторых примерах наблюдений полностью отсутствует. Такой же вывод можно сделать на основе корреляционного анализа динамики изменений ставок налогообложения. Коэффициенты корреляции по ставкам налогообложения в большинстве наблюдений являются отрицательными. Это означает, что корреляционная связь по уровню налогообложения между странами ЕАЭС отсутствует. Исключение составляет коэффициент корреляции ставок кредитования по комбинациям стран ЕАЭС.

В результате проведенного анализа основной вывод об оптимальности текущего потенциала для создания и функционирования единой платежной системы заключается в том, что страны-члены ЕАЭС не достаточно тесно коррелируют по фундаментальным макроэкономическим показателям, что препятствует созданию оптимальной системы сбалансированных расчетов через потенциальную единую платежную систему. Также по некоторым показателям развития стран ЕАЭС корреляция полностью отсутствует.

3. Оценка эффекта создания единого платежного пространства в рамках ЕАЭС

Оценка эффекта, который может быть получен в результате создания единого платежного пространства в рамках ЕАЭС, основана в статье на выявлении влияния, которое может оказать расширение предложения денег в едином платежном пространстве вследствие достижения процентной ставкой нового равновесия в каждой из стран ЕАЭС (см. табл. 1).

Таблица 1

Оценка эффекта внедрения единой платежной системы в ЕАЭС

|

Показатель, млрд долл.

|

Армения

|

Белоруссия

|

Казахстан

|

Киргизия

|

Россия

|

|

Функция денег (y=…)

|

-0,0116x + 0,127

|

-0,004x + 0,18

|

-0,005x + 0,4

|

-0,01x + 0,72

|

-0,0001x + 0,2

|

|

Ставка ЦБ, %

|

6,0

|

10,0

|

9,3

|

4,8

|

7,8

|

|

ИПЦ, %

|

2,5

|

4,9

|

7,4

|

3,2

|

2,9

|

|

ВВП

|

12,4

|

59,7

|

170,5

|

8,1

|

1657,6

|

|

Масса денег

|

5,7

|

21,2

|

60,4

|

2,4

|

979,8

|

|

Ставка платежной системы

|

4,0

|

4,0

|

4,0

|

4,0

|

4,0

|

|

Скорость обращения денег

|

18,3

|

7,3

|

4,8

|

9,3

|

20,5

|

|

Масса денег со скоростью

|

105,4

|

154,9

|

287,2

|

22,1

|

20121,5

|

|

Масса денег к 100% ВВП

|

847,4

|

259,6

|

168,4

|

273,0

|

1213,9

|

|

ВВП к массе денег, %

|

46,2

|

35,6

|

35,4

|

29,4

|

59,1

|

|

Новые деньги

|

1,7

|

16,0

|

11,0

|

0,8

|

278,3

|

|

Общая масса денег

|

7,5

|

37,2

|

71,4

|

3,2

|

1258,1

|

|

ВВП к новой массе денег

|

60,0

|

62,3

|

41,9

|

39,5

|

75,9

|

|

ВВП, вновь созданный

|

16,1

|

104,5

|

201,7

|

10,9

|

2128,4

|

|

Прирост ВВП, млрд долл.

|

3,7

|

44,9

|

31,1

|

2,8

|

470,8

|

|

Рост ВВП, %

|

29,8

|

75,2

|

18,3

|

34,3

|

28,4

|

Источник: рассчитано автором.

Базовыми параметрами проводимой оценки являются уровень текущей инфляции, существующего объема денежной массы, значения ставки рефинансирования, номинального объема ВВП, годового прироста ВВП и другие расчетные показатели (см. табл. 1). Результаты оценки на основе построенной оптимизационной модели показывают, что в результате создания единой платежной системы в ходе нескольких этапов (на протяжении 2020-2030 гг.) произойдут соответствующие изменения в количестве денег в обращении, величине учетной ставки, номинальном объеме ВВП и темпах прироста ВВП в странах ЕАЭС, определяемыми величинами, не вызывающими инфляции, перегрева, дефляции, кризиса и прочих отклонений.

Согласно построенной модели, если страны ЕАЭС перейдут сразу на единую платежную систему по сценарию шоковой терапии (например, за один год), то их экономики в течение этого времени должны потребить все кредитные ресурсы, на величину которых вырастет предложение денег на их внутренних рынках в результате свободного рыночного самоопределения и принципа рыночного фундаментализма. Тогда, если сопоставить ВВП и количество дополнительных кредитных средств, как показано в табл. 1, то экономика Армении, чтобы уравновесить и сбалансировать макросистему, должна будет вырасти на 30%, по меньшей мере за один год, экономика Белоруссии ‒ на 75, Казахстана ‒ 18, Киргизии ‒ 34 и России – на 28, то есть ВВП стран ЕАЭС должен будет увеличиться на нереально большую величину, чтобы предложение и производство адекватно отреагировали на рост денег, что, согласно здравому смыслу, невозможно реализовать без острых негативных последствий для промышленности, сферы услуг, стабильности цен и прочих макроэкономических показателей.

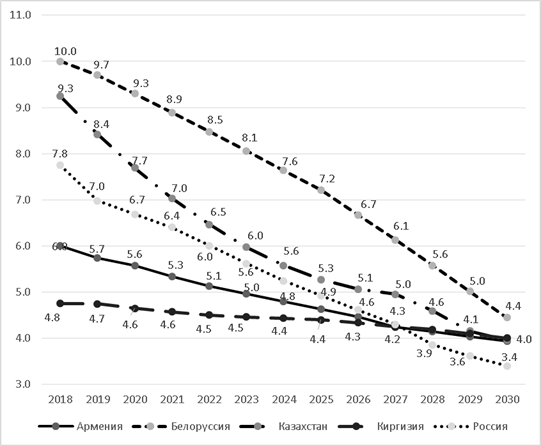

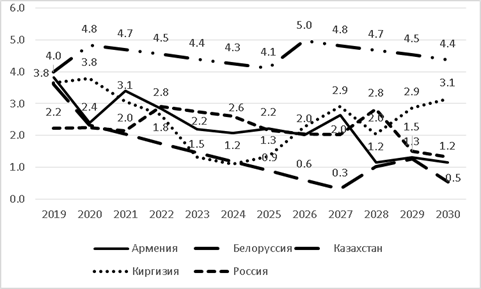

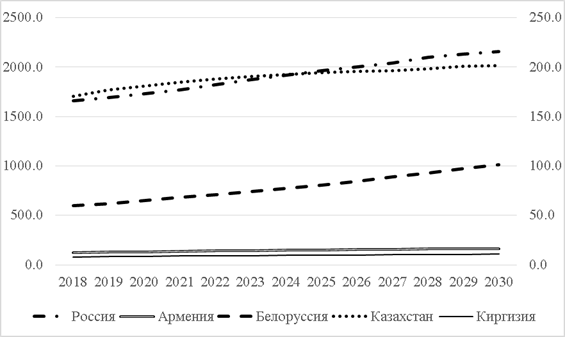

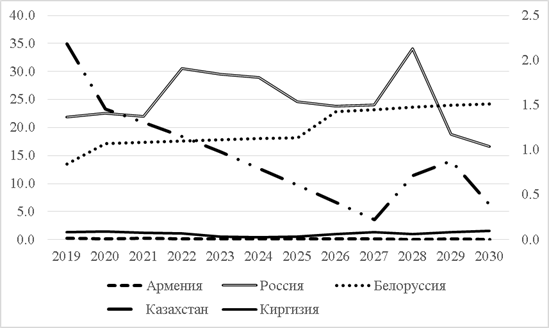

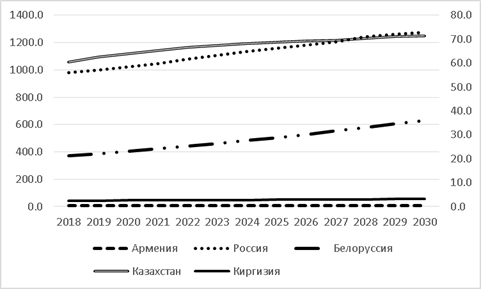

Во избежание негативных последствий в странах ЕАЭС в данной работе предлагается градуалистская модель перехода к единой платежной системе. В этой модели устанавливается величина кредитных денег, на которую разумно и целесообразно увеличивать денежную массу в экономике для адекватной реакции на рост ВВП. Эта величина называется оптимальной, поскольку именно на нее целесообразно расширять предложение денег для создания дополнительной покупательной способности населения, чтобы приобрести товары и услуги, производимые в количестве, увеличиваемом на темп среднегодового роста экономики. В результате складывается планомерная динамика, на основании которой гармонизация предложения денег и процентной ставки в странах ЕАЭС может завершиться к 2030 г. приблизительно на уровне 4% (см. рис. 1), при условии, что их ВВП будет расти с темпом, спрогнозированном в пределах, отраженных на рисунке 2. На рисунке 3 показаны прогнозные значения потенциального ВВП, который может быть получен по окончании планируемой гармонизации. Для достижения плановых показателей темпов экономического роста, не вызывающих перегрева, необходимо придерживаться жестко ограниченными вливаниями денежной массы в экономику стран ЕАЭС, которые отражены на рисунке 4 для каждой страны в отдельности. Благодаря этому возможно будет контролировать объем оптимального расширения количества денег в обращении и денежной массы, которые увеличатся к 2030 г. на величины, представленные на рисунке 5.

Рисунок 1. План гармонизации ставок рефинансирования стран ЕАЭС до 2030 г., %

Составлено автором.

Рисунок 2. Прироста ВВП стран ЕАЭС до 2030 г., % (прогноз)

Составлено автором.

Рисунок 3. Динамика ВВП стран ЕАЭС до 2030 г., млрд долл. (прогноз)

Составлено автором.

Рисунок 4. Адекватный прирост массы денег в странах ЕАЭС до 2030 г., млрд долл. (прогноз)

Рисунок 5. Динамика массы денег в странах ЕАЭС до 2030 г., млрд долл. (прогноз)

Дополнительная оценка эффекта от создания единого платежного пространства ЕАЭС базируется на корреляционном анализе, который с учетом гипотезы существования связи между внутрирегиональной торговлей и торговлей национальными валютами на бирже преследует цель ‒ выявить тесноту связи между торгами валютами этих стран на бирже и величиной взаимных торговых потоков между странами-членами, при условии опосредования всех товаропотоков в национальных валютах.

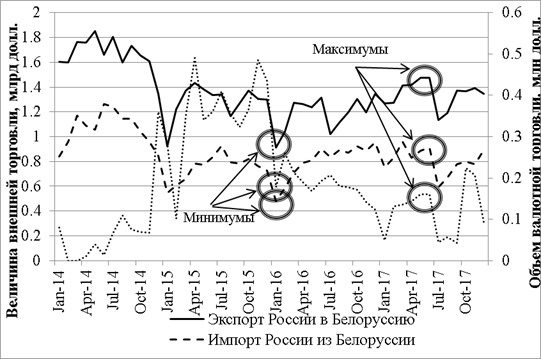

На рисунке 6 выделены точки экстремумов как индикаторы общей тенденции и зависимости от одних и тех же факторов. Этими моментами следует считать случаи, когда уровень корреляции между экспортом/импортом и валютными торгами достигает 0,7 и выше. По расчетам автора, в 2017 г. данные величины коррелировали на уровне 0,96-0,99. Также по расчетам автора, самая высокая корреляция имеет место между экспортом России в Белоруссию и торговлей парой валют этих стран на Московской бирже. Из этого можно сделать вывод о том, что с высокой долей вероятности увеличение объемов торгов по валютной паре российский рубль/белорусский рубль следует связывать с усилением интеграционных процессов между странами-эмитентами.

Составлено по данным: Московская биржа (2018), Федеральная таможенная служба (2018).

Рисунок 6. Динамика величины торговых потоков России и Белоруссии и торгов национальными валютами на бирже, 2015-2018 гг.

Теснота корреляционной связи между рассматриваемыми величинами хорошо видна при графическом анализе. Особенно эта связь прослеживается в российско-белорусской внешней торговле. Так, на рисунке 6 показано, что контуры кривых экспорта/импорта повторяют контуры динамики торгов валютной парой российский рубль/белорусский рубль на Московской бирже. На рисунке 6 показано, что с падением взаимного экспорта/импорта России и Белоруссии одновременно сокращаются объемы торгов по соответствующей валютной паре либо, наоборот, ‒ вместе с уменьшением величины продаваемых российских и белорусских рублей имеет место отрицательная динамика внутрирегиональной торговли.

4. Основные выводы и результаты исследования

В ходе исследования функционирования сектора финансовых технологий в странах ЕАЭС были получены новые данные, на основе которых сделаны следующие выводы:

1) рынок финансовых, цифровых технологий очень мал по размеру по сравнению с рынком капитала не только в России, странах ЕАЭС в целом, но и в мире. Создание единой платежной системы ЕАЭС приведет к созданию инфраструктуры, которая станет основой более широкого валютно-финансового пространства и рынка для развития новой формирующейся отрасли;

2) рынок финансовых технологий в странах ЕАЭС характеризуется ограниченными масштабами развития и сугубо национальной принадлежностью при малом объеме трансграничных потоков. Создание единой платежной системы в ЕАЭС расширит масштабы развития рынка финансовых технологий и увеличит трансграничный поток финансовых ресурсов;

3) сектор финансовых технологий в ЕАЭС не имеет масштабного распространения на клиентскую базу в рамках единого экономического пространства. При условии функционирования единой платежной системы в рамках ЕАЭС российская база клиентов увеличится в результате роста обслуживаемого населения в рамках общего экономического пространства. Однако даже с учетом двукратного расширения клиентской базы платежная система ЕАЭС не сможет обеспечить формирующейся системе конкурентных позиций в мировой платежной системе вследствие малого эффекта масштаба;

4) крупные российские интернет-компании еще не утвердились на рынке финансовых технологий, однако их участие на большей территории общего экономического пространства ЕАЭС благодаря формированию единой платежной системы могло бы ускорить всеобщую трансформацию в отрасли и выход на более высокую ступень организации;

5) возможности формирования единой платежной системы на базе России как центра интеграции в ЕАЭС ограничены волатильностью обменного курса рубля, мировых цен на нефть и экономического роста в стране. Однако усиление позиций рубля в ЕАЭС нужно для развития интеграционного процесса, и это возможно осуществить на основе: привлечения больше участников для торговли национальными валютами на Московской бирже, включая резидентов стран-членов ЕАЭС, СНГ и других стран мира; повышения заинтересованности участников ВЭД стран ЕАЭС ‒ использовать свои валюты во взаимной торговле путем обеспечения благоприятных условий торговли валютами на бирже, включая льготы при налогообложении, упрощенные административные и бюрократические барьеры; стабилизации валютного курса рубля и национальной валютной системы; увеличения объема торгов российским рублем, с одной стороны, и национальными валютами остальных стран ЕАЭС, с другой стороны, на бирже;

6) хотя Россия обладает потенциалом высококвалифицированных специалистов, сокращение рыночного роста, санкции, волатильность рубля, рост налогового бремени, увеличение роли государства в бизнесе заставляют многих субъектов, занятых в отрасли финансовых технологий, переводить свои мощности в зарубежные страны, которые предоставляют им более стабильные, устойчивые условия развития предпринимательской деятельности, запуска новых идей, гарантии, дешевые инвестиции. Страны Запада предъявляют интенсивный спрос на финансовые технологии развивающихся стран, включая Россию, по причине их дешевизны и достаточно высокого качества и интеллектуального потенциала. Возможно, единая платежная система ЕАЭС будет способствовать сдерживанию ухода российского бизнеса за рубеж в результате расширения клиентской базы в регионе;

7) государство узко смотрит на возможности, которые могут принести финансовые технологии российской экономики. В частности, государство полагает, что внедрение цифровой платежной системы будет способствовать антикоррупционной политике и ликвидации потерь бюджета от ухода компаний от уплаты налогов, упуская при этом возможности создания отраслей, которые принципиальным образом могли бы изменить структуру экономики, таких как страхование, робо-консалтинг, рейтингование продуктов финансовых технологий и т.д. Создание единой платежной системы ЕАЭС заставит государство по-новому смотреть на рынок финансовых технологий и поможет прийти к осознанию необходимости использования ее потенциала как движущей силы интеграционного процесса в регионе;

8) для интеграции платежных систем России и мира необходим многоступенчатый, градуалистский подход, который предполагает не только первоначальную интеграцию систем финансовых технологий, платежей, переводов, инвестиций на уровне ЕАЭС, но, прежде всего, создание подобных систем, обеспечение их стабильного и устойчивого функционирования, приведения к общим стандартам, утверждению принципов транспарентности, преодолению потенциальных возможностей кибератак и отмывания криминальных доходов;

9) страны-члены ЕАЭС не достаточно тесно коррелируют по фундаментальным макроэкономическим показателям, что препятствует созданию оптимальной системы сбалансированных расчетов через потенциальную единую платежную систему. Также по некоторым макроэкономическим показателям развития стран-членов ЕАЭС корреляционная связь полностью отсутствует;

10) опыт функционирования единой платежной системы в Европе показывает, что эффект от функционирования таких систем может быть как положительным, так и отрицательным одновременно для сильных и слабых стран экономического союза. Существенный вопрос, который нужно будет решить, если все-таки страны ЕАЭС согласятся на создание единой платежной системы, состоит в следующих позициях: а) как преодолеть издержки оппортунизма, связанные с принципом солидарности в вопросах обслуживания долгов; б) как остановить возможности кредитования и финансирования долгов через единую платежную систему, если отказ от этого означает прекращение работы платежной системы;

11) создание единой платежной системы может сопровождаться возвратом к тому, от чего Россия отказалась в 1991 г. Тогда одним из существенных аргументов в поддержку тезиса о необходимости независимости России от других стран СССР было то, что, находясь в условиях политического, экономического и валютного союза, центр (Россия) брал на себя функции обеспечения стабильного развития периферии. Поэтому периферия, ощущая постоянную опеку и поддержку, брала на себя риски, несовместимые с масштабами своей экономики и бюджетными ограничениями. Эта проблема сегодня формулируется в литературе как «too big to fail», или издержи морального ущерба. В результате Россия оплачивала долги остальных стран политического, валютного и экономического союза;

12) возможно, для преодоления эксплуатации интересов России следует создавать единую платежную систему ЕАЭС на базе инфраструктуры и ответственности периферии, например, на платформе международного финансового центра, который был создан в Астане в 2017 г. В этом случае ответственность за реализацию платежно-расчетных операций ляжет на периферию, и тогда могут быть минимизированы издержки оппортунизма. Если Россия как центр ЕАЭС делегирует функции осуществления платежно-расчетных операций периферии, то это потребует введение новой валютной единицы по образцу существовавшей в прошлом ЭКЮ в рамках единой платежной системы ЕС;

13) единую платежную систему следует создавать в рамках относительно равных по уровню экономического развития стран. Анализ статистических данных показал, что даже с учетом изменения основных макропоказателей в период гармонизации, Россия намного перевешивает остальные страны-члены. Это означает, что создание платежной системы и валютно-финансовая интеграция будут проходить в условиях, не стандартных для подобного рода объединений в соответствии с лучшей практикой и опытом других региональных соглашений. Если все же эта система будет создана, и Россия станет во главе этой системы, остальные страны ЕАЭС должны быть лишены бюджетной, фискальной и кредитно-денежной самостоятельности, и ЕАЭС должен быть организован на основе принципов федерализма с единым центром принятия решений.

References

1. Avdokushin E.F., Ivanova V.N. Inklyuzivnoe razvitie: osnovnye napravleniya, bazovye predposylki i vozmozhnye ogranicheniya // Voprosy novoi ekonomiki. 2014. № 3 (31). S. 4-13.

2. Afontsev S.A. Global'nyi krizis i regulirovanie mirovykh finansov // Mezhdunarodnye protsessy. 2009. T. 7. № 19. S. 17-31.

3. Braterskii M.V. Finansovye interesy vo vneshnepoliticheskoi strategii Rossii // Mezhdunarodnaya ekonomika. 2011. № 8. S. 50.

4. Mel'yantsev V.A. Sravnitel'nyi analiz modelei ekonomicheskogo razvitiya Kitaya, Rossii i Zapada // Mir peremen. 2015. № 3. S. 177-180.

5. Perskaya V.V., Eskindarov M.A. Konkurentosposobnost' natsional'nogo khozyaistva v usloviyakh mnogopolyarnosti. Rossiya, Indiya, Kitai / Monografiya. M.: Finansovyi un-t pri Pravitel'stve RF, 2015. 220 s.

6. Chinn M.D., Ito H. A new measure of financial openness // Journal of Comparative Policy Analysis. 2008. T. 10. № 3. R. 309-322.

7. Gourinchas P.-O., Obstfeld M. Stories of the Twentieth Century for the Twenty-First // American Economic Journal: Macroeconomics. 2012. № 4 (1). R. 226-265.

8. Hankel W., Isaak R. Brave New World Economy: Global Finance Threatens Our Future. Hoboken, New Jersey: John Wiley & Sons, 2011. P. 110-135.

9. Lane P.R., Milesi-Ferretti G.M. The External Wealth of Nations Mark II: Revised and Extended Estimates of Foreign Assets and Liabilities, 1970-2004 // Journal of International Economics. 2007. № 73. R. 223-250.

10. Ostry J. Managing Capital Flows: What Tools to Use? // Asian Development Review. 2012. № 1. R. 82-88.

11. Robleh D.A., Haldane A.G., Nahai-Williamson P. Towards a Common Financial Language // Bank of England Speeches. 2012. № 552. R. 5.

12. Rousseau P.L., Wachtel P. What is happening to the impact of financial deepening on economic growth? // Economic Inquiry. 2011. № 49 (1). R. 276-288.

13. Schäffler F. Nicht mit unserem Geld! Die Krise unseres Geldsystems und die Folgen für uns alle. München: Finanzbuch Verlag, 2014. S. 153-165.

14. Sinn H.-W. The Euro Trap. On Bursting Bubbles, Budgets, and Beliefs. Oxford: Oxford University Press, 2014. P. 116-145.

15. Vaubel R. Das Ende der Euromantik: Neustart jetzt. Wiesbaden: Springer, 2018. S. 131-146.

Link to this article

You can simply select and copy link from below text field.

|

|