|

MAIN PAGE

> Back to contents

Theoretical and Applied Economics

Reference:

Popova E.M., Siyal S., Mezentseva I.V.

Comparative analysis of saving behavior of the population of Russia and China (on the examples of the cities of Chita and Hefei)

// Theoretical and Applied Economics.

2019. № 3.

P. 65-80.

DOI: 10.25136/2409-8647.2019.3.30391 URL: https://en.nbpublish.com/library_read_article.php?id=30391

Comparative analysis of saving behavior of the population of Russia and China (on the examples of the cities of Chita and Hefei)

Popova Evgeniya Mikhailovna

Senior Educator, the department of World Economy, Entrepreneurship and Humanities, Chita Institute (Branch) of Baikal State University

672000, Russia, Zabaikal'skii krai, g. Chita, ul. Anokhina, 56

|

p_e_m_2013@mail.ru

|

|

|

Other publications by this author

|

|

Siyal Saeed

Postgraduate student, the department of Economics and Management, Beijing University of Chemical Technology

100029, Kitai, g. Pekin, ul. Bei San Khuan, 15

|

saeed@mail.ustc.edu.cn

|

|

|

|

Mezentseva Irina Vitalevna

PhD in History

Docent, the department of World Economics, Entrepreneurship and Humanitarian Disciplines, Chita Branch of Baikal State University

672000, Russia, Zabaikal'skii krai, g. Chita, ul. Anokhina, 56

|

iv_mezenseva@mail.ru

|

|

|

Other publications by this author

|

|

|

DOI: 10.25136/2409-8647.2019.3.30391

Received:

27-07-2019

Published:

30-09-2019

Abstract:

People’s savings play an important role in the development of national economy as they are referred to the main sources of financial investments. An essential condition for implementation of this role is the consumer demand for the services of financial intermediaries, which transform unorganized savings into organized savings, with subsequent involvement into investment process. Russia’s economy experiences deficit of “long-term money” that can be restored in form of bank deposits, insurance contracts, and pension plan. The subject of this research is the analysis of saving behavior of the population of Russia and China, namely such fundamental aspects as the goals and motives, frequency and rate of savings, and relevance of various saving instruments. The sociological survey became the main research method. The author also used the methods of formal logics, statistical methods, and basic methodology devised by the scholars of University of Michigan. The scientific novelty consists in calculation of the indexes of saving behavior that the encompassing indicators of the people’s saving activity. It is concluded that the population of Hefei is known for its higher level of optimism. Lack of interest in acquiring additional income results in the fact that the majority of respondents from both countries form unorganized savings; while bank deposits remain the most demanded for of organized savings. The low percentage of organized savings is associated with the limited financial capacities, insufficient level of financial literacy, and low yield of the basic saving instruments.

Keywords:

savings, investment, saving tools, saving sentiment index, family wealth, savings ratio, expectations of population, savings motives, derive extra revenue, order of income distribution

This article written in Russian. You can find original text of the article here

.

Введение. Сбережения являются одной из фундаментальных категорий в научной литературе и важным пунктом государственных программ, поскольку создают основу для будущего экономического роста. Экономические теории сбережений разрабатывались такими учеными, как Дж. М. Кейнсом, Ф. Модильяни, М. Фридманом, Р. Холлом, Н. Леффом, Д. Ибрагимовой, М. Красильниковой и др. [1, 2] Сбережения населения относятся к наиболее устойчивым источникам финансирования инвестиций. Уже на протяжении ряда лет в докладах официальных ведомств, прежде всего Центрального Банка и Министерства финансов РФ, формулируется проблема дефицита «длинных денег» и подчеркивается необходимость повышения доли организованных сбережений населения и их привлечения в реальный сектор экономики [3]. Правительством РФ был реализован ряд финансовых мер (например, повышение страхового покрытия по банковским вкладам, налоговые вычеты), направленных на стимулирование таких форм организованных сбережений, как банковские депозиты, договоры страхования, добровольные пенсионные взносы. Исходя из выше изложенного можно сделать вывод, что на сегодняшний день сберегательное поведение населения является актуальной темой исследования.

Цель настоящего исследования заключалась в проведении сравнительного анализа сберегательного поведения населения Россия и Китая, на примере г. Чита и г. Хэфэй. Выбор в пользу Китая продиктован тем, что во-первых, Китай имеет одну из самых высоких норм сбережения в мире — в 2018 г. по данным Всемирного Банка она составила 46% ВВП, в России — 31% ВВП [4]. Во-вторых, Забайкальский край, столицей которого, является г. Чита, имеет тесные торгово-экономические, инвестиционные и научно-образовательные связи с Китаем. Именно существование научных связей с Научно-техническим университетом Китая (University of Science and Technology of China), который расположен в г. Хэфэй (провинция Аньхой), повлияло на решение изучать сберегательное поведение населения Китая на примере данного города. Среди населения г. Чита и г. Хэфэй был проведен социологический опрос: анкета включала 16 вопросов, 3 из которых это вопросы о возрасте респондента, уровне образования и ежемесячном доходе. В ходе социологического исследования были сформированы квотные выборки, в которых каждая возрастная группа имеет одинаковую квоту. Особенность квотной выборки состоит в том, что устанавливаются определенные пропорции (квоты) между респондентами по некоторому параметру, в нашем случае по возрасту. Таким образом, респонденты были распределены между тремя равными квотами: 1) от 18 до 30 лет; 2) от 30 до 45 лет; 3) старше 45 лет. Выбор возрастной квоты связан с тем, что в ходе исследования проводилось сравнение сберегательного поведения респондентов, принадлежащих разным возрастным группам. Для того чтобы исключить смещение ответов и, как следствие, неправильную интерпретацию полученных данных, необходимо обеспечить равные пропорции возрастных групп в выборке. Для статистической обработки данных использовалась компьютерная программа «SPSS Statistics». В следующем разделе статьи на основе результатов проведенного опроса были рассчитаны индексы сберегательных настроений населения г. Чита и г. Хэфэй.

Индекс сберегательных настроений как обобщающий индикатор сберегательной активности населения. Одним из первых научно-образовательных учреждений, где начали измерять потребительские и сберегательные настроения, стал Институт социологических исследований при Мичиганском университете (США). Данным институтом была предложена специальная методика построения индексов потребительских и сберегательных настроений, основанная на анкетировании населения по пяти вопросам, связанным с оценкой их материального положения, перспектив развития национальной экономики и ситуации на потребительском рынке [5]. Анализ научной литературы показал, что наибольшую популярность приобрел индекс потребительских настроений, индекс сберегательных настроений рассчитывается гораздо реже. В России исследования, направленные на вычисление индекса потребительских настроений, впервые начали проводиться в 1993 г., в то время как индекс сберегательных настроений не рассчитывался. С 2009 г. Центр макроэкономических исследований ПАО «Сбербанк» и Левада-Центр организовали совместную работу по исчислению индекса финансовых настроений, который строился по аналогии с индексом потребительских настроений, с тем отличием, что учитывался спрос населения на различные финансовые услуги, в том числе, склонность к приобретению товаров в кредит, и ожидания относительно развития финансовой сферы в будущем [6].

Однако несмотря на то, что индекс финансовых настроений включает ответы респондентов о способности сберегать, а также востребованность некоторых сберегательных инструментов, это все же не индекс сберегательных настроений. В связи с чем в настоящей статье рассчитывается индекс сберегательных настроений, который был построен на основе базовой методологии Мичиганского университета. Данный индекс учитывает изменения в текущей сберегательной активности и материальном положении населения, прогнозы относительно изменений в семейном благосостоянии и сберегательной активности в ближайшем будущем, перспективы развития национальной экономики, а также такие важные аспекты сберегательного поведения как планы на приобретение дорогостоящих товаров и услуг в будущем и склонность населения к формированию организованных сбережений.

Таким образом, концепцию построения данного индекса можно описать следующим образом: главным мотивом сбережений выступает наличие финансовых ресурсов, которое напрямую зависит от материального положения семьи. В свою очередь, ожидания относительно будущей сберегательной активности во многом определяются прогнозами в отношении изменения личного благосостояния, а также намерения приобретать товары длительного пользования, оплачивать образовательные (туристические) услуги и т. д. Свои прогнозы население строит не в вакууме, а на основе представлений о будущем развитии экономики. Наконец, организованные сбережения населения — это один из источников финансирования инвестиций, динамика которых является наиболее значимым фактором, оказывающим влияние на темпы экономического роста [7, с. 283]. В связи с чем при расчете индекса сберегательных настроений учитывалась вовлеченность финансовых посредников в сберегательный процесс, поскольку через обращение к их услугам происходит трансформация неорганизованных сбережений населения в организованные.

Интегральный индекс сберегательных настроений представляет собой среднее арифметическое 7 частных индексов. Частный индекс — это разница между долей положительных и долей отрицательных ответов на определенный вопрос анкеты, увеличенная на 100, чтобы исключить отрицательные величины. В ниже приведенных таблицах представлен расчет частных индексов сберегательных настроений населения г. Хэфэй и г. Чита (таблица 1, таблица 2). Интегральный индекс сберегательных настроений для г. Хэфэй составил 138,2%, для г. Чита — 129%.

Таблица 1

Расчет индекса сберегательных настроений населения г. Чита

|

Вопрос анкеты

|

Доля положительных ответов, %

|

Доля отрицательных ответов, %

|

Частный индекс,%

|

|

1

|

2

|

3

|

4=(2–3)+100

|

|

Как Вы оцениваете свою текущую сберегательную активность: она лучше или хуже, чем год назад?

|

33,5

|

24,7

|

108,8

|

|

Как Вы считаете в ближайшие 12 месяцев Ваши сбережения возрастут или снизятся?

|

50,5

|

14,3

|

136,2

|

|

Как Вы оцениваете свое материальное положение: оно лучше или хуже, чем было год назад?

|

46,2

|

22,5

|

123,7

|

|

На Ваш взгляд, как изменится Ваше материальное положение через год?

|

62,1

|

6,6

|

155,5

|

|

Как Вы считаете в течение следующих 12 месяцев национальная экономика будет характеризоваться благоприятными или неблагоприятными условиями для роста семейного благосостояния?

|

61,5

|

38,5

|

123

|

|

В ближайшие 12 месяцев Вы планируете приобретать дорогостоящие вещи, в том числе, автомобиль, квартиру (дом) или оплачивать туристические, образовательные услуги?

|

53,3

|

31,3

|

122

|

|

Пользуетесь ли Вы услугами банков, страховых организаций, пенсионных фондов, фондовых бирж при осуществлении сбережений?

|

67

|

33

|

134

|

Таблица 2

Расчет индекса сберегательных настроений населения г. Хэфэй

|

Вопрос анкеты

|

Доля положительных ответов, %

|

Доля отрицательных ответов, %

|

Частный индекс, %

|

|

1

|

2

|

3

|

4=(2–3)+100

|

|

Как Вы оцениваете свою текущую сберегательную активность: она лучше или хуже, чем год назад?

|

54,8

|

14,4

|

140,4

|

|

Как Вы считаете в ближайшие 12 месяцев Ваши сбережения возрастут или снизятся?

|

54,8

|

12,5

|

142,3

|

|

Как Вы оцениваете свое материальное положение: оно лучше или хуже, чем было год назад?

|

47,1

|

12,5

|

134,6

|

|

На Ваш взгляд, как изменится Ваше материальное положение через год?

|

65,4

|

17,3

|

148,1

|

|

Как Вы считаете в течение следующих 12 месяцев национальная экономика будет характеризоваться благоприятными или неблагоприятными условиями для роста семейного благосостояния?

|

81,7

|

18,3

|

163,4

|

|

В ближайшие 12 месяцев Вы планируете приобретать дорогостоящие вещи, в том числе, автомобиль, квартиру (дом) или оплачивать туристические, образовательные услуги?

|

43,3

|

39,4

|

103,9

|

|

Пользуетесь ли Вы услугами банков, страховых организаций, пенсионных фондов, фондовых бирж при осуществлении сбережений?

|

67,3

|

32,7

|

134,6

|

Полученные индексы выше 100, это означает, что преобладают положительные ответы, при этом население г. Хэфэй отличается большей оптимистичностью в своих сберегательных настроениях. Развернутый сравнительный анализ сберегательного поведения населения г. Хэфэй и г. Чита представлен в следующем разделе настоящей статьи.

Результаты социологического опроса, проведенного среди населения г. Хэфэй и г. Чита. Прошлый опыт сберегательной активности респондентов. Более половины китайских респондентов, а именно 54,8%, считают, что их сберегательная активность стала выше по сравнению с прошлым годом, при этом 80% из них — это лица старше 30 лет. Дополнительный анализ данных в разрезе возрастных категорий показал, что наибольшее число опрошенных жителей г. Хэфэй, которые отмечают рост сбережений в текущем году, относятся к возрастной категории «старше 45 лет» (47,4%). Кроме того, если посмотреть распределение ответов по отдельно взятой возрастной категории, то отрицательные оценки текущей сберегательной активности в большей степени склонны давать респонденты, находящиеся в возрасте от 18 до 30 лет (26,1%). Для сравнения в возрастной категории от 30 до 45 лет респондентов, у которых сбережения снизились, почти в два раза меньше (13,6%), а в возрасте старше 45 лет — только 8,1%.

Таким образом, прослеживается достаточно четкая статистическая зависимость: чем выше возраст респондента, тем больше положительных оценок текущей сберегательной активности и меньше отрицательных оценок, и наоборот. Сложившуюся ситуацию можно объяснить тем, что молодые люди сталкиваются с большими проблемами трудоустройства в силу отсутствия должного опыта, им назначаются меньшие надбавки за стаж к заработной плате, в то время как люди старших возрастов имеют более устойчивое финансовое положение, и соответственно, располагают большими ресурсами для сбережений.

Социологический опрос показал, что сберегательная активность большей части респондентов, проживающих в г. Чита (41,8%), осталась прежней. В отличие от населения г. Хэфэй гораздо меньше российских респондентов отмечают повышение текущей сберегательной активности: только 33,5% (напомним 54,8% в г. Хэфэй) и, напротив, у большего числа российских респондентов наблюдается снижение сбережений: 24,7% в г. Чита и 14,4% в г. Хэфэй. При этом 64% российских респондентов, сбережения которых возросли в текущем году, это лица моложе 30 лет. В г. Хэфэй, как уже упоминалось, это преимущественно люди старше 45 лет. Если по аналогии с анализом сберегательного поведения населения Китая рассмотреть распределение ответов по отдельно взятой возрастной категории, то не наблюдается явного перевеса отрицательных ответов в группе до 30 лет, во всех трех возрастных группах около 23% респондентов отмечают ухудшение текущей сберегательной активности.

Как уже успели заметить, большинство респондентов, отмечающих рост сбережений, это люди моложе 30 лет. Можно выдвинуть следующее предположение: поскольку в последние годы наблюдается тенденция повышения возраста вступления в брак и рождения детей (по данным Росстата за период 2010–2016 гг. число браков, заключенных в возрасте 18–24 сократилось в 1,8 раза, в то время как ежегодно увеличивается число браков, заключенных старше 30 лет), представители этой возрастной категории в меньшей степени обременены ипотечными и кредитными обязательствами, текущими расходами на содержание квартиры (дома), оплаты дошкольных учреждений, соответственно, имеют финансовые возможности для увеличения сбережений [8].

Оценки респондентов относительно изменений в материальном положении семьи. Одним из определяющих факторов сберегательного поведения населения выступает материальное положение семьи. Проведенный опрос показал, что по оценкам 47% жителей г. Хэфэй их материальное положение улучшилось, по оценкам 40% осталось прежним, наконец, только 13% считают, что благосостояние их семьи по сравнению с прошлым годом ухудшилось. Положительные оценки населения совпадают с данными официальной статистики. Согласно отчетам Национального бюро статистики КНР, среднегодовой темп прироста располагаемого дохода на душу населения в г. Хэфэй в 2013–2018 гг. составил 12%, а в 2018 г. располагаемый годовой доход вырос до 35 175 юаней (по официальному курсу ЦБ РФ это 29 660 руб. в месяц) [9].

При этом 87,7% респондентов, которые отмечают улучшение материального положения — это люди старше 30 лет. Полученные результаты согласуются с ранее сделанными выводами относительного того, что рост сбережений обеспечен, прежде всего, людьми старше 30 лет. То есть, согласно опросу, благосостояние жителей г. Хэфэй, главным образом, в возрасте старше 30 лет улучшилось в текущем году, что имеет своим следствием и повышение сберегательной активности.

Кроме того, анализ распределения ответов по каждой возрастной категории показал, что наибольшее число респондентов (21,7%), которые полагают, что их материальное положение ухудшилось, находятся в возрастной группе от 18 до 30 лет. Как уже было отмечено ранее, именно в данной группе больше всего респондентов, сокративших сбережения в текущем году. Таким образом, наблюдается вполне устойчивая прямая связь между оценками материального положения семьи и сберегательной активности.

Далее рассмотрим результаты, полученные в ходе опроса российских респондентов: 46,2% опрошенного населения г. Чита считают, что их материальное положение улучшилось, 31,3% респондентов отмечают, что оно осталось неизменным, а 22,5% респондентов — ухудшилось. По данным Росстата, с 2014 по 2017 г. в Забайкальском крае наблюдалось снижение реальных среднедушевых денежных доходов населения в среднем на 5,5% ежегодно, и только в 2018 г. реальные денежные доходы выросли на 2,1% и составили 23 683 руб. в месяц [10]. При этом в отличие от опрошенного населения г. Хэфэй, более половины российских респондентов, которые отмечают улучшение материального положения (54,8%) — это люди младше 30 лет. Как и в случае с оценками сберегательной активности, среди населения г. Чита на 10% больше респондентов, семейное благосостояние которых в текущем году снизилось.

Прогнозы сберегательной активности на ближайшие 12 месяцев. Что касается прогнозов на будущее, то также большинство опрошенных жителей г. Хэфэй (54,8%) полагают, что сбережения в ближайшие 12 месяцев возрастут. Как и в предыдущем случае свыше 80% респондентов, дающих оптимистичные прогнозы — это люди старше 30 лет. Это связано с тем, что в подавляющем большинстве именно представители этой возрастной категории ожидают рост семейного благосостояния в ближайший год: из опрошенных жителей г. Хэфэй, выбравших вариант ответа «материальное положение будет лучше» 39,7% — это респонденты в возрасте от 30 до 45 лет, 45,6% — респонденты старше 45 лет. Напротив, молодые люди строят пессимистичные прогнозы относительно своей будущей сберегательной активности. Так из респондентов, выбравших вариант ответа «в ближайшие 12 месяцев сбережения снизятся», 61,5% приходится на лиц, принадлежащих возрастной категории от 18 до 30 лет. Такие сберегательные настроения можно объяснить тем, что по сравнению с другими возрастными категориями в данной возрастной группе больше людей, ожидающих ухудшение своего материального положения, а именно 34,8%. В группе от 30 до 45 лет 18,2% респондентов прогнозируют снижение семейного благосостояния, а в группе старше 45 лет — только 5,4%.

Половина опрошенных российских респондентов (50,5%) ожидают роста своих сбережений в ближайшие 12 месяцев. Оптимистичные прогнозы в большей степени строят жители г. Чита в возрасте до 30 лет (53,3%), в меньшей степени — респонденты старше 45 лет (19,6%). При интерпретации результатов социологического опроса, проведенного среди китайского населения, была выявлена прямая статистическая связь между оценками материального положения и сберегательного поведения. Эта связь может быть использована для объяснения полученного распределения ответов: так 56,6% респондентов, которые прогнозируют улучшение своего материального положения, это люди моложе 30. В отличие от опрошенного населения г. Хэфэй, где оптимистичные прогнозы относительно своего будущего благосостояния строят в первую очередь люди старше 30 лет, в большей степени старше 45 лет, российские респонденты данных возрастных групп, напротив, проявляют большую сдержанность в своих суждениях относительно улучшения материального положения семьи. Так доля респондентов, которые выбрали вариант ответа «материальное положение будет лучше», в возрасте от 30 до 45 лет составила 25,7%, а в возрасте старше 45 лет — 17,7%.

Далее, если в г. Хэфэй пессимистичные оценки своей будущей сберегательной активности в большинстве своем дают самые молодые респонденты, то в г. Чита респонденты в возрасте от 30 до 45 лет — 44% от общего числа опрошенных горожан, ожидающих снижение сбережений. Это можно связать с тем фактом, что среди респондентов, прогнозирующих ухудшение своего материального положения, именно эта возрастная группа имеет наибольший вес — 42%.

Построение таблиц сопряженности в программе «SPSS Statistics» позволило сделать вывод о том, что 58% респондентов из г. Хэфэй и 59,8% респондентов из г. Чита, которые собираются увеличивать свои сбережения в ближайший год, планируют приобретать дорогостоящие вещи, в том числе, автомобиль, квартиру (дом), а также оплачивать образовательные и туристические услуги. Таким образом, можно предположить, что сбережения, осуществляемые данной группой опрошенного населения, продиктованы потребительско-инвестиционными мотивами. В свою очередь, остальные 42% китайских респондентов (40,2% российских респондентов) либо не намерены предъявлять спрос на товары длительного пользования (роскоши), либо пока не определились. Прогнозируемый рост сбережений, скорее всего, связан с действием страховых мотивов (про запас, на случай непредвиденных обстоятельств).

Взаимосвязь между ожиданиями респондентов относительно будущего развития национальной экономики и прогнозируемыми изменениями в личном благосостоянии. Ранее была выявлена статистическая зависимость между оценками материального положения семьи и сберегательной активности. В свою очередь, одним из факторов, оказывающих влияние на прогнозы населения относительно будущего семейного благосостояния являются ожидания того, как будет развиваться национальная экономика. Так было получено следующее распределение ответов: из респондентов, полагающих, что их материальное положение будет лучше, 52,9% ожидают, что национальная экономика будет характеризоваться благоприятными условиями для роста семейного благосостояния, 36,8% — благоприятными, но не во всем, 8,8% — неблагоприятными условиями, 1,5% — неблагоприятными, но не во всем. Таким образом, население г. Хэфэй, которое прогнозирует улучшение материального положения, формирует оптимистичные ожидания относительно развития национальной экономики.

В двух других случаях ситуация менее однозначная. Ответы респондентов, которые считают, что их материальное положение останется неизменным, распределились почти равным образом: 33,3% респондентов сделали выбор в пользу варианта «благоприятные, но не во всем», по 27,8% — в пользу вариантов «благоприятные» и «неблагоприятные условия». Можно заключить, что эта часть населения г. Хэфэй настроена менее оптимистично, хотя больше половины респондентов, рассчитывающих на сохранение своего прежнего дохода, прогнозируют, что развитие национальной экономики в большей мере будет характеризоваться положительными тенденциями. Интересно то, что 72,2% респондентов, которые ожидают ухудшение своего материального положения, выбрали вариант ответа «благоприятные, но не во всем».

Таким образом, можно сделать вывод, что независимо от прогноза относительно изменения своего материального положения, подавляющее большинство опрошенных ожидают, что в экономике будут преобладать благоприятные условия. Однако нельзя отрицать влияние ожиданий, формируемых населением в отношении развития национальной экономики, на прогнозы изменений в материальном положении семьи. Как уже было отмечено ранее, те респонденты, которые ожидают повышение семейного благосостояния, строят более оптимистичные прогнозы развития национальной экономики по сравнению с теми, кто считает, что оно сохранится на прежнем уровне или снизится.

Хотя здесь имеет право на жизнь и такая интерпретация полученных результатов: респонденты могут переносить свои субъективные ожидания относительно того, как возможно измениться их личное благосостояние под воздействием локальных факторов, или как будет развиваться экономика того города (села), где они проживают, на будущее состояние национальной экономики в целом. Ведь в действительности начиная с 2010 г. темпы роста ВВП Китая демонстрируют отчетливую тенденцию к снижению, в 2018 г. темп роста ВВП упал до 6,6%, что является самым низким показателем за последние 28 лет [11]. Однако по результатам опроса среди населения г. Хэфэй преобладают оптимистичные прогнозы относительно развития национальной экономики. Это можно объяснить тем, что экономика г. Хэфэй стабильно растет, среднегодовой темп роста за 2014–2018 гг. составил 11% [12].

При анализе ответов населения г. Чита складывается несколько иная картина. Из респондентов, ожидающих улучшение своего материального положения, 56,6% считают, что национальная экономика в ближайшие 12 месяцев будет характеризоваться благоприятными условиями для роста семейного благосостояния, но не во всем. Только 12,4% респондентов выбрали вариант ответа «благоприятными условиями» (в г. Хэфэй этот вариант выбрали 52,9%), а респондентов, дающих пессимистичные прогнозы развития экономики и в то же время ожидающих роста своего благосостояния, в г. Чита больше, чем в г. Хэфэй: 17,7% жителей г. Чита выбрали вариант «неблагоприятными условиями», 13,3% — «неблагоприятными, но не во всем».

Большинство респондентов, склоняющихся к тому, что их материальное положение не будет претерпевать каких-либо изменений, как и в предыдущем случае считают, что национальная экономика будет характеризоваться благоприятными условиями, но не во всем (49,1%). Однако явно прослеживается смещение ответов в пользу более пессимистичных прогнозов: только 1,8% респондентов ожидают благоприятные условия, по 24,6% респондентов выбрали варианты «неблагоприятные» и «неблагоприятные, но не во всем». Наконец, 54,8% участников опроса, кто прогнозирует ухудшение своего материального положения, считают, что в национальной экономике будут преобладать негативные тенденции.

Таким образом, результаты анализа ответов российских респондентов, свидетельствуют о существовании достаточно явной статистической зависимости между оценками своего будущего благосостояния и условий развития национальной экономики. В завершении следует отметить, что население г. Хэфэй настроено более оптимистично в своих ожиданиях относительно развития национальной экономики в ближайшие 12 месяцев. Пессимистичные настроения среди российского населения нельзя считать необоснованными: темпы роста как национальной, так и региональной экономики не обнадеживают. По данным Всемирного Банка, темп прироста ВВП России в 2016 г. составил 0,33%, в 2017 г. — 1,63%, в 2018 г. — 2,25% [13].

Цели, преследуемые населением при осуществлении сбережений. При организации социологического исследования ставилась следующая задача: выяснить, какую цель ставят респонденты при осуществлении сбережений. Опрос показал, что 74% китайских респондентов делают сбережения, чтобы накопить определенную сумму, и только 26% — не только сохранить, но и получить дополнительный доход. Логично предположить, что получение дополнительного дохода требует предъявление спроса на услуги финансовых институтов. Как показало проведенное исследование, 67,3% опрошенного населения г. Хэфэй пользуются услугами банков, страховых организаций, пенсионных фондов, фондовых бирж при осуществлении сбережений. Однако необходимо уточнить, все ли респонденты, которые выбрали в качестве цели сбережений не только сохранить, но и получить прибыль, прибегают к услугам финансовых организаций. Для этого снова была построена таблица сопряженности в программе «SPSS Statistics».

Результаты свидетельствуют о существовании явного противоречия в целях и средствах их достижения у части опрошенного населения г. Хэфэй: 37% респондентов, планирующих заработать дополнительный доход, совсем не пользуются финансовыми услугами. Возникшее противоречие можно объяснить низким уровнем финансовой грамотности некоторых респондентов, а именно недостатком понимания того, что получение прибыли невозможно без обращения к субъектам финансовой инфраструктуры.

Следует отметить, что в большинстве своем респонденты, которые преследуют цель получить дополнительную прибыль, имеют высокий доход: ежемесячный доход 29,6% опрошенных жителей г. Хэфэй варьируется в диапазоне от 4900 до 6000 юаней (по официальному курсу ЦБ РФ 45 до 55 тыс. руб.), а доход 59,3% респондентов превышает 6000 юаней (по официальному курсу ЦБ РФ 55 тыс. руб.) Кроме того, 59% респондентов, нацеленных на извлечение дохода, имеют высшее образование, исходя из этого можно сделать предположение, что данная группа опрошенных жителей г. Хэфэй обладает базовыми знаниями в области использования сберегательных инструментов. Выдвинутую гипотезу можно подтвердить тем фактом, что 65,7% респондентов, которые предъявляют спрос на услуги финансовых организаций, это люди с высшим образованием.

Опрос, проведенный среди населения г. Читы, показал, что 55,5% респондентов преследуют цель накопить определенную сумму, а 44,5% респондентов — не только сохранить, но и получить дополнительный доход. То есть, среди опрошенного населения г. Чита больше респондентов, стремящихся заработать прибыль при осуществлении сбережений. Также как и в г. Хэфэй больше 60% респондентов пользуются услугами финансовых организаций. При этом 21% респондентов, планирующих получить дополнительный доход, не обращаются к услугам банков, страховых организаций, пенсионных фондов и т. д. Ранее было высказано предположение о недостатке финансовой грамотности у таких респондентов. Однако респондентов, у которых наблюдается явное противоречие между целями и средствами их достижения, в г. Чита на 16% меньше, чем в г. Хэфэй.

Дополнительный анализ ответов в разрезе доходных групп позволил сделать следующий вывод. Если в г. Хэфэй около 90% респондентов, чья сберегательная активность направлена на извлечение дополнительного дохода, имеют доход свыше 4900 юаней (по официальному курсу ЦБ РФ 45 тыс. руб.), то в г. Чита не наблюдается такого значительного перевеса в пользу наиболее состоятельных людей. Так можно выделить три наиболее многочисленные группы респондентов, нацеленных на дополнительный доход: респонденты с доходом свыше 55 тыс. руб. — 35,8%, с доходом от 25 до 35 тыс. руб. — 27,2%, с доходом менее 25 тыс. руб. — 18,5%.

Частота и норма сбережений. В ходе настоящего исследования также удалось выяснить частоту сбережений: 42,3% респондентов делают сбережения очень редко, от случая к случаю, 26% респондентов — несколько раз в год, 17,3% респондентов — почти каждый месяц, 14,4% опрошенных жителей г. Хэфэй не имеют финансовой возможности осуществлять сбережений. Далее был проведен дополнительный анализ полученного распределения ответов в разрезе доходных групп. Доход более половины респондентов (53,3%), которым ничего не удается откладывать, составляет от 2700 до 3800 юаней (по официальному курсу ЦБ РФ от 25 до 35 тыс. руб.) Согласно данным Национального бюро статистики КНР, среднедушевой располагаемый доход домохозяйств, относящихся к четвертому доходному квинтилю «выше среднего», составляет 2878 юаней в месяц [14]. То есть, респонденты, даже имея доход выше среднего, лишены возможности сберегать. В то время как делать сбережения несколько раз в год или каждый месяц могут себе позволить преимущественно состоятельные респонденты с доходом свыше 4900 юаней (по официальному курсу ЦБ РФ 45 тыс. руб.) Эти респонденты, скорее всего, принадлежат пятому доходному квинтилю «высокий доход», где средний доход домохозяйств — 5411 юаней в месяц.

Опрос, проведенный среди российских респондентов, позволил сделать вывод о том, что население г. Читы делает сбережения чаще, чем жители г. Хэфэй. Так вариант «очень редко, от случая к случаю» выбрали 30% респондентов, в то время как 29,7% респондентов осуществляют сбережения почти каждый месяц. Доход большинства респондентов, которым ничего не удается откладывать, не превышает 35 тыс. руб., а именно, 33,3% — имеют доход менее 25 тыс. руб., 25% — от 25 до 35 тыс. руб. Согласно официальной статистике среднемесячная начисленная заработная плата по Забайкальскому краю в 2018 г. составила 39 793 руб. (именно заработная плата является основным источником дохода) [15]. Таким образом, большинство респондентов не делают никаких сбережений, если их доход ниже средней заработной платы, начисленной в крае. В то время как ежемесячные сбережения в большинстве своем делают люди с ежемесячным доходом свыше 55 тыс. руб. (46,3% респондентов).

Также социологический опрос показал, что норма сбережений 44,2% респондентов г. Хэфэй составляет менее 10% от ежемесячного дохода, а 37,5% респондентов — от 10 до 30%. Если рассмотреть норму сбережений по отдельно взятой группе опрошенного населения с конкретным диапазоном ежемесячного дохода, то можно сделать следующие выводы: более половины респондентов, принадлежащих к таким группам, как «доход менее 2700 юаней», «доход от 2700 до 3800 юаней» и «доход от 4900 до 6000 юаней» имеют норму сбережений менее 10%; норма сбережений большей части опрошенного населения г. Хэфэй, доход которого варьируется от 3800 до 4900 юаней, а также свыше 6000 юаней составляет 10–30% от ежемесячного дохода.

Норма сбережения большей части опрошенного населения г. Читы также не превышает 30%: 43,4% сберегают менее 10% от ежемесячного дохода, 40,7% — от 10 до 30%. Если рассмотреть норму сбережений по отдельно взятой группе опрошенного населения с конкретным диапазоном ежемесячного дохода, то в трех группах, где доход не превышает 45 тыс. руб., большая часть респондентов имеют норму сбережений менее 10%, а более половины респондентов в двух других группах сберегают10–30% от ежемесячного дохода.

Анализ порядка распределения доходов респондентов. Сбережения населения образуются как часть доходов, которая остается после удовлетворения потребностей и осуществления обязательных платежей. Однако бывают случаи, когда склонность к сбережению сильнее, чем склонность к потреблению, то есть, индивид сначала сберегает часть дохода, а что остается направляет на потребление. В связи с чем, респондентам был предложен вопрос о порядке распределения дохода: 63,5% опрошенного населения г. Хэфэй вначале тратят доход на текущие нужды, а что остается откладывают. Большая половина тех, кто вначале делают сбережения, это респонденты с доходом свыше 6000 юаней. Хотя 20% респондентов, выбравших данный вариант распределения дохода, имеют доход на два порядка ниже, от 2700 до 3800 юаней.

В г. Чита сбережения также преимущественно формируются по остаточному принципу — 48,9% респондентов вначале потребляют свой доход, 27,5% респондентов вначале делают сбережения, 23,6% респондентов полностью потребляют заработанный доход, для сравнения в г. Хэфэй таких респондентов на 10% меньше. Примечательно и то, что в г. Хэфэй вначале делают сбережения, прежде всего, наиболее состоятельные люди, а в г. Чита респонденты, принадлежащие не только к группе с самым высоким доходом, но и к двум группам с самыми низкими доходами. Итак, из респондентов, выбравших вариант «вначале делаю сбережения, а оставшуюся сумму направляю на финансирование текущих расходов», 32% имеют доход свыше 55 тыс. руб., 30% — от 25 до 35 тыс. руб., 24% — менее 25 тыс. руб.

Анализ практикуемых форм сбережений. В завершении необходимо обсудить такой важный вопрос, как склонность населения к формированию организованных сбережений, которые выступают источником инвестиционных ресурсов. Респондентам было предложено выбрать те формы сбережений, которые они использовали последние 3 года (несколько вариантов ответа). Самые распространенные формы сбережений — это хранение денег дома в наличных юанях и хранение денег на сберегательном счете в банке (пластиковых картах) в юанях, их использует каждый второй житель г. Хэфэй. Каждый третий респондент принимал участие в программах накопительного страхования жизни и открывал срочные депозиты в банке в юанях. В большинстве своем эти сберегательные инструменты имеют спрос у респондентов с высшим образованием и ежемесячным доходом свыше 6000 юаней.

Следует отметить, что каждый пятый житель г. Хэфэй имеет опыт сбережений посредством приобретения ценных бумаг (акций и облигаций). В настоящее время в Китае действует много частных компаний и государственных банков, которые предлагают брокерские услуги по приобретению ценных бумаг, в том числе, предоставляя возможность осуществлять сбережения в такой форме онлайн [16, с. 384]. Например, это такие компании, как Хэфэйский промышленно-инвестиционный холдинг (Hefei Industry Investment Holding's) и Инвестиционная группа провинции Аньхой (Anhui Investment Group).

Гораздо реже встречаются такие сберегательные инструменты, как хранение денег дома в наличной валюте (10% опрошенного населения), открытие срочных валютных депозитов (5% опрошенного населения), а также перечисление денежных средств на формирование будущей пенсии (3% опрошенного населения). Это связано с тем, что система негосударственного пенсионного обеспечения в Китае до сих пор находится в стадии зарождения, хотя недавно Правительство КНР запустило пилотный проект по предоставлению налоговых преференций участникам данной системы в целях стимулирования добровольных пенсионных накоплений [17].

Опрос, проведенный среди населения г. Читы, показал, что как и в г. Хэфэй наиболее востребованными формами сбережений остаются хранение денег дома в наличных рублях и хранение денег на сберегательном счете в банке (пластиковых картах) в рублях. Однако по сравнению с населением г. Хэфэй в г. Чита большее число респондентов отдает предпочтение сберегательным счетам (банковским пластиковым картам) — 66% респондентов (в Китае 63%), в то время как 55% российских респондентов выбрали наличную форму хранения денег (в Китае 63%) [18, с. 65]. Можно заметить, что разрыв совсем незначительный, и более половины как российского, так и китайского городского населения формируют неорганизованные сбережения.

На третьем месте находится такая форма сбережений, как открытие срочных рублевых депозитов в банке — 24% респондентов, в г. Хэфэй таких респондентов на 10% больше. Следующие по востребованности формы сбережений — это хранение денег дома в наличной валюте (13% респондентов), хранение денег на сберегательном счете (пластиковой карте) в валюте (10%) и перечисление денежных средств на формирование будущей пенсии (10%). Забайкальский край, столицей которого является г. Чита, граничит с Китаем, следствием данного факта выступают частые выезды населения в соседнюю страну для приобретения товаров, отдыха, стажировок и учебных практик. Поэтому часть опрошенного населения формируют сбережения в валюте, в частности, в юанях. Остальные формы сбережений (покупка ценных бумаг, программы накопительного страхования жизни, валютные депозиты) представлены единичными случаями [19, 20].

Как уже успели выяснить, сбережения в форме перечисления денежных средств на пенсионный счет остаются достаточно редким явлением. На настоящий момент государство предлагает ряд мер, направленных на стимулирование добровольных пенсионных накоплений, прежде всего, это Программа государственного софинансирования формирования пенсионных накоплений (сейчас действует только для тех граждан, кто вступили в названную программу до 1 января 2015 г.) и социальный налоговый вычет по расходам на накопительную пенсию, а также по негосударственному пенсионному обеспечению (13% от суммы произведенных расходов) [21].

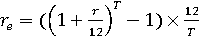

Опрос показал, что 67% российских респондентов, которые выбрали перечисление денежных средств на формирование будущей пенсии в качестве практикуемой формы сбережения, преследуют цель не просто сохранить, а получить дополнительный доход. Принимая во внимание особенности налогового регулирования и процентную политику банков, данную форму сбережений можно считать более выгодной альтернативой банковским депозитам с точки зрения величины дополнительного дохода. Средневзвешенные процентные ставки по депозитным операциям в рублях за 2018–2019 гг. составили 6–7% [22]. Рассчитаем эффективную ставку с учетом капитализации процентов. Формула расчета эффективной ставки по вкладу с учетом ежемесячной капитализации процентов представлена ниже:

, где (1) , где (1)

re — эффективная ставка по вкладу;

r — номинальная ставка по вкладу;

T — срок размещения вклада в месяцах.

Таким образом, эффективная ставка по вкладу, размещенному на год, при условии ежемесячной капитализации процентов под 7% годовых составит 7,23%, что ниже ставки налогового вычета в 13%. Например, если физическое лицо в начале года откроет вклад размером 10 тыс. руб., то в конце года получит инвестиционный доход, равный 723 руб., а если перечислит эту сумму на пенсионный счет, то величина налогового возмещения окажется почти в два раза выше, 1300 руб. Кроме того, собственные средства граждан, добровольно перечисляемые в пенсионную систему, инвестируются. Однако несмотря на очевидные финансовые выгоды, все же только каждый десятый респондент выбрал отчисления на формирование будущей пенсии, в то время как банковские депозиты — каждый четвертый. Во многом это обусловлено двумя обстоятельствами.

Во-первых, средства, перечисленные на депозит, можно получить обратно в полном объеме через достаточно короткий период времени, причем этот период определяется самим вкладчиком, в то время как средства в форме дополнительных страховых взносов на накопительную пенсию или пенсионных взносов по договору негосударственного пенсионного обеспечения будут получены только при назначении пенсии. Во-вторых, доходность от инвестирования пенсионных накоплений (резервов — по негосударственному пенсионному обеспечению) остается достаточно низкой. Так за 2018 г. доходность пенсионных накоплений, инвестированных государственной управляющей компанией «Внешэкономбанк» по расширенному инвестиционному портфелю составила 6,42%, а средневзвешенная доходность пенсионных накоплений и пенсионных резервов, размещенных НПФ — 0,1% (в 2017 г. 4,6%) и 5,55% (в 2017 г. 5,4%) соответственно [23].

Выводы. Проведенное исследование показало, что население г. Хэфэй имеет более оптимистичные сберегательные настроения. В ходе социологического опроса была установлена статистическая зависимость между оценками сберегательной активности и материального положения, влияние ожиданий респондентов относительно будущего развития национальной экономики на прогнозируемые ими изменения в личном благосостоянии. Население как г. Чита, так и г. Хэфэй преимущественно преследует цель накопить определенную сумму без получения дополнительного дохода. Этот результат согласуется с тем, что преобладают потребительско-инвестиционные мотивы сбережений, то есть, люди откладывают денежные средства для осуществления крупных покупок в будущем. Незаинтересованность в извлечении дополнительного дохода имеет своим следствием тот факт, что более половины опрошенных респондентов обеих стран формируют неорганизованные сбережения. Самые востребованные формы организованных сбережений среди населения г. Хэфэй — это срочные депозиты и программы накопительного страхования жизни, в г. Чита — такие сберегательные инструменты, как срочные рублевые депозиты и добровольные пенсионные взносы. При этом, как показал опрос, срок депозита в большинстве своем не превышает одного года, а значит, проблема дефицита «длинных денег» остается актуальной.

References

1. Strebkov D. O. Faktory i tipy sberegatel'nykh strategii naseleniya Rossii vo vtoroi polovine 1990-kh godov : dis. …kand. sotsiol. nauk : 22.00.03 / D. O. Strebkov. – M., 2002. – 188 s.

2. Ibragimova D. Kh. Indeks potrebitel'skikh nastroenii / D. Kh. Ibragimova, M. D. Krasil'nikova, S. A. Nikolenko // Monitoring. – 1996. – №6. – S. 36-42. URL : https://cyberleninka.ru/article/n/indeks-potrebitelskih-nastroeniy (data obrashcheniya: 10.06.2019).

3. Vystuplenie Predsedatelya Banka Rossii El'viry Nabiullinoi na XXVIII Mezhdunarodnom finansovom kongresse 4 iyulya 2019 goda : ofitsial'nyi sait TsB RF. URL : http://www.cbr.ru/press/st/2019-07-04 (data obrashcheniya: 15.07.2019).

4. The World Bank Data. URL : https://data.worldbank.org/indicator/NY.GNS.ICTR.ZS?end=2018&locations=CN&start=1990&view=chart (data obrashcheniya: 10.07.2019).

5. Lily Qiu, Ivo Welch. Investor sentiment measure : working paper 10794. National Bureau of Economic Research. – Cambridge, 2004. – 50 p. URL : https://www.nber.org/papers/w10794 (data obrashcheniya: 07.06.2019).

6. Indeks finansovykh nastroenii (IFN) Sberbanka. URL : https://www.sberbank.ru/ru/about/analytics/mood (data obrashcheniya: 15.06.2019).

7. Maiorova L. N. Teoreticheskie osnovy sberezhenii naseleniya kak ekonomicheskoi kategorii / L. N. Maiorova // Ekonomicheskie nauki. – 2012. – № 87. – S. 280-283.

8. Demograficheskii ezhegodnik Rossii. 2017 : stat. sb. / Rosstat. – M., 2017. – 263 s.

9. Disposable income per capita. Anhui. Hefei. URL : https://www.ceicdata.com/en/china/disposable-income-per-capita-prefecture-level-city/disposable-income-per-capita-anhui-hefei (data obrashcheniya: 08.07.2019).

10. Srednedushevye denezhnye dokhody naseleniya. Zabaikalkraistat. URL : http://chita.gks.ru/wps/wcm/connect/rosstat_ts/chita/ru/statistics/standards_of_life (data obrashcheniya: 04.07.2019).

11. The World Bank Data. URL : https://data.worldbank.org/indicator/NY.GDP.MKTP.KD.ZG?end=2018&locations=CN&start=1990&view=chart (data obrashcheniya: 10.07.2019).

12. Gross Domestic Product. Anhui. Hefei. URL : https://www.ceicdata.com/en/china/gross-domestic-product-prefecture-level-city/cn-gdp-anhui-hefei (data obrashcheniya: 08.07.2019).

13. The World Bank Data. URL : https://data.worldbank.org/indicator/NY.GDP.MKTP.KD.ZG?locations=RU&view=chart (data obrashcheniya: 10.07.2019).

14. Per Capita Disposable Income of Nationwide Households by Income Quintile. China Statistical Yearbook 2018. URL : http://www.stats.gov.cn/tjsj/ndsj/2018/indexeh.htm (data obrashcheniya: 02.07.2019).

15. Srednemesyachnaya nominal'naya nachislennaya zarabotnaya plata rabotnikov organizatsii. Zabaikalkraistat. URL : http://chita.gks.ru/wps/wcm/connect/rosstat_ts/chita/resources/acc5dd004064ba8f96f2f7367ccd0f13/1 (data obrashcheniya: 05.07.2019).

16. Polyakova N. V. Spetsifika denezhnykh nakoplenii v sem'yakh stran Aziatskogo regiona / N. V. Polyakova , V. V. Polyakov // Evraziiskii integratsionnyi proekt: tsivilizatsionnaya identichnost' i global'noe pozitsionirovanie : materialy Mezhdunar. Baikal. foruma, g. Irkutsk, 20-21 sent. 2018 g. / pod nauch. red. E. R. Metelevoi. – Irkutsk, 2018. – S. 382-388.

17. Zheng X., Fang X., Brown D. S. Social Pensions and Child Health in Rural China. The Journal of Development Studies, 2019. – P. 1-15.

18. Polyakov V. V. Tendentsii izmeneniya povedeniya potrebitelei na rynke finansovykh uslug / V. V. Polyakov // Izvestiya Irkutskoi gosudarstvennoi ekonomicheskoi akademii (Baikal'skii gosudarstvennyi universitet ekonomiki i prava). – 2013. – № 1. – S. 64-67.

19. Stepanova M. N. Investitsionnoe strakhovanie zhizni v Rossii: aktual'nost' i osnovnye napravleniya razvitiya / M. N. Stepanova, A. A. Nefed'ev // Aktivizatsiya intellektual'nogo i resursnogo potentsiala regionov : materialy 4-i Vseros. nauch.-prakt. konf., g. Irkutsk, 17 maya 2018 g. : v 2 ch. – Irkutsk, 2018. – Ch. 2. – S. 438-443.

20. Kuznetsova N. V. Blagosostoyanie naseleniya kak faktor razvitiya strakhovogo rynka / N. V. Kuznetsova // Baikal Research Journal. – 2016. – T. 7, № 6. URL : https://elibrary.ru/contents.asp?id=34336927 (data obrashcheniya: 03.07.2019).

21. Ageeva E. V. Formirovanie dopolnitel'noi pensii: stimuly i bar'ery / E. V. Ageeva // Rossiiskaya ekonomika v sovremennykh usloviyakh : materialy mezhdunar. nauch. konf., Irkutsk, 25 marta 2015 g. – Irkutsk, 2015. – S. 3-8.

22. Srednevzveshennye protsentnye stavki po depozitnym operatsiyam. Ofitsial'nyi sait TsB RF. URL : https://www.cbr.ru/statistics/pdko/int_rat/ (data obrashcheniya: 01.07.2019).

23. Obzor klyuchevykh pokazatelei negosudarstvennykh pensionnykh fondov v 2018 g. : informatsionno-analiticheskii material. – M. : Tsentral'nyi bank Rossiiskoi Federatsii, 2019. – 18 s.

Link to this article

You can simply select and copy link from below text field.

|

|