|

DOI: 10.7256/2409-8647.2016.3.20108

Received:

15-08-2016

Published:

16-01-2017

Abstract:

Amplification of the amplitude and frequency of crises phenomena on the credit market has become a serious challenge for academic society and monetary regulation authorities. The growth of financial instability, large-scale realization of "systemic" risk, which are based on cyclic processes in monetary sphere, have once once again highlighted the relevance of research. The need to identify causality between credit cycles in Russia and various macroeconomic variables identifies the subject of this study. The subject of study is the set of economic relations associated with lending to non-financial sector on the example of Russia. Main research methods include a mathematical-statistical method. The study is based on the use of regression analysis and vector autoregression modelling (VAR). The composition of the sample includes values of selected variables at the macroeconomic level on the example of Russia. The sample period is January 2005 – June 2016, reference period for the sample include monthly values of the variables. In the result of the study we determined structural and causal relationship between bank credit supply in Russia and selected macroeconomic variables. Testing of our hypotheses shows that on the Russian market of corporate credit there are several empirical anomalies that contradict the basic provisions of imperfect credit market theory(such as pricing and operating anomalies).

Keywords:

credit, credit cycle, bank, inflation, key rate, bank capital, corporate lending, exchange rate, non-performing loans, loan loss reserves

This article written in Russian. You can find original text of the article here

.

Введение

Продолжающаяся депрессия в отечественном национальном хозяйстве на фоне сохранявшихся долгое время положительных темпов роста портфеля ссуд, предоставленных нефинансовому сектору представляет собой своего рода эмпирическую аномалию. Схожий паттерн поведения коммерческих банков наблюдался в период кризиса 2008-2010гг. По мере сокращения объемов производства и потребления, падения реальных заработных плат населения, сокращения инвестиций, как внутренних, так и внешних, корпоративное кредитование демонстрировало положительный прирост.

Согласно общепринятой в мировом научном сообществе теории несовершенного кредитного рынка, рост просроченной задолженности, вызванный реализацией кредитного (и иных) рисков в существенном объеме приводит к пересмотру ожиданий кредиторов и сокращению предложения кредита, равно как и к росту ставки ссудного процента (в части хотя бы рисковой премии). Однако рост ставки ссудного процента отнюдь не означает сохранение предложения кредита на заданном уровне. В связи с существованием эффекта рационирования кредита, применение количественного подхода (в части теории общего равновесия) к анализу кредитных отношений крайне затруднительно [10] С другой стороны, допуская существование различий в готовности к принятию риска со стороны кредиторов, реакция на шок плохих долгов будет разниться: для кредиторов, характеризуемых низким уровнем готовности к принятию риска ответом станет сокращение предложения кредита, для кредиторов, работающих в высоко рисковом сегменте – наоборот – сохранение предложения. Однако на рынках кредита, характеризуемых институциональной оптимальностью, доля таких кредиторов чрезвычайно мала.

Таким образом, наиболее ожидаемой реакцией на шок плохих долгов становится сокращение предложения кредита и рост ставки ссудного процента при прочих равных условиях. Как правило, теория несовершенного рынка кредита описывает кредиторов и заемщиков с позиции транзакционного (кредитование основного и оборотного капитала) и спекулятивного мотивов спроса на кредит. Реструктуризационный же мотив находится «за скобкой». Причиной тому служат, с одной стороны, повсеместное распространение в англо-саксонских странах модели обеспеченного кредитования, где анализ кредитоспособности заемщика (screening) и мониторинг использования ссуженной стоимости (monitoring), являясь весьма крупной величиной агентских (транзакционных) издержек, почти не применяются, а обеспечение качества ссудного портфеля сводится к определению ликвидности и качества залогового имущества. [1] С другой стороны, причиной тому служит отсутствие либо крайне малая степень вовлеченности государства в кредитную сферу. [1] Ввиду этого, потребность и необходимость входить в положение заемщика для кредиторов в ряде развитых стран лишена какого-либо экономического смысла.

В случае же России доминирует скрининговая модель банковской деятельности в силу ряда причин: неразвитости фондовых рынков, отсутствия необходимой нормативно-правовой базы и инфраструктуры для быстрой реализации объекта обеспечения, низкой эластичности рынков товаров, услуг и активов и пр. Государство также весьма сильно представлено на банковского кредитном рынке. Так, например, доля кредитов, предоставленных нефинансовому сектору, банками с государственным участием в капитале (не менее 25%) составляет примерно 75% от всех корпоративных ссуд по состоянию на июль 2016 года. [14, 15] Также важной отличительной чертой российских реалий от англо-саксонских теорий является институционально неоптимальный характер отечественной системы хозяйствования, характеризующей институциональной дисфункцией или пребыванием в институциональной ловушке. [12]

В этой связи применение положений англо-саксонской теории несовершенного кредитного рынка к анализу циклических процессов кажется крайне неэффективным. Однако это не отрицает необходимости совершенствования положений данной теории применительно к российским условиям. Данная задача может частично быть выполнена посредством исследования паттернов и закономерностей движения отечественного рынка банковского корпоративного кредитования в разрезе анализа циклов движения кредита.

Цикличность движения кредита, являясь источником т.н. «системных» рисков, основой финансовой нестабильности в национальной экономики, представляет собой важный объект исследования, т.к. понимание особенностей и закономерностей движения кредита в национальной экономике, чувствительности и эластичности спроса и предложения кредита к шокам в различных параметрах действующей экономической модели, может способствовать сокращению объема и скорости накопления противоречий в кредитной сфере с одной стороны. С другой стороны, выявление особенностей взаимосвязи позволит укрепить существующие и сформировать новые положения теории, позволяющей описать и объяснить движение экономических переменных в рамках шокового подхода.

Теория кредитной цикличности: обзор литературы Современная теория кредитного рынка относит вопрос динамики – совокупности изменений количественного и качественного толка в кредитных отношениях, к разряду дискуссионных вопросов, в связи с отсутствием общепринятой и установленной точки зрения по вопросу движения и развития экономической системы. В этой связи, теории цикличности движения кредита определенным образом перекликаются с теориями общей экономической динамики.

Как было уже установлено в ряде исследований, современное состояние теории кредитной динамики (в части краткосрочных и среднесрочных изменений на кредитном рынке) весьма неоднозначно. [11] Условно можно выделить две ключевые исследовательские парадигмы, описывающие и объясняющие циклический паттерн движения кредитного рынка.

Первой выступает парадигма случайных колебаний. Согласно данной совокупности воззрений, цикличность движения кредита выступает в виде ритмичности – реакции кредитного рынка на шоки экзогенной (внешней для кредитного рынка) природы – шоки спроса, технологические, экологические, географические. В данном случае микроэкономическим основанием данной модели выступает совокупность допущений, превращающих цикличность в процесс случайных, непостоянных осцилляций:

- система кредитных отношений представляется как совокупность отношений экономических агентов, характеризующихся полной рациональностью, максимизирующим поведением; [3]

- экономические агенты (кредитор и заемщик) характеризуются преимущественно отвращением к риску и потерям, перманентностью отношения к риску во времени; [7]

- при этом также допускается, что возможности восприятия и оценки риска в кредитных отношениях существенным образом затруднены в связи с наличием условия информационной асимметрии между кредитором и заемщиком, что, с одной стороны, обосновывает отвращение к риску, а с другой снижает вероятность (если не нивелирует) осознанного и намеренного принятия избыточных рисков; [7]

- на макроэкономическом уровне модели ритмических осцилляций характеризуются допущением институциональной оптимальности, согласно которой, степень защиты прав и обязательств сторон отношений, а также деятельность институтов, регулирующих кредитные отношения стремится к максимальным значением (оптимальным в ряде случаев). [3]

Таким образом, согласно совокупности моделей цикличности движения кредита, смена повышательных фаз движения понижательными является следствием реализации экзогенного шокового явления, предвидеть или оценить вероятность которого кредиторы в большинстве случаев не могут в связи с действием информационной асимметрии (о чем непрестанно в период Великой Рецессии напоминал экс глава ФРС США Б.Бернанке). Так, например, шок спроса на рынках товаров и услуг приводит к сокращению спроса на продукцию производящего сектора, что, в свою очередь, приводит к увеличению запасов готовой нереализованной продукции, что сокращает объемы входящих денежных потоков, необходимых и достаточных для обслуживания тела долга и процентных платежей, позволяющих обеспечивать непрерывность воспроизводственного процесса. Это приводит к трансмиссии данного шока на рынок кредита в виде роста просроченной задолженности и сокращения прибыли кредитора. В зависимости от масштаба и длительности реализации данного шокового явления, реакция кредитора на шок плохих долгов может разнится. В случае формирования диспропорции существенных масштабов, реакцией кредитора становится сокращение предложения кредита с одной стороны и рост рисковой премии в структуре ставки ссудного процента с другой. По мере абсорбирования шока плохих долгов кредитным рынком, равновесный уровень постепенно восстанавливается.

Таким образом, в рамках парадигмы случайных осцилляций, цикличность движения кредита как закономерность его движения предстает в виде непостоянной и случайной по природе своей реакции кредитного рынка на трения в экономической и иных сферах.

Вторая парадигма – парадигма внутреннего несовершенства кредитного рынка – имеет гораздо больше сторонников и основана на описании и объяснении циклических процессов движения кредита как естественного, устойчивого и внутренне присущего кредитному рынку паттерну. В основе кредитных циклов как частных форм проявления циклического движения кредита лежит процесс накопления и реализации противоречий между объективной экономической реальностью и субъективным её восприятием. [2,4] В число основополагающих допущений данной группы моделей входят:

- кредитные отношения – совокупность отношений между экономическими агентами (кредитором и заемщиком), характеризующиеся условием ограниченной рациональности и оптимизирующим поведением. В данном случае речь идет о том, что возможности восприятия, оценки и формирования суждений, предпочтений и основанные на них принятие решений и совершение выбора, далеки от абсолютно эффективных и не связаны с максимизацией полезности; находятся в зависимости от совокупности когнитивно-аффективных отклонений и эвристик, влияющих на восприятие и оценку информации;[5,6]

- кредитные агенты характеризуются различным отношением к риску (от отвращения до готовности к принятию), а также изменчивостью во времени готовности к его принятию. В данном случае речь идет о том, что существует высоко рискованный и низко-рисковый сегменты кредитного рынка, а также то, что готовность к принятию риска со стороны кредиторов и заемщиков меняется в зависимости от фазы цикла; [2,9]

- в отличие от парадигмы случайных осцилляций допускается, что фактором, ограничивающих восприятие и оценку риска является не только информационная асимметрия и неопределенность условий хозяйствования, но и ограниченная рациональность, порождающая к жизни периоды недооценки и переоценки риска кредитных отношений; [6,8]

- в большинстве моделей также закладывается условие институциональной оптимальности, хотя отдельные авторы выделяют институциональную среду (баланс защиты прав и обязательств сторон отношений, степень соблюдения закона в национальной экономике как один из факторов, оказывающих воздействие на модели поведения кредитных агентов); [4-6]

В самом общем виде, учитывая большое количество моделей эндогенных кредитных циклов, процесс осцилляций описывается как чередование периодов недооценки и переоценки кредитного риска с реализацией шокового явления в кредитной сфере. Даже учитывая трансмиссию шока с, например, рынков товаров, услуг или активов, сторонники эндогенного подхода считают, что именно недооценка риска (т.е. ошибки в действии кредиторов и заемщиков) приводят к формированию условий для реализации кризисного явления.

При этом важно отметить, что анализ кризисных явлений в банковской сфере показывает, что отнюдь не все кризисы плохих долгов являются следствием реализации эффектов ограниченной рациональности. В ряде случаев, возможности оценки кредитного риска затруднены настолько, что вероятность их учета в различных сценариях попросту количественно невозможно (например, кризис плохих долгов в Италии 1993-1995гг., ставший следствием Пенсионной еформы, кризис плохих долгов в Германии 2002, являющийся в основном следствием неудачной Налоговой реформы, кризис доверия 2004 года в России, вызванный неудачной политикой Банка России в части обеспечения транспарентности его действий, кризис 1990-1991гг. в США, вызвавший затяжную рецессию в банковском секторе США вплоть до начала 1994 года, кризис плохих долгов в Индии 2004 года вследствие затопления ряда регионов и т.д.). [11]

Другими словами, важно понимать существование тонкой грани между неопределенностью условий хозяйствования и ограниченностью потенциала оценки риска. В этой связи появилось еще одно направление в теории кредитной динамики, призванное синтезировать существующие исследовательские подходы – парадигма гетерогенности (разнородности) кредитных циклов, которая в число источников цикличности движения кредита вносит как неопределенность условий хозяйствования, так и ограниченную рациональность участников отношений. Работы последних лет в области кредитной цикличности также все больше переходят к синтезу отдельных положений двух исследовательских парадигм, что позволит в дальнейшем вывести теорию кредитной динамики на качественно новый уровень (детальный обзор представлен в работах Д. Буракова (2015)).

При этом важно отметить, что количество работ, посвященных объяснению эмпирических аномалий кредитных циклов в развивающихся странах носит ограниченный характер. [13] Объяснение характеристик и причинно-следственных связей между экономическими переменными и движением кредита в странах, характеризующихся условием институциональной оптимальности или пребывающих в условиях институциональной ловушки чрезвычайно ограничено. При этом понимание особенностей и специфики реакции кредитных агентов на экономические шоки в таких условиях как никогда актуально, в том числе и в случае России.

Именно достижению данной цели и посвящено наше исследование – на основе использования регрессионного анализа в рамках шокового подхода определить чувствительность спроса и предложения кредитных ресурсов к шокам в различных макроэкономических переменных, а также представить объяснение полученных результатов в рамках теории несовершенного кредитного рынка. Методология исследования В данном разделе раскрывается содержание инструментария и излагаются гипотезы, положенные в основу нашего исследования.

Состав выборки. Для проведения исследования по выявлению взаимосвязи между движением кредита и вошедшими в состав выборки макроэкономическими переменными мы используем данные о движении кредита на территории Российской Федерации. В частности, используются количественные данные об объемах предоставленных банковским сектором кредитов нефинансовому сектору экономики РФ.

Таким образом состав выборки позволяет проанализировать наличие или отсутствие эластичности кредитного тренда к шокам в выбранных переменных. Более того применение такого инструмента как разложение дисперсий позволяет определить удельный вес (силу) воздействия отдельных шоков на тренд кредита.

Период выборки. Период выборки представляет собой временной период, за который выбранные переменные для анализа используются в целях решения поставленных задач. В нашем случае период выборки включает в себя данные с января 2004 по июль 2016 г. Базовым периодом для проведения расчетов является 1 месяц. Выбор ежемесячных значений в качестве базового периода в отличие от использования годовых значений темпов роста кредитов, предоставленных нефинансовому сектору национальной экономики или использования квартальных значений отрыва кредитного тренда от тренда ВВП (credit to GDP gap) объясняется тем, что использование помесячной статистики позволяет в большей мере учесть и отразить чувствительность национальных кредитных рынков к шоковым явлениям и тем самым способствует усилению достоверности и статистической значимости проводимого анализа.

Информационные источники. Статистические массивы информации по функционированию банковского кредитного рынка России и других переменных были получены из официальных источников, включающих в себя Росстат и Банк России.

Структура выборки. Под выборкой понимается совокупность экономических переменных, используемых в целях проведения исследования. В состав выборки были включены макроэкономические величины, представляющие по мнению автора наибольшую значимость для объяснения совокупных изменений в движении предложения и спроса на кредитные ресурсы банковского сектора. Переменные выборки включают в себя данные по объемам предоставленных банковским сектором кредитов нефинансовому сектору экономики, удельный вес просроченной задолженности по кредитам предоставленным нефинансовому сектору, удельный вес резервов, начисленных по потерям по ссудам, значения прироста капитала банковских кредитных организаций, значения ключевой ставки Банка России, значения средневзвешенной ставки ссудного процента по ссудам, предоставленным нефинансовому сектору, данные по инфляции, значения курса рубля по отношению к доллару США, данные по объемам предоставленных кредитов населению.

Выбор показателей служит цели установления причинно-следственной связи и степени влияния ряда указанных переменных на макроэкономическом уровне на динамику кредитной переменной. Значения валового внутреннего продукта не включены в регрессионное уравнение сознательно, в связи с фактом уже установленного характера взаимосвязи между кредитом и ВВП ранее. С другой стороны, показатель просроченной задолженности, как известно, служит весьма качественным аналогом отражения трансмиссии шоков экономики в кредитный сектор.

Гипотезы исследования и методы их проверки. К числу методов анализа, используемых в данном исследовании, относятся: сравнительный метод анализа, динамический анализ, корреляционный и регрессионный анализ.

В целях проведения эмпирического исследования мы ставим перед собой задачу проверить следующие гипотезы на примере российского рынка банковского корпоративного кредитования на предмет соответствия положениям теории несовершенного кредитного рынка.

Первой гипотезой является утверждение, согласно которому, при прочих равных условиях, шок плохих долгов (рост удельного веса просроченной задолженности) приводит к существенному сокращению предложения кредита и снижению темпов роста кредитов нефинансовому сектору.

Вторая гипотеза гласит, что начисление резервов по потерям по ссудам (в рамках группы экзогенных моделей) не носит проциклического характера. Другими словами, начисление резервов носит оптимальный характер, эффект недоначисления резервов не существует.

Третья гипотеза определяет характер взаимосвязи между движением банковского капитала и кредитованием. При прочих равных условиях, а также в рамках предложений Базельского комитета (Базель III), считается что положительный шок банковского капитала (необходимость его увеличения) должно приводить к сокращению кредитной активности коммерческих банков в связи с действием сигнального эффекта, схожего с процентной политикой. Альтернативная реакция кредитного рынка на шок банковского капитала допускается в случае высокой эластичности рынка кредита, когда действия кредитных агентов носят скоординированный характер и присутствует эффект стадного поведения либо следования тренду. В таком случае, шок капитала приведет лишь к усилению готовности к принятию риска и продолжению наращивания кредитного портфеля в целях сохранения рыночной ниши и обеспечения не ниже средних по рынку краткосрочных результатов деятельности кредитной организация.

Четвертая гипотеза определяет взаимосвязь между себестоимостью ресурсной базы коммерческих банков и спросом на кредит. Ортодоксальная модель кредитного рынка в таком случае предсказывает сокращение спроса на кредит при росте предложения. Модифицированные модели, учитывающие информационную асимметрию и наличие различий в отношении к кредитному риску со стороны кредитных агентов, гласит, что сокращению будет подлежать предложение и спрос со стороны качественных агентов, в то время как высоко рискованный сегмент продолжит рост.

Пятая гипотеза гласит, что положительный шок инфляции (рост ценовых показателей) приведет к увеличению потребности в ресурсах в номинальных значениях, что должно привести к росту спроса на кредитные ресурсы до определенных границ (случай гиперинфляции не рассматривается).

Шестая гипотеза гласит, что изменение курса национальной валюты влияет на кредитный рынок амбивалентно. В одних случаях положительный курсовой шок приводит к росту спроса на кредитные ресурсы, в случае же существенного силы шока, реакция может быть обратной.

Седьмая гипотеза гласит, что спрос и предложение на рынке банковского корпоративного кредита при прочих равных условиях зависят от изменений в бюджетном ограничении домохозяйств. Одним из инструментов расширения данных границ служит кредитование населения. В связи с этим, допускается, что в краткосрочной/среднесрочной перспективе шок спроса, вызванный расширением потребительского кредитования должен привести к росту спроса на заемные ресурсы со стороны корпоративного сегмента в целях либо увеличения оборотного капитала для производства готовой продукции либо её закупки в рамках импортных операций.

Так, осуществление проверки данных гипотез в циклическом срезе позволяет выявлять особенности движения кредитного рынка, амплитуду осцилляций, а также чувствительность к шокам в различных переменных.

В целях общего сравнительного исследования, используется корреляционный метод анализа, позволяющий выявить наличие либо отсутствие взаимосвязи между переменными выборки, а также негативный либо позитивный характер данной взаимосвязи. Однако важно помнить, что результаты корреляционного анализа временных рядов не позволяют снять проблему временного лага – задержки в реакции результирующей переменной от зависимой с одной стороны. С другой стороны, результаты корреляционного анализа могут быть ложными в связи с наличием серийной корреляции в рассматриваемых переменных.

В этой связи оптимальным для целей исследования является использование регрессионного анализа, позволяющего устранить данные проблемы, обладающие потенциалом ухудшения качества полученных результатов.

Однако даже при использовании методов регрессионного анализа существует опасность получения ложных результатов. В связи с тем, что анализ временных рядов в большинстве случаев сопряжен с нестационарностью данных, наличием серийной корреляции и гетероскедастичности, не говоря уже о наличии сезонных эффектов, первым шагом на пути проведения исследования является использование методов статистической фильтрации и получения стационарных значений используемых данных для исследования.

Для фильтрации временных рядов выборки и получения сглаженного ряда в целях выявления взаимосвязи в долгосрочном периоде мы использует фильтр Ходрика-Прескотта. Полученный в результате временной ряд состоит из совокупности элементов, минимизирующих следующее выражение:

`sum_(t=1)^T (yt-st)^2 + mu ` `sum_(t=2)^(T-1) ((s_(t+1) - s_(t)) -` `(s_(t) - s_(t-1))^2 ->min`` `` `

В целях устранения проблемы нестационарности данных, все данные выборки тестируются на наличие единичного корня, используя традиционный расширенный тест Дикки-Фуллера (ADF test). Необходимое количество лагов определяется на основе использование информационных критериев Акайке и Шварца.

`dely_(t) =Delta + beta_(t) +Piy_(t) + sum_(j=1)^p c_(j)dely_(t-j) +epsi_(t)`

где –`delta` константа, t – значение тренда, `y_(t)` – исследуемая переменная временного ряда, например, динамики корпоративного кредитования в РФ, `epsi` – значение «белого шума» или ошибки; нулевой гипотезой (`H_(0)` ) является (единичный корень), альтернативной (`H_(1)` ) - (стационарность).

Вторым этапом анализа в целях проверки выдвинутых гипотез, является проверка анализируемых временных рядов на наличие коинтеграции посредством теста Йохансена, в целях определения наличия либо отсутствия взаимосвязи между переменными в долгосрочном периоде. Однако применение теста Йохансена возможно только в случае выполнения условия нестационарности исходных переменных. В противном случае, использование теста коинтеграции невозможно. В случае отсутствия коинтеграции между элементами выборки, более подходящим способом регрессионного анализа служит использование модели векторной авторегрессии:

Yt = a0 + a1Yt-1 +..... + apYt-p + b1Xt-1 +..... + bpXt-p + … + ut

Xt = c0 + c1Xt-1 +..... + cpXt-p + d1Yt-1 +..... + dpYt-p + … +vt

где Yt представляет значение на момент времени t кредитного цикла РФ (результирующая переменная), Xt представляет значение на момент времени t переменной выборки (зависимая переменная). Регрессионный анализ элементов выборки посредством использования модели векторной авторегрессии позволит определить наличие существенной и статистически значимой зависимости не только от значений различных переменных, но и зависимости от предыдущих значений отдельной переменной. Однако ВАР-модель должна отвечать требованиям отсутствия серийной корреляции, гетероскедастичности остатков и отвечать требованию стабильности. Только в этом случае полученные результаты можно считать истинными.

Последним этапом определения взаимосвязи и её направления выступает использование теста на выявление причинно-следственной связи Грейнджера. Так, отвержение нулевой гипотезы теста Грейнджера (H0), согласно которой

b1 = b2 = ..... = bp = 0,

в пользу альтернативной гипотезы (H1), позволяет говорить о том, что изменение в переменной Х определяют движение кредитной переменной Y. То же справедливо и для обратного. Так, отвержение нулевой гипотезы теста Грейнджера (H0), согласно которой

d1 = d2 = ..... = dp = 0,

в пользу альтернативной гипотезы (H1), позволяет говорить о том, что изменение в переменной X определяют движение результирующей кредитной переменной Y.

Завершающим этапом анализа становится определение краткосрочной чувствительности кредитных циклов РФ к шокам в переменных выборки. На основе построенных ВАР моделей мы используем функцию импульсного отклика для определения наличия/отсутствия и скорости реакции кредитных рынков стран выборки в рамках тестируемых гипотез. Для определения степени значимости (удельного веса) шока в каждой переменной используется разложение (декомпозиция) дисперсий ошибок прогнозов.

` ` Результаты исследования В данном разделе представлены результаты проведенного исследования. В связи с ограниченностью возможностей простой ВАР-модели по учету эндогенных переменных, мы разделили исследование на анализ двух ВАР-моделей. Первая модель включает в себя макроэкономические переменные экзогенного толка (внешние для кредитования нефинансового сектора, за исключением просроченной задолженности). Вторая модель включает в себя внутренние для банковского корпоративного кредитования переменные (динамика капитала, резервов, просроченной задолженности, ставки ссудного процента). В таблицах 1 и 2 представлена описательная статистика данных (темпов роста), используемых для построения модели. Стоит обратить внимание на несколько особенностей. Во-первых, ключевая ставка и инфляция отличаются максимальным значением стандартного отклонения, что говорит о высоком уровне волатильности данных переменных в противовес циклическим осцилляциям. Во-вторых, тоже справедливо для банковского капитала в рамках модели II. В большинстве случаев, данные переменные носят реакционный характер и являются следствием изменений макроэкономической ситуации. В-третьих, как и предполагалось большая часть переменных не соответствует требованию нормального распределения, что характерно для финансовых и экономических временных рядов.

Таблица 1. Описательная статистика (модель I)

|

Значение

|

Кредитование населения

|

Обменный курс

|

Ключевая ставка

|

Инфляция

|

Просроченная задолженность

|

Кредиты нефинансовому сектору

|

|

Среднее

|

1.988095

|

0.766749

|

0.230933

|

3.051073

|

1.138326

|

1.735714

|

|

Медианное

|

1.850000

|

-0.264762

|

0.000000

|

0.000000

|

0.000000

|

1.750000

|

|

Максимальное

|

7.500000

|

19.93177

|

78.94737

|

31.25000

|

18.00000

|

7.000000

|

|

Минимальное

|

-2.500000

|

-13.68485

|

-33.33333

|

-35.43307

|

-11.40940

|

-4.700000

|

|

Стандартное отклонение

|

2.157465

|

4.605822

|

8.685469

|

8.191134

|

4.518350

|

1.868752

|

|

Асимметрия

|

0.237011

|

1.438673

|

5.788332

|

0.088932

|

1.243532

|

-0.125702

|

|

Эксцесс

|

2.418639

|

7.578212

|

57.22333

|

7.713671

|

5.946392

|

3.927635

|

|

|

|

|

|

|

|

|

|

Тест Харке-Бера

|

2.954059

|

153.5055

|

16139.49

|

116.8142

|

78.05023

|

4.849480

|

|

P-вероятность

|

0.228315

|

0.000000

|

0.000000

|

0.000000

|

0.000000

|

0.088501

|

|

|

|

|

|

|

|

|

|

Сумма

|

250.5000

|

96.61042

|

29.09750

|

-6.435234

|

143.4291

|

218.7000

|

|

Сумма разницы квадратов

|

581.8321

|

2651.699

|

9429.671

|

8386.835

|

2551.936

|

436.5293

|

|

|

|

|

|

|

|

|

|

Количество наблюдений

|

126

|

126

|

126

|

126

|

126

|

126

|

Источник: расчеты автора по данным Банка России и Росстата.

Таблица 2. Описательная статистика (модель II)

|

Значение

|

Банковский капитал

|

Резервы на потери по ссудам

|

Кредиты нефинансовому сектору

|

Ставка ссудного процента

|

Просроченная задолженность

|

|

Среднее

|

2.000000

|

5.955435

|

1.938043

|

11.06087

|

2.866196

|

|

Медианное

|

1.500000

|

5.050000

|

2.000000

|

10.55000

|

1.825000

|

|

Максимальное

|

16.40000

|

9.800000

|

6.900000

|

17.40000

|

5.400000

|

|

Минимальное

|

-3.600000

|

3.500000

|

-1.500000

|

8.000000

|

1.200000

|

|

Стандартное отклонение

|

2.736084

|

2.070534

|

1.665542

|

2.150490

|

1.633249

|

|

Асимметрия

|

2.476356

|

0.450402

|

0.006460

|

1.152165

|

0.269930

|

|

Эксцесс

|

12.34198

|

1.752390

|

2.909978

|

3.714892

|

1.288793

|

|

|

|

|

|

|

|

|

Тест Харке-Бера

|

428.5744

|

9.077249

|

0.031705

|

22.31385

|

12.34209

|

|

P-вероятность

|

0.000000

|

0.010688

|

0.984272

|

0.000014

|

0.002089

|

|

|

|

|

|

|

|

|

Сумма

|

184.0000

|

547.9000

|

178.3000

|

1017.600

|

263.6900

|

|

Сумма разницы квадратов

|

681.2400

|

390.1273

|

252.4368

|

420.8391

|

242.7428

|

|

|

|

|

|

|

|

|

Количество наблюдений

|

92

|

92

|

92

|

92

|

92

|

Источник: расчеты автора по данным Банка России.

В таблицах 3 и 4 представлены результаты простого корреляционного анализа переменных, входящих в состав выборки. В рамках обеих моделей стоит обратить внимание на отсутствие четкой и сильной корреляции между переменными выборки (менее 0.6) за исключением корреляции между просроченной задолженности и резервами по потерям по ссудам. Зависимость резервов на потери по ссудам от значений просроченной задолженности носит логичный характер и является следствием реакции на шок плохих долгов, что не противоречит общей теории кредитного рынка. С другой стороны, проявляется также прогнозируемая зависимость кредитов нефинансовому сектору от значений просроченной задолженности, что позволяет допустить наличие зависимости предложения кредита от уровня риска и значений ожиданий. Однако применение корреляционного анализа и его выводы могут носить ложный характер в связи с проблей мультиколлинеарности, серийной корреляции временных рядов. В этой связи в целях усиления аргументации следует обратиться к методам регрессионного анализа.

Таблица 3. Корреляционная матрица (модель I)

|

Переменная

|

Кредитование населения

|

Обменный курс

|

Ключевая ставка

|

Инфляция

|

Просроченная задолженность

|

Кредиты нефинансовому сектору

|

|

Кредитование населения

|

1.000000

|

|

|

|

|

|

|

Обменный курс

|

-0.045245

|

1.000000

|

|

|

|

|

|

Ключевая ставка

|

0.017267

|

0.385496

|

1.000000

|

|

|

|

|

Инфляция

|

0.083852

|

0.211337

|

0.302095

|

1.000000

|

|

|

|

Просроченная задолженность

|

-0.486010

|

0.001713

|

-0.020450

|

-0.049260

|

1.000000

|

|

|

Кредиты нефинансовому сектору

|

0.399058

|

0.050448

|

0.147031

|

0.282859

|

-0.154154

|

1.000000

|

Источник: расчеты автора по данным Банка России и Росстата.

Таблица 4. Корреляционная матрица (модель II)

|

Переменная

|

Капитал

|

Резервы

|

Кредиты

|

Ставка ссудного процента

|

Просроченная задолженность

|

|

Капитал

|

1.000000

|

|

|

|

|

|

Резервы

|

-0.402557

|

1.000000

|

|

|

|

|

Кредиты

|

0.197978

|

-0.545072

|

1.000000

|

|

|

|

Ставка ссудного процента

|

0.109331

|

-0.173894

|

-0.289482

|

1.000000

|

|

|

Просроченная задолженность

|

-0.379641

|

0.965353

|

-0.565882

|

-0.073218

|

1.000000

|

Источник: расчеты автора по данным Банка России.

Первым шагом на пути построения регрессионной модели является проверка используемых временных рядов выборки на стационарность. Как видно из данных Таблиц 5 и 6, результаты общего и частного тестирования переменных показывают их стационарный характер, что избавляет нас от необходимости дифференцирования переменных с одной стороны и устраняет возможность использования модели векторной коррекции ошибок и определения коинтеграции между переменными.

Таблица 5. Результаты тестирования временных рядов на стационарность (модель I)

|

Метод тестирования

|

Статистика

|

P-вероятность**

|

Поперечный разрез

|

Число наблюдений

|

|

Нулевая гипотеза: Наличие единичного корня (общего для переменных)

|

|

Тест Левина, Лин и Чу

|

-11.6703

|

0.0000*

|

6

|

748

|

|

Нулевая гипотеза: Наличие единичного корня (для каждой из переменных)

|

|

Тест Им, Песаран и Шин (W-статистика)

|

-12.6626

|

0.0000*

|

6

|

748

|

|

(Расширенный тест Дикки-Фуллера) - значение Хи-квадрат Фишера

|

174.996

|

0.0000*

|

6

|

748

|

|

(Тест Филлипса-Перрона) - значение Хи-квадрат

|

165.533

|

0.0000*

|

6

|

750

|

* означает отсутствие единичного корня (стационарность временных рядов).

Источник: расчеты автора по данным Банка России и Росстата.

Таблица 6. Результаты тестирования временных рядов на стационарность (модель II)

|

Метод тестирования

|

Статистика

|

P-вероятность**

|

Поперечный разрез

|

Число наблюдений

|

|

Нулевая гипотеза: Наличие единичного корня (общего для переменных)

|

|

Тест Левина, Лин и Чу

|

-2.7611

|

0.0028*

|

5

|

450

|

|

Нулевая гипотеза: Наличие единичного корня (для каждой из переменных)

|

|

Тест Им, Песаран и Шин (W-статистика)

|

-8.53427

|

0.0000*

|

5

|

450

|

|

(Расширенный тест Дикки-Фуллера) - значение Хи-квадрат Фишера

|

72.6759

|

0.0000*

|

5

|

450

|

|

(Тест Филлипса-Перрона) - значение Хи-квадрат

|

68.2028

|

0.0000*

|

5

|

455

|

* означает отсутствие единичного корня (стационарность временных рядов).

Источник: расчеты автора по данным Банка России.

Следующий этапом построения модели служит определение оптимального временного лага для ВАР-моделей в целях обеспечения максимального качества. Для этого будем рассматривать информационный критерий Акаике и финальную ошибку предсказания как оптимальные критерии для определения временного лага моделей. В случае первой модели оптимальным временным лагом является значение в 8 месяцев (Таблица 7). В случае второй – два месяца (Таблица 8).

Таблица 7. Результаты теста на определение оптимального временного лага для ВАР-модели (I)

|

Лаг

|

Натуральный логарифм

|

Тест отношения правдоподобия

|

ФОП

|

ИКА

|

ИКШ

|

ИКХК

|

|

0

|

-1968.859

|

NA

|

13865704

|

33.47219

|

33.61307

|

33.52939

|

|

1

|

-1738.391

|

433.5919

|

513856.6

|

30.17613

|

37.25766

|

33.15735

|

|

2

|

-1685.602

|

93.94699

|

388359.6

|

29.89156

|

31.72303

|

30.63519

|

|

3

|

-1648.225

|

62.71830

|

845295.4

|

30.35443

|

32.54498

|

30.95506

|

|

4

|

-1624.328

|

37.66746

|

481755.2

|

30.07336

|

33.59541

|

31.50341

|

|

5

|

-1603.087

|

31.32124

|

641738.0

|

30.32351

|

34.69086

|

32.09678

|

|

6

|

-1577.421

|

35.23629

|

808184.9

|

30.49866

|

35.71131

|

32.61515

|

|

7

|

-1544.713

|

41.57867

|

925237.4

|

30.55445

|

36.61239

|

33.01415

|

|

8

|

-1496.911

|

55.90315*

|

383814.0*

|

29.86821*

|

31.16230*

|

30.57654*

|

* означает оптимальный временной период использования в качестве значения лага согласно соответствующему информационному критерию. ФОП – финальная ошибка предсказания; ИКА – информационный критерий Акайке; ИКР – информационный критерий Шварца; ИКХК – информационный критерий Ханнан-Куинна.

Источник: расчеты автора по данным Банка России и Росстата.

Таблица 8. Результаты теста на определение оптимального временного лага для ВАР-модели (II)

|

Лаг

|

Натуральный логарифм

|

Тест отношения правдоподобия

|

ФОП

|

ИКА

|

ИКШ

|

ИКХК

|

|

0

|

-328.9467

|

NA

|

0.002150

|

8.046909

|

8.192622

|

8.105449

|

|

1

|

-269.9747

|

109.4180

|

0.000949

|

7.228306

|

8.102586*

|

7.579543*

|

|

2

|

-240.6192

|

50.93007*

|

0.000860*

|

7.123354*

|

8.726200

|

7.767287

|

|

3

|

-221.7944

|

30.39187

|

0.001015

|

7.272153

|

9.603566

|

8.208784

|

|

4

|

-198.4549

|

34.86855

|

0.001091

|

7.312167

|

10.37215

|

8.541495

|

|

5

|

-178.8901

|

26.87219

|

0.001311

|

7.443135

|

11.23168

|

8.965160

|

|

6

|

-167.1097

|

14.76093

|

0.001954

|

7.761680

|

12.27879

|

9.576403

|

|

7

|

-137.8803

|

33.10318

|

0.001985

|

7.659767

|

12.90545

|

9.767187

|

|

8

|

-108.7893

|

29.44154

|

0.002123

|

7.561187

|

13.53543

|

9.961304

|

* означает оптимальный временной период использования в качестве значения лага согласно соответствующему информационному критерию. ФОП – финальная ошибка предсказания; ИКА – информационный критерий Акайке; ИКР – информационный критерий Шварца; ИКХК – информационный критерий Ханнан-Куинна.

Источник: расчеты автора по данным Банка России.

Обеспечив выполнение требований стационарности временных рядов и определив оптимальный временной лаг, возможно построение самих моделей. Однако в целях обеспечения уверенности в истинности полученных результатов необходимо их тестирование на предмет отсутствия гетероскедастичности и серийной корреляции остатков, а также стабильности. Результаты диагностических тестов наших моделей представлены в таблицах 9 и 10. Как видно, обе модели соответствуют предъявляемым требованиям, что позволяет нам перейти к анализу полученных результатов и верификации выдвинутых гипотез.

Таблица 9. Результаты диагностического теста ВАР-модели (I)

|

Тип диагностического теста

|

Результаты

|

|

|

ЛМ-тест серийной корреляции остатков ВАР модели

|

Лаг

|

ЛМ-статистика

|

p-значение

|

|

|

1

|

20.60612

|

0.9814

|

|

|

2

|

31.36602

|

0.6886

|

|

|

3

|

37.33099

|

0.4077

|

|

|

4

|

51.98004

|

0.0413

|

|

|

5

|

41.34069

|

0.2487

|

|

|

|

6

|

39.35166

|

0.3222

|

|

|

|

7

|

24.90647

|

0.9180

|

|

|

|

8

|

36.83858

|

0.4299**

|

|

|

Тест стабильности остатков

|

Все корни находятся внутри круга

|

|

|

ВАР модель отвечает требованию стабильности

|

|

|

Тест на гетероскедастичность остатков (тест Уайта)

|

0,4183*

|

|

| |

|

Тест кросс-корреляции остатков ВАР модели

|

В остатках модели автокорреляция не выявлена

|

|

** означает принятие нулевой гипотезы (отсутствие серийной корреляции); * означает принятие нулевой гипотезы (гомоскедастичность остатков).

Источник: расчеты автора по данным Банка России и Росстата.

Таблица 10. Результаты диагностического теста ВАР-модели (II)

|

Тип диагностического теста

|

Результаты

|

|

|

ЛМ-тест серийной корреляции остатков ВАР модели

|

Лаг

|

ЛМ-статистика

|

p-значение

|

|

|

1

|

30.51544

|

0.2056

|

|

|

2

|

23.56120

|

0.5448**

|

|

|

3

|

50.17283

|

0.0020

|

|

|

4

|

21.42271

|

0.6688

|

|

|

5

|

21.58666

|

0.6595

|

|

|

Тест стабильности остатков

|

Все корни находятся внутри круга

|

|

|

ВАР модель отвечает требованию стабильности

|

|

|

Тест на гетероскедастичность остатков (тест Уайта)

|

0,1173*

|

|

| |

|

Тест кросс-корреляции остатков ВАР модели

|

В остатках модели автокорреляция не выявлена

|

|

** означает принятие нулевой гипотезы (отсутствие серийной корреляции); * означает принятие нулевой гипотезы (гомоскедастичность остатков).

Источник: расчеты автора по данным Банка России.

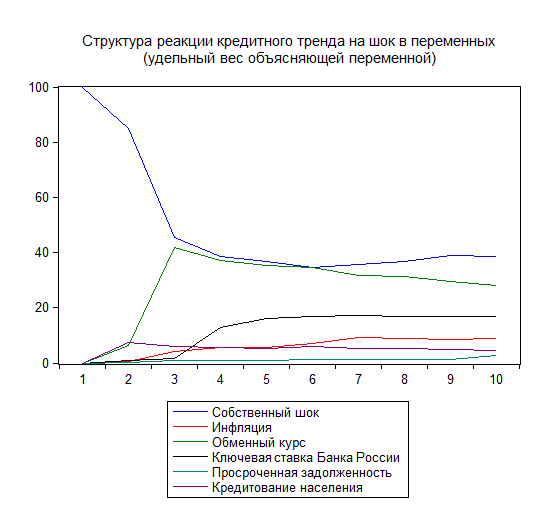

В целях проверки истинности выдвинутых гипотез мы используем стандартные инструменты анализа: декомпозицию дисперсий и функции импульсного отклика. Использование первого инструмента позволяет определить структуру реакции зависимой переменной на шок в эндогенных переменных. Другими словами, разложение дисперсий отражает удельный вес (и его изменение во времени) каждой объясняющей переменной в изменении результирующей. Результаты тестирования первой модели, включающей в себя такие переменные, как инфляция, ключевая ставка, обменный курс, кредитование населения и просроченная задолженность представлены на Рисунке 1. Как видно из данных Рисунка 1, перечисленные переменные позволяют объяснить в краткосрочной перспективе (до 10 периодов) лишь 55% изменений в предложении кредитов нефинансовому сектору, в то время как собственный шок занимает 45%. Другими словами, собственный шок включает в себя реакцию кредитной переменной на шок в неизвестных переменных, не включенных в состав выборки. Наибольший удельный вес в объяснении занимание движение обменного курса рубля, что согласуется с положениями теории кредитного рынка, когда изменение курса приводит к изменению потребности в кредитных ресурсах со стороны заемщиков. Второе место занимает ключевая ставка Банка России, что также соответствует положениям теории кредитного рынка. Причем в отличие от обменного курса структурная композиция реакции кредита носит кумулятивный характер постепенного приспособления. Однако стоит обратить внимание на крайне низкую значимость данной переменной в структуре реакции кредита, что позволяет допустить наличие низкой чувствительности кредитного рынка к изменению в себестоимости ссудных операций. Инфляция в структуре реакции кредита носит более стабильный, но крайне несущественный характер, что также соответствует положениям теории кредитного рынка, в связи с учетом инфляционной компоненты в ставке ссудного процента. Наиболее противоречащим положениям теории результатом является реакция кредитной переменной на изменение в просроченной задолженности. Её доля в реакции кредита составляет менее 2%, что необходимо трактовать как низкую чувствительность предложения кредита к изменениям в просроченной задолженности. В целях перепроверки данного результата, переменная просроченной задолженности включена во вторую модель. Полученный результат однозначно противоречит общей теории несовершенного кредитного рынка и теориям кредитной динамики, т.к. нарушает базовые допущения о взаимосвязи между целевой функцией кредитного агента и функцией отношения к риску. В случае России, при этом весьма часто наблюдались эмпирические аномалии подобного рода: на фоне сокращения ВВП и роста просроченной задолженности, предложение кредита оставалось в положительной плоскости.

Рисунок 1. Декомпозиция дисперсий (модель I)

Источник: расчеты автора по данным Банка России и Росстата.

Таким образом, результат разложения дисперсий в первой модели позволяет подтвердить гипотезы 4, 5 и 6. Однако характер взаимосвязи и реакции кредитной переменной на шоки в объясняющих переменных еще предстоит определить. Аномальным остается также и наблюдение того, что использованных переменных недостаточно, чтобы объяснить структуру реакции предложения кредита на изменение в макроэкономической среде России.

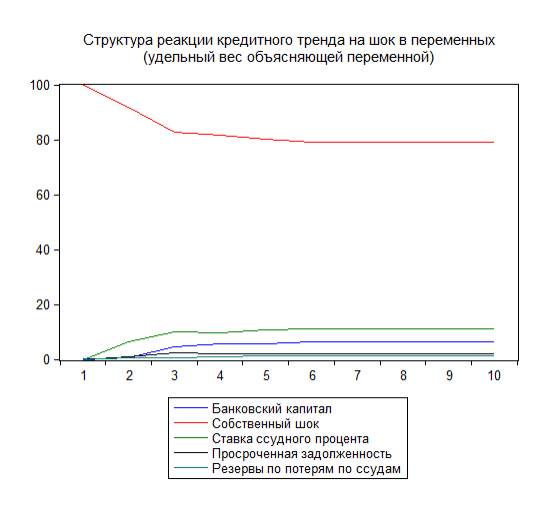

В целях поиска дополнительного объяснения обратимся к модели II, учитывающей внутренние переменные кредитного рынка, обладающие потенциалом воздействия на предложение кредита: банковский капитал, резервы на потери по ссудам, ставка ссудного процента. Как видно, из данных Рисунка 2, переменные второй выборки еще хуже объясняют реакцию предложения кредита на макроэкономических шок. Доля собственного шока (неизвестных переменных) составляет порядка 80%. Наиболее важной в разложении дисперсий является ставка ссудного процента, что позволяет косвенно подтвердить гипотезу 4 (о зависимости предложения кредита от цены ресурсов). Опять просроченная задолженность показывает не более 2% веса в объяснении изменений в предложении кредита.

Таким образом, предположение о том, что внутренние банковские факторы обладают достаточной объясняющей силой также не находит подтверждение.

Рисунок 2. Декомпозиция дисперсий (модель II)

Источник: расчеты автора по данным Банка России.

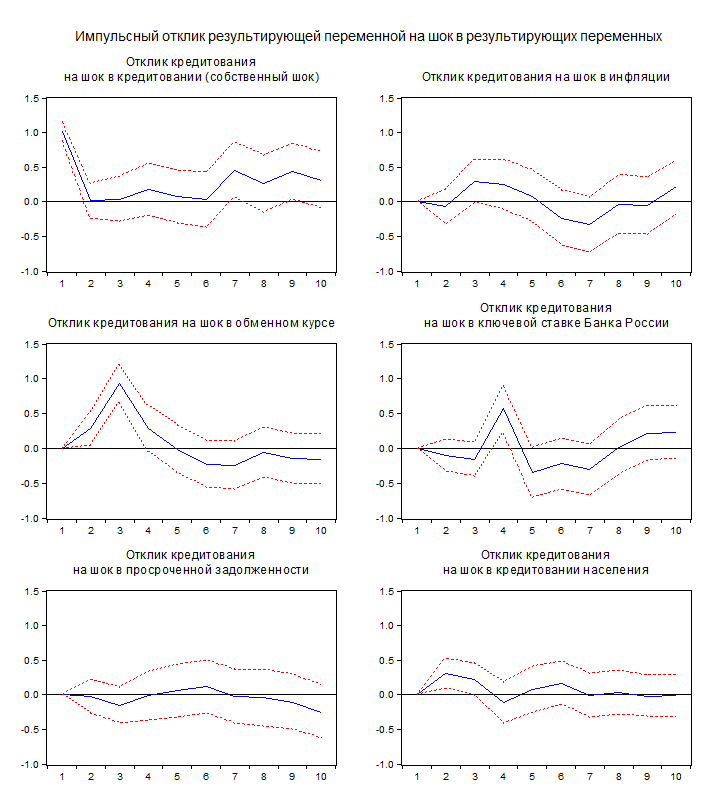

В целях определения характера взаимосвязи между результирующей и объясняющими переменными обратимся к функциям импульсного отклика, позволяющим определить характер и длительность причинно-следственной связи между переменными. Так, на Рисунках 3-8 представлены результаты анализа реакции предложения кредита на шок в отдельных переменных. Из представленного на Рисунках можно сделать несколько выводов. Во-первых, реакция предложения кредита на инфляционный шок носит амбивалентный и статистически незначимый характер, что не позволяет утверждать о наличии причинно-следственной связи, а это, в свою очередь, приводит к отрицанию соответствующей гипотезы.

Рисунок 3-8. Реакция кредитного тренда на шок в объясняющей переменной (модель I)

Источник: расчеты автора по данным Банка России и Росстата.

Другими словами, зависимость предложения кредита нефинансовому сектору от потребительских цен отсутствует, что вполне вероятно, учитывая масштабность импорта на рынках товаров и услуг.

Альтернативной выглядит картина с реакцией предложения кредита на шок в обменном курсе. Так, импульс в одно стандартное отклонение значений обменного курса приводит к росту кредитования в краткосрочной перспективе. Результат статистически значим. Это позволяет подтвердить гипотезу о взаимосвязи между кредитованием и обменным курсом, а также данный результат согласуется с разложением дисперсий.

Реакция на шок в ключевой ставки носит статистически значимый характер лишь с временным лагом в 3-4 месяца. При этом характер взаимосвязи носит противоречащий положениям теории характер: положительный шок в ключевой ставке (её рост) приводит в течение 3-4 месяцев к росту кредитования, но не наоборот! Полученный результат подкрепляется даже элементарными эмпирическими наблюдениями за изменением ключевой ставки и темпами роста кредитования нефинансового сектора согласно данным Банка России. Данный результат также представляет собой ценовую аномалию российского кредитного рынка. Возможным объяснением служит отсутствие субститутов банковскому кредитованию либо избыточный уровень доходности российских заемщиков, что позволяет нести повышенное бремя процентных выплат. Однако тогда встает вопрос о степени конкурентного давления на различных рынках товаров, услуг и активов, что требует отдельного исследования.

Еще одна аномалия проявляется при поиске взаимосвязи между предложением кредита и просроченной задолженностью по выбранной группе кредитов. Во-первых, статистически значимая связь между переменными не прослеживается. Если даже не придерживаться требования 5% доверительного интервала, то можно увидеть, что рост просроченной задолженности почти не влияет на кредитную переменную. Данное эмпирическое наблюдение представляет собой, на наш взгляд, операционную аномалию банковского кредитного рынка в России – низкая чувствительность банковских агентов к результатам операционной деятельности. Данное наблюдение можно объяснить лишь двумя путями: сильной ролью реструктуризационного мотива спроса на кредит либо нерыночным (рентным) характером поведения кредитных агентов. Учитывая тот факт, что более 75% всех ссуд нефинансовому сектору России выдается банками с государственным участием, гипотеза о существенности реструктуризационного мотива кажется правдоподобной, правда, при этом поднимает множество вопросов о «рыночности» поведения крупных банковских организаций.

Шок в кредитовании населения приводит к несущественному, но статистически значимому в краткосрочной перспективе росту спроса на кредит со стороны нефинансового сектора, что соответствует положениям теории кредитного рынка. Рост спроса со стороны населения приводит к росту потребности в оборотном капитале со стороны хозяйствующих субъектов и, как следствие, росту спроса на кредит.

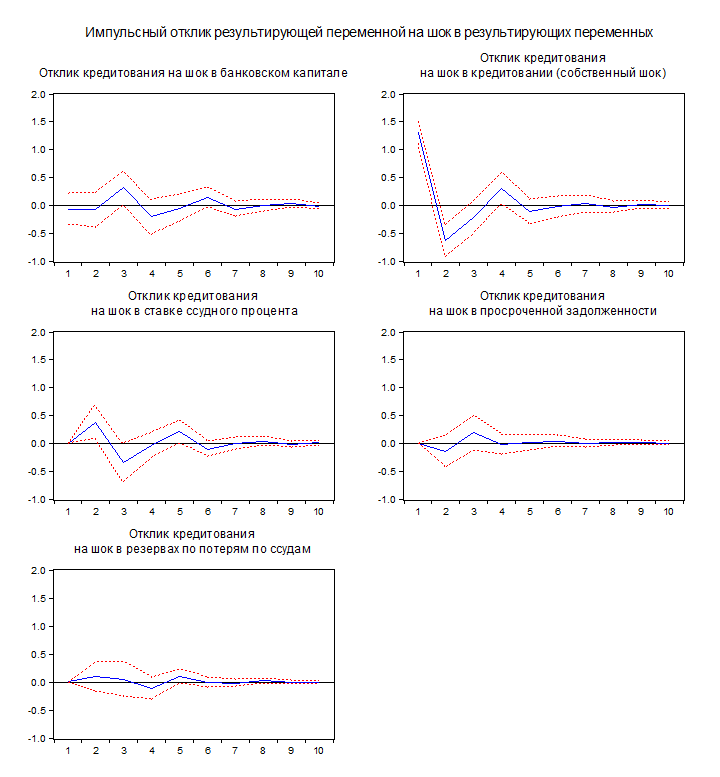

Рисунок 9-13. Реакция кредитного тренда на шок в объясняющей переменной (модель II)

Источник: расчеты автора по данным Банка России.

Если мы обратимся к данным Рисунков 9-13, то увидим, что единственной переменной, шок в которой приводит к статистически значимому результату, является шок в ставке ссудного процента, рост которой приводит к росту кредитования со стороны банковских агентов, что также подтверждает ценовую аномалию кредитного рынка. Возможным объяснением, является необходимость агентов рефинансировать текущие долги посредством новых кредитных вливаний.

В остальных случаях статистически значимой реакции на шок в переменных не наблюдается, что не позволяет с уверенностью утверждать о важности данных переменных для объяснения структуры и особенностей движения предложения кредита в России.

Завершающим этапом анализа является использование теста причинно-следственной связи Грейнджера, позволяющего определить направление зависимости между зависимой и объясняющей переменными. Результаты данного теста представлены в Таблице 11.

Таблица 11. Результаты теста причинно-следственной связи по Грейнджеру

|

Переменная

|

Кредиты нефинансовому сектору

|

|

Инфляция

|

0.6332

|

|

Обменный курс

|

0.0000*

|

|

Ключевая ставка

|

0.0469*

|

|

Просроченная задолженность

|

0.8052 (0.4693)

|

|

Кредитование населения

|

0.0216*

|

|

Банковский капитал

|

0.1349

|

|

Резервы по потерям по ссудам

|

0.5111

|

|

Ставка ссудного процента

|

0.0176*

|

* означает опровержение нулевой гипотезы теста Грейнджера (H0: объясняющая переменная не является причиной результирующей по Грейнджеру). В квадратных скобках указан результат тестирования переменной для модели 2.

Как видно из результатов анализа, большая часть полученных результатов получает подтверждение. Лишь в случае обменного курса, ключевой ставки, ставки ссудного процента и кредитования существует причинно-следственная связь. Другими словами, изменения в данных объясняющих переменных реально приводят к изменениям в кредитовании нефинансового сектора. При этом в случае ключевой ставки и ставки ссудного процента, характер реакции на их рост носит противоречащий положениям теории кредитного рынка характер, что требует разработки соответствующих положений для случая России и других стран, характеризующихся условием институциональной неоптимальности.

При этом ни просроченная задолженность, ни банковский капитал, ни резервы не позволяют объяснить изменение в движении кредита.

Заключение Данное исследование посвящено анализу специфики предложения банковского корпоративного кредита в России в призме цикличности его движения. На основе использования регрессионного метода анализа мы протестировали чувствительность предложения кредита к шокам в ряде экономических и банковских переменных. Теоретической основой для формирования гипотез послужили положения общей теории несовершенного кредитного рынка. Тестирование гипотез осуществлялось посредством использования неограниченных моделей векторной авторегрессии.

В результате исследования нам удалось выявить ряд существенных причинно-следственных взаимосвязей между переменными. Однако ключевые переменные (просроченная задолженность и ценовые переменные) в противовес теории кредитного рынка показали альтернативную реакцию. Полученные результаты позволили нам выдвинуть допущение о существовании, как минимум, двух аномалий на рынке банковского корпоративного кредита в России, объяснение которых представляется важным и актуальным при проведении дальнейших исследований.

References

1. Barth, J.R., Caprio, G., Levine, R., 2008. “Rethinking Bank Regulation: Till Angels Govern”, Cambridge University Press;

2. Berger, A.,G.; Udell, The Institutional Memory Hypothesis and the Procyclicality of Bank Lending Behavior. Journal of Financial Intermediation. 2004. 13 (4): 458-495;

3. Bernanke, B., M. Gertler, and S. Gilchrist, 1996, “The Financial Accelerator and the Flight to Quality”, The Review of Economics and Statistics, 78(1), pp. 1-15;

4. Geanakoplos, J. 2010. The leverage cycle. NBER Macroeconomics Annual 2009, University of Chicago Press.Vol. 24, pp.:1–65;

5. Hauswald, R., and R. Marquez, 2006, “Competition and Strategic Information Acquisition in Credit Markets”, Review of Economic Studies, 19, pp. 967-1000;

6. Kindleberger, Ch. Manias, Panics, and Crashes: A History of Financial Crises. Palgrave Macmillan. 1978 – 432 p.

7. Kiyotaki, N.; Moore, J. Credit Cycles. Journal of Political Economy. 1997. 105(2): 211-248.

8. Minsky, H., 1992. “The financial instability hypothesis”. Working Paper No. 74, The Jerome Levy Economics Institute of Bard College;

9. Rötheli, T. 2012. Boundedly Rational Banks’ Contribution to the Credit Cycle. Journal of Socio-Economics. 2012. 41(5): 730-737.

10. Werner, Richard A. (2012) Towards a new research programme on ‘banking and the economy’-implications of the quantity theory of credit for the prevention and resolution of banking and debt crises. [in special issue: Banking and the Economy] International Review of Financial Analysis, 25, 1-17

11. Burakov D.V. Upravlenie tsiklichnost'yu dvizheniya kredita. M.:Rusains.-2015. – 286 s.

12. Burakov D.V. Korporativnoe kreditovanie v usloviyakh institutsional'noi lovushki na primere Rossii /D.V. Burakov// Aktual'nye voprosy ekonomicheskikh nauk. – 2012.-№25-2. – S. 58-72.

13. Burakov D.V. Restrukturizatsiya dolga na kreditnom rynke: teoriya i rossiiskaya praktika /D.V. Burakov// Finansy i kredit. – 2016.-№ 24(696). – S.2-16.

14. Byulleten' bankovskoi statistiki», TsB RF, 2005-2016g. Elektronnyi resurs, [Rezhim dostupa: http://www.cbr.ru];

15. «Obzor bankovskogo sektora Rossiiskoi Federatsii», Departament bankovskogo nadzora TsB RF, 2005-2016gg. Elektronnyi resurs, [Rezhim dostupa: http://www.cbr.ru];

16. Ofitsial'nyi sait Federal'noi sluzhby gosudarstvennoi statistiki, Elektronnyi resurs, [Rezhim dostupa: http:// www.gks.ru/];

17. Litvinova A.V., Chernaya E.G., Parfenova M.V. Vliyanie roznichnogo kreditovaniya na ekonomicheskii rost v Rossii // Voprosy bezopasnosti. - 2015. - 6. - C. 70 - 102. DOI: 10.7256/2409-7543.2015.6.17992. URL: http://www.e-notabene.ru/nb/article_17992.html

Link to this article

You can simply select and copy link from below text field.

|