|

MAIN PAGE

> Back to contents

Theoretical and Applied Economics

Reference:

Lebedev S., Dallakyan A.K.

The Problem of Encouraging Savings in Terms of Discoveries Made in Behavioral and Cognitive Economy

// Theoretical and Applied Economics.

2017. № 2.

P. 26-36.

DOI: 10.25136/2409-8647.2017.2.22669 URL: https://en.nbpublish.com/library_read_article.php?id=22669

The Problem of Encouraging Savings in Terms of Discoveries Made in Behavioral and Cognitive Economy

Lebedev Sergei

PhD in Politics

Management Consultant

117499, Russia, g. Moscow, ul. Shvernika, 5

|

sergei.lebedeff@gmail.com

|

|

|

Other publications by this author

|

|

|

Dallakyan Arsen Karlenovich

PhD in Philosophy

consultant on consumer behavior www.arsendallan.com

115211, Russia, Moscow Region, Moscow, str. Borisovskie Prudy, 13

|

arsdallan@gmail.com

|

|

|

|

DOI: 10.25136/2409-8647.2017.2.22669

Received:

12-04-2017

Published:

13-07-2017

Abstract:

The subject of the research is the saving behavior of economic agents (in this case, population) under limited resources nd uncertain environment. The object of the research is the combination of cognitive and behavioral effects and phenomena that encourage or prevent from savings. These factors can be successfully used to encourage this type of economic behavior, moreover, some of them can be used directly by the government as well as financial institutions (retail banks, etc.). In their research the authors have used traditional economic research methods such as analysis, synthesis, deduction, induction, and research abstraction. They have also used the method of case study (analysis of particular situations) and others. The researchers focuse on qualitative instead of quantitative analysis. The authors have offered a classification of discovered made in the fields of behavioral and cognitive economy, these discoveries facilitating or preventing from saving behavior of economic agents. The authors also analyze the experience of financial institutions aimed at encouraging saving behavior and developing relevant behavioral patterns (the habit to save money). The authors also offer to adapt a number of instruments that are used in modern marketing. In particular, they analyze savings gamification methods (based on the goal gradient hypothesis) and opportunities to apply the endowment effect through visualisation of the future value in account, etc.

Keywords:

behavioral economics, bounded rationality, hyperbolic discounting, loss aversion, gamification, endowment effect, goal-gradient hypothesis, conspicuous consumption, impulse saving(s), default options

This article written in Russian. You can find original text of the article here

.

Актуальность исследования Вопрос сбережений является крайне актуальным, как с теоретический, как и с практической точки зрения. Существует определенный научный консенсус, что сбережения на национальном уровне являются одним из драйверов экономического роста. При этом отмечается, что регионы, где уровень сбережений низок, страдают от повышенного уровня социальной напряженности и преступности. К примеру, исследование, проведенное экономистами из Университета штата Арканзас, продемонстрировало, что сбережения, инвестированные в образование, приводят к существенному снижению уровня преступности[1]. Согласно выкладкам исследователей, в рамках одного штата Техас это приведет к тому, что к 2025 году общество сможет сэкономить до $7 млн, к 2025 -$74 млн, к 2035 - $194 млн.

Для Российской Федерации проблема сбережения населения стоит особенно остро. Как отмечается в докладе НИУ ВШЭ, «более половины населения России не имели сбережений осенью 2016 года, равно как и в течение двух предшествовавших лет. Большинство тех, кто располагал сбережениями, заявили, что по сравнению с осенью 2014 года стали откладывать существенно меньше или даже перешли к расходованию накопленных средств»[2].

Несмотря на актуальность и важность проблемы, экономическая теория до сих пор не смогла выработать четкого рецепта по тому, как можно стимулировать сбережения. Данная работа, разумеется, не претендует на создание универсального руководства к действию в данном направлении. В ней будет предпринята попытка систематизировать уже имеющиеся наработки и предложить новые методы.

Сбережения в свете экономической теории Воззрения на проблему сбережений до «когнитивной революции» в экономике

Проблема сбережений рассматривалась в экономической науке достаточно давно – как минимум, с конца 19го века. Самые первые работы по сбережения были написаны в глубоко рационалистическом ключе – домохозяйства рассматривались как экономические агенты, которые ничем не отличаются от фирм и рационально максимизируют свою полезность. Поэтому сбережения домохозяйств напрямую увязывались со ставкой процента, как предлагала теория корпоративных финансов. Однако достаточно быстро стало понятно, что такой подход характеризуется низкой продуктивностью – мотивы домохозяйств и фирм очень сильно различались.

Следующим этапом развития теории сбережений стал кейнсианский подход, в рамках которого была предпринята первая попытка интегрировать психологические идеи. Сам Дж.М. Кейнс в своей работе писал, что существует психологический закон, согласно которому «люди склонны, как правило, увеличивать свое потребление вслед за увеличением дохода, но в несколько меньшей степени по сравнению с ростом дохода»[1]. Формализовать это правило Кейнс смог, введя в экономическую науку такие понятия, как средняя склонность к сбережениям и средняя я склонность к потреблению, а также предельная склонность к потреблению и предельная склонность к сбережениям. Средняя склонность к потреблению больше предельной склонности к потреблению, но при этом средняя склонность к сбережениям меньше предельной склонности к сбережениям. Иными словами, по мере роста дохода все меньшая часть идет на потребление и все большая – сберегается.

Следующим этапом развития теории сбережений стали идеи Ф. Модильяни о «жизненном цикле» и идеи М.Фридмана о «постоянном доходе», суть которых сводилась к идее о рациональных домохозяйствах, которые стремятся распределить доходы на протяжении всей своей жизни. К примеру, рациональное домохозяйство понимает, что с выходом на пенсию доходы снизятся и стремится запастись ресурсами к этому времени[2]. В определенном смысле, идеи Ф. Модильяни и М. Фридмана были попыткой «изгнать» субъективную составляющую из экономической теории сбережений, привнесенную туда Кейнсом.

Плоды «когнитивной революции»

С началом когнитивной революции в социальных науках, у экономистов появилась возможность посмотреть на проблему сбережений по совершенно новым углом.

В первую очередь, необходимо отметить идею «ограниченной рациональности», сформулированную Гербертом Саймоном и ставшую краеугольным камнем всей поведенческой экономики. Саймон в своих работах показал, что экономический агент не имеет когнитивных «мощностей» и времени, чтобы перебрать все существующие альтернативы и варианты развития ситуации, поэтому ограничивается рассмотрением лишь нескольких самых очевидных и принимает решение на основании этого анализа. Логическим продолжением идей об «ограниченной рациональности» можно считать работу Дэниэла Каннемана, который отметил, что человеческую психику можно условно поделить на две когнитивные системы – Систему 1 и Систему 2 – автоматическую и периферийную. Система 1 (автоматическая) является чем-то вроде когнитивного автопилота, который помогает нам принимать огромное число решений, даже не задумываясь над ними, «на автомате». Система 2 (периферийная) включается в ситуациях, когда требуется серьезный и глубокий анализ происходящего, однако преимущественно она находится в дремлющем режиме.

Маркетинговый эксперт Фил Барден в своей книге «Взлом маркетинга» предлагает использовать широко известный в психологии «эффект Струпа[3]» для того, чтобы продемонстрировать перманентность влияния Системы 1 на мышление и поведение.

Рис.1. Эффект Струпа и влияние Системы 1.

Источник: University of Washington

Суть «эффекта Струпа» заключается в том, чтобы испытуемый называл цвета, которыми написан текст. Большинство находят это достаточно затруднительным, так как Система 1 быстрее распознает сам текст, чем его цвет.

Большинство экономических решений принимается Системой 1. Система 1 работает с помощью так называемых эвристик. Следует отметить, что термин эвристика имеет целый ряд значений (программирование, математика, логика), однако в когнитивной психологии под этим понимается набор ментальных правил, которые позволяют оперативно и быстро принимать решения. К примеру, если говорить про финансовые рынки, то примером такого ментального правила может быть стремление сформировать портфель исключительно из бумаг компаний, которые находятся «на слуху». Эвристики помогают экономическим агентам принимать ограниченно-рациональные субоптимальные решения. Система 1 обрабатывает 11 миллионов бит в секунду и когнитивные эвристики ей в этом активно помогают. Решения, принимаемые Системой 1, далеко не всегда являются совершенно рациональными, однако без ее участия большинство решений не было бы принято вообще.

Проблема сбережений в свете когнитивной экономики

Когнитивная революция в социальных науках позволила перенести вопрос сбережений в сферу моделирования поведения экономических агентов с учетом особенностей их мышления. К примеру, эксперимент, проведенный в Кении продемонстрировал, что экономические агенты часто рационализируют свой подход к сбережениям, не пытаясь проанализировать его. Долгое время вопрос низких сбережений кенийского населения увязывался с низкими доходами. Однако выдача обычных сейфов для хранения денег беднейшим слоям населения привела к тому, что сбережения на здравоохранения выросли на 66%[4].Когнитивный переворот в экономической науке позволил по-новому взглянуть на проблему сбережений – через призму представлений об ограниченной рациональности индивидов, эвристик и других ментальных явлений.

В первую очередь, необходимо затронуть такую масштабную и сложную проблему, как гиперболическое дисконтирование. Суть этого явления сводится к тому, что большинство потребителей предпочитает удовольствие здесь и сейчас отложенному удовольствию.

Неоклассический экономический подход предполагает, что экономические агенты дисконтируют полезность экспоненциально. К примеру, если предположить, что ставка дисконтирования – 10%, то индивиду должно быть одинаково выгодно получить $100 сегодня или $110 через год.

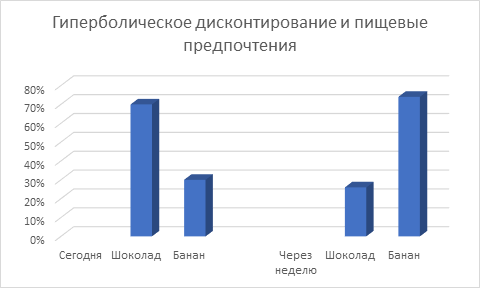

Однако на практике ситуация выглядит не столь однозначно. Большинство предпочтет $100 сегодня, чем $110 завтра, однако при этом скорее выберут $110 через 31 день, чем $100 через 30. Иными словами, ставка, по которой экономические агенты дисконтируют будущее вознаграждения, оказывается достаточно высокой в краткосрочной перспективе, но со временем ощутимо снижается. Сила гиперболического дисконтирования была продемонстрирована в одном из классических исследований по психологии питания[5]. Участникам предлагали определить свою меню на ближайший день и через неделю, выбрав между шоколадом и бананами. Удивительным образом, большинство опрошенных предпочли шоколад здесь и сейчас, а бананы через неделю.

Рис.2. Гиперболическое дисконтирование и пищевые предпочтения.

Эта склонность потребителей максимизировать свое удовольствие здесь и сейчас – одно из объяснений, почему сбережения являются целой психолого-экономической проблемой. Импульсивное потребление оказывается намного привлекательнее, чем ре-инвестирование средств.

Во-вторых, следует отметить такую когнитивно-психологическую особенность экономических агентов, как избегание потерь (loss aversion), в результате которым убыткам придается куда больший экономический вес, чем прибыли. Очень условно принято считать, что соотношение составляет 2:1 - то есть психологический дискомфорт от потери $100 будет настолько же интенсивен, насколько удовольствие от получения $200. Доверять деньги финансовым институтам и тем более вкладывать их в финансовые инструменты – психологически сложно во многом именно по этой причине.

В-третьих, необходимо отметить такие психологические особенности, как проблема с самоконтролем и прокрастинация. В исследованиях неоднократно подчеркивается, что в целом экономические агенты осознают необходимость сберегать, однако большинство не предпринимает никаких действий в этом направлении. Опрос, проведенный экономистами, показал, что хотя 35% респондентов были недовольны своим текущим уровнем сбережений, большинство в итоге не скорректировало свое поведение[6].

Следует отметить, склонность экономических агентов дисконтировать гиперболически, а также другие когнитивные искажения ни в коем случае нельзя расценивать как однозначно негативные явления. Они имеют определенную эволюционную логику, помогавшую выживать в первобытной саванне, в которой возможности долгосрочного планирования были весьма ограничены. Как когнитивная экономика предлагает решать проблему сбережений? "Сбереги больше завтра"

Первыми, кто попытался использовать инструментарий когнитивной экономики для стимулирования сбережений, были экономисты Роберт Талер и Шломо Бернаци. Исследователи предложили «умную» программу сбережений – SMarT[1]. Название является игрой слов, так как с одной стороны является аббревиатурой фразы Save more tomorrow, с другой – может быть переведено как «умный» или «сообразительный». Программа SMarT была разработана с учетом открытых особенностей поведения экономических агентов и основывалась на таких эффектах, как гиперболическое дисконтирование и склонность к сохранению статус-кво

Первой особенностью программы было то, что платежи на сберегательный счет начинались не сразу, а спустя некоторое время («завтра») – в идеале, после прибавки к зарплате. Таким образом получалось, что участник ничего не терял в настоящем времени. Это позволяло нивелировать эффект избегания потерь (loss aversion). При этом, из-за склонности к гиперболическому дисконтированию, участник не мог учесть долгосрочную перспективу, поэтому участие в программе не вызывало у него дискомфорта.

Второй важной особенностью SMarT было то, что участник соглашался с тем, что перечисления на сберегательный счет начнутся сразу после повышения зарплаты и будут составлять фиксированный процент. Очень важно было, чтобы участник не успел привыкнуть к новой зарплате, поэтому перевод должен был происходить автоматически, без его участия.

Третьей важной особенностью программы была возможность выйти из нее в любой момент. Это повышало психологический комфорт для участников.

Психологическое стремление к сохранению статус-кво[2] позволяло предсказать, что скорее всего участники не выйдут из программы, несмотря на имеющуюся возможность Исследования показывают, что в ситуации выбора экономические агенты склоняются к «опции по умолчанию», если им ее предложить. В данном случае участие в программе является «опцией по умолчанию».

Экспериментальная проверка программы SMarT продемонстрировала ее высокую эффективность. Участники пилотного проекта, проводившегося с 1998 по 2002 год, увеличили свои сбережения с 3,5% до 13,6%[3].

Геймификация сбережений

Представляется, что для стимулирования сбережений также можно использовать некоторые технологии геймификации (то есть превращения экономического процесса в игровой процесс), успешно применяющиеся в маркетинге. К примеру, эффект градиента цели успешно используется в ритейле.

Гипотеза градиента цели была впервые сформулирована в 1930-х годах в ходе наблюдения за лабораторными крысами. Исследователи обратили внимание, что грызуны, которых они запускали в лабиринт, начинали быстрее бежать по мере приближения к цели (то есть еде)[4]. Однако долгое время эта работа не получала должного внимания. Только в 2006 в престижном Journal of Marketing Research вышла статья «Воскрешение гипотезы градиента цели: ускорение покупок, иллюзорные цели и удержание покупателя»[5]. В этой работе был продемонстрирован интересный эффект – т.н. «карты лояльности», позволяющие, к примеру, получить 10ую чашку кофе бесплатно, действительно ведут к стимулированию спроса на продукцию компании. Потребление превращается в «гонку», в ходе которой потребитель стремится как можно скорее получить бесплатный товар.

Представляется, что гипотеза градиента цели может быть использована банками для стимулирования сберегательного поведения клиентов. К примеру, можно устанавливать целевые суммы на депозитах, по достижению которых потребитель получает какое-то ощутимое вознаграждение – к примеру, в виде бонусных баллов, которые он может потратить в магазинах-партнерах банка или еще каким-то иными образом.

Повышение престижа сбережений

Если посмотреть на проблему сбережений со стороны государственной политики, то можно отметить, что государство может стимулировать сберегательное поведение своих граждан с помощью рекламных компаний, повышающих его престиж. К похожей мысли впервые пришел коллектив американских экономистов под эгидой Н. Русанова, которые в своей статье «Демонстративное потребление и национальность»[6] помимо исследования предрасположенности различных этнических групп к демонстративному потреблению также задались вопросом, каким образом можно стимулировать сберегательное поведение среди этих социальных групп. Они обратили внимание, что беднейшие группы населения тратят значительные суммы на товары демонстративного потребления (до $2300 ежегодно), которые могли бы быть вместо этого инвестированы. Причина такого поведения заключается в том, что в американиских этнически-однородных беднейших районах товары демонстративного потребления являются самым простым способом завысить свой социальный статус относительно референтной группы. Исследователи предположили, что решить эту проблему можно решить, превратив сбережения в такой же «товар» демонстративного потребления. Очевидная проблема заключается в том, что сбережения очень сложно «выставить на показ». Но группа Н. Русанова считает, что некоторые варианты все же существуют. К примеру, государство могло бы поспособствовать открытию дополнительных офисов финансовых компаний в этих районах. Таким образом, посещение собственного финансового консультанта могло бы быть фактором, который позволял бы экономическим агентам повысить свой престиж относительно референтной группы.

Представляется, что эта идея допускает расширительную трактовку и может быть применена к населению в целом, а не только к этническим меньшинствам. Государство должно проводить коммуникационные кампании, которые будут повышать престиж сберегательного поведения и таким образом способствовать росту сбережений.

Визуализация будущего

Следует отметить, что даже открытый депозит периодически оказывается «под угрозой» - в том смысле, что у экономических агентов существует искушение закрыть вклад и использовать денежные средства. В качестве одной из мер, направленных на нивелирование этого эффекта, можно предложить графическую визуализацию суммы вклада с потенциально начисленными процентами в Интернет-кабинете пользователя[7]. Как это можно выглядеть будет продемонстрировано на изображении ниже.

Рис.3. Использование эффекта владения и визуализация сбережений будущего

Следует отметить, что это изображение, конечно же, не является готовым дизайнерским решением для оформления личного кабинета пользователя и только примерно иллюстрирует, как это может выглядеть.

Психологический эффект, который используется в данной ситуации, получил в когнитивной экономике название «эффект владения» (endowment effect)[8]. Его суть заключается в склонности экономического агента переоценивать стоимость имеющегося у него актива относительно рыночной стоимости. В расширительной трактовке «эффект владения» часто используется для обозначения иррациональной привязанности к тому или иному имуществу. В случае с визуализацией будущих накоплений экономический агент начинает считать их своей собственностью, что повышает субъективные издержки закрытия счета, так как в этом случае он лишится накопленных процентов, которые воспринимаются им уже как его собственные деньги.

Формирование привычек сберегать

Представляется не менее важным разработка механизмов формирования у населения привычек сберегать. Для этого можно использовать механизм формирования привычек, описанный в книге «Покупатель на крючке». Несмотря на практическую ориентацию, книга содержит немало ценных экономических идей. Автор работы Эяль Нир рассматривает формирование покупательских привычек как 4 этапа – триггер (то есть побудитель к действию), действие, вознаграждение и инвестиции.

Триггеры могут быть как внешние (sms-уведомление), так и внутренние, связанные с психическими процессами. Триггеры вынуждают совершить действие, за которым должно последовать вознаграждение за это действие. Наконец, чтобы клиент остался с компанией надолго, необходимо, чтобы он совершил определенные инвестиции – то есть вовлекся в жизнь бренда

Часть этих идей уже используется в финансовой индустрии – речь идет о так называемых мобильных приложений для «импульсивных сбережений». Примером таких приложений являются Westpac Impulse Saver и Small Sacrifices. Основное достоинство этих приложений в том, что деньги переводятся «простым нажатием кнопки». Внутренним триггером в данном случае выступает чувство вины, появляющееся после больших трат. В приложениях также используются и внешние триггеры – например, не-агрессивные напоминания о том, что нужно отложить деньги на сберегательный счет – как на иллюстрации ниже.

Однако для формирования привычки недостаточно просто побудить к действию. Как уже отмечалось выше, необходимо поощрить «хорошее» поведение экономического агента. Разработчики сберегательного Dream Account в банке Barclays plc, к примеру, начисляют клиентам дополнительные проценты, если те придерживаются поставленных инвестиционных целей (то есть, к примеру, стабильно откладывают фиксированную сумму).

Рис. 4. Внешний триггер сберегательного поведения в мобильном приложении

Источник: The Huffington Post

Наконец, для окончательного формирования привычки от экономического агента необходимо добиться инвестиций – то есть заставить его принять деятельное участие в развитии проекта. В случае со сберегательными программами такими инвестициями могут стать усилия, предпринятые пользователем, по оформлению и кастомизации интерфейса в мобильном приложении, разработка личного сберегательного плана и т.п.

References

1. Corey A. DeAngelis & Patrick J. Wolf. “Whether to Approve an Education Savings Account Program in Texas: Preventing Crime Does Pay.” EDRE Working Paper 2016-20.

2. Monitoring NIU VShE «Naselenie Rossii v 2016 godu: dokhody, raskhody i sotsial'noe samochuvstvie»-https://isp.hse.ru/data/2017/01/11/1115545507/09_%D0%9C%D0%BE%D0%BD%D0%B8%D1%82%D0%BE%D1%80%D0%B8%D0%BD%D0%B3_%D0%92%D0%A8%D0%AD_%D0%98%D1%82%D0%BE%D0%B3%D0%B8.pdf

3. Keynes J. M. The general theory of employment, interest and money, London, Macmillan, 1973, p.96-97.

4. Modigliani F., Ando A.K. Tests of the Life Cycle Hypothesis of Saving. Bulletin of the Oxford University Institute of Statistics 19 (May 1957), pp. 99-124.

5. Stroop, J. R. (1935). Studies of interference in serial verbal reactions. Journal of Experimental Psychology: General, 18, 643-662.

6. Dupas, Pascaline and Jonathan Robinson. 2013. "Why Don't the Poor Save More? Evidence from Health Savings Experiments." American Economic Review, 103(4): 1138-71.

7. Read, Daniel, and Barbara van Leeuwen, 1998, “Predicting Hunger: The Effects of Appetite and Delay on Choice,” Organizational Behavior and Human Decision Processes 76.2 (Nov.), pp. 189-205

8. Choi, James J., David Laibson, Brigitte Madrian, and Andrew Metrick. In press.“For Better or for Worse: Default Effects and 401(k) Savings Behavior.” In Perspectives on the Economics of Aging, edited by David A. Wise. Chicago: Univ. Chicago Press (for NBER).

9. Benartzi, Shlomo, and Richard Thaler. 2007. "Heuristics and Biases in Retirement Savings Behavior." Journal of Economic Perspectives, 21(3): 81-104.

10. Samuelson, William, and Richard J. Zeckhauser. 1988. “Status Quo Bias in Decision Making.” J. Risk and Uncertainty 1 (March): 7–59.

11. Benartzi, Shlomo, and Richard Thaler. 2007. "Heuristics and Biases in Retirement Savings Behavior." Journal of Economic Perspectives, 21(3): 81-104.

12. Hull, Clark L. (1932). "The goal-gradient hypothesis and maze learning". Psychological Review. 39 (1): 25

13. Kivetz, R., Urminsky, O., & Zheng, Y (2006). "The goal-gradient hypothesis resurrected: Purchase acceleration, illusionary goal progress, and customer retention". Journal of Marketing Research. 43 (1): 39–58

14. Kerwin Kofi Charles & Erik Hurst & Nikolai Roussanov, 2009. "Conspicuous Consumption and Race," The Quarterly Journal of Economics, MIT Press, vol. 124(2), pages 425-467

15. Dallakyan A.K. Upravlyai udovol'stviem. Tvorchestvo, povedencheskii marketing, korporatsii. M.: Eksmo, 2016. ISBN: 978-5-699-83768-7

16. Kahneman, Daniel; Knetsch, Jack L.; Thaler, Richard H. (1990). «Experimental Tests of the Endowment Effect and the Coase Theorem». Journal of Political Economy 98 (6): 1325—1348

Link to this article

You can simply select and copy link from below text field.

|

|